Florida State Minimum Auto Insurance Coverage is a crucial aspect of driving in the Sunshine State. It dictates the minimum amount of insurance you must carry to legally operate a vehicle, ensuring you have some financial protection in the event of an accident. Understanding these requirements is essential for all Florida drivers, whether you’re a seasoned veteran or a new resident.

This coverage is designed to protect you and others in case of an accident, but it also comes with certain limitations. It’s important to understand these limitations, as well as the potential consequences of driving without sufficient coverage. This guide will delve into the specifics of Florida’s minimum insurance requirements, the no-fault system, and the factors that can influence your insurance costs.

Florida’s Minimum Auto Insurance Requirements

Driving a car in Florida comes with certain legal responsibilities, including carrying the right auto insurance coverage. The state of Florida mandates that all drivers carry a minimum amount of auto insurance to protect themselves and others on the road. These requirements ensure that drivers are financially responsible for any accidents they may cause.

Florida’s Minimum Auto Insurance Coverage Requirements

Florida’s minimum auto insurance requirements are Artikeld in the Florida Motor Vehicle No-Fault Law. This law mandates that all drivers carry specific types of coverage, including:

- Bodily Injury Liability: This coverage protects you if you cause an accident that injures another person. It pays for the injured person’s medical expenses, lost wages, and other damages.

- Property Damage Liability: This coverage protects you if you cause an accident that damages another person’s property, such as their car or home. It pays for the cost of repairs or replacement.

- Personal Injury Protection (PIP): This coverage, often referred to as “no-fault” insurance, covers your own medical expenses and lost wages, regardless of who caused the accident. It also covers medical expenses for passengers in your car.

- Uninsured Motorist Coverage: This coverage protects you if you are involved in an accident with an uninsured or underinsured driver. It covers your medical expenses, lost wages, and property damage.

Minimum Coverage Amounts

The minimum coverage amounts required in Florida are as follows:

| Coverage Type | Minimum Amount |

|---|---|

| Bodily Injury Liability per person | $10,000 |

| Bodily Injury Liability per accident | $20,000 |

| Property Damage Liability | $10,000 |

| Personal Injury Protection (PIP) | $10,000 |

| Uninsured Motorist Coverage | $10,000 |

Understanding Florida’s No-Fault System

Florida operates under a no-fault insurance system, which means that after an accident, each driver involved is primarily responsible for covering their own medical expenses and lost wages, regardless of who caused the accident. This system aims to streamline the claims process and reduce the number of lawsuits.

Personal Injury Protection (PIP) Coverage

Florida’s no-fault system relies heavily on Personal Injury Protection (PIP) coverage. This coverage is mandatory for all drivers in the state and provides benefits for medical expenses and lost wages following an accident.

PIP coverage is a vital component of Florida’s no-fault system, as it ensures that injured individuals have access to immediate medical care and financial support, regardless of fault. However, there are limitations to PIP coverage, which you should understand.

Limitations of PIP Coverage

PIP coverage in Florida has specific limitations, including a maximum coverage amount and specific benefits covered.

Maximum Coverage Amount

The maximum amount of PIP coverage required in Florida is $10,000 per person, per accident. This means that a driver can only receive a maximum of $10,000 in PIP benefits for their medical expenses and lost wages, regardless of the severity of their injuries.

Benefits Covered

PIP coverage in Florida covers the following benefits:

- Medical Expenses: This includes expenses for doctor’s visits, hospital stays, ambulance services, and other medical treatments.

- Lost Wages: PIP coverage can help cover lost wages if you are unable to work due to injuries sustained in an accident.

- Death Benefits: In the unfortunate event of a fatality, PIP coverage may provide a death benefit to the deceased’s beneficiaries.

Limitations on Benefits

It’s important to note that PIP coverage in Florida has limitations on the types of medical expenses and lost wages covered.

- Medical Expenses: PIP coverage may not cover all medical expenses, such as cosmetic surgery or experimental treatments.

- Lost Wages: PIP coverage for lost wages is typically limited to a certain percentage of your income and may not cover all lost earnings.

It’s essential to understand the limitations of PIP coverage in Florida. While it provides valuable benefits, it may not cover all of your medical expenses or lost wages, especially in severe accidents.

