Florida State Minimum Auto Insurance Limits are a crucial aspect of driving in the Sunshine State. Understanding these requirements is essential for all drivers, as they dictate the minimum financial protection you must have in case of an accident. Failure to comply can result in hefty fines and even license suspension. Let’s delve into the specifics of these limits and explore what they mean for you.

Florida’s unique “no-fault” insurance system, where drivers are primarily responsible for their own medical expenses after an accident, adds another layer of complexity. This system relies heavily on Personal Injury Protection (PIP), a type of coverage that helps pay for medical bills and lost wages. Understanding how PIP works and how it interacts with other coverage types is vital for making informed decisions about your auto insurance.

Florida’s Minimum Auto Insurance Requirements

Driving a car in Florida requires you to have auto insurance, as it’s the law. Florida’s financial responsibility law requires all drivers to carry a minimum amount of auto insurance coverage. This ensures that you have financial protection in case of an accident.

Minimum Coverage Limits

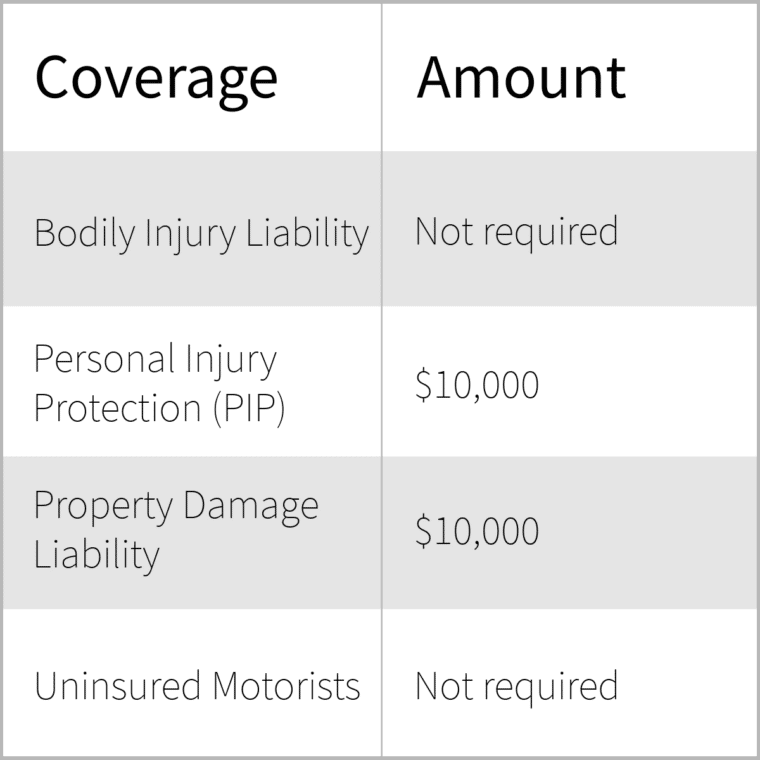

The minimum auto insurance coverage limits required in Florida are:

| Coverage | Minimum Limit |

|---|---|

| Bodily Injury Liability per person | $10,000 |

| Bodily Injury Liability per accident | $20,000 |

| Property Damage Liability | $10,000 |

| Personal Injury Protection (PIP) | $10,000 |

| Uninsured Motorist Coverage | $10,000 |

Penalties for Driving Without Insurance

Driving without the required minimum auto insurance in Florida is a serious offense. You can face various penalties, including:

- A fine of up to $500

- Suspension of your driver’s license

- Impoundment of your vehicle

- Court costs

- Possible jail time

Understanding Florida’s No-Fault System

Florida operates under a “no-fault” insurance system for auto accidents. This means that after an accident, each driver involved is primarily responsible for their own medical expenses and lost wages, regardless of who caused the accident.

Personal Injury Protection (PIP)

PIP coverage is a mandatory part of auto insurance in Florida. It helps cover medical expenses and lost wages for you and your passengers, regardless of who caused the accident.

PIP coverage provides benefits for:

- Medical expenses: This includes doctor visits, hospital stays, surgery, and other medical treatments related to the accident.

- Lost wages: This covers income you lose while recovering from your injuries and unable to work.

PIP coverage has limitations:

- Coverage limit: The maximum amount of PIP coverage you can purchase is $10,000. This means that if your medical expenses exceed $10,000, you will be responsible for the remaining costs.

