Four States Insurance is a leading provider of insurance solutions, serving individuals and businesses across a wide range of needs. With a rich history and a commitment to customer satisfaction, Four States Insurance has earned a reputation for its comprehensive coverage options, competitive pricing, and exceptional customer service.

The company’s deep understanding of its target audience, coupled with its innovative approach to product development, has enabled Four States Insurance to consistently adapt to evolving industry trends and deliver tailored solutions that meet the specific requirements of its clients.

Understanding Four States Insurance

Four States Insurance is a prominent insurance provider with a rich history and a comprehensive suite of products and services. It has earned a strong reputation for its commitment to customer satisfaction and financial stability.

History and Background

Four States Insurance was founded in [Year] by [Founder’s Name] with a vision to provide reliable insurance solutions to individuals and businesses in [State]. The company began as a small, local agency and gradually expanded its operations through strategic acquisitions and organic growth. It has since grown into a regional powerhouse, serving customers across multiple states.

Services and Products

Four States Insurance offers a wide range of insurance products and services to meet the diverse needs of its clientele. The company’s portfolio includes:

- Personal Insurance: Auto, home, renters, life, health, and disability insurance.

- Business Insurance: Commercial property, liability, workers’ compensation, and professional liability insurance.

- Financial Services: Retirement planning, investment management, and estate planning.

Four States Insurance is known for its personalized approach to customer service. The company employs a team of experienced insurance professionals who are dedicated to providing clients with tailored solutions and expert advice.

Key Facts and Figures, Four states insurance

Four States Insurance is a financially sound company with a strong track record of profitability. Key facts and figures include:

- Number of Employees: [Number] employees.

- Market Share: [Percentage] market share in [Region].

- Financial Performance: Consistent annual revenue growth and strong profitability.

The company’s financial stability is supported by its strong capital reserves and its commitment to responsible underwriting practices.

Target Audience and Market

Four States Insurance, as its name suggests, focuses its services on individuals and businesses within the four states of Oklahoma, Arkansas, Missouri, and Kansas. This regional approach allows the company to understand the unique needs and challenges of its target audience in these specific areas.

Understanding the specific needs and challenges of the target audience is crucial for any insurance company. This helps them tailor their products and services to meet those needs effectively.

Target Audience

Four States Insurance primarily targets individuals and businesses within its four-state service area. This includes:

- Individuals: This includes families, young professionals, retirees, and individuals with specific needs like homeowners, renters, and car owners.

- Businesses: This encompasses small to medium-sized enterprises (SMEs), large corporations, and various industries operating within the four-state region.

Needs and Challenges

The target audience of Four States Insurance faces various needs and challenges in terms of insurance. These include:

- Personal Insurance: Individuals need protection for their homes, vehicles, health, and personal belongings. They also seek affordable premiums and comprehensive coverage options.

- Business Insurance: Businesses require insurance to protect their assets, employees, and operations from various risks like property damage, liability claims, and business interruptions.

- Natural Disasters: The region is prone to natural disasters like tornadoes, floods, and severe weather, increasing the demand for comprehensive insurance coverage.

- Economic Fluctuations: The region’s economy can be influenced by factors like agriculture, energy, and manufacturing, leading to fluctuations in income and insurance needs.

Market Position

Four States Insurance competes with a range of national and regional insurance companies within its service area. The company aims to differentiate itself by:

- Regional Expertise: By focusing on the four-state region, Four States Insurance has developed a deep understanding of local risks and regulations, allowing it to offer tailored solutions.

- Personalized Service: The company emphasizes personal relationships and customer service, providing agents who are knowledgeable about local needs and responsive to customer inquiries.

- Competitive Pricing: Four States Insurance strives to offer competitive premiums while providing comprehensive coverage options.

Key Features and Benefits

Four States Insurance offers a wide range of insurance plans designed to cater to the diverse needs of its customers. The company’s commitment to providing comprehensive coverage, competitive pricing, and exceptional customer service sets it apart in the insurance industry.

Comprehensive Coverage

Four States Insurance provides a comprehensive suite of insurance products, ensuring that customers are adequately protected against a wide range of risks. The company’s policies are designed to provide peace of mind, knowing that you are covered in the event of an unexpected event.

- Auto Insurance: Four States Insurance offers a variety of auto insurance options to suit different needs, including liability, collision, comprehensive, and uninsured motorist coverage. Customers can choose from various coverage levels and deductibles to customize their policies to meet their specific requirements.

- Home Insurance: Four States Insurance offers home insurance policies that protect against damage from fire, theft, vandalism, and natural disasters. The policies also provide coverage for personal property and liability.

- Life Insurance: Four States Insurance offers various life insurance plans, including term life, whole life, and universal life insurance. These plans help ensure financial security for loved ones in the event of an unexpected death.

