Does car insurance vary by state? Absolutely! The cost of car insurance can fluctuate significantly depending on where you live, and understanding the factors that contribute to these differences is crucial for finding the best coverage at an affordable price.

From state regulations and minimum coverage requirements to risk factors like population density and accident rates, numerous variables influence car insurance premiums. This article will explore the key reasons why car insurance costs vary across states and provide valuable insights into finding the most suitable coverage for your individual needs.

Factors Influencing Car Insurance Rates

Car insurance rates are influenced by a variety of factors, including your driving history, the type of car you drive, and where you live. State regulations play a significant role in determining car insurance costs, as they dictate the minimum coverage requirements and how insurance companies can operate within their borders.

State Regulations Impact on Car Insurance Costs

State regulations directly impact car insurance costs by setting minimum coverage requirements, regulating insurance company operations, and influencing risk factors like population density and accident rates.

- Minimum Coverage Requirements: Each state has its own set of minimum coverage requirements, known as “financial responsibility laws,” that specify the minimum amount of insurance coverage drivers must carry. These requirements vary widely across states, with some states requiring higher levels of coverage than others. For instance, states like New York have higher minimum coverage requirements compared to states like Idaho. These minimum requirements influence car insurance costs by setting a baseline for coverage that all drivers must carry. States with higher minimum coverage requirements generally have higher average insurance premiums.

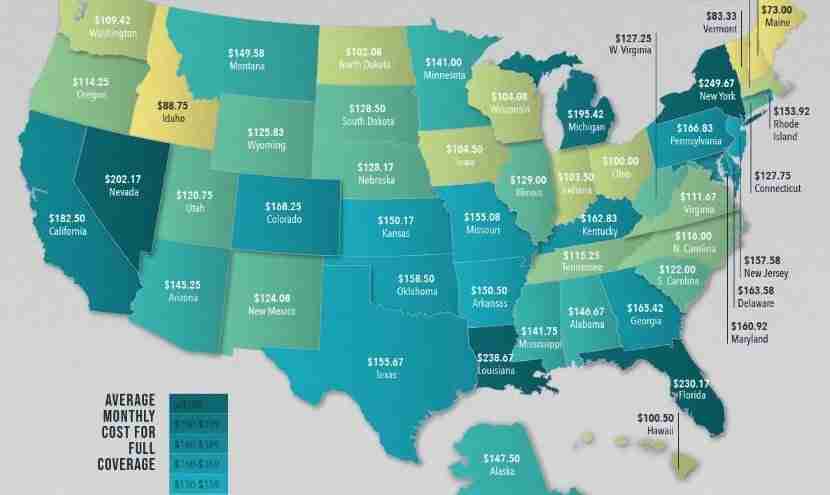

- State-Specific Risk Factors: State-specific risk factors, such as population density and accident rates, also influence car insurance costs. States with higher population densities tend to have more traffic congestion and higher accident rates, which can lead to higher insurance premiums. For example, states like California and Texas have higher population densities and accident rates, resulting in higher average insurance premiums. Conversely, states with lower population densities and lower accident rates tend to have lower insurance premiums.

