Florida State Minimum Car Insurance Coverage is a crucial aspect of driving in the Sunshine State. It Artikels the essential coverage drivers must have to be legally on the road. This coverage acts as a safety net, providing financial protection in case of accidents or incidents involving other drivers. Understanding the minimum requirements and the implications of driving without adequate coverage is vital for every Florida driver.

Florida’s minimum car insurance requirements are designed to ensure that drivers have basic financial protection in the event of an accident. The state mandates that all drivers carry Personal Injury Protection (PIP) and Property Damage Liability (PDL) coverage. PIP covers medical expenses and lost wages for the insured driver and passengers, while PDL covers damages to the other driver’s vehicle and property. Failure to carry these minimum requirements can lead to serious consequences, including fines, license suspension, and even jail time.

Florida’s Minimum Car Insurance Requirements

Driving in Florida requires you to have a minimum amount of car insurance to protect yourself and others on the road. These requirements are set by the state to ensure that drivers are financially responsible for any accidents they may cause.

Florida’s Minimum Car Insurance Requirements

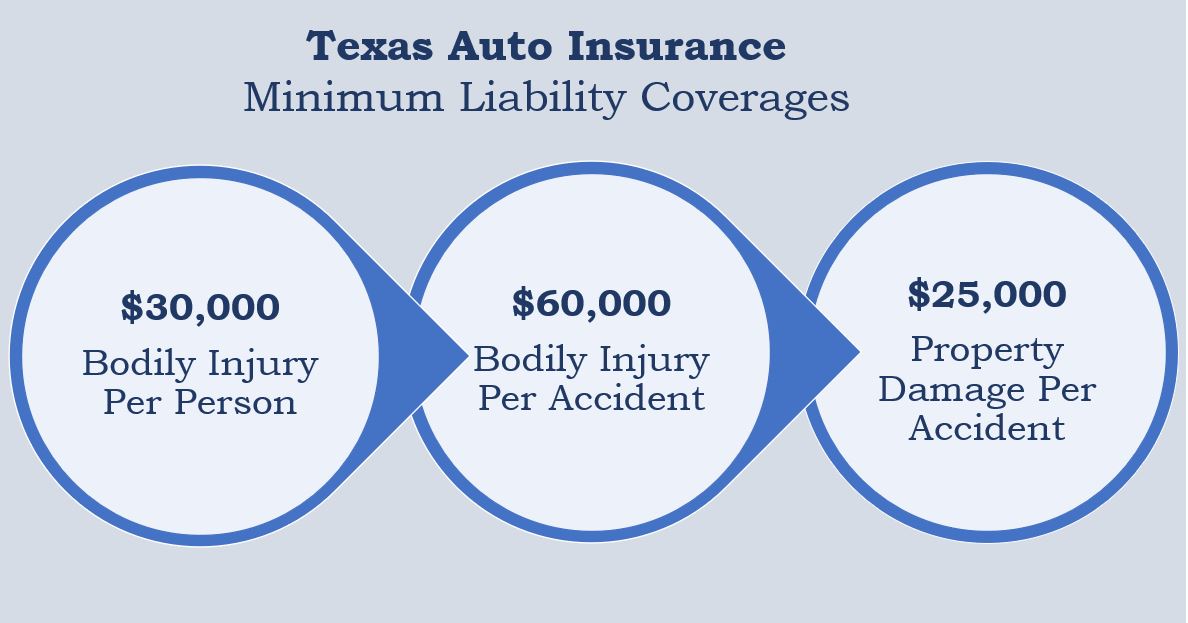

Florida’s minimum car insurance requirements are known as the “Financial Responsibility Law”. This law mandates that all drivers in Florida must have a minimum amount of coverage in the following categories:

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other related costs, regardless of who is at fault in an accident. The minimum amount required is $10,000 per person.

- Property Damage Liability (PDL): This coverage pays for damages to another person’s property if you are at fault in an accident. The minimum amount required is $10,000 per accident.

It’s important to note that Florida is a “no-fault” state. This means that your PIP coverage will pay for your medical expenses, regardless of who caused the accident. However, you can sue the other driver if your injuries exceed your PIP coverage.

Driving Without Minimum Required Insurance

Driving without the minimum required car insurance in Florida is a serious offense. This can result in several consequences, including:

- Suspension of your driver’s license: If you are caught driving without insurance, your license will be suspended. You will need to pay a fine and provide proof of insurance to get your license reinstated.

- Fines and penalties: You may face fines and penalties for driving without insurance. The amount of the fine will vary depending on the severity of the offense.

