Florida no fault insurance state – Florida No-Fault Insurance State is a unique system that sets it apart from other states in terms of handling car accident claims. This system, established in 1971, is designed to simplify the claims process and provide prompt medical coverage for accident victims, regardless of fault. The no-fault system operates through Personal Injury Protection (PIP) coverage, which is mandatory for all Florida drivers.

While Florida’s no-fault system aims to streamline accident claims, it also has specific rules and limitations that drivers should be aware of. Understanding these rules, including the threshold for filing a lawsuit, the advantages and disadvantages of the system, and recent developments and reforms, is crucial for navigating the complexities of Florida’s insurance landscape.

Florida No-Fault Insurance System

Florida’s no-fault insurance system is a unique approach to handling car accidents, designed to streamline the claims process and reduce litigation. It requires all drivers to carry personal injury protection (PIP) coverage, which covers medical expenses and lost wages for the insured regardless of who is at fault in an accident. This system aims to provide swift and efficient compensation for injuries while minimizing the need for lawsuits.

History and Implementation

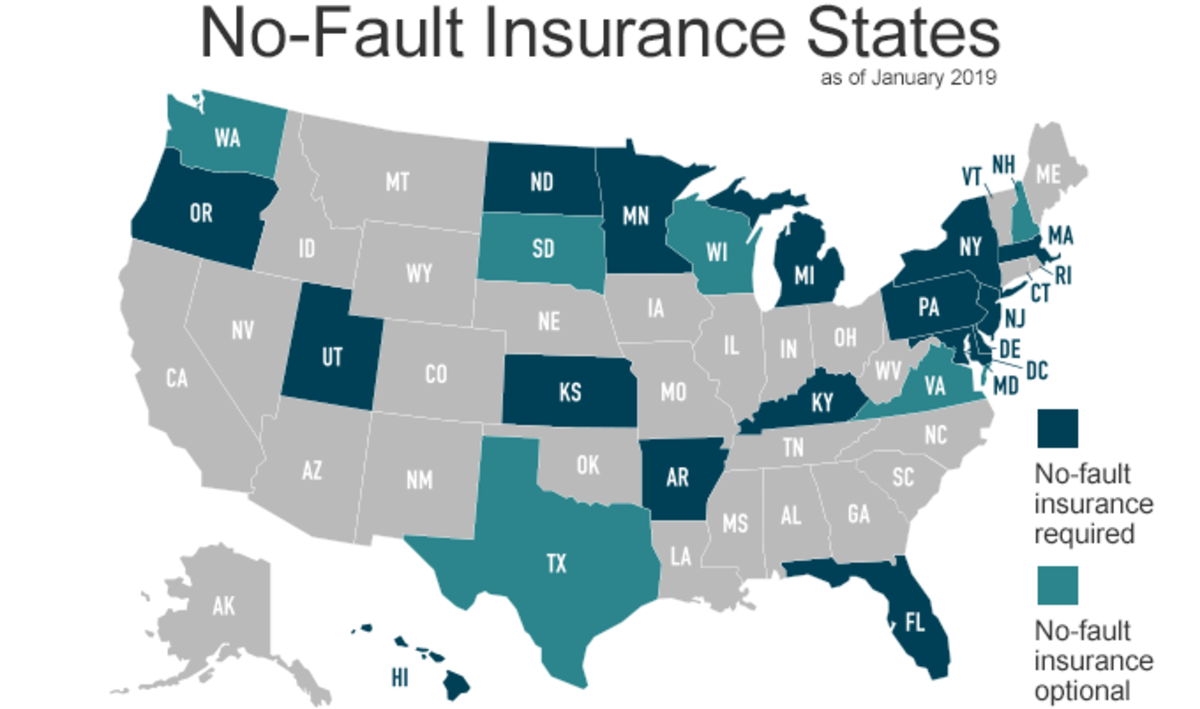

Florida adopted its no-fault insurance system in 1971, becoming one of the first states to implement such a system. The primary goal was to address the increasing number of car accident lawsuits and the rising costs associated with them. The system aimed to reduce court congestion and provide quicker access to benefits for injured individuals.

