Erie Insurance states of operation encompass a significant portion of the United States, offering a wide range of insurance products to individuals and businesses. Founded in 1925, Erie Insurance has grown to become a major player in the insurance industry, known for its commitment to customer service and financial stability. This article delves into the geographical reach of Erie Insurance, exploring the states where it operates and the specific insurance products available in each region.

Understanding the geographical presence of Erie Insurance is crucial for potential customers seeking insurance coverage in their specific area. This article aims to provide a comprehensive overview of Erie Insurance’s operations across the country, highlighting the factors that contribute to its geographic presence and the diverse insurance products offered in each state.

Erie Insurance

Erie Insurance is a well-established and respected insurance company with a strong reputation for providing quality coverage and exceptional customer service. Founded in 1925, Erie Insurance has grown into a major player in the insurance industry, offering a comprehensive range of insurance products and services.

History and Milestones

Erie Insurance was founded in 1925 in Erie, Pennsylvania, by a group of local businessmen. The company began as a small, regional insurer, focusing on providing auto insurance to residents of northwestern Pennsylvania. Over the years, Erie Insurance expanded its operations, gradually increasing its product offerings and geographic reach.

- In the 1950s, Erie Insurance began offering homeowners insurance, expanding its product portfolio beyond auto insurance.

- During the 1960s, the company expanded its geographic footprint, entering new states and establishing a national presence.

- In the 1970s, Erie Insurance introduced a variety of new insurance products, including commercial insurance and life insurance.

- In the 1980s, the company began to leverage technology to improve its operations and enhance customer service.

- In the 1990s and beyond, Erie Insurance continued to grow and innovate, expanding its product offerings and investing in new technologies.

Mission Statement and Core Values

Erie Insurance’s mission statement is to provide quality insurance products and services to its customers while maintaining a strong commitment to community involvement and ethical business practices. The company’s core values are:

- Customer Focus: Erie Insurance prioritizes the needs and satisfaction of its customers.

- Integrity: The company operates with honesty and transparency in all its dealings.

- Financial Strength: Erie Insurance maintains a strong financial position to ensure the long-term stability of the company.

- Community Involvement: Erie Insurance is committed to supporting the communities it serves.

- Employee Development: The company values its employees and invests in their professional growth.

Business Model and Primary Focus

Erie Insurance operates a direct-to-consumer business model, meaning that it sells its insurance products directly to customers through its network of agents. The company’s primary focus is on providing personal lines insurance, including:

- Auto Insurance

- Homeowners Insurance

- Renters Insurance

- Life Insurance

- Business Insurance

Erie Insurance is known for its competitive pricing, comprehensive coverage options, and excellent customer service. The company’s commitment to customer satisfaction has earned it a loyal following and a strong reputation in the insurance industry.

