Florida state run insurance – Florida State-Run Insurance takes center stage in the Sunshine State’s complex insurance landscape. This program, designed to provide coverage for those struggling to find policies in the private market, has a fascinating history and a significant impact on the state’s financial health and the lives of its residents.

This program, formally known as Citizens Property Insurance Corporation, was established in 2002 following a series of devastating hurricanes that left many Floridians uninsured. It serves as a safety net for those who cannot obtain coverage from private insurers, often due to high risk factors like proximity to the coast or aging homes. The program offers a range of policies, including homeowners, windstorm, and flood insurance, with premiums set based on a complex formula that considers factors like property value, location, and construction type.

Overview of Florida State Run Insurance

Florida’s state-run insurance program, officially known as Citizens Property Insurance Corporation, was established in 2002 to address the state’s challenging property insurance market. This program was created to provide insurance coverage to homeowners who were unable to obtain coverage from private insurers, especially after a series of devastating hurricanes in the early 2000s.

History and Purpose

The creation of Citizens Property Insurance Corporation was a direct response to the difficulties faced by Florida homeowners in securing affordable and accessible property insurance. Following the hurricanes of 2004 and 2005, many private insurers either withdrew from the state or significantly increased premiums, leaving many homeowners without coverage. The state legislature recognized the need for a safety net and established Citizens to provide a last resort for property insurance in Florida.

Types of Insurance Offered

Citizens Property Insurance Corporation offers a range of insurance products designed to protect homeowners from various perils, including:

- Homeowners Insurance: This provides coverage for damage to the insured’s dwelling, personal property, and liability for accidents on the property.

- Flood Insurance: Citizens offers flood insurance coverage through the National Flood Insurance Program (NFIP), providing protection against losses caused by flooding.

- Windstorm Insurance: This coverage is specifically designed to protect against damage caused by hurricanes and other strong winds.

Program Structure and Organization

Citizens Property Insurance Corporation operates as a not-for-profit, state-run entity governed by a board of directors appointed by the Florida governor. The board oversees the corporation’s operations and sets policy for the program. The corporation is funded by premiums collected from policyholders and through assessments levied on private insurers operating in Florida. Citizens is subject to oversight by the Florida Office of Insurance Regulation, which ensures compliance with state laws and regulations.

Financial Stability and Performance: Florida State Run Insurance

The financial health and performance of Florida’s state-run insurance program are crucial for its long-term sustainability and ability to provide affordable coverage to residents. The program’s financial stability depends on factors such as its reserve levels, claims payouts, and profitability. This section examines the program’s financial performance in recent years, including its profitability, solvency, and key metrics such as premiums and coverage limits.

Reserves and Claims Payouts

The program’s financial health is heavily reliant on its reserves, which serve as a buffer to cover unexpected claims and potential losses.

- Reserves are built up through premium payments and investment income.

- Claims payouts are the amounts paid out to policyholders for covered losses.

A healthy balance between reserves and claims payouts is essential for the program’s long-term stability.

Profitability and Solvency

The program’s profitability is determined by its ability to generate revenue exceeding its expenses, including claims payouts and administrative costs.

- Profitability is essential for maintaining adequate reserves and ensuring the program’s long-term sustainability.

- Solvency refers to the program’s ability to meet its financial obligations as they become due.

A solvent program is able to pay its claims and maintain adequate reserves, even in the event of major catastrophic events.

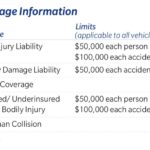

Premiums and Coverage Limits

Premiums are the payments policyholders make to the program for coverage.

- Premium rates are typically determined based on factors such as property value, location, and coverage limits.

- Coverage limits refer to the maximum amount the program will pay for a covered loss.

The program’s premiums and coverage limits are subject to regulation and oversight by the Florida Office of Insurance Regulation.

Impact on the Florida Insurance Market

The state-run insurance program in Florida, known as Citizens Property Insurance Corporation, plays a significant role in the state’s insurance market. It exists to provide insurance coverage when private insurers are unwilling or unable to do so, particularly in high-risk areas. This program’s presence impacts both private insurance companies and consumer rates, influencing the overall landscape of insurance in Florida.

Impact on Private Insurance Companies

The presence of Citizens Property Insurance Corporation has a direct impact on private insurance companies operating in Florida. Here’s how:

- Competition: Citizens Property Insurance Corporation competes with private insurers for policyholders, particularly those residing in high-risk areas where private insurers may be reluctant to offer coverage due to potential claims. This competition can put pressure on private insurers to lower their rates or offer more competitive coverage options to remain attractive to customers.

