Florida state car insurance requirements are a crucial aspect of driving in the Sunshine State. Understanding these requirements ensures you’re legally compliant and financially protected in case of an accident. While Florida’s no-fault insurance system might seem unique, it’s designed to simplify the claims process and ensure swift medical care for those involved in accidents. But navigating the complexities of Florida’s insurance landscape can be overwhelming. This guide delves into the essential information about car insurance in Florida, covering everything from minimum coverage requirements to the different types of insurance available and the factors influencing your rates.

This comprehensive guide will break down the essential information about Florida car insurance, helping you make informed decisions to ensure you have the right coverage at the right price. We’ll cover everything from the minimum coverage required by law to the different types of insurance available, and the factors that can affect your rates. We’ll also discuss Florida’s unique no-fault insurance system and provide valuable resources to help you find the best insurance for your needs.

Florida State Minimum Car Insurance Requirements

Florida law requires all drivers to carry a minimum amount of car insurance to protect themselves and others in case of an accident. These requirements are designed to ensure financial responsibility and help cover the costs of injuries and damages.

Liability Coverage Requirements

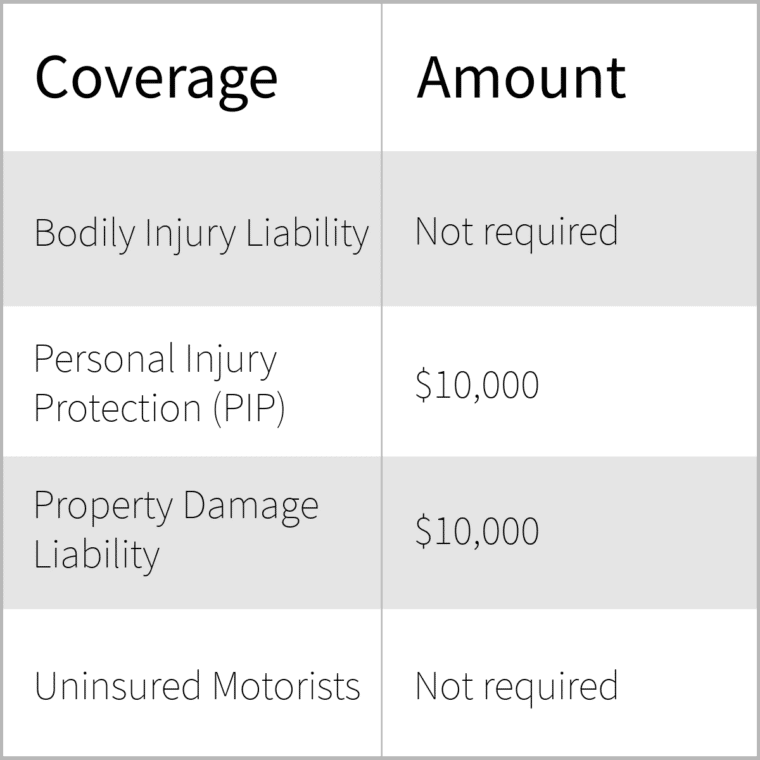

Florida’s minimum liability coverage requirements are as follows:

- Bodily Injury Liability: $10,000 per person/$20,000 per accident. This coverage pays for medical expenses, lost wages, and other damages to the other driver and passengers if you are at fault in an accident.

- Property Damage Liability: $10,000 per accident. This coverage pays for damages to the other driver’s vehicle and property if you are at fault in an accident.

Personal Injury Protection (PIP), Florida state car insurance requirements

Florida also requires all drivers to carry Personal Injury Protection (PIP) coverage, which is a type of no-fault insurance. This means that your own insurance will cover your medical expenses and lost wages, regardless of who was at fault in an accident.

- PIP Coverage: $10,000 per person. This coverage pays for medical expenses, lost wages, and other damages to you and your passengers, regardless of who was at fault in an accident.

Penalties for Driving Without Insurance

Driving without the minimum required car insurance in Florida can result in serious consequences, including:

- Fines: You could face fines of up to $500 for driving without insurance.

- License Suspension: Your driver’s license could be suspended for up to three years if you are caught driving without insurance.

- Vehicle Impoundment: Your vehicle could be impounded if you are caught driving without insurance.

- Jail Time: In some cases, you could even face jail time for driving without insurance.

It is crucial to remember that these penalties can significantly impact your ability to drive and your overall financial well-being.

Types of Car Insurance in Florida

In addition to the minimum car insurance requirements, you can choose from various types of car insurance in Florida to customize your coverage and protect yourself financially. Understanding these options and their benefits can help you make informed decisions about your insurance policy.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault. It covers damage caused by collisions with another vehicle, an object, or even a rollover. Collision coverage is optional in Florida, but it’s highly recommended, especially if you have a financed or leased vehicle.

Collision coverage helps you recover from the financial burden of repairing or replacing your car after an accident.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damages not caused by collisions, such as theft, vandalism, fire, hail, or natural disasters. It also covers damage from events like falling objects or animal collisions. Like collision coverage, comprehensive coverage is optional, but it can be beneficial if you want to safeguard your vehicle against various risks.

