Florida State Minimum Insurance Coverage is a crucial aspect of driving in the Sunshine State. It’s not just a legal requirement; it’s a safety net that protects you and others in case of an accident. Understanding these minimums is vital, as they dictate the financial coverage you have in the event of a collision.

Florida’s no-fault insurance system, a unique feature, plays a significant role in determining how accident claims are handled. This system emphasizes covering your own medical expenses regardless of who’s at fault. However, it’s essential to remember that minimum coverage might not always be enough, especially in serious accidents.

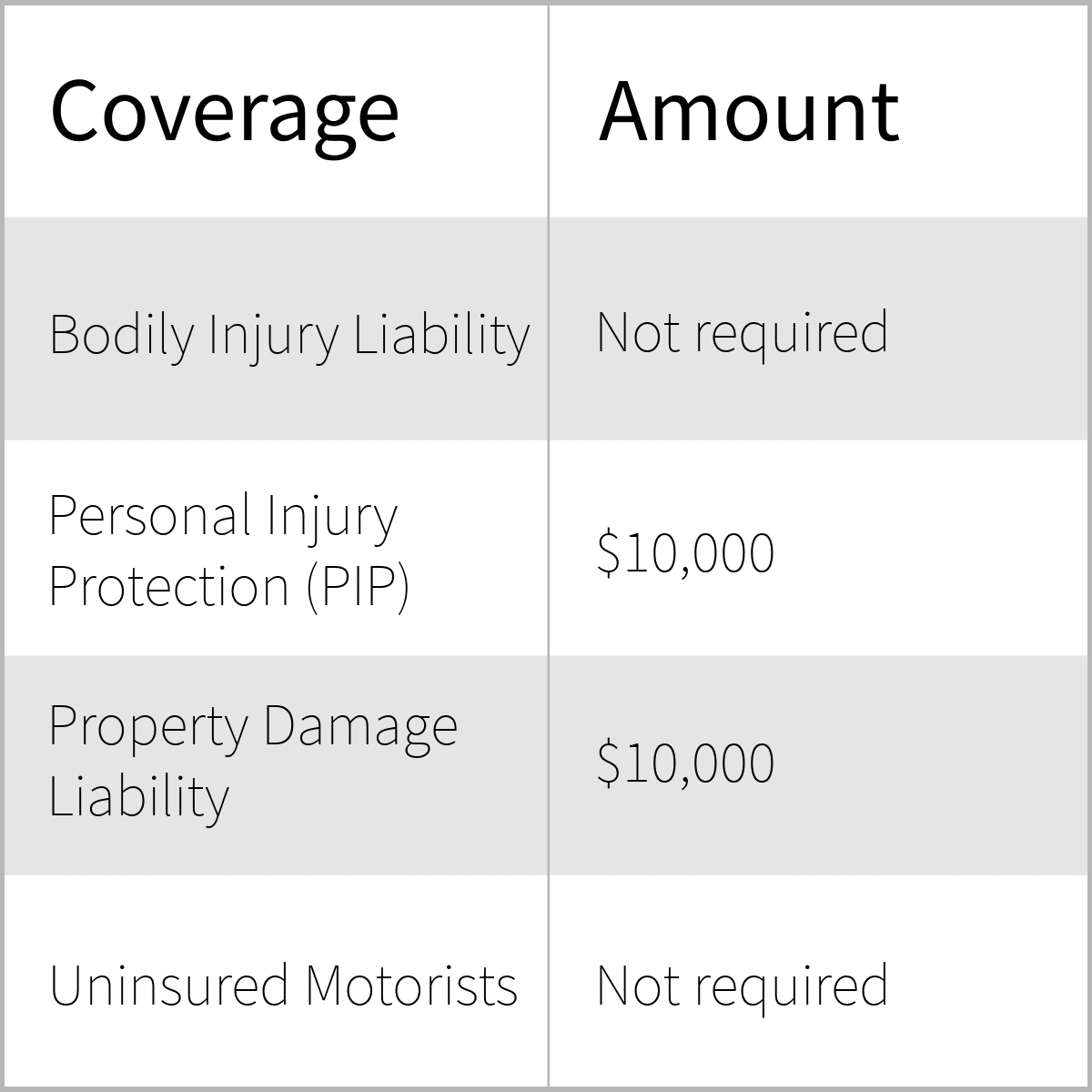

Florida’s Minimum Insurance Requirements

Driving a vehicle in Florida comes with certain responsibilities, including carrying the minimum required auto insurance. This ensures that you’re financially protected in case of an accident, and it also safeguards other drivers on the road.

Liability Coverage

Liability insurance is essential to cover the costs of damages and injuries you may cause to others in an accident. In Florida, drivers are required to have the following minimum liability coverage:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages for injuries you cause to others in an accident. The minimum requirement is $10,000 per person and $20,000 per accident.

- Property Damage Liability: This coverage pays for damages to another person’s vehicle or property that you cause in an accident. The minimum requirement is $10,000 per accident.

These minimum limits may not be enough to cover all potential costs in a serious accident, so consider increasing your liability coverage for greater protection.