- Market Share: As Citizens Property Insurance Corporation gains market share, private insurers may experience a decrease in their own market share. This can affect their profitability and ability to invest in new products and services.

- Risk Pool: Citizens Property Insurance Corporation serves as a safety net for the insurance market. By taking on high-risk policyholders, it helps to stabilize the market and prevent a potential collapse of the private insurance sector due to catastrophic events.

Challenges and Opportunities

The Florida state-run insurance program, while aiming to provide affordable and accessible insurance, faces several challenges. These challenges stem from factors such as the state’s unique vulnerability to natural disasters, the complex regulatory environment, and the evolving needs of the insurance market. However, opportunities exist to overcome these challenges and strengthen the program’s effectiveness.

Addressing Financial Sustainability, Florida state run insurance

Financial stability is crucial for any insurance program, especially one operating in a hurricane-prone state like Florida. The state-run insurance program faces the challenge of balancing affordability for policyholders with the need to maintain adequate reserves to cover potential catastrophic losses.

The program can enhance its financial sustainability through several strategies:

- Strengthening Reinsurance Coverage: Reinsurance plays a critical role in transferring risk and mitigating potential losses. By securing robust reinsurance agreements, the program can protect itself against significant financial shocks from catastrophic events.

- Diversifying Investment Portfolio: The program can enhance its financial resilience by diversifying its investment portfolio. This diversification can help reduce exposure to market volatility and ensure that the program has sufficient funds available when needed.

- Improving Risk Management Practices: Proactive risk management practices, such as building codes, mitigation strategies, and effective disaster preparedness plans, can help reduce the frequency and severity of claims, thereby improving the program’s financial stability.

Expanding Access and Affordability

The state-run insurance program aims to provide affordable coverage, particularly for those who struggle to find insurance in the private market. However, maintaining affordability while managing risk is a constant challenge.

The program can expand access and affordability through the following initiatives:

- Developing Targeted Programs: The program can develop targeted programs to address the specific needs of vulnerable populations, such as low-income households or homeowners in high-risk areas. These programs can offer tailored insurance products with flexible payment options.

- Enhancing Consumer Education: Effective consumer education can empower policyholders to make informed decisions about their insurance coverage. The program can provide clear and accessible information about insurance options, risk mitigation strategies, and disaster preparedness.

- Promoting Public-Private Partnerships: Collaboration with private insurers can create innovative solutions to expand access and affordability. For instance, public-private partnerships can explore shared risk pools or develop new insurance products.

Adapting to Climate Change

Climate change is exacerbating the frequency and intensity of natural disasters, posing significant challenges to the state-run insurance program. The program needs to adapt to these evolving risks to ensure its long-term sustainability.

The program can adapt to climate change by:

- Implementing Climate-Resilient Building Codes: Enacting stricter building codes that incorporate climate change considerations can help reduce the vulnerability of homes and businesses to extreme weather events.

- Investing in Coastal Protection Measures: Investments in coastal protection infrastructure, such as seawalls and dune restoration, can help mitigate the impacts of rising sea levels and storm surge.

- Developing Climate Change Adaptation Strategies: The program can develop comprehensive climate change adaptation strategies that incorporate risk assessment, mitigation measures, and long-term planning.

Leveraging Technology and Innovation

Technology and innovation can play a vital role in enhancing the efficiency and effectiveness of the state-run insurance program.

The program can leverage technology and innovation by:

- Implementing Digital Platforms: Utilizing digital platforms for policy management, claims processing, and customer service can streamline operations and improve efficiency.

- Utilizing Data Analytics: Data analytics can provide valuable insights into risk assessment, pricing models, and fraud detection. The program can leverage these insights to improve decision-making and enhance operational efficiency.

- Exploring Emerging Technologies: The program can explore emerging technologies, such as artificial intelligence and blockchain, to automate processes, improve accuracy, and enhance customer experiences.

Comparison with Other States

While Florida’s state-run insurance program is unique, other states have implemented similar initiatives to address insurance market challenges. Examining these programs offers valuable insights into the strengths and weaknesses of different approaches and the lessons learned from their experiences.

