FL State Minimum Auto Insurance sets the stage for understanding the essential coverage required to legally drive in Florida. This guide explores the specific types of coverage mandated by Florida law, delving into the financial responsibility limits for each. We’ll also shed light on the state’s no-fault system and the potential consequences of driving without minimum insurance.

This information is crucial for all Florida drivers, whether you’re a seasoned motorist or a new resident. Understanding these requirements can help you make informed decisions about your insurance needs and ensure you’re adequately protected on the road.

Florida’s Minimum Auto Insurance Requirements

Driving in Florida requires you to have minimum auto insurance coverage. This helps protect you and others in case of an accident. Let’s explore the specific requirements set by Florida law.

Coverage Types and Financial Responsibility Limits, Fl state minimum auto insurance

Florida law mandates that all drivers carry certain types of auto insurance coverage to ensure financial responsibility in case of an accident. These coverage types include:

- Bodily Injury Liability: This coverage protects you from financial responsibility if you cause an accident that results in injuries to another person. The minimum requirement in Florida is $10,000 per person and $20,000 per accident.

- Property Damage Liability: This coverage protects you from financial responsibility if you cause an accident that damages another person’s property. The minimum requirement in Florida is $10,000 per accident.

- Personal Injury Protection (PIP): This coverage covers medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault, after an accident. The minimum requirement in Florida is $10,000 per person.

- Uninsured Motorist Coverage: This coverage protects you and your passengers from financial losses if you are involved in an accident with an uninsured or underinsured motorist. The minimum requirement in Florida is $10,000 per person and $20,000 per accident.

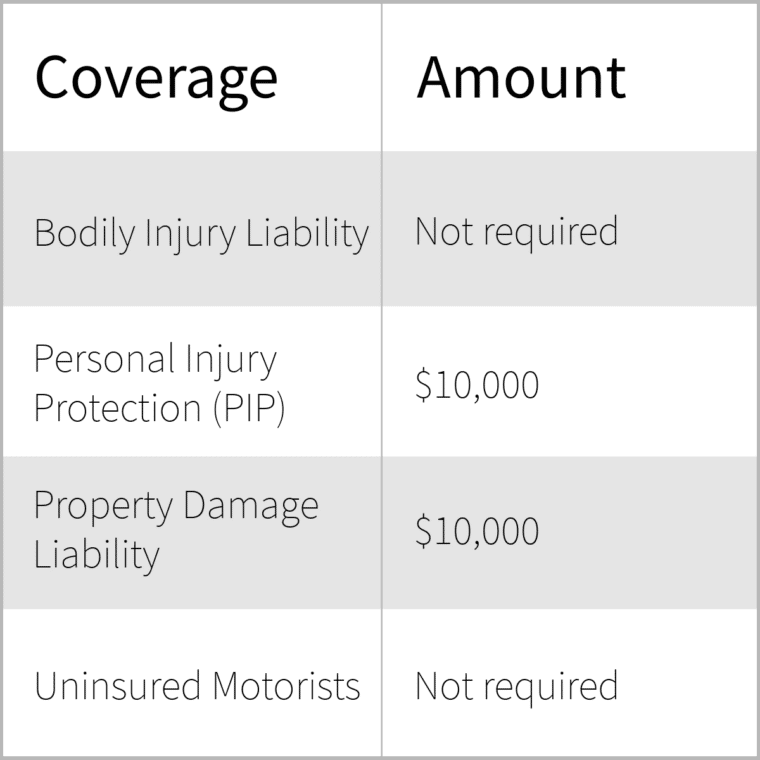

Here is a table summarizing the financial responsibility limits for each coverage type:

| Coverage Type | Minimum Financial Responsibility Limit |

|---|---|

| Bodily Injury Liability | $10,000 per person, $20,000 per accident |

| Property Damage Liability | $10,000 per accident |

| Personal Injury Protection (PIP) | $10,000 per person |

| Uninsured Motorist Coverage | $10,000 per person, $20,000 per accident |

It is crucial to understand that these are minimum requirements. You may want to consider purchasing higher coverage limits to provide more comprehensive protection in case of an accident.

Understanding Florida’s No-Fault System

Florida operates under a no-fault insurance system, which means that drivers are primarily responsible for covering their own medical expenses and lost wages after an accident, regardless of who caused it. This system relies heavily on Personal Injury Protection (PIP) coverage, a type of insurance that helps pay for medical bills and lost wages after an accident.

