Florida State Minimum Insurance: It’s a phrase that often sparks confusion and concern for drivers. While Florida is known for its sunshine and beaches, navigating its auto insurance landscape can feel like a maze. This guide delves into the intricacies of Florida’s minimum insurance requirements, explaining the mandatory coverage types, financial responsibility limits, and potential consequences of driving without proper insurance.

Understanding these requirements is crucial for any driver in Florida, as it ensures financial protection in case of an accident. We’ll explore the concept of Florida’s no-fault system, the role of Personal Injury Protection (PIP), and how these factors influence insurance premiums. We’ll also discuss key factors that determine the cost of auto insurance, such as driving history, vehicle type, and location.

Florida’s Minimum Insurance Requirements

Driving in Florida without the minimum required auto insurance coverage can lead to serious consequences, including fines, license suspension, and even jail time. Understanding the mandatory coverage types and their financial responsibility limits is crucial for every driver in the state.

Mandatory Auto Insurance Coverage Types in Florida

Florida law mandates that all drivers carry at least four types of auto insurance coverage. These coverages protect you and others in the event of an accident:

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of who caused the accident. PIP coverage is limited to $10,000 per person.

- Property Damage Liability (PDL): This coverage pays for damages to another person’s property, such as their vehicle or other assets, if you are at fault in an accident. The minimum PDL coverage required in Florida is $10,000.

- Bodily Injury Liability (BIL): This coverage pays for medical expenses, lost wages, and other related costs for injuries to others if you are at fault in an accident. The minimum BIL coverage required in Florida is $10,000 per person and $20,000 per accident.

- Uninsured Motorist Coverage (UM): This coverage protects you and your passengers if you are injured in an accident caused by an uninsured or hit-and-run driver. The minimum UM coverage required in Florida is $10,000 per person and $20,000 per accident.

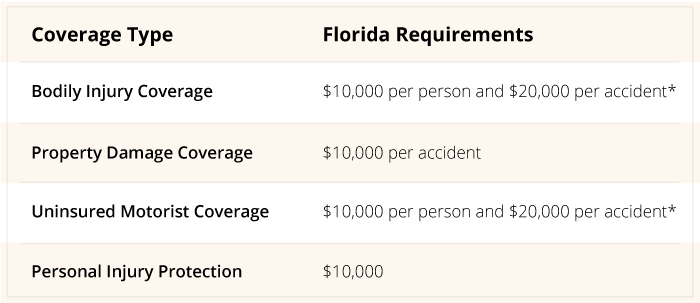

Minimum Financial Responsibility Limits in Florida

The minimum financial responsibility limits for each coverage type in Florida are:

| Coverage Type | Minimum Limit |

|---|---|

| Personal Injury Protection (PIP) | $10,000 per person |

| Property Damage Liability (PDL) | $10,000 per accident |

| Bodily Injury Liability (BIL) | $10,000 per person, $20,000 per accident |

| Uninsured Motorist Coverage (UM) | $10,000 per person, $20,000 per accident |

Situations Where Minimum Coverage Might Be Insufficient

While the minimum insurance requirements are mandatory, they may not be sufficient to cover all potential expenses in the event of a serious accident. Here are some situations where the minimum coverage might be insufficient:

- High medical bills: In a severe accident, medical expenses can easily exceed the $10,000 PIP coverage limit. If you are injured and require extensive medical treatment, you could be left responsible for the remaining costs.

- Multiple injuries: If multiple people are injured in an accident, the $20,000 BIL coverage limit may not be enough to cover all the medical expenses and lost wages.

- Expensive property damage: If you cause significant damage to another person’s vehicle or property, the $10,000 PDL coverage limit may not be sufficient to cover the repairs or replacement costs.

- Uninsured or underinsured motorists: If you are injured by an uninsured or underinsured driver, your UM coverage may not be enough to compensate you for your injuries and losses.

Understanding Florida’s No-Fault System

Florida’s no-fault system is a unique approach to car insurance that aims to streamline the claims process and reduce litigation. It revolves around the concept of Personal Injury Protection (PIP), which is a mandatory coverage in Florida.

