Get a quote for car insurance state farm – Getting a quote for car insurance from State Farm is a crucial step for anyone seeking affordable and reliable coverage. Whether you’re a new driver, a seasoned motorist, or simply looking for a better deal, understanding the process and factors involved is essential.

State Farm offers a convenient online quoting tool that allows you to quickly receive personalized rates based on your specific needs and driving history. This digital platform provides a transparent and user-friendly experience, enabling you to compare different coverage options and find the best fit for your budget.

Understanding the Search Intent

The search phrase “get a quote for car insurance state farm” reveals a clear intent from the user: they are looking to obtain an insurance quote specifically from State Farm. This search query indicates a potential customer interested in exploring State Farm’s insurance offerings for their vehicle.

Types of Users

Understanding the types of users searching for this phrase is crucial for tailoring the response effectively. There are several potential user categories, each with distinct needs and expectations:

- New Drivers: Individuals who are new to driving and require insurance for the first time. They may be seeking affordable options and exploring different insurance providers. They may be particularly interested in discounts and features specific to new drivers.

- Existing Customers: Current State Farm policyholders who may be looking to renew their policy, change their coverage, or simply compare their current rates with other options. They may have a specific need in mind, such as adding a new vehicle to their policy or adjusting their coverage levels.

- Potential Customers: Individuals who are not currently insured with State Farm but are considering switching providers. They may be seeking a more competitive rate, better coverage options, or a more convenient customer experience. They are likely comparing quotes from multiple insurers.

- Current Policyholders Seeking Changes: Existing customers who want to make changes to their policy, such as adding a new driver, updating their vehicle information, or changing their coverage levels. They may be searching for a quick and easy way to obtain a revised quote reflecting their new needs.

User Needs and Expectations

The needs and expectations of these users vary depending on their specific situation:

- New Drivers: New drivers typically prioritize affordability and coverage that meets their specific needs. They may also be interested in discounts and programs tailored for young drivers. They expect a user-friendly quote process and clear explanations of coverage options.

- Existing Customers: Existing customers may be looking for a quick and easy way to obtain a quote, ideally without having to re-enter all their personal information. They expect competitive rates and a smooth renewal process. They may also be interested in exploring additional coverage options or discounts.

- Potential Customers: Potential customers are likely comparing quotes from multiple insurers. They expect competitive rates, comprehensive coverage options, and a user-friendly online experience. They may also value positive customer reviews and a strong reputation for customer service.

- Current Policyholders Seeking Changes: These customers need a straightforward process to update their policy information and obtain a new quote. They expect accurate calculations reflecting their changes and a transparent explanation of any adjustments to their premium. They may also value prompt and responsive customer support.

State Farm’s Online Quoting Process

Getting a car insurance quote from State Farm online is a straightforward process that can be completed in just a few minutes. You can obtain a personalized quote without leaving the comfort of your home, allowing you to compare rates and find the best coverage for your needs.

Information Required for a Quote

To generate an accurate car insurance quote, State Farm requires some key information about you, your vehicle, and your driving history. This information helps them assess your risk and provide you with a tailored quote.

- Personal Information: Your name, address, date of birth, and contact information are essential to identify you and establish your policy.

- Vehicle Information: Details about your vehicle, including the make, model, year, VIN, and mileage, are crucial to determine the insurance coverage needed.

- Driving History: Information about your driving record, including any accidents, violations, or driving experience, plays a significant role in calculating your insurance premium.

- Coverage Preferences: State Farm offers various coverage options, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. You can select the level of coverage that best suits your needs and budget.

Benefits of Using State Farm’s Online Quoting Tool

State Farm’s online quoting tool offers several benefits that make it a convenient and efficient way to get a car insurance quote.

- Convenience: You can access the tool anytime, anywhere, using your computer, tablet, or smartphone, eliminating the need for phone calls or in-person visits.

- Speed: The online quoting process is quick and easy, typically taking just a few minutes to complete. This allows you to compare quotes from different insurance providers efficiently.

- Transparency: State Farm’s online tool provides clear and concise information about the coverage options and pricing, enabling you to make informed decisions about your insurance.

- Customization: The tool allows you to personalize your quote by adjusting coverage levels and deductibles, ensuring you get the best possible rate for your specific needs.

Factors Influencing Car Insurance Quotes

Car insurance premiums are calculated based on various factors that assess the risk associated with insuring a particular driver and vehicle. These factors can vary depending on the insurance provider, but some common elements are consistent across most companies, including State Farm.