Comprehensive coverage offers peace of mind by protecting your car against a wider range of unexpected events.

Uninsured/Underinsured Motorist (UM/UIM) Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage protects you and your passengers if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. UM coverage covers damages from a driver without insurance, while UIM coverage applies when the other driver has insurance but not enough to cover your losses. Both UM and UIM coverage are optional in Florida but are crucial for financial protection.

UM/UIM coverage acts as a safety net in case you’re hit by a driver who is uninsured or underinsured.

Medical Payments Coverage (Med Pay)

Medical Payments Coverage (Med Pay) helps pay for medical expenses for you and your passengers, regardless of fault, after an accident. Med Pay is optional and covers medical bills, including hospital stays, doctor visits, and ambulance fees. It’s a valuable addition to your policy, especially if you have a high deductible on your health insurance.

Med Pay provides quick and easy access to funds for medical expenses after an accident, regardless of fault.

Factors Affecting Car Insurance Rates in Florida

Car insurance rates in Florida are determined by a variety of factors, with some being more influential than others. Understanding these factors can help you make informed decisions about your coverage and potentially save money on your premiums.

Factors Affecting Car Insurance Rates in Florida

| Factor | Impact on Rates | Explanation | Examples |

|---|---|---|---|

| Driving History | Higher rates for drivers with poor history | Insurance companies consider your driving record, including accidents, tickets, and DUI convictions. A history of these events indicates a higher risk of future claims, leading to higher premiums. | Drivers with multiple speeding tickets or a recent accident will generally pay higher premiums than those with a clean driving record. |

| Age | Lower rates for older drivers | Younger drivers are statistically more likely to be involved in accidents. As drivers age, they gain more experience and tend to drive more cautiously, resulting in lower risk profiles. | A 20-year-old driver will typically pay higher premiums than a 50-year-old driver with the same driving history. |

| Vehicle Type | Higher rates for high-performance or expensive vehicles | The type of vehicle you drive impacts insurance costs. High-performance vehicles are more expensive to repair and are often targeted by thieves, leading to higher premiums. | A sports car like a Porsche 911 will generally have higher insurance premiums than a compact sedan like a Honda Civic. |

| Location | Higher rates in areas with higher accident rates | Insurance companies consider the location where you live and drive. Areas with higher crime rates or traffic congestion tend to have higher accident rates, leading to higher premiums. | Drivers in densely populated urban areas like Miami or Orlando may pay higher premiums than those in rural areas with less traffic. |

| Credit Score | Higher rates for drivers with poor credit | In many states, including Florida, insurance companies use credit scores as an indicator of risk. Drivers with lower credit scores are considered less financially responsible and may be more likely to file claims. | Drivers with excellent credit scores may qualify for discounts, while those with poor credit may face higher premiums. |

| Driving Habits | Higher rates for drivers with risky habits | Insurance companies may consider factors like your annual mileage, driving history, and commuting patterns. Drivers who frequently drive long distances or in hazardous conditions may face higher premiums. | Drivers who commute long distances daily or frequently drive in heavy traffic may pay higher premiums than those who drive less frequently or in less congested areas. |

How to Obtain Car Insurance in Florida

Securing car insurance in Florida involves a straightforward process that can be simplified by following a few key steps. This guide will walk you through the process of getting quotes, comparing options, and choosing a policy that best suits your needs and budget.

Getting Quotes

Before you can compare insurance options, you need to get quotes from various insurance companies. Here’s how to get started:

- Gather your information: Before contacting insurance companies, have your driver’s license, vehicle information (make, model, year, VIN), and details about your driving history readily available. This will expedite the quote process.

- Contact insurance companies directly: You can obtain quotes by calling insurance companies directly, visiting their websites, or working with an insurance broker.

- Use online comparison tools: Several online platforms allow you to compare quotes from multiple insurance companies simultaneously. These tools can save you time and effort.

Comparing Options

Once you have multiple quotes, it’s essential to compare them carefully to find the best deal. Consider the following factors:

- Coverage: Compare the coverage offered by each policy, ensuring it meets your specific needs.

- Premiums: The price of each policy is a significant factor. Compare the monthly premiums to find the most affordable option.

- Deductibles: Higher deductibles generally result in lower premiums. Determine the deductible amount you’re comfortable with.

- Discounts: Many insurance companies offer discounts for various factors, such as good driving records, safety features in your vehicle, and bundling multiple insurance policies.

- Customer service: Research the reputation of each insurance company for customer service and claims handling. Read online reviews and check with the Better Business Bureau.

Choosing a Policy

After carefully comparing options, you’re ready to choose the policy that best fits your requirements.

- Review the policy details: Before finalizing your decision, carefully review the policy documents to ensure you understand the coverage, exclusions, and terms and conditions.

- Ask questions: If you have any questions or concerns, don’t hesitate to contact the insurance company or your broker for clarification.

- Make your decision: Once you’re confident in your choice, you can finalize the policy and pay your premium.

