Health insurance in Delaware state is a crucial aspect of navigating the healthcare system. Delaware’s unique healthcare landscape presents a diverse range of options, catering to the needs of its residents. From understanding the role of the Delaware Health Insurance Marketplace to exploring the different types of plans available, this guide aims to provide comprehensive information to help you make informed decisions about your health insurance coverage.

This guide will delve into the intricacies of health insurance in Delaware, covering topics such as the types of plans available, key considerations for choosing the right plan, the enrollment process, accessing healthcare services, cost and affordability, and available resources. Whether you’re an individual, a family, or an employer seeking coverage, this comprehensive resource will empower you with the knowledge you need to make confident decisions about your health insurance in Delaware.

Understanding Delaware’s Healthcare Landscape

Delaware’s healthcare system presents a unique blend of characteristics, influenced by its small size, diverse population, and proximity to major metropolitan areas. This combination shapes the healthcare needs and access for residents, impacting how health insurance plays a crucial role in navigating the system.

The Delaware Health Insurance Marketplace

The Delaware Health Insurance Marketplace serves as a central platform for individuals and families to explore and enroll in health insurance plans that meet their needs and budget. This platform provides a transparent and convenient avenue to compare plans from different insurers, understand coverage options, and determine eligibility for financial assistance. The Marketplace is designed to simplify the process of finding affordable and comprehensive health insurance, particularly for those who might not have access to employer-sponsored coverage.

Demographics and Healthcare Needs

Delaware’s population exhibits a diverse range of demographics, influencing the healthcare needs and challenges faced by residents.

- Age Distribution: Delaware’s population is aging, with a significant proportion of residents over 65 years old. This demographic trend increases the demand for Medicare and other senior-specific health services.

- Rural vs. Urban: While the state boasts a mix of urban and rural areas, access to healthcare can vary depending on location. Rural communities often face challenges in accessing specialized medical care and services, requiring greater reliance on telehealth and mobile clinics.

- Income Levels: Delaware has a range of income levels, impacting access to healthcare. Lower-income individuals and families may face financial barriers to obtaining health insurance and accessing essential medical care. This highlights the importance of programs like Medicaid and the Marketplace’s financial assistance to bridge the gap.

Types of Health Insurance in Delaware

Delaware offers a range of health insurance options to cater to diverse needs and budgets. Understanding the different types of plans available is crucial for making an informed decision about your health coverage. This section delves into the various types of health insurance plans available in Delaware, highlighting their key features, benefits, and limitations.

Individual Health Insurance

Individual health insurance plans are purchased directly by individuals or families, independent of any employer. These plans offer flexibility in choosing coverage options and providers, but they can be more expensive than employer-sponsored plans.

- Coverage Options: Individual health insurance plans offer various coverage options, including plans with different deductibles, copayments, and coinsurance rates. Some plans may also include additional benefits like dental or vision coverage.

- Benefits: The main benefit of individual health insurance is its flexibility. You can choose a plan that best suits your individual needs and budget. You are not tied to your employer’s health insurance plan, allowing for more control over your coverage.

- Limitations: Individual health insurance plans can be more expensive than employer-sponsored plans, and you may be subject to higher deductibles and copayments. You are also responsible for paying your premiums directly, which can be a burden for some individuals.

Family Health Insurance

Family health insurance plans are designed to cover multiple family members under a single policy. These plans provide comprehensive coverage for a family’s healthcare needs, including preventive care, hospitalization, and prescription drugs.

- Coverage Options: Family health insurance plans offer various coverage options, including plans with different deductibles, copayments, and coinsurance rates. Some plans may also include additional benefits like dental or vision coverage.

- Benefits: Family health insurance plans provide comprehensive coverage for a family’s healthcare needs at a lower cost than purchasing individual plans for each family member. They offer peace of mind knowing that all family members are covered under a single policy.

- Limitations: Family health insurance plans can be expensive, and you may be subject to higher deductibles and copayments. You are also responsible for paying your premiums directly, which can be a burden for some families.

