Farm State Car Insurance has become a prominent name in the world of automotive protection. With a rich history and a dedication to customer satisfaction, they offer a comprehensive range of policies designed to meet diverse needs. From liability coverage to collision and comprehensive options, Farm State provides tailored solutions to ensure drivers feel secure on the road.

Their commitment to affordability and customer service has earned them a loyal following, making them a popular choice for individuals and families across the country. This guide delves into the intricacies of Farm State Car Insurance, exploring their services, pricing, customer experience, and the competitive landscape they navigate.

Farm State Car Insurance

Farm State Car Insurance is a leading provider of auto insurance in the United States, known for its commitment to customer satisfaction and competitive rates. The company has a long history of serving the needs of drivers across the country, with a focus on providing reliable coverage and exceptional customer service.

Origins and History

Farm State Car Insurance traces its roots back to the early 20th century, when it was founded as a small, regional insurance company serving farmers in the Midwest. Over the years, the company expanded its operations and broadened its customer base, eventually becoming a national provider of auto insurance. Farm State Car Insurance’s growth has been driven by its commitment to providing affordable and reliable coverage, as well as its focus on building strong relationships with its customers.

Mission and Core Values

Farm State Car Insurance is dedicated to providing its customers with the best possible insurance experience. The company’s mission is to protect its customers’ financial well-being and provide them with peace of mind on the road. Farm State Car Insurance’s core values are:

- Customer Focus: Farm State Car Insurance believes in putting its customers first and providing them with the highest level of service and support.

- Integrity: The company is committed to conducting business with honesty and transparency, building trust with its customers and partners.

- Innovation: Farm State Car Insurance is constantly seeking ways to improve its products and services, leveraging technology and innovation to enhance the customer experience.

- Community Involvement: The company is committed to giving back to the communities it serves through various philanthropic initiatives and partnerships.

Key Facts and Figures

Farm State Car Insurance is a major player in the auto insurance industry, with a significant market share and a large customer base. Some key facts and figures about the company include:

- Market Share: Farm State Car Insurance holds a significant market share in the auto insurance industry, ranking among the top providers in the United States.

- Customer Base: The company serves millions of customers nationwide, providing coverage for a wide range of vehicles and driving needs.

- Financial Strength: Farm State Car Insurance is a financially sound company with a strong track record of profitability and stability.

- Awards and Recognition: The company has received numerous awards and recognitions for its customer service, financial strength, and commitment to innovation.

Services Offered

At Farm State Car Insurance, we offer a comprehensive range of car insurance policies designed to meet your individual needs and provide you with the peace of mind you deserve. We understand that every driver has unique requirements, and our policies are tailored to provide the right coverage for your specific situation.

Car Insurance Policy Options

Our car insurance policies are designed to offer you the protection you need in various scenarios. We provide different coverage options, each with its own benefits and features. These options allow you to customize your policy to fit your budget and risk tolerance.

| Policy Type | Coverage | Benefits |

|---|---|---|

| Liability Coverage | Covers damages to other people’s property or injuries caused by you in an accident. | Protects you from financial liability in case of an accident where you are at fault. |

| Collision Coverage | Covers damages to your own vehicle in an accident, regardless of who is at fault. | Helps you repair or replace your vehicle after an accident. |

| Comprehensive Coverage | Covers damages to your vehicle from events other than accidents, such as theft, vandalism, or natural disasters. | Protects you from financial losses due to unforeseen events that damage your vehicle. |

| Uninsured/Underinsured Motorist Coverage | Covers damages to you or your vehicle if you are hit by an uninsured or underinsured driver. | Provides financial protection in situations where the other driver does not have sufficient insurance. |

| Personal Injury Protection (PIP) | Covers medical expenses, lost wages, and other related costs for you and your passengers in an accident. | Helps you recover from injuries and lost income after an accident. |

Choosing the Right Coverage, Farm state car insurance

The best car insurance policy for you depends on your individual circumstances and risk tolerance. It’s important to consider factors such as the value of your vehicle, your driving history, and your financial situation. We recommend consulting with one of our experienced insurance agents to discuss your specific needs and determine the most suitable coverage options for you.

