Does car insurance change by state? Absolutely! The price you pay for car insurance can vary significantly depending on where you live. This is because state governments have different regulations and requirements for car insurance, which can affect coverage options, minimum liability limits, and overall costs.

Factors like the number of accidents, population density, and even the cost of living in a particular state can all play a role in determining insurance rates. Understanding how state regulations impact car insurance can help you make informed decisions about your coverage and save money.

State-Specific Insurance Regulations

Car insurance regulations vary significantly from state to state, creating a complex landscape for drivers. Understanding these differences is crucial for choosing the right coverage and ensuring you meet the minimum requirements in your jurisdiction.

Factors Influencing State Regulations

Several key factors influence the specific car insurance regulations in each state. These include:

- State Laws and Mandates: Each state has its own set of laws outlining minimum coverage requirements, including liability limits, uninsured/underinsured motorist coverage, and personal injury protection (PIP). These laws are designed to protect drivers and passengers in the event of an accident.

- Economic Factors: The cost of living, traffic density, and the frequency of accidents in a particular state can influence insurance rates. States with higher accident rates or more expensive medical care tend to have higher insurance premiums.

- Political Climate: The political climate in a state can influence insurance regulations. For example, some states may have more consumer-friendly laws, while others may favor the interests of insurance companies.

- Insurance Industry Lobbying: Insurance companies often lobby state legislatures to influence regulations in their favor. This can lead to variations in coverage requirements and pricing across different states.

State-Specific Insurance Requirements

Here’s a comprehensive list of states with their unique car insurance requirements:

| State | Minimum Liability Coverage | Other Requirements |

|---|---|---|

| Alabama | 25/50/25 | Uninsured Motorist Coverage |

| Alaska | 25/50/10 | PIP, Uninsured Motorist Coverage |

| Arizona | 15/30/10 | Uninsured Motorist Coverage |

| Arkansas | 25/50/25 | Uninsured Motorist Coverage |

| California | 15/30/5 | PIP, Uninsured Motorist Coverage |

| Colorado | 25/50/15 | Uninsured Motorist Coverage |

| Connecticut | 20/40/10 | PIP, Uninsured Motorist Coverage |

| Delaware | 30/60/5 | Uninsured Motorist Coverage |

| Florida | 10/20/10 | PIP, Uninsured Motorist Coverage |

| Georgia | 25/50/25 | Uninsured Motorist Coverage |

| Hawaii | 20/40/10 | PIP, Uninsured Motorist Coverage |

| Idaho | 25/50/15 | Uninsured Motorist Coverage |

| Illinois | 20/40/15 | Uninsured Motorist Coverage |

| Indiana | 25/50/10 | Uninsured Motorist Coverage |

| Iowa | 20/40/15 | Uninsured Motorist Coverage |

| Kansas | 25/50/10 | Uninsured Motorist Coverage |

| Kentucky | 25/50/10 | Uninsured Motorist Coverage |

| Louisiana | 10/20/10 | PIP, Uninsured Motorist Coverage |

| Maine | 50/100/25 | Uninsured Motorist Coverage |

| Maryland | 30/60/15 | Uninsured Motorist Coverage |

| Massachusetts | 20/40/5 | PIP, Uninsured Motorist Coverage |

| Michigan | 20/40/10 | PIP, Uninsured Motorist Coverage |

| Minnesota | 30/60/10 | Uninsured Motorist Coverage |

| Mississippi | 25/50/10 | Uninsured Motorist Coverage |

| Missouri | 25/50/10 | Uninsured Motorist Coverage |

| Montana | 25/50/10 | Uninsured Motorist Coverage |

| Nebraska | 25/50/10 | Uninsured Motorist Coverage |

| Nevada | 15/30/10 | Uninsured Motorist Coverage |

| New Hampshire | 25/50/10 | Uninsured Motorist Coverage |

| New Jersey | 15/30/5 | PIP, Uninsured Motorist Coverage |

| New Mexico | 25/50/10 | Uninsured Motorist Coverage |

| New York | 25/50/10 | Uninsured Motorist Coverage |

| North Carolina | 30/60/25 | Uninsured Motorist Coverage |

| North Dakota | 25/50/10 | Uninsured Motorist Coverage |

| Ohio | 25/50/10 | Uninsured Motorist Coverage |

| Oklahoma | 25/50/10 | Uninsured Motorist Coverage |

| Oregon | 25/50/20 | Uninsured Motorist Coverage |

| Pennsylvania | 15/30/5 | Uninsured Motorist Coverage |

| Rhode Island | 25/50/25 | PIP, Uninsured Motorist Coverage |

| South Carolina | 25/50/25 | Uninsured Motorist Coverage |

| South Dakota | 25/50/10 | Uninsured Motorist Coverage |

| Tennessee | 25/50/15 | Uninsured Motorist Coverage |

| Texas | 30/60/25 | Uninsured Motorist Coverage |

| Utah | 25/65/15 | Uninsured Motorist Coverage |

| Vermont | 25/50/10 | Uninsured Motorist Coverage |

| Virginia | 25/50/20 | Uninsured Motorist Coverage |

| Washington | 25/50/10 | Uninsured Motorist Coverage |

| West Virginia | 25/50/10 | Uninsured Motorist Coverage |

| Wisconsin | 25/50/10 | Uninsured Motorist Coverage |

| Wyoming | 25/50/10 | Uninsured Motorist Coverage |

Impact of State Laws on Coverage Options and Pricing

State laws can significantly affect the coverage options and pricing of car insurance. For example:

- No-Fault Insurance: States with no-fault insurance laws, such as Michigan and New York, require drivers to file claims with their own insurance company, regardless of who is at fault in an accident. This can result in lower liability premiums but higher PIP premiums.

- Uninsured Motorist Coverage: States that require uninsured motorist coverage protect drivers in the event of an accident with a driver who doesn’t have insurance. This coverage can be mandatory or optional, and the limits can vary by state.

- PIP Coverage: States with mandatory PIP coverage, such as Florida and New Jersey, require drivers to purchase insurance that covers their own medical expenses and lost wages after an accident, regardless of fault. This can lead to higher premiums but also provide greater financial protection.

Examples of State Law Impact

* Texas: Texas requires drivers to carry a minimum of $30,000 in liability coverage for bodily injury per person, $60,000 for bodily injury per accident, and $25,000 for property damage. This means if you cause an accident that results in injuries or property damage exceeding these limits, you could be personally liable for the remaining costs.

* Florida: Florida has a no-fault insurance system and requires drivers to carry Personal Injury Protection (PIP) coverage. This means that drivers are required to file claims with their own insurance company, regardless of who is at fault in an accident. PIP coverage typically covers medical expenses and lost wages up to a certain limit.

* California: California has a unique system where drivers can choose between “full tort” or “limited tort” coverage. Full tort coverage allows drivers to sue for pain and suffering in an accident, while limited tort coverage restricts this right. This can result in lower premiums for limited tort coverage but also limits the amount of compensation drivers can receive.

Minimum Coverage Requirements

Each state in the United States has its own set of minimum car insurance requirements, which Artikel the least amount of coverage drivers must have to be legally allowed on the road. These minimums are designed to protect drivers and other parties involved in accidents, ensuring that there are funds available to cover damages and injuries.

State Minimum Coverage Requirements

The minimum liability coverage limits vary significantly across states. Here’s a table illustrating the differences:

| State | Bodily Injury Liability per Person | Bodily Injury Liability per Accident | Property Damage Liability |

|---|---|---|---|

| Alabama | $25,000 | $50,000 | $25,000 |

| Alaska | $50,000 | $100,000 | $25,000 |

| Arizona | $25,000 | $50,000 | $15,000 |

| Arkansas | $25,000 | $50,000 | $25,000 |

| California | $15,000 | $30,000 | $5,000 |

It’s important to note that this table only shows a few examples, and the actual minimums can change over time. It’s always best to check with your state’s Department of Motor Vehicles (DMV) for the most up-to-date information.

Consequences of Driving Without Adequate Insurance

Driving without adequate insurance coverage can have severe consequences. If you are involved in an accident and do not have sufficient insurance, you could be held personally liable for:

- Medical expenses of the other driver and passengers

- Property damage to the other vehicle and any other property involved

- Legal fees and court costs

- Loss of your driver’s license and vehicle registration

- Potential jail time

In some cases, you may even be required to pay for the other driver’s lost wages and other expenses. Furthermore, your insurance premiums may increase significantly if you are caught driving without adequate coverage.

