Ga state minimum insurance requirements – Georgia State Minimum Insurance Requirements are a vital aspect of driving safely and responsibly within the state. These regulations ensure that drivers are financially protected in the event of an accident, providing peace of mind for both themselves and other road users. Understanding these requirements is crucial for every driver, as failure to comply can lead to significant penalties and consequences.

The state of Georgia mandates specific types of insurance coverage for all vehicles registered within its borders. These minimum coverage requirements are designed to protect drivers and their passengers from financial hardship in the event of an accident. The minimum limits for each type of coverage are determined by Georgia law, and they can vary depending on the type of vehicle and the circumstances of the accident.

Understanding Georgia’s Minimum Insurance Requirements

Driving in Georgia, like in any other state, comes with certain responsibilities. One of the most crucial is carrying the minimum required insurance coverage. This ensures financial protection for yourself and others in case of an accident.

Georgia’s Minimum Insurance Requirements Explained

Georgia’s minimum insurance requirements are the minimum levels of coverage that every driver must carry to be legally allowed to operate a vehicle on public roads. These requirements are Artikeld in the Georgia Motor Vehicle Safety Act and are designed to protect both drivers and their passengers from financial hardship in the event of an accident.

History of Georgia’s Minimum Insurance Requirements

Georgia’s minimum insurance requirements have evolved over time to reflect changes in driving patterns, accident rates, and the cost of healthcare. The requirements have been amended several times to ensure that they remain adequate to address the evolving needs of the state’s drivers.

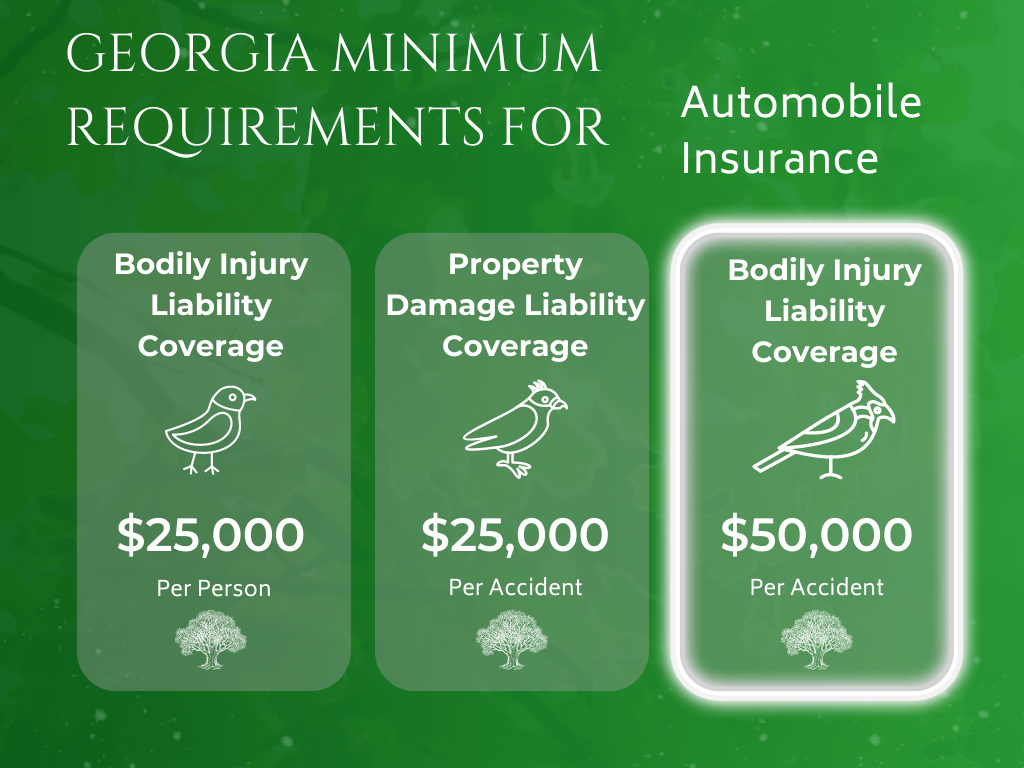

Types of Coverage and Their Minimum Limits: Ga State Minimum Insurance Requirements

Georgia law requires drivers to carry a minimum amount of insurance to protect themselves and others in case of an accident. This ensures financial responsibility for any damages or injuries caused.

