Highest state car insurance rates can be a significant financial burden for drivers, leaving many wondering why their premiums are so high. This phenomenon isn’t a mystery, though, as a complex interplay of factors contributes to these elevated costs. From driving history and vehicle type to state regulations and the overall cost of living, a multitude of elements influence the price tag for car insurance in different parts of the country.

This guide delves into the intricate world of car insurance, examining the factors that drive up premiums in certain states. We’ll explore the key elements that influence car insurance rates, including driving history, vehicle characteristics, and state-specific regulations. By understanding these factors, drivers can gain valuable insights into how to navigate the car insurance landscape and potentially save money.

Understanding “Highest State Car Insurance”

Car insurance premiums can vary significantly from state to state, and some states are consistently ranked as having the highest rates. Understanding why these rates are higher is crucial for drivers in these states, as it helps them make informed decisions about their insurance coverage.

Factors Contributing to High Car Insurance Rates

High car insurance premiums in certain states are influenced by a combination of factors, including:

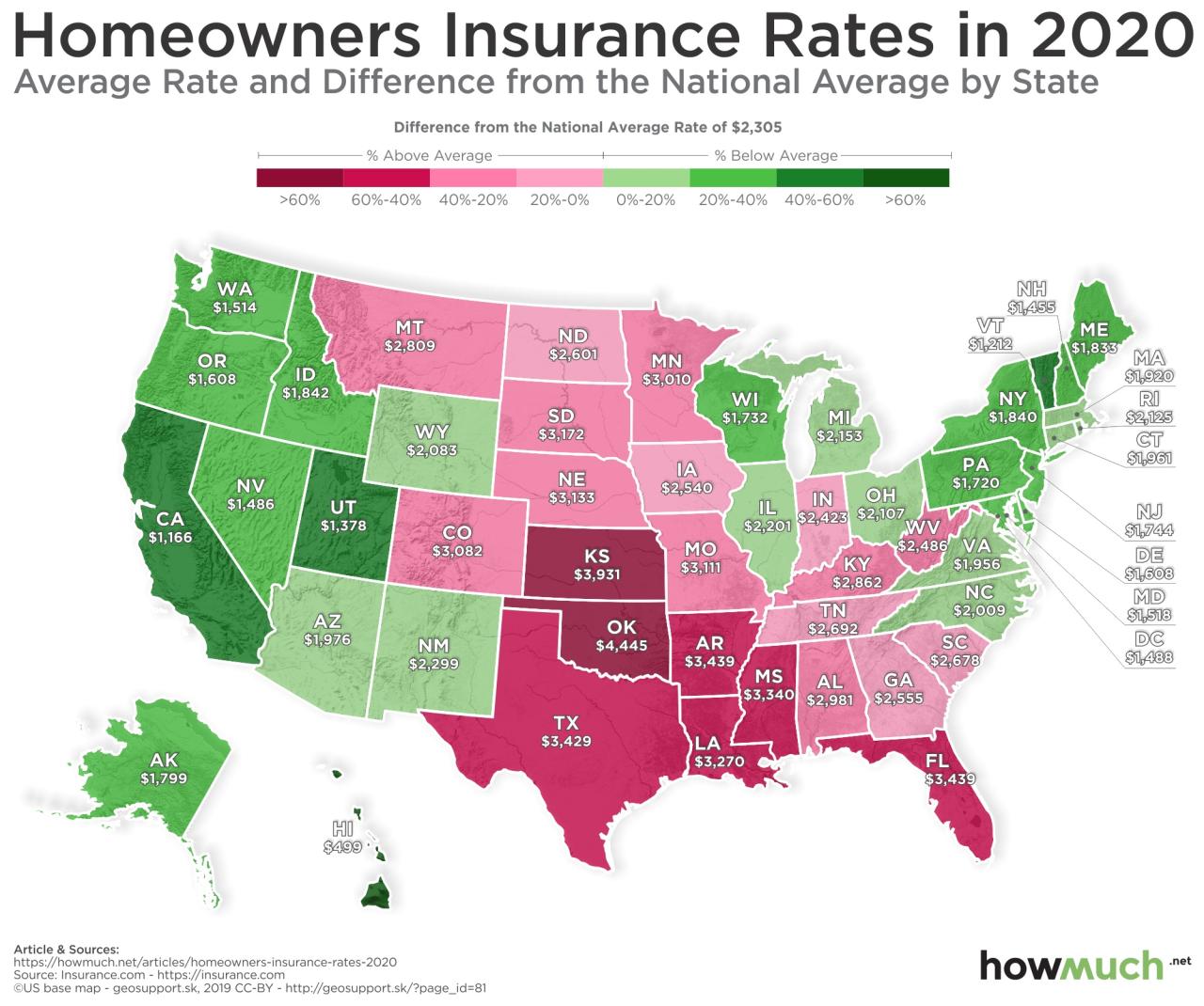

- Cost of Repairs and Medical Expenses: States with higher costs of living, particularly for healthcare and vehicle repairs, tend to have higher insurance premiums. This is because insurance companies have to pay more to cover claims in these states.

- Number of Accidents and Claims: States with higher rates of accidents and insurance claims often have higher premiums. This is because insurance companies face higher payouts in these states.

- Traffic Density and Congestion: Areas with heavy traffic and congestion can increase the likelihood of accidents, leading to higher insurance rates.

- Insurance Regulations and Laws: State regulations and laws regarding insurance coverage, such as minimum liability limits and no-fault laws, can influence insurance premiums. For example, states with higher minimum liability limits may have higher insurance rates to cover potential payouts.

- Natural Disasters and Weather Conditions: States prone to natural disasters like hurricanes, earthquakes, or floods may have higher insurance rates to cover potential damage to vehicles.

- Driving Habits and Demographics: Factors such as the age and driving experience of drivers, the prevalence of risky driving behaviors, and the types of vehicles driven can also impact insurance premiums.