- 80% rule: PIP coverage will only pay 80% of your medical expenses, and you are responsible for the remaining 20%. This is known as the “80% rule”.

- Deductible: You may have to pay a deductible before PIP coverage starts paying for your medical expenses.

Choosing the Right Coverage Levels: Florida State Minimum Auto Insurance Limits

While Florida’s minimum auto insurance requirements are the law, it’s crucial to consider if these limits provide adequate protection in the event of an accident. Choosing the right coverage levels goes beyond simply meeting the minimum requirements; it involves assessing your individual needs and potential risks.

Factors Influencing Coverage Level Decisions

The decision to purchase coverage levels beyond the minimum requirements is influenced by several factors.

- Financial Situation: Your ability to cover potential expenses in case of an accident is a significant factor. Higher coverage limits provide greater financial protection, but they also come with higher premiums. Consider your financial stability and ability to absorb potential costs.

- Vehicle Value: The value of your vehicle plays a role in determining the appropriate coverage levels. If your vehicle is relatively new or has a high market value, comprehensive and collision coverage might be essential to protect your investment.

- Driving Habits and Risk Profile: If you frequently drive in high-traffic areas or engage in risky driving behaviors, higher coverage levels can provide greater peace of mind. Consider your driving experience, history, and potential risks associated with your driving habits.

- Personal Liability: In case of an accident where you are at fault, you could be held liable for damages beyond your vehicle’s repair costs. Higher liability limits protect you from significant financial burdens in such situations.

Consequences of Choosing Minimum Coverage Levels

While minimum coverage levels may seem appealing due to lower premiums, they can have significant consequences.

- Insufficient Coverage: Minimum coverage limits may not be sufficient to cover all expenses in the event of a serious accident, leaving you financially responsible for the difference. This could include medical bills, property damage, or lost wages.

- Financial Strain: If you are involved in an accident where you are at fault and your coverage is insufficient, you could face substantial financial burdens. This could lead to debt, legal disputes, and even bankruptcy.

- Limited Protection: Minimum coverage limits may not provide adequate protection for your vehicle or your passengers. In the event of a major accident, you might not be able to fully repair or replace your vehicle, or cover medical expenses for your passengers.

Determining Appropriate Coverage Levels

Determining the appropriate coverage levels involves a careful evaluation of your individual circumstances.

- Consult with an Insurance Agent: An insurance agent can provide personalized guidance based on your specific needs and risk profile. They can help you understand different coverage options and recommend appropriate limits.

- Review Your Financial Situation: Assess your ability to cover potential expenses in case of an accident. Consider your income, savings, and other financial obligations.

- Evaluate Your Vehicle’s Value: If your vehicle is worth a significant amount, consider comprehensive and collision coverage to protect your investment.

- Assess Your Driving Habits and Risk Profile: If you frequently drive in high-traffic areas or engage in risky driving behaviors, higher coverage levels can provide greater protection.

- Consider Your Personal Liability: If you are concerned about potential financial burdens in case of an accident, higher liability limits can offer greater peace of mind.

The Impact of Florida’s Minimum Insurance Limits on Accident Victims

Florida’s minimum auto insurance limits, while designed to ensure basic financial protection, can leave accident victims facing significant financial hardship, especially in cases involving serious injuries. The state’s “no-fault” system, while intended to simplify the claims process, can also limit compensation for accident victims, particularly when the at-fault driver carries only minimum coverage.

Financial Hardship for Accident Victims

The minimum insurance limits in Florida may not be enough to cover all the expenses incurred by accident victims. These expenses can include medical bills, lost wages, property damage, and other related costs.

- Medical Expenses: Even a seemingly minor accident can result in substantial medical bills. Minimum coverage may not be sufficient to cover the costs of hospitalization, surgery, physical therapy, and ongoing medical care.

- Lost Wages: Accident victims may be unable to work for an extended period due to injuries, resulting in lost wages. Minimum insurance limits might not cover the full extent of these lost earnings.

- Property Damage: Accidents can cause significant damage to vehicles and other property. The minimum coverage may not be adequate to cover the full cost of repairs or replacement.

Limitations of Florida’s No-Fault System

Florida’s no-fault system requires drivers to seek compensation for their injuries from their own insurance company, regardless of who caused the accident. However, this system can limit the amount of compensation available to accident victims, especially in cases of serious injuries.