Personal Injury Protection (PIP)

Florida requires drivers to have Personal Injury Protection (PIP) coverage, also known as “no-fault” insurance. This coverage pays for your medical expenses, lost wages, and other related costs, regardless of who caused the accident. The minimum PIP coverage required is $10,000.

PIP coverage is designed to help you recover from injuries without having to go through the traditional claims process. It covers 80% of your medical expenses, up to $10,000, and 60% of your lost wages, up to $2,500.

You can choose to opt out of PIP coverage, but you must have valid health insurance to do so.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage is crucial to protect yourself in case you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. This coverage pays for your medical expenses, lost wages, and other damages.

- Uninsured Motorist Coverage: This coverage protects you if you’re hit by a driver who has no insurance. The minimum required coverage is the same as your bodily injury liability limits.

- Underinsured Motorist Coverage: This coverage protects you if you’re hit by a driver who has insurance, but their coverage isn’t enough to cover your losses. The minimum required coverage is the same as your bodily injury liability limits.

It’s highly recommended to purchase UM/UIM coverage at least equal to your bodily injury liability limits, or even higher, to ensure you have adequate protection.

Understanding Florida’s No-Fault System

Florida’s no-fault insurance system is a unique approach to handling car accident claims. Unlike many other states, where fault is determined to assign liability, Florida’s system focuses on providing immediate medical coverage to all involved parties, regardless of who caused the accident. This system aims to expedite the claims process and reduce litigation.

The Role of PIP Coverage

Personal Injury Protection (PIP) coverage is the cornerstone of Florida’s no-fault system. It is a mandatory component of every car insurance policy in the state, providing coverage for medical expenses, lost wages, and other related costs incurred by the insured and their passengers, regardless of who caused the accident.

Examples of Situations Where PIP Coverage Applies

PIP coverage applies to a wide range of situations, including:

- Medical expenses incurred by the insured or their passengers after an accident, regardless of who was at fault. This includes emergency room visits, doctor’s appointments, physical therapy, and prescription medications.

- Lost wages due to an accident-related injury. This coverage can help compensate for income lost while recovering from injuries.

- Other related expenses, such as transportation costs for medical appointments or household help if the insured is unable to perform daily tasks due to injuries.

Limitations of PIP Coverage

While PIP coverage provides valuable benefits, it does have limitations:

- Maximum Amount Payable: Florida law sets a maximum limit for PIP coverage, which is currently $10,000 per person. This means that PIP will only cover up to $10,000 in medical expenses and lost wages per person involved in the accident.

- Deductible: Most PIP policies have a deductible, which is the amount the insured must pay out-of-pocket before PIP coverage kicks in. Deductibles can range from $0 to $1,000 or more.

- Coverage for Non-Emergency Treatment: PIP coverage may not cover all types of medical treatment, such as elective procedures or cosmetic surgery, unless it is directly related to the accident injuries.

- Time Limits: PIP coverage has a time limit for seeking treatment. Typically, this limit is 14 days from the date of the accident. After this period, the insured may need to seek coverage from other sources.

The Importance of Adequate Coverage: Florida State Minimum Insurance Coverage

While Florida’s minimum insurance requirements are designed to protect drivers from financial ruin in the event of an accident, they often fall short of covering the full extent of damages and expenses. This can leave drivers with significant out-of-pocket costs and potential financial hardship.

Potential Financial Consequences of Minimum Coverage

Having only minimum insurance coverage can result in significant financial burdens for drivers involved in accidents, particularly if the accident is serious. This can lead to substantial out-of-pocket expenses for medical bills, vehicle repairs, lost wages, and other related costs.

Risks Associated with Insufficient Coverage

In the event of a serious accident, insufficient insurance coverage can lead to several risks for drivers:

* Financial Ruin: If the accident results in substantial damages, drivers with only minimum coverage may be forced to pay significant amounts out of pocket to cover the difference.

* Medical Expenses: In cases of serious injuries, medical bills can quickly escalate, exceeding the limits of minimum coverage, leaving drivers responsible for substantial medical expenses.

* Lost Wages: If the accident prevents a driver from working, they may face significant lost wages, which are not covered by minimum insurance policies.

* Legal Expenses: In cases of liability, drivers with inadequate coverage may face costly legal expenses to defend themselves.

* Property Damage: If the accident causes significant property damage, the minimum coverage may not be enough to cover the full repair or replacement costs.

Real-Life Scenarios Demonstrating the Need for Higher Limits

* Scenario 1: A driver with only minimum coverage is involved in a head-on collision, resulting in serious injuries to both drivers and significant damage to both vehicles. The cost of medical bills, vehicle repairs, and lost wages exceeds the minimum coverage limits, leaving the driver responsible for substantial out-of-pocket expenses.

* Scenario 2: A driver with minimum coverage is involved in an accident with a pedestrian. The pedestrian suffers severe injuries and requires extensive medical treatment. The driver’s minimum coverage is insufficient to cover the pedestrian’s medical expenses, leading to a potential lawsuit and significant financial liability for the driver.

Examples of How Additional Coverage Can Protect Drivers

* Higher Liability Limits: Increased liability limits can protect drivers from financial ruin by covering larger claims for damages and injuries.

