Florida car insurance no fault state – Florida car insurance operates under a no-fault system, a unique approach that sets it apart from many other states. This system, centered around Personal Injury Protection (PIP) coverage, aims to streamline the claims process and reduce litigation following accidents. However, it also presents its own set of benefits and drawbacks that drivers should carefully consider.

In Florida, drivers are required to carry PIP coverage, which covers their medical expenses and lost wages regardless of who caused the accident. This means that even if you are at fault, your own insurance will cover your initial medical costs. While this system can expedite the claims process and reduce the need for lawsuits, it also comes with limitations, such as caps on benefits and potential for higher premiums. Understanding the nuances of Florida’s no-fault system is crucial for making informed decisions about your car insurance.

Introduction to Florida’s No-Fault System

Florida operates under a no-fault insurance system, which means that drivers are primarily responsible for covering their own medical expenses and lost wages after an accident, regardless of who was at fault. This system is designed to streamline the claims process and reduce litigation.

Personal Injury Protection (PIP) Coverage

Personal Injury Protection (PIP) coverage is a mandatory component of auto insurance in Florida. It provides financial protection for medical expenses, lost wages, and other related costs incurred by the policyholder and their passengers, regardless of who caused the accident. PIP coverage typically covers up to $10,000 in medical expenses and $5,000 in lost wages.

Key Differences Between No-Fault and Traditional Fault-Based Insurance Systems

- Fault Determination: In a no-fault system, fault is not a primary factor in determining who pays for damages. In contrast, traditional fault-based systems require the determination of fault to establish liability and determine who is responsible for paying damages.

- Claims Process: No-fault systems typically have a more streamlined claims process as the focus is on prompt payment of benefits to the insured. In fault-based systems, the claims process can be more complex and time-consuming as it involves determining fault and negotiating settlements.

- Litigation: No-fault systems are generally designed to reduce litigation by eliminating the need for fault determination in many cases. However, drivers can still sue for pain and suffering if their injuries meet certain thresholds.

Benefits and Drawbacks of Florida’s No-Fault System

Florida’s no-fault insurance system, implemented in 1971, aims to streamline the claims process and reduce litigation following car accidents. However, like any system, it has its own set of advantages and disadvantages. This section explores both sides of the coin, shedding light on the benefits and drawbacks of Florida’s no-fault system.

Advantages of Florida’s No-Fault System

The no-fault system in Florida is designed to simplify the claims process and reduce litigation, offering several advantages for both drivers and insurers.

- Faster Claims Processing: Under the no-fault system, drivers are required to file claims with their own insurance companies, regardless of who caused the accident. This eliminates the need to determine fault, leading to quicker processing times and faster payouts for covered medical expenses and lost wages.

- Reduced Litigation: The no-fault system aims to minimize lawsuits by providing coverage for basic economic losses, such as medical expenses and lost wages, regardless of fault. This, in theory, should reduce the number of lawsuits filed and the overall cost of litigation.

Drawbacks of Florida’s No-Fault System

While the no-fault system aims to simplify the claims process, it also comes with some drawbacks.

- Limitations on Benefits: Florida’s no-fault system sets limits on the benefits available to injured drivers. For example, there is a limit on the amount of medical expenses that will be covered. This can leave drivers with significant out-of-pocket costs if their injuries are severe. Additionally, the system doesn’t cover pain and suffering, which can be a significant factor in accident-related damages.

- Potential for Higher Premiums: While the no-fault system aims to reduce litigation costs, it can also lead to higher premiums. This is because insurers may have to pay out more in benefits, even for minor accidents. Additionally, the system can incentivize fraud, as people may be tempted to exaggerate their injuries to receive more benefits.