PIP Coverage

PIP coverage is a mandatory component of Florida’s auto insurance policy, providing financial assistance for medical expenses and lost wages resulting from a car accident, regardless of fault.

Benefits of PIP Coverage

* Medical Expenses: PIP covers reasonable and necessary medical expenses, including doctor visits, hospital stays, ambulance services, and physical therapy.

* Lost Wages: PIP can help compensate for lost income if you are unable to work due to injuries sustained in an accident.

* Death Benefits: In the event of a fatal accident, PIP can provide death benefits to the deceased’s beneficiaries.

Limitations of PIP Coverage

* Coverage Limit: Florida law requires a minimum PIP coverage of $10,000, which may not be sufficient to cover all medical expenses in serious accidents.

* Time Limits: PIP benefits have a time limit of 80% of the coverage amount, typically 2 years.

* Deductible: Many PIP policies have a deductible, which is the amount you pay out-of-pocket before PIP coverage kicks in.

* Medical Provider Choice: You are not always free to choose your own medical provider, as PIP policies often have a network of preferred providers.

Filing a PIP Claim

The following steps are typically involved in filing a PIP claim:

- Report the Accident: Notify your insurance company of the accident as soon as possible.

- Seek Medical Attention: If you have been injured, seek medical attention immediately.

- Submit a PIP Claim: Complete and submit a PIP claim form to your insurance company.

- Provide Documentation: Provide your insurance company with all necessary documentation, including medical bills, lost wage statements, and police reports.

- Follow Up: Follow up with your insurance company regularly to check on the status of your claim.

Consequences of Driving Without Minimum Insurance

Driving without the minimum required auto insurance in Florida is a serious offense. You could face severe penalties, including fines, license suspension, and even jail time. Understanding the consequences of driving uninsured can help you avoid them.

Penalties for Driving Without Minimum Insurance

Driving without the minimum required auto insurance in Florida can result in significant penalties. These penalties can include fines, license suspension, and even jail time. The severity of the penalties depends on the specific circumstances of the violation.

| Violation | Penalty | Additional Details |

|---|---|---|

| Driving without insurance | $150 – $500 fine | The fine can be increased for repeat offenses. |

| Driving with a suspended license | $100 – $500 fine, up to 6 months in jail | This penalty applies if your license was suspended due to driving without insurance. |

| Causing an accident without insurance | $150 – $500 fine, up to 6 months in jail | This penalty applies if you cause an accident while driving without insurance. |

Exploring Additional Coverage Options: Fl State Minimum Auto Insurance

While Florida’s minimum auto insurance requirements are designed to provide basic financial protection in case of an accident, many drivers opt for additional coverage to enhance their financial security and peace of mind. These optional coverage types offer protection against a wider range of risks and can help you avoid significant out-of-pocket expenses.

Understanding Optional Coverage Types

Here’s a closer look at some of the most common optional auto insurance coverages available in Florida:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. It’s particularly important if you have a newer or more expensive vehicle.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. It’s a good option if your vehicle is a significant investment or if you live in an area prone to these types of incidents.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage provides protection if you’re involved in an accident with a driver who doesn’t have adequate insurance or no insurance at all. It can help cover your medical expenses, lost wages, and property damage.

- Personal Injury Protection (PIP): This coverage is mandatory in Florida and covers your medical expenses, lost wages, and other related expenses, regardless of who is at fault in an accident. While PIP is required, you can choose the coverage level you want, with higher levels providing more comprehensive protection.

- Medical Payments Coverage (Med Pay): This coverage provides additional medical expense coverage, regardless of fault, for you and your passengers, even if you’re not at fault in an accident. It can be a valuable supplement to PIP, especially if you have higher medical expenses.

- Rental Reimbursement Coverage: This coverage provides reimbursement for rental car expenses if your vehicle is damaged in an accident and is being repaired. It can be helpful if you rely on your vehicle for daily transportation and need a temporary replacement.

- Roadside Assistance Coverage: This coverage provides assistance with unexpected roadside emergencies, such as flat tires, dead batteries, or lockouts. It can be a valuable resource for peace of mind, especially if you’re driving long distances or in unfamiliar areas.

