Get State Farm Insurance and unlock a world of reliable coverage and personalized protection. Whether you’re seeking auto, home, life, or other insurance products, State Farm has you covered. With a rich history spanning decades, State Farm has earned a reputation for its commitment to customer satisfaction and financial stability. Their comprehensive insurance solutions are designed to meet the diverse needs of individuals and families, offering peace of mind and financial security.

Navigating the insurance landscape can be overwhelming, but State Farm simplifies the process. From obtaining a personalized quote to exploring various coverage options, their user-friendly online platform and dedicated agents make it easy to find the right insurance plan for your specific needs.

State Farm Insurance Overview

State Farm Insurance is a leading insurance provider in the United States, known for its wide range of products and services. Founded in 1922, the company has grown to become one of the largest and most trusted insurance companies in the country.

State Farm Insurance offers a comprehensive suite of insurance products to meet the diverse needs of its customers. Its core services include auto, home, life, and other insurance products, providing protection against a wide range of risks.

State Farm’s History and Origins

State Farm was founded in 1922 by George J. Mecherle, a farmer from Bloomington, Illinois. Mecherle’s vision was to create an insurance company that would provide affordable and reliable coverage for farmers. State Farm’s initial focus was on auto insurance, which quickly gained popularity among rural residents.

Core Services Offered by State Farm Insurance

State Farm’s primary insurance products include:

- Auto Insurance: State Farm offers a wide range of auto insurance options, including liability, collision, comprehensive, and uninsured motorist coverage. They also provide various discounts and features, such as accident forgiveness and usage-based insurance programs.

- Home Insurance: State Farm provides comprehensive coverage for homeowners, including protection against fire, theft, natural disasters, and other perils. They offer various policy options to suit different needs and budgets.

- Life Insurance: State Farm offers a variety of life insurance products, including term life, whole life, and universal life insurance. These policies help provide financial security for loved ones in the event of an untimely death.

- Other Insurance Products: State Farm also provides a range of other insurance products, such as renters insurance, condo insurance, business insurance, and health insurance. These products cater to diverse needs and offer protection against various risks.

State Farm’s Market Presence and Customer Base

State Farm is a dominant player in the US insurance market, with a vast customer base and a strong reputation for reliability and customer service. Some key facts and figures about State Farm’s market presence include:

- Largest Auto Insurer in the US: State Farm is the largest auto insurer in the United States, holding a significant market share in this segment.

- Extensive Agent Network: State Farm has a vast network of agents across the country, providing personalized service and local expertise to its customers.

- Strong Financial Stability: State Farm is known for its strong financial stability and consistently high ratings from independent agencies, reflecting its commitment to paying claims and fulfilling its obligations.

- Customer Satisfaction: State Farm consistently ranks high in customer satisfaction surveys, indicating its commitment to providing excellent customer service and meeting the needs of its policyholders.

Getting a Quote

Getting a quote for State Farm insurance is a straightforward process that can be completed online in just a few minutes. State Farm’s website is user-friendly and allows you to personalize your coverage options to meet your specific needs.

Factors Affecting Insurance Premiums

Insurance premiums are determined by a variety of factors, including your driving history, vehicle type, location, and coverage options.

- Driving History: Your driving record, including any accidents, violations, or points on your license, significantly impacts your premium. A clean driving history generally results in lower premiums.

- Vehicle Type: The make, model, and year of your vehicle play a crucial role in determining your premium. Higher-value vehicles or those with a history of theft or accidents often have higher premiums.

- Location: Your geographic location influences your premium due to factors like population density, crime rates, and weather conditions. Areas with higher traffic congestion or a history of severe weather events may have higher premiums.

- Coverage Options: The level of coverage you choose, such as liability, collision, comprehensive, and uninsured motorist coverage, directly affects your premium. Higher coverage limits generally result in higher premiums.

Comparison of State Farm Rates with Competitors

State Farm is a major player in the insurance industry, and its rates are generally competitive with other leading insurers. However, premiums can vary significantly depending on the factors mentioned above. Here is a comparison of State Farm’s average rates with those of its major competitors, based on a hypothetical profile:

| Insurer | Average Annual Premium | Key Differences |

|---|---|---|

| State Farm | $1,200 | Strong customer service reputation, extensive agent network, various discounts available. |

| Geico | $1,150 | Known for its online convenience and competitive rates, often offering lower premiums for good drivers. |

| Progressive | $1,180 | Offers a wide range of coverage options and discounts, including personalized pricing based on driving behavior. |

| Allstate | $1,250 | Strong focus on customer satisfaction, offers a variety of insurance products, and provides 24/7 customer support. |

It’s important to note that these are just average rates and your actual premium may vary. It’s always advisable to obtain quotes from multiple insurers to compare rates and find the best coverage for your needs.