States with High Car Insurance Premiums

Some states are consistently ranked among those with the highest car insurance premiums. These include:

- Michigan: Michigan has the highest average car insurance premiums in the United States, due in part to its no-fault insurance system and high costs of healthcare.

- Louisiana: Louisiana has the second-highest average car insurance premiums, driven by factors such as high accident rates and a high cost of living.

- Florida: Florida is known for its high car insurance premiums, primarily due to a high number of accidents, a large population of senior drivers, and a high cost of living.

- New Jersey: New Jersey has a high average car insurance premium, influenced by a high population density, a high cost of living, and a no-fault insurance system.

- Rhode Island: Rhode Island has the fifth-highest average car insurance premium, attributed to factors such as a high population density and a high cost of living.

Key Factors Influencing Car Insurance Rates

Car insurance rates are not one-size-fits-all. Several factors play a role in determining how much you pay for coverage. Understanding these factors can help you make informed decisions about your insurance policy and potentially save money.

Driving History

Your driving history is a major factor in determining your car insurance rates. Insurance companies use this information to assess your risk as a driver. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or other violations will likely lead to higher rates.

- Accidents: Insurance companies consider the number, severity, and fault of any accidents you’ve been involved in. A major accident, even if you weren’t at fault, can significantly impact your rates.

- Violations: Traffic violations, such as speeding tickets, reckless driving, or DUI, can increase your premiums. The severity of the violation and the frequency of offenses will influence the impact on your rates.

- Points on Your License: In many states, traffic violations result in points being added to your driving record. These points can increase your insurance premiums. The more points you accumulate, the higher your rates are likely to be.

Vehicle Type and Value

The type and value of your car also play a significant role in your insurance rates. Insurance companies consider factors like:

- Make and Model: Some car models are statistically more prone to accidents or thefts than others. Insurance companies factor in these statistics when setting rates.

