Florida state required car insurance is a crucial aspect of responsible driving in the Sunshine State. Understanding the minimum coverage requirements and available options can help you make informed decisions about your insurance needs and ensure you’re adequately protected on the road.

Florida law mandates that all drivers carry a minimum level of car insurance to protect themselves and others in the event of an accident. These requirements include bodily injury liability, property damage liability, and personal injury protection (PIP). While these coverages are essential, drivers can also choose additional protection, such as collision, comprehensive, and uninsured/underinsured motorist coverage, depending on their individual needs and risk tolerance.

Florida’s Minimum Car Insurance Requirements

Driving a car in Florida requires you to have the legally mandated minimum car insurance coverage. This is crucial for protecting yourself financially in case of an accident and ensuring you meet the state’s legal requirements.

Florida’s Mandatory Car Insurance Coverage Types

Florida requires all drivers to carry two main types of insurance coverage: Personal Injury Protection (PIP) and Property Damage Liability (PDL).

Minimum Financial Responsibility Limits

The minimum financial responsibility limits in Florida for each coverage type are as follows:

- Personal Injury Protection (PIP): $10,000 per person. This coverage pays for medical expenses, lost wages, and other related costs for injuries sustained in an accident, regardless of who is at fault.

- Property Damage Liability (PDL): $10,000 per accident. This coverage pays for damages to another person’s property, such as their vehicle, if you are at fault in an accident.

Penalties for Driving Without Required Insurance

Driving without the required minimum car insurance in Florida is a serious offense. The penalties for driving without insurance can include:

- Fines: You could face a fine of up to $500 for the first offense, and even higher fines for subsequent offenses.

- License Suspension: Your driver’s license could be suspended until you provide proof of insurance.

- Vehicle Impoundment: Your vehicle could be impounded until you provide proof of insurance.

- Jail Time: In some cases, you could even face jail time for driving without insurance.

It’s important to note that these penalties can vary depending on the specific circumstances of your case.

Types of Car Insurance Coverage in Florida

While Florida mandates certain minimum car insurance coverages, drivers have the option to purchase additional types of coverage to enhance their protection. These optional coverages provide broader financial security in the event of an accident or other unforeseen circumstances.

Collision Coverage

Collision coverage protects your vehicle against damage caused by a collision with another vehicle or object, regardless of fault.

- Description: This coverage reimburses you for repairs or replacement of your car if you are involved in an accident, even if you are at fault.

- Benefits: Collision coverage provides peace of mind, knowing that you can repair or replace your vehicle after an accident, regardless of who is responsible. It is particularly beneficial for newer or more expensive vehicles.

- Drawbacks: Collision coverage can be costly, especially for newer or high-value vehicles. It is generally not recommended for older vehicles with a lower market value, as the cost of repairs may exceed the vehicle’s worth.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Description: This coverage reimburses you for repairs or replacement of your car due to non-collision incidents, such as theft, vandalism, hail damage, or floods.

- Benefits: Comprehensive coverage offers broad protection against a wide range of risks, providing financial security for unexpected events that could damage your vehicle.

- Drawbacks: Like collision coverage, comprehensive coverage can be expensive, particularly for high-value vehicles. It is generally not recommended for older vehicles with a lower market value, as the cost of repairs may exceed the vehicle’s worth.

Personal Injury Protection (PIP)

PIP coverage provides medical and wage loss benefits to you and your passengers, regardless of fault, if you are injured in an accident.

- Description: This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, even if you are at fault for the accident.

- Benefits: PIP coverage offers financial protection for medical expenses and lost income, ensuring you can access necessary treatment and support during recovery.

- Drawbacks: While PIP is mandatory in Florida, the coverage limits can be relatively low. It is important to choose a PIP coverage limit that meets your needs and potential medical expenses.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) protects you if you are injured in an accident caused by a driver who does not have insurance or has insufficient insurance.

- Description: This coverage pays for your medical expenses, lost wages, and other related costs if you are injured by a driver who is uninsured or underinsured.

- Benefits: UM/UIM coverage provides crucial protection in situations where the other driver lacks sufficient insurance to cover your damages.

- Drawbacks: UM/UIM coverage can be expensive, but it offers significant financial protection in the event of an accident with an uninsured or underinsured driver.

