Find State Farm Insurance and discover a trusted name in the insurance industry. State Farm has been providing reliable coverage for over 100 years, offering a wide range of insurance products to protect your assets and your future. Whether you’re looking for auto, home, life, or health insurance, State Farm has a solution tailored to your needs. Their commitment to customer satisfaction and comprehensive coverage has made them a leading provider in the market.

Navigating the world of insurance can be overwhelming, but finding State Farm insurance is easier than you might think. With a user-friendly website and a network of agents across the country, you can easily get the information and support you need. State Farm makes it simple to compare quotes, understand your coverage options, and make informed decisions about your insurance.

Understanding State Farm Insurance

State Farm Insurance is one of the largest and most well-known insurance providers in the United States. It has a long history of serving customers and a reputation for reliability and customer satisfaction. This article will delve into the history, services, and reputation of State Farm Insurance.

History and Background

State Farm was founded in 1922 by George J. Mecherle in Bloomington, Illinois. Mecherle’s vision was to provide affordable and accessible insurance to the average American. The company initially focused on auto insurance but has since expanded to offer a wide range of insurance products and financial services. State Farm’s commitment to its customers and its strong financial position have helped it become one of the most trusted insurance companies in the country.

Services and Coverage Options

State Farm offers a comprehensive range of insurance products, including:

- Auto Insurance: State Farm’s auto insurance provides coverage for damage to your vehicle, injuries to others, and medical expenses. It also offers optional coverage, such as collision, comprehensive, and uninsured/underinsured motorist coverage.

- Home Insurance: State Farm’s home insurance protects your dwelling and personal property from damage caused by fire, theft, vandalism, and other perils. It also offers optional coverage, such as earthquake, flood, and liability coverage.

- Life Insurance: State Farm offers a variety of life insurance products, including term life, whole life, and universal life insurance. These policies can provide financial protection for your loved ones in the event of your death.

- Renters Insurance: State Farm’s renters insurance protects your personal belongings from damage or loss due to covered perils. It also provides liability coverage in case someone is injured on your property.

- Business Insurance: State Farm offers a variety of business insurance products, including property, liability, workers’ compensation, and commercial auto insurance. These policies can help protect your business from financial losses due to unexpected events.

Reputation and Customer Satisfaction

State Farm has consistently received high ratings for customer satisfaction and financial strength. The company has been recognized by J.D. Power for its excellent customer service and has received an A++ rating from A.M. Best, a leading credit rating agency for insurance companies. State Farm is also known for its strong financial position, which provides its customers with confidence that their claims will be paid promptly and fairly.

“State Farm is a highly reputable insurance company with a long history of serving customers. Its commitment to customer satisfaction and its strong financial position have earned it a high level of trust among consumers.”

Finding State Farm Insurance

Finding the right State Farm insurance agent can be the first step in securing the coverage you need. State Farm has a vast network of agents across the United States, making it convenient to connect with one near you.

Finding a State Farm Agent

State Farm provides various ways to find an agent who can help you with your insurance needs. These methods offer different levels of detail and allow you to choose the option that best suits your preferences.

- Using the State Farm Website: The State Farm website is a comprehensive resource for finding agents. You can use the website’s agent locator tool to search for agents by zip code, city, or state. The tool provides a list of agents in your area, along with their contact information and office hours. You can also filter your search by language preference, specialty, and other criteria.

- Using the State Farm Mobile App: The State Farm mobile app is another convenient way to find an agent. The app’s agent locator tool functions similarly to the website’s tool, allowing you to search for agents by location and filter your results. You can also use the app to contact agents directly or schedule appointments.

- Asking for Referrals: If you know someone who has a State Farm insurance policy, you can ask them for a referral. This can be a great way to find an agent who has a good reputation and understands your specific needs.

- Checking Online Directories: Several online directories list State Farm agents, such as Yelp, Google Maps, and Yellow Pages. These directories often include customer reviews and ratings, which can help you choose an agent who has a good track record.

Using the State Farm Website to Find an Agent

The State Farm website offers a user-friendly experience for finding an agent. Here’s a step-by-step guide:

- Visit the State Farm Website: Go to the State Farm website at www.statefarm.com.

