Full coverage insurance washington state – Full coverage insurance in Washington State offers vital protection for your vehicle and financial well-being. It’s not just about covering damages in an accident; it encompasses a range of essential components like liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. These elements ensure you’re adequately protected against various risks, including accidents, theft, and natural disasters.

Understanding the factors influencing full coverage insurance costs in Washington State is crucial. Factors like driving history, age, vehicle type, and location all play a significant role in determining your premiums. By being aware of these factors, you can potentially lower your insurance costs through safe driving practices, choosing a less expensive vehicle, and exploring options like discounts for good students or multiple car insurance policies.

Understanding Full Coverage Insurance

Full coverage insurance in Washington State is a common term that refers to a comprehensive insurance policy that covers a wide range of potential risks associated with owning and operating a vehicle. It is important to note that “full coverage” is not an official insurance term, and the exact coverage included can vary depending on the insurance company and the specific policy. However, it generally includes the following key components.

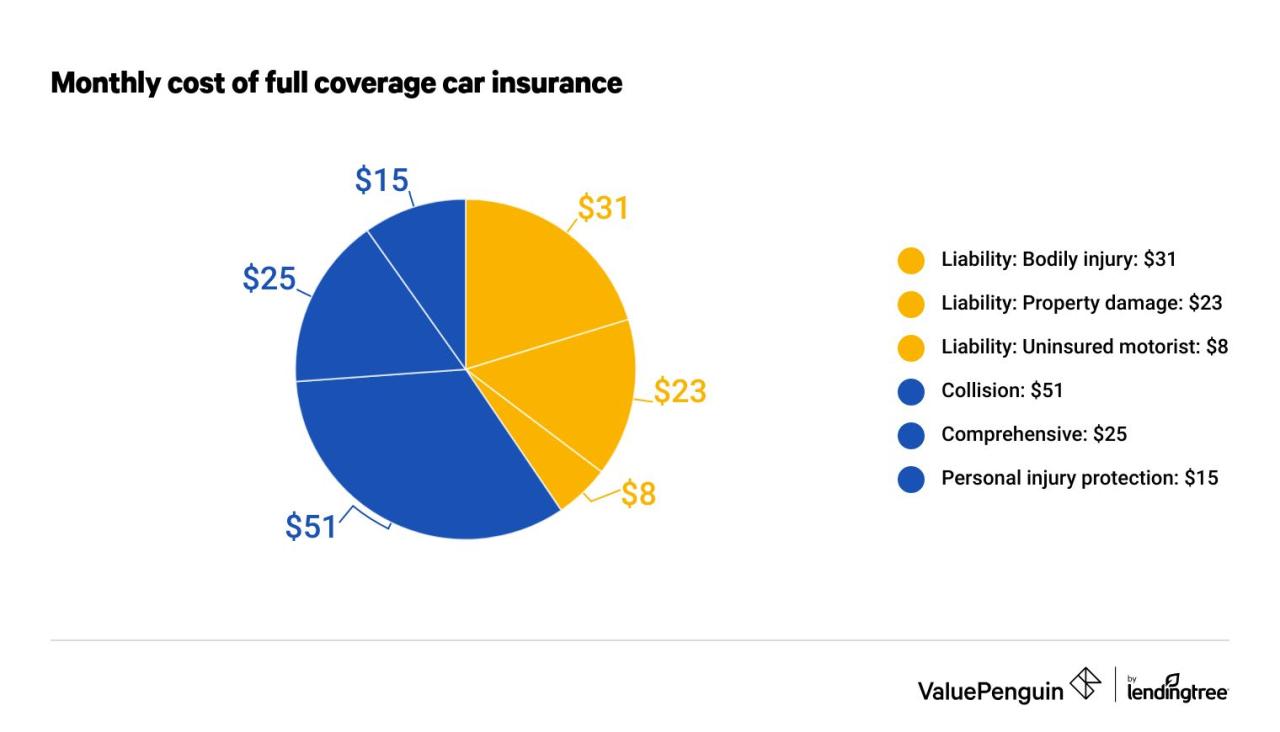

Liability Coverage

Liability coverage is essential for any driver in Washington State. It protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries to another person. Liability coverage includes:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages to the other party if you are at fault in an accident that causes injury. The amount of coverage is typically expressed as a per-person limit and a per-accident limit. For example, a 25/50/10 policy would provide up to $25,000 for bodily injury per person, up to $50,000 for bodily injury per accident, and up to $10,000 for property damage per accident.

- Property Damage Liability: This coverage pays for damages to the other party’s vehicle or property if you are at fault in an accident. The amount of coverage is typically expressed as a per-accident limit.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional but highly recommended, especially if you have a financed or leased vehicle.

- Deductible: With collision coverage, you will have to pay a deductible, which is the amount you pay out of pocket before your insurance company covers the remaining costs. The deductible amount can vary depending on your policy and the level of coverage you choose.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. This coverage is also optional, but it can be beneficial for protecting your investment in your vehicle.

- Deductible: Like collision coverage, comprehensive coverage also has a deductible. You will have to pay this deductible before your insurance company covers the remaining costs.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you and your passengers if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages. This coverage is also optional, but it is highly recommended, as it can help you recover costs if the other driver is at fault and cannot afford to pay for your damages.