Employer-Sponsored Health Insurance

Employer-sponsored health insurance plans are offered by employers to their employees. These plans are typically more affordable than individual plans and offer a wider range of coverage options.

- Coverage Options: Employer-sponsored health insurance plans offer various coverage options, including plans with different deductibles, copayments, and coinsurance rates. Some plans may also include additional benefits like dental or vision coverage.

- Benefits: Employer-sponsored health insurance plans are generally more affordable than individual plans, and employers often contribute to the premiums. These plans offer a wider range of coverage options and may include additional benefits not available in individual plans.

- Limitations: Employer-sponsored health insurance plans are tied to your employment. If you lose your job, you may lose your health insurance coverage. You may also have limited choices in coverage options and providers depending on your employer’s plan.

Medicare

Medicare is a federal health insurance program for individuals aged 65 and older, as well as younger individuals with certain disabilities. Medicare offers different coverage options, including Hospital Insurance (Part A), Medical Insurance (Part B), and Prescription Drug Coverage (Part D).

- Coverage Options: Medicare offers various coverage options, including Original Medicare (Part A and Part B) and Medicare Advantage (Part C). Medicare Advantage plans are offered by private insurance companies and provide additional benefits like dental, vision, and hearing coverage.

- Benefits: Medicare provides comprehensive coverage for a wide range of healthcare services, including hospitalization, doctor visits, and prescription drugs. It is a government-funded program, making it affordable for many individuals.

- Limitations: Medicare coverage may not cover all healthcare costs, and individuals may still have to pay deductibles and copayments. Medicare also has waiting periods for some services.

Medicaid

Medicaid is a state-funded health insurance program for low-income individuals and families. Medicaid eligibility is based on income and family size.

- Coverage Options: Medicaid offers various coverage options, including comprehensive health insurance coverage, dental care, and prescription drugs.

- Benefits: Medicaid provides affordable health insurance coverage for low-income individuals and families. It covers a wide range of healthcare services, ensuring access to essential medical care.

- Limitations: Medicaid eligibility is based on income and family size, and individuals may need to meet specific requirements to qualify. Medicaid coverage may vary depending on the state.

Table Comparing Key Features of Different Health Insurance Plans in Delaware

| Plan Type | Coverage Options | Benefits | Limitations |

|---|---|---|---|

| Individual Health Insurance | Flexible coverage options, various deductibles, copayments, and coinsurance rates. | Flexibility in choosing plans and providers. | Higher costs, higher deductibles and copayments, and responsibility for paying premiums directly. |

| Family Health Insurance | Comprehensive coverage for multiple family members, various deductibles, copayments, and coinsurance rates. | Comprehensive coverage at a lower cost than individual plans, peace of mind for all family members. | Higher costs, higher deductibles and copayments, and responsibility for paying premiums directly. |

| Employer-Sponsored Health Insurance | Various coverage options, different deductibles, copayments, and coinsurance rates. | More affordable than individual plans, employer contributions to premiums, wider range of coverage options, and additional benefits. | Tied to employment, limited choices in coverage options and providers, and potential loss of coverage if you lose your job. |

| Medicare | Original Medicare (Part A and Part B), Medicare Advantage (Part C), and Prescription Drug Coverage (Part D). | Comprehensive coverage for a wide range of healthcare services, affordable government-funded program. | May not cover all healthcare costs, deductibles and copayments, waiting periods for some services. |

| Medicaid | Comprehensive health insurance coverage, dental care, and prescription drugs. | Affordable health insurance coverage for low-income individuals and families, covers a wide range of healthcare services. | Eligibility based on income and family size, specific requirements to qualify, coverage may vary depending on the state. |

Key Considerations for Choosing Health Insurance

Choosing the right health insurance plan is crucial in Delaware, as it significantly impacts your healthcare costs and access to care. It’s essential to understand the factors that influence your choice and to carefully evaluate your needs and budget.