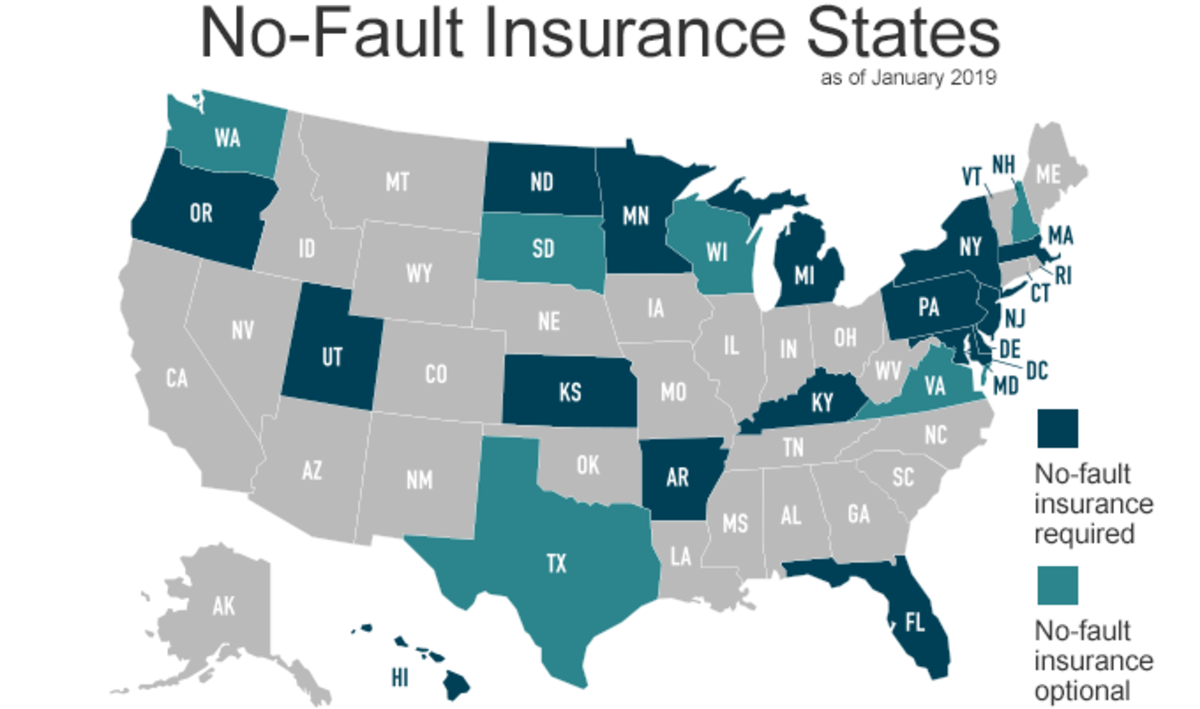

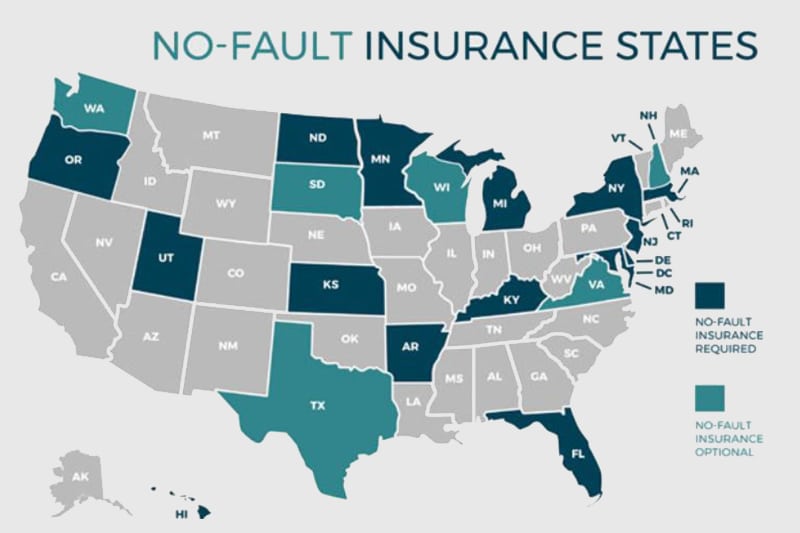

Comparison with Other States’ Systems

Florida’s no-fault system differs from other states’ systems in several ways. Some states have pure no-fault systems, where drivers can only sue for damages if their injuries are severe. Other states have a modified no-fault system, where drivers can sue for damages if their injuries exceed a certain threshold. Florida’s system is considered a modified no-fault system, as drivers can sue for damages if their injuries meet certain criteria.

PIP Coverage in Florida

Florida’s no-fault system mandates that all drivers carry Personal Injury Protection (PIP) coverage, which is designed to cover medical expenses and lost wages resulting from a car accident, regardless of fault. This coverage is essential for all drivers in Florida, as it provides financial protection in the event of an accident, even if the driver is not at fault.

PIP Coverage Requirements

PIP coverage is mandatory in Florida, meaning that all drivers must carry this coverage on their insurance policy. The minimum PIP coverage requirement is $10,000 per person, but drivers can choose to purchase higher coverage limits. This coverage is essential for all drivers in Florida, as it provides financial protection in the event of an accident, even if the driver is not at fault.

PIP Coverage Benefits

PIP coverage provides benefits for medical expenses and lost wages resulting from a car accident. These benefits are typically paid out on a 80/20 basis, meaning that the PIP coverage pays 80% of the medical expenses and lost wages, and the insured person is responsible for the remaining 20%.

- Medical Expenses: PIP coverage covers reasonable and necessary medical expenses incurred as a result of a car accident, such as hospital bills, doctor’s visits, ambulance fees, and prescription medications. The coverage also includes expenses for rehabilitation, physical therapy, and other necessary medical treatments.

