Do you have to have car insurance in Washington state? The answer is a resounding yes. Driving without insurance in Washington state is not only illegal, but it can also result in hefty fines, license suspension, and even jail time. The state’s insurance laws are designed to protect drivers and pedestrians from the financial burden of accidents, ensuring that those who are at fault are held accountable.

This guide will delve into the specifics of Washington state’s car insurance requirements, outlining the minimum coverage mandated by law, the penalties for non-compliance, and the various types of insurance available. We’ll also discuss who needs car insurance, how to obtain it, and the importance of maintaining adequate coverage.

Washington State’s Insurance Requirements: Do You Have To Have Car Insurance In Washington State

In Washington State, driving without car insurance is against the law. This means that every driver is required to have a minimum amount of car insurance coverage to be legally allowed to operate a vehicle.

Penalties for Driving Without Insurance

Driving without insurance in Washington State can result in serious consequences. The penalties can include:

- Fines: A driver without insurance may be fined up to $1,000.

- License Suspension: The driver’s license may be suspended for up to 90 days.

- Vehicle Impoundment: The vehicle may be impounded, and the driver may be required to pay fees to have it released.

- Increased Insurance Rates: After a driver is caught driving without insurance, they may face much higher insurance premiums.

Minimum Insurance Coverage Requirements

Washington State requires all drivers to have the following minimum insurance coverage:

- Liability Coverage: This covers damages to other people and their property in the event of an accident that is your fault.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages to the other party involved in an accident. The minimum requirement is $25,000 per person and $50,000 per accident.

- Property Damage Liability: This coverage pays for damages to the other party’s vehicle or property. The minimum requirement is $10,000.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages. The minimum requirement is $25,000 per person and $50,000 per accident.

Types of Car Insurance Available, Do you have to have car insurance in washington state

Washington State offers various types of car insurance that drivers can choose from to meet their needs and budget.

- Collision Coverage: This coverage pays for damages to your vehicle in the event of an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage pays for damages to your vehicle caused by events other than an accident, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses and lost wages, regardless of who is at fault in an accident.

- Rental Car Coverage: This coverage pays for the cost of a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: This coverage provides help with services such as towing, flat tire changes, and jump starts.

Who Needs Car Insurance in Washington State?

In Washington State, the requirement for car insurance applies to a wide range of individuals and entities. It’s essential to understand the specific categories and exceptions to ensure compliance with the law.

Individuals and Entities Required to Have Car Insurance

Washington State law mandates that all vehicle owners must have car insurance. This includes individuals, businesses, and other organizations that own or operate vehicles within the state.

Exceptions to the Insurance Requirement

While most vehicle owners must have car insurance, certain exceptions exist. For example, vehicles that are:

- Registered as historical vehicles and used for display purposes only

- Used solely on private property

- Used for agricultural purposes and not driven on public roads

Insurance Requirements for Different Vehicle Types

The specific insurance requirements can vary depending on the type of vehicle.

- Personal Vehicles: Owners of personal vehicles must have liability insurance, which covers damage or injuries caused to others in an accident. They may also choose to purchase additional coverage, such as collision or comprehensive insurance, to protect their own vehicle.

- Commercial Vehicles: Commercial vehicles, such as trucks, vans, and buses, typically require higher insurance limits than personal vehicles. They must have liability insurance, as well as coverage for cargo, accidents, and other potential risks associated with their commercial use.

Insurance Requirements for Out-of-State Drivers

Out-of-state drivers who operate vehicles in Washington State must comply with the state’s insurance requirements. They must have at least the minimum liability coverage required for Washington residents, even if their home state has different requirements.

Understanding Insurance Coverage

In Washington State, understanding your car insurance policy is crucial to ensure you’re adequately protected in case of an accident or other unforeseen events. Your policy Artikels the coverage you have, the limits of that coverage, and any exclusions that may apply.

Key Elements of a Standard Car Insurance Policy

A standard car insurance policy in Washington State typically includes several key elements:

- Policy Declarations: This section provides basic information about the policy, such as the insured’s name, address, vehicle details, policy period, and premium amount.

- Coverage Details: This section Artikels the specific types of coverage included in the policy and the limits of each coverage.

- Exclusions and Limitations: This section specifies situations or circumstances where coverage may not apply.

- Conditions: This section Artikels the responsibilities of both the insurer and the insured, such as the duty to cooperate in claims investigations and the requirement to notify the insurer of any changes in information.

Coverage Types

Car insurance policies in Washington State typically include several types of coverage:

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or damage to another person’s property. Liability coverage is divided into two parts:

- Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for injuries caused to others.

- Property Damage Liability: Covers damages to another person’s vehicle or property.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged by something other than an accident, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient insurance to cover your losses.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, pays for your medical expenses and lost wages, regardless of who is at fault in an accident.

Exclusions and Limitations

It’s important to understand that insurance policies often have exclusions and limitations. These can include:

- Certain types of vehicles: Coverage may be limited or excluded for vehicles used for commercial purposes, modified vehicles, or vehicles used for racing.

- Certain types of accidents: Coverage may be excluded for accidents that occur while driving under the influence of alcohol or drugs, or while participating in illegal activities.

- Certain types of damage: Coverage may be excluded for damage caused by wear and tear, mechanical breakdowns, or acts of God.

- Deductibles: You’ll typically have to pay a deductible, which is a fixed amount, before your insurance coverage kicks in.

- Coverage limits: The amount of coverage you have is limited to a specific dollar amount.