Coverage Options

State Farm offers a variety of insurance coverage options to protect you and your assets. Understanding the different types of coverage and their benefits is crucial to ensuring you have the right protection.

Liability Coverage

Liability coverage protects you financially if you are found responsible for an accident that causes damage to another person’s property or injuries to another person. It covers the costs of:

- Medical expenses for the injured party

- Property damage

- Legal fees

- Lost wages

Liability coverage is typically divided into two parts: bodily injury liability and property damage liability. Bodily injury liability covers injuries to other people, while property damage liability covers damage to their property.

The amount of liability coverage you need will depend on your individual circumstances, but it’s generally recommended to have at least $100,000 per person and $300,000 per accident for bodily injury liability and $100,000 for property damage liability.

Collision Coverage

Collision coverage pays for repairs to your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional and may not be necessary if you have an older vehicle or if you can afford to pay for repairs out of pocket.

Collision coverage typically has a deductible, which is the amount you pay out of pocket before your insurance company covers the remaining costs.

Comprehensive Coverage

Comprehensive coverage protects you from damage to your vehicle caused by events other than accidents, such as:

- Theft

- Vandalism

- Fire

- Hail

- Flooding

Like collision coverage, comprehensive coverage typically has a deductible.

Uninsured Motorist Coverage

Uninsured motorist coverage protects you if you are injured in an accident caused by an uninsured or hit-and-run driver. This coverage will pay for your medical expenses, lost wages, and other damages.

Uninsured motorist coverage is mandatory in many states, and it’s a good idea to have it even if you have full coverage on your vehicle.

Coverage Limits and Deductibles

Here is a table outlining the typical coverage limits and deductibles for various State Farm insurance policies:

| Coverage Type | Coverage Limit | Deductible |

|—|—|—|

| Liability | $100,000/$300,000 | N/A |

| Collision | Actual Cash Value (ACV) | $500 – $1,000 |

| Comprehensive | Actual Cash Value (ACV) | $500 – $1,000 |

| Uninsured Motorist | $100,000/$300,000 | N/A |

Customer Experience: Get State Farm Insurance

State Farm is one of the largest and most well-known insurance companies in the United States. With a long history and a vast network of agents, the company has built a reputation for its customer service and claims handling.

Customer Service and Claims Handling

State Farm is known for its strong customer service and claims handling processes. The company has consistently ranked high in customer satisfaction surveys, and its agents are often praised for their responsiveness and helpfulness. State Farm has a reputation for being fair and efficient in handling claims, with a focus on resolving issues quickly and effectively.

Customer Testimonials and Reviews

Online reviews and testimonials from State Farm customers generally reflect a positive experience. Many customers appreciate the company’s personalized service, friendly agents, and straightforward claims process.

“I’ve been with State Farm for over 20 years and have always been happy with their service. My agent is always there to answer my questions and help me with any issues. When I had a claim, they were very responsive and helped me get everything sorted out quickly.” – John Smith, State Farm customer

“I was very impressed with how quickly State Farm handled my claim. They were very professional and kept me informed every step of the way. I would definitely recommend them to anyone looking for insurance.” – Jane Doe, State Farm customer

Advantages and Disadvantages of Working with State Farm Agents

Advantages

- Personalized service: State Farm agents can provide personalized advice and support, tailored to your specific needs and circumstances.

- Local expertise: Agents have a deep understanding of the local market and can offer insights into coverage options and pricing.

- Convenience: Agents can provide a convenient one-stop shop for all your insurance needs, from obtaining quotes to filing claims.

Disadvantages

- Limited availability: Agents may not be available outside of business hours, which can be inconvenient for customers with busy schedules.

- Potential for bias: Agents may be more likely to recommend products that benefit them financially, rather than those that are best for the customer.

Digital Tools and Resources

State Farm understands the importance of convenient and accessible services in today’s digital world. They have invested in developing a robust suite of digital tools and resources that empower customers to manage their insurance needs efficiently and effectively.

State Farm Mobile App, Get state farm insurance

The State Farm mobile app is a comprehensive platform that allows policyholders to access a wide range of services from the convenience of their smartphones.

- View Policy Details: Easily access policy information, including coverage details, deductibles, and payment history.

- Manage Payments: Make payments, view payment history, and set up automatic payments.

- Report Claims: Submit claims quickly and easily with photos and detailed descriptions.