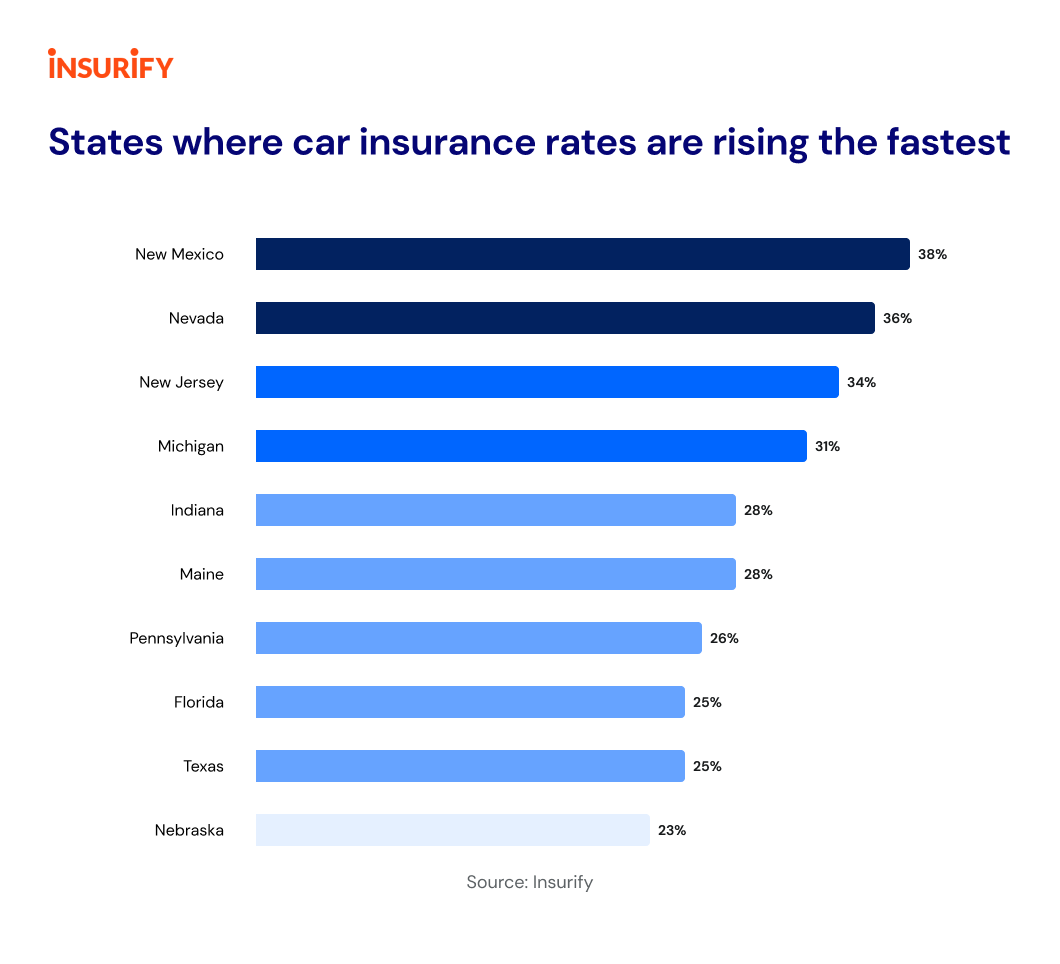

- Insurance Company Operations: State regulations also affect how insurance companies operate within their borders, influencing pricing. States can regulate factors such as insurance rates, claim handling practices, and advertising. These regulations can impact the pricing strategies of insurance companies, potentially leading to variations in insurance costs across states. For instance, states with stricter regulations on insurance rate increases may see lower average premiums compared to states with more lenient regulations.

Key Coverage Variations

Car insurance coverage requirements and options can vary significantly across different states. Understanding these variations is crucial for drivers to ensure they have adequate protection and comply with local regulations.

Mandatory Coverages

Each state mandates certain minimum insurance coverages to protect drivers and other road users in case of accidents. These mandatory coverages typically include:

- Liability Coverage: This coverage protects you financially if you cause an accident that injures another person or damages their property. It typically includes bodily injury liability and property damage liability.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses, lost wages, and property damage.

- Personal Injury Protection (PIP): Some states require PIP coverage, which pays for your medical expenses and lost wages regardless of fault in an accident.

Optional Coverages

Beyond the mandatory coverages, many states offer optional coverages that provide additional protection. These include:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Rental Reimbursement: This coverage reimburses you for rental car expenses while your vehicle is being repaired after an accident.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of fault, up to a certain limit.

Coverage Cost Variations

The cost of car insurance can vary significantly across states due to differences in factors such as:

- State Laws and Regulations: State-specific laws and regulations regarding insurance requirements, minimum coverage limits, and pricing practices can influence the cost of insurance.

- Traffic Density and Accident Rates: States with higher traffic density and accident rates tend to have higher insurance premiums.

- Cost of Living: States with a higher cost of living, including medical expenses and vehicle repair costs, may have higher insurance premiums.

Uninsured/Underinsured Motorist Coverage Impact

State-specific laws regarding uninsured/underinsured motorist coverage can significantly impact insurance rates.

- Mandatory Coverage: States that mandate UM/UIM coverage often have higher premiums than those that do not.

- Coverage Limits: States with higher mandatory UM/UIM coverage limits may have higher premiums.

