Do you need car insurance in Washington state? The answer is a resounding yes. Washington state, like many others, has strict laws mandating car insurance coverage for all drivers. This ensures that you’re financially protected in case of an accident and that others involved are compensated for any damages or injuries.

Understanding the specific requirements, types of coverage available, and factors influencing premiums is crucial for making informed decisions about your car insurance policy. Let’s delve into the intricacies of car insurance in Washington state and explore how to find the best coverage for your needs.

Washington State’s Car Insurance Laws: Do You Need Car Insurance In Washington State

Washington state requires all drivers to have car insurance. This is a legal requirement that helps protect drivers and others on the road in case of an accident.

Minimum Liability Coverage Requirements

Washington state law mandates minimum liability coverage amounts that all drivers must carry. These amounts are designed to ensure that drivers have sufficient financial resources to cover the costs of injuries or damages they may cause to others in an accident.

- Bodily Injury Liability: This coverage protects you if you injure someone else in an accident. The minimum requirement is $25,000 per person and $50,000 per accident. This means that you are covered for up to $25,000 for injuries to one person and up to $50,000 for injuries to multiple people in the same accident.

- Property Damage Liability: This coverage protects you if you damage someone else’s property in an accident. The minimum requirement is $10,000. This means that you are covered for up to $10,000 in damages to another person’s vehicle or property.

Consequences of Driving Without Insurance

Driving without insurance in Washington state is a serious offense. The consequences can be severe, including:

- Fines: Drivers caught driving without insurance face hefty fines, which can range from hundreds to thousands of dollars. The specific amount of the fine may vary depending on the circumstances of the violation.

- License Suspension: In addition to fines, driving without insurance can result in the suspension of your driver’s license. This means you will not be legally allowed to drive until you obtain insurance and reinstate your license.

- Impoundment of Vehicle: Your vehicle may be impounded if you are caught driving without insurance. This means you will have to pay fees to retrieve your vehicle from the impound lot.

- Financial Responsibility: If you are involved in an accident without insurance, you will be personally liable for all damages and injuries caused. This could include medical bills, property damage, and lost wages. Without insurance, you could face significant financial hardship.

Types of Car Insurance Coverage

In Washington state, you have a variety of car insurance coverage options to choose from, each offering different levels of protection. Understanding these coverage types and their benefits can help you make informed decisions about your insurance needs.

Liability Coverage

Liability coverage is the most common type of car insurance and is required by law in Washington state. It protects you financially if you cause an accident that injures someone or damages their property.

Liability coverage consists of two parts:

- Bodily injury liability: Covers medical expenses, lost wages, and pain and suffering for injuries you cause to others in an accident.

- Property damage liability: Covers repairs or replacement costs for damage you cause to another person’s vehicle or property.

For example, if you cause an accident that injures another driver and damages their car, your liability coverage would help pay for their medical bills, lost wages, and vehicle repairs.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. It helps you cover the costs of repairs or a replacement vehicle, even if you’re the one who caused the accident.

This coverage is optional but can be beneficial if you want to protect yourself financially in case of an accident.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as:

- Theft

- Vandalism

- Natural disasters (e.g., hail, floods, earthquakes)

- Fire

- Animal collisions

If your vehicle is damaged by any of these events, comprehensive coverage can help pay for repairs or replacement costs.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

UM/UIM coverage can help pay for:

- Medical expenses

- Lost wages

- Pain and suffering

- Property damage

This coverage is essential in Washington state, where there are a significant number of uninsured drivers.

Personal Injury Protection (PIP)

PIP coverage, also known as “no-fault” insurance, helps cover your medical expenses and lost wages after an accident, regardless of who is at fault.

It is required in Washington state and typically covers:

- Medical expenses, including ambulance, hospital, and doctor visits

- Lost wages

- Death benefits

PIP coverage can help ensure you have access to necessary medical care and financial support after an accident, regardless of who is responsible.

Factors Influencing Insurance Premiums

Your car insurance premium in Washington state is determined by a variety of factors. These factors are used to assess your risk as a driver and help insurance companies determine how much to charge you for coverage.