Understanding Policy Terms and Conditions

Reading and understanding your insurance policy is essential. It’s crucial to know the details of your coverage, including the limits, exclusions, and conditions. If you have any questions about your policy, don’t hesitate to contact your insurance agent or company.

Obtaining Car Insurance in Washington State

Securing car insurance in Washington State is a straightforward process that involves several steps. You can choose from various insurance providers, each offering different coverage options and prices.

Steps to Obtain Car Insurance

To obtain car insurance in Washington State, follow these steps:

- Gather your information: Before contacting insurance providers, gather essential information, including your driving history, vehicle details, and personal information.

- Get quotes from multiple providers: Contact several insurance companies to obtain quotes for car insurance. This allows you to compare prices, coverage options, and customer service.

- Choose a provider and policy: Once you’ve compared quotes, select the insurance provider and policy that best suits your needs and budget.

- Pay your premium: After selecting a policy, you’ll need to pay your premium. This can be done online, by phone, or in person.

- Receive your insurance card: Your insurance provider will issue you an insurance card, which you must keep in your vehicle at all times.

Reputable Insurance Providers in Washington State

Washington State has a wide range of reputable insurance providers. Some of the well-known companies operating in the state include:

- State Farm

- Geico

- Progressive

- Allstate

- Farmers Insurance

- USAA

- Liberty Mutual

Factors Influencing Insurance Premiums

Various factors can influence your car insurance premiums in Washington State. These factors include:

- Age: Younger drivers typically pay higher premiums due to their higher risk of accidents.

- Driving record: Drivers with a clean driving record, without accidents or traffic violations, generally receive lower premiums.

- Vehicle type: The make, model, and year of your vehicle can influence your insurance premium. For example, luxury or high-performance vehicles often have higher premiums.

- Location: Your location, specifically the zip code, can affect your premium. Areas with higher accident rates tend to have higher insurance costs.

- Coverage options: The type and amount of coverage you choose will also influence your premium. Higher coverage levels typically result in higher premiums.

Comparing Insurance Providers

Here’s a table comparing some popular insurance providers in Washington State based on coverage, cost, and customer service:

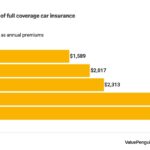

| Provider | Coverage Options | Cost (Average Annual Premium) | Customer Service Rating |

|---|---|---|---|

| State Farm | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | $1,200 | 4.5/5 |

| Geico | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | $1,050 | 4/5 |

| Progressive | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | $1,100 | 4/5 |

| Allstate | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | $1,250 | 4/5 |

Maintaining Car Insurance

In Washington State, maintaining car insurance is crucial for ensuring you’re protected in case of an accident and complying with state laws. This involves understanding how to renew your policy, keeping your information updated, and knowing how to navigate claims and disputes with your insurance provider.

Renewing Car Insurance

Renewing your car insurance policy in Washington State is a straightforward process. Your insurance company will typically send you a renewal notice a few weeks before your policy expires. You can then renew your policy online, over the phone, or in person at your insurance agent’s office. To renew your policy, you’ll need to provide your insurance company with your current contact information and payment details.

Keeping Insurance Information Up-to-Date

Keeping your insurance information up-to-date is crucial for ensuring you’re properly covered and avoiding any potential issues. This includes informing your insurance company about any changes to your:

- Address

- Contact information (phone number, email)

- Vehicle ownership

- Driving record

Failure to update your information could lead to delays in claims processing or even policy cancellation.

Finding Affordable Car Insurance

Finding affordable car insurance in Washington State requires some research and comparison. Here are some tips to help you find the best rates:

- Shop around: Get quotes from multiple insurance companies to compare prices and coverage options.

- Consider your driving history: A clean driving record can significantly reduce your premiums.

- Explore discounts: Many insurance companies offer discounts for things like safe driving, good student status, and bundling multiple insurance policies.

- Increase your deductible: A higher deductible can lower your monthly premium, but you’ll pay more out of pocket if you need to file a claim.

- Compare coverage options: Different insurance companies offer varying levels of coverage. Choose the option that best suits your needs and budget.

Filing a Claim and Resolving Disputes

If you need to file a claim with your insurance company, you’ll need to provide them with all the necessary information, such as the date and time of the accident, the location, and the other parties involved. You should also keep detailed records of all communication with your insurance company, including any claim numbers, dates, and times.

In case of a dispute with your insurance provider, you have several options:

- Contact your insurance company’s customer service department: Explain the issue and attempt to resolve it amicably.

- File a complaint with the Washington State Office of the Insurance Commissioner: This office can help investigate your complaint and mediate a resolution.

- Seek legal advice: If you’re unable to resolve the dispute through other means, you may need to consult with an attorney.

Conclusive Thoughts

Driving in Washington state without proper car insurance is a risky proposition. Understanding the state’s insurance laws and ensuring you have the right coverage is crucial for responsible driving. By following the guidelines Artikeld in this guide, you can navigate the complexities of car insurance in Washington state with confidence, knowing you are protected in the event of an accident.

Clarifying Questions

What happens if I get into an accident without car insurance?

If you are involved in an accident without car insurance, you could be held liable for all damages and injuries, even if the accident wasn’t your fault. This could result in significant financial hardship.

Can I get car insurance if I have a bad driving record?

Yes, but it might be more expensive. Insurance companies consider driving history when calculating premiums, so a poor driving record could lead to higher rates. However, there are options available, such as seeking out specialized insurance providers for high-risk drivers.

What if I only drive my car occasionally?

Even if you don’t drive frequently, it’s still important to have car insurance in Washington state. The state’s insurance laws apply to all registered vehicles, regardless of usage.