Handyman insurance state farm – Handyman insurance from State Farm provides a safety net for those who work with their hands, offering protection against unexpected risks and financial burdens. Whether you’re a seasoned contractor or just starting out, this insurance can provide peace of mind and security knowing you’re covered in the event of accidents, property damage, or lawsuits.

State Farm’s handyman insurance policies are designed to meet the unique needs of independent contractors, offering a range of coverage options to tailor protection to your specific business activities. From liability coverage to workers’ compensation, State Farm provides a comprehensive suite of solutions to safeguard your livelihood and reputation.

Introduction to Handyman Insurance

Being a handyman can be a rewarding career, but it also comes with its share of risks. Accidents can happen, and unexpected events can arise, potentially leading to financial hardship. This is where handyman insurance comes in, providing a safety net to protect your business and your livelihood.

State Farm’s handyman insurance is designed to offer comprehensive coverage for the unique needs of skilled tradespeople. It’s more than just basic liability insurance; it provides a range of protections to safeguard your business from various risks.

Key Features and Benefits of State Farm’s Handyman Insurance

State Farm’s handyman insurance offers a comprehensive suite of benefits, designed to address the specific needs of skilled tradespeople.

- General Liability Coverage: This protects you from claims arising from property damage or bodily injury caused by your work or your employees. This is crucial for protecting your business from lawsuits and financial losses.

- Professional Liability Coverage: Also known as errors and omissions insurance, this protects you against claims of negligence or mistakes in your work, which can lead to financial losses or legal disputes.

- Property Coverage: This covers your tools, equipment, and materials from theft, damage, or loss, providing financial protection for your business assets.

- Workers’ Compensation Coverage: This protects your employees in case of work-related injuries or illnesses, ensuring they receive medical care and financial support. It also protects your business from lawsuits related to workplace accidents.

- Business Income Coverage: This provides financial support if your business is forced to shut down due to an insured event, such as a fire or natural disaster. This helps you cover your ongoing expenses and ensure business continuity.

- Other Coverage Options: State Farm also offers additional coverage options, such as auto insurance for your work vehicles and umbrella insurance for increased liability protection.

Common Risks Faced by Handymen

Handymen face a variety of risks in their day-to-day operations. These risks can be categorized as follows:

- Property Damage: Accidents can happen, leading to damage to the customer’s property or your own tools and equipment. This can result in expensive repairs and potential legal claims.

- Bodily Injury: Injuries can occur to you, your employees, or customers during work. This can lead to medical expenses, lost wages, and potential lawsuits.

- Professional Errors: Mistakes in your work, even unintentional ones, can lead to costly repairs, customer dissatisfaction, and potential lawsuits. This is where professional liability insurance comes in.

- Theft and Vandalism: Your tools, equipment, and materials can be stolen or vandalized, leading to significant financial losses.

- Natural Disasters: Events like fires, floods, and earthquakes can damage your property and disrupt your business operations.

Coverage Options for Handymen

State Farm offers various coverage options for handymen, tailored to their specific needs and the risks they face. These options are designed to protect handymen from financial hardship due to accidents, injuries, or property damage.

Liability Coverage

Liability coverage protects you from financial loss if you are found legally responsible for causing bodily injury or property damage to others while working on a job. This coverage can pay for medical expenses, legal fees, and settlements.

- General Liability: This is the most common type of liability coverage for handymen. It covers bodily injury and property damage caused by your work, as well as advertising injuries, such as copyright infringement.

- Products Liability: This coverage protects you if someone is injured or their property is damaged by a product you have made or sold.

- Completed Operations Liability: This coverage protects you after you have finished a job, if someone is injured or their property is damaged by your work.

Property Damage Coverage, Handyman insurance state farm

This coverage protects you from financial loss if your tools, equipment, or materials are damaged or stolen. It can also cover damage to your vehicle if it is used for work.

- Tools and Equipment Coverage: This coverage can help pay for repairs or replacement of tools and equipment damaged or stolen during work.

- Materials Coverage: This coverage can help pay for replacement of materials damaged or stolen during work.

- Vehicle Coverage: This coverage can help pay for repairs or replacement of your vehicle if it is damaged or stolen while being used for work.