- Navigate to the Agent Locator: Click on the “Find an Agent” or “Agent Locator” link, usually found in the navigation menu or footer.

- Enter Your Location: Enter your zip code, city, or state in the search bar provided. You can also refine your search by entering a specific address.

- Filter Your Results: Use the available filters to narrow down your search results. You can filter by language preference, specialty (e.g., auto, home, life insurance), and other criteria.

- Review Agent Profiles: Click on an agent’s profile to view their contact information, office hours, and other details. You can also read customer reviews and ratings.

- Contact an Agent: Once you’ve found an agent who meets your needs, you can contact them by phone, email, or through the website’s messaging feature.

Resources for Finding State Farm Agent Contact Information

Here are some additional resources where you can find State Farm agent contact information:

- State Farm Agent Directory: State Farm maintains an online directory of agents, which you can access through their website. The directory allows you to search for agents by location, specialty, and other criteria.

- State Farm Mobile App: The State Farm mobile app includes an agent locator tool that provides contact information for agents in your area.

- Yellow Pages: Yellow Pages is a traditional directory that lists businesses, including insurance agencies. You can search for State Farm agents by location and specialty.

- Google Maps: Google Maps is a popular online mapping service that also lists businesses. You can search for State Farm agents by location and view their contact information, customer reviews, and business hours.

Types of State Farm Insurance

State Farm offers a comprehensive range of insurance products designed to protect individuals and families against various risks. From auto and home insurance to life and health coverage, State Farm provides tailored solutions to meet diverse needs.

Types of State Farm Insurance, Find state farm insurance

Here’s a breakdown of the key insurance products offered by State Farm:

| Insurance Type | Key Features | Benefits |

|---|---|---|

| Auto Insurance |

|

|

| Home Insurance |

|

|

| Life Insurance |

|

|

| Health Insurance |

|

|

| Renters Insurance |

|

|

| Business Insurance |

|

|

Additional Insurance Products

State Farm also offers a range of other insurance products, including:

- Motorcycle Insurance: Protects your motorcycle and provides liability coverage in case of an accident.

- Boat Insurance: Covers your boat, its equipment, and liability in case of accidents or damage.

- RV Insurance: Provides comprehensive coverage for your recreational vehicle, including liability, collision, and comprehensive coverage.

- Umbrella Insurance: Provides additional liability coverage beyond your existing policies, offering extra protection in case of a significant lawsuit.

- Pet Insurance: Covers veterinary expenses for your pet in case of illness or injury.

State Farm Insurance Quotes

Getting a quote for State Farm insurance is a straightforward process that can be completed online, over the phone, or in person at a local State Farm agent’s office. This process allows you to understand the potential cost of coverage and make informed decisions about your insurance needs.

Obtaining a State Farm Insurance Quote

To get a State Farm insurance quote, you’ll typically need to provide some basic information about yourself and your vehicle(s) or property. This may include:

- Your name, address, and date of birth

- Your driving history, including any accidents or violations

- The make, model, and year of your vehicle(s)

- Your desired coverage levels and deductibles

- Information about your home, including its location, size, and age

Once you provide this information, State Farm will use it to calculate your potential insurance premiums. The quote will Artikel the various coverage options available, their costs, and the total estimated premium.

Tips for Getting the Most Accurate and Competitive Quote

Here are some tips to ensure you receive the most accurate and competitive quote from State Farm:

- Be honest and accurate with your information: Providing false or misleading information can lead to inaccurate quotes and potential problems later on.

- Compare quotes from multiple insurers: Getting quotes from different insurance companies allows you to compare prices and coverage options to find the best deal.

- Shop around at different times of the year: Insurance rates can fluctuate based on factors like the time of year, so it’s a good idea to compare quotes periodically.

- Consider bundling your policies: Combining multiple insurance policies, such as auto and home insurance, with the same company can often result in discounts.

- Explore discounts: State Farm offers a variety of discounts, such as good driver discounts, multi-car discounts, and safety feature discounts. Ask your agent about these options to potentially lower your premiums.

Comparing Quotes from Different Insurance Providers

When comparing quotes from different insurance providers, it’s essential to focus on the following factors:

- Coverage levels: Ensure the coverage levels offered by each insurer meet your specific needs.