States of Operation

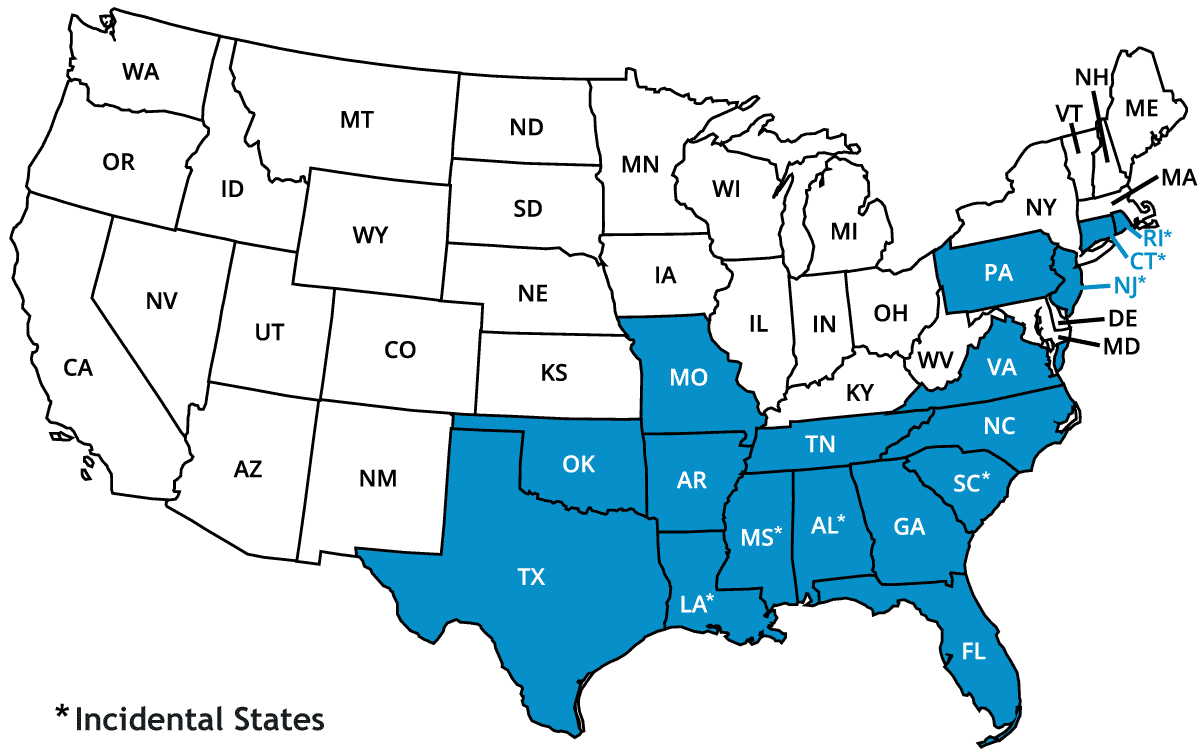

Erie Insurance, a regional insurance provider, boasts a strong presence in the Mid-Atlantic and Great Lakes regions of the United States. This geographical focus reflects the company’s strategic approach to serving specific markets effectively.

Geographic Reach and Insurance Products

Erie Insurance operates in 12 states, offering a comprehensive range of insurance products to cater to the diverse needs of its customers. The table below provides a detailed overview of the states where Erie Insurance operates and the insurance products offered in each state:

| State | Insurance Products Offered |

|---|---|

| Pennsylvania | Auto, Home, Business, Life, Health, and Umbrella Insurance |

| New York | Auto, Home, Business, Life, and Umbrella Insurance |

| Ohio | Auto, Home, Business, Life, and Umbrella Insurance |

| Maryland | Auto, Home, Business, and Umbrella Insurance |

| Virginia | Auto, Home, Business, and Umbrella Insurance |

| North Carolina | Auto, Home, Business, and Umbrella Insurance |

| West Virginia | Auto, Home, Business, and Umbrella Insurance |

| Indiana | Auto, Home, Business, and Umbrella Insurance |

| Kentucky | Auto, Home, Business, and Umbrella Insurance |

| Illinois | Auto, Home, Business, and Umbrella Insurance |

| Wisconsin | Auto, Home, Business, and Umbrella Insurance |

| Michigan | Auto, Home, Business, and Umbrella Insurance |

Factors Contributing to Erie Insurance’s Geographic Presence

Several factors contribute to Erie Insurance’s strategic focus on the Mid-Atlantic and Great Lakes regions. These include:

* Strong Regional Roots: Erie Insurance was founded in Erie, Pennsylvania, in 1925. The company has a long history of serving these regions, fostering strong relationships with local communities and building a loyal customer base.

* Concentrated Population Centers: The Mid-Atlantic and Great Lakes regions are home to significant population centers, providing a large pool of potential customers for Erie Insurance. This concentration of people translates to a larger customer base and increased revenue potential.

* Competitive Landscape: Erie Insurance has found success in these regions due to its ability to compete effectively with other insurance providers. The company has a strong reputation for providing quality products and services at competitive prices.

