Home and auto insurance state farm – Home and auto insurance from State Farm is a popular choice for many, offering a comprehensive suite of coverage options tailored to diverse needs. From the company’s humble beginnings as a small insurance agency in Illinois, State Farm has grown into a major player in the insurance industry, boasting a vast customer base and a reputation for reliability.

State Farm’s commitment to customer satisfaction is evident in their wide range of insurance products, including homeowners, renters, auto, life, and health insurance. They offer competitive rates, flexible payment options, and a variety of discounts to help customers save money.

State Farm Overview

State Farm is a prominent name in the insurance industry, known for its wide range of products and services. The company’s history spans over a century, during which it has grown from a small, regional insurer to a global financial powerhouse. This overview delves into State Farm’s journey, its core values, and its significant presence in the insurance market.

State Farm’s History and Evolution

State Farm was founded in 1922 by G.J. Mecherle in Bloomington, Illinois. Initially focusing on automobile insurance, the company quickly expanded its offerings to include home, life, and other types of insurance. Throughout the years, State Farm has consistently adapted to the changing needs of its customers and the evolving insurance landscape. It has embraced technological advancements, implemented innovative products, and expanded its operations both domestically and internationally. This continuous evolution has solidified State Farm’s position as a leader in the insurance industry.

State Farm’s Core Values and Mission Statement

State Farm’s core values are centered around customer service, integrity, and financial strength. The company’s mission statement reflects these values: “To be the leading provider of insurance and financial services products and to be known for our commitment to customer service, our financial strength, and our ethical business practices.” These values guide State Farm’s decision-making, product development, and customer interactions, fostering trust and loyalty among its customers.

State Farm’s Size, Market Share, and Customer Base

State Farm is one of the largest insurance companies in the world. As of 2023, the company has over 80,000 employees and serves over 83 million policyholders globally. State Farm holds a significant market share in the United States, ranking among the top providers of auto, home, and life insurance. The company’s vast customer base is a testament to its strong brand reputation, reliable products, and commitment to customer satisfaction.

Home Insurance Offerings

State Farm offers a variety of home insurance policies to meet the needs of different homeowners. These policies provide financial protection against various risks, such as fire, theft, and natural disasters. Understanding the different types of policies and coverage options can help you choose the right one for your specific needs.

Types of Home Insurance Policies

State Farm offers several types of home insurance policies, each designed to cater to specific needs and circumstances. These include:

- Standard Homeowners Insurance: This is the most common type of home insurance policy, providing coverage for dwelling, personal property, liability, and additional living expenses. It offers comprehensive protection against a wide range of risks, including fire, theft, vandalism, and natural disasters.

- Condominium Insurance: This policy is specifically designed for homeowners living in condominiums. It covers the interior of the unit and personal property, but does not cover the building structure itself. It also includes liability coverage for incidents occurring within the unit.

- Renters Insurance: This policy provides coverage for personal property and liability for renters. It protects your belongings against damage or loss due to covered perils and also covers you if someone is injured on your property.

- Mobile Home Insurance: This policy is designed for homeowners living in mobile homes. It covers the structure of the home, personal property, and liability. It also offers optional coverage for specific risks, such as windstorms and hail.

Coverage Options

The coverage options available for different types of homes vary depending on the policy and the specific needs of the homeowner. Some common coverage options include:

- Dwelling Coverage: This covers the structure of your home, including the foundation, walls, roof, and fixtures. It also covers any attached structures, such as garages and porches.

- Personal Property Coverage: This covers your belongings inside your home, such as furniture, electronics, clothing, and jewelry. The coverage amount is typically a percentage of the dwelling coverage.

- Liability Coverage: This protects you from financial losses if someone is injured on your property or if you are found liable for damages caused to others. It also covers legal defense costs.

- Additional Living Expenses: This coverage helps pay for temporary housing, food, and other expenses if you are unable to live in your home due to a covered event.

- Optional Coverage: State Farm offers a range of optional coverage options to enhance your protection. These include flood insurance, earthquake insurance, and identity theft protection.