- Premiums: Compare the total cost of the policy, including any deductibles or fees.

- Customer service: Research the insurer’s reputation for customer service and claims handling.

- Financial stability: Consider the insurer’s financial strength and ability to pay claims.

Remember, the cheapest quote isn’t always the best option. It’s crucial to choose a policy that provides adequate coverage at a price you can afford.

Benefits of Choosing State Farm

State Farm is one of the largest and most well-respected insurance companies in the United States. With a reputation for reliability, excellent customer service, and a wide range of insurance products, State Farm has earned the trust of millions of customers. This section explores the advantages of choosing State Farm insurance, highlighting the key factors that contribute to their strong customer loyalty and comparing them with other leading insurance companies.

Customer Loyalty and Satisfaction

State Farm consistently ranks high in customer satisfaction surveys, indicating a strong commitment to customer service. The company has been recognized for its commitment to customer satisfaction, consistently ranking among the top insurance providers in customer surveys. This loyalty stems from several key factors:

- Personalized Service: State Farm emphasizes personalized service, with agents who are knowledgeable and responsive to individual customer needs. Agents are trained to provide tailored solutions, ensuring that each policy meets the specific requirements of the policyholder.

- Claims Handling: State Farm has a reputation for efficient and hassle-free claims handling. The company employs a streamlined process to ensure that claims are processed promptly and fairly. Their dedication to resolving claims efficiently and effectively has been a significant contributor to their customer satisfaction.

- Financial Stability: State Farm is a financially stable company with a strong track record of paying claims. Their financial strength provides customers with peace of mind, knowing that they can rely on State Farm to fulfill their insurance obligations.

- Community Involvement: State Farm is known for its active involvement in communities across the country. This commitment to local communities strengthens the bond between State Farm and its customers, fostering a sense of trust and goodwill.

Comparison with Other Leading Insurance Companies

While State Farm is a leading insurance company, it’s essential to compare its offerings with other top providers. Here’s a comparison with some of the leading competitors:

| Feature | State Farm | Other Leading Companies |

|---|---|---|

| Customer Service | Highly rated for personalized service and claims handling | Varying levels of customer service, with some companies emphasizing digital interactions over personal relationships |

| Product Variety | Offers a comprehensive range of insurance products, including auto, home, life, and health | Similar product offerings, with some companies specializing in specific types of insurance |

| Pricing | Competitive pricing with potential discounts for bundling policies | Prices can vary significantly depending on factors such as location, coverage, and driving history |

| Financial Stability | Financially strong with a long history of paying claims | Financial stability varies among companies, with some having stronger ratings than others |

State Farm Customer Service

State Farm is known for its commitment to providing excellent customer service. Whether you have a question about your policy, need to file a claim, or just want to make a change to your coverage, State Farm’s customer service representatives are there to help.

State Farm offers a variety of ways to contact customer service, ensuring that you can reach them through your preferred channel. You can connect with them through phone, email, online chat, or in person at a local State Farm agent’s office.

Customer Testimonials and Reviews

Customer feedback plays a crucial role in understanding a company’s customer service quality. State Farm consistently receives positive feedback from its customers, who praise the company’s responsiveness, helpfulness, and professionalism. Numerous online reviews and testimonials highlight the positive experiences customers have had with State Farm’s customer service.

- Many customers appreciate the ease of access to State Farm’s customer service representatives, with their phone lines being readily available and wait times being minimal.

- Customers often commend the representatives for their knowledge, patience, and willingness to go the extra mile to resolve issues.