Driving History

Your driving history is a crucial factor in determining your car insurance rates. This includes your past driving record, including accidents, traffic violations, and driving experience. Insurance companies use this information to assess your likelihood of filing a claim in the future.

- Accidents: A history of accidents, especially those deemed your fault, can significantly increase your premiums. This is because you are considered a higher risk to insure.

- Traffic Violations: Similarly, traffic violations, such as speeding tickets, DUI/DWI, or reckless driving convictions, can also lead to higher rates. These violations indicate a pattern of risky driving behavior.

- Driving Experience: Drivers with less experience, particularly younger drivers, are generally considered higher risk due to their lack of experience on the road. As you gain more experience, your premiums may decrease.

Vehicle Type

The type of vehicle you drive plays a significant role in your car insurance premiums. Insurance companies consider factors like the vehicle’s make, model, year, safety features, and value.

- Make and Model: Some car models are known for their safety features and lower repair costs, while others may have a history of more frequent accidents or higher repair bills. This can influence your rates.

- Year: Newer vehicles often have more advanced safety features, which can lower your premium. Older vehicles may be less safe and have higher repair costs, potentially increasing your rates.

- Value: The value of your vehicle is another factor. More expensive cars are generally more costly to insure due to the higher repair costs and replacement value.

Location

Where you live can significantly impact your car insurance rates. Insurance companies consider factors like the density of population, traffic congestion, crime rates, and weather conditions.

- Urban vs. Rural: Urban areas tend to have higher rates due to increased traffic congestion, higher risk of accidents, and greater potential for theft. Rural areas often have lower rates due to less traffic and lower crime rates.

- Weather Conditions: Areas with extreme weather conditions, such as hurricanes, tornadoes, or frequent hailstorms, can have higher rates due to the increased risk of damage to vehicles.

Coverage Options

The type and amount of coverage you choose can also influence your car insurance premiums. You can choose different levels of coverage for liability, collision, comprehensive, and other options.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injury or damage to others. Higher liability limits generally result in higher premiums.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. Higher coverage limits usually mean higher premiums.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged by events other than an accident, such as theft, vandalism, or natural disasters.

State Farm’s Customer Experience

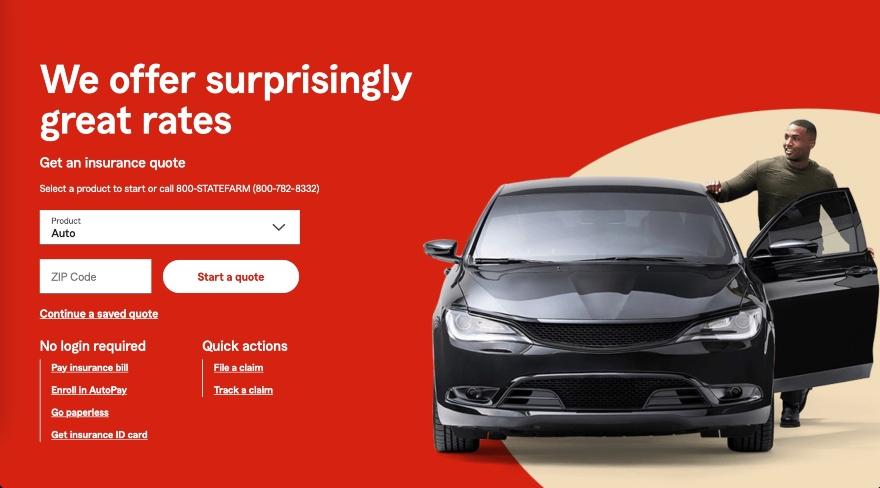

State Farm, a well-known insurance provider, offers a comprehensive online quoting platform designed to simplify the process of getting a car insurance quote. The platform’s user experience is a crucial factor in attracting and retaining customers, and State Farm aims to provide a seamless and efficient journey for potential policyholders.

Website Design and Navigation

The State Farm website prioritizes a clean and intuitive design, aiming to make navigation straightforward for users. The website’s layout is organized logically, with prominent calls to action guiding users through the quoting process. Key features like the “Get a Quote” button are easily accessible, leading users directly to the online quoting tool. The website’s visual appeal and consistent branding contribute to a positive user experience.