- Lost Wages: PIP coverage can help compensate for lost wages resulting from a car accident. This benefit is typically limited to a certain amount per week and for a specific period of time, depending on the policy.

Filing a PIP Claim

To file a PIP claim, the insured person must notify their insurance company of the accident and provide the necessary documentation, such as a police report and medical records. The insurance company will then review the claim and determine if the expenses are covered under the PIP policy.

Factors Affecting PIP Coverage

Several factors can affect the amount of PIP coverage available to an insured person. These factors include:

- Coverage Limits: The amount of PIP coverage available is determined by the coverage limits selected on the insurance policy. Drivers can choose to purchase higher coverage limits, which will provide greater financial protection in the event of an accident.

- Deductible: Some PIP policies have a deductible, which is the amount the insured person must pay out-of-pocket before the PIP coverage kicks in. The deductible can vary depending on the policy.

- Time Limits: PIP coverage typically has a time limit for filing claims and receiving benefits. This time limit can vary depending on the policy.

- Medical Necessity: The insurance company will review the medical expenses to determine if they are reasonable and necessary. If the expenses are deemed unnecessary or excessive, the insurance company may not cover them.

Threshold for Filing a Lawsuit

In Florida, the “no-fault” system applies to personal injury protection (PIP) coverage, but it doesn’t eliminate the possibility of filing a lawsuit for damages. However, there’s a crucial hurdle: the “serious injury” threshold. This means you can’t sue for pain and suffering unless your injuries meet specific criteria.

This threshold is intended to prevent frivolous lawsuits and keep insurance costs down. However, it can be a significant barrier for those seeking compensation for their injuries.

Types of Injuries Qualifying as “Serious”

The law defines “serious injury” as one that results in:

- Permanent injury: This refers to an injury that has lasting effects and cannot be fully healed. Examples include permanent disfigurement, loss of a bodily function, or significant impairment of a body system.

- Significant and permanent impairment of an important bodily function: This requires a demonstrable and significant loss of function, such as loss of mobility, loss of hearing, or loss of sight.

- Permanent disfigurement: This refers to a visible and permanent alteration to the body’s appearance that is considered disfiguring.

- Significant and permanent scarring: This includes scarring that is both noticeable and has a lasting impact on the appearance or function of the affected area.

- Death: This is the most severe type of injury and automatically meets the “serious injury” threshold.

Implications of the Threshold on Compensation

The “serious injury” threshold has significant implications for accident victims seeking compensation:

- Limited access to compensation: Only those who can demonstrate “serious injury” can seek compensation beyond PIP benefits, including pain and suffering, lost wages, and other non-economic damages.

- Increased burden of proof: Proving “serious injury” requires medical documentation, expert opinions, and a convincing case to meet the legal standard.

- Potential for disputes: Insurance companies may challenge the severity of injuries, leading to potential legal battles and delays in receiving compensation.

The Role of Fault in Florida Accidents: Florida Car Insurance No Fault State

In Florida, the no-fault system is the primary method for handling car accident claims, but fault still plays a significant role in determining liability and potential legal actions. This section explores how fault is determined in Florida car accidents and its implications for insurance claims and legal proceedings.

Determining Fault in Florida Accidents

Florida law uses a comparative negligence system to determine fault in car accidents. This means that the responsibility for the accident is shared among all parties involved, based on their individual negligence. The degree of fault is assigned to each driver, and it directly affects the amount of compensation they can receive.

The determination of fault is based on the following factors:

- Traffic Laws: Drivers are expected to follow traffic laws, such as speed limits, right-of-way rules, and stop signs. Any violation of these laws can be considered negligence.

- Driving Practices: Driving under the influence of alcohol or drugs, distracted driving, and reckless driving are all considered negligent actions.

- Road Conditions: While drivers are responsible for safe driving practices, the condition of the road can also play a role in accidents. If a road is poorly maintained or has dangerous conditions, it may contribute to the accident.

- Weather Conditions: Adverse weather conditions, such as heavy rain or fog, can significantly impact driving conditions and may contribute to accidents.

- Witness Testimony: Eyewitness accounts and statements from involved parties can provide valuable information about the accident and help determine fault.

- Police Reports: Police reports often include detailed descriptions of the accident, including information about the drivers, vehicles, and any contributing factors.

- Physical Evidence: Physical evidence such as skid marks, damage to vehicles, and debris can be analyzed to determine the sequence of events leading to the accident.

Fault and Insurance Claims, Florida car insurance no fault state

Fault is a critical factor in determining insurance coverage and compensation in Florida car accidents. The no-fault system requires drivers to seek coverage for their own injuries and damages from their own insurance company, regardless of who caused the accident. However, fault comes into play when seeking compensation for pain and suffering, lost wages, and other non-economic damages.