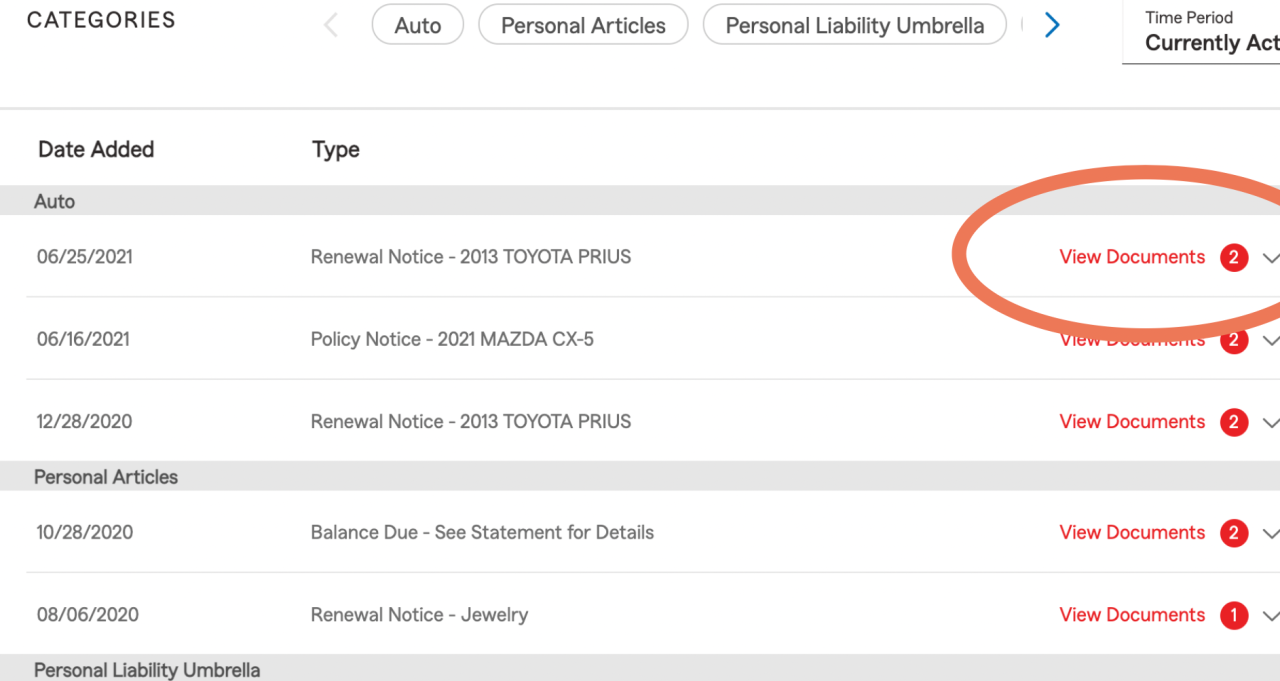

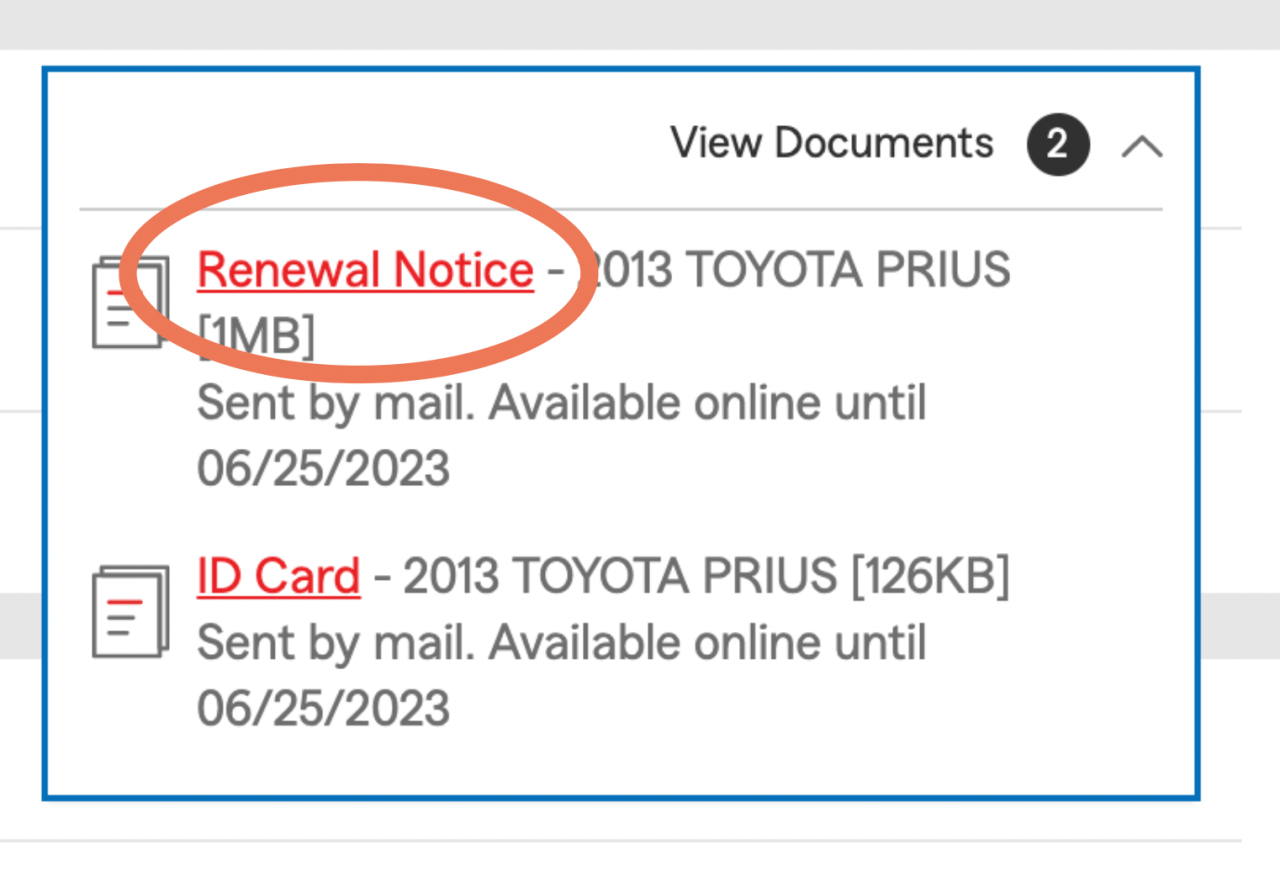

- State Farm’s online platforms, such as their website and mobile app, are also praised for their user-friendliness and ease of navigation, making it convenient for customers to manage their policies and contact customer service.

Examples of Customer Service Interactions

State Farm’s customer service representatives are trained to handle a wide range of inquiries and complaints. They are equipped with the necessary knowledge and tools to provide efficient and effective solutions to customers’ needs.

- For instance, if a customer has a question about their auto insurance policy, a representative can provide detailed information about coverage, deductibles, and other relevant aspects of their policy. They can also assist with policy changes or adjustments, ensuring that the customer’s needs are met.

- In the event of an accident, State Farm’s customer service representatives can guide customers through the claims process, providing support and assistance every step of the way. They can help customers gather necessary documentation, estimate repair costs, and navigate the complexities of filing a claim.

- For complaints or concerns, State Farm’s customer service representatives are trained to listen attentively and address issues promptly and professionally. They strive to find solutions that are fair and equitable to both the customer and the company.

Final Conclusion

Finding the right insurance is a crucial step in protecting yourself and your loved ones. State Farm Insurance offers a comprehensive range of solutions, backed by a strong reputation for reliability and customer service. From understanding your needs to providing personalized coverage options, State Farm simplifies the insurance process and provides peace of mind. Explore their website, connect with a local agent, and discover how State Farm can be your trusted partner in securing your future.

Essential FAQs: Find State Farm Insurance

How do I find a State Farm agent near me?

You can easily find a State Farm agent by using their website’s agent locator tool. Simply enter your zip code or address, and the website will display a list of agents in your area. You can also contact State Farm’s customer service line for assistance.

What types of insurance does State Farm offer?

State Farm offers a wide range of insurance products, including auto, home, life, health, renters, business, and more. You can find a detailed list of their offerings on their website.

How do I get a quote for State Farm insurance?

You can get a quote for State Farm insurance online, over the phone, or by visiting a local agent. The online quote tool is quick and easy to use. Simply provide some basic information about yourself and your vehicle or property, and the website will generate a personalized quote.

What are the benefits of choosing State Farm?

State Farm is known for its strong financial stability, excellent customer service, and wide range of coverage options. They also offer various discounts and programs to help you save money on your insurance.