Workers’ Compensation Coverage

This coverage protects you if you are injured or become ill as a result of your work. It can help pay for medical expenses, lost wages, and rehabilitation.

- State Requirements: The specific requirements for workers’ compensation coverage vary by state. You should consult with a State Farm agent to determine your state’s requirements.

- Coverage for Employees: If you have employees, you are required to have workers’ compensation coverage in most states. This coverage protects your employees if they are injured or become ill on the job.

- Coverage for Yourself: Even if you are a sole proprietor or independent contractor, you may want to consider workers’ compensation coverage for yourself. This can protect you from financial hardship if you are injured or become ill while working.

Coverage Levels and Premiums

The cost of your handyman insurance policy will depend on a number of factors, including your coverage options, the type of work you do, your location, and your experience.

- Basic Coverage: This level of coverage provides essential protection, such as general liability, tools and equipment coverage, and workers’ compensation coverage. It is the most affordable option.

- Comprehensive Coverage: This level of coverage provides broader protection, including higher liability limits, products liability, completed operations liability, and additional coverage for your vehicle. It is more expensive than basic coverage.

- Customized Coverage: You can customize your coverage to meet your specific needs. This allows you to choose the coverage options that are most important to you and your business.

Eligibility and Application Process

State Farm’s handyman insurance is designed to protect independent contractors and small business owners who perform various home repair and improvement tasks. To qualify for this insurance, you must meet specific criteria and follow the application process.

Eligibility Criteria

To be eligible for State Farm’s handyman insurance, you must meet the following requirements:

- Be a licensed and insured contractor: State Farm requires you to have a valid contractor’s license and general liability insurance to protect yourself and your clients from potential risks. This ensures you meet industry standards and have the necessary coverage for your business.

- Work within a defined geographic area: State Farm’s handyman insurance is typically available in specific regions. You should confirm if your work area is covered by contacting a State Farm agent or visiting their website.

- Have a good credit history: State Farm may consider your credit history as a factor in determining your eligibility and premium rates. Maintaining a good credit score can enhance your chances of approval.

- Provide accurate and complete information: During the application process, you must provide truthful and comprehensive details about your business, including your work history, types of services offered, and financial records. This information helps State Farm assess your risk and determine the appropriate coverage for your needs.

Application Process

The application process for State Farm’s handyman insurance typically involves the following steps:

- Contact a State Farm agent: The first step is to contact a local State Farm agent to discuss your insurance needs and obtain a quote. They can guide you through the application process and answer any questions you may have.

- Provide required documentation: State Farm will require you to provide certain documents, including:

- Proof of contractor’s license

- Proof of general liability insurance

- Business financial records

- Work history documentation

- Complete an application form: You will need to fill out an application form with detailed information about your business and insurance requirements. This form will help State Farm assess your risk and determine the appropriate coverage and premium rates.

- Receive a decision: Once State Farm reviews your application and documentation, they will notify you of their decision. If approved, you will receive a policy outlining your coverage and premium details.

Tips for Maximizing Your Chances of Approval

Here are some tips to improve your chances of getting approved for State Farm’s handyman insurance:

- Maintain a good credit score: A good credit history can positively impact your application and premium rates.

- Provide accurate and complete information: Ensure you provide truthful and comprehensive details about your business and insurance requirements.

- Obtain a contractor’s license: Having a valid contractor’s license demonstrates your professionalism and compliance with industry standards.

- Maintain general liability insurance: Having adequate general liability insurance protects you and your clients from potential risks.

- Work with a State Farm agent: Engaging with a State Farm agent can provide guidance and support throughout the application process.

Claims and Policy Management

It’s important to understand the process of filing a claim and managing your policy with State Farm. This section will provide you with the necessary information to navigate these aspects smoothly.

Filing a Claim

State Farm offers various methods for reporting a claim, ensuring convenience and accessibility for their policyholders. Here’s a breakdown of the common methods:

- Online Claim Reporting: This method is available 24/7 through the State Farm website. Simply log in to your account and follow the prompts to report your claim. This option is ideal for quick and easy reporting, particularly for non-emergency situations.