Key Provisions and Requirements

Florida’s no-fault law mandates that all drivers carry PIP coverage, which provides benefits for medical expenses and lost wages up to a certain limit. The minimum PIP coverage required is $10,000 per person, and drivers can choose higher limits if desired.

- PIP Coverage: This coverage pays for medical expenses and lost wages for the insured, regardless of who caused the accident. It has a limit of $10,000 per person, and drivers can choose higher limits.

- Personal Injury Protection (PIP): PIP is a mandatory coverage in Florida, and it covers medical expenses, lost wages, and other related expenses. The maximum coverage is $10,000, and drivers can choose higher limits.

- Property Damage Liability (PDL): This coverage protects the insured against damages caused to another person’s property. It is not mandatory, but it is recommended to have adequate coverage.

- Bodily Injury Liability (BIL): This coverage protects the insured against claims for injuries caused to another person. It is not mandatory, but it is recommended to have adequate coverage.

- Uninsured Motorist (UM) Coverage: This coverage protects the insured against damages caused by an uninsured or hit-and-run driver. It is not mandatory, but it is recommended to have adequate coverage.

- Underinsured Motorist (UIM) Coverage: This coverage protects the insured against damages caused by an underinsured driver. It is not mandatory, but it is recommended to have adequate coverage.

Covered and Non-Covered Benefits

Florida’s no-fault system covers a wide range of benefits for injuries sustained in a car accident. However, there are also certain limitations and exclusions.

- Covered Benefits: Medical expenses, lost wages, and other related expenses are covered under PIP.

- Non-Covered Benefits: Pain and suffering, emotional distress, and punitive damages are generally not covered under Florida’s no-fault system.

“Under Florida’s no-fault law, a person injured in a car accident can only sue the other driver for pain and suffering if their medical expenses exceed $1,000 or if they have suffered a permanent injury, such as disfigurement, loss of a bodily function, or a significant scarring.”

Personal Injury Protection (PIP) Coverage

Personal Injury Protection (PIP) coverage is a crucial component of Florida’s no-fault insurance system. It’s designed to cover your medical expenses and lost wages following an accident, regardless of who was at fault. This means that even if you’re involved in an accident caused by another driver, you can rely on your own PIP coverage to pay for your immediate medical needs.

Mandatory PIP Coverage Requirements

Florida law mandates that all drivers carry a minimum of $10,000 in PIP coverage. This means that your insurance policy must provide at least $10,000 in benefits to cover your medical expenses and lost wages after an accident. This requirement applies to all vehicles registered in Florida, including cars, trucks, motorcycles, and even golf carts.

Limitations and Exclusions of PIP Coverage

While PIP coverage provides valuable protection, it’s important to understand its limitations and exclusions.

Limitations

- 80% Rule: PIP coverage will only pay 80% of your reasonable and necessary medical expenses. The remaining 20% is your responsibility.

- $2,500 Threshold: You’ll need to have medical expenses exceeding $2,500 before you can pursue a claim against the at-fault driver for pain and suffering.

- Time Limits: PIP coverage has a time limit for claiming benefits. You typically have 14 days to notify your insurer about an accident and 2 years to file a claim for benefits.

Exclusions

- Non-Covered Medical Expenses: PIP coverage doesn’t cover all medical expenses. For example, it may not cover cosmetic surgery or experimental treatments.

- Non-Covered Injuries: Certain injuries, such as those resulting from intentional acts or illegal activities, may not be covered by PIP.

- Non-Covered Vehicles: PIP coverage typically doesn’t apply to accidents involving vehicles not registered in Florida.