Pros and Cons of State Farm’s Online Quoting Platform

State Farm’s online quoting platform presents both advantages and disadvantages.

Pros

- Convenience and Speed: The online quoting platform allows users to obtain a quote quickly and easily from the comfort of their homes. Users can avoid the need for phone calls or in-person visits to an agent, saving time and effort.

- Transparency and Control: The online quoting tool provides users with transparency regarding the factors influencing their insurance premiums. Users can adjust various parameters, such as coverage options and driving history, to see how they affect the final quote.

- Availability: The platform is accessible 24/7, allowing users to obtain quotes at their convenience, regardless of business hours.

Cons

- Limited Customization: While the online quoting platform offers a degree of customization, it may not cater to all specific needs. Users with complex insurance requirements or unique situations may find the online tool insufficient and require assistance from an agent.

- Potential for Errors: Entering incorrect information during the online quoting process can result in inaccurate quotes. Users need to ensure accuracy when providing personal and vehicle details.

Customer Service Influence

State Farm’s customer service plays a significant role in the quoting process, even when users opt for the online platform.

- Clarification and Support: If users encounter difficulties or have questions during the online quoting process, they can reach out to State Farm’s customer service representatives for assistance. Representatives can clarify insurance terms, explain coverage options, and address any concerns users may have.

- Personalized Recommendations: State Farm’s agents can provide personalized recommendations based on individual circumstances. They can assess a user’s specific needs and suggest coverage options tailored to their situation. This personalized approach can help users make informed decisions about their insurance coverage.

- Post-Quote Assistance: Even after obtaining an online quote, users can contact State Farm’s customer service for further assistance. Representatives can answer questions about policy details, explain payment options, and guide users through the policy purchasing process.

Alternative Ways to Get a Quote

While State Farm’s online quoting system offers a convenient and efficient way to get an insurance quote, you may prefer other methods depending on your needs and preferences. State Farm provides several alternatives for obtaining a quote, allowing you to choose the method that best suits your situation.

Alternative Quote Methods, Get a quote for car insurance state farm

State Farm offers various ways to get a quote beyond their online platform. Here’s a breakdown of the pros and cons of each method:

| Method | Pros | Cons |

|---|---|---|

| Call an Agent |

|

|

| Visit a Branch |

|

|

Considerations for Choosing a Quote

Once you’ve gathered quotes from State Farm and other insurance providers, it’s time to compare them carefully to find the best fit for your needs and budget. This involves evaluating various factors, not just the bottom line price.

Comparing Quotes

It’s crucial to compare quotes side-by-side to understand the true value each provider offers. This includes examining coverage options, discounts, and customer service.

| Factor | State Farm | Competitor |

|---|---|---|

| Coverage Options | State Farm offers a comprehensive range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection. They also provide specialized coverage like rental reimbursement and roadside assistance. | [Competitor Name] may offer similar coverage options, but their specific policies and coverage limits might differ. It’s important to compare these details carefully. |

| Discounts | State Farm offers a wide array of discounts, such as good driver, safe vehicle, multi-policy, and defensive driving courses. Their website provides a comprehensive list of available discounts. | [Competitor Name] might offer similar or different discounts. Some competitors may specialize in specific discounts, such as those for certain professions or affiliations. |

| Customer Service | State Farm has a reputation for excellent customer service. They have a vast network of agents and offer 24/7 online and phone support. | [Competitor Name] may have different customer service policies and accessibility. It’s important to consider factors like response time, availability of online resources, and customer reviews. |

Ending Remarks: Get A Quote For Car Insurance State Farm

By understanding the factors that influence car insurance quotes and exploring the various methods to obtain them, you can make an informed decision about your coverage. Whether you choose to get a quote online, by phone, or in person, State Farm offers multiple avenues to ensure a smooth and efficient experience.

Popular Questions

How long does it take to get a car insurance quote from State Farm?

The online quoting process is typically quick, taking only a few minutes to complete. However, the time it takes to receive a quote may vary depending on the complexity of your request and the availability of information.

What are the benefits of getting a quote from State Farm?

State Farm offers a variety of benefits, including competitive rates, customizable coverage options, and excellent customer service. They also provide a range of discounts for safe drivers, good students, and those who bundle multiple insurance policies.

Can I get a quote for car insurance from State Farm without providing my personal information?

While you can explore State Farm’s website and learn about their coverage options, obtaining a personalized quote requires providing some basic information, such as your name, address, and driving history.