- Safety Features: Cars with advanced safety features, such as anti-lock brakes, airbags, and stability control, are often associated with lower accident risks and can result in lower insurance premiums.

- Value: The value of your car influences your insurance premiums, particularly for collision and comprehensive coverage. More expensive cars generally cost more to repair or replace, leading to higher insurance rates.

Location, Highest state car insurance

Where you live can have a significant impact on your car insurance rates. Insurance companies consider factors like:

- Urban vs. Rural: Car insurance rates tend to be higher in urban areas due to factors such as increased traffic congestion, higher population density, and a greater risk of theft or vandalism.

- Crime Rates: Areas with high crime rates often have higher car insurance rates due to an increased risk of theft or vandalism.

- Weather Conditions: Areas prone to severe weather events, such as hurricanes, tornadoes, or heavy snowfall, can have higher insurance rates due to the increased risk of damage to vehicles.

Age and Gender of the Driver

Insurance companies often use age and gender as factors in determining car insurance rates.

- Age: Younger drivers, particularly teenagers, have statistically higher accident rates. Insurance companies often charge higher premiums for young drivers due to their lack of experience and higher risk of accidents.

- Gender: Historically, insurance companies have charged different rates for men and women, with men often paying higher premiums. This practice is becoming less common as more states are enacting laws that prohibit gender-based pricing.

Coverage Levels

The amount of coverage you choose for your car insurance policy will also affect your rates.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident. Higher liability limits will provide greater protection but will also increase your premiums.

- Collision Coverage: This coverage pays for repairs or replacement of your car if it’s damaged in an accident, regardless of who is at fault. The higher your deductible, the lower your premiums will be.

- Comprehensive Coverage: This coverage protects your car from damage caused by events other than accidents, such as theft, vandalism, or natural disasters. The higher your deductible, the lower your premiums will be.

State-Specific Regulations and Laws

State-specific regulations and laws play a significant role in shaping car insurance premiums. These regulations can influence the cost of insurance in various ways, including the types of coverage required, the minimum liability limits, and the availability of discounts.

Understanding how these regulations vary across states can help you navigate the complexities of car insurance and potentially find more affordable options.

Regulations Influencing Insurance Costs

State-specific regulations can directly impact insurance costs by influencing the types of coverage required, the minimum liability limits, and the availability of discounts.

- Required Coverage: Some states mandate specific coverage types, such as personal injury protection (PIP) or uninsured/underinsured motorist (UM/UIM) coverage. These requirements can increase premiums, as insurers are obligated to provide these coverages.

- Minimum Liability Limits: States establish minimum liability limits, which determine the minimum amount of coverage an insured must carry for bodily injury and property damage. Higher minimum limits generally lead to higher premiums.

- Discounts: Some states offer discounts for specific behaviors or vehicle features. For example, states might provide discounts for good driving records, safety features, or participation in driver safety courses.

Examples of Laws and Regulations Contributing to Higher Rates

Specific laws and regulations can contribute to higher insurance rates in certain states. These regulations can include:

- No-Fault Laws: States with no-fault laws typically require drivers to carry PIP coverage, which covers medical expenses and lost wages regardless of fault. This can lead to higher premiums, as insurers must pay for claims even if the insured is not at fault.

- High Minimum Liability Limits: States with high minimum liability limits can result in higher premiums, as insurers must carry more coverage to meet these requirements.

- Limited Discount Availability: Some states may have limited availability of discounts, which can impact the overall cost of insurance. For example, states with limited discounts for safe driving records or safety features can result in higher premiums for drivers with good driving records or vehicles equipped with advanced safety technologies.

