FL State Insurance encompasses a vast and complex market, shaped by Florida’s unique environment and regulatory landscape. This guide explores the intricacies of this industry, from the types of insurance available to the challenges faced by both insurers and consumers.

Florida’s insurance market is a dynamic ecosystem influenced by factors such as hurricane risk, population growth, and evolving consumer needs. Understanding the key players, regulations, and trends is crucial for navigating this complex landscape.

Florida Insurance Market Overview

The Florida insurance market is a complex and dynamic ecosystem, characterized by its significant size, unique challenges, and ongoing evolution. It is one of the largest and most important insurance markets in the United States, playing a vital role in the state’s economy and the well-being of its residents.

Size and Scope of the Florida Insurance Market

The Florida insurance market is characterized by its sheer size and scope. The state has a large and diverse population, with a significant concentration of residents in coastal areas. This combination of factors creates a high demand for insurance products, particularly for property and casualty insurance. The Florida insurance market is dominated by a few large insurers, but also includes a significant number of smaller, regional companies. The market is also highly competitive, with insurers constantly vying for market share.

Key Characteristics of the Florida Insurance Landscape

The Florida insurance landscape is shaped by a number of unique challenges and opportunities. One of the most significant challenges is the state’s vulnerability to natural disasters, particularly hurricanes. Florida is a hurricane-prone state, and these storms can cause billions of dollars in damage to property and infrastructure. This risk has led to higher insurance premiums and a limited availability of coverage in some areas.

Another challenge is the state’s high litigation costs. Florida has a high number of insurance lawsuits, which can drive up insurance premiums. This is partly due to the state’s “tort reform” laws, which have made it easier for plaintiffs to sue insurers.

Despite these challenges, the Florida insurance market also presents a number of opportunities. The state’s large and growing population creates a strong demand for insurance products. Additionally, the state’s economy is diverse, with a number of industries that require insurance coverage. This creates opportunities for insurers to expand their market share and develop new products.

Historical Overview of the Florida Insurance Market

The Florida insurance market has undergone significant changes over the years. In the early 20th century, the market was dominated by a few large insurers. However, the growth of the state’s population and economy led to the emergence of a more competitive market.

The 1990s saw a period of significant growth in the Florida insurance market, driven by the state’s economic boom. However, this growth was also accompanied by an increase in insurance claims, particularly for hurricane damage. This led to a number of insurers leaving the state or reducing their coverage.

The early 2000s saw a number of hurricanes that caused billions of dollars in damage to Florida. These storms had a significant impact on the insurance market, leading to higher premiums and a decrease in the availability of coverage.

In recent years, the Florida insurance market has become more regulated. The state has enacted a number of laws and regulations designed to protect consumers and stabilize the market. However, the market remains challenging, with insurers facing a number of risks, including hurricanes, litigation, and fraud.

Types of Insurance in Florida

Florida, a state renowned for its beautiful beaches and vibrant culture, also faces unique insurance challenges due to its susceptibility to natural disasters like hurricanes and severe weather events. Understanding the different types of insurance available in Florida is crucial for residents and businesses to mitigate risk and protect their assets.

Property Insurance

Property insurance in Florida covers losses to real estate and personal property from various perils, including hurricanes, windstorms, fire, theft, and vandalism. The state’s regulatory framework for property insurance is comprehensive, aiming to ensure affordability and stability in the market.

Key Features of Property Insurance in Florida

- Hurricane Coverage: This is a critical component of property insurance in Florida, covering damage caused by wind and rain from hurricanes.

- Flood Insurance: While not typically included in standard property insurance policies, flood insurance is available through the National Flood Insurance Program (NFIP) or private insurers.

- Deductibles: Property insurance policies in Florida often have high deductibles, especially for hurricane coverage, to manage risk and reduce premiums.

- Windstorm Coverage: Florida has a separate windstorm insurance program for coastal areas, providing coverage for wind damage not covered by standard property insurance.