- Mobile App Reporting: State Farm’s mobile app allows you to file a claim directly from your smartphone or tablet. The app provides a user-friendly interface for reporting claims, uploading photos, and tracking claim progress.

- Phone Reporting: For immediate assistance or complex situations, you can contact State Farm’s customer service hotline. A representative will guide you through the claim reporting process and gather necessary details.

Claim Handling Procedures

Once you’ve reported your claim, State Farm will initiate the handling process, aiming to provide a fair and efficient resolution. Here’s a general Artikel of the steps involved:

- Initial Assessment: State Farm will review your claim details and determine the extent of the damage or loss. This assessment may involve an inspection by a qualified professional, such as an adjuster, to assess the damage and determine the cause.

- Claim Investigation: Based on the initial assessment, State Farm may conduct further investigation to gather evidence and verify the details of the claim. This could include contacting witnesses, reviewing documentation, or conducting additional inspections.

- Claim Evaluation: Once the investigation is complete, State Farm will evaluate the claim and determine the amount of coverage available. This evaluation will consider factors such as policy limits, deductibles, and the cause of the damage or loss.

- Claim Settlement: State Farm will offer a settlement based on the evaluation. You have the option to accept or negotiate the settlement offer. If you accept, State Farm will process the payment, and you will receive compensation for the covered losses.

Communication with State Farm

Maintaining clear and timely communication with State Farm is crucial throughout the claim process. This ensures that all parties are on the same page and that the claim progresses smoothly. Here are some tips for effective communication:

- Keep Records: Maintain records of all communication with State Farm, including dates, times, and details of conversations. This documentation can be helpful in case of any disputes or misunderstandings.

- Respond Promptly: Respond to all inquiries from State Farm in a timely manner. This demonstrates your commitment to resolving the claim and helps avoid delays in the process.

- Be Clear and Concise: When communicating with State Farm, use clear and concise language to avoid confusion. Provide all necessary information and avoid unnecessary details or jargon.

Policy Renewal Options

Renewing your State Farm handyman insurance policy ensures ongoing protection for your business. State Farm offers various renewal options to suit your needs:

- Automatic Renewal: By default, your policy will automatically renew at the end of the current term. This option provides seamless coverage, ensuring you don’t face any gaps in protection.

- Manual Renewal: You can choose to manually renew your policy before the current term expires. This option allows you to review your coverage options and make any necessary adjustments before renewing.

- Cancellation: If you decide to discontinue your coverage, you can cancel your policy before the renewal date. However, cancellation may result in a refund based on the remaining premium for the unexpired term.

Policy Changes

As your business needs evolve, you may need to make changes to your State Farm handyman insurance policy. State Farm offers various options for policy modifications:

- Coverage Adjustments: You can adjust your coverage levels to reflect changes in your business operations, such as increasing liability limits or adding specific types of coverage.

- Premium Payments: You can adjust your payment schedule or payment method, such as switching to monthly payments or setting up automatic payments.

- Contact Information: You can update your contact information, including your address, phone number, and email address, to ensure accurate communication from State Farm.

Importance of Professional Licensing and Insurance

In the realm of handyman services, obtaining professional licensing and insurance is not just a suggestion, it’s a necessity. It ensures you operate within legal boundaries, builds trust with clients, and safeguards your business from potential risks.

Legal Requirements for Handymen

The legal requirements for handymen vary depending on the specific location and type of work performed. However, most jurisdictions require some form of licensing or registration for those who perform certain types of services, especially those involving electrical, plumbing, or structural work.

- Licensing: In many areas, handymen are required to obtain a general contractor’s license or a specific trade license for the type of work they perform. This typically involves meeting educational and experience requirements, passing an exam, and paying a fee.

- Registration: Some jurisdictions may require handymen to register with the state or local government, even if they don’t need a full license. This often involves providing basic information about the business and paying a fee.

- Insurance: Carrying liability insurance is usually a requirement for licensed handymen, and it’s often a good idea even if not legally mandated. This protects you from financial losses if you are found liable for property damage or injuries that occur while working on a job.

Benefits of Being Licensed and Insured

The benefits of being licensed and insured go beyond simply complying with the law. They can significantly improve your business’s standing and your success.