Target Audience

Farm State Car Insurance targets a specific demographic of customers, primarily those residing in rural and agricultural areas. These individuals often share similar values, lifestyles, and insurance needs.

Farm State Car Insurance appeals to this audience by offering policies that cater to their unique circumstances. They understand the challenges of living in rural areas, such as longer commutes, limited access to services, and the need for specialized coverage for farm equipment and livestock.

Demographic Profile

Farm State Car Insurance’s target audience is primarily composed of:

- Individuals living in rural areas with a significant agricultural presence.

- Families with multiple vehicles, including trucks, SUVs, and farm equipment.

- Individuals and families with a strong sense of community and local values.

- Customers seeking affordable and reliable insurance coverage.

Why Customers Choose Farm State Car Insurance

Farm State Car Insurance stands out from competitors by offering:

- Specialized coverage for farm equipment, livestock, and other agricultural assets.

- Competitive rates and flexible payment options.

- Personalized customer service and a strong local presence.

- A commitment to community involvement and support.

Unique Needs and Preferences

Farm State Car Insurance’s target audience has specific needs and preferences, including:

- Reliable and affordable coverage: Rural residents often face higher insurance premiums due to factors such as longer commutes and limited access to services. Farm State Car Insurance provides competitive rates and flexible payment options to address these concerns.

- Specialized coverage for agricultural assets: Farm equipment, livestock, and other agricultural assets require specific insurance coverage that traditional insurers may not offer. Farm State Car Insurance provides comprehensive coverage for these assets, ensuring peace of mind for their customers.

- Local presence and personalized service: Rural residents value strong community ties and personalized service. Farm State Car Insurance has a network of local agents who understand the unique needs of their customers and provide personalized support.

- Commitment to community: Farm State Car Insurance is committed to supporting the communities it serves through sponsorships, charitable donations, and other initiatives.

Pricing and Discounts

At Farm State Car Insurance, we understand that finding affordable car insurance is important. Our pricing structure is designed to be transparent and competitive, reflecting the unique risks associated with each individual driver. We offer a variety of discounts to help you save money on your premiums.

Factors Influencing Premium Rates

The cost of your car insurance policy is determined by a number of factors. These factors are designed to accurately assess your individual risk profile and ensure that your premium reflects the likelihood of you filing a claim.

- Driving History: Your driving record, including any accidents or traffic violations, plays a significant role in determining your premium. Drivers with a clean driving history typically receive lower rates.

- Vehicle Information: The make, model, year, and safety features of your vehicle are also considered. Newer cars with advanced safety features generally have lower insurance premiums.

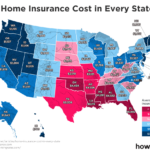

- Location: Where you live influences your insurance rates. Areas with higher crime rates or more traffic congestion tend to have higher premiums.

- Coverage Levels: The amount of coverage you choose, such as liability, collision, and comprehensive, affects your premium. Higher coverage levels typically mean higher premiums.

- Age and Gender: Statistics show that younger drivers and males tend to have higher risk profiles, which can lead to higher premiums.

- Credit History: In some states, your credit history can be used to determine your insurance rates. Individuals with good credit scores may receive lower premiums.

Discounts Offered

Farm State Car Insurance offers a variety of discounts to help you save money on your premiums. These discounts are designed to reward safe driving habits, responsible behavior, and loyalty.

- Safe Driving Discount: Drivers with a clean driving record, free of accidents and violations, may qualify for a significant discount on their premiums.

- Good Student Discount: Students who maintain a certain GPA may be eligible for a discount, recognizing their responsible behavior and academic achievements.

- Multi-Car Discount: If you insure multiple vehicles with Farm State Car Insurance, you may be eligible for a discount on your premiums. This discount reflects the reduced risk associated with insuring multiple vehicles with the same company.