Medical Payments Coverage, Florida state required car insurance

Medical payments coverage (MedPay) provides coverage for medical expenses for you and your passengers, regardless of fault, even if the accident occurs outside of Florida.

- Description: This coverage pays for medical expenses for you and your passengers, regardless of who is at fault, up to the policy limit.

- Benefits: MedPay coverage offers supplemental protection for medical expenses, providing peace of mind knowing that your medical costs will be covered, even if you are at fault for the accident.

- Drawbacks: MedPay coverage is not mandatory in Florida, but it can be a valuable addition to your policy, especially if you frequently travel outside the state.

Factors Affecting Car Insurance Costs in Florida

Several factors contribute to the cost of car insurance in Florida. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving Record

Your driving record is a crucial factor in determining your insurance premiums. Insurance companies assess your past driving behavior to predict your future risk.

- Accidents: Having a history of accidents, even minor ones, can significantly increase your premiums. Each accident is a data point indicating higher risk, resulting in higher premiums.

- Traffic Violations: Speeding tickets, reckless driving citations, and DUI convictions all negatively impact your premiums. These violations signal risky behavior, leading to higher premiums.

- Insurance Claims: Filing insurance claims, even for minor incidents, can impact your premiums. Each claim adds to your risk profile, increasing the cost of insurance.

Age and Gender

Insurance companies consider age and gender when calculating premiums, as these factors correlate with risk.

- Young Drivers: Young drivers, especially those under 25, are statistically more likely to be involved in accidents. This higher risk translates to higher premiums.

- Older Drivers: While older drivers have more experience, they may face health issues that affect their driving abilities. Insurance companies adjust premiums based on these factors.

- Gender: Historically, insurance companies have observed that men tend to be involved in more accidents than women. However, this trend is changing, and many states are now moving towards gender-neutral pricing.

Vehicle Type and Value

The type and value of your vehicle directly influence your insurance premiums.

- Vehicle Type: Sports cars and luxury vehicles are often associated with higher risk and are typically more expensive to repair. These factors contribute to higher premiums.

- Vehicle Value: The higher the value of your car, the more expensive it is to replace in case of an accident. This higher replacement cost translates to higher premiums.

Location and Driving History

Your location and driving history significantly impact your insurance premiums.

- Location: Areas with high traffic density and crime rates tend to have higher accident rates. Insurance companies factor this into their pricing.

- Driving History: Your driving habits, such as the number of miles you drive annually and your commute, can influence your premiums. Higher mileage and longer commutes generally lead to higher premiums.

Credit Score

In some states, including Florida, insurance companies can use your credit score as a factor in determining your premiums.

- Credit Score Correlation: Studies have shown a correlation between credit score and driving behavior. Individuals with lower credit scores may be more likely to engage in risky behaviors, including driving without insurance.

- Premium Impact: While not all insurance companies use credit score as a factor, those that do may offer lower premiums to individuals with good credit.

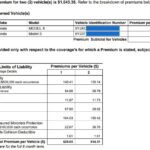

Impact of Different Factors on Insurance Premiums

| Factor | Impact on Premiums |

|---|---|

| Driving Record | Higher premiums for accidents, violations, and claims |

| Age and Gender | Higher premiums for young drivers, older drivers with health issues, and historically, men |

| Vehicle Type and Value | Higher premiums for sports cars, luxury vehicles, and vehicles with high replacement costs |

| Location and Driving History | Higher premiums for areas with high accident rates, higher mileage, and longer commutes |

| Credit Score | Potentially lower premiums for individuals with good credit |

Finding Affordable Car Insurance in Florida

Finding affordable car insurance in Florida is crucial, as the state has a high average cost of insurance. Fortunately, several strategies can help you lower your premiums and save money.

Comparing Quotes from Multiple Insurers

Obtaining quotes from multiple insurers is essential for finding the most affordable coverage. Different insurance companies have varying rates based on their risk assessments, customer profiles, and coverage options. By comparing quotes, you can identify the insurer offering the most competitive rates for your specific needs.

Maintaining a Good Driving Record

A clean driving record is a significant factor in determining your insurance premiums. Maintaining a good driving record, free of accidents, traffic violations, or DUI convictions, can significantly reduce your insurance costs. Insurance companies consider drivers with a history of safe driving to be lower risk and, therefore, offer them lower premiums.