- Track Claim Status: Stay informed about the progress of your claim with real-time updates.

- Find Agents: Locate nearby State Farm agents and schedule appointments.

- Access Digital ID Cards: Store and access digital copies of your insurance cards for easy reference.

- Get Roadside Assistance: Request roadside assistance services directly through the app.

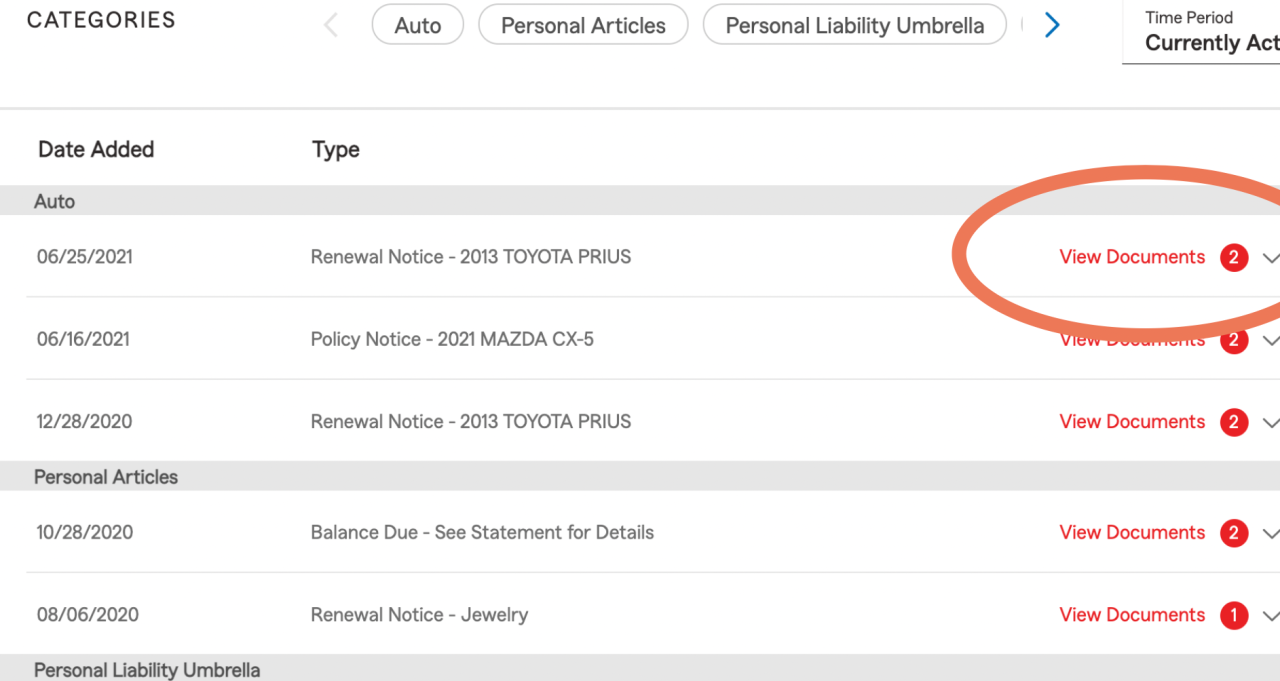

State Farm Online Portal

The State Farm online portal offers a similar set of features as the mobile app, providing customers with a desktop-based platform to manage their insurance needs.

- Policy Management: View and update policy details, make changes to coverage, and manage payments.

- Claim Reporting: File claims online with detailed information and supporting documentation.

- Document Upload: Upload necessary documents, such as proof of loss or vehicle registration.

- Communication Center: Send and receive messages with State Farm representatives regarding policy inquiries or claims.

Technology-Driven Customer Experience

State Farm leverages technology to enhance the customer experience in several ways:

- AI-Powered Chatbots: State Farm utilizes AI-powered chatbots to provide instant support and answer common questions, reducing wait times and improving customer satisfaction.

- Personalized Recommendations: Based on customer data and preferences, State Farm can provide personalized recommendations for coverage options and discounts.

- Digital Document Management: State Farm’s digital document management system allows customers to securely store and access important insurance documents online, eliminating the need for physical paperwork.

- Real-Time Claims Tracking: Customers can track the progress of their claims in real-time through the mobile app and online portal, providing transparency and peace of mind.

Discounts and Promotions

State Farm Insurance offers a wide range of discounts and promotions to help customers save money on their insurance premiums. These savings can be significant, and by understanding the various discount programs, customers can maximize their savings.