- Coverage Limits: Property insurance policies have limits on the amount of coverage for specific perils, and it’s important to choose coverage levels that meet individual needs.

Regulatory Framework for Property Insurance

- Florida Office of Insurance Regulation (OIR): The OIR oversees the property insurance market, ensuring fair and competitive pricing, financial stability of insurers, and consumer protection.

- Florida Hurricane Catastrophe Fund (FHCF): This state-funded reinsurance program provides financial support to insurers in the event of major hurricane losses, helping to stabilize the market.

- Licensing Requirements: Property insurance agents and brokers must be licensed by the OIR, ensuring they have the necessary knowledge and expertise to advise clients.

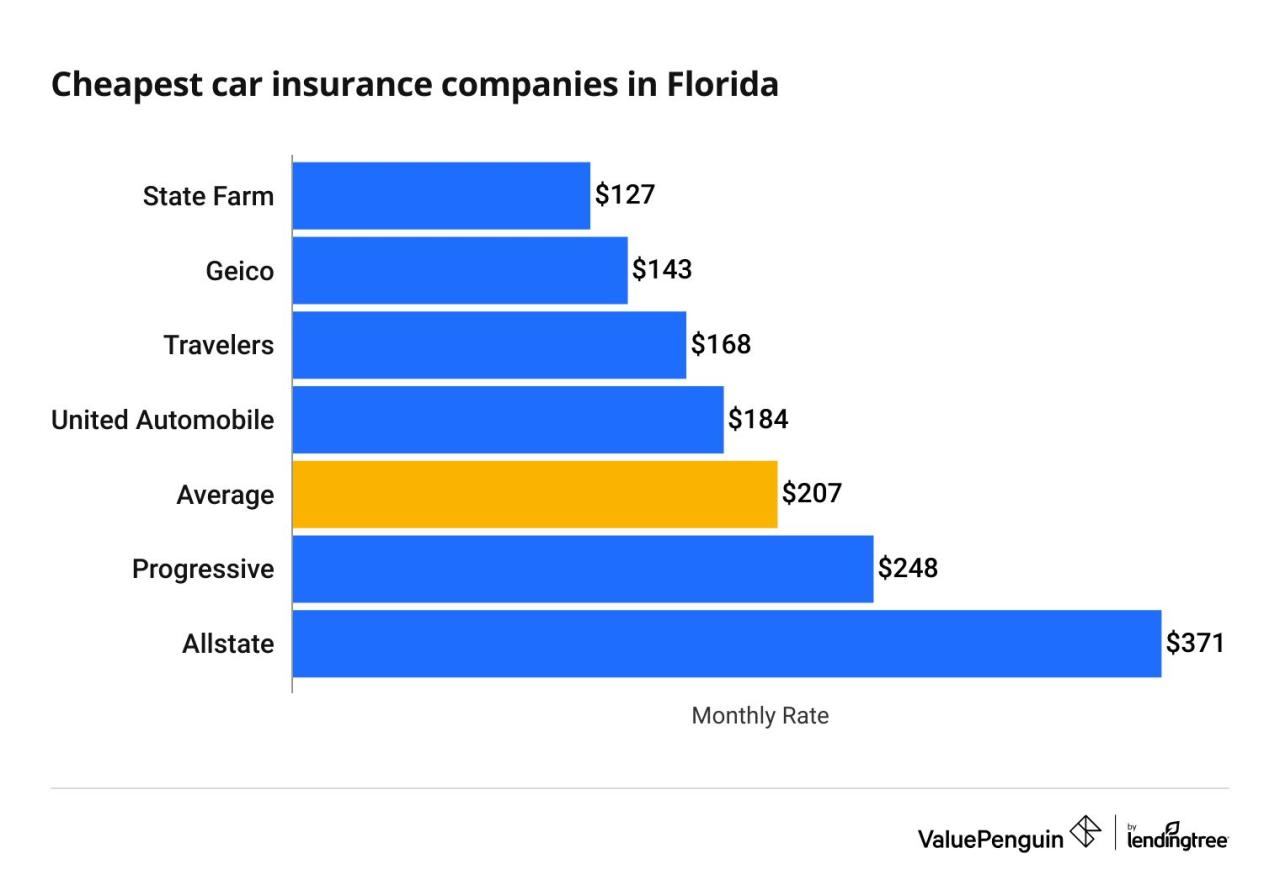

Auto Insurance

Auto insurance is mandatory in Florida, covering financial losses resulting from accidents, injuries, and property damage. The state’s regulatory framework for auto insurance aims to balance affordability with consumer protection.

Key Features of Auto Insurance in Florida

- Liability Coverage: This is the most basic type of auto insurance, covering damages to other people and their property in an accident caused by the insured.

- Personal Injury Protection (PIP): Florida requires PIP coverage, which pays for medical expenses, lost wages, and other related costs for the insured and passengers in an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects the insured if they are involved in an accident with a driver who is uninsured or has insufficient coverage.

- Collision Coverage: This coverage pays for repairs to the insured’s vehicle if it is damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects the insured against damage to their vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

Regulatory Framework for Auto Insurance

- Florida Office of Insurance Regulation (OIR): The OIR regulates auto insurance rates, ensuring they are fair and reasonable.

- Florida Department of Highway Safety and Motor Vehicles (DHSMV): The DHSMV issues driver’s licenses and vehicle registrations, enforcing mandatory auto insurance requirements.

- Licensing Requirements: Auto insurance agents and brokers must be licensed by the OIR, demonstrating their knowledge of insurance products and regulations.

Health Insurance

Health insurance is essential for individuals and families in Florida, providing financial protection against the high costs of medical care. The state’s regulatory framework for health insurance is complex, reflecting the national Affordable Care Act (ACA) and state-specific programs.