- Limited Coverage: The no-fault system provides limited coverage for pain and suffering, which can be a significant expense in cases of serious injuries.

- Threshold for Filing a Lawsuit: To sue the at-fault driver for additional compensation, accident victims must meet a threshold requirement, such as having sustained a permanent injury or exceeding a certain amount of medical expenses. This threshold can be difficult to meet, especially for those with less severe injuries.

- Reduced Compensation: Even if an accident victim meets the threshold to sue, the no-fault system can still limit the amount of compensation they receive. The at-fault driver’s minimum insurance limits may not be enough to cover all of the victim’s damages.

Importance of Adequate Insurance Coverage

To protect themselves from significant financial losses in the event of an accident, drivers in Florida should consider carrying insurance coverage that exceeds the state minimum limits.

- Higher Liability Limits: Increased liability coverage provides greater protection against financial losses if the driver is found at fault in an accident. It ensures that the victim has access to sufficient funds to cover their medical expenses, lost wages, and other damages.

- Personal Injury Protection (PIP): Higher PIP coverage provides greater financial protection for medical expenses and lost wages, regardless of who caused the accident.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects drivers in cases where the at-fault driver is uninsured or underinsured. It ensures that the victim has access to funds to cover their losses, even if the at-fault driver cannot afford to pay.

The Role of the Florida Department of Highway Safety and Motor Vehicles (DHSMV)

The Florida Department of Highway Safety and Motor Vehicles (DHSMV) plays a crucial role in enforcing Florida’s auto insurance laws. It ensures that drivers are adequately insured and that they comply with the state’s minimum coverage requirements.

Verifying Insurance Coverage

The DHSMV provides several ways to verify insurance coverage for a vehicle or driver.

- Online Verification: The DHSMV’s website offers an online service that allows you to check the insurance status of a vehicle or driver by entering the vehicle’s license plate number or the driver’s license number. This service is available 24/7 and provides real-time information.

- Phone Verification: You can also verify insurance coverage by calling the DHSMV’s customer service line. A representative can check the insurance status of a vehicle or driver over the phone.

- Insurance Company Verification: You can contact the insurance company directly to verify coverage. This method is often used by insurance companies to verify coverage for their own policyholders.

Resources Available to Drivers, Florida state minimum auto insurance limits

The DHSMV provides a variety of resources to help drivers understand Florida’s insurance requirements and coverage options.

- Website: The DHSMV website provides comprehensive information about Florida’s auto insurance laws, including minimum coverage requirements, coverage options, and how to file a claim. It also offers a variety of resources for consumers, such as brochures, videos, and FAQs.

- Publications: The DHSMV publishes several brochures and pamphlets that provide detailed information about Florida’s auto insurance laws. These publications are available for download on the DHSMV website and can be obtained at DHSMV offices throughout the state.

- Customer Service: The DHSMV’s customer service line is available to answer questions about Florida’s auto insurance laws. Representatives can provide guidance on coverage options, filing claims, and other insurance-related matters.

Closure

Navigating Florida’s auto insurance landscape can be challenging, but it’s crucial to ensure you have adequate coverage to protect yourself and others on the road. By understanding the state’s minimum requirements, the “no-fault” system, and the importance of choosing appropriate coverage levels, you can make informed decisions that safeguard your financial well-being and peace of mind. Remember, driving without the necessary insurance can lead to serious consequences, so it’s always best to err on the side of caution and ensure you’re properly covered.

Frequently Asked Questions

What happens if I get into an accident and only have minimum coverage?

If you only have minimum coverage, you may be financially responsible for damages exceeding those limits. You could face significant out-of-pocket expenses for medical bills, property damage, and lost wages.

Can I choose to opt out of PIP coverage?

No, Florida law requires all drivers to have PIP coverage. You can, however, choose to reduce the coverage amount to a lower limit.

How can I verify that my insurance is valid and meets Florida’s requirements?

You can contact your insurance company directly or visit the Florida Department of Highway Safety and Motor Vehicles (DHSMV) website for verification.

What are the penalties for driving without the required minimum insurance?

Penalties include fines, license suspension, and potential jail time. You may also be required to pay for damages caused in an accident if you’re uninsured.