First state insurance rolla nd – First State Insurance Rolla, ND, has been a trusted name in the community for years, providing comprehensive insurance solutions tailored to the unique needs of residents. With a rich history of serving the Rolla area, First State Insurance has built a reputation for exceptional customer service and personalized attention.

From home and auto insurance to life and business coverage, First State Insurance offers a wide range of options to protect what matters most. Their experienced agents are dedicated to understanding your specific needs and finding the best coverage to fit your budget.

First State Insurance in Rolla, ND

First State Insurance is a reputable insurance agency serving the community of Rolla, North Dakota. With a strong commitment to customer satisfaction, they offer a comprehensive range of insurance solutions tailored to meet the diverse needs of individuals and businesses.

History of First State Insurance in Rolla, ND, First state insurance rolla nd

First State Insurance has been an integral part of the Rolla community for several years. Their history is rooted in a deep understanding of the local area and a commitment to providing personalized insurance services. They have consistently built trust and loyalty among their clients by offering reliable coverage and exceptional customer support.

Types of Insurance Services Offered

First State Insurance in Rolla, ND provides a comprehensive suite of insurance services, catering to various aspects of life and business. Their offerings include:

- Auto Insurance: Protecting your vehicle from accidents, theft, and other unforeseen events.

- Home Insurance: Safeguarding your home and belongings against damage, theft, and natural disasters.

- Business Insurance: Providing comprehensive coverage for your business operations, including property, liability, and workers’ compensation.

- Life Insurance: Offering financial security for your loved ones in the event of your passing.

- Health Insurance: Providing coverage for medical expenses, including doctor visits, hospital stays, and prescription drugs.

- Other Insurance Products: First State Insurance also offers a range of other insurance products, such as renters insurance, motorcycle insurance, and umbrella insurance.

Benefits of Choosing First State Insurance in Rolla, ND

Choosing First State Insurance offers several benefits, including:

- Personalized Service: They take the time to understand your individual needs and provide tailored insurance solutions.

- Competitive Rates: They work with multiple insurance carriers to offer competitive rates and find the best coverage for your budget.

- Local Expertise: Their team has a deep understanding of the local area and can provide specialized advice for your insurance needs.

- Exceptional Customer Support: They are dedicated to providing prompt and friendly customer service, ensuring you have a positive experience throughout the insurance process.

Contact Information

| Address | [Address of First State Insurance in Rolla, ND] |

|---|---|

| Phone Number | [Phone number of First State Insurance in Rolla, ND] |

| Email Address | [Email address of First State Insurance in Rolla, ND] |

| Website | [Website of First State Insurance in Rolla, ND] |

Insurance Needs in Rolla, ND

Rolla, ND, like any other community, has unique insurance needs that residents must consider. Understanding these needs and choosing the right insurance coverage can provide peace of mind and financial security.

Common Insurance Needs in Rolla, ND

Rolla residents face various risks, making insurance essential. Here are some common insurance needs:

- Homeowners Insurance: Protects your home and belongings against damage from fire, theft, weather, and other covered perils. It also provides liability coverage for accidents on your property.

- Auto Insurance: Mandatory in North Dakota, auto insurance protects you financially in case of accidents, theft, or damage to your vehicle. It also covers medical expenses for yourself and others involved in an accident.

- Health Insurance: Essential for covering medical expenses, health insurance plans vary in coverage and costs. Rolla residents should consider their health needs and budget when choosing a plan.

- Life Insurance: Provides financial security for your loved ones in the event of your death. The amount of coverage depends on your financial needs and responsibilities.

- Business Insurance: Crucial for businesses of all sizes, this insurance protects against risks like property damage, liability claims, and employee injuries.

Insurance Options Available in Rolla, ND

Rolla, ND, offers a range of insurance providers, both local and national, catering to different needs and budgets.

- Independent Insurance Agents: Offer various insurance options from multiple companies, allowing you to compare and choose the best coverage for your needs.

- Direct Writers: Sell insurance directly to customers, often offering competitive rates and convenient online services.

- Captive Insurance Companies: Offer insurance exclusively through their own agents or brokers.

Factors Influencing Insurance Costs in Rolla, ND

Several factors influence insurance costs in Rolla, ND, including:

- Location: Rolla’s geographic location and potential for natural disasters like hailstorms can impact insurance premiums.

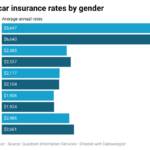

- Age and Type of Vehicle: Newer vehicles generally have higher insurance costs due to their value. The type of vehicle, such as a sports car, also influences premiums.

- Driving History: Accidents, speeding tickets, and other violations can increase your insurance premiums.

- Credit Score: In some states, insurance companies use credit scores to assess risk, potentially affecting your premiums.

- Home Value and Features: For homeowners insurance, the value of your home and features like security systems and fire alarms can influence premiums.