- PIP Coverage: Personal Injury Protection (PIP) coverage pays for medical expenses, lost wages, and other related costs regardless of fault. However, PIP benefits are limited to $10,000 per person.

- Threshold for Filing a Lawsuit: In Florida, drivers are generally prohibited from suing the other driver for non-economic damages unless they meet a specific threshold. This threshold is typically met when the driver suffers a serious injury, such as a permanent disability, significant disfigurement, or death.

- Fault and Liability: If a driver is found to be at fault for the accident, they may be held liable for the other driver’s damages. This liability can extend beyond the PIP coverage limits and may include compensation for pain and suffering, lost wages, and other non-economic damages.

Choosing Car Insurance in Florida

Navigating the car insurance landscape in Florida can be a bit tricky, especially with the state’s unique no-fault system. This guide will help you make informed decisions about your car insurance coverage, ensuring you have the right protection without overpaying.

Understanding Coverage Options and Limits

It’s crucial to understand the different types of coverage available and how they relate to Florida’s no-fault system. Here’s a breakdown of key coverage options:

- Personal Injury Protection (PIP): This coverage is mandatory in Florida and pays for medical expenses, lost wages, and other related costs regardless of who is at fault in an accident. PIP coverage is typically limited to $10,000, but you can choose higher limits.

- Property Damage Liability (PDL): This coverage pays for damages to other people’s vehicles or property if you are at fault in an accident. The minimum required coverage in Florida is $10,000.

- Bodily Injury Liability (BIL): This coverage pays for injuries to other people if you are at fault in an accident. The minimum required coverage in Florida is $10,000 per person and $20,000 per accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. It’s optional coverage, and you may choose to waive it if your vehicle is older or has a lower value.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged by events other than an accident, such as theft, vandalism, or natural disasters. It’s also optional coverage, and you may choose to waive it if your vehicle is older or has a lower value.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This coverage protects you if you are injured in an accident caused by a driver who is uninsured or underinsured. It’s highly recommended, especially considering the high number of uninsured drivers in Florida.

Negotiating Rates and Finding Affordable Insurance

Finding affordable car insurance in Florida requires some effort and strategy. Here are some tips to help you secure the best rates:

- Shop Around: Get quotes from multiple insurance companies to compare prices and coverage options. You can use online comparison websites or contact insurance agents directly.

- Bundle Your Policies: Consider bundling your car insurance with other policies, such as homeowners or renters insurance, to potentially get a discount.

- Improve Your Credit Score: Your credit score can affect your insurance rates in some states, including Florida. Improving your credit score can lead to lower premiums.

- Maintain a Clean Driving Record: Avoiding accidents and traffic violations can significantly reduce your insurance costs.

- Ask About Discounts: Many insurance companies offer discounts for various factors, such as good student discounts, safe driver discounts, and discounts for anti-theft devices. Be sure to inquire about any discounts you may qualify for.

- Consider Higher Deductibles: Choosing a higher deductible can lower your monthly premium, but you’ll have to pay more out of pocket if you have to file a claim.

Legal Considerations in Florida Car Accidents

Navigating the legal aspects of a car accident in Florida can be complex, especially within the framework of the state’s no-fault system. Understanding the role of attorneys, potential legal issues, and the process of pursuing claims beyond PIP coverage is crucial for maximizing your rights and ensuring a fair outcome.

The Role of Attorneys in Florida Car Accident Cases

Hiring an attorney can significantly benefit you in a Florida car accident case. Attorneys possess specialized knowledge of Florida’s no-fault laws and can provide valuable guidance throughout the legal process. They can:

- Assess the severity of your injuries and potential damages.

- Negotiate with insurance companies on your behalf.

- File necessary paperwork and meet deadlines.

- Represent you in court if a lawsuit becomes necessary.

Attorneys can also help you understand your rights and options, ensuring you receive the compensation you deserve.

End of Discussion

Navigating Florida’s no-fault car insurance system requires a clear understanding of its intricacies. While it offers advantages like faster claims processing, it also presents limitations on benefits and potential for higher premiums. By carefully considering your coverage options, understanding the “serious injury” threshold for lawsuits, and knowing your rights, you can ensure you have the right protection for yourself and your family on the road.

Q&A

What are the minimum PIP coverage limits in Florida?

Florida requires a minimum of $10,000 in PIP coverage.

Can I choose to have higher PIP coverage limits?

Yes, you can choose to have higher PIP coverage limits, which can provide greater financial protection in case of a serious accident.

What happens if my medical expenses exceed my PIP coverage?

If your medical expenses exceed your PIP coverage, you may be able to pursue a claim against the at-fault driver’s insurance, but only if you meet the “serious injury” threshold.

How do I file a PIP claim?

You should contact your insurance company as soon as possible after an accident and provide them with the necessary information, including details about the accident and your injuries.