Factors Influencing Home Insurance Premiums

Several factors influence the cost of your home insurance premium, including:

- Location: The risk of damage from natural disasters, crime rates, and other factors can vary depending on your location. Homes in areas with higher risk typically have higher premiums.

- Age of the Home: Older homes may have outdated wiring, plumbing, or other features that increase the risk of damage. This can lead to higher premiums.

- Value of the Property: The higher the value of your home, the more it will cost to rebuild or repair it. This is reflected in your insurance premium.

- Deductible: Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible generally leads to lower premiums.

- Credit Score: Your credit score can influence your insurance premium, as it is a factor used to assess your risk profile.

- Safety Features: Homes with security systems, smoke detectors, and other safety features may qualify for discounts, as they reduce the risk of damage or loss.

Auto Insurance Products

State Farm offers a comprehensive range of auto insurance products designed to protect you and your vehicle in the event of an accident or other covered incidents. These products are tailored to meet individual needs and preferences, providing financial security and peace of mind on the road.

Coverage Options

State Farm provides various auto insurance coverage options to meet the diverse needs of its customers. These options can be combined to create a personalized policy that offers the right level of protection.

- Liability Coverage: This coverage protects you financially if you are responsible for an accident that causes injury or damage to others. It covers medical expenses, property damage, and legal defense costs. Liability coverage is usually required by law in most states.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. It helps cover the cost of repairs or replacement, less your deductible.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than accidents, such as theft, vandalism, natural disasters, or collisions with animals. It helps cover the cost of repairs or replacement, less your deductible.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have adequate insurance or is uninsured. It helps cover your medical expenses and property damage.

- Personal Injury Protection (PIP): This coverage, also known as No-Fault insurance, helps cover your medical expenses and lost wages if you are injured in an accident, regardless of who is at fault. It is mandatory in some states.

- Rental Car Coverage: This coverage helps pay for a rental car while your vehicle is being repaired after an accident. It provides transportation while your vehicle is unavailable.

- Roadside Assistance: This coverage provides assistance with services like towing, flat tire changes, jump starts, and lockout services. It offers peace of mind knowing help is available in case of unexpected breakdowns.

Factors Determining Premiums

Auto insurance premiums are calculated based on several factors that assess your risk profile. These factors influence the cost of your insurance policy and are designed to reflect the likelihood of you filing a claim.

- Driving Record: Your driving history is a key factor in determining your premiums. A clean driving record with no accidents or violations generally results in lower premiums. However, accidents, traffic violations, and DUI convictions can significantly increase your rates.

- Vehicle Type: The type of vehicle you drive impacts your premium. Higher-performance cars, luxury vehicles, and expensive vehicles are generally associated with higher risk and therefore higher premiums. Factors such as safety features, engine size, and theft risk also play a role.

- Location: Your location influences your premium due to factors such as traffic density, accident rates, and crime rates. Areas with higher traffic and accident rates tend to have higher premiums.

- Age and Gender: Your age and gender can affect your premiums. Younger drivers with less experience generally have higher premiums, while older drivers with a proven track record often enjoy lower rates. Gender can also influence premiums, as statistics show that men tend to have higher accident rates than women.

- Credit Score: In some states, insurance companies use credit scores as a factor in determining premiums. A good credit score is generally associated with responsible behavior, which can translate to lower insurance rates. However, this practice is controversial and subject to regulations.

- Coverage Levels: The amount of coverage you choose impacts your premium. Higher coverage limits, such as higher liability limits, generally result in higher premiums. However, they provide greater financial protection in case of an accident.

- Deductible: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, as you are taking on more financial responsibility in case of a claim. However, it’s important to choose a deductible you can comfortably afford.

Rate Comparisons

State Farm’s auto insurance rates are competitive with other major insurance providers. However, rates can vary depending on individual factors, such as your location, driving record, and the vehicle you drive. It’s essential to compare quotes from multiple insurers to find the best rates for your specific needs.

