Florida State Minimum Car Insurance Requirements are crucial for all drivers in the Sunshine State. Understanding these requirements ensures you’re legally compliant and financially protected in case of an accident. Florida’s unique approach to car insurance involves a blend of mandatory coverage and a focus on personal injury protection, offering a unique perspective on how drivers are safeguarded on the road.

This guide delves into the specifics of Florida’s minimum car insurance requirements, providing insights into the coverage types, financial responsibility limits, and factors that influence insurance costs. It also explores the importance of choosing the right insurance coverage to suit individual needs and circumstances, emphasizing the benefits of consulting with an insurance agent for personalized guidance.

Florida’s Minimum Car Insurance Requirements

Florida law mandates that all drivers carry a minimum amount of car insurance to protect themselves and others in case of an accident. These requirements are designed to ensure that drivers are financially responsible for any damages or injuries they may cause while driving.

Penalties for Driving Without Minimum Coverage

Driving without the required minimum car insurance in Florida is a serious offense that can result in significant penalties.

- Fines: Drivers caught without the required insurance can face hefty fines, which can vary depending on the circumstances.

- License Suspension: The Florida Department of Motor Vehicles (DMV) can suspend your driver’s license if you fail to provide proof of insurance.

- Vehicle Impoundment: Your vehicle may be impounded until you provide proof of insurance.

- Court Costs: You may be required to appear in court and face additional costs if you are found guilty of driving without insurance.

Breakdown of Required Coverage Types

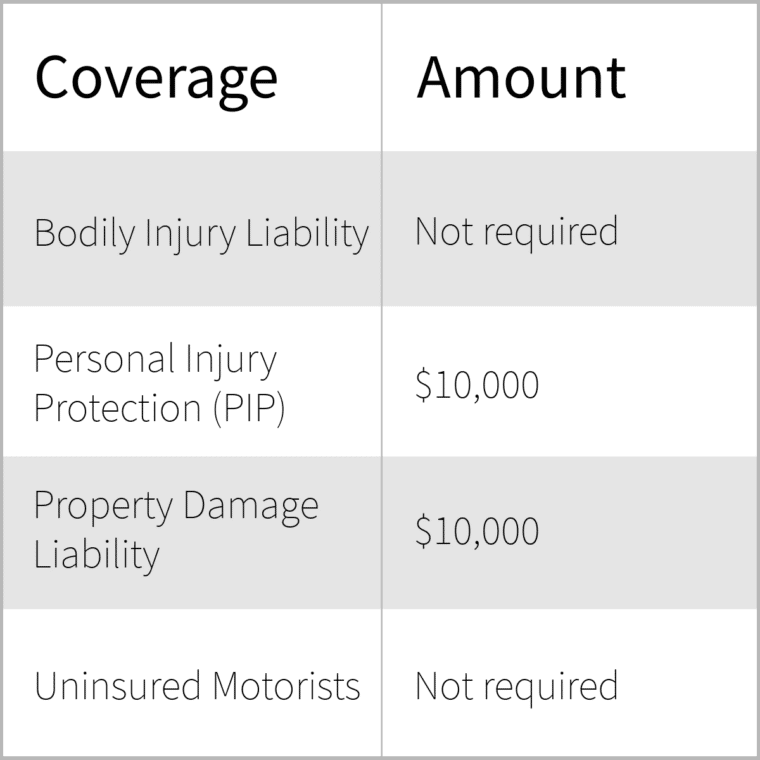

Florida law mandates the following minimum coverage types:

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault, up to a limit of $10,000 per person.

- Property Damage Liability (PDL): This coverage pays for damages to another person’s vehicle or property if you are at fault in an accident, up to a limit of $10,000 per accident.

Florida’s No-Fault System

Florida operates under a no-fault insurance system, meaning that drivers are primarily responsible for covering their own medical expenses and lost wages following an accident, regardless of who caused the accident. However, there are exceptions to this rule, such as when the accident involves a hit-and-run driver or when the injuries are severe.