* Economic Stability: The Mid-Atlantic and Great Lakes regions have historically enjoyed relatively stable economies, creating a favorable environment for insurance businesses. Erie Insurance has benefited from this stability, enabling it to grow and expand its operations.

* Favorable Regulatory Environment: The regulatory environments in these regions have been generally supportive of insurance businesses. This has allowed Erie Insurance to operate efficiently and effectively, contributing to its overall success.

Insurance Products and Services: Erie Insurance States Of Operation

Erie Insurance is a well-established insurance company that offers a comprehensive range of products to meet the diverse needs of its customers. The company’s product portfolio includes various types of insurance, catering to individuals, families, and businesses.

Personal Insurance

Erie Insurance offers a wide array of personal insurance products designed to protect individuals and their families from financial hardship in the event of unforeseen circumstances. These products include:

- Auto Insurance: Erie’s auto insurance provides coverage for liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection. It also offers various optional coverages, such as rental reimbursement, roadside assistance, and accident forgiveness.

- Homeowners Insurance: Erie’s homeowners insurance protects your home and belongings from damage caused by fire, theft, vandalism, and other covered perils. It also provides liability coverage for injuries that occur on your property.

- Renters Insurance: For renters, Erie offers coverage for personal property, liability, and additional living expenses in case of a covered loss. It provides protection against theft, fire, and other perils that could damage your belongings.

- Life Insurance: Erie provides various life insurance options, including term life, whole life, and universal life insurance. These policies help ensure your loved ones are financially secure in the event of your passing.

- Health Insurance: Erie offers individual and family health insurance plans that provide coverage for medical expenses, including hospitalization, surgery, and prescription drugs. The plans vary in coverage levels and premiums to meet different needs and budgets.

- Disability Insurance: Erie’s disability insurance provides financial protection in case you become unable to work due to an illness or injury. It replaces a portion of your lost income, helping you maintain your financial stability during a challenging time.

Commercial Insurance, Erie insurance states of operation

Erie Insurance caters to businesses of all sizes with a comprehensive suite of commercial insurance products designed to protect their assets and operations. These products include:

- Business Owners Policy (BOP): Erie’s BOP combines property and liability coverage into a single policy, simplifying insurance management for small businesses. It protects against various risks, including fire, theft, vandalism, and liability claims.

- Commercial Auto Insurance: Erie offers various commercial auto insurance options, including coverage for trucks, vans, and other vehicles used for business purposes. It provides liability, collision, comprehensive, and other essential coverages.

- Workers’ Compensation Insurance: Erie’s workers’ compensation insurance provides coverage for medical expenses, lost wages, and other benefits for employees who suffer work-related injuries or illnesses.

- General Liability Insurance: Erie’s general liability insurance protects businesses from financial losses arising from third-party claims due to property damage or bodily injury. It also covers legal defense costs.

- Professional Liability Insurance: Erie’s professional liability insurance, also known as errors and omissions (E&O) insurance, protects professionals from claims related to negligent acts or omissions in their work. This is essential for industries like healthcare, law, and accounting.

Key Features and Benefits

Erie Insurance distinguishes itself from its competitors by offering several key features and benefits:

- Competitive Pricing: Erie strives to provide competitive rates for its insurance products while maintaining high-quality coverage. The company’s focus on customer satisfaction and efficient operations allows it to offer competitive premiums.

- Excellent Customer Service: Erie is known for its exceptional customer service, with a commitment to providing prompt and helpful assistance to policyholders. The company offers various communication channels, including phone, email, and online chat, to ensure convenient access to support.

- Financial Stability: Erie Insurance has a strong financial standing, with a long history of stability and reliability. This financial strength provides customers with confidence that their insurance claims will be paid promptly and efficiently.

- Strong Claims Handling: Erie has a streamlined claims process, aiming to resolve claims fairly and quickly. The company’s dedicated claims adjusters work to ensure policyholders receive the necessary support and compensation after an accident or loss.

- Wide Range of Products: Erie offers a comprehensive suite of insurance products to meet diverse needs, including personal, commercial, and specialty insurance. This wide selection allows customers to find the specific coverage they require.