Note: It’s crucial to compare quotes from multiple insurance companies, including State Farm, to find the best rates for your individual circumstances. Factors such as your location, driving record, and the vehicle you drive can significantly impact premiums.

Customer Experience

State Farm prioritizes providing a seamless and positive customer experience across all touchpoints. The company strives to make insurance accessible and convenient for its policyholders, offering a range of customer service channels to cater to diverse needs and preferences.

Customer Service Channels

State Farm offers a comprehensive suite of customer service channels, enabling policyholders to connect with representatives and access information easily.

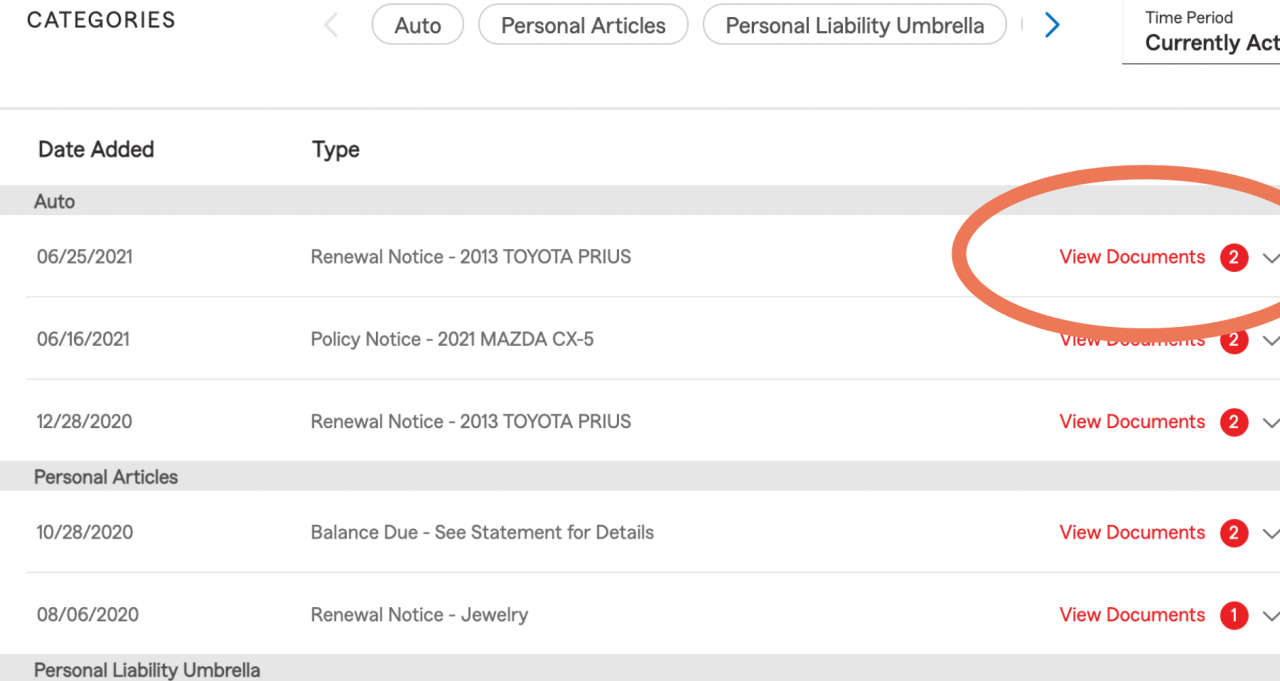

- Online Platforms: State Farm’s website provides a wealth of resources, including policy information, claims filing, and payment options. Customers can access their accounts, manage policies, and find answers to frequently asked questions online.

- Mobile Apps: The State Farm mobile app offers a convenient and user-friendly platform for managing policies, submitting claims, and accessing roadside assistance. The app provides real-time updates and allows for quick and easy communication with customer service representatives.

- Call Centers: State Farm operates 24/7 call centers, providing immediate assistance and support to policyholders. Customers can reach a representative by phone for a wide range of inquiries, including policy changes, claims reporting, and general information.