Consequences of Insufficient Coverage

Driving without the required minimum auto insurance coverage in Florida can lead to significant consequences, including fines, license suspension, and even vehicle impoundment. Moreover, being involved in an accident without adequate coverage can result in substantial financial responsibility for damages and potential legal repercussions.

Penalties for Driving Without Insurance

Driving without the required minimum auto insurance coverage in Florida is a serious offense that can result in several penalties. These penalties are designed to discourage uninsured driving and ensure that all drivers are financially responsible for any accidents they may cause.

- Fines: A first-time offense can result in a fine of up to $1,000, and subsequent offenses can lead to even higher fines.

- License Suspension: The Florida Department of Motor Vehicles (DMV) may suspend your driver’s license for up to three years if you are caught driving without insurance.

- Vehicle Impoundment: Your vehicle may be impounded until you provide proof of insurance. You will also be responsible for any storage fees incurred during the impoundment period.

Risks of Being Involved in an Accident with Insufficient Coverage

Being involved in an accident without sufficient insurance coverage can have severe financial and legal consequences.

- Financial Responsibility for Damages: If you are at fault for an accident, you may be held financially responsible for all damages, including medical expenses, property damage, and lost wages.

- Legal Repercussions: The injured party may file a lawsuit against you to recover damages, and you could be held personally liable for a significant amount of money.

Factors Influencing Insurance Costs

In Florida, several factors determine the cost of your auto insurance. Understanding these factors can help you make informed decisions to potentially reduce your premiums.

Driving History, Florida state minimum auto insurance coverage

Your driving history is a significant factor in determining your insurance rates. Insurance companies assess your risk based on your past driving behavior. A clean driving record with no accidents, violations, or claims will typically result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your insurance costs.

Age

Your age also plays a role in your insurance rates. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. Insurance companies consider them higher risk and charge higher premiums. As you age and gain more driving experience, your rates tend to decrease.

Vehicle Type

The type of vehicle you drive also influences your insurance costs. Luxury vehicles, sports cars, and high-performance cars are generally more expensive to repair and replace, leading to higher insurance premiums. Vehicles with advanced safety features, such as anti-lock brakes and airbags, may qualify for discounts.

Location

Your location in Florida can significantly impact your insurance rates. Areas with higher crime rates, traffic congestion, and a greater number of accidents tend to have higher insurance premiums. For example, major metropolitan areas like Miami and Orlando may have higher rates compared to more rural areas.

Credit Score

In Florida, insurance companies can consider your credit score when setting your rates. This practice is legal and is based on the idea that individuals with good credit are more likely to be responsible drivers. A higher credit score can lead to lower insurance premiums.

Coverage Levels

The amount of coverage you choose will directly impact your insurance premiums. Minimum coverage, while legally required, offers limited protection. Higher coverage levels, such as comprehensive and collision coverage, provide more comprehensive protection but will result in higher premiums.

Optional Add-ons

Optional add-ons, such as roadside assistance, rental car reimbursement, and uninsured motorist coverage, can also affect your insurance costs. These add-ons offer additional protection but come with an additional cost.

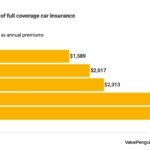

Average Cost Comparison

Here’s a table comparing the average cost of minimum coverage insurance in different Florida cities or regions:

| City/Region | Average Annual Premium |

|---|---|

| Miami | $1,200 |

| Orlando | $1,050 |

| Tampa | $950 |

| Jacksonville | $850 |

| Tallahassee | $750 |

Obtaining Auto Insurance Quotes

Finding the right auto insurance policy in Florida involves getting quotes from different insurance providers to compare and choose the best option. This process involves gathering information about your vehicle, driving history, and desired coverage, and then submitting this information to various insurance companies.

Factors to Consider When Comparing Quotes

When comparing quotes, you need to carefully analyze various factors to ensure you’re making an informed decision. These factors include coverage levels, deductibles, and discounts, each playing a crucial role in determining the overall cost of your insurance.

- Coverage Levels: This refers to the types of protection you choose for your vehicle and yourself. Different insurance providers offer various coverage options, including liability, collision, comprehensive, and personal injury protection (PIP). Comparing these options and their costs across different insurers is essential to determine the most suitable coverage for your needs.

- Deductibles: This is the amount you pay out-of-pocket before your insurance covers the remaining costs of an accident or damage. Higher deductibles generally lead to lower premiums, while lower deductibles result in higher premiums. Evaluating your risk tolerance and financial capacity is crucial when deciding on the right deductible amount.

