Delaware State Minimum Auto Insurance is a crucial aspect of driving in the state, ensuring financial protection in case of accidents. Understanding the requirements and implications of this law is essential for all Delaware drivers. This guide will provide a comprehensive overview of Delaware’s minimum auto insurance requirements, outlining the different coverage types, factors influencing premiums, and practical tips for finding affordable insurance.

Navigating the world of auto insurance can be overwhelming, but understanding the fundamentals of Delaware’s minimum requirements can help you make informed decisions. This guide will provide clarity on the legal obligations, coverage options, and strategies for finding the best insurance plan for your needs.

Delaware Minimum Auto Insurance Requirements

Driving a car in Delaware is a privilege that comes with responsibilities. One of the most important is having adequate auto insurance to protect yourself and others in case of an accident. The state of Delaware has specific minimum auto insurance requirements that all drivers must meet.

Minimum Coverage Amounts

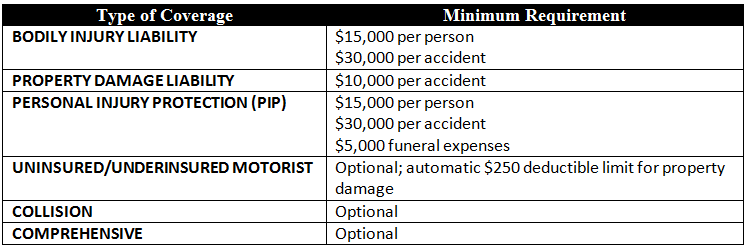

Delaware requires all drivers to carry the following minimum auto insurance coverages:

- Liability Coverage: This covers damages you cause to other people’s property or injuries you cause to other people in an accident. Delaware requires a minimum of $30,000 for bodily injury liability per person, $60,000 for bodily injury liability per accident, and $10,000 for property damage liability per accident. This means that if you cause an accident that results in injuries to three people, your insurance would cover up to $30,000 per person for a total of $90,000, and up to $10,000 for property damage.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses and lost wages if you are injured in an accident, regardless of who is at fault. Delaware requires a minimum of $15,000 in PIP coverage.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. Delaware requires a minimum of $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $10,000 for property damage.

Exceptions and Exemptions

While most drivers in Delaware must comply with the minimum insurance requirements, there are some exceptions and exemptions.

- Antique Vehicles: Vehicles classified as antique vehicles and used for display or occasional use may be exempt from certain insurance requirements.

- Non-Operational Vehicles: Vehicles that are not operational, such as those undergoing repairs or being stored, may be exempt from some insurance requirements.

- Government-Owned Vehicles: Vehicles owned by the state of Delaware or federal government may have different insurance requirements.

Understanding Delaware’s Financial Responsibility Law

Delaware’s Financial Responsibility Law is a crucial aspect of driving in the state. It ensures that drivers have the financial means to cover the costs of any accidents they might cause, protecting both themselves and others on the road. This law is directly linked to the state’s minimum auto insurance requirements, as it Artikels the specific coverage amounts drivers must maintain.

Consequences of Driving Without Insurance

Driving without the required insurance coverage in Delaware can have severe consequences. The state takes a strict approach to ensure compliance with its Financial Responsibility Law. Here’s a breakdown of the potential consequences:

- Fines and Penalties: Driving without insurance in Delaware can result in substantial fines. The exact amount can vary depending on the circumstances but can range from hundreds to thousands of dollars. These fines can be a significant financial burden, especially if you are already struggling to make ends meet.

- License Suspension: If you are caught driving without insurance, your driver’s license can be suspended. This suspension can last for a period of time, ranging from a few months to even years, depending on the severity of the offense. This means you will not be able to legally drive any vehicle until your license is reinstated.

- Vehicle Impoundment: Your vehicle can be impounded if you are caught driving without insurance. This means your car will be taken away and you will need to pay a fee to have it released. The impoundment fee can be significant, adding to the financial burden of driving without insurance.

- Court Appearance: In some cases, you may be required to appear in court to answer charges related to driving without insurance. This can be a stressful and time-consuming process. Additionally, you may face additional fines and penalties if you are found guilty of the offense.

- Difficulty Obtaining Insurance: Driving without insurance can make it challenging to obtain insurance in the future. Insurance companies may view you as a higher risk and charge you higher premiums or even refuse to insure you altogether. This can have a significant impact on your ability to drive legally and safely.

- Financial Responsibility: The most serious consequence of driving without insurance is the financial responsibility you face if you cause an accident. If you are at fault for an accident and do not have insurance, you will be personally liable for all damages, including medical bills, property damage, and lost wages. This can lead to significant financial hardship and even bankruptcy.

Types of Auto Insurance Coverage in Delaware

Delaware requires drivers to carry certain types of auto insurance, but there are other coverage options that can provide additional protection and peace of mind.

While the minimum requirements cover the basics, you may want to consider additional coverage to protect yourself financially in the event of an accident.

Collision Coverage

Collision coverage pays for damage to your vehicle if you are involved in an accident, regardless of who is at fault. It helps cover the cost of repairs or replacement of your vehicle, up to the actual cash value or the amount of your coverage, whichever is less. Collision coverage is not required by law in Delaware but can be beneficial if you have a financed or leased vehicle.

Comprehensive Coverage

Comprehensive coverage pays for damage to your vehicle caused by events other than an accident, such as theft, vandalism, fire, hail, or falling objects. This coverage helps protect your vehicle from unforeseen events and can be especially valuable if you live in an area prone to natural disasters. It is not mandatory in Delaware, but it is often included in auto insurance policies.