Personal Injury Protection (PIP)

PIP coverage is designed to cover your medical expenses and lost wages if you’re injured in a car accident, regardless of who was at fault. This means that even if you’re the one who caused the accident, you can still use your own PIP coverage to pay for your medical bills and lost wages. This system aims to reduce the number of lawsuits and speed up the recovery process.

How PIP Coverage Works in Practice

PIP coverage is a first-party benefit, meaning you can file a claim with your own insurance company, regardless of who caused the accident. You can access your PIP benefits for up to 80% of your medical expenses, up to a maximum of $10,000. You can also receive up to $2,000 in lost wages, but this is subject to certain conditions.

Limitations of PIP Coverage

While PIP coverage provides a valuable safety net, it’s important to understand its limitations. It doesn’t cover all your expenses, and it may not be enough to fully compensate you for your losses. For instance, PIP doesn’t cover pain and suffering, or other non-economic damages, such as emotional distress or loss of companionship.

Filing a PIP Claim

To file a PIP claim, you’ll need to contact your insurance company as soon as possible after the accident. You’ll typically need to provide them with information about the accident, your injuries, and your medical treatment. Your insurance company will then review your claim and determine if it’s eligible for coverage.

Challenges in Filing a PIP Claim, Florida state minimum insurance

Filing a PIP claim can sometimes be challenging. Insurance companies may try to deny your claim or limit your benefits. You may also face delays in processing your claim or getting your medical bills paid. It’s essential to understand your rights and responsibilities under Florida’s no-fault system and to be prepared to advocate for yourself.

Factors Influencing Insurance Premiums: Florida State Minimum Insurance

Understanding the factors that influence your auto insurance premiums is crucial for making informed decisions about your coverage and potentially saving money. Numerous factors play a role in determining the cost of your car insurance in Florida.

Driving History

Your driving history is a significant factor that insurance companies consider when calculating your premiums. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can lead to significantly higher premiums.

Vehicle Type

The type of vehicle you drive also influences your insurance premiums. Insurance companies assess factors like the vehicle’s make, model, year, safety features, and repair costs to determine the risk associated with insuring it. For example, sports cars and luxury vehicles tend to have higher premiums due to their higher repair costs and increased risk of accidents.

Location

The location where you reside can significantly impact your insurance premiums. Insurance companies analyze factors like the density of population, traffic congestion, crime rates, and weather conditions in your area to assess the risk of accidents and claims. Areas with higher crime rates and more traffic accidents typically have higher insurance premiums.

Credit Score

Surprisingly, your credit score can also play a role in determining your auto insurance premiums in Florida. Insurance companies believe that individuals with good credit scores are more likely to be financially responsible and less likely to file claims. While this practice has been controversial, it’s important to understand its impact.

Finding Affordable Insurance Options

Finding affordable insurance options in Florida can be challenging, especially with the state’s unique requirements. However, with some research and planning, you can secure a policy that fits your budget without compromising on necessary coverage.

Comparing Insurance Providers

It’s crucial to compare different insurance providers and their minimum coverage options to find the best deal. Here’s a table showcasing some popular insurance providers and their minimum coverage options:

| Insurance Provider | Minimum Coverage Options |

|—|—|

| State Farm | $10,000 per person/$20,000 per accident for bodily injury liability; $10,000 for property damage liability |

| Geico | $10,000 per person/$20,000 per accident for bodily injury liability; $10,000 for property damage liability |

| Progressive | $10,000 per person/$20,000 per accident for bodily injury liability; $10,000 for property damage liability |

| Allstate | $10,000 per person/$20,000 per accident for bodily injury liability; $10,000 for property damage liability |

| USAA | $10,000 per person/$20,000 per accident for bodily injury liability; $10,000 for property damage liability |

This table provides a general overview, and specific coverage options may vary depending on your individual needs and circumstances. It’s essential to contact each provider directly for accurate and up-to-date information.

Finding the Most Affordable Plan

To find the most affordable insurance plan that meets your needs, follow these steps:

1. Determine Your Coverage Needs: Assess your individual requirements and understand the minimum coverage mandated by Florida law.