Choosing a Safe Vehicle

The type of vehicle you drive plays a crucial role in your insurance premiums. Insurance companies assess the safety features, repair costs, and theft risk of different vehicles. Choosing a safe vehicle with advanced safety features and a lower risk of theft can lower your insurance premiums.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can lead to significant discounts. Insurance companies often offer discounts for bundling multiple policies, as it reduces their administrative costs and increases customer loyalty.

Increasing Deductibles

Increasing your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, can lower your premiums. While increasing your deductible means you’ll pay more in the event of a claim, it can significantly reduce your monthly insurance payments.

Resources for Finding Car Insurance Quotes Online

Several online resources allow you to compare car insurance quotes from multiple insurers quickly and easily. Some popular platforms include:

- Insurify: A comprehensive platform that compares quotes from various insurance companies.

- Policygenius: A platform that offers personalized insurance recommendations and helps you find the best deals.

- The Zebra: A website that allows you to compare quotes from multiple insurers and get personalized recommendations.

Understanding Your Car Insurance Policy

Your car insurance policy is a legally binding contract between you and your insurance company. It Artikels the terms and conditions of your coverage, including the types of protection you have, the limits of your coverage, and the circumstances under which your insurance company will pay for claims. Understanding the contents of your policy is crucial to ensure you have the right coverage and know how to file a claim if needed.

Policy Sections

Each car insurance policy is divided into several sections, each containing specific information about your coverage.

- Declaration Page: This page summarizes the key details of your policy, including your name, address, policy number, vehicle information, coverage types, and premium amounts. It also states the effective date of your policy and the renewal date.

- Coverage Sections: This section Artikels the different types of coverage you have purchased, such as liability, collision, comprehensive, and personal injury protection (PIP). Each coverage section describes the specific risks covered, the limits of your coverage, and any exclusions or limitations.

- Exclusions and Limitations: This section lists specific events or situations that are not covered by your policy. For example, your insurance may not cover damages caused by driving under the influence of alcohol or drugs.

- Conditions: This section Artikels the terms and conditions that apply to your policy. It includes information on how to file a claim, how premiums are calculated, and how your policy can be cancelled.

- Endorsements: Endorsements are additions or changes to your policy that modify the original coverage. They can be used to add coverage, remove coverage, or adjust the limits of your coverage.

Importance of Reading Your Policy

Reading and understanding your car insurance policy is essential for several reasons:

- Ensure Adequate Coverage: By reviewing your policy, you can confirm that you have the right coverage for your needs and risk tolerance. For example, if you have a new car, you may want to consider adding collision and comprehensive coverage to protect against damage from accidents and other events.

- Understand Exclusions and Limitations: Your policy may contain exclusions or limitations that you are unaware of. Reading the policy carefully can help you avoid unpleasant surprises when you need to file a claim.

- Know Your Rights and Responsibilities: Your policy Artikels your rights and responsibilities as an insured individual. It explains how to file a claim, what documentation you need to provide, and how your insurance company will handle your claim.

- Avoid Disputes: Understanding your policy can help you avoid disputes with your insurance company. If you know what your coverage includes and how your policy works, you are less likely to misunderstand the terms of your coverage or be surprised by unexpected charges.

Last Recap: Florida State Required Car Insurance

Navigating the world of Florida car insurance can be complex, but understanding the state’s requirements and available options is essential for responsible driving. By comparing quotes, considering various factors, and carefully reviewing your policy, you can find affordable and comprehensive insurance that provides the peace of mind you deserve on the road.

FAQ

What happens if I get caught driving without the required car insurance in Florida?

Driving without the required car insurance in Florida is a serious offense. You could face fines, license suspension, and even jail time. Additionally, you’ll be responsible for any damages or injuries you cause in an accident.

Can I get a discount on my car insurance if I have a good driving record?

Yes, most insurance companies offer discounts for drivers with clean driving records. This means no accidents, traffic violations, or DUI convictions. Maintaining a good driving record can significantly reduce your insurance premiums.

How often should I review my car insurance policy?

It’s a good idea to review your car insurance policy at least once a year, or whenever there’s a significant life change, such as a new car, a change in your driving habits, or a change in your financial situation. This ensures that your coverage remains adequate and meets your current needs.