Key Features of Health Insurance in Florida

- Individual Health Insurance Marketplace: Florida participates in the federal health insurance marketplace, offering a range of plans from different insurers.

- Employer-Sponsored Health Insurance: Many employers in Florida offer health insurance plans to their employees, often with a variety of options and coverage levels.

- Medicaid: Florida’s Medicaid program provides health insurance to low-income individuals and families, as well as certain categories of individuals with disabilities.

- Medicare: This federal program provides health insurance to individuals aged 65 and older, as well as certain individuals with disabilities.

- Florida Healthy Kids Corporation: This state-run program provides health insurance to children from low-income families who are not eligible for Medicaid.

Regulatory Framework for Health Insurance

- Florida Office of Insurance Regulation (OIR): The OIR regulates health insurance rates and plans, ensuring consumer protection and affordability.

- Florida Agency for Health Care Administration (AHCA): The AHCA oversees Medicaid and other state-funded health programs, ensuring access to quality healthcare for eligible individuals.

- Licensing Requirements: Health insurance agents and brokers must be licensed by the OIR, demonstrating their knowledge of insurance products and regulations.

Business Insurance, Fl state insurance

Business insurance is crucial for protecting businesses in Florida from financial losses caused by various risks, including property damage, liability claims, and employee injuries. The state’s regulatory framework for business insurance ensures that businesses have access to adequate coverage.

Key Features of Business Insurance in Florida

- General Liability Insurance: This coverage protects businesses from claims of negligence, property damage, and personal injury caused by their operations.

- Workers’ Compensation Insurance: This coverage is mandatory in Florida for most businesses, protecting employees from financial losses due to work-related injuries or illnesses.

- Commercial Property Insurance: This coverage protects businesses from losses to their buildings, equipment, and inventory due to various perils, including hurricanes.

- Business Interruption Insurance: This coverage helps businesses recover lost income and expenses if they are forced to shut down due to a covered event, such as a hurricane.

- Cyber Liability Insurance: This coverage protects businesses from financial losses caused by data breaches, cyberattacks, and other cybersecurity incidents.