Coverage Types and Their Importance

In Florida, car insurance is mandatory, and understanding the different coverage types is crucial for protecting yourself and others in case of an accident. Here’s a breakdown of essential coverage types and their significance:

Bodily Injury Liability Coverage

Bodily injury liability coverage protects you financially if you cause an accident that injures another person. This coverage pays for the other driver’s medical expenses, lost wages, and pain and suffering.

For instance, if you are at fault in an accident that results in the other driver sustaining injuries, bodily injury liability coverage will help cover their medical bills and other related expenses, up to the limits of your policy.

Property Damage Liability Coverage

Property damage liability coverage protects you financially if you cause an accident that damages another person’s property, such as their vehicle or other belongings. This coverage pays for the repairs or replacement of the damaged property.

For example, if you cause an accident that damages another driver’s car, property damage liability coverage will help cover the cost of repairs or replacement, up to the limits of your policy.

Personal Injury Protection (PIP) Coverage

PIP coverage is a no-fault coverage that pays for your medical expenses and lost wages, regardless of who is at fault in an accident. This coverage also covers your passengers.

For instance, if you are involved in an accident, PIP coverage will help cover your medical bills, lost wages, and other related expenses, even if you are not at fault.

Understanding Financial Responsibility Limits

Florida’s financial responsibility limits are the minimum amounts of insurance coverage required by law to drive legally. They represent the maximum amount an insurance company will pay for damages or injuries caused by an insured driver. Understanding these limits is crucial for ensuring adequate financial protection in case of an accident.

Financial Responsibility Limits and Their Relevance

Financial responsibility limits are designed to ensure that drivers have sufficient financial resources to cover the costs of damages and injuries caused by an accident. They serve as a safety net for victims, protecting them from potentially devastating financial losses. The limits set by the state are the minimum requirements, but drivers can choose to purchase higher limits for greater protection.

Consequences of Insufficient Financial Responsibility Limits

Having insufficient financial responsibility limits can lead to severe consequences in the event of a major accident. If the damages or injuries exceed the limits of your insurance coverage, you may be held personally liable for the remaining costs. This can result in:

* Financial Ruin: You may be forced to pay substantial sums out of pocket, potentially leading to financial hardship or bankruptcy.

* Legal Action: Victims can sue you for damages beyond your insurance limits, leading to lengthy and costly legal battles.

* License Suspension: Failing to meet financial responsibility requirements can lead to the suspension of your driver’s license, preventing you from driving legally.

Financial Responsibility Limits for Different Coverage Types, Florida state minimum car insurance requirements

Florida’s financial responsibility limits vary depending on the type of insurance coverage:

Bodily Injury Liability

This coverage protects you against financial liability for injuries caused to others in an accident. The minimum limit for bodily injury liability is:

- $10,000 per person

- $20,000 per accident

This means that your insurance company will pay up to $10,000 for injuries to each person involved in the accident and up to $20,000 in total for all injuries in the accident.

Property Damage Liability

This coverage protects you against financial liability for damage to another person’s property in an accident. The minimum limit for property damage liability is:

- $10,000 per accident

Your insurance company will pay up to $10,000 for damage to property caused by the accident.

Personal Injury Protection (PIP)

PIP coverage is mandatory in Florida and covers your own medical expenses and lost wages after an accident, regardless of fault. The minimum limit for PIP coverage is:

- $10,000 per person

This means that your insurance company will pay up to $10,000 for your medical expenses and lost wages after an accident.

Factors Influencing Insurance Costs

Car insurance premiums in Florida, like anywhere else, are determined by a complex set of factors that assess your risk as a driver. These factors encompass various aspects of your driving history, vehicle characteristics, and personal circumstances. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Driving History

Your driving history is a primary determinant of your insurance premiums. A clean driving record with no accidents or violations typically translates into lower premiums. However, any incidents involving accidents, traffic violations, or DUI convictions can significantly increase your insurance costs. Insurance companies view these events as indicators of higher risk and adjust premiums accordingly.

- Accidents: Each accident, regardless of fault, can lead to premium increases. The severity of the accident, the number of claims filed, and the amount of damage incurred all contribute to the impact on your premiums.