Impact of State-Mandated Minimum Coverage on Insurance Costs

The state-mandated minimum coverage requirements can impact insurance costs in a few ways:

- Higher Minimums = Higher Premiums: States with higher minimum coverage requirements typically have higher average insurance premiums. This is because insurance companies need to charge more to cover the potential costs of larger payouts.

- Varying Risk Profiles: The risk profile of a state, including factors like the number of accidents and the average severity of accidents, can also affect insurance costs. States with higher accident rates may have higher insurance premiums, even if their minimum coverage requirements are lower.

- Competition in the Insurance Market: The level of competition in the insurance market can also influence prices. States with more insurance companies competing for customers may have lower premiums.

Factors Affecting Car Insurance Rates

Car insurance premiums are not a one-size-fits-all proposition. They are influenced by a multitude of factors, each contributing to the overall cost. Understanding these factors can help you navigate the complex world of car insurance and make informed decisions to potentially lower your premiums.

Demographic Factors

Your personal characteristics, such as age, driving history, and credit score, play a significant role in determining your car insurance rates. Insurers use these factors to assess your risk profile, as they correlate with the likelihood of accidents and claims.

Age

Age is a key factor considered by insurance companies because younger drivers statistically have a higher risk of accidents. This is primarily due to factors such as inexperience, lack of driving habits, and a tendency to engage in risky behaviors.

- Young Drivers (Under 25): These drivers often face higher premiums due to their higher accident risk. However, as drivers gain experience and reach their mid-20s, premiums tend to decrease.

- Mature Drivers (Over 65): While some insurers may offer discounts for senior drivers, others may charge slightly higher premiums due to potential health concerns or age-related driving limitations.

Driving History

Your driving history is a crucial factor in determining your insurance rates. A clean driving record with no accidents or violations generally translates into lower premiums. Conversely, a history of accidents, traffic violations, or DUI convictions will likely lead to higher premiums.

- Accidents: Insurance companies view accidents as a strong indicator of future risk. The severity of the accident, your level of fault, and the number of accidents you have been involved in all influence premium calculations.

- Traffic Violations: Violations like speeding tickets, reckless driving, or running red lights can significantly increase your insurance premiums. These violations suggest a higher risk of future accidents.

- DUI Convictions: Driving under the influence (DUI) convictions carry the most severe impact on insurance premiums. Insurers consider this a significant risk factor, reflecting a higher probability of future accidents.

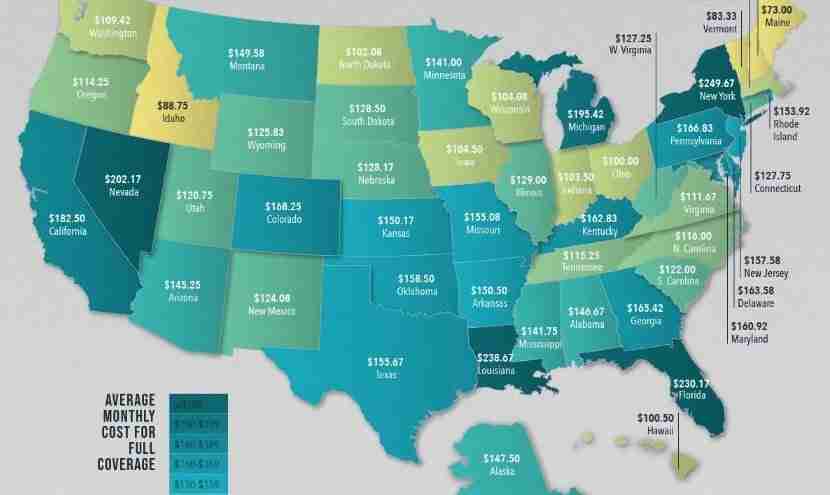

Geographic Factors

Where you live can significantly influence your car insurance rates. Factors like population density, accident rates, and the cost of living in a particular area are all taken into account by insurance companies.