Regulatory Framework for Business Insurance

- Florida Office of Insurance Regulation (OIR): The OIR regulates business insurance rates and plans, ensuring consumer protection and affordability.

- Florida Department of Financial Services (DFS): The DFS oversees the financial stability of insurance companies and investigates insurance fraud.

- Licensing Requirements: Business insurance agents and brokers must be licensed by the OIR, demonstrating their knowledge of insurance products and regulations.

Key Players in the Florida Insurance Industry

The Florida insurance market is a dynamic and competitive landscape, with a diverse range of players vying for market share. Understanding the key players in this industry is crucial for comprehending the market dynamics and the factors influencing insurance costs and availability in the state.

Major Insurance Companies in Florida

Florida’s insurance market is characterized by the presence of both national and regional insurance companies. These companies play a significant role in providing coverage to residents and businesses in the state.

- State Farm: One of the largest insurance companies in the United States, State Farm holds a substantial market share in Florida, offering a wide range of insurance products, including auto, home, and life insurance.

- Allstate: Another major national player, Allstate is a leading provider of auto, home, and life insurance in Florida, known for its extensive network of agents and customer service.

- Progressive: Progressive has gained significant market share in Florida through its focus on online and direct-to-consumer insurance products, particularly in the auto insurance sector.

- Geico: Geico is a well-known national insurer with a strong presence in Florida, offering competitive rates and a streamlined claims process.

- USAA: While primarily serving military personnel and their families, USAA has a considerable presence in Florida, known for its financial stability and customer satisfaction.

- Florida Peninsula Insurance Company: A leading provider of property insurance in Florida, Florida Peninsula Insurance Company specializes in covering homes in hurricane-prone areas.

- Citizens Property Insurance Corporation: A state-created insurer of last resort, Citizens Property Insurance Corporation provides coverage to homeowners who are unable to find insurance in the private market, particularly in areas with high risk of hurricanes.

Market Share and Competitive Landscape

The Florida insurance market is characterized by intense competition, with major insurance companies vying for market share. The competitive landscape is shaped by factors such as pricing, product offerings, customer service, and marketing strategies.

- National Insurance Companies: National insurance companies, such as State Farm, Allstate, Progressive, and Geico, dominate the market, leveraging their brand recognition, extensive distribution networks, and marketing capabilities.

- Regional Insurance Companies: Regional insurance companies, such as Florida Peninsula Insurance Company, specialize in specific geographic areas or insurance lines, offering competitive rates and tailored products to meet local needs.

- State-Created Insurer: Citizens Property Insurance Corporation plays a crucial role in providing coverage to homeowners who are unable to find insurance in the private market, particularly in high-risk areas. It serves as a safety net, ensuring that all Florida homeowners have access to insurance.

Role of Independent Insurance Agents and Brokers

Independent insurance agents and brokers play a crucial role in the Florida insurance market by providing personalized advice and guidance to clients. They represent multiple insurance companies, allowing them to compare rates and policies from different providers and find the best coverage for their clients’ needs.

- Personalized Advice: Independent agents and brokers have a deep understanding of the Florida insurance market and can provide personalized advice to clients, considering their individual needs and circumstances.

- Comparative Shopping: They can compare rates and policies from multiple insurance companies, ensuring that clients obtain the most competitive coverage at the best possible price.

- Claims Assistance: Independent agents and brokers can assist clients with the claims process, providing support and guidance throughout the process.

Florida Insurance Regulations and Laws

Florida’s insurance industry is governed by a complex and intricate regulatory framework designed to protect consumers and ensure the stability of the market. This framework comprises various laws, regulations, and oversight mechanisms, all aimed at maintaining a balance between consumer protection and industry competitiveness.

Key Laws and Regulations

The Florida Office of Insurance Regulation (OIR) plays a central role in administering and enforcing these laws and regulations. The OIR is responsible for licensing insurance companies, overseeing their financial solvency, and protecting consumers from unfair or deceptive practices. Some of the key laws and regulations impacting the Florida insurance industry include:

- Florida Insurance Code: This comprehensive code establishes the legal framework for insurance in Florida, covering topics such as licensing, rate regulation, consumer protection, and dispute resolution.

