Get an insurance quote state farm – Get an insurance quote from State Farm, and discover how this leading insurance provider can protect your assets and provide peace of mind. State Farm has a long history of offering comprehensive insurance solutions, ranging from auto and home to life and health insurance. They are known for their customer-centric approach, competitive rates, and commitment to providing excellent service.

Understanding the process of obtaining a quote is crucial. State Farm offers multiple avenues for requesting a quote, including online, over the phone, or through a local agent. The process is generally straightforward and involves providing essential information about yourself, your vehicle, and your desired coverage. Factors like your driving history, credit score, and location play a role in determining your quote price.

Understanding State Farm Insurance

State Farm Insurance is one of the largest and most well-known insurance providers in the United States. Founded in 1922 by George J. Mecherle, the company has grown significantly over the years, establishing itself as a household name synonymous with reliable and comprehensive insurance solutions.

History and Mission of State Farm Insurance

State Farm’s mission is to “help people manage the risks of everyday life, recover from the unexpected, and realize their dreams.” This commitment to customer well-being is reflected in the company’s history, which is marked by a focus on innovation and customer satisfaction. State Farm was one of the first insurers to offer auto insurance policies that covered liability, collision, and comprehensive coverage. This pioneering approach led to the company’s rapid growth and expansion, eventually becoming one of the most recognized insurance providers in the nation.

Types of Insurance Products Offered by State Farm

State Farm offers a wide range of insurance products to meet the diverse needs of its customers.

- Auto Insurance: This is State Farm’s flagship product, providing coverage for liability, collision, comprehensive, and other auto-related risks.

- Homeowners Insurance: State Farm provides comprehensive protection for homeowners against various perils, including fire, theft, and natural disasters.

- Renters Insurance: This policy protects renters against loss or damage to their personal belongings and provides liability coverage.

- Life Insurance: State Farm offers various life insurance products, including term life, whole life, and universal life, to help individuals financially secure their loved ones in the event of their passing.

- Health Insurance: State Farm provides health insurance plans through its partnership with Blue Cross Blue Shield.

- Business Insurance: State Farm offers a comprehensive suite of insurance products for businesses, including property, liability, and workers’ compensation coverage.

- Other Insurance Products: State Farm also provides insurance for motorcycles, boats, recreational vehicles, and more.

Customer Service Initiatives at State Farm

State Farm is known for its strong customer service focus. The company has implemented various initiatives to ensure customer satisfaction, including:

- 24/7 Customer Support: State Farm offers 24/7 customer support through phone, email, and online chat.

- Mobile App: The State Farm mobile app allows customers to manage their policies, file claims, and access other services conveniently.

- Agent Network: State Farm has a vast network of agents across the country, providing personalized service and guidance to customers.

- Customer Feedback Programs: State Farm actively solicits customer feedback through surveys and other channels to identify areas for improvement.

The Process of Getting a Quote

Getting a quote for insurance from State Farm is a straightforward process. You can choose from several methods, each offering its own benefits and convenience.

Methods of Requesting a Quote

State Farm provides various ways to obtain an insurance quote, catering to different preferences and levels of comfort with technology.

- Online: This method offers the most convenience and flexibility. You can access the State Farm website or mobile app and enter your details into an online form. The process is usually quick and allows you to compare different coverage options and adjust them to fit your needs.

- Phone: If you prefer personal interaction, you can call State Farm directly. A representative will guide you through the quote process, asking relevant questions and providing personalized recommendations. This method is particularly helpful for those who need more detailed explanations or have complex insurance needs.

- Agent: You can schedule an appointment with a local State Farm agent. This allows for face-to-face interaction and personalized advice. The agent can assess your specific situation and provide tailored recommendations, ensuring you have the right coverage for your needs.

Information Needed for a Quote, Get an insurance quote state farm

To receive an accurate and personalized quote, State Farm requires specific information about your situation.

| Category | Information Needed |

|---|---|

| Personal Details | Name, Address, Date of Birth, Contact Information |

| Vehicle Details | Year, Make, Model, VIN, Mileage, Usage, Location |

| Driving History | Driving Record, Accidents, Violations, Previous Insurance |

| Coverage Preferences | Desired Coverage Levels, Deductibles, Additional Features |

Factors Influencing Quote Prices

Your State Farm insurance quote is tailored to your specific circumstances. Several factors are considered to determine the price you’ll pay for your policy. Understanding these factors can help you make informed decisions about your insurance coverage.