Understanding Deductibles, Copayments, and Out-of-Pocket Expenses

These are important financial components of health insurance plans, and understanding them is crucial for making informed decisions.

- Deductible: The amount you pay out-of-pocket for healthcare services before your insurance coverage kicks in. For example, if you have a $2,000 deductible, you would need to pay the first $2,000 in medical expenses yourself before your insurance starts covering the costs.

- Copayment: A fixed amount you pay for each medical service, such as a doctor’s visit or prescription. Copayments are usually a smaller amount than deductibles, but they apply to every service you receive. For instance, a copayment for a doctor’s visit might be $25.

- Out-of-Pocket Maximum: The maximum amount you will pay for healthcare expenses in a given year. Once you reach your out-of-pocket maximum, your insurance will cover 100% of your medical expenses for the rest of the year. Out-of-pocket maximums vary by plan, but they are generally designed to protect individuals from catastrophic medical costs.

Available Resources for Navigating Health Insurance Selection

Several resources are available to help individuals navigate the health insurance selection process in Delaware.

- Health Insurance Marketplace: The Health Insurance Marketplace (healthcare.gov) provides a platform for comparing and enrolling in health insurance plans. You can use the Marketplace to find plans that meet your needs and budget, and you can receive financial assistance to help make coverage more affordable.

- Delaware Department of Health and Social Services (DHSS): The DHSS offers a variety of resources for individuals seeking health insurance, including information on eligibility for programs like Medicaid and CHIP. You can contact the DHSS directly or visit their website for more information.

- Independent Insurance Brokers: Independent insurance brokers can provide personalized advice and assistance with selecting a health insurance plan. They can help you understand your options and find a plan that best meets your needs.

Navigating the Enrollment Process

Enrolling in a health insurance plan in Delaware is a crucial step toward ensuring you have access to quality healthcare. The enrollment process is designed to be user-friendly and provide you with the necessary information to make informed decisions. This section will guide you through the steps involved, deadlines, and eligibility requirements.

Understanding the Enrollment Periods, Health insurance in delaware state

The enrollment period for health insurance plans in Delaware is determined by the type of coverage you’re seeking.

- Open Enrollment Period: This period typically occurs annually, from November 1st to January 15th, allowing individuals to choose or change their health insurance plans.

- Special Enrollment Period: If you experience a qualifying life event, such as losing your job, getting married, or having a baby, you may be eligible for a special enrollment period to enroll in a plan outside of the open enrollment period.

Eligibility Requirements

To be eligible for health insurance in Delaware, you must meet certain requirements. These typically include:

- Residency: You must be a resident of Delaware.

- Citizenship: You must be a U.S. citizen, a lawful permanent resident, or have other eligible immigration status.

- Income: Depending on the plan you choose, there may be income eligibility requirements.

Step-by-Step Enrollment Guide

To make the enrollment process smoother, follow these steps:

- Determine Your Eligibility: Visit the official Delaware Health Insurance Marketplace website or contact the Delaware Department of Health and Social Services to confirm your eligibility.

- Compare Plans: Use the Marketplace website or contact a licensed insurance agent to compare different plans based on your needs and budget. Factors to consider include premiums, deductibles, copayments, and coverage benefits.

- Select a Plan: Choose the plan that best meets your needs and budget.

- Provide Required Information: During the enrollment process, you’ll need to provide personal information, such as your Social Security number, income, and family size.

- Pay Your Premium: Once you’ve enrolled, you’ll need to pay your monthly premium. You can often set up automatic payments to ensure your coverage remains active.

Additional Tips for a Smooth Enrollment

- Start Early: The enrollment process can take time, so start early to avoid any last-minute rush.

- Read the Fine Print: Carefully review the details of your chosen plan, including the coverage benefits, exclusions, and limitations.

- Seek Assistance: If you have questions or need help with the enrollment process, contact the Delaware Health Insurance Marketplace or a licensed insurance agent.