- Jail time: In some cases, you may even face jail time for driving without insurance.

- Difficulty obtaining insurance in the future: Having a history of driving without insurance can make it difficult to obtain insurance in the future. You may have to pay higher premiums or may not be able to find an insurer willing to cover you.

Penalties for Violating Florida’s Minimum Car Insurance Requirements, Florida state minimum car insurance coverage

If you are caught driving without insurance, you will be subject to a number of penalties, including:

- First Offense: A $150 fine and a 90-day suspension of your driver’s license.

- Second Offense: A $250 fine and a one-year suspension of your driver’s license.

- Third Offense: A $500 fine and a three-year suspension of your driver’s license.

It is important to note that these penalties may vary depending on the circumstances of the violation. For example, if you are involved in an accident while driving without insurance, you may face more severe penalties.

Coverage Types Explained

In Florida, the state mandates a minimum amount of car insurance coverage to ensure financial protection for drivers and their victims in the event of an accident. These coverage types are designed to help cover costs associated with damages, injuries, and legal liabilities. Understanding each type of coverage and its purpose is crucial for responsible driving and financial security.

Florida’s Required Car Insurance Coverage

The following table summarizes the mandatory car insurance coverage in Florida, outlining their descriptions and minimum required amounts:

| Coverage Name | Description | Minimum Required Amount |

|---|---|---|

| Personal Injury Protection (PIP) | This coverage pays for medical expenses, lost wages, and other related costs for the policyholder and passengers in their vehicle, regardless of fault, up to the policy limits. | $10,000 per person |

| Property Damage Liability (PDL) | This coverage protects the policyholder from financial responsibility for damage caused to another person’s property, such as their vehicle, in an accident. | $10,000 per accident |

Personal Injury Protection (PIP)

PIP coverage provides financial protection for medical expenses, lost wages, and other related costs for the policyholder and passengers in their vehicle, regardless of fault, up to the policy limits. It covers a wide range of medical expenses, including:

- Emergency room visits

- Hospital stays

- Surgeries

- Physical therapy

- Prescription medications

PIP coverage also covers lost wages, up to 80% of the policyholder’s average weekly earnings, for a maximum of 52 weeks. This coverage is essential for ensuring that individuals can access necessary medical care and financial support after an accident, regardless of who was at fault.

Property Damage Liability (PDL)

PDL coverage protects the policyholder from financial responsibility for damage caused to another person’s property, such as their vehicle, in an accident. It covers the cost of repairs or replacement of the damaged property, up to the policy limits. For instance, if the policyholder is involved in an accident that damages another driver’s vehicle, PDL coverage will help pay for the repairs or replacement costs.

Factors Influencing Insurance Costs: Florida State Minimum Car Insurance Coverage

Car insurance premiums in Florida are influenced by a variety of factors, making it essential to understand how these factors impact your overall cost. Understanding these factors allows you to make informed decisions about your insurance coverage and potentially lower your premiums.

Age

Age plays a significant role in determining your car insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Insurance companies recognize this higher risk and often charge higher premiums to younger drivers. As drivers gain experience and age, their premiums tend to decrease. This reflects the reduced risk associated with more experienced drivers.

Driving History

Your driving history is a crucial factor that heavily influences your insurance rates. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, having a history of accidents, speeding tickets, or other violations can significantly increase your insurance costs. Insurance companies view these incidents as indicators of higher risk, leading to increased premiums.

Vehicle Type

The type of vehicle you drive is another important factor in determining your insurance premiums. Sports cars, luxury vehicles, and high-performance cars are generally considered higher risk due to their potential for higher speeds and greater damage in accidents. These vehicles often come with higher insurance premiums compared to standard sedans or hatchbacks.

Location

Your location in Florida can significantly impact your car insurance rates. Areas with higher population density, increased traffic, and higher crime rates often have higher insurance premiums. This is because insurance companies assess the risk of accidents and theft based on the location where you live.

Strategies for Minimizing Insurance Costs

- Maintain a Clean Driving Record: Avoiding accidents and traffic violations is crucial for keeping your premiums low.

- Consider a Safe Vehicle: Choosing a vehicle with good safety ratings can potentially lower your premiums.

- Increase Your Deductible: Raising your deductible, the amount you pay out of pocket before insurance kicks in, can lower your premiums.

- Bundle Your Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often lead to discounts.

- Shop Around: Comparing quotes from multiple insurance providers is essential to find the best rates.

- Take Advantage of Discounts: Many insurance companies offer discounts for good students, safe drivers, and other factors.