PIP Coverage Options

Florida drivers have options when it comes to PIP coverage. They can choose between different levels of coverage, each with its own benefits and costs.

| PIP Coverage Option | Benefits | Cost |

|---|---|---|

| $10,000 Minimum | Covers up to $10,000 in medical expenses and lost wages. | Lower premium |

| $25,000 Coverage | Covers up to $25,000 in medical expenses and lost wages. | Higher premium |

| $50,000 Coverage | Covers up to $50,000 in medical expenses and lost wages. | Highest premium |

Threshold for Filing a Lawsuit

In Florida, the “threshold” is a crucial requirement that determines whether you can file a personal injury lawsuit against the at-fault driver. This threshold essentially acts as a gatekeeper, allowing only certain types of injuries to proceed with a lawsuit.

Types of Injuries Meeting the Threshold

The threshold for filing a lawsuit in Florida is met if you experience one of the following:

- Significant and Permanent Injury: This refers to a serious injury that has a lasting impact on your health and well-being. Examples include permanent disfigurement, loss of a body part, or a permanent impairment of a bodily function.

- Significant and Permanent Loss of an Important Bodily Function: This category includes injuries that significantly impair your ability to perform essential bodily functions, such as walking, seeing, or hearing.

- Death: If the accident results in death, the threshold is automatically met.

Consequences of Failing to Meet the Threshold

If your injuries do not meet the threshold, you are generally limited to seeking compensation for your medical expenses and lost wages through your own PIP coverage. You cannot sue the at-fault driver for pain and suffering, or other non-economic damages.

Examples of Situations

- Example 1: A driver rear-ends another car causing whiplash. The injured driver experiences pain and stiffness for several months but eventually recovers fully. This injury likely does not meet the threshold for a lawsuit because it is not permanent.

- Example 2: A pedestrian is struck by a car, resulting in a broken leg and permanent nerve damage. This injury likely meets the threshold for a lawsuit because it is a significant and permanent impairment of a bodily function.

Benefits and Limitations of No-Fault Insurance

Florida’s no-fault insurance system has both advantages and disadvantages. It aims to simplify the claims process and provide quicker access to benefits after an accident, but it also has limitations that can affect individuals’ rights and access to full compensation.

Advantages of No-Fault Insurance

The no-fault system is designed to streamline the claims process and provide faster access to benefits. Here are some of the advantages:

- Faster Access to Benefits: No-fault insurance requires your own insurance company to pay for your medical expenses and lost wages, regardless of who caused the accident. This means you can get treatment and financial assistance without waiting for a lengthy legal battle.

- Reduced Litigation: The no-fault system aims to reduce the number of lawsuits by eliminating the need to prove fault in minor accidents. This can save time and resources for both individuals and the legal system.

- Lower Insurance Premiums: Some argue that the no-fault system can lead to lower insurance premiums because fewer lawsuits are filed, which reduces insurance companies’ costs. However, this is a complex issue and there is no clear consensus on the impact of no-fault on insurance premiums.

Disadvantages of No-Fault Insurance

While the no-fault system has its benefits, it also has limitations that can be detrimental to individuals seeking full compensation for their injuries.

- Limited Coverage: No-fault insurance typically has limited coverage for pain and suffering, and you may not be able to recover compensation for non-economic damages like emotional distress or loss of companionship. This can be particularly problematic for individuals with serious injuries.

- Threshold for Filing a Lawsuit: Florida has a “threshold” for filing a lawsuit. This means that you can only sue the at-fault driver if you meet certain criteria, such as having a permanent injury or exceeding a certain amount of medical expenses. This threshold can be difficult to meet, and it can prevent individuals from seeking full compensation for their injuries.

- Potential for Abuse: Some argue that the no-fault system can be abused by insurance companies, who may try to limit benefits or deny claims. It’s important to be aware of your rights and to seek legal advice if you believe your claim has been unfairly denied.

Comparison with Traditional Fault-Based Insurance

Traditional fault-based insurance systems require the driver at fault to pay for the damages caused by the accident. This means that the injured party must prove the other driver’s negligence in order to receive compensation.

- Advantages of Fault-Based Insurance: Fault-based insurance systems offer the potential for full compensation for all damages, including pain and suffering. They also provide a stronger incentive for drivers to be more cautious and avoid accidents.