Population Density

Areas with high population density often experience more traffic congestion, which can increase the likelihood of accidents. Insurance companies may adjust premiums to reflect the higher risk associated with congested areas.

Accident Rates

Areas with higher accident rates are generally considered more risky by insurance companies. This is because higher accident rates indicate a greater likelihood of claims, which can lead to increased premiums for drivers in those areas.

Coverage Options and Availability

The types of car insurance coverage available in different states can vary significantly. Understanding these differences is crucial for drivers to ensure they have adequate protection for their specific needs and circumstances.

The availability of certain coverage options is often influenced by state regulations and the overall insurance market in that particular region.

Types of Car Insurance Coverage

Car insurance policies typically include a combination of mandatory and optional coverage options. Here’s a breakdown of the most common types:

- Liability Coverage: This is the most basic type of car insurance, which is legally required in all states. It covers damages to other people’s property or injuries caused by an accident where you are at fault. Liability coverage typically includes two components:

- Bodily Injury Liability: This covers medical expenses, lost wages, and other damages related to injuries caused to other people in an accident.

- Property Damage Liability: This covers damages to other people’s vehicles or property involved in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It helps cover your medical expenses, lost wages, and property damage. This coverage is typically mandatory in many states.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. It is usually optional, but it may be required if you have a loan or lease on your vehicle.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than accidents, such as theft, vandalism, natural disasters, or falling objects. It is also typically optional.

- Personal Injury Protection (PIP): This coverage covers your medical expenses and lost wages, regardless of who is at fault in an accident. It is mandatory in some states, known as “no-fault” states.

- Medical Payments Coverage (Med Pay): This coverage provides medical expense coverage for you and your passengers, regardless of fault, up to a certain limit. It is usually optional.

- Rental Reimbursement: This coverage provides financial assistance for a rental car if your vehicle is damaged and needs repairs. It is often optional.

Availability of Optional Coverages

The availability of optional coverages like comprehensive and collision can vary from state to state. Some states may have regulations that limit the availability of certain coverages or require specific minimum coverage levels.

- State Regulations: State regulations play a significant role in determining the availability of optional coverages. Some states may require certain coverages to be offered by insurance companies, while others may have no such requirements. For example, some states may require insurance companies to offer comprehensive and collision coverage to drivers with financed vehicles.

- Insurance Market Dynamics: The availability of optional coverages can also be influenced by the overall insurance market in a particular state. If the insurance market is highly competitive, insurance companies may be more likely to offer a wider range of optional coverages to attract customers. Conversely, in states with less competition, insurance companies may offer fewer options.

- Driver Risk Profiles: The availability of optional coverages can also depend on the driver’s risk profile. Drivers with a history of accidents or traffic violations may find it difficult to obtain certain coverages, or they may have to pay higher premiums.

Influence of State Regulations on Specialized Insurance Products

State regulations can also influence the availability of specialized insurance products, such as:

- Ride-Sharing Insurance: State regulations can impact the availability of insurance coverage for ride-sharing drivers. Some states have specific laws that address insurance requirements for ride-sharing services, while others may have more general regulations that apply to all drivers.

- Electric Vehicle Insurance: As electric vehicles become more popular, some states are introducing specific insurance regulations that address the unique characteristics of these vehicles. For example, some states may require insurance companies to offer coverage for the battery packs and other electric components of electric vehicles.

- Autonomous Vehicle Insurance: The development of autonomous vehicles has led to discussions about how insurance regulations should adapt to this new technology. Some states are already considering legislation that addresses the liability and insurance needs of autonomous vehicles.

Insurance Company Practices

Insurance companies utilize a complex system to determine car insurance rates, factoring in state regulations and local conditions. They analyze numerous variables to arrive at a price that reflects their perceived risk and profitability.

Rate Determination Based on State Regulations and Local Factors

State regulations significantly influence insurance company practices, establishing minimum coverage requirements and setting guidelines for rate calculations. For example, states may mandate specific coverage types, such as personal injury protection (PIP) or uninsured motorist coverage (UM), which directly impact the cost of insurance. Additionally, local factors, such as traffic density, crime rates, and weather conditions, play a crucial role in rate determination. Insurance companies analyze historical claims data and local statistics to assess the likelihood of accidents and the potential severity of damages.