Customer Reviews and Testimonials

State Farm consistently receives positive feedback from customers regarding its customer service. Online review platforms like Trustpilot and Google Reviews showcase a high level of satisfaction among policyholders. Many customers praise the company’s responsiveness, helpfulness, and professionalism.

“I’ve been with State Farm for years, and I’ve always been impressed with their customer service. They are always quick to respond to my questions and concerns, and they make the process of filing a claim easy and straightforward.” – Sarah J.

“I recently had a car accident, and State Farm was incredibly helpful throughout the entire process. They kept me informed every step of the way, and they made sure I was taken care of. I would highly recommend State Farm to anyone.” – John D.

Benefits and Drawbacks of State Farm’s Customer Service

Benefits

- Accessibility: State Farm offers a wide range of customer service channels, making it easy for policyholders to connect with representatives regardless of their preferred method of communication.

- Responsiveness: The company is known for its prompt and efficient response times, whether it’s answering questions, resolving issues, or processing claims.

- Professionalism: State Farm’s customer service representatives are highly trained and knowledgeable, providing helpful and courteous assistance.

Drawbacks

- Wait Times: While State Farm strives to provide quick service, there may be instances where customers experience longer wait times, especially during peak hours or when dealing with complex issues.

- Limited Online Features: While State Farm’s online platforms are robust, some features may be limited compared to other insurance providers. For example, customers may need to contact a representative for certain policy changes or claims adjustments.

Claims Process

State Farm aims to make the claims process as smooth and efficient as possible for its policyholders. Whether it’s a home or auto insurance claim, the company has a well-defined process designed to ensure a fair and timely resolution.

Filing a Claim

Filing a claim with State Farm is a straightforward process that can be done online, over the phone, or through a State Farm agent. Here are the general steps involved:

- Report the Claim: Contact State Farm as soon as possible after an incident. This could be a car accident, a fire, or any other event covered by your policy.

- Provide Information: You’ll be asked to provide details about the incident, including the date, time, location, and any other relevant information. You may also be asked to provide details about your policy and your contact information.

- File the Claim: Once you’ve reported the claim, State Farm will guide you through the necessary steps to file it officially. This may involve completing a claim form and providing supporting documentation.

- Claim Assessment: State Farm will investigate the claim to determine the extent of the damage and whether it’s covered under your policy. This may involve an inspection of your property or vehicle.

- Claim Resolution: Once the claim is assessed, State Farm will notify you of the decision and proceed with the payment or other necessary actions.

Claim Processing Time

The time it takes to process a claim can vary depending on the complexity of the claim and the availability of information. In general, simple claims can be processed within a few days, while more complex claims may take several weeks or even months.

- Simple Claims: For example, a minor car accident with no injuries or a small property damage claim, can be processed quickly with minimal documentation.

- Complex Claims: Claims involving significant property damage, injuries, or disputes over coverage may require additional investigation and communication, which can extend the processing time.

Claim Resolution Examples

State Farm has a proven track record of resolving claims fairly and efficiently. Here are a few examples:

- Home Fire Claim: A policyholder’s home was damaged by a fire. State Farm worked with the homeowner to assess the damage and provided temporary housing while the home was being repaired. The claim was settled within a reasonable timeframe, and the homeowner was satisfied with the outcome.

- Car Accident Claim: A policyholder was involved in a car accident that resulted in injuries. State Farm worked with the policyholder and the other party to reach a settlement that covered medical expenses and vehicle repairs. The claim was settled amicably, and both parties were satisfied with the outcome.

- Dispute Resolution: In cases where there is a dispute over coverage or the amount of compensation, State Farm provides a clear and transparent process for resolving the dispute. This may involve mediation or arbitration, depending on the specific circumstances.

Discounts and Bundling Options

State Farm offers a wide array of discounts and bundling options that can help you save money on your home and auto insurance premiums. By taking advantage of these benefits, you can significantly reduce your overall insurance costs.