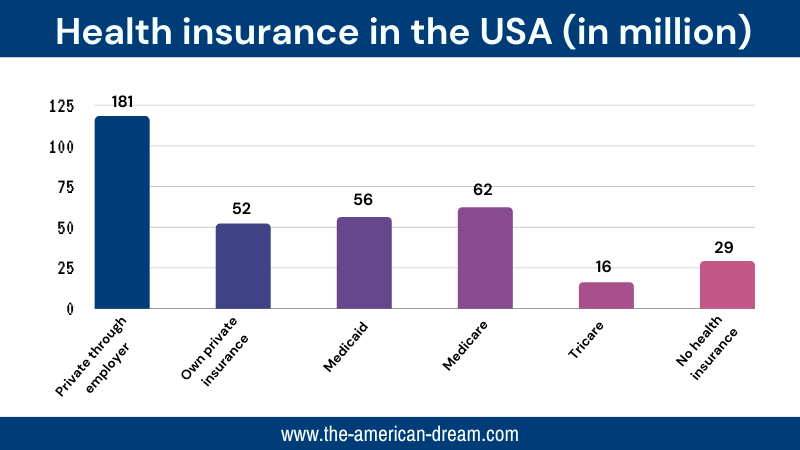

- Health Insurance: Four States Insurance offers a range of health insurance plans, including individual and family plans, to provide comprehensive coverage for medical expenses.

Competitive Pricing

Four States Insurance is committed to providing competitive pricing for its insurance policies. The company utilizes advanced technology and data analytics to ensure that its rates are fair and reflect the risks associated with each policy.

- Discounts: Four States Insurance offers a variety of discounts to help customers save money on their premiums. These discounts include safe driving discounts, good student discounts, multi-policy discounts, and more.

- Payment Options: Four States Insurance offers flexible payment options to make it easy for customers to manage their insurance premiums. Customers can choose to pay monthly, quarterly, or annually, and they can also set up automatic payments to ensure that their premiums are paid on time.

Exceptional Customer Service

Four States Insurance is committed to providing exceptional customer service. The company has a team of experienced and knowledgeable insurance professionals who are dedicated to helping customers understand their coverage options and make informed decisions.

- 24/7 Support: Four States Insurance offers 24/7 customer support, so customers can get help whenever they need it. The company’s customer service representatives are available by phone, email, and online chat.

- Claims Process: Four States Insurance has a streamlined claims process to ensure that customers receive prompt and efficient service. The company’s claims adjusters are available to assist customers with filing claims and navigating the claims process.

Key Features of Insurance Plans

The following table highlights the key features of different insurance plans offered by Four States Insurance:

| Plan Type | Key Features |

|---|---|

| Auto Insurance | Liability, collision, comprehensive, uninsured motorist coverage, various coverage levels and deductibles, discounts for safe driving, good student, and multi-policy. |

| Home Insurance | Coverage for damage from fire, theft, vandalism, and natural disasters, personal property and liability coverage, discounts for security systems and fire alarms. |

| Life Insurance | Term life, whole life, and universal life insurance, various coverage amounts and premiums, beneficiary designations, death benefit payouts. |

| Health Insurance | Individual and family plans, comprehensive coverage for medical expenses, prescription drug coverage, preventive care services, various deductible and co-pay options. |

Case Study: Helping Customers Overcome Challenges

Four States Insurance has a proven track record of helping customers overcome specific challenges. One such case involved a family whose home was damaged in a fire. The family was devastated by the loss and unsure of how they would rebuild their lives. Four States Insurance stepped in to provide support and guidance throughout the entire process. The company’s claims adjusters worked closely with the family to ensure that they received the necessary compensation to rebuild their home.

“Four States Insurance was there for us every step of the way. They were compassionate and understanding, and they made the entire claims process as easy as possible. We are so grateful for their help.” – John Smith, a satisfied customer.

Customer Experience and Reviews

At Four States Insurance, we prioritize providing exceptional customer service and fostering strong relationships with our policyholders. We strive to make the insurance process as smooth and stress-free as possible, and we value your feedback.

Customer Testimonials and Reviews

Customer feedback is crucial for us to understand what we are doing well and where we can improve. We actively collect and analyze customer testimonials and reviews from various sources, including our website, social media platforms, and independent review sites. These reviews provide valuable insights into our customers’ experiences with Four States Insurance.

Positive Feedback

- Many customers praise our friendly and knowledgeable agents who go above and beyond to understand their needs and provide personalized solutions.

- Our transparent and competitive pricing is frequently mentioned as a positive aspect of our service.

- Customers appreciate the ease of use of our online platform and mobile app, which allow them to manage their policies and make payments conveniently.

Areas for Improvement

- While our overall customer satisfaction is high, some customers have expressed concerns about the time it takes to process claims.

- We are continually working to improve our communication channels and ensure that customers receive timely and accurate updates.

