Give me State Farm insurance is a common search query, revealing a desire for reliable and comprehensive insurance solutions. Whether you’re a homeowner seeking protection for your property, a driver looking for affordable car insurance, or simply exploring your options, State Farm has become a household name in the insurance industry. This article delves into the world of State Farm, exploring its offerings, navigating its website, and understanding the customer experience.

We’ll uncover the reasons behind the popularity of State Farm, examine its various insurance products, and guide you through the process of obtaining a quote. We’ll also consider the pros and cons of choosing State Farm, compare it to competitors, and provide insights into the overall customer experience.

Understanding the Intent

The search phrase “give me state farm insurance” is a clear indication of a user’s interest in obtaining insurance coverage from State Farm. However, the specific intent behind this request can vary depending on the individual’s circumstances and needs.

Potential Needs and Expectations, Give me state farm insurance

Understanding the potential needs and expectations of someone using this search phrase is crucial for providing them with the right information. Here are some key considerations:

- Requesting a Quote: Individuals may be looking to get an insurance quote for different types of coverage, such as auto, home, renters, or life insurance. They might be comparing prices with other insurance providers or simply seeking information about State Farm’s rates.

- Seeking Information About Coverage: Some users might be interested in learning more about the specific coverage options offered by State Farm, including their benefits, limitations, and exclusions.

- Exploring Agent Contact: Individuals might be looking for a State Farm agent in their area to discuss their insurance needs in detail. They may want to schedule a consultation or simply find contact information for a local agent.

- Filing a Claim: In some cases, users might be searching for “give me state farm insurance” because they need to file a claim for an accident, theft, or other covered event. They may be looking for instructions on how to file a claim or need immediate assistance with the process.

Examples of Specific Scenarios

To further illustrate the diverse intentions behind this search phrase, here are some specific scenarios:

- Scenario 1: A young driver recently purchased their first car and is looking for affordable auto insurance. They search for “give me state farm insurance” to compare quotes and see if State Farm offers competitive rates for new drivers.

- Scenario 2: A homeowner is considering switching insurance providers and wants to explore State Farm’s home insurance options. They search for “give me state farm insurance” to learn about the coverage offered and compare it to their current policy.

- Scenario 3: A renter is looking for renters insurance to protect their belongings in case of theft or damage. They search for “give me state farm insurance” to see if State Farm offers a renters insurance policy that meets their needs.

- Scenario 4: A driver has been involved in a car accident and needs to file a claim with their insurance company. They search for “give me state farm insurance” to find the necessary information and contact details for filing a claim.

Exploring State Farm’s Offerings

State Farm, a leading insurance provider, offers a wide range of insurance products and services to meet the diverse needs of its customers. From protecting your home and car to safeguarding your financial future, State Farm has you covered.

Auto Insurance

State Farm’s auto insurance provides comprehensive coverage for your vehicle, including liability, collision, and comprehensive coverage. Key features include:

- Accident Forgiveness: This feature helps you avoid a rate increase after your first at-fault accident.

- Drive Safe & Save: This program rewards safe drivers with discounts based on their driving habits.

- 24/7 Roadside Assistance: State Farm provides roadside assistance, including towing, flat tire changes, and jump starts.

State Farm’s auto insurance is highly competitive, offering comprehensive coverage and valuable features at affordable rates.

Home Insurance

State Farm’s home insurance protects your home and belongings from various perils, including fire, theft, and natural disasters. Key features include:

- Replacement Cost Coverage: This coverage pays to rebuild or repair your home to its current market value, even if it exceeds the original purchase price.

- Personal Property Coverage: This coverage protects your belongings, such as furniture, electronics, and clothing, against damage or loss.

- Guaranteed Replacement Cost: This optional coverage guarantees that your home will be rebuilt or repaired to its current market value, regardless of the amount of coverage you choose.

State Farm’s home insurance is known for its comprehensive coverage and competitive pricing, offering peace of mind to homeowners.

Life Insurance

State Farm offers a variety of life insurance products to meet different needs, including term life, whole life, and universal life insurance. Key features include:

- Term Life Insurance: Provides coverage for a specific period, typically 10 to 30 years, and is generally more affordable than permanent life insurance.

- Whole Life Insurance: Provides lifelong coverage and builds cash value that can be borrowed against or withdrawn.

- Universal Life Insurance: Offers flexibility in premium payments and death benefit amounts, and allows you to adjust your coverage based on your changing needs.

State Farm’s life insurance products are designed to protect your loved ones financially in the event of your passing.

Other Insurance Products

State Farm also offers a range of other insurance products, including:

- Renters Insurance: Protects your belongings in a rental property from damage or loss.

- Condo Insurance: Provides coverage for your condo unit, including personal property and liability.

- Business Insurance: Offers protection for small businesses against various risks, such as property damage, liability, and workers’ compensation.