Discounts

State Farm offers a variety of discounts for both home and auto insurance policies. Here are some of the most common discounts:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, demonstrating responsible driving habits.

- Safe Driver Discount: Similar to the Good Driver Discount, this discount recognizes drivers who have not been involved in accidents or received traffic violations.

- Multi-Car Discount: If you insure multiple vehicles with State Farm, you can qualify for a discount on your premiums.

- Homeowner Discount: State Farm provides a discount to homeowners who bundle their home and auto insurance policies.

- Defensive Driving Course Discount: Completing a defensive driving course can qualify you for a discount on your auto insurance premiums.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle can reduce your auto insurance premiums.

- Loyalty Discount: State Farm often rewards long-term customers with loyalty discounts.

- Paperless Billing Discount: Opting for paperless billing can result in a discount on your premiums.

Bundling Home and Auto Insurance

Bundling your home and auto insurance policies with State Farm offers several benefits:

- Convenience: Managing both your home and auto insurance policies under one roof simplifies your insurance needs.

- Savings: Bundling often results in significant discounts on your premiums, saving you money in the long run.

- Streamlined Claims Process: If you need to file a claim for either your home or auto, dealing with a single insurer simplifies the process.

- Personalized Service: State Farm agents can provide tailored advice and solutions for your combined insurance needs.

Financial Advantages of Discounts and Bundling, Home and auto insurance state farm

Taking advantage of State Farm’s discounts and bundling options can lead to substantial financial savings. Here are some examples:

“A family in Chicago, Illinois, who bundled their home and auto insurance with State Farm and qualified for several discounts, saved an average of $500 per year on their premiums.”

“A single driver in Los Angeles, California, who completed a defensive driving course and installed an anti-theft device in their car, reduced their auto insurance premiums by 15%.”

These examples demonstrate the significant financial benefits that can be realized by taking advantage of State Farm’s discounts and bundling options.

Financial Strength and Stability

State Farm’s financial strength and stability are crucial for its ability to fulfill its commitments to policyholders. The company’s long-standing reputation for reliability and financial soundness is built on a strong track record of financial performance and a commitment to responsible risk management.

Financial Performance and Ratings

State Farm’s financial performance is consistently strong, reflecting its prudent investment strategies and effective risk management practices. The company’s financial strength is reflected in its high ratings from independent rating agencies. These ratings provide an objective assessment of an insurer’s ability to meet its financial obligations to policyholders.

- A.M. Best: A+ (Superior) – This rating signifies State Farm’s exceptional financial strength and ability to meet its policyholder obligations.

- Moody’s: Aa2 – This rating indicates State Farm’s high creditworthiness and low risk of default.

- Standard & Poor’s: AA+ – This rating reflects State Farm’s strong financial position and ability to meet its financial obligations.

Commitment to Financial Stability

State Farm’s commitment to financial stability is evident in its conservative investment practices and focus on long-term sustainability. The company maintains a diversified investment portfolio, minimizing exposure to market fluctuations and ensuring its ability to meet policyholder claims.

Comparison with Other Insurance Providers

State Farm’s financial strength and stability compare favorably with other major insurance providers. The company’s high ratings from independent agencies reflect its strong financial performance and responsible risk management practices. State Farm consistently ranks among the top insurance providers in terms of financial strength and stability.

Competitive Landscape

State Farm faces intense competition in the home and auto insurance market, with several major players vying for customers. Understanding the strengths and weaknesses of these competitors is crucial for State Farm to maintain its market share and continue to innovate.

Key Competitors

State Farm’s main competitors in the home and auto insurance market include:

- Progressive: Known for its innovative marketing campaigns and its focus on online and mobile experiences. Progressive also offers a wide range of insurance products and services, including bundled home and auto insurance.

- Geico: Known for its catchy commercials and its commitment to offering affordable rates. Geico has a strong online presence and a streamlined claims process.

- Allstate: Known for its brand recognition and its commitment to customer service. Allstate offers a variety of insurance products and services, including bundled home and auto insurance.