Driving History

Your driving history is a significant factor in determining your car insurance premiums. Insurance companies use this information to evaluate your risk as a driver. A clean driving record with no accidents or traffic violations will generally result in lower premiums. However, if you have a history of accidents, speeding tickets, or other driving offenses, your premiums will likely be higher.

Age

Your age is another crucial factor in determining your car insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This increased risk is reflected in higher premiums for young drivers. As you get older, your premiums typically decrease because you are considered a lower risk.

Vehicle Type

The type of vehicle you drive also plays a role in determining your insurance premiums. Cars that are considered more expensive to repair or replace, such as luxury vehicles or sports cars, will typically have higher premiums. Additionally, vehicles with safety features, such as anti-theft devices or airbags, may qualify for discounts.

Location

Your location can also impact your car insurance premiums. Insurance companies consider the risk of accidents and theft in different areas. Areas with higher crime rates or more traffic congestion may have higher premiums.

Other Factors

In addition to these key factors, several other factors can influence your car insurance premiums. These include:

- Credit Score: Your credit score can be used to assess your financial responsibility, and a higher credit score may result in lower premiums.

- Marital Status: Married drivers often have lower premiums than single drivers, as they are statistically less likely to be involved in accidents.

- Gender: In some states, gender can be a factor in determining premiums. However, this is not always the case in Washington state.

- Driving Habits: Your driving habits, such as how many miles you drive annually, can also impact your premiums.

- Insurance History: Your previous insurance history, including claims and lapses in coverage, can also be considered.

Tips for Lowering Car Insurance Premiums

There are several ways to lower your car insurance premiums in Washington state:

- Maintain a Clean Driving Record: Avoid accidents and traffic violations, as these can significantly increase your premiums.

- Consider a Higher Deductible: A higher deductible means you will pay more out of pocket if you have an accident, but it can lower your premiums.