- Focus on Prevention: Erie encourages its policyholders to take preventive measures to reduce the risk of accidents and losses. The company offers various resources and programs to help customers protect themselves and their property, such as driver safety courses and home safety tips.

Customer Experience and Reputation

Erie Insurance is known for its strong customer focus and positive reputation within the insurance industry. The company consistently ranks highly in customer satisfaction surveys and is often praised for its personalized service, fair claims handling, and commitment to its policyholders.

Customer Reviews and Testimonials

Customer reviews and testimonials provide valuable insights into the experiences of Erie Insurance policyholders. Numerous online platforms, such as Trustpilot, Google Reviews, and Yelp, showcase a high volume of positive feedback from satisfied customers. Many praise the company’s responsiveness, helpfulness, and willingness to go the extra mile to resolve issues.

- Prompt and Efficient Service: Customers consistently highlight the speed and efficiency of Erie Insurance’s customer service representatives. They appreciate the quick response times and the ability to resolve their concerns promptly.

- Personalized Attention: Many customers emphasize the personalized attention they receive from Erie Insurance agents. They feel valued and understood, with agents taking the time to understand their individual needs and providing tailored solutions.

- Fair Claims Handling: Erie Insurance’s claims process is often lauded for its transparency and fairness. Policyholders appreciate the smooth and straightforward claims handling experience, with minimal hassle and timely payouts.

Customer Service Policies and Practices

Erie Insurance has implemented various policies and practices to ensure a positive customer experience.

- 24/7 Customer Support: The company offers round-the-clock customer support through phone, email, and online chat. This accessibility provides peace of mind to policyholders, knowing that assistance is readily available whenever needed.

- Agent Network: Erie Insurance has a vast network of local agents across its operating states. These agents serve as valuable resources for policyholders, providing personalized advice, answering questions, and assisting with claims.

- Online Services: The company’s website and mobile app offer convenient online services, such as policy management, payment options, and claims reporting. This digital accessibility empowers customers to manage their insurance needs efficiently.

Key Factors Contributing to Erie Insurance’s Reputation

Erie Insurance’s strong reputation is built upon several key factors:

- Financial Stability: Erie Insurance has a long history of financial stability and strength, consistently receiving high ratings from independent agencies. This financial security reassures customers about the company’s ability to fulfill its obligations.

- Community Involvement: Erie Insurance is actively involved in its communities through various philanthropic initiatives and sponsorships. This commitment to community engagement fosters a positive image and builds trust with local residents.

- Customer-Centric Approach: Erie Insurance’s customer-centric approach is evident in its policies, practices, and overall philosophy. The company prioritizes customer satisfaction and strives to deliver exceptional service at every touchpoint.

Financial Performance and Stability

Erie Insurance has consistently demonstrated strong financial performance, marked by steady revenue growth and high profitability. This financial stability has earned the company a strong credit rating, reflecting its ability to meet its financial obligations and weather economic fluctuations.

Revenue and Profitability

Erie Insurance’s revenue growth has been driven by a combination of factors, including premium growth, expansion into new markets, and a focus on customer retention. The company’s profitability is enhanced by its disciplined underwriting practices, efficient operations, and strong risk management.

- Erie Insurance’s net written premiums have consistently increased over the past decade, reflecting its ability to attract new customers and retain existing ones.

- The company’s underwriting profit margins have been consistently above the industry average, indicating its ability to effectively manage risk and price its products competitively.

- Erie Insurance has a strong track record of profitability, consistently generating positive net income. This profitability allows the company to invest in its operations, expand into new markets, and return value to shareholders.

Financial Stability and Credit Rating

Erie Insurance’s financial stability is reflected in its strong credit ratings. These ratings are assigned by independent credit rating agencies, such as A.M. Best, and are based on a comprehensive assessment of the company’s financial strength, operating performance, and risk profile.