- Increased Credibility: A license demonstrates that you meet specific standards and have the necessary skills and knowledge to perform the work. It adds legitimacy and professionalism to your business.

- Enhanced Customer Trust: Clients are more likely to hire a licensed and insured handyman, as it shows that you are committed to providing safe and reliable services. They know that you are accountable for your work and that they have recourse if something goes wrong.

- Competitive Advantage: In a competitive market, being licensed and insured can set you apart from other handymen who may not have these credentials. It can attract more clients and help you command higher rates.

- Legal Protection: Insurance provides financial protection against potential lawsuits and claims. If a client is injured on your job site or suffers property damage due to your work, insurance can cover the costs of legal defense, settlements, and judgments.

Cost Considerations and Budgeting

The cost of State Farm’s handyman insurance can vary depending on several factors. Understanding these factors and how they influence your premium can help you make informed decisions and effectively budget for your insurance expenses.

Factors Influencing Premium Pricing

Several factors influence the cost of handyman insurance, including the level of coverage, your experience, and the location of your work.

- Coverage Levels: The amount of coverage you choose directly impacts your premium. Higher coverage limits for liability, property damage, and other risks will generally result in higher premiums. You should carefully consider the types and levels of coverage that are most relevant to your work and potential risks.

- Experience: Your experience as a handyman can influence your premium. Individuals with a proven track record and extensive experience in the field may be considered lower risk and receive more favorable rates.

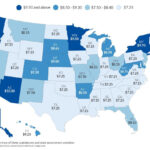

- Work Location: The location where you perform your handyman services can impact your premium. Areas with higher property values, denser populations, or a greater risk of natural disasters may have higher insurance rates.

Tips for Budgeting and Managing Insurance Expenses

- Compare Quotes: Obtain quotes from multiple insurance providers, including State Farm, to compare rates and coverage options. This allows you to identify the best value for your needs.

- Bundle Policies: If you have other insurance policies with State Farm, such as homeowners or auto insurance, consider bundling them together. This can often lead to discounts on your premiums.

- Review Coverage Regularly: As your business evolves and your needs change, it’s important to review your coverage regularly to ensure it remains adequate. You may need to adjust coverage levels or add specific endorsements as your business grows.

- Maintain a Good Payment History: Promptly paying your insurance premiums helps maintain a positive payment history, which can potentially qualify you for discounts or better rates in the future.

Safety Practices and Risk Mitigation

As a handyman, your safety and the safety of those around you are paramount. Taking proactive steps to minimize risks on the job site is essential for both personal well-being and business success.

Maintaining Safety on the Job Site

Maintaining a safe working environment is crucial for preventing accidents and injuries. Here are some best practices:

- Wear appropriate personal protective equipment (PPE): This includes safety glasses, gloves, hard hats, and footwear.

- Use proper tools and equipment: Ensure all tools are in good working order and are appropriate for the task at hand.

- Follow safety procedures: Familiarize yourself with and adhere to all relevant safety regulations and guidelines.

- Keep the work area clean and organized: Remove clutter and debris to prevent tripping hazards.

- Be aware of your surroundings: Pay attention to potential hazards and take precautions to avoid them.

Identifying and Mitigating Potential Risks

Handyman work often involves a variety of tasks that present unique risks. It’s essential to identify these risks and take steps to mitigate them:

- Working at heights: Use ladders and scaffolding safely, following manufacturer instructions and safety guidelines.

- Electrical hazards: Always de-energize circuits before working on them and use insulated tools.

- Fire hazards: Be aware of potential fire hazards, such as flammable materials and open flames, and take precautions to prevent fires.

- Tool and equipment hazards: Use tools and equipment properly and inspect them regularly for damage.

- Material handling hazards: Lift heavy objects safely and use proper lifting techniques.

The Role of Insurance in Promoting Safety

Handyman insurance plays a vital role in promoting safety and protecting your business:

- Liability coverage: Protects you against financial losses if you are held liable for an accident or injury on the job site.

- Property damage coverage: Covers damage to your customer’s property that occurs as a result of your work.

- Worker’s compensation coverage: Provides benefits to you or your employees if you are injured on the job.

“Having insurance encourages you to take safety seriously, knowing that you are protected in case of an accident.”

