Did car insurance go up in Washington State? The answer, unfortunately, is likely yes. Over the past year, car insurance rates in Washington State have seen a significant increase, leaving many drivers wondering why and what they can do about it. Several factors contribute to this trend, including rising costs for healthcare, repair materials, and even a rise in the number of accidents on the road.

Understanding the reasons behind these increases is crucial for drivers in Washington State. Factors like traffic accidents, driving history, age, and location all play a role in determining your car insurance premiums. Knowing how these factors influence your rates can help you make informed decisions about your coverage and potentially save money.

Recent Car Insurance Rate Trends in Washington State

Car insurance rates in Washington State have been on the rise in recent years, mirroring a national trend. Understanding the factors driving these increases is crucial for drivers in the state.

Average Car Insurance Rate Increases in Washington State

The average car insurance rate in Washington State increased by 5.2% in 2022, according to the National Association of Insurance Commissioners (NAIC). This increase is slightly higher than the national average of 4.8%.

Factors Contributing to Rate Increases

Several factors contribute to the rising cost of car insurance in Washington State:

- Inflation: The rising cost of vehicle repairs, medical care, and other expenses associated with car accidents has directly impacted insurance premiums.

- Increased Claims Costs: The number and severity of car accidents have increased in recent years, leading to higher claims costs for insurance companies. This, in turn, necessitates higher premiums to cover these expenses.

- Supply Chain Disruptions: The global supply chain disruptions caused by the COVID-19 pandemic have led to shortages of car parts and increased repair costs. This has contributed to higher insurance premiums as insurers face higher claim payouts.

- Rising Gas Prices: Higher gas prices have encouraged more people to drive, leading to increased traffic congestion and accidents, which can drive up insurance rates.

Average Rate Increases by Vehicle Type

The average car insurance rate increases vary depending on the type of vehicle:

- Sedans: The average rate increase for sedans in Washington State was 4.9% in 2022.

- SUVs: SUVs saw an average rate increase of 5.8% in 2022, slightly higher than sedans.

- Trucks: Trucks experienced the highest average rate increase at 6.2% in 2022, likely due to their higher repair costs and increased risk of accidents.

Factors Influencing Car Insurance Costs in Washington State

Several factors influence car insurance costs in Washington State, making it crucial for drivers to understand these elements to make informed decisions about their coverage. This understanding can help individuals optimize their premiums and ensure adequate protection.

Impact of Traffic Accidents and Accident Severity

The frequency and severity of traffic accidents significantly influence car insurance rates. When accidents are more common in a particular area, insurance companies anticipate higher claims payouts, leading to increased premiums for drivers in those regions. Additionally, the severity of accidents plays a crucial role. More severe accidents, resulting in higher repair costs or injuries, lead to greater financial burdens for insurance companies, ultimately reflected in higher premiums.

Role of Demographics in Premium Determination

Demographics play a significant role in determining car insurance premiums.

Age

Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This increased risk translates into higher premiums for young drivers. As drivers age and gain experience, their premiums tend to decrease.

Driving History

Drivers with a clean driving record, free of accidents or traffic violations, are considered lower risk and enjoy lower premiums. Conversely, drivers with a history of accidents or violations face higher premiums as they are deemed more likely to be involved in future incidents.

Location

The location where a driver resides also influences their insurance costs. Areas with higher crime rates, traffic congestion, and a greater density of vehicles often experience more accidents, leading to higher premiums for drivers in those locations.

Impact of Different Insurance Coverage Options

The type and amount of insurance coverage chosen directly impact the overall cost of car insurance.

Liability Coverage

Liability coverage protects drivers financially in the event of an accident where they are at fault. Higher liability limits, providing greater financial protection, result in higher premiums.

Collision and Comprehensive Coverage

Collision coverage covers damage to your vehicle in an accident, regardless of fault. Comprehensive coverage protects against non-collision damage, such as theft, vandalism, or natural disasters. These coverage options are optional, but opting for them increases the overall cost of insurance.

Deductible

The deductible is the amount a driver pays out of pocket before their insurance coverage kicks in. A higher deductible generally results in lower premiums, as the driver assumes more financial responsibility. Conversely, a lower deductible leads to higher premiums.

Understanding Car Insurance Rate Regulation in Washington State

Washington State, like other states, has a regulatory framework in place to ensure fair and transparent pricing of car insurance. This framework aims to protect consumers from excessive premiums while ensuring that insurance companies remain financially stable to meet their obligations.

Regulatory Bodies and their Roles, Did car insurance go up in washington state

The Washington State Office of the Insurance Commissioner (OIC) is the primary regulatory body responsible for overseeing car insurance rates. The OIC has a wide range of responsibilities, including:

- Setting guidelines for rate-setting practices, ensuring that insurance companies use sound actuarial methods to calculate premiums.

- Reviewing and approving insurance rate filings submitted by companies, ensuring that rates are justified based on risk factors and operating costs.