Driving Habits and Risk Assessment

Your driving habits are a major factor in determining your car insurance rates. Insurance companies use a complex system to assess risk and price policies accordingly, taking into account factors like your driving history, mileage, and other individual characteristics. This assessment is crucial in determining the cost of your car insurance.

Mileage and Driving Habits, Does car insurance change by state

The number of miles you drive annually significantly impacts your insurance rates. Higher mileage generally translates to a higher risk of accidents.

- States with higher mileage requirements: Some states, like California and New York, have higher average annual mileage compared to other states. Insurance companies may adjust rates accordingly, reflecting the increased risk associated with more miles driven.

- States with lower mileage requirements: States with lower average annual mileage, such as Wyoming or North Dakota, might see lower insurance rates due to the reduced likelihood of accidents.

Insurance companies often offer discounts for low-mileage drivers, rewarding those who drive less frequently.

State-Specific Risk Assessment Models

States have different approaches to assessing driver risk. These models consider various factors to determine the likelihood of accidents and adjust insurance rates accordingly.

- Credit-based insurance scores: Some states, like California and Hawaii, prohibit the use of credit history in determining insurance rates. Others, like Texas and Florida, allow it, potentially leading to higher rates for individuals with lower credit scores.

- Driving history: All states consider driving history when calculating insurance rates. States may vary in the weight they give to specific offenses, such as speeding tickets or accidents.

Impact of State-Specific Regulations

State regulations play a significant role in how insurance companies assess driver risk.

- Minimum coverage requirements: States have different minimum liability coverage requirements, influencing the base cost of insurance. States with higher minimum coverage requirements generally have higher insurance rates.

- Usage-based insurance (UBI): Some states encourage the use of UBI programs, which track driving behavior using telematics devices. This data can lead to discounts for safe drivers or higher rates for those exhibiting risky driving habits.

Impact on Consumers

State-specific car insurance regulations have a significant impact on consumer costs, influencing the price of insurance premiums and the availability of coverage options. Understanding these regulations is crucial for consumers to make informed decisions and find the most affordable and comprehensive insurance policies.