Personal Details

Your personal details, such as age, gender, marital status, and credit history, can influence your insurance quote. These factors are used to assess your risk profile, as they can indicate your likelihood of filing a claim. For example, younger drivers are statistically more likely to be involved in accidents, which can lead to higher premiums.

Vehicle Information

The type of vehicle you drive is a significant factor in determining your insurance quote. Factors like the vehicle’s make, model, year, safety features, and value can influence the cost of your insurance. For instance, a high-performance sports car is generally considered riskier to insure than a standard sedan due to its potential for higher repair costs.

Driving History

Your driving history is a crucial factor in determining your insurance quote. Factors like your driving record, including accidents, traffic violations, and driving experience, are considered to assess your risk profile. Drivers with a history of accidents or violations may face higher premiums compared to those with a clean driving record.

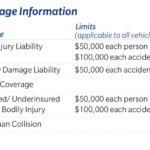

Insurance Products

State Farm offers a wide range of insurance products, each with its own pricing structure. Different types of coverage, such as liability, collision, and comprehensive, have varying costs. The level of coverage you choose can significantly affect your premium.

Benefits of Choosing State Farm

State Farm is one of the largest and most reputable insurance providers in the United States, known for its comprehensive coverage options, competitive pricing, and excellent customer service. Choosing State Farm as your insurance provider can offer numerous benefits, making it a wise decision for many individuals and families.

State Farm offers a wide range of insurance products, including auto, home, renters, life, health, and business insurance. This comprehensive coverage allows you to protect all your assets and financial well-being under one roof, simplifying your insurance needs and providing peace of mind.

Customer Satisfaction and Reputation

State Farm consistently receives high customer satisfaction ratings and positive reviews. The company is known for its responsive and helpful customer service representatives, efficient claims processing, and commitment to resolving issues promptly.

According to J.D. Power, State Farm has consistently ranked among the top insurance providers in customer satisfaction for auto insurance. In addition, State Farm has earned high marks from the Better Business Bureau, demonstrating its commitment to ethical business practices and customer satisfaction. These positive reviews and ratings highlight State Farm’s commitment to providing a positive and reliable insurance experience.

Competitive Pricing and Value

State Farm offers competitive insurance rates, making it a cost-effective choice for many individuals and families. The company’s pricing is often comparable to or even lower than other major insurance providers, while still offering comprehensive coverage and excellent service.

State Farm’s pricing is determined by various factors, including your driving history, location, vehicle type, and coverage options. However, the company is known for its transparent pricing structure and its ability to provide personalized quotes that reflect your individual needs. This competitive pricing ensures you get the best value for your insurance investment.

Financial Strength and Stability

State Farm is a financially strong and stable company, with a long history of paying claims and fulfilling its commitments to policyholders. The company has consistently received high ratings from financial institutions, indicating its robust financial health and ability to meet its obligations.

This financial strength provides peace of mind, knowing that State Farm will be there to support you in the event of an unexpected event or claim. Its financial stability is a testament to its long-standing commitment to providing reliable and secure insurance solutions.

Discounts and Bundling Options

State Farm offers a wide range of discounts and bundling options that can help you save money on your insurance premiums. These discounts can include:

- Good driver discounts

- Safe driving discounts

- Multi-policy discounts

- Homeowner discounts

- Defensive driving course discounts

By taking advantage of these discounts, you can further reduce your insurance costs and maximize your savings. Bundling multiple insurance policies, such as auto and home insurance, can also lead to significant discounts, making State Farm an even more cost-effective choice.

Innovative Technology and Online Services

State Farm is committed to using technology to enhance its customer experience. The company offers a variety of online services, including:

- Online quote requests

- Policy management

- Claim filing

- Mobile app access

These online tools make it easy to manage your insurance policies, access your information, and file claims from the comfort of your home. State Farm’s dedication to technological advancements ensures a seamless and convenient insurance experience.

Community Involvement and Social Responsibility

State Farm is deeply committed to giving back to the communities it serves. The company supports various charitable organizations and initiatives, promoting safety, education, and community well-being.