Discounts

State Farm offers a variety of discounts that can reduce your insurance premiums. Here are some of the most common discounts:

- Safe Driving Discount: This discount is available to drivers with a clean driving record. The discount amount varies depending on the driver’s driving history and the type of insurance policy.

- Bundling Discount: Customers who bundle multiple insurance policies, such as home, auto, and life insurance, with State Farm can receive a significant discount on their premiums.

- Good Student Discount: This discount is available to students who maintain a certain GPA. The discount amount varies depending on the student’s GPA and the type of insurance policy.

- Other Discounts: State Farm offers a variety of other discounts, such as discounts for homeowners who install safety features, discounts for drivers who complete defensive driving courses, and discounts for military personnel.

Eligibility Criteria

To be eligible for a discount, customers must meet specific criteria. For example, to qualify for the safe driving discount, drivers must have a clean driving record for a certain period of time. To qualify for the good student discount, students must maintain a certain GPA.

Maximizing Savings

Customers can maximize their savings by taking advantage of all available discounts. This includes making sure they meet the eligibility criteria for each discount and providing State Farm with all necessary documentation. Customers should also contact their State Farm agent to discuss their individual needs and see which discounts they qualify for.

Current Promotions

State Farm offers a variety of promotions throughout the year. These promotions can vary by location and time of year. To learn about current promotions, customers should contact their State Farm agent or visit the State Farm website.

Financial Stability and Ratings

When considering an insurance provider, financial stability is paramount. State Farm’s commitment to long-term financial strength is reflected in its consistently high ratings from independent agencies.

These ratings provide valuable insights into an insurance company’s ability to meet its obligations to policyholders. They are based on rigorous analysis of factors such as financial performance, reserve levels, and overall risk management practices.

Financial Strength Ratings

State Farm has consistently received top ratings from leading financial rating agencies, signifying its strong financial standing and ability to fulfill its obligations to policyholders.

- A.M. Best: State Farm holds an A++ (Superior) rating from A.M. Best, the highest possible rating. This rating reflects State Farm’s exceptional financial strength, operating performance, and business profile.

- Standard & Poor’s: State Farm has an AA+ rating from Standard & Poor’s, indicating its strong financial strength and stable outlook. This rating underscores State Farm’s ability to meet its financial commitments even in challenging economic conditions.

- Moody’s: State Farm boasts an Aa1 rating from Moody’s, indicating its excellent financial strength and very low credit risk. This rating highlights State Farm’s sound financial management and its ability to withstand economic downturns.

Impact of Financial Stability

These high ratings from independent agencies are a testament to State Farm’s financial stability and commitment to its customers. They offer several key benefits, including:

- Enhanced Customer Confidence: High ratings instill confidence in policyholders, knowing that State Farm is financially sound and capable of fulfilling its obligations in the event of a claim.

- Long-Term Reliability: State Farm’s strong financial standing ensures its long-term viability and its ability to continue providing insurance services for years to come. This provides policyholders with peace of mind knowing that their insurance coverage will remain in place.

- Stability in Challenging Times: During economic downturns or unexpected events, financially stable insurance companies like State Farm are better equipped to weather the storm and continue providing reliable coverage.

Community Involvement and Philanthropy

Beyond its financial stability, State Farm is deeply committed to its communities. The company actively supports various philanthropic initiatives, demonstrating its dedication to social responsibility and making a positive impact.

- State Farm Neighborhood Assist Program: This program provides grants to non-profit organizations that address critical community needs, such as education, safety, and environmental sustainability.

- State Farm Youth Advisory Councils: State Farm engages youth in its community efforts by establishing Youth Advisory Councils, providing them with a platform to advocate for issues that matter to them and make a difference in their communities.

- Disaster Relief Efforts: State Farm plays a crucial role in disaster relief efforts, providing financial assistance and support to communities affected by natural disasters.

Ultimate Conclusion

In conclusion, getting State Farm insurance provides a robust foundation for financial security and peace of mind. Their commitment to customer service, financial stability, and innovative digital tools makes them a trusted partner in protecting what matters most. Whether you’re a seasoned driver or a new homeowner, State Farm offers tailored solutions that meet your unique requirements, ensuring that you’re adequately protected against life’s uncertainties.

Questions and Answers

How do I file a claim with State Farm?

You can file a claim online, through their mobile app, or by calling their customer service line. They have a dedicated claims team available 24/7 to assist you.

What are the common discounts offered by State Farm?

State Farm offers a wide range of discounts, including safe driver, good student, multi-policy, and bundling discounts. You can find a detailed list on their website.

How can I contact a State Farm agent?

You can find a State Farm agent in your area using their online agent locator tool. They also have a dedicated customer service line for general inquiries.