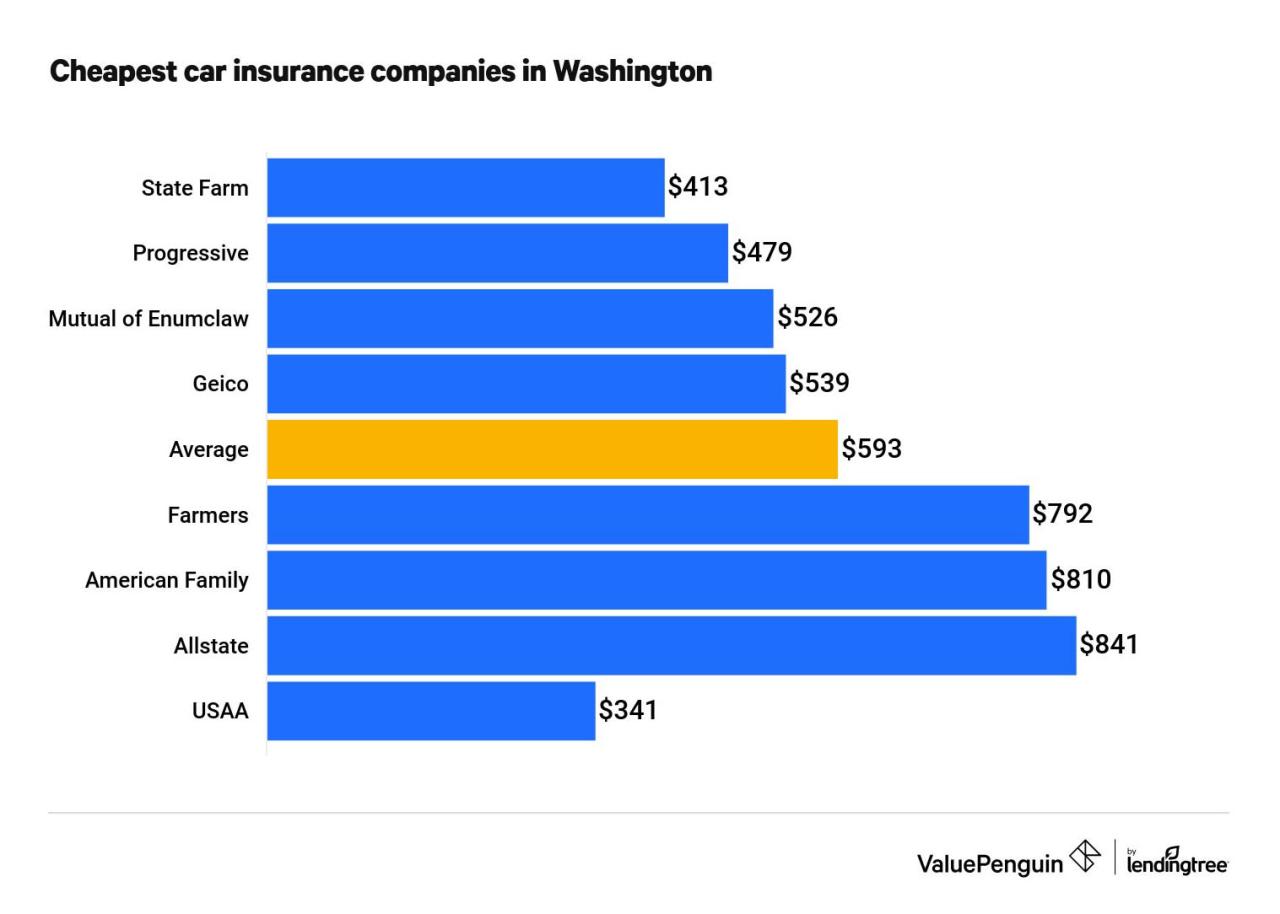

- Shop Around for Quotes: Compare quotes from different insurance companies to find the best rates.

- Take Defensive Driving Courses: Completing a defensive driving course can demonstrate your commitment to safe driving and may qualify you for discounts.

- Bundle Your Policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often result in discounts.

- Ask About Discounts: Inquire about available discounts, such as those for good students, safe drivers, or vehicle safety features.

Finding the Right Car Insurance Policy

Navigating the world of car insurance in Washington State can feel overwhelming, especially with the numerous providers and policy options available. However, with a systematic approach and careful consideration of your needs, you can find a policy that offers the right coverage at a competitive price.

Step-by-Step Guide to Finding the Best Car Insurance Policy

This section will Artikel a step-by-step guide to help you find the best car insurance policy in Washington state.

- Assess Your Needs: Start by considering your individual needs and circumstances.

- What type of car do you drive?

- How often do you drive?

- What is your driving history?

- Do you have any assets you need to protect?

- Gather Quotes: Once you understand your needs, you can start gathering quotes from different insurance providers.

- Utilize online comparison websites to quickly compare quotes from multiple insurers.

- Contact insurance agents directly for personalized quotes.

- Make sure you are comparing quotes for the same coverage levels.

- Compare Quotes: Carefully review the quotes you receive and compare factors such as:

- Premium costs

- Coverage levels

- Deductibles

- Customer service ratings

- Financial stability of the insurer

- Negotiate and Choose: Once you have identified a few promising options, consider negotiating with the insurers to see if you can secure a better rate.

- Ask about discounts for safe driving, bundling policies, or paying your premium in full.

- Read the policy documents carefully before making a final decision.

Tips for Comparing Quotes

This section will provide tips to help you effectively compare quotes from different insurance providers.

- Use online comparison tools: These tools allow you to enter your information once and receive quotes from multiple insurers, making the process more efficient.

- Be consistent with your information: Ensure you provide the same information to each insurer to ensure an accurate comparison.

- Compare coverage levels: Don’t just focus on the price; make sure you are comparing quotes for the same coverage levels.

- Consider deductibles: A higher deductible will typically result in a lower premium, but you will have to pay more out of pocket in the event of an accident.

- Check customer service ratings: Look at independent reviews and ratings to gauge the insurer’s reputation for customer service.