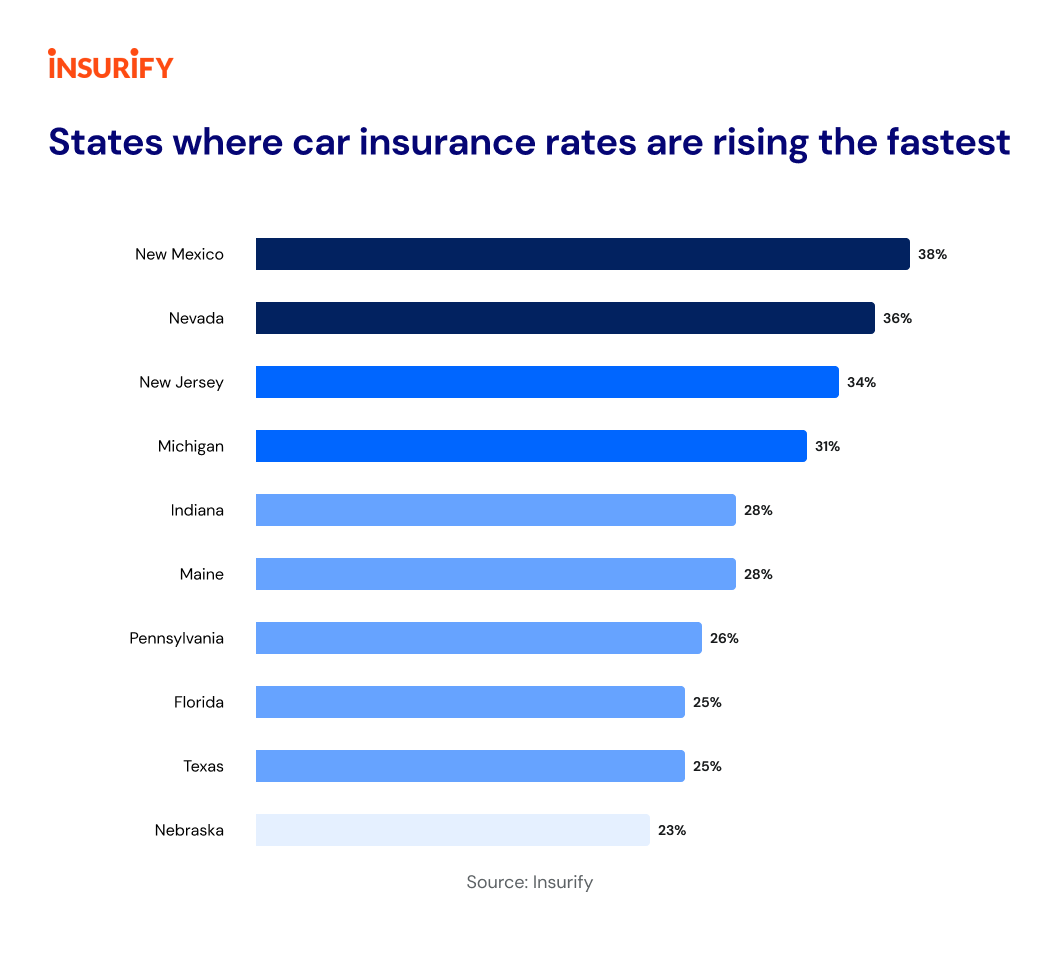

Cost Comparison and Analysis

Understanding the cost of car insurance is crucial for making informed decisions about your coverage. This section will delve into a comparison of car insurance premiums across states with high rates, providing insights into the factors influencing these variations.