Accessing Healthcare Services: Health Insurance In Delaware State

Delaware boasts a robust healthcare infrastructure, providing residents with access to a wide range of medical professionals and facilities. The state is home to several hospitals, clinics, and specialized medical centers, ensuring comprehensive healthcare services are readily available.

Finding In-Network Doctors and Specialists

Locating in-network healthcare providers is crucial for maximizing your health insurance benefits. Most health insurance plans maintain a directory of doctors and specialists who participate in their network. These providers have agreed to specific rates with the insurance company, resulting in lower out-of-pocket costs for patients.

- Online Directories: Your health insurance company’s website usually offers a searchable directory of in-network providers. You can filter by specialty, location, and other criteria to find the right doctor for your needs.

- Phone Calls: Contact your insurance company’s customer service line to request a list of in-network providers in your area. They can also assist you in finding specialists based on your specific requirements.

- Referrals: Your primary care physician can often provide referrals to specialists within the network, ensuring seamless coordination of care.

Telehealth Options

Telehealth services have become increasingly popular, providing convenient and accessible healthcare options. Delaware offers a range of telehealth services, including virtual consultations, remote monitoring, and online prescription refills.

- Virtual Consultations: Many healthcare providers offer virtual consultations via video conferencing platforms, allowing patients to receive medical advice and diagnosis from the comfort of their homes.

- Remote Monitoring: Telehealth platforms can monitor patients’ health remotely, using wearable devices or other technologies to track vital signs and provide timely alerts to healthcare professionals.

- Online Prescription Refills: Patients can often refill their prescriptions online through their healthcare provider’s website or mobile app, eliminating the need for in-person visits.

Alternative Healthcare Services

Beyond traditional medical care, Delaware offers a variety of alternative healthcare services, catering to diverse health and wellness needs. These services can complement conventional treatments or provide holistic approaches to healthcare.

- Acupuncture: This ancient Chinese practice involves inserting thin needles into specific points on the body to stimulate energy flow and promote healing.

- Massage Therapy: Massage therapy can alleviate muscle tension, reduce stress, and improve circulation. Licensed massage therapists offer a range of techniques tailored to individual needs.

- Yoga and Meditation: These practices can promote relaxation, reduce stress, and improve overall well-being. Numerous studios and classes offer yoga and meditation instruction throughout Delaware.

Cost and Affordability

Understanding the cost of health insurance in Delaware is crucial for making informed decisions. This section will explore the average cost of premiums, available financial assistance programs, and strategies for minimizing your healthcare expenses.