- Florida Residential Property and Casualty Joint Underwriting Association (JUA): The JUA is a state-mandated insurer of last resort for residential property insurance, providing coverage when private insurers are unwilling or unable to do so.

- Florida Hurricane Catastrophe Fund (FHCF): This fund provides reinsurance to private insurers, helping them to cover catastrophic losses from hurricanes and other natural disasters.

- Florida Insurance Guaranty Association (FIGA): This association provides financial protection to policyholders in the event of an insurer’s insolvency.

- Florida Consumer Protection Laws: These laws protect consumers from unfair or deceptive insurance practices, including fraud, misrepresentation, and unfair claims handling.

Role of the Florida Office of Insurance Regulation (OIR)

The OIR is responsible for overseeing the Florida insurance market and ensuring its stability and consumer protection. Its key functions include:

- Licensing and Regulation of Insurance Companies: The OIR licenses and regulates insurance companies operating in Florida, ensuring they meet financial solvency requirements and comply with state laws and regulations.

- Rate Regulation: The OIR reviews and approves insurance rates, ensuring they are fair, reasonable, and non-discriminatory.

- Consumer Protection: The OIR investigates consumer complaints, mediates disputes, and enforces consumer protection laws to safeguard policyholders’ rights.

- Market Monitoring and Analysis: The OIR monitors the Florida insurance market to identify trends, potential risks, and areas for improvement.

Florida Insurance Rates and Costs: Fl State Insurance

Florida’s insurance market is complex and heavily influenced by factors such as weather, demographics, and economic conditions. These factors significantly impact insurance rates and costs, making it crucial for individuals and businesses to understand the dynamics at play.

Factors Influencing Insurance Rates in Florida

Understanding the factors that influence insurance rates is essential for making informed decisions about insurance coverage. Here are some of the key factors:

- Hurricane Risk: Florida is highly vulnerable to hurricanes, making hurricane insurance a significant expense. Rates are determined based on factors such as the property’s location, construction type, and proximity to the coast. For example, properties in coastal areas with high hurricane risk will typically have higher insurance rates than properties located inland.

- Property Value: The value of a property directly impacts insurance rates. Higher property values typically translate to higher premiums as the potential cost of damage is greater.

- Claims History: Insurance companies consider the claims history of a property and its owner when determining rates. Frequent claims can lead to higher premiums, while a clean claims history can result in lower rates.

- Property Features: Features like roof age, security systems, and fire sprinklers can influence insurance rates. For instance, newer roofs and safety features may qualify for discounts, while older roofs or lack of safety measures may result in higher premiums.

- Demographics: Factors like age, gender, and credit score can also influence insurance rates. For example, younger drivers may face higher auto insurance premiums due to their higher risk profile.

- Competition in the Market: The level of competition among insurance companies in a particular area can also affect rates. Areas with more insurers often see lower premiums due to increased competition.

Trends in Insurance Premiums and Cost of Coverage

Over time, insurance premiums and the cost of coverage in Florida have exhibited significant trends. Here’s a breakdown:

- Rising Premiums: Florida has seen a steady increase in insurance premiums over the past few years. This rise is primarily attributed to factors like increased hurricane risk, rising reinsurance costs, and litigation costs. For instance, in 2022, Florida homeowners saw an average premium increase of 15%, highlighting the escalating costs.

- Limited Coverage: In response to rising costs, some insurance companies have limited coverage options or imposed stricter underwriting guidelines. This means that homeowners may find it harder to obtain coverage or face higher deductibles, potentially increasing out-of-pocket expenses.

- Increased Government Intervention: The Florida legislature has taken steps to address the rising insurance costs, including creating the Florida Hurricane Catastrophe Fund (FHCF) to provide reinsurance for private insurers. However, the effectiveness of these interventions remains a subject of debate.