Evaluating the Advantages and Disadvantages

It’s important to carefully consider the advantages and disadvantages of each optional coverage type before making a decision. Here’s a comparison to help you make an informed choice:

| Coverage Type | Advantages | Disadvantages |

|---|---|---|

| Collision Coverage |

|

|

| Comprehensive Coverage |

|

|

| Uninsured/Underinsured Motorist Coverage (UM/UIM) |

|

|

| Personal Injury Protection (PIP) |

|

|

| Medical Payments Coverage (Med Pay) |

|

|

| Rental Reimbursement Coverage |

|

|

| Roadside Assistance Coverage |

|

|

Finding Affordable Auto Insurance in Florida

Navigating the world of auto insurance in Florida can feel overwhelming, especially when you’re trying to find the best price. However, with a little research and some strategic planning, you can find affordable coverage that meets your needs.

Factors Influencing Insurance Premiums

Several factors contribute to the cost of your auto insurance in Florida. Understanding these factors can help you make informed decisions to potentially lower your premiums.

- Driving History: Your driving record is a major factor in determining your insurance rates. A clean record with no accidents or violations will generally result in lower premiums. However, accidents, traffic violations, and even DUI convictions can significantly increase your rates.

- Vehicle Type: The type of car you drive also plays a role in your insurance costs. Sports cars, luxury vehicles, and high-performance models tend to be more expensive to insure due to their higher repair costs and greater risk of theft.

- Location: Where you live in Florida can impact your insurance rates. Areas with higher crime rates or more traffic congestion tend to have higher insurance premiums.

- Age and Gender: Younger drivers and male drivers often face higher insurance rates due to statistical trends.

- Credit Score: In some states, including Florida, insurers may consider your credit score when calculating your rates. A good credit score can lead to lower premiums.

- Coverage Levels: The amount of coverage you choose, such as liability limits and deductibles, directly impacts your insurance costs. Higher coverage levels generally result in higher premiums.

Tips for Lowering Insurance Costs

There are several things you can do to potentially reduce your auto insurance premiums.

| Area | Tips |

|---|---|

| Driving Habits |

|

| Vehicle Maintenance |

|

| Policy Choices |

|

The Role of the Florida Department of Highway Safety and Motor Vehicles

The Florida Department of Highway Safety and Motor Vehicles (DHSMV) plays a crucial role in regulating auto insurance within the state. This department ensures that all drivers have the necessary financial protection to cover potential damages or injuries caused by accidents.

Enforcing Insurance Requirements

The DHSMV enforces Florida’s minimum auto insurance requirements through various measures. They maintain a database of all registered vehicles and their insurance status, enabling them to verify that drivers have the required coverage. The department also investigates reports of uninsured or underinsured drivers, potentially leading to fines, license suspension, or other penalties.

Handling Complaints

The DHSMV investigates complaints related to auto insurance, including issues with coverage, claims processing, or insurer practices. They act as a mediator between policyholders and insurers, striving to resolve disputes fairly. If a complaint involves a potential violation of state law, the department may take further action, such as imposing fines or initiating legal proceedings.

Additional Information

For comprehensive information about Florida’s auto insurance laws, regulations, and resources, visit the DHSMV website at [Insert DHSMV Website URL here]. The website provides detailed information on minimum insurance requirements, coverage options, complaint procedures, and other relevant topics.

Ending Remarks

Navigating Florida’s auto insurance landscape can seem complex, but by understanding the minimum requirements, the no-fault system, and available optional coverage, you can make informed choices to protect yourself and your finances. Remember, driving without proper insurance comes with serious consequences. By taking the time to understand these regulations, you can ensure a safe and secure driving experience in Florida.

FAQ Summary

How much does Florida’s minimum auto insurance cost?

The cost of minimum auto insurance in Florida varies depending on factors like your driving history, vehicle type, and location. It’s best to get quotes from multiple insurance companies to find the most affordable option.

What if I can’t afford the minimum auto insurance?

If you can’t afford the minimum insurance, it’s crucial to contact the Florida Department of Highway Safety and Motor Vehicles for assistance. They may have resources available to help you find affordable options.

Can I use my out-of-state insurance in Florida?

No, you must have Florida-compliant auto insurance to drive legally in the state. Contact your insurance company to inquire about options for Florida coverage.

What happens if I get into an accident and only have minimum insurance?

If you have only the minimum insurance and are involved in an accident, your coverage will be limited to the minimum limits. This may not be enough to cover all the damages or injuries, potentially leaving you responsible for additional costs.