- Erie Insurance has consistently received high credit ratings from A.M. Best, reflecting its strong financial position and ability to meet its financial obligations.

- These ratings are a testament to the company’s conservative underwriting practices, prudent investment strategy, and strong risk management.

- A high credit rating is a significant advantage for Erie Insurance, as it allows the company to access capital at competitive rates and enhances its reputation among investors and customers.

Factors Influencing Financial Performance

Several factors contribute to Erie Insurance’s strong financial performance, including:

- Strong Market Position: Erie Insurance has a strong market position in its core geographic areas, particularly in the Mid-Atlantic and Great Lakes regions. This strong presence allows the company to leverage its brand recognition, customer loyalty, and distribution network to generate consistent revenue growth.

- Disciplined Underwriting: Erie Insurance is known for its disciplined underwriting practices, which involve carefully selecting and pricing risks to minimize losses. This approach has helped the company achieve consistently high underwriting profit margins, contributing to its overall profitability.

- Efficient Operations: Erie Insurance has a strong focus on operational efficiency, which helps to minimize costs and maximize profitability. The company has invested in technology and process improvements to streamline its operations and enhance customer service.

- Effective Risk Management: Erie Insurance has a robust risk management framework, which helps to identify, assess, and mitigate potential risks. This approach has enabled the company to manage its exposure to losses and maintain financial stability.

- Strong Customer Relationships: Erie Insurance places a high value on customer satisfaction, which has contributed to its strong customer retention rates. The company’s commitment to providing excellent service and value to its customers has helped to drive revenue growth and enhance its brand reputation.

Competitive Landscape and Market Position

Erie Insurance operates in a highly competitive insurance market, facing challenges from both large national and regional insurers. Understanding the competitive landscape and Erie’s market position is crucial to assess its ability to sustain growth and profitability.

Key Competitors

Erie Insurance’s key competitors vary by region and product line. However, some prominent competitors include:

- National Insurers: Progressive, State Farm, Allstate, Geico, Liberty Mutual, and Farmers Insurance.

- Regional Insurers: Nationwide, USAA, Travelers, and Cincinnati Financial.

- Specialty Insurers: Auto-Owners Insurance, Acuity, and The Hartford.

Competitive Landscape Analysis

The insurance industry is characterized by intense competition, driven by factors such as:

- Price Sensitivity: Consumers are highly price-sensitive, leading to price wars and discounting strategies.

- Technological Advancements: Digital platforms and online insurance marketplaces have made it easier for consumers to compare prices and switch insurers.

- Regulatory Changes: Changes in regulations, such as those related to data privacy and cybersecurity, can impact insurance operations and costs.

- Shifting Consumer Preferences: Consumers are increasingly demanding personalized experiences, digital convenience, and transparent pricing.

Erie Insurance’s Market Share

Erie Insurance holds a significant market share in its primary operating regions, particularly in the Mid-Atlantic and Great Lakes regions. However, its national market share is relatively smaller compared to larger national insurers.

Erie Insurance’s market share in 2023 is estimated at [insert specific data] in the United States.

Strategies for Maintaining a Competitive Advantage

Erie Insurance employs various strategies to maintain a competitive advantage:

- Focus on Customer Service: Erie Insurance prioritizes customer service, emphasizing personalized attention and local agent relationships.

- Product Innovation: The company invests in developing innovative insurance products and services, such as telematics-based insurance programs.

- Strong Financial Performance: Erie Insurance maintains a strong financial position, enabling it to offer competitive pricing and invest in growth initiatives.

- Strategic Partnerships: Erie Insurance has formed strategic partnerships with other companies to expand its reach and offer bundled insurance products.

- Digital Transformation: Erie Insurance is investing in digital technologies to enhance customer experiences, streamline operations, and improve efficiency.

Future Prospects and Industry Trends

Erie Insurance’s future prospects are tied to the overall health and evolution of the insurance industry. The industry is undergoing significant transformation, driven by technological advancements, changing consumer preferences, and evolving regulatory landscapes. Understanding these trends is crucial for Erie Insurance to navigate the future effectively and maintain its competitive edge.