- Bundling Discount: You can save even more by bundling your car insurance with other insurance products, such as homeowners or renters insurance. This discount acknowledges the convenience and loyalty of having multiple policies with Farm State Car Insurance.

- Loyalty Discount: As a valued customer, you may receive a discount for your continued loyalty to Farm State Car Insurance. This discount reflects our appreciation for your ongoing business and commitment to our company.

Customer Experience

At Farm State Car Insurance, we believe in providing our customers with a seamless and positive experience. We strive to make the process of obtaining and managing your car insurance as simple and convenient as possible. We understand that your time is valuable, and we are committed to providing you with the support you need, when you need it.

Customer Service Channels

We offer a variety of customer service channels to meet your needs. You can reach us by phone, email, or chat, and our friendly and knowledgeable representatives are available to assist you 24/7.

- Phone: Call us at 1-800-FARM-STATE to speak with a representative directly.

- Email: Contact us at customerservice@farmstatecar.com for inquiries or assistance.

- Chat: Connect with a live agent through our website’s chat feature for immediate assistance.

Customer Reviews and Testimonials

Our customers are our top priority, and we are proud of the positive feedback we receive. Here are a few examples of what our customers have to say about Farm State Car Insurance:

“I was so impressed with the level of service I received from Farm State Car Insurance. The representative I spoke with was incredibly helpful and patient, and he answered all of my questions thoroughly. I would highly recommend this company to anyone.” – John S.

“I recently had to file a claim with Farm State Car Insurance, and the process was so easy. The claims adjuster was very professional and efficient, and I was able to get my car repaired quickly. I am so grateful for the excellent service I received.” – Sarah M.

Pros and Cons of Farm State Car Insurance

To help you make an informed decision, here is a comparison of the pros and cons of using Farm State Car Insurance:

| Pros | Cons |

|---|---|

| Competitive pricing and discounts | Limited availability in certain areas |

| Excellent customer service and support | May not offer as many coverage options as some larger insurers |

| Easy-to-use online portal and mobile app | Limited online resources for policy management |

Competition

The insurance industry is fiercely competitive, with numerous players vying for market share. Farm State Car Insurance faces competition from national giants, regional insurers, and even smaller, specialized companies. Understanding the competitive landscape is crucial for Farm State Car Insurance to effectively position itself and attract customers.

Major Competitors

The major competitors of Farm State Car Insurance can be categorized into national, regional, and specialized insurance companies.

- National Insurers: These companies operate across the country and have extensive resources, brand recognition, and marketing capabilities. Examples include Geico, Progressive, State Farm, and Allstate. They offer a wide range of insurance products, including auto insurance, and often compete on price, convenience, and customer service.

- Regional Insurers: These companies focus on specific geographic areas and may have a stronger understanding of local market conditions and customer needs. Examples include Farmers Insurance, Nationwide, and USAA. They often compete on price, local expertise, and community involvement.

- Specialized Insurers: These companies cater to specific customer segments or insurance needs. Examples include companies specializing in high-risk drivers, classic car insurance, or insurance for specific occupations. They compete on specialized expertise, niche offerings, and personalized service.

Comparison of Offerings and Strengths

Each competitor has its unique strengths and offerings.

- National Insurers: They often offer competitive pricing, extensive coverage options, and convenient online and mobile platforms. Their strong brand recognition and nationwide presence make them attractive to many customers. However, they may lack the personalized touch and local expertise of regional insurers.

- Regional Insurers: They often offer competitive pricing tailored to local market conditions, strong customer service with local agents, and community involvement. However, they may have a smaller selection of coverage options compared to national insurers.

- Specialized Insurers: They offer specialized expertise and tailored insurance solutions for specific customer needs. They often have strong relationships with their niche customer segments and provide personalized service. However, their offerings may be limited to specific needs and may not be as widely available as national or regional insurers.

Competitive Landscape and Potential Threats

The competitive landscape for car insurance is constantly evolving.