- We are committed to addressing any negative feedback and using it to enhance our services.

Customer Service Channels and Resources

Four States Insurance offers a variety of customer service channels and resources to ensure that our policyholders have convenient access to support.

Contact Options

- Phone: Our dedicated customer service line is available 24/7 to answer your questions and provide assistance.

- Email: You can reach our customer support team via email for non-urgent inquiries or to provide feedback.

- Live Chat: Our website features a live chat option for real-time assistance during business hours.

- Social Media: We are active on various social media platforms and respond to customer inquiries promptly.

Online Resources

- FAQ Section: Our website provides a comprehensive FAQ section that addresses common questions and concerns.

- Policy Documents: You can access your policy documents online, including coverage details and terms and conditions.

- Claim Filing Portal: Our online claim filing portal allows you to submit claims quickly and easily.

Customer Experience Comparison

When comparing Four States Insurance to other insurance providers, we strive to offer a more personalized and customer-centric approach. We believe in building long-term relationships with our policyholders and providing them with the support they need.

Key Differentiators

- Personalized Service: Our agents take the time to understand your individual needs and recommend the most suitable insurance coverage.

- Proactive Communication: We keep you informed throughout the entire insurance process, from policy purchase to claim resolution.

- Digital Convenience: Our online platform and mobile app provide you with convenient access to your policies and services.

Industry Trends and Innovations

The insurance industry is undergoing a rapid transformation, driven by technological advancements, evolving customer expectations, and changing market dynamics. Four States Insurance recognizes these shifts and is actively adapting to remain competitive and provide innovative solutions.

Four States Insurance is committed to staying ahead of the curve by embracing emerging technologies and incorporating industry best practices into its operations and product offerings. This approach ensures that the company remains relevant and responsive to the evolving needs of its customers.

Artificial Intelligence and Machine Learning

The use of AI and ML is transforming various aspects of the insurance industry, from risk assessment and pricing to claims processing and customer service. Four States Insurance leverages these technologies to enhance efficiency, improve accuracy, and personalize customer experiences.

- Risk Assessment and Pricing: AI-powered algorithms analyze vast amounts of data to assess risks more accurately, leading to more precise pricing and fairer premiums for customers. This enables Four States Insurance to offer competitive rates while ensuring financial stability.

- Claims Processing: Automated claims processing systems powered by AI can streamline the claims process, reducing processing time and improving customer satisfaction. These systems can also identify potential fraud and expedite legitimate claims.

- Customer Service: Chatbots and virtual assistants powered by AI provide 24/7 support, answering customer inquiries and resolving simple issues quickly. This improves customer service efficiency and frees up human agents to handle more complex issues.

Digital Transformation and Customer Experience

Digital transformation is reshaping the way customers interact with insurance companies. Four States Insurance embraces digital channels to provide convenient and personalized experiences.

- Online Platforms: Four States Insurance offers a user-friendly online platform where customers can obtain quotes, manage policies, submit claims, and access account information. This digital platform enhances customer convenience and accessibility.

- Mobile Apps: The company provides a mobile app that allows customers to access policy information, file claims, contact customer support, and receive personalized notifications. This mobile-first approach caters to the increasing reliance on smartphones.

- Data Analytics and Personalization: Four States Insurance utilizes data analytics to understand customer preferences and behavior. This information is used to personalize communication, offer tailored products and services, and improve customer engagement.

Cybersecurity and Data Privacy

Cybersecurity and data privacy are paramount in the digital age. Four States Insurance invests in robust security measures to protect customer data and ensure compliance with industry regulations.

- Data Encryption: All customer data is encrypted to prevent unauthorized access and protect sensitive information. This ensures that customer information remains secure and confidential.

- Multi-Factor Authentication: Four States Insurance implements multi-factor authentication to prevent unauthorized access to customer accounts. This adds an extra layer of security, requiring users to provide multiple forms of verification.

- Regular Security Audits: The company conducts regular security audits to identify and address potential vulnerabilities. This proactive approach helps maintain a secure environment and prevent cyberattacks.

Final Thoughts

From its origins to its current position as a market leader, Four States Insurance has consistently demonstrated a dedication to providing reliable and affordable insurance protection. The company’s commitment to customer satisfaction, coupled with its commitment to innovation, ensures that Four States Insurance remains a trusted partner for individuals and businesses seeking comprehensive insurance solutions.

Query Resolution: Four States Insurance

What types of insurance does Four States Insurance offer?

Four States Insurance offers a wide range of insurance products, including auto, home, business, life, and health insurance.

How can I get a quote for insurance from Four States Insurance?

You can get a quote online, by phone, or by visiting a local Four States Insurance agent.

What are the benefits of choosing Four States Insurance?

Benefits include competitive pricing, comprehensive coverage options, excellent customer service, and a commitment to innovation.