- Disadvantages of Fault-Based Insurance: Fault-based systems can be time-consuming and expensive, as they often involve lengthy legal battles and high legal fees. They can also lead to higher insurance premiums due to the increased cost of litigation.

Challenges and Issues Associated with No-Fault Insurance

The no-fault system faces various challenges and issues that need to be addressed to ensure fairness and effectiveness.

- Fraud and Abuse: No-fault insurance is susceptible to fraud and abuse, as individuals may attempt to exaggerate their injuries or claim benefits they are not entitled to. This can lead to higher insurance premiums for everyone.

- Limited Access to Care: The limited coverage under no-fault insurance can make it difficult for individuals to access the necessary medical care, especially for long-term or complex injuries. This can result in inadequate treatment and long-term health problems.

- Complexity and Confusion: The no-fault system can be complex and confusing, making it difficult for individuals to understand their rights and benefits. This can lead to misunderstandings and disputes with insurance companies.

Pros and Cons of Florida’s No-Fault System

The following table Artikels the pros and cons of Florida’s no-fault insurance system:

| Pros | Cons |

|---|---|

| Faster access to benefits | Limited coverage for pain and suffering |

| Reduced litigation | Threshold for filing a lawsuit |

| Potentially lower insurance premiums | Potential for abuse by insurance companies |

Impact on Drivers and Accidents: Florida No Fault Insurance State

Florida’s no-fault insurance system has a significant impact on drivers and accidents. The system aims to streamline accident claims and reduce litigation, but it also introduces unique dynamics that influence driving behavior and accident outcomes.

Impact on Accident Frequency

The effect of no-fault insurance on accident frequency is a complex issue with mixed opinions. Some argue that the system might encourage more accidents, as drivers might feel less responsible for their actions, knowing their own insurance will cover their medical expenses. However, others argue that the system could lead to fewer accidents, as drivers are incentivized to be more cautious to avoid increasing their insurance premiums.

There is no definitive consensus on whether no-fault insurance increases or decreases accident frequency. More research is needed to analyze the long-term impact of the system on driving behavior and accident rates.

Impact on Insurance Premiums

No-fault insurance has a direct impact on insurance premiums. In Florida, drivers pay higher premiums than in states with traditional fault-based systems. This is primarily due to the mandatory PIP coverage, which increases insurance costs for all drivers.

However, the system can also lead to lower premiums for drivers with good driving records. Since no-fault insurance reduces the number of lawsuits, insurance companies can potentially save money on legal costs, which can be reflected in lower premiums for drivers with good records.

Impact on Healthcare Costs

No-fault insurance impacts healthcare costs in several ways. The system encourages prompt medical attention for accident victims, leading to increased healthcare utilization. This can lead to higher healthcare costs overall, but it also ensures timely treatment for injured individuals.

The system also introduces a new layer of bureaucracy, as insurance companies are involved in managing medical expenses. This can lead to delays and disputes, potentially increasing healthcare costs due to administrative overhead.

Illustration of Potential Effects

Imagine two drivers involved in an accident. In a traditional fault-based system, the driver at fault would be responsible for the other driver’s medical expenses. In a no-fault system, both drivers would rely on their own PIP coverage to pay for their medical expenses.

In the no-fault system, the driver who caused the accident might feel less responsible for their actions, as they know their own insurance will cover the other driver’s medical expenses. This could potentially lead to more accidents, as drivers might feel less incentivized to be cautious.

However, the no-fault system also incentivizes both drivers to seek prompt medical attention, as they know their insurance will cover the costs. This can lead to higher healthcare utilization but also ensures timely treatment for injured individuals.

The impact of no-fault insurance on healthcare costs is a complex issue, with both potential benefits and drawbacks.

Recent Developments and Reforms

Florida’s no-fault insurance system has been a subject of debate for years, with ongoing discussions about its effectiveness and potential for reform. Recent developments and proposed reforms aim to address concerns regarding rising costs, access to care, and litigation.

Recent Developments and Proposed Reforms

The Florida legislature has been actively considering reforms to the no-fault system, driven by concerns about rising insurance premiums and limited access to care for injured drivers.