Insurance Provider Comparison

Insurance providers often have different pricing structures and policies. It is crucial to compare quotes from multiple providers to find the best coverage at the most affordable price. Factors to consider when comparing providers include:

- Coverage Options: Compare the types of coverage offered, such as liability, collision, and comprehensive.

- Premium Rates: Obtain quotes from multiple providers and compare the premium rates for similar coverage.

- Customer Service: Read reviews and consider the reputation of the insurance provider in terms of customer service and claims handling.

- Financial Stability: Choose a provider with a strong financial rating to ensure they can pay claims if needed.

Additional Coverage Options

While Florida’s minimum car insurance requirements provide basic protection, many drivers choose to purchase additional coverage for enhanced financial security. These optional coverages offer extra protection against various risks, potentially mitigating financial burdens in the event of an accident.

Uninsured/Underinsured Motorist Coverage (UM/UIM)

This coverage protects you and your passengers if you’re involved in an accident with a driver who has no insurance or insufficient insurance to cover your damages. It compensates for medical expenses, lost wages, and property damage.

UM/UIM coverage is highly recommended, as it acts as a safety net in situations where the at-fault driver lacks adequate insurance.

Collision Coverage

Collision coverage reimburses you for repairs or replacement of your vehicle if you’re involved in an accident, regardless of who’s at fault. It covers damage caused by collisions with other vehicles, objects, or even single-car accidents.

While not mandatory, collision coverage is crucial for newer vehicles or those with significant loan balances, as it safeguards against financial loss due to damage.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, fire, natural disasters, or falling objects.

This coverage is essential for safeguarding your vehicle from unforeseen events, especially if you live in an area prone to natural disasters.

Personal Injury Protection (PIP)

PIP coverage covers your medical expenses and lost wages after an accident, regardless of fault. This coverage is mandatory in Florida and has a limit of $10,000.

PIP is a vital component of Florida’s car insurance system, providing immediate financial assistance for medical treatment and lost income.

Rental Reimbursement

This coverage provides you with reimbursement for rental car expenses while your vehicle is being repaired after an accident.

Rental reimbursement coverage is beneficial for those who rely on their vehicle for daily commutes or work, ensuring uninterrupted transportation.

Towing and Labor Coverage

This coverage pays for towing and labor costs if your vehicle breaks down or needs to be towed.

Towing and labor coverage offers peace of mind, especially for drivers who frequently travel long distances or live in areas with limited roadside assistance.

Roadside Assistance

This coverage provides assistance for various roadside emergencies, including flat tires, jump starts, and lockout services.

Roadside assistance coverage is a convenient and valuable service, especially for drivers who often travel alone or in unfamiliar areas.

Table of Optional Coverages

| Coverage | Features | Potential Costs |

|---|---|---|

| Uninsured/Underinsured Motorist Coverage (UM/UIM) | Covers damages caused by uninsured or underinsured drivers. | Varies based on factors like coverage limits, driving history, and vehicle type. |

| Collision Coverage | Covers repairs or replacement for collision-related damage. | Varies based on factors like vehicle value, driving history, and deductible. |

| Comprehensive Coverage | Covers damage caused by events other than collisions. | Varies based on factors like vehicle value, driving history, and deductible. |

| Rental Reimbursement | Reimburses rental car expenses while your vehicle is being repaired. | Varies based on factors like daily rental rate and duration of repairs. |

| Towing and Labor Coverage | Covers towing and labor costs for breakdowns or repairs. | Varies based on factors like towing distance and labor costs. |

| Roadside Assistance | Provides assistance for roadside emergencies. | Varies based on factors like service coverage and provider. |

Understanding Your Policy

Your car insurance policy is a legally binding contract outlining the terms and conditions of coverage between you and your insurance company. It’s essential to thoroughly understand the details of your policy to ensure you’re adequately protected and aware of your rights and responsibilities.

Interpreting Policy Terms

To navigate your car insurance policy effectively, it’s crucial to understand the key terms and conditions. Here’s a guide to help you interpret the policy:

- Declarations Page: This page summarizes your policy’s key information, including your name, address, vehicle details, coverage types, and premiums.

- Coverages: This section Artikels the specific types of coverage you’ve purchased, such as liability, collision, comprehensive, and personal injury protection (PIP). Each coverage has its own terms, limits, and exclusions.

- Exclusions: This section lists events or situations that are not covered by your policy. It’s crucial to carefully review these exclusions to understand what situations your policy won’t protect you against.