* Medical Payments Coverage: This coverage provides additional financial protection for medical expenses, regardless of fault, ensuring drivers receive necessary medical treatment without facing financial hardship.

* Uninsured/Underinsured Motorist Coverage: This coverage protects drivers from financial losses caused by accidents involving uninsured or underinsured drivers.

* Collision and Comprehensive Coverage: These coverages provide protection for vehicle repairs or replacement in case of accidents or other incidents, such as theft or vandalism.

Factors Influencing Insurance Costs

Several factors contribute to the cost of car insurance in Florida. Understanding these factors can help you make informed decisions about your coverage and potentially save money on your premiums.

Driving History, Florida state minimum insurance coverage

Your driving history is a significant factor in determining your insurance rates. Insurance companies consider your past driving record, including accidents, traffic violations, and even the number of years you’ve been driving. A clean driving record with no accidents or violations usually translates to lower premiums. Conversely, drivers with multiple accidents or traffic violations may face higher premiums.

Choosing the Right Coverage

While Florida’s minimum insurance requirements provide basic protection, it’s essential to consider your individual needs and choose coverage that offers adequate financial security in case of an accident. Many factors can influence your decision, such as your driving habits, the value of your vehicle, and your financial situation.

Optional Coverage Options

Understanding the different types of optional coverage available can help you make informed decisions. These options can provide additional financial protection beyond the minimum requirements, offering peace of mind in the event of an accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. It’s typically recommended for newer vehicles or those with significant value.

- Comprehensive Coverage: This coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. It’s generally advisable for newer or more expensive vehicles.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. It’s essential for protecting yourself from significant financial losses.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of fault, in the event of an accident. It can be helpful for covering medical costs that exceed your health insurance coverage.

- Rental Reimbursement Coverage: This coverage provides financial assistance for renting a vehicle while your car is being repaired after an accident. It can be beneficial if you rely on your vehicle for work or other essential activities.

Benefits and Drawbacks of Optional Coverage

Each optional coverage option has its own set of benefits and drawbacks. Carefully weighing these factors can help you decide which options are most suitable for your circumstances.

- Collision Coverage:

- Benefit: Provides financial protection for repairs or replacement of your vehicle after an accident, regardless of fault.

- Drawback: Higher premiums, especially for newer or more expensive vehicles.

- Comprehensive Coverage:

- Benefit: Covers damage to your vehicle caused by events other than collisions, providing protection against various risks.

- Drawback: Higher premiums, especially for newer or more expensive vehicles.

- Uninsured/Underinsured Motorist Coverage (UM/UIM):

- Benefit: Protects you from significant financial losses if you’re involved in an accident with an uninsured or underinsured driver.

- Drawback: May increase premiums, but it’s crucial for financial security.

- Medical Payments Coverage (Med Pay):

- Benefit: Pays for medical expenses for you and your passengers, regardless of fault, providing additional financial protection.

- Drawback: May increase premiums, but it can be beneficial for covering medical costs beyond your health insurance.

- Rental Reimbursement Coverage:

- Benefit: Provides financial assistance for renting a vehicle while your car is being repaired, ensuring you have transportation.

- Drawback: May increase premiums, but it can be valuable if you rely on your vehicle for essential activities.

Consulting with an Insurance Agent

Consulting with a knowledgeable insurance agent is crucial for finding the most suitable coverage for your specific needs. They can help you:

- Assess your individual risk factors: An agent can evaluate your driving history, the value of your vehicle, and other factors to determine the appropriate level of coverage.

- Explain different coverage options: They can clarify the benefits and drawbacks of each optional coverage and help you understand their implications.

- Compare quotes from different insurance companies: Agents can help you compare quotes from multiple insurers to find the most competitive rates and coverage options.

- Provide personalized recommendations: Based on your needs and budget, they can recommend coverage options that offer the best balance of protection and affordability.

Last Word

While Florida’s minimum insurance coverage fulfills legal requirements, it’s wise to consider the potential financial consequences of relying solely on these minimums. Adequate coverage provides peace of mind and safeguards you from significant financial hardship in the event of a major accident. Consulting with an insurance agent can help you determine the right level of coverage to meet your individual needs and financial circumstances.

FAQ Summary

What happens if I get into an accident and only have the minimum insurance coverage?

If you only have the minimum coverage, you may be responsible for covering the costs of the other driver’s injuries and property damage beyond your policy limits. This could lead to significant financial burdens.

How do I know if I have enough insurance coverage?

Consult with an insurance agent to review your current coverage and discuss your individual needs and risk tolerance. They can help you determine if your current policy provides sufficient protection.

Can I get a discount on my car insurance if I have a clean driving record?

Yes, most insurance companies offer discounts for drivers with a good driving history. Safe driving habits and a clean record can significantly lower your premiums.

What are some examples of additional coverage I might consider?

Optional coverage includes collision coverage (which pays for repairs to your vehicle in a collision, regardless of fault), comprehensive coverage (which covers damage from non-collision events like theft or hail), and uninsured/underinsured motorist coverage (which protects you if you’re hit by someone without adequate insurance).