- Traffic Violations: Speeding tickets, reckless driving, and other moving violations can significantly raise your premiums. The type of violation and the frequency of occurrences are considered in determining the impact. Insurance companies often view these violations as indicators of a driver’s recklessness and potential for future accidents.

- DUI Convictions: A DUI conviction is one of the most severe offenses that can significantly increase your insurance premiums. Insurance companies consider this a serious risk factor due to the potential for future accidents and legal consequences.

Vehicle Type

The type of vehicle you drive also plays a crucial role in determining your insurance premiums. Insurance companies consider factors such as the vehicle’s make, model, year, safety features, and value. Vehicles with a higher risk of theft, accidents, or repair costs generally have higher insurance premiums. For example, sports cars, luxury vehicles, and high-performance cars often have higher insurance premiums compared to standard sedans or hatchbacks.

- Make and Model: Certain car models are known to have higher rates of accidents or theft. Insurance companies often use historical data and claims statistics to determine premiums based on make and model.

- Year: Newer vehicles generally have more advanced safety features and are more expensive to repair, leading to higher premiums. Older vehicles, on the other hand, may have depreciated in value and have lower repair costs, potentially resulting in lower premiums.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, are often considered safer and may qualify for discounts on insurance premiums.

- Value: The value of your vehicle is a key factor in determining the amount of coverage you need and the cost of your premiums. More expensive vehicles generally have higher insurance premiums.

Location

Your location, specifically your zip code, is a significant factor in determining your car insurance premiums. Insurance companies consider factors such as the density of population, traffic congestion, crime rates, and the frequency of accidents in your area. Areas with higher traffic volumes, higher crime rates, and more frequent accidents tend to have higher insurance premiums.

Age

Age is a significant factor in determining car insurance premiums, as younger drivers are statistically more likely to be involved in accidents. Insurance companies often view drivers under the age of 25 as higher risk and charge them higher premiums. As drivers gain experience and age, their premiums typically decrease.

- Young Drivers: Drivers under 25, especially those with limited driving experience, are often considered higher risk due to their lack of experience and potentially higher risk-taking behaviors.

- Mature Drivers: Drivers over the age of 55 or 65 often receive discounts on their insurance premiums, as they tend to have more driving experience and fewer accidents.

Credit Score

In many states, including Florida, your credit score can influence your car insurance premiums. Insurance companies argue that individuals with poor credit are more likely to file claims and are less financially responsible. However, the correlation between credit score and driving behavior is not always clear.

- Impact on Premiums: A lower credit score can lead to higher insurance premiums, while a good credit score may qualify you for discounts.

- Fairness and Privacy Concerns: Some argue that using credit score as a factor in determining insurance premiums is unfair and violates privacy.

Discounts

Insurance companies offer various discounts to reduce your premiums. These discounts can be based on your driving history, vehicle features, or other factors. By taking advantage of available discounts, you can potentially lower your insurance costs.

- Safe Driving Discounts: Discounts for maintaining a clean driving record, such as no accidents or traffic violations, are commonly offered by insurance companies.

- Good Student Discounts: Students with good grades may qualify for discounts as they are often viewed as more responsible drivers.

- Multi-Car Discounts: Insuring multiple vehicles with the same insurance company often qualifies you for a discount.

- Multi-Policy Discounts: Bundling your car insurance with other insurance policies, such as home or renters insurance, can also lead to discounts.

- Safety Feature Discounts: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, may qualify for discounts.

- Payment Discounts: Paying your premium in full or opting for automatic payments can sometimes lead to discounts.

Choosing the Right Insurance Coverage: Florida State Minimum Car Insurance Requirements

While Florida mandates minimum car insurance coverage, it’s crucial to understand that these requirements may not be sufficient to protect you and your assets in the event of an accident. The right car insurance coverage should be tailored to your individual needs and circumstances. This involves carefully considering your driving habits, the value of your vehicle, and your financial situation.

Factors Influencing Coverage Decisions

Several factors play a significant role in determining the appropriate level of car insurance coverage for you. These factors help you assess your risks and make informed decisions about your coverage needs.