Understanding Required Coverage

| Coverage Type | Minimum Limit | Description of Coverage |

|---|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident | Covers medical expenses, lost wages, and pain and suffering for injuries caused to other people in an accident. |

| Property Damage Liability | $25,000 per accident | Covers damages to another person’s vehicle or property caused by an accident. |

| Personal Injury Protection (PIP) | $2,500 | Covers medical expenses, lost wages, and other expenses for the policyholder and passengers in their vehicle, regardless of fault. |

| Uninsured/Underinsured Motorist Coverage | $25,000 per person / $50,000 per accident | Protects you if you are injured by an uninsured or underinsured driver. |

Consequences of Driving Without Required Coverage

Driving without the required minimum insurance coverage in Georgia can have serious consequences. You could face:

– Fines and penalties

– Suspension of your driver’s license

– Impoundment of your vehicle

– Difficulty registering your vehicle in the future

– Responsibility for all damages and injuries caused in an accident, even if you are not at fault.

In addition, if you are involved in an accident and do not have the required insurance coverage, you could be sued by the other party, potentially leading to significant financial losses.

Financial Responsibility Laws

Georgia’s financial responsibility laws are designed to ensure that drivers have the means to cover the costs associated with accidents they may cause. These laws aim to protect victims and the public by requiring drivers to demonstrate their ability to pay for damages and injuries resulting from accidents.

Demonstrating Financial Responsibility

There are several ways to demonstrate financial responsibility in Georgia. The most common method is by carrying the minimum required auto insurance coverage. This insurance provides financial protection to the driver and others involved in an accident. Other options include:

- Proof of Insurance: This is the most common method of demonstrating financial responsibility. Drivers must present proof of insurance upon request by law enforcement or other authorities. This can be done through an insurance card, a copy of the insurance policy, or an electronic version of the policy.

- Surety Bond: Drivers can also demonstrate financial responsibility by posting a surety bond with the Georgia Department of Motor Vehicles. This bond guarantees that the driver will pay for any damages or injuries caused by an accident. The bond amount is typically set at a higher level than the minimum insurance requirements.

- Cash Deposit: Drivers can also demonstrate financial responsibility by depositing a certain amount of cash with the Georgia Department of Motor Vehicles. The amount of the deposit is typically set at a higher level than the minimum insurance requirements.

Penalties for Failure to Comply

Failing to comply with Georgia’s financial responsibility laws can result in severe penalties, including:

- Suspension of Driver’s License: The most common penalty for failing to provide proof of insurance or meet other financial responsibility requirements is the suspension of the driver’s license. This suspension can last for an extended period, depending on the severity of the violation.

- Fines: Drivers who fail to comply with financial responsibility laws can face significant fines. The amount of the fine will vary depending on the nature of the violation and the driver’s history.

- Vehicle Impoundment: In some cases, the driver’s vehicle may be impounded until the financial responsibility requirements are met. This can be a significant inconvenience and expense for the driver.

- Court Proceedings: Failure to comply with financial responsibility laws can also lead to court proceedings, which can result in additional fines and penalties.

Consequences of Uninsured Driving

In addition to the penalties listed above, drivers who are uninsured or underinsured face several other consequences, including:

- Financial Liability: Uninsured drivers are fully responsible for any damages or injuries they cause in an accident. This can lead to significant financial hardship, as they may be required to pay for medical bills, property damage, and other expenses out of pocket.

- Limited Coverage: Uninsured drivers may not be able to receive compensation for their own injuries or damages if they are involved in an accident with another uninsured or underinsured driver.

- Criminal Charges: In some cases, driving without insurance can result in criminal charges.

Exemptions and Exceptions

While Georgia mandates minimum insurance coverage for most vehicles, there are some exceptions and exemptions to this rule. These exceptions apply to specific vehicle types, situations, or uses, allowing certain drivers to operate vehicles without the standard minimum insurance coverage.

Vehicles Exempt from Minimum Insurance Requirements

There are specific types of vehicles that are exempt from Georgia’s minimum insurance requirements. This exemption typically applies to vehicles that are not regularly used on public roads or that are used for specific purposes.

- Vehicles Owned by the Government: Vehicles owned by the federal, state, or local government are generally exempt from minimum insurance requirements. This includes vehicles used by law enforcement agencies, fire departments, and other government entities.

- Vehicles Used Exclusively on Private Property: Vehicles used exclusively on private property, such as farm vehicles, construction equipment, or vehicles used solely for recreational purposes on private land, are typically exempt. This exemption does not apply if the vehicle is used on public roads, even occasionally.