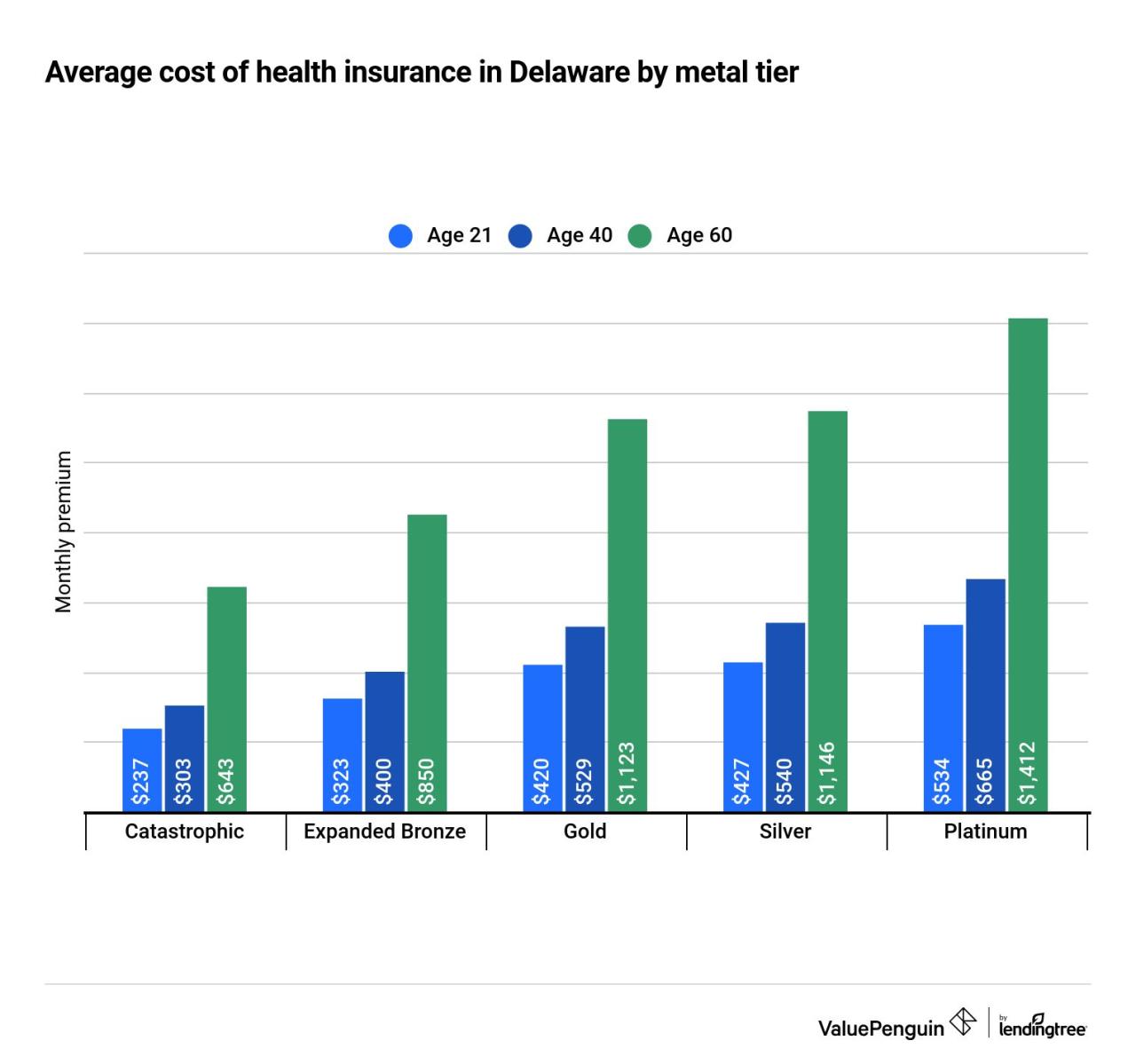

Average Cost of Health Insurance Premiums

The average cost of health insurance premiums in Delaware can vary significantly based on factors such as age, health status, location, and the type of plan chosen.

- According to the Kaiser Family Foundation, the average annual premium for employer-sponsored health insurance in Delaware was $7,978 for single coverage and $22,744 for family coverage in 2022.

- For individual plans purchased through the Health Insurance Marketplace, the average monthly premium ranged from $400 to $800, depending on the plan’s coverage and the individual’s income.

Financial Assistance Programs and Subsidies

Delaware offers several programs and subsidies to help individuals and families afford health insurance.

- The Affordable Care Act (ACA) Marketplace: This federal program provides tax credits to eligible individuals and families to lower their monthly premiums. The amount of the tax credit depends on income and family size.

- Delaware Health Insurance Assistance Program (DHIAP): This state-funded program provides financial assistance to low-income individuals and families to purchase health insurance.

- Medicaid: Delaware’s Medicaid program provides health coverage to low-income individuals, families, children, pregnant women, and people with disabilities.

Cost Comparison and Cost-Saving Strategies

Comparing the cost of different health insurance plans can help you find the most affordable option.

- Consider your needs: Evaluate your healthcare needs and prioritize coverage for essential services.

- Compare plans: Use online tools or contact insurance brokers to compare premiums, deductibles, copayments, and coverage levels of different plans.

- Explore cost-saving strategies:

- Negotiate with your employer: If you have employer-sponsored insurance, try to negotiate a lower premium or a higher employer contribution.

- Take advantage of preventive care: Many health insurance plans cover preventive services at no cost, such as annual checkups, vaccinations, and screenings.