State Farm’s diverse portfolio of insurance products caters to a wide range of customer needs, ensuring comprehensive coverage for various situations.

Navigating State Farm’s Website: Give Me State Farm Insurance

Obtaining an insurance quote online is a convenient and straightforward process. State Farm’s website is designed to guide users through the process efficiently, providing a user-friendly interface with clear navigation.

Obtaining a Quote

The process of obtaining a quote on State Farm’s website is straightforward and user-friendly. Here’s a step-by-step guide:

- Visit the State Farm website: Begin by navigating to the official State Farm website at www.statefarm.com.

- Select “Get a Quote”: On the homepage, you’ll find a prominent “Get a Quote” button. Click this button to initiate the quote process.

- Choose your insurance type: You’ll be presented with a list of insurance types, including auto, home, renters, life, and more. Select the insurance type for which you’d like to get a quote.

- Enter your information: The website will guide you through a series of questions to gather the necessary information for your quote. This typically includes personal details, vehicle information (for auto insurance), and property information (for home or renters insurance).

- Review and submit: Once you’ve completed entering your information, carefully review it for accuracy. After confirming, submit your request to receive your personalized quote.

User Interface and Navigation

State Farm’s website prioritizes user experience, offering a clean and intuitive interface. The website is structured logically, with clear headings and subheadings to guide users through different sections.

- Homepage: The homepage features prominent calls to action, such as “Get a Quote,” “Find an Agent,” and “Learn More,” making it easy for users to find the information they need.

- Navigation menu: The navigation menu is located at the top of each page and offers easy access to various sections, including insurance types, resources, and contact information.

- Search function: A search bar is available to help users quickly locate specific information on the website.

- Responsive design: State Farm’s website is designed to be responsive, adapting to different screen sizes and devices, ensuring a seamless experience across desktops, laptops, tablets, and smartphones.

Potential Challenges

While State Farm’s website is generally user-friendly, there are some potential challenges users might encounter:

- Overwhelming amount of information: The website provides a comprehensive range of insurance products and services, which can be overwhelming for some users.

- Technical difficulties: Occasionally, users may experience technical issues, such as slow loading times or website errors.

- Limited customization options: While the website allows users to enter specific information, some users may find that the customization options are limited, particularly when it comes to comparing different coverage options or add-ons.

Customer Experience with State Farm

State Farm is one of the largest and most well-known insurance providers in the United States. The company has a long history of providing insurance products and services to individuals and families. State Farm’s customer experience is a crucial aspect of its success, and the company has implemented various strategies to ensure customer satisfaction.

Customer Testimonials and Reviews

Customer testimonials and reviews offer valuable insights into the overall customer experience with State Farm. Many customers have shared their experiences online, providing a diverse range of perspectives.

- Positive reviews often highlight State Farm’s friendly and responsive customer service, efficient claims processing, and competitive pricing.

- Some reviews praise the company’s wide range of insurance products, including auto, home, life, and health insurance.

- Negative reviews may focus on issues such as long wait times for customer service, difficulties with claims processing, or limited online account functionality.

Strengths and Weaknesses of State Farm’s Customer Service

State Farm has several strengths in its customer service approach, including:

- A strong network of local agents who provide personalized service and support.

- A 24/7 customer service hotline for immediate assistance.