Medical Payments Coverage

Medical payments coverage, also known as MedPay, pays for medical expenses for you and your passengers, regardless of who is at fault in an accident. This coverage is often limited to a specific amount per person and per accident. MedPay can help cover expenses such as doctor’s visits, hospital stays, and ambulance fees. It is not mandatory in Delaware, but it can be a valuable addition to your auto insurance policy.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you are injured in an accident caused by a driver who is uninsured or underinsured. It can also provide coverage for damage to your vehicle. UM/UIM coverage is not required by law in Delaware, but it is highly recommended.

It is important to note that UM/UIM coverage only applies to accidents caused by drivers who are uninsured or underinsured. It does not cover accidents caused by a hit-and-run driver or a driver who is unable to pay for damages.

Factors Affecting Auto Insurance Premiums in Delaware

Understanding what influences your auto insurance premiums in Delaware is crucial for making informed decisions about your coverage. Several factors contribute to the cost of your policy, and knowing these factors can help you find ways to potentially lower your premiums.

Driving History

Your driving history plays a significant role in determining your auto insurance premiums. Insurance companies consider your driving record, including any accidents, violations, and traffic tickets. A clean driving record typically translates to lower premiums, while a history of accidents or violations can result in higher premiums.

Age

Age is another factor that influences auto insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This increased risk is reflected in higher premiums for young drivers. As drivers gain experience and age, their premiums tend to decrease.

Vehicle Type

The type of vehicle you drive is a key factor in determining your auto insurance premiums. Vehicles with higher safety ratings and advanced safety features, such as anti-lock brakes and airbags, are generally considered safer and may result in lower premiums. Conversely, vehicles with a history of accidents or thefts or those considered high-performance or luxury models can have higher premiums.

Location

Your location, specifically your zip code, can also impact your auto insurance premiums. Insurance companies analyze accident rates and crime statistics in different areas. Areas with higher accident rates or more vehicle thefts tend to have higher insurance premiums.

| Factor | Potential Impact on Premiums |

|---|---|

| Driving History (Accidents, Violations) | Higher premiums for a history of accidents or violations, lower premiums for a clean driving record. |

| Age (Under 25) | Higher premiums for younger drivers due to higher risk, lower premiums for older drivers with more experience. |

| Vehicle Type (Safety Features, Performance, Luxury) | Lower premiums for vehicles with high safety ratings and advanced safety features, higher premiums for high-performance or luxury vehicles. |

| Location (Accident Rates, Crime Statistics) | Higher premiums in areas with higher accident rates or crime, lower premiums in areas with lower accident rates and crime. |

Finding Affordable Auto Insurance in Delaware

Securing affordable auto insurance in Delaware is a priority for many drivers. With a little effort and understanding of the factors that influence premiums, you can find a policy that fits your budget and provides the necessary coverage.

Comparing Quotes from Multiple Insurers

Comparing quotes from multiple insurers is crucial for finding the best deal on auto insurance. This process involves requesting quotes from several companies and then comparing the rates and coverage options they offer. This allows you to identify the most competitive rates and choose the policy that best suits your needs.

- Use online comparison tools: Many websites, like Insurance.com and The Zebra, allow you to enter your information once and receive quotes from multiple insurers. These tools streamline the comparison process and save you time.

- Contact insurance agents directly: You can also contact insurance agents directly to obtain quotes. This gives you the opportunity to ask questions and discuss your specific needs with an expert.

- Utilize your existing insurance company: Don’t forget to contact your current insurer and inquire about any discounts or rate adjustments they may offer. They might have special deals or promotions available for existing customers.

Negotiating Your Auto Insurance Premium

Once you have gathered quotes from different insurers, you can start negotiating your premium.

- Highlight your good driving record: If you have a clean driving record, be sure to emphasize this when negotiating. A good driving history often translates into lower premiums.

- Explore discounts: Many insurers offer discounts for factors like safe driving courses, multiple car policies, or bundling auto and home insurance. Ask about available discounts and see if you qualify.

- Consider raising your deductible: A higher deductible means you pay more out of pocket in case of an accident, but it can lead to lower premiums. Evaluate your risk tolerance and determine if a higher deductible is suitable for your situation.

Other Strategies for Finding Affordable Auto Insurance, Delaware state minimum auto insurance

Besides comparing quotes and negotiating, other strategies can help you find affordable auto insurance in Delaware.

- Improve your credit score: Your credit score can influence your insurance premiums. Improving your credit score can potentially lead to lower rates.

- Choose a safe car: Certain car models are considered safer than others, which can result in lower insurance premiums. If you’re planning to purchase a new car, consider models with safety features and good safety ratings.

- Drive less: Reducing your mileage can impact your insurance premiums. If you drive less frequently, consider discussing this with your insurer to see if they offer discounts for lower mileage drivers.

Last Point

Ensuring you have the right Delaware State Minimum Auto Insurance coverage is crucial for protecting yourself and others on the road. By understanding the requirements, exploring different coverage options, and comparing quotes, you can find an affordable plan that meets your specific needs. Remember, driving without adequate insurance can lead to serious consequences, so prioritize your safety and financial security by following the law and securing appropriate coverage.

FAQ Overview: Delaware State Minimum Auto Insurance

What happens if I get into an accident without the required minimum insurance coverage?

You could face serious consequences, including fines, license suspension, and even jail time. Additionally, you may be held personally liable for any damages or injuries caused by the accident.

Can I get a discount on my auto insurance premium if I have a clean driving record?

Yes, many insurance companies offer discounts for drivers with a good driving history. You can often receive a lower premium if you haven’t been involved in any accidents or received any traffic violations.

What are the different types of auto insurance coverage available beyond the minimum requirements?

Beyond the minimum, you can choose additional coverage options like collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage, which can provide greater financial protection in various situations.