- Increased Online Competition: The rise of online insurance providers, like Lemonade and Root, has increased competition by offering streamlined digital experiences, personalized pricing, and data-driven risk assessments.

- Technological Advancements: Advances in telematics, AI, and data analytics are changing the way insurance is priced and offered. Insurers are using these technologies to develop more personalized and accurate risk assessments, leading to more competitive pricing and personalized insurance products.

- Economic Fluctuations: Economic downturns can lead to increased price sensitivity among customers, forcing insurers to adjust their pricing strategies to remain competitive. Conversely, economic growth can lead to increased demand for insurance, presenting opportunities for expansion.

Future Trends: Farm State Car Insurance

The car insurance industry is constantly evolving, driven by technological advancements, changing consumer preferences, and a growing awareness of sustainability. These trends present both opportunities and challenges for Farm State Car Insurance, requiring the company to adapt and innovate to remain competitive.

Impact of Technology

The increasing adoption of technology is transforming the car insurance landscape.

- Telematics: Telematics devices and smartphone apps collect data on driving behavior, enabling insurers to offer personalized premiums based on actual driving habits. This data-driven approach allows for more accurate risk assessment and incentivizes safe driving practices.

- Artificial Intelligence (AI): AI is being used for various tasks, including fraud detection, claims processing, and customer service. AI-powered chatbots can provide instant support and answer common questions, enhancing customer experience and reducing operational costs.

- Autonomous Vehicles: The emergence of autonomous vehicles is expected to significantly impact the car insurance industry. As self-driving cars become more prevalent, traditional risk factors like driver error will become less relevant. Insurers will need to adapt their pricing models and coverage options to reflect the unique characteristics of autonomous vehicles.

Shifting Consumer Preferences

Consumers are increasingly demanding personalized experiences and seamless digital interactions.

- Digital-First Approach: Consumers prefer online platforms for purchasing insurance, managing policies, and filing claims. Farm State Car Insurance needs to invest in a user-friendly website and mobile app to meet these expectations.

- Transparency and Customization: Consumers want clear and concise information about their coverage options and pricing. Insurers need to provide personalized quotes and flexible policies that cater to individual needs.

- Value-Added Services: Consumers are looking for more than just basic insurance coverage. Value-added services such as roadside assistance, accident forgiveness, and rental car reimbursement can enhance customer satisfaction and loyalty.

Sustainability and Climate Change

The growing concern for sustainability and climate change is influencing the car insurance industry.

- Electric Vehicles (EVs): The adoption of EVs is increasing, presenting both opportunities and challenges for insurers. EVs have unique risks and maintenance requirements, necessitating specialized coverage options.

- Climate-Related Risks: Extreme weather events like floods, hurricanes, and wildfires are becoming more frequent and severe. Insurers need to assess and manage these risks effectively, adjusting premiums and coverage accordingly.

- Green Initiatives: Consumers are increasingly interested in supporting companies that prioritize sustainability. Farm State Car Insurance can differentiate itself by offering green insurance options, such as discounts for eco-friendly vehicles or promoting sustainable driving practices.

Final Summary

As you weigh your options for car insurance, consider the value proposition of Farm State Car Insurance. Their commitment to customer satisfaction, coupled with their competitive pricing and comprehensive coverage options, makes them a strong contender in the industry. Whether you’re a seasoned driver or just starting out, understanding their offerings and exploring their customer testimonials can help you make an informed decision about your automotive protection.

Query Resolution

What types of discounts does Farm State Car Insurance offer?

Farm State offers a variety of discounts, including safe driver, good student, multi-car, and bundling discounts. These discounts can significantly reduce your premium costs.

How can I contact Farm State Car Insurance customer service?

You can reach Farm State customer service by phone, email, or through their online portal. They have dedicated representatives available to assist you with any questions or concerns.

Is Farm State Car Insurance available in all states?

Farm State Car Insurance operates in a specific geographic region. It’s best to check their website or contact them directly to see if they provide coverage in your state.