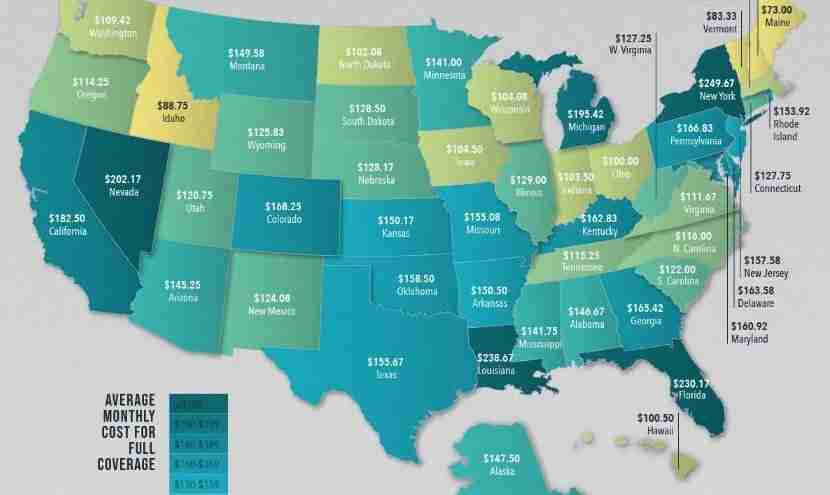

Comparison of Car Insurance Premiums

To understand the disparities in car insurance costs, let’s examine average premiums in several states known for their higher rates. The following table presents a standardized comparison based on a hypothetical driver and vehicle profile:

| State | Average Premium | Liability Coverage | Collision Coverage | Comprehensive Coverage |

|---|---|---|---|---|

| Michigan | $2,800 | $50,000/$100,000 | $1,000 deductible | $500 deductible |

| Louisiana | $2,500 | $25,000/$50,000 | $500 deductible | $250 deductible |

| Florida | $2,200 | $10,000/$20,000 | $1,000 deductible | $500 deductible |

| New Jersey | $2,000 | $15,000/$30,000 | $500 deductible | $250 deductible |

| Pennsylvania | $1,800 | $20,000/$40,000 | $1,000 deductible | $500 deductible |

This table demonstrates significant variations in average premiums across states. Michigan, for instance, has the highest average premium at $2,800, while Pennsylvania has the lowest at $1,800.

Factors Influencing Premium Differences

Several factors contribute to the disparities in car insurance premiums. Some key factors include:

- Frequency and Severity of Accidents: States with higher accident rates tend to have higher insurance premiums. This is because insurance companies face greater payouts for claims in these areas.

- Cost of Vehicle Repairs: States with high costs of living and expensive vehicle repair services often have higher premiums. This is because insurance companies need to cover the costs of repairs in these areas.

- State Regulations: Different states have varying regulations regarding minimum coverage requirements and other insurance-related factors. These regulations can impact insurance premiums.

- Competition Among Insurers: States with a high number of insurance companies often have more competitive pricing. This is because insurers are vying for customers and may offer lower premiums to attract them.

Important Note: These are just some of the factors that can influence car insurance premiums. It is essential to consider your individual circumstances and compare quotes from multiple insurance companies to find the best coverage at the most affordable price.

Tips for Saving on Car Insurance in High-Rate States: Highest State Car Insurance

Living in a state with high car insurance rates can put a strain on your budget. However, there are strategies you can implement to lower your premiums and make insurance more affordable. By understanding the factors that influence your rates and taking proactive steps, you can significantly reduce your car insurance costs.

Maintaining a Good Driving Record

A clean driving record is crucial for obtaining lower car insurance premiums. Insurance companies consider your driving history a significant factor when determining your rates. A history of accidents, traffic violations, or driving under the influence can significantly increase your premiums.

- Avoid speeding tickets and other traffic violations. Every violation adds points to your driving record, increasing your insurance costs.

- Drive defensively and avoid accidents. Accidents, even those you’re not at fault for, can still affect your premiums.

- Consider taking a defensive driving course. These courses can teach you safe driving techniques and help you earn discounts on your insurance.

Choosing a Safe and Fuel-Efficient Vehicle

The type of car you drive plays a significant role in your car insurance rates. Insurance companies assess the safety features, theft risk, and repair costs of your vehicle. Choosing a safe and fuel-efficient car can lead to lower premiums.

- Select a vehicle with advanced safety features such as anti-lock brakes, airbags, and stability control. These features reduce the risk of accidents and injuries, leading to lower premiums.