- Deductible: This coverage may have a deductible, which you will have to pay before your insurance company covers the remaining costs.

Examples of Situations Where Full Coverage Insurance Would Be Beneficial

Full coverage insurance can be beneficial in a variety of situations, such as:

- If you are financing or leasing your vehicle: Lenders often require full coverage insurance as a condition of financing or leasing a vehicle. This protects their investment in case of an accident or damage to the vehicle.

- If you drive in a high-risk area: If you live in an area with a high incidence of accidents, theft, or vandalism, full coverage insurance can provide valuable protection for your vehicle.

- If you have a newer or more expensive vehicle: The cost of repairing or replacing a newer or more expensive vehicle can be significant. Full coverage insurance can help you cover these costs in the event of an accident or damage.

- If you have a poor driving record: If you have a history of accidents or traffic violations, you may have difficulty obtaining insurance or may have to pay higher premiums. Full coverage insurance can help you protect your vehicle in case of an accident.

Factors Affecting Full Coverage Insurance Costs

Full coverage insurance, while providing comprehensive protection, comes with a price tag that can vary significantly depending on several factors. Understanding these factors can help you make informed decisions about your insurance policy and potentially save money on your premiums.

Driving History

Your driving history is a major factor influencing your insurance costs. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents, traffic violations, or DUI convictions can significantly increase your insurance rates. Insurance companies assess your risk based on your past driving behavior, and a history of incidents indicates a higher likelihood of future claims.

Age

Age is another crucial factor affecting insurance costs. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This higher risk profile translates to higher insurance premiums. As drivers gain experience and age, their risk profile generally decreases, leading to lower insurance rates.

Vehicle Type

The type of vehicle you drive also plays a role in determining your insurance costs. Sports cars, luxury vehicles, and high-performance cars are often more expensive to repair or replace, leading to higher insurance premiums. Conversely, less expensive and safer vehicles, like compact cars, tend to have lower insurance rates.

Location, Full coverage insurance washington state

Your location in Washington State can significantly impact your insurance costs. Areas with higher crime rates, traffic congestion, and accident frequencies generally have higher insurance premiums. This is because insurance companies assess the risk of potential claims based on the geographic location of their policyholders.

Choosing the Right Full Coverage Insurance Policy

Finding the right full coverage insurance policy in Washington State requires careful consideration and comparison. You need to ensure that the policy provides the necessary coverage for your specific needs at a price you can afford.