- Investigating complaints from consumers regarding insurance rates and practices.

- Educating consumers about their rights and responsibilities related to car insurance.

In addition to the OIC, the Washington State Legislature also plays a role in shaping car insurance regulations. The Legislature has the authority to pass laws that impact the insurance industry, such as setting minimum coverage requirements or creating consumer protection measures.

Key Regulations and Guidelines

The OIC has established several regulations and guidelines that govern car insurance rate setting practices in Washington State. These include:

- Rate Filing Requirements: Insurance companies must file their proposed rates with the OIC for review and approval. The filings must include detailed information about the company’s financial condition, pricing methodology, and supporting actuarial data.

- Risk Classification: Insurance companies can use various factors to classify drivers and determine their risk levels. These factors include age, driving history, vehicle type, and geographic location. However, the OIC prohibits the use of discriminatory factors, such as race, gender, or marital status.

- Rate Review and Approval: The OIC reviews rate filings to ensure that they are justified based on the company’s operating costs and risk factors. The OIC may approve, modify, or reject rate filings based on its assessment.

- Consumer Protection Measures: The OIC has implemented various consumer protection measures to safeguard policyholders from unfair or deceptive practices. These measures include requiring insurance companies to provide clear and concise policy information, offering discounts for safe driving habits, and providing access to dispute resolution mechanisms.

Impact of Regulations on Affordability and Accessibility

The regulatory framework in Washington State aims to balance the interests of insurance companies and consumers by ensuring fair and transparent pricing practices.

- Affordability: By setting guidelines for rate-setting practices and reviewing rate filings, the OIC helps to prevent excessive premiums and make car insurance more affordable for residents. The regulations also promote competition among insurance companies, which can drive down prices.

- Accessibility: The OIC’s consumer protection measures help to ensure that all residents have access to affordable and adequate car insurance. The regulations prohibit discriminatory practices and promote transparency, which can make it easier for consumers to compare rates and find the best coverage for their needs.

Tips for Saving on Car Insurance in Washington State

Car insurance costs can be a significant expense, especially in Washington State where rates are relatively high. Fortunately, there are several strategies you can employ to lower your premiums and save money. By understanding your options and taking proactive steps, you can find a policy that fits your budget and provides the necessary coverage.

Discounts

Taking advantage of discounts offered by insurance companies can significantly reduce your car insurance premiums. These discounts are often available for a variety of factors, such as good driving records, safety features in your car, and bundling insurance policies.

- Good Driver Discount: Maintaining a clean driving record with no accidents or violations can qualify you for a substantial discount. Insurance companies reward drivers who demonstrate safe driving habits.

- Safe Vehicle Discount: Cars equipped with advanced safety features, such as anti-theft systems, airbags, and anti-lock brakes, are generally considered safer and may qualify for discounts.

- Multi-Policy Discount: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often lead to significant savings.

- Payment Discount: Paying your premium in full or opting for automatic payments can often result in a discount.

- Student Discount: If you are a good student with a high GPA, you may qualify for a discount. This discount typically applies to young drivers who are considered responsible.

- Military Discount: Active military personnel or veterans may be eligible for discounts. Check with individual insurance companies for specific requirements.

- Loyalty Discount: Many insurance companies offer discounts to long-term customers who have maintained a good driving record and have been with the company for a certain period.

Improving Driving Habits

Adopting safe driving habits can not only reduce your risk of accidents but also lower your car insurance premiums. Insurance companies often reward drivers who demonstrate responsible behavior on the road.

- Defensive Driving Courses: Completing a defensive driving course can often lead to a discount. These courses teach safe driving techniques and help you become a more aware and responsible driver.

- Avoiding Distractions: Distracted driving is a major cause of accidents. Avoid using your phone, eating, or engaging in other activities that take your attention away from the road.

- Maintaining a Safe Speed: Speeding is a major factor in accidents. Always adhere to posted speed limits and adjust your speed based on road conditions.

- Avoiding Aggressive Driving: Aggressive driving, such as tailgating, weaving in and out of traffic, and speeding, increases your risk of accidents. Drive calmly and courteously.

- Regular Vehicle Maintenance: Ensure your vehicle is properly maintained with regular oil changes, tire rotations, and brake inspections. This can help prevent breakdowns and accidents.