Comparison of Insurance Rates Across Regions and Demographics

Insurance rates vary significantly across different regions and demographics in Florida.

- Coastal vs. Inland Areas: Properties located in coastal areas with high hurricane risk typically face significantly higher insurance rates than properties located inland. For example, homeowners in Miami-Dade County may pay substantially more for hurricane coverage compared to homeowners in central Florida.

- Urban vs. Rural Areas: Insurance rates can also vary based on the density and characteristics of the area. Urban areas with higher population density and increased property values may have higher premiums compared to rural areas.

- Age and Driving History: Auto insurance rates are heavily influenced by age and driving history. Young drivers with limited driving experience may face higher premiums than older drivers with a clean driving record.

- Credit Score: In some cases, credit score can also be a factor in determining insurance rates. Individuals with lower credit scores may face higher premiums as they are perceived as higher risk.

Florida Insurance Claims and Disputes

Navigating the process of filing and resolving insurance claims in Florida can be complex. Understanding the procedures and potential challenges is crucial for policyholders. This section delves into the intricacies of insurance claims in Florida, encompassing the filing process, common disputes, and the role of the Florida Department of Financial Services (DFS).

The Process of Filing and Resolving Insurance Claims

Filing an insurance claim in Florida generally involves the following steps:

- Notify Your Insurer: Immediately contact your insurance company to report the claim, providing details about the incident and any damages incurred.

- File a Claim: Your insurer will provide you with a claim form to complete, outlining the details of the incident, the extent of damages, and any supporting documentation.

- Investigation: The insurance company will investigate the claim, examining the incident, reviewing documentation, and potentially conducting inspections.

- Negotiation and Settlement: Once the investigation is complete, the insurer will assess the claim and offer a settlement amount. You have the right to negotiate the settlement if you believe it is inadequate.

- Payment or Denial: If the claim is approved, the insurance company will issue payment for the damages. If the claim is denied, you will receive a written explanation outlining the reasons for denial.

Common Types of Insurance Claims and Disputes

Florida insurance claims and disputes can arise from various situations, including:

- Property Damage: Claims related to property damage are common in Florida, especially due to hurricane risks, floods, and other natural disasters. Disputes may arise over the scope of coverage, the amount of damages, or the insurer’s assessment of the cause of the damage.

- Personal Injury: Claims involving personal injury can be complex, particularly in cases of car accidents, slip and falls, or medical malpractice. Disputes often focus on the extent of injuries, the cause of the injury, and the appropriate level of compensation.

- Business Interruption: Businesses impacted by disasters or other unforeseen events may file claims for business interruption insurance, covering lost income and expenses. Disputes can arise over the duration of the interruption, the calculation of lost income, and the scope of covered expenses.

The Role of the Florida Department of Financial Services (DFS)

The Florida Department of Financial Services (DFS) plays a crucial role in resolving insurance disputes. Its responsibilities include:

- Consumer Protection: The DFS works to protect consumers from unfair or deceptive insurance practices.

- Dispute Resolution: The DFS offers a mediation program to help policyholders and insurers resolve disputes amicably.

- Enforcement: The DFS has the authority to investigate and take action against insurance companies that violate state laws or regulations.

Consumer Issues and Concerns in Florida Insurance

Florida’s insurance market is unique and faces several challenges, leading to various consumer issues and concerns. Understanding these concerns is crucial for both consumers and insurers to ensure a fair and transparent market.

Impact of Insurance Fraud and Scams on Consumers

Insurance fraud and scams are a significant problem in Florida, impacting consumers in various ways. These fraudulent activities can lead to increased premiums, denial of legitimate claims, and even financial ruin for unsuspecting individuals.

- Increased Premiums: When insurance companies experience high levels of fraud, they often pass the costs onto policyholders through increased premiums. This can make insurance unaffordable for some consumers, particularly those who are already struggling financially.