Comparing Quotes from Multiple Insurance Providers

It’s crucial to compare quotes from multiple insurance providers to find the best value. Obtaining quotes from various companies allows you to assess different coverage options, deductibles, and premiums. This comparison process helps you identify the most suitable policy that meets your budget and coverage requirements.

Reputable Insurance Companies in Washington State

Several reputable insurance companies operate in Washington State, offering full coverage insurance policies.

- State Farm: Known for its comprehensive coverage and excellent customer service.

- Geico: Offers competitive rates and convenient online services.

- Progressive: Renowned for its innovative features and personalized coverage options.

- Allstate: Provides a wide range of insurance products, including full coverage for vehicles.

- Farmers Insurance: Offers personalized insurance solutions and strong community support.

Tips for Negotiating Insurance Rates

Negotiating your insurance rates can help you save money on your full coverage policy.

- Bundle your policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often result in significant discounts.

- Improve your credit score: A good credit score can lead to lower insurance premiums, as insurance companies often consider it a factor in assessing risk.

- Ask about discounts: Inquire about available discounts, such as safe driver discounts, good student discounts, or multi-car discounts.

- Shop around regularly: Compare quotes from different insurance companies periodically, as rates can fluctuate over time.

- Consider increasing your deductible: Choosing a higher deductible can lower your premium, but it means you’ll pay more out of pocket if you need to file a claim.

Understanding Insurance Coverage Exclusions

While full coverage insurance provides extensive protection, it’s crucial to understand that it doesn’t cover every possible scenario. There are certain situations and events specifically excluded from coverage.

Knowing these exclusions is essential to avoid surprises and ensure you have the right coverage for your needs. It’s important to carefully review the terms and conditions of your policy to understand what’s covered and what’s not.

Common Exclusions in Full Coverage Insurance Policies

Full coverage insurance policies in Washington State typically exclude coverage for:

- Wear and Tear: Normal wear and tear on your vehicle, such as fading paint or worn-out tires, is not covered by full coverage insurance. This type of damage is expected over time and is not considered an insured event.

- Mechanical Failure: Full coverage insurance doesn’t cover breakdowns or malfunctions due to mechanical issues. For example, if your engine seizes up or your transmission fails, you’ll need to pay for repairs yourself.

- Acts of War: Coverage for damage caused by acts of war or terrorism is typically excluded from full coverage insurance policies.

- Driving While Intoxicated or Under the Influence: If you are driving under the influence of alcohol or drugs and cause an accident, your insurance may not cover the damage or injuries.

- Unlicensed Driving: Driving without a valid driver’s license can also lead to a denial of coverage in the event of an accident.

- Driving Without Insurance: Driving without the required minimum insurance coverage can result in hefty fines and penalties, and your insurance company may not cover any damages caused by your uninsured vehicle.

- Certain Types of Vehicles: Full coverage insurance policies may not cover certain types of vehicles, such as motorcycles, off-road vehicles, or commercial trucks.

- Damage to Property Belonging to the Insured: Full coverage insurance typically covers damage to your vehicle, but it may not cover damage to your personal belongings inside the vehicle.

Examples of Situations Where Coverage Might Not Be Provided

Here are some real-life examples of situations where full coverage insurance might not provide coverage:

- Driving on a Closed Road: If you are driving on a road that is closed due to construction or other hazards and you have an accident, your insurance company may not cover the damage. This is because you were driving in a prohibited area, which is considered a risky and preventable event.

- Racing or Off-Road Driving: Full coverage insurance policies generally exclude coverage for accidents that occur during racing or off-road driving. These activities are considered high-risk and are not covered under standard insurance policies.

- Damage Caused by a Natural Disaster: While full coverage insurance covers damage from certain natural disasters, it may not cover damage caused by floods, earthquakes, or volcanic eruptions. These events are often excluded from coverage due to their unpredictable nature and the potential for widespread damage.