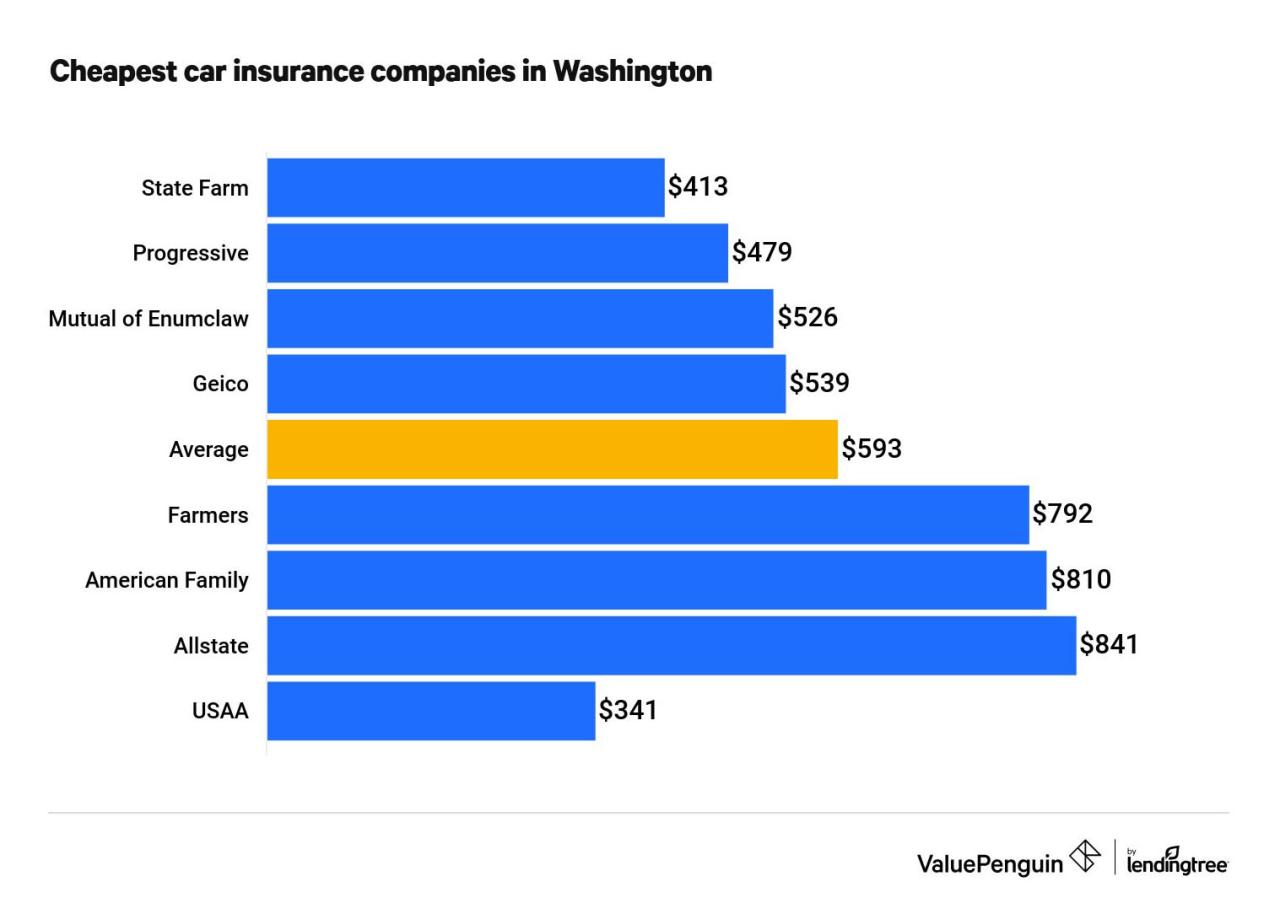

Car Insurance Providers in Washington State

Comparing quotes from different insurance companies is crucial to finding the best rates and coverage options. Here is a list of some major car insurance providers in Washington State, along with their general coverage options and rates:

| Insurance Company | Coverage Options | Rates |

|---|---|---|

| State Farm | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | Competitive rates, often offering discounts for good drivers and safe vehicles |

| Geico | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | Known for affordable rates and a user-friendly online experience |

| Progressive | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | Offers a wide range of coverage options and personalized discounts |

| Allstate | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | Provides comprehensive coverage and a strong customer service reputation |

| Farmers Insurance | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | Known for its personalized service and local agents |

It’s important to note that rates can vary significantly based on individual factors, such as your driving record, age, location, and vehicle type. It’s highly recommended to obtain quotes from multiple insurers and compare them side-by-side to find the best value for your specific needs.

Last Recap: Did Car Insurance Go Up In Washington State

While car insurance costs may seem like an unavoidable expense, there are steps you can take to mitigate the impact. By understanding the factors that influence your rates and taking advantage of available discounts, you can potentially lower your premiums. It’s also important to stay informed about car insurance regulations in Washington State, as they can impact your options and choices. Ultimately, being a proactive and informed driver can help you navigate the complex world of car insurance and find the best coverage for your needs at a price that fits your budget.

Commonly Asked Questions

How much did car insurance rates increase in Washington State?

The average car insurance rate increase in Washington State over the past year has been around 5%, though this can vary depending on individual factors.

What are some common discounts available for car insurance in Washington State?

Common discounts include safe driving discounts, good student discounts, multi-car discounts, and bundling discounts for home and auto insurance.

What are some tips for improving my driving habits and reducing risk factors?

Consider taking a defensive driving course, maintaining a safe driving record, and avoiding distractions while driving.