- Vehicles Used for Agricultural Purposes: Vehicles used exclusively for agricultural purposes, such as tractors, combines, and other farm equipment, are generally exempt. This exemption applies only if the vehicle is used on private property or on public roads for short distances and for agricultural purposes.

- Vehicles Used for Certain Specific Purposes: Vehicles used for specific purposes, such as vehicles used for transporting goods or materials within a company’s private property or vehicles used for specific types of transportation, such as funeral processions, may be exempt.

Exceptions to Minimum Insurance Requirements, Ga state minimum insurance requirements

In some cases, vehicles that would typically be required to carry minimum insurance may be exempt under specific circumstances. These exceptions are generally based on the purpose of the vehicle or the situation in which it is being used.

- Vehicles Used for Certain Specific Purposes: Vehicles used for specific purposes, such as vehicles used for transporting goods or materials within a company’s private property or vehicles used for specific types of transportation, such as funeral processions, may be exempt.

- Vehicles Involved in Certain Events: Vehicles participating in specific events, such as parades, rallies, or other organized events, may be exempt from minimum insurance requirements. These exemptions are often granted by local authorities and may require specific conditions to be met.

- Vehicles Used for Testing or Demonstration: Vehicles used for testing or demonstration purposes, such as vehicles used by manufacturers or dealerships, may be exempt from minimum insurance requirements. This exemption typically applies to vehicles that are not being used for transportation on public roads.

- Vehicles Used for Military Purposes: Vehicles used for military purposes by the United States Armed Forces are generally exempt from minimum insurance requirements.

Criteria for Exemptions and Exceptions

To determine if a vehicle is exempt from minimum insurance requirements, it is important to understand the specific criteria that apply. These criteria are often defined by state law and may vary depending on the type of vehicle, its purpose, and the circumstances surrounding its use.

- Vehicle Type: The type of vehicle is often a primary factor in determining whether it is exempt. For example, vehicles owned by the government, vehicles used exclusively on private property, and vehicles used for agricultural purposes are often exempt.

- Purpose of Use: The purpose for which the vehicle is used is also a critical factor. Vehicles used for specific purposes, such as transporting goods or materials within a company’s private property, may be exempt.

- Location of Use: The location where the vehicle is used can also influence whether it is exempt. For example, vehicles used exclusively on private property are often exempt, while vehicles used on public roads are generally not.

Obtaining and Maintaining Insurance

In Georgia, obtaining and maintaining the required minimum insurance coverage is crucial for all drivers. Understanding the process and available resources can help you ensure you’re legally compliant and financially protected.

Steps to Obtain Minimum Insurance Coverage

This section provides a step-by-step guide to help you obtain the minimum insurance coverage required in Georgia.

- Determine Your Coverage Needs: Before you begin shopping for insurance, it’s essential to understand your specific needs. Consider your driving history, the type of vehicle you own, and your personal financial situation.

- Gather Information: To get accurate quotes, you’ll need to provide some basic information to insurance companies. This includes your driver’s license number, vehicle identification number (VIN), and details about your driving history and any prior claims.

- Compare Quotes from Multiple Insurers: Contact several insurance companies to obtain quotes for the required minimum coverage. This allows you to compare prices, coverage options, and customer service.

- Choose a Policy: After comparing quotes, select the policy that best meets your needs and budget. Ensure the policy includes the minimum coverage requirements Artikeld in Georgia law.

- Pay Your Premium: Once you’ve chosen a policy, you’ll need to pay your premium to activate your coverage. You can usually pay your premium monthly, quarterly, or annually.

- Receive Your Proof of Insurance: Your insurance company will provide you with proof of insurance, which you must carry in your vehicle at all times.

Resources for Finding Affordable Insurance Options

There are several resources available to help Georgia drivers find affordable insurance options.

- Georgia Department of Insurance: The Georgia Department of Insurance (DOI) provides a wealth of information on insurance matters, including consumer guides and resources for finding affordable coverage. You can visit their website or contact their office for assistance.

- Insurance Comparison Websites: Online comparison websites allow you to compare quotes from multiple insurance companies simultaneously. This can save you time and effort when shopping for coverage.

- Local Insurance Agents: Working with a local insurance agent can provide personalized guidance and help you navigate the insurance process. They can provide you with quotes from various companies and assist you in finding the best policy for your needs.

Maintaining Insurance Coverage

Maintaining continuous insurance coverage is crucial in Georgia. Here are some tips to help you avoid lapses in coverage.