This commitment to social responsibility demonstrates State Farm’s values and its dedication to making a positive impact on society. It reinforces the company’s reputation as a responsible and trustworthy corporate citizen.

Comparison with Other Insurance Providers

| Feature | State Farm | Geico | Progressive | Allstate |

|—|—|—|—|—|

| Customer Satisfaction | High | High | High | High |

| Financial Strength | Strong | Strong | Strong | Strong |

| Coverage Options | Comprehensive | Comprehensive | Comprehensive | Comprehensive |

| Pricing | Competitive | Competitive | Competitive | Competitive |

| Discounts and Bundling | Many options | Many options | Many options | Many options |

| Technology and Online Services | Excellent | Excellent | Excellent | Excellent |

State Farm compares favorably with other major insurance providers in terms of customer satisfaction, financial strength, coverage options, pricing, discounts, and technology. The company consistently ranks among the top insurance providers in these areas, making it a strong contender for your insurance needs.

Tips for Getting the Best Quote: Get An Insurance Quote State Farm

Getting the best insurance quote from State Farm involves understanding the factors influencing your rate and strategically navigating the process. By following these tips, you can potentially save money on your insurance premiums.

Factors Affecting Your Quote

- Driving History: Your driving record plays a significant role in determining your premium. A clean record with no accidents or violations will result in lower rates.

- Vehicle Information: The make, model, year, and safety features of your vehicle directly impact your insurance cost. Newer cars with advanced safety features often have lower premiums.

- Location: Where you live affects your insurance rate due to factors like crime rates, traffic density, and weather conditions.

- Coverage Options: The type and amount of coverage you choose, such as liability, collision, and comprehensive, will influence your premium.

- Deductible: A higher deductible, which is the amount you pay out-of-pocket before insurance covers the rest, generally leads to lower premiums.

- Discounts: State Farm offers various discounts, including good driver, multi-car, and safety feature discounts. Taking advantage of these can significantly reduce your premium.

Strategies for Negotiating Insurance Rates

- Shop Around: Comparing quotes from multiple insurance providers, including State Farm, is crucial. You can use online comparison tools or contact insurance agents directly.

- Bundle Policies: Combining your car insurance with other policies like homeowners or renters insurance can often lead to discounts.

- Review Your Coverage: Periodically review your insurance coverage to ensure you have the right amount and type of protection. You may be able to reduce your premium by lowering unnecessary coverage.

- Improve Your Driving Record: Maintaining a clean driving record is the most effective way to lower your insurance rates.

- Ask About Discounts: Be sure to ask your State Farm agent about any available discounts you might qualify for, such as good student, safe driver, or multi-policy discounts.

- Negotiate: Don’t be afraid to negotiate with your agent. They may be willing to offer a lower rate if you demonstrate a good driving record and willingness to bundle policies.

Checklist Before Requesting a Quote

- Gather Vehicle Information: Have your vehicle’s make, model, year, VIN (Vehicle Identification Number), and mileage ready.

- Driving Record: Collect information about your driving history, including accidents, violations, and any other relevant details.

- Current Policy Details: If you have existing insurance, gather information about your current coverage and premium.

- Contact Information: Provide accurate contact information, including your phone number, email address, and mailing address.

Final Summary

Choosing the right insurance provider is a significant decision. State Farm stands out with its comprehensive coverage options, competitive pricing, and exceptional customer service. By understanding the factors that influence your quote and utilizing strategies to secure the best rates, you can make an informed decision that meets your specific insurance needs.

Essential FAQs

How do I know if State Farm is the right insurance provider for me?

The best way to determine if State Farm is right for you is to compare their rates and coverage options with other providers. Consider factors like your individual needs, budget, and preferred level of coverage.

What are the benefits of getting an insurance quote from State Farm?

State Farm offers numerous benefits, including competitive rates, a wide range of insurance products, excellent customer service, and a strong reputation for reliability.

Can I get an insurance quote online from State Farm?

Yes, State Farm offers an easy-to-use online quoting tool. You can request a quote in minutes by providing your basic information and vehicle details.

What are the steps involved in getting an insurance quote from State Farm?

The process typically involves providing your personal details, vehicle information, desired coverage levels, and driving history. State Farm will then generate a personalized quote based on your specific needs.