- Opt-Out Provisions: States that allow drivers to opt out of UM/UIM coverage may have lower premiums but leave drivers vulnerable to financial losses in the event of an accident with an uninsured or underinsured driver.

Driving Factors and Insurance Premiums

Your driving habits and characteristics significantly influence your car insurance rates. Insurance companies use a complex system to assess risk and determine your premium. Let’s explore how various driving factors affect your insurance costs.

Driver Demographics

Your age, gender, and driving history play a crucial role in determining your insurance premium. Insurance companies have collected data over years that show certain demographic groups tend to have higher accident risks.

- Age: Younger drivers, especially those under 25, generally pay higher premiums. This is because they have less experience behind the wheel and are statistically more likely to be involved in accidents. As drivers gain experience and age, their premiums typically decrease.

- Gender: Historically, insurance companies have charged men higher premiums than women. This is based on data indicating that men tend to have higher accident rates. However, this gap is narrowing, and some states have prohibited gender-based pricing.

- Driving History: Your driving record is a key factor in determining your insurance rates. Having a clean driving history with no accidents or traffic violations will generally lead to lower premiums. On the other hand, a history of accidents, speeding tickets, or DUI convictions can significantly increase your rates.

Vehicle Type and Value

The type and value of your vehicle also impact your insurance premium. Insurance companies consider factors like the car’s safety features, repair costs, and theft risk.

- Safety Features: Cars with advanced safety features like anti-lock brakes, airbags, and electronic stability control generally have lower insurance premiums. These features reduce the likelihood and severity of accidents.

- Repair Costs: Vehicles that are expensive to repair or replace will typically have higher insurance premiums. Luxury cars and sports cars often fall into this category.

- Theft Risk: Cars that are more susceptible to theft will have higher premiums. This is because insurance companies need to cover the cost of replacing stolen vehicles.

Driving Habits

Your driving habits, such as mileage and commute distance, can also affect your insurance rates.

- Mileage: Drivers who drive fewer miles annually generally pay lower premiums. This is because they have a lower risk of being involved in an accident.

- Commute Distance: Long commutes, especially in congested areas, can increase your risk of accidents. Insurance companies may charge higher premiums for drivers with long commutes.

Car Usage Scenarios, Does car insurance vary by state

The purpose for which you use your car can also influence your insurance premiums.

- Commuting: Drivers who use their cars primarily for commuting to work typically pay higher premiums than those who use their cars for recreational purposes. This is because commuting often involves driving in congested areas and during peak hours, increasing the risk of accidents.

- Recreational Driving: Drivers who use their cars primarily for recreational purposes, such as weekend trips or driving to social events, generally pay lower premiums. This is because they are less likely to be driving in high-risk situations.

State-Specific Insurance Market Dynamics: Does Car Insurance Vary By State

The insurance market is a dynamic landscape influenced by various factors, including state-specific regulations, competitive dynamics, and consumer preferences. Understanding these dynamics is crucial for consumers to navigate the insurance landscape effectively and secure the best possible rates.

Dominant Insurance Companies in Each State

The insurance industry in the United States is characterized by a diverse range of companies, each with its unique strengths and market presence. Some companies dominate specific states, offering a wider range of products and services, while others cater to niche markets. Analyzing the dominant players in each state provides valuable insights into the competitive landscape and the availability of insurance options.

- California: State Farm, Geico, Farmers, Progressive, and Liberty Mutual are the leading insurance companies in California, accounting for a significant portion of the market share. These companies offer a wide array of coverage options and discounts, catering to the diverse needs of California residents.

- Texas: State Farm, Nationwide, USAA, Geico, and Farmers are the dominant insurance companies in Texas. The state’s large population and diverse demographics contribute to a competitive insurance market, offering consumers a wide range of choices.

- Florida: State Farm, Geico, Progressive, Nationwide, and Allstate are the leading insurance companies in Florida. The state’s vulnerability to hurricanes and other natural disasters influences the insurance market, with companies offering specialized coverage options and discounts.

- New York: Geico, State Farm, Allstate, Progressive, and Liberty Mutual are the dominant insurance companies in New York. The state’s dense population and urban environment contribute to a competitive insurance market, with companies offering a wide range of coverage options and discounts.

- Pennsylvania: State Farm, Geico, Nationwide, Erie Insurance, and Progressive are the leading insurance companies in Pennsylvania. The state’s diverse demographics and economic landscape contribute to a competitive insurance market, offering consumers a wide range of choices.