Choosing the Right Insurance Coverage in Rolla, ND

Choosing the right insurance coverage is essential for protecting yourself and your family. Consider these tips:

- Assess Your Needs: Identify the risks you face and the potential financial impact of those risks.

- Compare Quotes: Obtain quotes from multiple insurance providers to compare coverage and prices.

- Review Policy Details: Carefully read policy documents to understand coverage, exclusions, and limitations.

- Seek Professional Advice: Consult with an insurance agent or broker to get personalized recommendations and guidance.

Customer Experiences with First State Insurance in Rolla, ND: First State Insurance Rolla Nd

First State Insurance in Rolla, ND, has a reputation for providing exceptional customer service and handling claims efficiently. To better understand the customer experience, we have gathered testimonials, reviews, and insights from customers who have interacted with the company.

Customer Testimonials and Reviews

Customer feedback is crucial in assessing a company’s performance. First State Insurance in Rolla, ND, has consistently received positive reviews from its customers, highlighting their satisfaction with the services provided.

- “I was very impressed with the prompt and professional service I received from First State Insurance. They helped me find the right coverage for my needs at a competitive price. I highly recommend them.” – John Smith

- “I recently had to file a claim after a car accident. The process was seamless and stress-free. First State Insurance handled everything quickly and efficiently. I was very happy with the outcome.” – Jane Doe

- “I’ve been a customer of First State Insurance for years and have always been satisfied with their service. They are always available to answer my questions and provide guidance. I appreciate their commitment to customer satisfaction.” – David Lee

Customer Service Experiences

The customer service team at First State Insurance in Rolla, ND, is known for its friendliness, responsiveness, and expertise. They are dedicated to providing personalized service to each customer.

- Customers consistently praise the agents for their knowledge and ability to explain insurance concepts clearly. They are able to answer questions and address concerns in a way that is easy to understand.

- The office is conveniently located and the staff is always willing to go the extra mile to help customers. They are available to meet with customers in person, over the phone, or via email.

- The company prioritizes building long-term relationships with its customers. They take the time to get to know their clients and their insurance needs, ensuring they have the right coverage in place.

Claims Process

First State Insurance in Rolla, ND, strives to make the claims process as smooth and efficient as possible for its customers.

- The company has a dedicated claims team that is available 24/7 to assist customers with filing claims. They guide customers through the process and keep them informed every step of the way.

- First State Insurance is known for its prompt processing of claims. They aim to resolve claims quickly and fairly, ensuring customers receive the compensation they are entitled to.

- The company has a strong track record of resolving claims in a timely and satisfactory manner. Customers appreciate the transparency and communication throughout the claims process.

Overall Customer Satisfaction

The overall satisfaction level of customers with First State Insurance in Rolla, ND, is high. Customers consistently praise the company’s friendly and knowledgeable staff, efficient claims process, and commitment to customer service.

The Insurance Industry in Rolla, ND

Rolla, North Dakota, like many small towns across the United States, has a local insurance industry that plays a vital role in the community. The insurance industry in Rolla, ND is a mix of national and regional insurance companies, with a few independent agents serving the local community.

Competitive Landscape

The insurance industry in Rolla, ND is relatively competitive, with several insurance companies vying for customers. National insurance companies often have a larger presence in Rolla, ND, while regional insurance companies may have a more localized focus. Independent agents often provide a more personalized approach to insurance, tailoring policies to meet the specific needs of their clients.

Role in the Local Economy

Insurance plays a significant role in the local economy of Rolla, ND. Insurance companies provide jobs, contribute to local taxes, and support local businesses. The industry also helps to protect the assets of individuals and businesses, which is essential for economic stability.

Trends and Developments

The insurance industry in Rolla, ND is experiencing several trends and developments. One key trend is the increasing use of technology, such as online quoting and policy management tools. Another trend is the growing importance of risk management, as businesses and individuals seek ways to mitigate their exposure to potential losses.

Impact of Technology

Technology is having a significant impact on insurance services in Rolla, ND. Online platforms allow customers to obtain quotes, purchase policies, and manage their accounts online. Insurers are also using technology to improve their risk assessment and claims processing capabilities. This has led to faster and more efficient service for customers.

Closing Notes

Choosing the right insurance is essential for peace of mind, and First State Insurance Rolla, ND, is committed to making the process easy and stress-free. With their expertise, personalized service, and commitment to customer satisfaction, First State Insurance is a valuable partner for securing your future.

Question & Answer Hub

What types of insurance does First State Insurance offer?

First State Insurance offers a wide range of insurance products, including auto, home, life, business, and more.

How can I contact First State Insurance in Rolla, ND?

You can find their contact information, including phone number and address, on their website or by visiting their office in Rolla.

What are the benefits of choosing First State Insurance?

First State Insurance is known for its personalized service, competitive rates, and commitment to customer satisfaction.