- Use generic medications: Generic medications are typically much cheaper than brand-name medications.

- Shop around for healthcare services: Compare prices and quality of care from different providers.

Resources and Support

Navigating the world of health insurance can sometimes feel overwhelming, especially when you’re trying to understand your options and find the right coverage for your needs. Fortunately, Delaware offers a range of resources and support to help you through the process.

This section will provide information on key government agencies and organizations involved in healthcare in Delaware, consumer assistance programs and support services, and links to relevant websites and resources for obtaining additional information about health insurance in Delaware.

Government Agencies and Organizations

Government agencies and organizations play a crucial role in ensuring access to affordable and quality healthcare for Delaware residents. Here are some key entities to know:

- Delaware Department of Health and Social Services (DHSS): DHSS oversees various health programs and services, including Medicaid, CHIP, and the state’s health insurance marketplace, known as the Delaware Health Insurance Marketplace. They offer information, resources, and assistance to individuals and families seeking health insurance coverage.

- Delaware Insurance Commissioner: The Delaware Insurance Commissioner is responsible for regulating the state’s insurance industry, including health insurance. They ensure that insurance companies comply with state laws and protect consumers’ rights.

- Delaware Health Information Network (DHIN): DHIN is a non-profit organization that facilitates the secure exchange of health information among healthcare providers, insurers, and patients in Delaware. This network helps improve the coordination of care and ensures that patients’ health information is readily available to those who need it.

Consumer Assistance Programs and Support Services

Delaware offers various consumer assistance programs and support services to help individuals navigate the health insurance landscape. These programs can provide guidance on enrollment, eligibility, and financial assistance options.

- Delaware Health Insurance Marketplace Navigators: These trained professionals provide free, unbiased assistance to individuals and families seeking health insurance through the Delaware Health Insurance Marketplace. They can help with enrollment, eligibility determination, and understanding plan options.

- Consumer Health Information Centers: These centers offer free information and resources on health insurance, healthcare providers, and other health-related topics. They can answer questions, provide referrals, and help individuals understand their rights and options.

- Legal Aid Society of Delaware: This organization provides legal assistance to low-income individuals and families, including those facing challenges with health insurance or healthcare access.

Relevant Websites and Resources

Several online resources can provide comprehensive information about health insurance in Delaware. These websites offer details on plans, eligibility, enrollment processes, and consumer assistance programs.

- Delaware Health Insurance Marketplace: This website provides information on health insurance plans available through the state’s marketplace, eligibility criteria, and enrollment options.

- Delaware Department of Health and Social Services: DHSS’s website offers information on various health programs and services, including Medicaid, CHIP, and the state’s health insurance marketplace.

- Delaware Insurance Commissioner: The Delaware Insurance Commissioner’s website provides information on health insurance regulations, consumer protection, and resources for filing complaints.

- HealthCare.gov: This website provides national information about health insurance options, including eligibility criteria, plan details, and enrollment procedures.

Final Summary

Choosing the right health insurance plan in Delaware is a significant decision, requiring careful consideration of your individual needs and circumstances. By understanding the different plan types, factors to consider, and available resources, you can navigate the process effectively and secure coverage that meets your requirements. Remember, health insurance is an investment in your well-being, and making informed choices can ensure peace of mind and access to quality healthcare services.

Clarifying Questions

What are the eligibility requirements for financial assistance programs in Delaware?

Eligibility for financial assistance programs in Delaware is based on income and family size. You can visit the Delaware Health Insurance Marketplace website or contact the Delaware Department of Health and Social Services for specific eligibility criteria.

How can I find a doctor in my network?

Your health insurance plan will provide you with a directory of doctors and specialists within your network. You can access this directory online or through your insurance company’s customer service.

What are the deadlines for open enrollment?

The open enrollment period for health insurance plans in Delaware typically runs from November 1st to January 15th. However, there may be special enrollment periods for certain life events, such as losing your job or getting married.