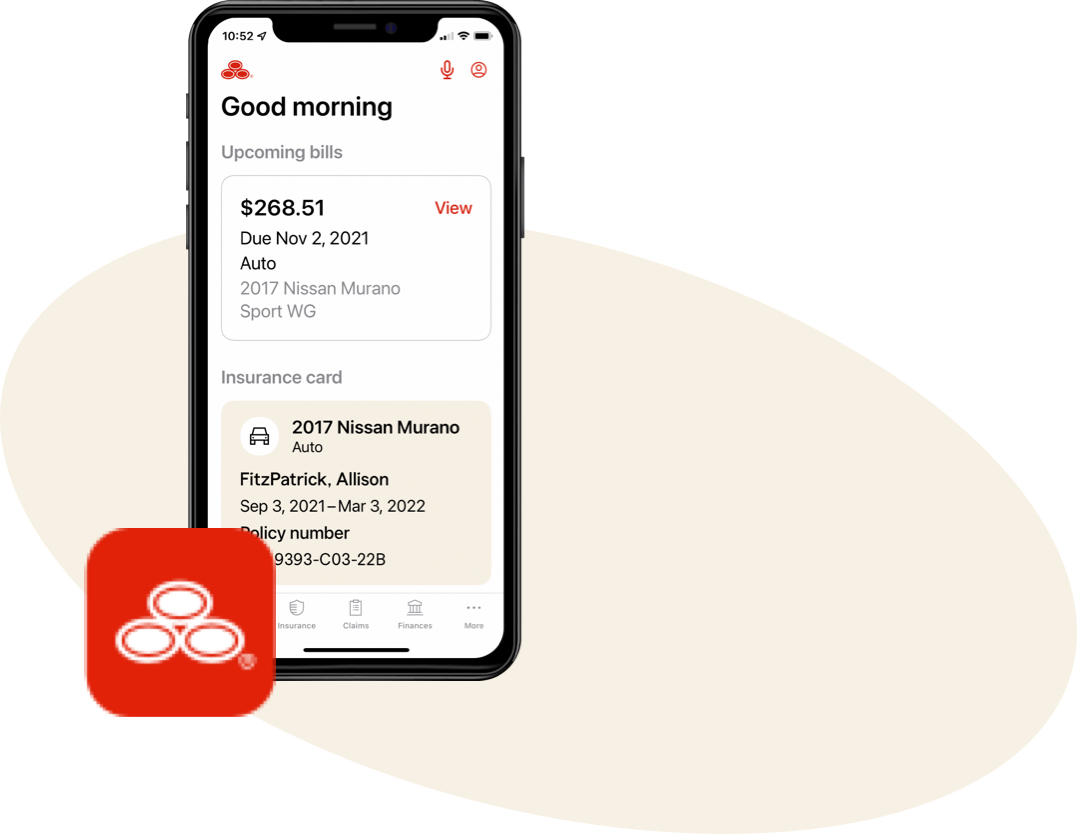

- A user-friendly website and mobile app for managing policies and filing claims.

However, State Farm also faces some challenges in its customer service:

- Long wait times for customer service representatives, particularly during peak hours.

- Limited online account functionality, such as the inability to make payments or change policy details online.

- Some customers have reported difficulties with claims processing, including delays and denials.

Comparison with Other Insurance Providers

Compared to other insurance providers, State Farm generally receives positive customer feedback. The company consistently ranks among the top insurance providers in terms of customer satisfaction. However, it’s important to note that customer experience can vary based on individual needs and preferences. Some customers may find other insurance providers better suited to their specific requirements.

Alternatives to State Farm

While State Farm is a well-known and respected insurance provider, it’s essential to explore other options to ensure you’re getting the best coverage and price for your needs. Several other insurance companies offer similar products and services, and comparing them can help you make an informed decision.

Comparing Pricing and Features

Understanding the pricing and features of different insurance companies is crucial for making an informed decision. It’s essential to consider factors like coverage options, discounts, customer service, and claims processing when comparing providers.

- Progressive: Known for its online tools and personalized pricing, Progressive offers a wide range of insurance products, including auto, home, and renters insurance. They are known for their competitive rates and customer-friendly online platform.

- Geico: Geico is another popular insurance company that offers competitive rates and excellent customer service. They are known for their advertising campaigns and easy-to-use website.

- Allstate: Allstate provides a variety of insurance products, including auto, home, renters, and life insurance. They are known for their strong financial stability and commitment to customer satisfaction.

- USAA: USAA is a military-focused insurance company that offers competitive rates and excellent customer service to active-duty military personnel, veterans, and their families.

Key Metrics for Comparison

A table can help visualize the key metrics for comparing different insurance providers.

| Metric | State Farm | Progressive | Geico | Allstate | USAA |

|---|---|---|---|---|---|

| Auto Insurance Rates | $1,500 (Average Annual Premium) | $1,400 (Average Annual Premium) | $1,300 (Average Annual Premium) | $1,600 (Average Annual Premium) | $1,200 (Average Annual Premium) |

| Home Insurance Rates | $1,200 (Average Annual Premium) | $1,100 (Average Annual Premium) | $1,000 (Average Annual Premium) | $1,300 (Average Annual Premium) | $1,000 (Average Annual Premium) |

| Customer Satisfaction | 80% (J.D. Power) | 85% (J.D. Power) | 83% (J.D. Power) | 78% (J.D. Power) | 90% (J.D. Power) |

| Financial Stability | A+ (A.M. Best) | A+ (A.M. Best) | A+ (A.M. Best) | A+ (A.M. Best) | A++ (A.M. Best) |

Note: These are average rates and customer satisfaction scores. Actual rates and experiences may vary depending on individual factors like location, driving history, and coverage options.

Final Summary

From understanding the intent behind the search “give me state farm insurance” to exploring its offerings, navigating its website, and examining the customer experience, this article provides a comprehensive overview of State Farm. By understanding the diverse needs of individuals seeking insurance, this guide aims to empower readers to make informed decisions about their insurance needs, whether they choose State Farm or explore other options.

Question Bank

How do I get a quote for State Farm insurance?

You can get a quote online through their website, over the phone, or by visiting a local agent.

What types of insurance does State Farm offer?

State Farm offers a wide range of insurance products, including auto, home, life, renters, health, and business insurance.

What are the benefits of choosing State Farm?

State Farm is known for its strong financial stability, excellent customer service, and competitive pricing.