- SB 76: This bill, passed in 2023, aimed to reduce healthcare costs by limiting the amount of PIP benefits available to injured drivers. It also introduced a new “emergency” threshold for lawsuits, allowing drivers to file a lawsuit if they meet certain criteria, such as a permanent injury or significant medical expenses.

- SB 102: This bill, passed in 2021, aimed to address fraud and abuse in the no-fault system. It introduced stricter regulations for medical providers and required the use of electronic billing systems.

- HB 719: This bill, passed in 2020, aimed to increase transparency and accountability in the no-fault system. It required insurers to provide more information to policyholders about their coverage and benefits.

Potential Implications of Reforms

The proposed reforms have generated significant debate, with varying perspectives on their potential impact on drivers and insurers.

- Impact on Drivers: Supporters of the reforms argue that they will reduce insurance premiums and provide greater access to care by streamlining the claims process and curbing fraud. However, critics argue that the reforms will limit access to necessary medical care and make it more difficult for injured drivers to receive fair compensation.

- Impact on Insurers: The reforms are expected to reduce insurance payouts for insurers, leading to lower premiums for policyholders. However, the reforms could also lead to an increase in litigation, as drivers may be more likely to file lawsuits to seek compensation for their injuries.

Arguments for and Against the Proposed Reforms, Florida no fault insurance state

The debate surrounding the proposed reforms revolves around several key arguments.

- Arguments for Reform: Proponents of reform argue that the current no-fault system is plagued by fraud, abuse, and excessive litigation. They believe that reforms are necessary to reduce insurance premiums, improve access to care, and streamline the claims process.

- Arguments Against Reform: Opponents of reform argue that the proposed changes will limit access to necessary medical care, make it more difficult for injured drivers to receive fair compensation, and potentially lead to an increase in litigation. They believe that the reforms will ultimately harm drivers and undermine the principles of the no-fault system.

Timeline of Key Events and Changes

A timeline of key events and changes in Florida’s no-fault system highlights the evolution of the system over time.

| Year | Event | Description |

|---|---|---|

| 1971 | Passage of the Florida No-Fault Law | Florida adopts a no-fault insurance system, requiring drivers to carry personal injury protection (PIP) coverage. |

| 1972 | First Significant Reforms | Amendments to the no-fault law introduce changes to PIP coverage and the threshold for filing lawsuits. |

| 1988 | Major Reforms | Significant reforms are implemented, including changes to PIP benefits, the threshold for filing lawsuits, and the role of medical providers. |

| 2020-2023 | Recent Developments and Proposed Reforms | The Florida legislature actively considers reforms to the no-fault system, aimed at addressing concerns about rising insurance premiums and limited access to care. |

Final Review

Navigating Florida’s no-fault insurance system requires a comprehensive understanding of its intricacies. From the mandatory PIP coverage to the threshold requirements for filing lawsuits, the system presents both benefits and challenges for drivers. By staying informed about the latest developments and reforms, drivers can better protect themselves and make informed decisions regarding their insurance needs.

FAQ Corner

What are the benefits of Florida’s no-fault insurance system?

The no-fault system aims to provide prompt medical coverage for accident victims, regardless of fault, and reduce the number of lawsuits. It also simplifies the claims process, potentially leading to faster payments for medical expenses.

What are the limitations of Florida’s no-fault insurance system?

The system can be restrictive in terms of compensation for pain and suffering, and it may not cover all medical expenses. Additionally, drivers may face challenges in seeking compensation for serious injuries if they don’t meet the threshold for filing a lawsuit.

How does Florida’s no-fault insurance system impact insurance premiums?

The no-fault system aims to reduce the number of lawsuits, potentially leading to lower insurance premiums. However, the cost of PIP coverage can vary depending on factors such as coverage limits and driving history.

What are some recent developments in Florida’s no-fault insurance system?

There have been ongoing discussions and proposed reforms to address issues such as rising healthcare costs and insurance fraud. These reforms aim to strike a balance between protecting drivers and ensuring the system’s sustainability.