- Denial of Legitimate Claims: Insurance companies may be more likely to deny legitimate claims if they suspect fraud is involved. This can leave consumers with significant financial losses and create a sense of distrust in the insurance system.

- Financial Ruin: In extreme cases, insurance fraud can lead to financial ruin for consumers. This can happen if a fraudulent claim is filed against a consumer’s policy, or if they are the victim of a scam that results in the theft of their personal information.

Tips and Resources for Consumers to Protect Their Rights and Interests in the Insurance Market

Consumers in Florida have several resources and strategies to protect their rights and interests in the insurance market. By understanding these resources and following these tips, consumers can navigate the complexities of the insurance market and ensure their needs are met.

- Research and Compare Insurance Companies: Before purchasing insurance, consumers should thoroughly research and compare different insurance companies. This includes reviewing their financial stability, customer service ratings, and claim-handling processes. Reputable online resources and independent consumer organizations can provide valuable information for this comparison.

- Understand Your Policy: Carefully read and understand your insurance policy before signing it. This includes understanding the coverage limits, deductibles, and exclusions. If you have any questions, do not hesitate to ask your insurance agent for clarification.

- Report Suspicious Activity: If you suspect insurance fraud or a scam, report it to the appropriate authorities. This includes the Florida Department of Financial Services (DFS), the National Insurance Crime Bureau (NICB), and your local law enforcement agency. Early detection and reporting are crucial to preventing further damage and protecting others.

- Contact the Florida Department of Financial Services (DFS): The DFS is the primary regulatory agency for the insurance industry in Florida. Consumers can contact the DFS for assistance with insurance-related issues, including complaints, fraud reporting, and consumer education. The DFS website provides valuable information and resources for consumers, including a searchable database of licensed insurance agents and companies.

Future Trends and Challenges in Florida Insurance

The Florida insurance industry faces a complex landscape, marked by significant challenges and evolving trends that will shape its future. The confluence of climate change, technological advancements, and evolving consumer demands presents both opportunities and obstacles for insurers.

Impact of Climate Change and Natural Disasters

The frequency and severity of natural disasters, particularly hurricanes, pose a significant threat to Florida’s insurance industry. Rising sea levels, increased storm intensity, and coastal erosion contribute to escalating insurance risks. The impact of these events can be devastating, leading to substantial claims payouts, potential financial instability for insurers, and even market disruptions.

“Florida is the most hurricane-prone state in the U.S., with an average of one hurricane making landfall every two years.” – National Oceanic and Atmospheric Administration (NOAA)

- Increased Reinsurance Costs: As the risk of catastrophic events rises, reinsurance companies, which provide backup coverage to primary insurers, are demanding higher premiums, making it more expensive for Florida insurers to secure reinsurance. This cost burden can be passed on to policyholders in the form of higher premiums.

- Insurer Insolvency: The potential for significant losses from natural disasters can strain the financial stability of insurers. In extreme cases, insurers may face insolvency, leaving policyholders without coverage and creating further instability in the market.

- Limited Availability of Coverage: Some insurers may become reluctant to offer coverage in high-risk areas, leading to a limited availability of insurance options for homeowners and businesses. This can create a “coverage gap” and make it difficult for people to obtain the insurance they need.

Closure

From understanding the diverse insurance offerings to navigating the regulatory landscape, this exploration of FL State Insurance provides valuable insights for both individuals and businesses operating within this dynamic market. By staying informed about the key trends, challenges, and consumer rights, participants can make informed decisions and navigate the complexities of this essential industry.

Questions Often Asked

What are the most common types of insurance in Florida?

Florida residents typically seek insurance for property, auto, health, and life. However, specific needs may vary based on individual circumstances.

How do I find a reputable insurance agent or broker in Florida?

Seek recommendations from trusted sources, check online reviews, and ensure the agent or broker is licensed and reputable.

What are the common insurance claims and disputes in Florida?

Hurricane damage, property theft, and auto accidents are common claims, while disputes often arise over coverage limitations and claim valuations.