Competitive Landscape of the Insurance Market in Different States

The competitive landscape of the insurance market varies significantly across states, influenced by factors such as market saturation, regulatory environment, and consumer preferences. Some states are characterized by a highly competitive market with numerous insurance companies vying for customers, while others have a more concentrated market with fewer dominant players.

- Highly Competitive States: States like California, Texas, and Florida have a highly competitive insurance market, with a large number of insurance companies operating within their borders. This intense competition benefits consumers, as companies are constantly striving to offer competitive rates and innovative products to attract customers.

- Concentrated Markets: States like Pennsylvania, New York, and Massachusetts have a more concentrated insurance market, with a smaller number of dominant players. While this may limit consumer choice, it can also lead to more stable pricing and a focus on customer service by the dominant companies.

Impact of State-Specific Regulations on Insurance Company Pricing Strategies

State-specific regulations play a significant role in shaping the insurance market and influencing pricing strategies. These regulations cover various aspects, including minimum coverage requirements, pricing factors, and consumer protection measures.

- Minimum Coverage Requirements: State regulations mandate minimum coverage levels for auto insurance, ensuring that drivers have adequate financial protection in case of accidents. These requirements can influence pricing strategies, as insurance companies need to factor in the cost of providing these minimum coverages.

- Pricing Factors: State regulations often restrict the factors that insurance companies can use to determine insurance premiums. For example, some states prohibit the use of credit scores or gender as pricing factors. These restrictions can impact pricing strategies, as companies need to find alternative ways to assess risk.

- Consumer Protection Measures: State regulations often include consumer protection measures, such as requiring insurance companies to provide clear and understandable information about their policies and rates. These measures can influence pricing strategies, as companies need to ensure transparency and fairness in their pricing practices.

Availability of Discounts and Rate Negotiation Options by State

Insurance companies offer a wide range of discounts to attract customers and reward safe driving practices. The availability of discounts and rate negotiation options varies significantly by state, influenced by factors such as regulatory environment, competitive landscape, and consumer preferences.

- Common Discounts: Discounts for safe driving, good student records, multiple policy bundling, and vehicle safety features are commonly offered in most states. These discounts can significantly reduce insurance premiums and make coverage more affordable.

- State-Specific Discounts: Some states offer unique discounts, such as discounts for hybrid or electric vehicles or discounts for completing defensive driving courses. These state-specific discounts can provide additional savings for eligible drivers.

- Rate Negotiation Options: The availability of rate negotiation options also varies by state. Some states allow consumers to negotiate their insurance rates directly with insurance companies, while others have stricter regulations that limit negotiation opportunities.

Tips for Finding Affordable Car Insurance

Finding the right car insurance policy can be a daunting task, especially when considering the wide range of options and the constant fluctuations in rates. However, by implementing effective strategies and utilizing available resources, you can significantly reduce your premiums and secure the coverage you need.

Comparing Insurance Quotes Across Multiple Providers

Comparing quotes from multiple insurance providers is essential for finding the most competitive rates. This involves gathering quotes from a variety of companies, both online and offline, to identify the best deals.

- Use Online Comparison Websites: Several websites specialize in comparing insurance quotes from multiple providers. These platforms allow you to input your details and receive personalized quotes within minutes. Some popular options include:

- Insurify

- Policygenius

- The Zebra

- Contact Insurance Companies Directly: Don’t solely rely on comparison websites. Contact insurance companies directly to request quotes and discuss your specific needs. This allows for more personalized interactions and potential negotiation opportunities.

- Consider Bundling Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often result in discounts. Bundling your insurance can be a significant way to save money.

Ultimate Conclusion

Ultimately, finding the right car insurance policy involves understanding the unique factors that affect premiums in your state and comparing quotes from multiple providers. By taking the time to research and explore your options, you can secure the best possible coverage at a price that fits your budget.

FAQs

What are some common discounts offered by car insurance companies?

Discounts can vary by state and insurer, but common ones include good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts for combining home and auto insurance.

How often should I review my car insurance policy?

It’s generally a good idea to review your policy at least once a year, especially if you experience any significant life changes, such as a new car purchase, a change in your driving habits, or a move to a new state.