- USAA: Focused on serving military members and their families, USAA is known for its excellent customer service and its competitive rates.

- Liberty Mutual: Offers a wide range of insurance products and services, including bundled home and auto insurance. Liberty Mutual is known for its strong financial stability and its commitment to customer satisfaction.

Strengths and Weaknesses of Competitors

Each of State Farm’s competitors has unique strengths and weaknesses.

- Progressive:

- Strengths: Strong online presence, innovative marketing, focus on customer experience, wide range of products and services.

- Weaknesses: Can be perceived as less personal than some competitors, may not be as widely recognized in some markets.

- Geico:

- Strengths: Affordable rates, strong online presence, streamlined claims process, memorable marketing.

- Weaknesses: May not offer as many customization options as some competitors, customer service can sometimes be impersonal.

- Allstate:

- Strengths: Strong brand recognition, commitment to customer service, wide range of products and services.

- Weaknesses: Rates can be higher than some competitors, may not be as innovative as some competitors.

- USAA:

- Strengths: Excellent customer service, competitive rates, strong financial stability, focus on military members and their families.

- Weaknesses: Limited market reach, only available to military members and their families.

- Liberty Mutual:

- Strengths: Wide range of products and services, strong financial stability, commitment to customer satisfaction.

- Weaknesses: May not be as well-known as some competitors, marketing can be less memorable.

Key Differentiators

State Farm differentiates itself from its competitors through several key factors:

- Agent Network: State Farm has a vast network of local agents who provide personalized service and support to customers. This provides a more personal touch compared to competitors that rely heavily on online platforms.

- Community Involvement: State Farm is known for its strong commitment to community involvement. This helps to build trust and goodwill among customers.

- Financial Strength: State Farm has a long history of financial stability and strength. This provides customers with peace of mind knowing that their insurance company is financially sound.

- Customer Satisfaction: State Farm consistently ranks high in customer satisfaction surveys. This demonstrates the company’s commitment to providing a positive customer experience.

Industry Trends and Future Outlook

The home and auto insurance industry is constantly evolving, driven by factors such as technological advancements, changing customer expectations, and economic fluctuations. Understanding these trends is crucial for State Farm to maintain its competitive edge and cater to the evolving needs of its customers.

Impact of Emerging Technologies

The insurance industry is undergoing a digital transformation, with emerging technologies playing a significant role in reshaping the landscape. These technologies are driving efficiency, improving customer experience, and creating new opportunities for insurers.

- Artificial Intelligence (AI): AI is being used to automate tasks, personalize customer interactions, and enhance risk assessment. For instance, AI-powered chatbots can handle routine customer inquiries, while AI algorithms can analyze vast amounts of data to identify patterns and predict potential risks.

- Internet of Things (IoT): Connected devices, such as smart home sensors and telematics devices in cars, are generating real-time data that can be used to monitor risks and provide personalized insurance solutions. This data can help insurers offer discounts to safe drivers or provide proactive alerts to homeowners about potential hazards.

- Blockchain: Blockchain technology can streamline claims processing, improve transparency, and reduce fraud. For example, blockchain can be used to create a secure and tamper-proof record of claims data, eliminating the need for intermediaries and reducing the risk of fraudulent claims.

Epilogue

Whether you’re seeking protection for your home, vehicle, or both, State Farm provides a solid foundation for peace of mind. With their strong financial standing, comprehensive coverage options, and customer-centric approach, State Farm remains a trusted choice for insurance needs across the country.

General Inquiries: Home And Auto Insurance State Farm

What are the main types of home insurance coverage offered by State Farm?

State Farm offers a variety of home insurance policies, including dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage.

How can I get a quote for home and auto insurance from State Farm?

You can get a quote online, over the phone, or by visiting a local State Farm agent.

Does State Farm offer discounts for bundling home and auto insurance?

Yes, State Farm offers significant discounts for bundling home and auto insurance policies.

What is the claims process like with State Farm?

State Farm provides a straightforward claims process that can be initiated online, over the phone, or through their mobile app.