State-Run Insurance Programs in Other States

Several states have implemented state-run insurance programs, often in response to specific challenges within their insurance markets. Some notable examples include:

- California: The California FAIR Plan (Fair Access to Insurance Requirements) provides coverage for properties deemed uninsurable by private insurers, primarily due to wildfire risks. This program serves as a safety net for high-risk properties, but it is often criticized for its high premiums and limited coverage.

- Texas: Texas Windstorm Insurance Association (TWIA) is a state-created entity that provides windstorm insurance coverage for properties located in coastal areas. TWIA faces challenges in managing its exposure to catastrophic events and maintaining financial stability, particularly during hurricane seasons.

- Louisiana: Louisiana Citizens Property Insurance Corporation is a state-run insurer that covers properties deemed uninsurable by private insurers, primarily due to hurricane risks. It has been criticized for its high premiums and its role in driving up insurance costs for all property owners in the state.

- New York: New York State of Emergency System for Insurance (S.E.S.I.) provides coverage for property owners who are unable to obtain insurance from private insurers due to catastrophic events. This program serves as a temporary solution during emergencies, but it does not offer long-term coverage.

Public Perception and Policy Implications

Public perception of Florida’s state-run insurance program is a complex issue, influenced by factors like the program’s performance, the state’s unique insurance market, and broader political dynamics. Understanding these perceptions is crucial for assessing the program’s long-term viability and potential policy changes.

Public Opinion on State-Run Insurance

Public opinion regarding Florida’s state-run insurance program is diverse, shaped by factors like personal experiences with the program, media coverage, and political affiliations.

- Positive Views: Supporters of the program often highlight its role in providing affordable insurance options, particularly for those struggling to find coverage in the private market. They may also appreciate its focus on addressing the unique challenges of Florida’s insurance market, like hurricane risk.

- Negative Views: Critics of the program may raise concerns about its financial stability, potential for higher premiums in the future, or its impact on the private insurance market. They might also question the government’s role in providing insurance services.

- Mixed Views: Many Floridians hold mixed opinions, acknowledging the program’s benefits while also expressing concerns about its long-term sustainability. They may support the program’s goals but question its execution or the government’s involvement.

Political and Policy Implications

The state-run insurance program has significant political and policy implications, influencing both state and national insurance debates.

- Political Support: The program’s political support is often linked to its ability to provide affordable insurance options to Floridians, particularly in areas vulnerable to hurricanes. This can be a crucial issue for elected officials seeking to appeal to a broad range of voters.

- Policy Debates: The program’s existence has sparked ongoing debates about the role of government in insurance markets, the balance between affordability and financial stability, and the potential for competition between public and private insurers.

- Policy Changes: The program’s performance and public perception can influence policy changes, including adjustments to premiums, coverage, or the program’s overall structure.

Future Directions for the Program

The future direction of Florida’s state-run insurance program will depend on various factors, including its financial performance, public opinion, and political priorities.

- Maintaining Financial Stability: Ensuring the program’s long-term financial stability will be a key focus, likely involving strategies to manage risk, optimize premiums, and potentially explore partnerships with private insurers.

- Expanding Coverage: The program may consider expanding coverage options to address specific needs within the state, such as providing more comprehensive flood insurance or offering policies tailored to certain demographics.

- Improving Transparency: Strengthening transparency and communication with the public regarding the program’s operations, financial health, and policy decisions could be crucial for maintaining public trust and support.

Concluding Remarks

Florida State-Run Insurance plays a vital role in the state’s insurance market, providing a critical safety net for residents. While it faces challenges in balancing affordability with financial stability, it remains a crucial element of the state’s insurance landscape. Its future hinges on finding solutions to address its challenges and ensuring its long-term sustainability, a task that requires careful consideration of both financial and policy implications.

FAQ Guide

What is the purpose of Florida State-Run Insurance?

Florida State-Run Insurance, or Citizens Property Insurance Corporation, was created to provide insurance coverage to Floridians who have difficulty finding policies in the private market, often due to high-risk factors.

How does Florida State-Run Insurance compare to private insurance companies?

Florida State-Run Insurance is a government-run entity, while private insurance companies are for-profit businesses. The program aims to provide coverage to those who might not be able to secure it from private insurers, but its premiums and coverage terms may differ from those offered by private companies.

Is Florida State-Run Insurance financially stable?

The program’s financial stability has been a topic of debate, with concerns about its ability to handle major hurricane events. Its financial health is influenced by factors such as premiums, claims payouts, and the frequency and severity of hurricanes.