- Deductibles: This refers to the amount you’re responsible for paying out of pocket before your insurance kicks in. Understanding your deductibles is essential when deciding how much coverage you need.

- Limits: These are the maximum amounts your insurer will pay for covered losses. For example, your liability coverage might have a limit of $100,000 per accident.

- Premium Payment Schedule: This section details how you’ll pay your premiums, whether it’s monthly, annually, or through other payment options.

- Cancellation and Non-Renewal: This section Artikels the conditions under which your policy can be canceled or not renewed.

Filing a Claim

When you need to file a claim, understanding the process and your responsibilities is crucial. Here’s a general Artikel of the claim filing process:

- Report the Accident: Contact your insurance company immediately after an accident, providing details of the incident and any injuries.

- Gather Information: Collect all relevant information, including police reports, witness statements, and photographs of the damage.

- Submit a Claim: Complete and submit the claim form, providing all necessary documentation.

- Insurance Company Investigation: Your insurer will investigate the claim, reviewing the information you’ve provided and potentially conducting their own investigation.

- Claim Approval or Denial: Based on the investigation, your insurer will decide whether to approve or deny your claim. If denied, they’ll provide a reason for the denial.

- Payment: If your claim is approved, your insurer will issue payment for covered losses, minus your deductible.

Determining Coverage

Several factors influence whether your claim will be covered, including:

- Type of Coverage: Your claim must fall under the specific type of coverage you’ve purchased, such as liability, collision, or comprehensive.

- Policy Exclusions: Your claim won’t be covered if it falls under any of your policy’s exclusions, such as driving under the influence or participating in illegal activities.

- Fault Determination: In many cases, your insurer will determine who was at fault for the accident to determine coverage. If you’re found at fault, your coverage may be limited or denied.

- Deductible: You’ll be responsible for paying your deductible before your insurer covers the remaining costs.

- Policy Limits: Your claim payment will be limited to the maximum amount Artikeld in your policy for each coverage.

Resources for Further Information

It’s essential to have access to reliable resources for staying informed about Florida’s car insurance laws and regulations. This section provides you with key websites and organizations that offer valuable information and consumer protection resources.

Government Websites and Organizations

These government websites provide official information about Florida car insurance laws, regulations, and consumer protection resources:

- Florida Department of Financial Services (DFS): The DFS is the primary regulatory agency for the insurance industry in Florida. Their website offers comprehensive information on car insurance requirements, consumer rights, and resources for filing complaints. You can access their website at [insert DFS website URL].

- Florida Office of Insurance Regulation (OIR): The OIR is responsible for overseeing the insurance industry in Florida, including car insurance. Their website provides information on insurance rates, consumer protection, and complaint resolution processes. Visit their website at [insert OIR website URL].

Consumer Protection Organizations

These organizations provide advocacy and support for consumers regarding insurance issues:

- Florida Consumer Action Network (FCAN): FCAN is a non-profit organization that advocates for consumer rights and protection. Their website offers resources on insurance issues, including car insurance, and provides assistance with filing complaints. You can access their website at [insert FCAN website URL].

- National Association of Insurance Commissioners (NAIC): The NAIC is a national organization that represents state insurance regulators. Their website offers information on insurance issues, including car insurance, and provides resources for consumers. Visit their website at [insert NAIC website URL].

Insurance Companies and Agencies

To obtain quotes and information about specific insurance policies, you can contact insurance companies and agencies directly. You can find a list of insurance companies operating in Florida on the DFS website.

It’s crucial to compare quotes from multiple insurance companies to ensure you’re getting the best coverage at the most affordable price.

Outcome Summary

Navigating Florida’s car insurance landscape can seem complex, but understanding the state’s minimum requirements is essential for all drivers. By ensuring you have the necessary coverage, you can drive with peace of mind, knowing that you are financially protected in the event of an accident. It’s also important to remember that the minimum coverage may not be enough for every situation. Consider additional coverage options to ensure you have adequate protection for your needs and circumstances.

Frequently Asked Questions

What happens if I get into an accident without the minimum car insurance?

You could face serious consequences, including fines, license suspension, and even jail time. You would also be responsible for all damages and injuries caused by the accident, even if you were not at fault.

How can I find the best car insurance rates in Florida?

Shop around and compare quotes from different insurance companies. Consider factors like your driving history, age, vehicle type, and location.

What are some optional car insurance coverages I should consider?

Some popular optional coverages include collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and rental reimbursement.

How do I file a claim with my insurance company?

Contact your insurance company as soon as possible after an accident. They will guide you through the claims process.