2. Get Multiple Quotes: Contact several insurance providers and request personalized quotes based on your specific information.

3. Compare Quotes and Coverage: Carefully analyze each quote, considering factors like coverage limits, deductibles, and additional features.

4. Consider Discounts: Inquire about available discounts, such as good driver discounts, safe driver courses, and multi-policy discounts.

Negotiating Lower Premiums

You can often negotiate lower premiums by:

* Improving Your Driving Record: Maintaining a clean driving record with no accidents or violations can significantly reduce your premiums.

* Shopping Around: Comparing quotes from multiple insurers can help you identify the best rates.

* Bundling Policies: Combining your auto insurance with other policies, such as homeowners or renters insurance, can result in substantial savings.

* Raising Your Deductible: Increasing your deductible can lower your premium, but ensure you can afford to pay the deductible in case of an accident.

* Exploring Discounts: Ask about discounts for safe driving, good student status, or other eligible factors.

Tips for Exploring Discounts

Here are some tips for exploring discounts:

* Good Driver Discounts: Maintaining a clean driving record and avoiding accidents and violations can qualify you for good driver discounts.

* Safe Driver Courses: Completing a defensive driving course can lower your premium by demonstrating your commitment to safe driving practices.

* Multi-Policy Discounts: Bundling your auto insurance with other policies, such as homeowners or renters insurance, can often result in significant discounts.

* Student Discounts: If you’re a student with good grades, you may be eligible for a student discount.

* Other Discounts: Some insurers offer discounts for factors like being a member of certain organizations or having safety features in your vehicle.

Consequences of Driving Without Insurance

Driving without the required minimum insurance in Florida is not only illegal but also carries significant financial and legal risks. You could face serious penalties, including fines, license suspension, and even imprisonment. Moreover, driving without insurance can lead to financial ruin if you are involved in an accident.

Legal Consequences of Driving Without Insurance

Driving without the required minimum insurance in Florida is a serious offense. You could face a range of legal consequences, including fines, license suspension, and even imprisonment.

- Fines: The first offense for driving without insurance in Florida can result in a fine of up to $1,000.

- License Suspension: If you are caught driving without insurance, your license may be suspended for up to three years.

- Imprisonment: In some cases, driving without insurance can lead to imprisonment for up to 90 days.

Financial Risks of Driving Uninsured

Driving without insurance in Florida is a risky decision that can have devastating financial consequences. If you are involved in an accident, you could be held personally liable for all damages, including medical expenses, property damage, and lost wages. This could lead to significant financial hardship and even bankruptcy.

- Medical Expenses: If you are injured in an accident, you will be responsible for paying your own medical bills. This can be a significant financial burden, especially if you have serious injuries.

- Property Damage: If you damage another person’s property in an accident, you will be responsible for paying for the repairs.

- Lost Wages: If you are unable to work due to injuries sustained in an accident, you will not be compensated for lost wages.

- Legal Fees: You may also be required to pay legal fees to defend yourself in court if you are sued by the other party involved in the accident.

It is important to remember that driving without insurance in Florida is a serious offense that can have severe legal and financial consequences.

Last Recap

Driving without the required minimum insurance in Florida can have serious consequences, including fines, license suspension, and even financial ruin. This guide empowers you with the knowledge to navigate the Florida insurance landscape, understand your options, and make informed decisions that protect you and your finances. By being aware of your responsibilities and understanding the nuances of Florida’s insurance system, you can drive with confidence and peace of mind.

Q&A

What are the minimum coverage types required in Florida?

Florida requires drivers to carry Personal Injury Protection (PIP), Property Damage Liability (PDL), and Bodily Injury Liability (BIL).

What are the minimum financial responsibility limits for each coverage type?

The minimum limits are $10,000 for PIP, $10,000 for PDL, and $10,000 per person/$20,000 per accident for BIL.

What happens if I get into an accident and only have the minimum coverage?

If you’re at fault for an accident, the minimum coverage might not be enough to cover all damages, leaving you financially responsible for the difference.

How do I find affordable insurance options in Florida?

Shop around for quotes from different insurance providers, consider increasing your deductible, and explore available discounts. You can also use online comparison tools to find the best deals.