Customer Service and Support

State Farm is committed to providing excellent customer service and support to its policyholders. They understand that having a reliable and responsive insurance provider is crucial, especially when dealing with unexpected events.

State Farm offers a range of customer service channels to ensure you can reach them easily and conveniently.

Contacting State Farm

There are several ways to contact State Farm for assistance with your handyman insurance policy or to file a claim:

- Phone: You can call State Farm’s customer service hotline at 1-800-STATE-FARM (1-800-782-8332). Their customer service representatives are available 24/7 to answer your questions and assist with your needs.

- Online: State Farm’s website provides a comprehensive online portal where you can access your policy information, manage your account, file claims, and find answers to frequently asked questions. You can also submit inquiries through their online contact form.

- Mobile App: The State Farm mobile app allows you to manage your insurance policies, file claims, track claim status, and access other features directly from your smartphone or tablet.

- Local Agent: You can also contact your local State Farm agent for personalized assistance. They can provide guidance on your policy, help you file a claim, and answer any questions you may have.

Customer Testimonials and Reviews

State Farm has a strong reputation for its customer service. Numerous online reviews and testimonials highlight their responsiveness, helpfulness, and professionalism. For example, on independent review websites like Trustpilot and ConsumerAffairs, State Farm consistently receives high ratings for its customer service. Many customers praise their agents’ knowledge and willingness to go the extra mile to resolve issues.

Comparison with Other Insurance Providers: Handyman Insurance State Farm

Choosing the right insurance provider is crucial for handymen, as it safeguards their business and financial well-being. While State Farm is a reputable option, it’s essential to compare its offerings with other insurance providers to make an informed decision. This comparison helps you identify the best fit for your specific needs and budget.

Coverage Comparisons

Understanding the differences in coverage offered by various insurance providers is essential. Here’s a breakdown of key coverage areas and how State Farm stacks up against its competitors:

- General Liability: This covers bodily injury and property damage caused by your work. Most providers offer this coverage, but limits and deductibles can vary. State Farm typically offers competitive general liability limits, but it’s crucial to compare specific policy details with other providers.

- Workers’ Compensation: If you have employees, this coverage is mandatory in most states. State Farm offers workers’ compensation insurance, but it’s essential to compare rates and coverage with other providers, as pricing can fluctuate based on factors like industry and employee count.

- Professional Liability: This coverage protects you against claims of negligence or errors in your work. State Farm may offer professional liability as an optional add-on, but other providers might include it as standard coverage. Comparing these options is vital to ensure you have adequate protection.

- Property Coverage: This protects your tools, equipment, and vehicles used for your business. State Farm typically offers this coverage as part of its comprehensive handyman insurance package, but other providers might have separate policies for tools and equipment. It’s important to compare the extent of coverage and any exclusions.

Final Wrap-Up

Investing in handyman insurance from State Farm is a wise decision for any professional who takes pride in their work and wants to protect their business. With the right coverage, you can confidently pursue your passion, knowing you have the financial security and legal protection to navigate the challenges of the industry. By understanding your specific needs and exploring the various options available, you can choose a policy that provides the right level of protection and peace of mind for your handyman business.

Query Resolution

What are the benefits of having handyman insurance?

Handyman insurance offers several benefits, including protection against liability claims, coverage for property damage, and compensation for injuries sustained on the job. It also helps to enhance your credibility and build trust with clients, as it demonstrates your commitment to professionalism and responsibility.

How much does handyman insurance from State Farm cost?

The cost of handyman insurance from State Farm varies depending on factors such as your coverage levels, work location, experience, and the types of services you provide. It’s best to contact State Farm directly for a personalized quote.

What are the eligibility requirements for State Farm’s handyman insurance?

Eligibility requirements for State Farm’s handyman insurance may vary depending on your location and specific business activities. Generally, you’ll need to be a licensed and insured handyman with a clean business record. Contact State Farm for detailed eligibility criteria.

How do I file a claim with State Farm?

To file a claim with State Farm, you can contact their customer service department by phone, email, or through their website. They will guide you through the process and provide the necessary documentation. It’s important to keep accurate records of your work and any incidents that may occur.