- Discounts: Insurance providers often offer various discounts to reduce premiums. These discounts can be based on factors such as good driving records, safety features in your vehicle, multiple policy bundling, or affiliations with specific organizations. Understanding the available discounts and qualifying for them can significantly impact your overall insurance costs.

Tips for Finding the Best Auto Insurance Rates

Finding the best auto insurance rates in Florida involves a combination of strategies, including using online comparison tools and contacting multiple insurers. This approach allows you to compare quotes from different companies and potentially identify the most competitive rates.

- Online Comparison Tools: Several online comparison tools can help you compare quotes from multiple insurance providers simultaneously. These tools typically require you to enter basic information about your vehicle, driving history, and desired coverage. They then generate a list of quotes from various insurers, allowing you to compare rates and coverage options side-by-side.

- Contacting Multiple Insurers: While online comparison tools can be helpful, it’s still advisable to contact multiple insurance providers directly. This allows you to discuss your specific needs and ask questions about their policies and rates. It can also help you understand the nuances of different insurance plans and find customized solutions.

Choosing the Right Coverage for Your Needs

While Florida’s minimum auto insurance requirements are the law, it’s crucial to consider your individual needs and circumstances when deciding on the right level of coverage. Simply meeting the minimum requirements may not provide sufficient protection in case of an accident, leaving you vulnerable to significant financial losses.

Determining the Right Coverage

Understanding your individual needs and circumstances is the foundation for choosing the right coverage. This involves assessing your financial situation, the value of your vehicle, and your driving habits.

- Financial Situation: Assess your ability to absorb potential costs associated with accidents, including medical bills, vehicle repairs, and lost wages. If you have limited financial resources, higher coverage levels can offer crucial protection.

- Vehicle Value: Consider the value of your vehicle and its potential replacement cost. If you own a newer or more expensive car, comprehensive and collision coverage become more relevant.

- Driving Habits: Evaluate your driving frequency and the areas where you typically drive. Drivers who frequently commute in high-traffic areas or engage in longer trips might benefit from increased coverage.

Benefits of Exceeding Minimum Coverage

Going beyond the minimum requirements can offer significant financial protection in case of an accident. Here are some key benefits:

- Enhanced Financial Security: Higher coverage limits provide greater financial security by covering a wider range of expenses, such as extensive medical bills or significant vehicle damage.

- Peace of Mind: Knowing you have adequate coverage can provide peace of mind, allowing you to focus on recovery without worrying about overwhelming financial burdens.

- Protection from Lawsuits: In case of an accident where you are at fault, sufficient coverage can protect you from potential lawsuits seeking damages exceeding your policy limits.

Selecting Optional Add-ons

Optional add-ons like collision, comprehensive, and rental car reimbursement can further enhance your coverage.

- Collision Coverage: This covers damage to your vehicle caused by an accident, regardless of fault. It’s particularly valuable for newer or more expensive vehicles.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters.

- Rental Car Reimbursement: This covers the cost of renting a car while your vehicle is being repaired after an accident.

Closure

Driving in Florida requires a certain level of responsibility, and that includes having the appropriate auto insurance coverage. By understanding the minimum requirements and the nuances of Florida’s no-fault system, you can make informed decisions about your insurance needs and protect yourself financially in the event of an accident. Remember, exceeding the minimum coverage may offer greater peace of mind and financial security, especially in situations involving significant damages or injuries. It’s always wise to consult with an insurance agent to determine the best coverage options for your individual needs and circumstances.

FAQ Section: Florida State Minimum Auto Insurance Coverage

What happens if I get into an accident and don’t have the minimum required insurance coverage?

You could face serious consequences, including fines, license suspension, and even vehicle impoundment. You may also be held financially responsible for any damages or injuries caused by the accident, potentially leading to significant financial burdens.

How can I find the best auto insurance rates in Florida?

Start by using online comparison tools to get quotes from multiple insurance providers. You can also contact insurers directly and compare their rates and coverage options. Don’t forget to ask about discounts you may qualify for, such as safe driving discounts or bundling discounts for multiple policies.

Can I choose to have more coverage than the minimum required?

Absolutely! While the minimum coverage fulfills the legal requirements, exceeding it can provide you with greater financial protection in case of an accident. Higher coverage limits can help cover more significant damages and injuries, giving you peace of mind.