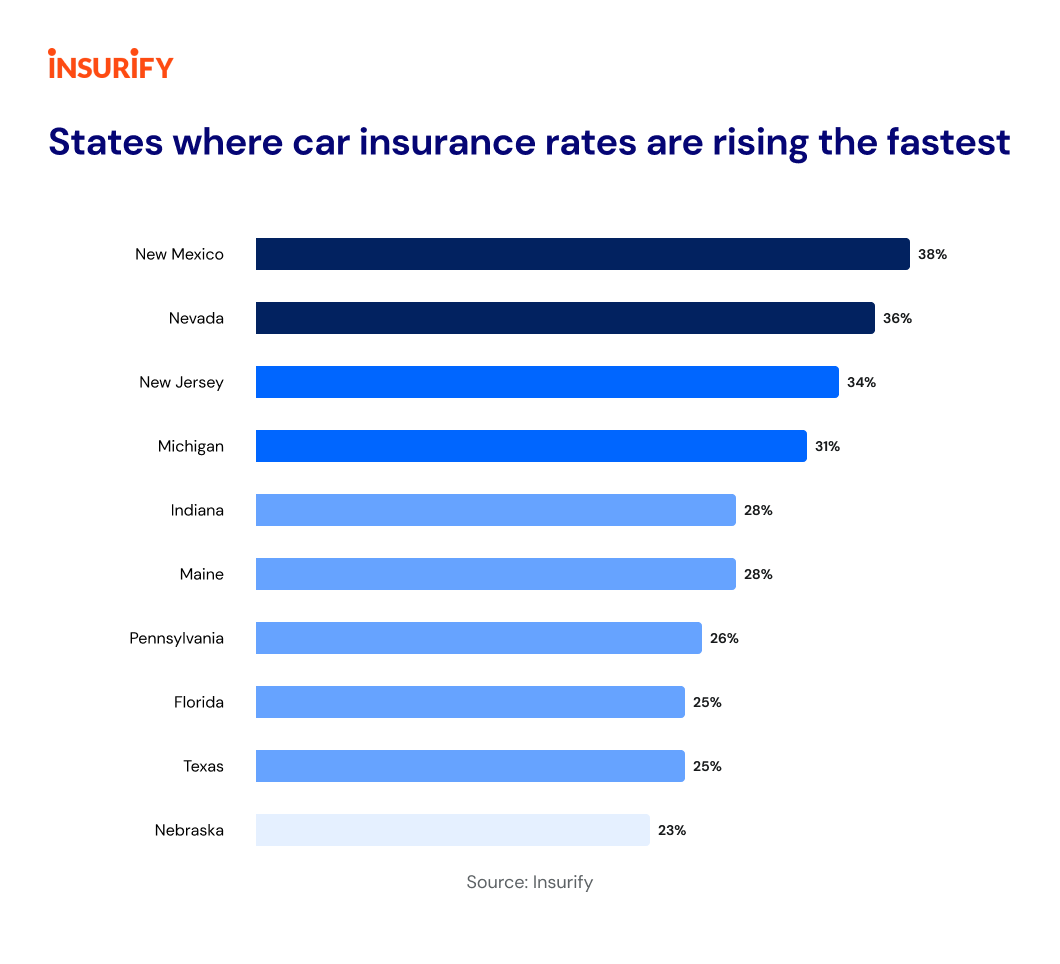

Affordability of Car Insurance Across States

The cost of car insurance varies considerably across states, primarily due to differences in state-specific regulations. These regulations influence factors such as minimum coverage requirements, insurance company practices, and risk assessment methodologies.

- Minimum Coverage Requirements: States with higher minimum coverage requirements, such as those mandating higher liability limits, generally have higher average insurance premiums. This is because drivers in these states are required to carry more coverage, which increases the overall cost of insurance. For example, in states with high minimum liability limits, drivers are required to pay for more extensive damages in the event of an accident, leading to higher premiums.

- Insurance Company Practices: State regulations can influence the practices of insurance companies, impacting premium pricing. For example, some states have regulations that restrict the use of certain factors in rate setting, such as credit scores. These restrictions can limit the ability of insurance companies to differentiate premiums based on individual risk factors, potentially leading to lower premiums for some consumers. However, these regulations can also result in higher premiums for other consumers who may be considered higher risk.

- Risk Assessment: States may have different methodologies for assessing risk, which can affect premium pricing. For instance, some states may allow insurance companies to use more factors in risk assessment, such as driving history, age, and vehicle type, while others may have stricter limitations. These differences in risk assessment can lead to variations in premium rates across states.

Impact of State Regulations on Consumer Choices

State regulations can significantly influence consumer choices and the insurance shopping experience.

- Coverage Options: States may have different regulations regarding the availability of coverage options, such as uninsured/underinsured motorist coverage or personal injury protection. This can affect the comprehensiveness of insurance policies available to consumers in different states.

- Shopping Experience: State regulations can also influence the insurance shopping experience. For example, some states have regulations that require insurance companies to provide standardized rate quotes, making it easier for consumers to compare prices. Additionally, some states may have consumer protection laws that regulate insurance company practices, such as advertising and claims handling.

Final Wrap-Up

Navigating the world of car insurance can feel like driving through a maze, especially when you consider the impact of state-specific regulations. However, by understanding the factors that influence car insurance costs in different states, you can make informed choices about your coverage and find the best value for your needs. Remember to shop around and compare quotes from different insurance companies to ensure you’re getting the best possible deal.

Helpful Answers: Does Car Insurance Change By State

What is the minimum liability coverage required in my state?

The minimum liability coverage requirements vary by state. You can find this information on your state’s Department of Motor Vehicles website.

How can I get a lower car insurance rate?

There are several ways to lower your car insurance rate, such as maintaining a good driving record, taking a defensive driving course, and bundling your car insurance with other types of insurance.

What is the difference between comprehensive and collision coverage?

Comprehensive coverage protects you from damage to your car caused by events like theft, vandalism, or natural disasters. Collision coverage protects you from damage to your car caused by accidents.

Can I get car insurance without a car?

Yes, you can get car insurance without a car if you are planning to buy a car soon or if you are leasing a car.