Tips for Finding Affordable and Comprehensive Coverage

- Shop around: Don’t settle for the first quote you receive. Compare prices from multiple insurance companies.

- Improve your driving record: Maintaining a clean driving record can significantly reduce your insurance premiums.

- Consider a higher deductible: Choosing a higher deductible can lower your monthly premiums.

- Bundle your insurance: Combining your car insurance with other insurance policies, such as homeowners or renters insurance, can often result in discounts.

- Ask about discounts: Many insurance companies offer discounts for various factors, such as good student status, safety features in your vehicle, and membership in certain organizations.

- Review your policy regularly: It’s a good practice to review your policy annually to ensure it still meets your needs and that you’re taking advantage of all available discounts.

Florida’s No-Fault Insurance System

Florida operates under a unique no-fault insurance system, which significantly impacts how car insurance claims are handled. This system, designed to streamline the claims process and reduce litigation, has both advantages and disadvantages.

The No-Fault System’s Impact on Claims

Florida’s no-fault system mandates that drivers involved in an accident must first seek coverage from their own insurance company, regardless of who was at fault. This means that after an accident, drivers primarily file claims with their Personal Injury Protection (PIP) coverage, which covers medical expenses, lost wages, and other related costs. This approach aims to reduce the number of lawsuits filed and the overall cost of car insurance.

Comparing Florida’s System to Other States

Florida’s no-fault system differs from other states’ insurance systems in several ways. For instance, many states operate under a “fault-based” system, where the driver at fault is held financially responsible for the damages caused. In these states, the injured party typically files a claim with the at-fault driver’s insurance company.

- Fault-based systems often lead to more litigation as parties dispute fault and liability, potentially increasing the cost of insurance and the time it takes to resolve claims.

- No-fault systems like Florida’s aim to reduce litigation and expedite claims processing by eliminating the need to determine fault in minor accidents. However, this can also limit the amount of compensation available to injured parties.

The Role of PIP Coverage

PIP coverage plays a crucial role in Florida’s no-fault system. This coverage, mandatory for all Florida drivers, covers medical expenses, lost wages, and other related costs for the insured and their passengers, regardless of who was at fault in an accident.

PIP coverage is essential in Florida’s no-fault system as it provides immediate financial assistance for medical treatment and other expenses, regardless of fault.

- PIP coverage is typically limited to a specific amount, such as $10,000 per person, and has a deductible. This means the insured must pay a certain amount out of pocket before the coverage kicks in.

- The amount of PIP coverage available and the deductible can vary depending on the insurance policy.

Resources for Florida Drivers

Navigating the world of car insurance in Florida can be overwhelming, especially with the state’s unique insurance regulations. Fortunately, various resources are available to help Florida drivers make informed decisions about their coverage.

Florida Department of Motor Vehicles (FLHSMV)

The Florida Department of Motor Vehicles (FLHSMV) serves as a central hub for information related to driving and vehicle registration in Florida. The FLHSMV provides valuable resources for drivers, including information on car insurance requirements, licensing, and vehicle registration.

| Resource Name | Website URL |

|---|---|

| Florida Department of Motor Vehicles (FLHSMV) | https://www.flhsmv.gov/ |

The FLHSMV’s website offers a wealth of information, including frequently asked questions (FAQs) and downloadable forms.

Florida Office of Insurance Regulation

The Florida Office of Insurance Regulation (OIR) is responsible for overseeing the insurance industry in Florida. The OIR plays a crucial role in ensuring that insurance companies operate fairly and transparently.

| Resource Name | Website URL |

|---|---|

| Florida Office of Insurance Regulation (OIR) | https://www.floir.com/ |

The OIR’s website provides information on insurance regulations, consumer protection, and complaint resolution.

Consumer Protection Organizations

Consumer protection organizations are dedicated to advocating for the rights of consumers and providing resources to help them navigate complex issues, including insurance.

| Resource Name | Website URL |

|---|---|

| Florida Department of Financial Services | https://www.myfloridacfo.com/ |

| National Association of Insurance Commissioners (NAIC) | https://www.naic.org/ |

These organizations provide valuable information on insurance issues, consumer rights, and complaint resolution.

Ultimate Conclusion: Florida State Car Insurance Requirements

Being aware of Florida’s car insurance requirements is crucial for all drivers. From understanding the minimum coverage to exploring the different types of insurance available, this guide provides a comprehensive overview to help you make informed decisions. Remember, choosing the right insurance coverage is a personal decision, and it’s essential to compare options and seek advice from insurance professionals to find the best fit for your individual needs and budget.

FAQ Section

What are the penalties for driving without car insurance in Florida?

Driving without the minimum required car insurance in Florida can result in fines, license suspension, and even vehicle impoundment.

How often should I review my car insurance policy?

It’s a good idea to review your car insurance policy annually, or even more frequently if there are significant changes in your life, such as getting married, buying a new car, or changing your driving habits.

What are some tips for finding affordable car insurance in Florida?

Consider increasing your deductible, taking a defensive driving course, bundling your car insurance with other policies, and comparing quotes from multiple insurance providers.