- Driving Habits: Drivers with a history of accidents or traffic violations may require higher coverage levels to mitigate potential risks. Similarly, drivers who frequently commute long distances or drive in high-traffic areas might consider increased coverage.

- Vehicle Value: The value of your vehicle is a critical factor. If you own a new or high-value vehicle, you’ll likely need more comprehensive coverage to ensure adequate protection in case of an accident or theft.

- Financial Situation: Your financial stability also influences your insurance needs. If you have significant assets to protect, such as a home or investments, you may want to consider higher liability limits to safeguard against potential financial losses in the event of an accident.

Benefits of Consulting an Insurance Agent

Consulting with an experienced insurance agent can be invaluable in choosing the right car insurance coverage. An agent can help you navigate the complexities of insurance policies, explain different coverage options, and provide personalized recommendations based on your specific needs.

- Expert Guidance: Insurance agents possess in-depth knowledge of insurance policies and can guide you through the various coverage options available.

- Personalized Recommendations: They can tailor insurance plans to your individual circumstances, ensuring you have the right level of protection without paying for unnecessary coverage.

- Negotiation Skills: Agents can leverage their relationships with insurance companies to negotiate better rates and coverage terms on your behalf.

Resources and Additional Information

It’s essential to have access to reliable resources for obtaining further information about Florida’s minimum car insurance requirements. The following list provides links to relevant government websites, insurance companies, and consumer protection organizations that can offer valuable insights and guidance.

Government Websites

These websites offer official information about Florida’s car insurance requirements, regulations, and laws.

- Florida Department of Highway Safety and Motor Vehicles (FLHSMV): https://www.flhsmv.gov/ – This website provides comprehensive information about Florida’s driver licensing, vehicle registration, and insurance requirements. It also offers resources for consumers to file complaints and access other relevant information.

- Florida Office of Insurance Regulation (OIR): https://www.floir.com/ – This website provides information about Florida’s insurance market, including regulations, consumer protection resources, and information about insurance companies operating in the state.

Insurance Companies

These websites provide information about their insurance products, coverage options, and pricing.

- State Farm: https://www.statefarm.com/ – State Farm is one of the largest insurance companies in the United States, offering a wide range of insurance products, including car insurance.

- Geico: https://www.geico.com/ – Geico is another major insurance company that offers competitive car insurance rates and comprehensive coverage options.

- Progressive: https://www.progressive.com/ – Progressive is known for its innovative insurance products and services, including its Name Your Price tool that allows customers to customize their coverage.

Consumer Protection Organizations

These organizations provide information and resources to help consumers understand their rights and make informed decisions about their insurance.

- National Association of Insurance Commissioners (NAIC): https://www.naic.org/ – The NAIC is a non-profit organization that works to promote fair and competitive insurance markets. It provides resources for consumers, including information about insurance regulations and consumer protection.

- Florida Department of Financial Services: https://www.myfloridacfo.com/ – This website provides information about Florida’s insurance regulations, consumer protection resources, and information about insurance companies operating in the state.

Conclusive Thoughts

Navigating Florida’s car insurance landscape requires a clear understanding of the minimum requirements and the factors that influence insurance costs. By familiarizing yourself with the coverage types, financial responsibility limits, and available discounts, you can make informed decisions about your insurance coverage and ensure you’re adequately protected on the road. Remember, consulting with an insurance agent can provide personalized guidance and help you find the best coverage options to meet your specific needs and financial situation.

Expert Answers

What happens if I get into an accident without the required minimum car insurance?

Driving without the minimum required car insurance in Florida can result in serious consequences, including fines, license suspension, and even jail time. You may also be held personally liable for any damages or injuries caused in an accident.

Can I choose to have more coverage than the minimum required?

Absolutely! While the minimum coverage is legally required, you can choose to have more coverage than the minimum. This can provide greater financial protection in case of a serious accident and can offer peace of mind.

How can I find out the exact insurance requirements for my specific vehicle?

The best way to get accurate information is to contact your insurance agent or visit the Florida Department of Highway Safety and Motor Vehicles website. They can provide you with the most up-to-date information based on your vehicle and individual circumstances.