- Pay Your Premiums on Time: Failing to pay your premiums on time can result in your policy being canceled. Set reminders or use automatic payment options to ensure timely payments.

- Renew Your Policy on Time: Most insurance policies have a renewal date. Make sure to renew your policy before the expiration date to avoid a lapse in coverage.

- Review Your Policy Regularly: Review your insurance policy periodically to ensure it still meets your needs and that the coverage limits are adequate.

- Inform Your Insurer of Changes: If you experience any changes in your driving record, vehicle, or living situation, inform your insurance company immediately. This helps ensure your coverage remains accurate and appropriate.

Impact of Minimum Insurance Requirements

Georgia’s minimum insurance requirements play a crucial role in protecting drivers and society as a whole. These regulations ensure that drivers have adequate financial resources to cover damages and injuries caused in accidents, mitigating potential financial hardship for both victims and at-fault drivers.

Benefits for Drivers and Society

The minimum insurance requirements in Georgia offer a range of benefits, contributing to a safer and more financially secure driving environment.

- Financial Protection for Drivers: In the event of an accident, the minimum insurance requirements ensure that drivers have sufficient coverage to pay for damages to other vehicles, injuries to others, and property damage. This protection prevents drivers from facing significant financial burdens and potential bankruptcy.

- Compensation for Accident Victims: The requirements ensure that accident victims have access to compensation for medical expenses, lost wages, and other damages. This helps victims recover financially and focus on their well-being.

- Promoting Responsible Driving: The knowledge that they are financially liable for accidents encourages drivers to be more cautious and responsible on the road. This can lead to a reduction in accidents and overall improved road safety.

- Financial Stability for the Insurance Industry: The requirements provide a stable financial base for the insurance industry, allowing insurers to adequately assess risks and provide coverage at reasonable rates. This contributes to a healthy insurance market that benefits both drivers and insurers.

- Protection for Society: By ensuring that drivers have adequate insurance, these regulations protect society from the burden of uninsured drivers who may not be able to compensate for damages. This helps to maintain a fair and equitable system for all road users.

Effectiveness in Promoting Responsible Driving

Georgia’s minimum insurance requirements have proven effective in promoting responsible driving by deterring drivers from engaging in risky behaviors. The knowledge that they are financially responsible for accidents encourages drivers to be more cautious and avoid reckless driving.

- Financial Deterrent: The potential for significant financial liability in the event of an accident acts as a strong deterrent for drivers, encouraging them to prioritize safe driving practices.

- Increased Awareness: The requirement for insurance creates a heightened awareness of the potential consequences of driving without proper coverage. This can lead to more responsible driving decisions.

- Data Analysis: Studies have shown a correlation between states with higher minimum insurance requirements and lower accident rates. This suggests that these requirements contribute to a safer driving environment.

Comparison with Other States

Georgia’s minimum insurance requirements are comparable to those of many other states, but there are some notable differences.

- Minimum Liability Limits: Georgia’s minimum liability limits are relatively low compared to some other states. For instance, some states require higher limits for bodily injury and property damage liability.

- Uninsured/Underinsured Motorist Coverage: While Georgia requires uninsured/underinsured motorist coverage, the minimum limits are relatively low compared to some other states. This can leave drivers with limited protection in the event of an accident with an uninsured or underinsured driver.

- Other Coverage Requirements: Some states have additional coverage requirements beyond the basic liability coverage, such as personal injury protection (PIP) or collision coverage. Georgia does not mandate these coverages.

Final Conclusion

Navigating the world of Georgia’s minimum insurance requirements can seem daunting, but it’s essential for responsible driving. By understanding the types of coverage, financial responsibility laws, and exemptions, drivers can ensure they are adequately protected and avoid potential legal complications. Remember, compliance with these requirements is not just about avoiding penalties but about fostering a safer and more secure driving environment for everyone on the road.

Commonly Asked Questions

What happens if I get into an accident without the required minimum insurance?

You could face serious consequences, including fines, license suspension, and even jail time. You may also be held personally liable for all damages and injuries caused by the accident, even if it wasn’t your fault.

How can I find affordable insurance options in Georgia?

Georgia offers various resources to help drivers find affordable insurance, including online comparison websites, insurance brokers, and consumer advocacy groups. You can also contact your local insurance agent or the Georgia Department of Insurance for assistance.

Are there any discounts available for drivers who meet certain criteria?

Yes, many insurance companies offer discounts for good driving records, safe driving courses, multiple vehicle policies, and other factors. It’s worth inquiring about available discounts to potentially reduce your insurance premiums.