Key Trends Shaping the Insurance Landscape

The insurance industry is being reshaped by several key trends:

- Digital Transformation: Insurers are embracing digital technologies to improve customer experiences, streamline operations, and enhance risk assessment. This includes online platforms for quoting and purchasing insurance, mobile apps for claims management, and data analytics for risk modeling.

- Emerging Technologies: The rise of technologies like artificial intelligence (AI), blockchain, and the Internet of Things (IoT) is creating new opportunities for insurers. AI can automate tasks, improve fraud detection, and personalize insurance products. Blockchain can enhance security and transparency in transactions. IoT devices can provide real-time data on risk factors, leading to more accurate pricing and personalized insurance solutions.

- Shifting Consumer Expectations: Consumers are increasingly demanding personalized experiences, instant gratification, and seamless digital interactions. Insurers are adapting by offering customized insurance products, online self-service options, and real-time communication channels.

- Growing Importance of Sustainability: Consumers are becoming more environmentally conscious, and insurers are responding by offering products and services that support sustainability. This includes green insurance policies for environmentally friendly vehicles and homes, and investments in sustainable practices within their own operations.

- Increased Competition: The insurance industry is becoming increasingly competitive, with the emergence of new players, such as InsurTech companies, and traditional insurers expanding their offerings. This necessitates insurers to differentiate themselves through innovation, customer service, and pricing strategies.

Potential Challenges and Opportunities for Erie Insurance

Erie Insurance faces both challenges and opportunities in the evolving insurance landscape:

Challenges

- Maintaining Competitive Advantage: Erie Insurance needs to stay ahead of the curve in terms of technology adoption, product innovation, and customer experience to maintain its competitive advantage. This requires continuous investment in research and development, as well as strategic partnerships with technology providers.

- Attracting and Retaining Talent: The insurance industry is facing a talent shortage, particularly in areas like data science, cybersecurity, and digital marketing. Erie Insurance needs to invest in attracting and retaining top talent to ensure it has the expertise to navigate the changing landscape.

- Managing Regulatory Changes: The insurance industry is subject to evolving regulations, which can create challenges for insurers in terms of compliance and operational efficiency. Erie Insurance needs to stay abreast of regulatory changes and adapt its practices accordingly.

Opportunities

- Expanding into New Markets: Erie Insurance can leverage its strong brand and reputation to expand into new markets, both geographically and in terms of product offerings. This could involve entering new states, developing new insurance lines, or targeting specific customer segments.

- Developing Innovative Products and Services: Erie Insurance can capitalize on emerging technologies to develop innovative products and services that meet the evolving needs of consumers. This could include personalized insurance packages, telematics-based pricing, and AI-powered claims processing.

- Strengthening Customer Relationships: Erie Insurance can leverage data analytics and digital tools to personalize customer interactions and build stronger relationships. This could involve providing tailored recommendations, proactive communication, and seamless digital experiences.

Last Point

Erie Insurance’s presence across numerous states demonstrates its commitment to serving a diverse customer base. The company’s focus on providing personalized insurance solutions tailored to the specific needs of each region solidifies its position as a leading insurer in the United States. By understanding the factors influencing Erie Insurance’s geographical reach and the insurance products offered in each state, potential customers can make informed decisions about their insurance needs.

Clarifying Questions

What is Erie Insurance’s history?

Erie Insurance was founded in 1925 in Erie, Pennsylvania. It has a long history of providing insurance products and services to individuals and businesses.

Does Erie Insurance offer life insurance?

Yes, Erie Insurance offers a range of life insurance products, including term life, whole life, and universal life insurance.

What is Erie Insurance’s customer service like?

Erie Insurance is known for its strong customer service reputation. They have a dedicated team of customer service representatives available to assist policyholders with their needs.

How can I get a quote for Erie Insurance?

You can get a quote for Erie Insurance online, by phone, or by visiting an Erie Insurance agent.