- Consider purchasing a car with a good safety rating from organizations like the Insurance Institute for Highway Safety (IIHS) or the National Highway Traffic Safety Administration (NHTSA).

- Opt for fuel-efficient vehicles. Insurance companies often offer discounts for vehicles with better fuel economy, recognizing their lower risk of accidents and environmental impact.

Increasing Deductibles

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lower your monthly premiums. However, it’s essential to choose a deductible you can afford in case of an accident.

“Increasing your deductible from $500 to $1000 could save you 15% to 30% on your premium.” – Insurance Information Institute

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can result in significant discounts. Insurance companies often offer discounts for multiple policies, rewarding customers for their loyalty.

Shopping Around for Quotes

Don’t settle for the first insurance quote you receive. It’s essential to shop around and compare quotes from multiple insurance companies. Online comparison websites and insurance brokers can help you easily compare prices and coverage options.

Impact of High Car Insurance Rates on Drivers

High car insurance premiums can significantly impact drivers, especially in states with consistently high rates. These costs can strain household budgets, limit access to transportation, and even lead to financial hardship.

Economic Impact of High Premiums

High car insurance premiums can significantly impact a driver’s financial well-being. In states with high rates, drivers may face a substantial portion of their income being dedicated to insurance costs. This can lead to reduced disposable income, making it challenging to meet other financial obligations such as rent, utilities, and groceries. Furthermore, high premiums can create a cycle of financial strain, as drivers may need to cut back on other essential expenses to afford insurance, potentially leading to further financial challenges.

Impact on Affordability and Access to Insurance

High car insurance rates can make car insurance unaffordable for some drivers, especially those with lower incomes. This can lead to a lack of access to insurance, leaving drivers uninsured and vulnerable to significant financial losses in the event of an accident. In some cases, drivers may choose to drive without insurance, risking hefty fines and penalties, further exacerbating their financial difficulties.

Potential Solutions to Address High Car Insurance Rates

Several potential solutions can address the issue of high car insurance rates. These solutions can help to make car insurance more affordable and accessible for all drivers.

- Increased Competition in the Insurance Market: Promoting competition among insurance companies can help to drive down prices. This can be achieved through deregulation, allowing new insurance providers to enter the market, and fostering a more competitive landscape.

- Risk-Based Pricing: Implementing risk-based pricing models can ensure that drivers are charged premiums that accurately reflect their individual risk profiles. This can help to reduce premiums for safe drivers and encourage safe driving practices.

- State-Funded Programs: Some states have implemented programs to assist low-income drivers with affordable car insurance. These programs can provide subsidies or discounts to make insurance more accessible.

- Driver Education and Safety Programs: Investing in driver education and safety programs can help to reduce accidents and claims, ultimately lowering insurance costs. These programs can target young drivers, senior drivers, and other high-risk groups.

Final Summary

Navigating the world of car insurance can be challenging, especially when faced with high premiums. By understanding the factors that influence rates, drivers can make informed decisions to mitigate costs. From maintaining a clean driving record and choosing a safe vehicle to exploring options like bundling policies and increasing deductibles, there are strategies to help manage car insurance expenses. Remember, knowledge is power, and by arming yourself with information, you can navigate the complexities of car insurance and find the best coverage for your needs at a price that fits your budget.

FAQ Overview

What are some common reasons for high car insurance premiums in certain states?

Factors like high population density, a greater number of accidents, higher cost of living, and stricter state regulations can contribute to higher car insurance premiums in certain states.

Is it possible to find affordable car insurance in states with high premiums?

Yes, there are ways to reduce your car insurance costs even in states with high premiums. Consider maintaining a clean driving record, choosing a safe and fuel-efficient vehicle, and shopping around for quotes from different insurance companies.

What are some tips for reducing car insurance premiums?

Some effective tips include maintaining a clean driving record, choosing a safe and fuel-efficient vehicle, increasing your deductible, bundling insurance policies, and shopping around for quotes from different insurance companies.