Essential Factors to Consider When Choosing a Policy, Do you need car insurance in washington state

This section will provide a checklist of essential factors to consider when choosing a car insurance policy.

- Coverage Levels:

- Liability coverage: This is required in Washington state and covers damages to other people and property if you are at fault in an accident.

- Collision coverage: This covers damage to your own vehicle in an accident, regardless of fault.

- Comprehensive coverage: This covers damage to your vehicle from events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: This protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages.

- Medical payments coverage: This covers medical expenses for you and your passengers in an accident, regardless of fault.

- Deductibles: This is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium.

- Premium Costs: Consider the total cost of the premium, including any discounts or surcharges.

- Customer Service: Look for an insurer with a good reputation for customer service and claims handling.

- Financial Stability: Choose an insurer that is financially sound and has a strong track record of paying claims.

Understanding Your Policy

Your car insurance policy is a legal document that Artikels the terms of your agreement with your insurance company. It’s important to understand the key sections and terms within it to ensure you have the coverage you need and know how to file a claim if necessary.

Key Sections and Terms

The standard car insurance policy in Washington state includes various sections that detail your coverage, responsibilities, and procedures. Here’s a breakdown of some of the key sections:

- Declarations Page: This page summarizes your policy details, including your name, address, policy number, vehicle information, coverage types, and premium amounts.

- Coverages: This section Artikels the specific types of insurance you’ve purchased, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. It also defines the limits and conditions for each coverage.

- Exclusions: This section details the circumstances and situations where your insurance coverage doesn’t apply. For instance, your policy may exclude coverage for damage caused by wear and tear or intentional acts.

- Duties and Responsibilities: This section Artikels your responsibilities as the insured, including reporting accidents promptly, cooperating with the insurance company’s investigations, and maintaining accurate information.

- Claims Process: This section details the steps involved in filing a claim, including the necessary documentation, deadlines, and procedures for reporting an accident or incident.

Filing a Claim

When you need to file a claim, it’s crucial to understand the steps involved and follow the procedures Artikeld in your policy. Here’s a general overview of the claims process:

- Report the Incident: Contact your insurance company immediately after an accident or incident. Provide them with the necessary details, including the date, time, location, and any injuries or damage involved.

- File a Claim: Complete the necessary claim forms and provide any supporting documentation, such as police reports, medical records, or repair estimates.

- Investigation: Your insurance company will investigate the claim to verify the details and assess the extent of damage or losses.

- Settlement: Once the investigation is complete, your insurance company will determine the settlement amount based on your policy coverage and the extent of the losses.

- Payment: You’ll receive payment for your claim according to the agreed-upon settlement terms.

Deductibles and Coverage Limits

Understanding deductibles and coverage limits is essential to ensure you have adequate protection.

- Deductible: This is the amount you’re responsible for paying out-of-pocket before your insurance coverage kicks in. For example, if you have a $500 deductible for collision coverage and your car sustains $2,000 in damage, you’ll pay $500, and your insurance will cover the remaining $1,500.

- Coverage Limit: This is the maximum amount your insurance company will pay for a covered loss. For instance, if you have a $100,000 liability coverage limit and you cause an accident resulting in $150,000 in damages, your insurance company will pay $100,000, and you’ll be responsible for the remaining $50,000.

Final Review

Navigating the world of car insurance in Washington state can seem daunting, but by understanding the legal requirements, exploring different coverage options, and considering factors influencing premiums, you can make informed choices that protect you and your loved ones. Remember, driving without insurance in Washington state carries significant consequences, so ensuring you have adequate coverage is essential.

Top FAQs

How much liability insurance is required in Washington state?

Washington state mandates a minimum of $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage.

What happens if I get into an accident without car insurance?

Driving without insurance in Washington state can result in fines, license suspension, and even jail time. You could also be held personally liable for any damages or injuries caused.

How can I lower my car insurance premiums?

There are several ways to reduce your premiums, such as maintaining a clean driving record, taking defensive driving courses, bundling your insurance policies, and choosing a higher deductible.