- Damage Caused by a Driver Without a License: If an unlicensed driver is involved in an accident while driving your insured vehicle, your insurance company may not cover the damages. This is because the unlicensed driver is considered a high-risk driver, and their actions may not be covered under your policy.

Filing a Claim with Full Coverage Insurance

In the unfortunate event of an accident or damage to your vehicle, understanding the claim filing process is crucial. This section will guide you through the steps involved in filing a claim with your full coverage insurance provider in Washington State, along with essential documentation and tips for a smooth and successful experience.

Steps Involved in Filing a Claim

Filing a claim with your full coverage insurance provider in Washington State typically involves the following steps:

- Contact Your Insurance Provider: Immediately report the incident to your insurance company, providing details of the accident or damage. This is usually done by phone or online through their website.

- File a Claim: After reporting the incident, you will need to file a formal claim. This can often be done online, by phone, or through a mobile app.

- Provide Necessary Documentation: You will need to provide your insurance company with specific documentation to support your claim. This may include:

- Police report (if applicable)

- Photos and videos of the damage

- Witness statements

- Medical records (if injuries are involved)

- Repair estimates from a qualified mechanic

- Claim Review and Approval: Your insurance company will review your claim and supporting documentation. They may conduct an investigation to verify the details of the incident.

- Payment or Denial: Once the claim is reviewed, your insurance company will notify you of their decision. If approved, they will process payment for covered repairs or other expenses. If denied, they will provide a reason for the denial.

Documentation Required for a Successful Claim

Having the right documentation is crucial for a successful claim. Here are some key documents you should gather:

- Police Report: If the incident involved a collision, a police report is essential. It provides an official record of the accident and details of the involved parties.

- Photos and Videos: Take clear and detailed photos or videos of the damage to your vehicle from multiple angles. These visuals will help your insurance company assess the extent of the damage.

- Witness Statements: If there were witnesses to the incident, obtain their contact information and written statements describing what they observed.

- Medical Records: If you sustained injuries in the accident, gather all relevant medical records, including doctor’s notes, bills, and treatment plans.

- Repair Estimates: Obtain estimates from qualified mechanics for the cost of repairs. These estimates should be detailed and include all necessary parts and labor.

Tips for Maximizing the Chances of a Smooth and Successful Claim Process

Here are some helpful tips to ensure a smooth and successful claim process:

- Be Prompt: Report the incident to your insurance company as soon as possible. This helps ensure a faster processing time.

- Be Accurate: Provide accurate and complete information to your insurance company. Avoid any discrepancies or omissions, as this can delay the claim process.

- Be Cooperative: Cooperate with your insurance company throughout the claim process. Respond to requests for information promptly and be available for any necessary inspections or interviews.

- Keep Good Records: Maintain a detailed record of all communications with your insurance company, including dates, times, and the content of conversations.

- Seek Legal Advice: If you are unsure about any aspect of the claim process or feel your claim is being unfairly denied, it is advisable to consult with an attorney specializing in insurance law.

Last Recap: Full Coverage Insurance Washington State

Navigating the world of full coverage insurance in Washington State requires careful consideration and planning. Comparing quotes from multiple insurance providers, understanding policy exclusions, and filing claims effectively are essential steps in ensuring you have the right coverage at the best price. By staying informed and taking proactive measures, you can safeguard yourself and your vehicle while navigating the complexities of insurance in Washington State.

Helpful Answers

What are the penalties for driving without full coverage insurance in Washington State?

Driving without the minimum required insurance coverage in Washington State can result in fines, license suspension, and even vehicle impoundment.

How often should I review my full coverage insurance policy?

It’s recommended to review your insurance policy annually or whenever you experience significant life changes, such as a new vehicle, a change in your driving record, or a move to a different location.

What are some tips for negotiating my insurance rates?

Negotiating insurance rates can be successful by comparing quotes from multiple providers, demonstrating a good driving record, exploring discounts for bundling policies, and considering options like increasing your deductible.