Cotton States Home Insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

The Cotton States, with their rich history and unique agricultural landscape, face a variety of risks that homeowners need to consider. From the threat of hurricanes and tornadoes to the potential for flooding and pest infestations, understanding the specific challenges of this region is crucial for securing adequate home insurance coverage.

Understanding the Cotton States

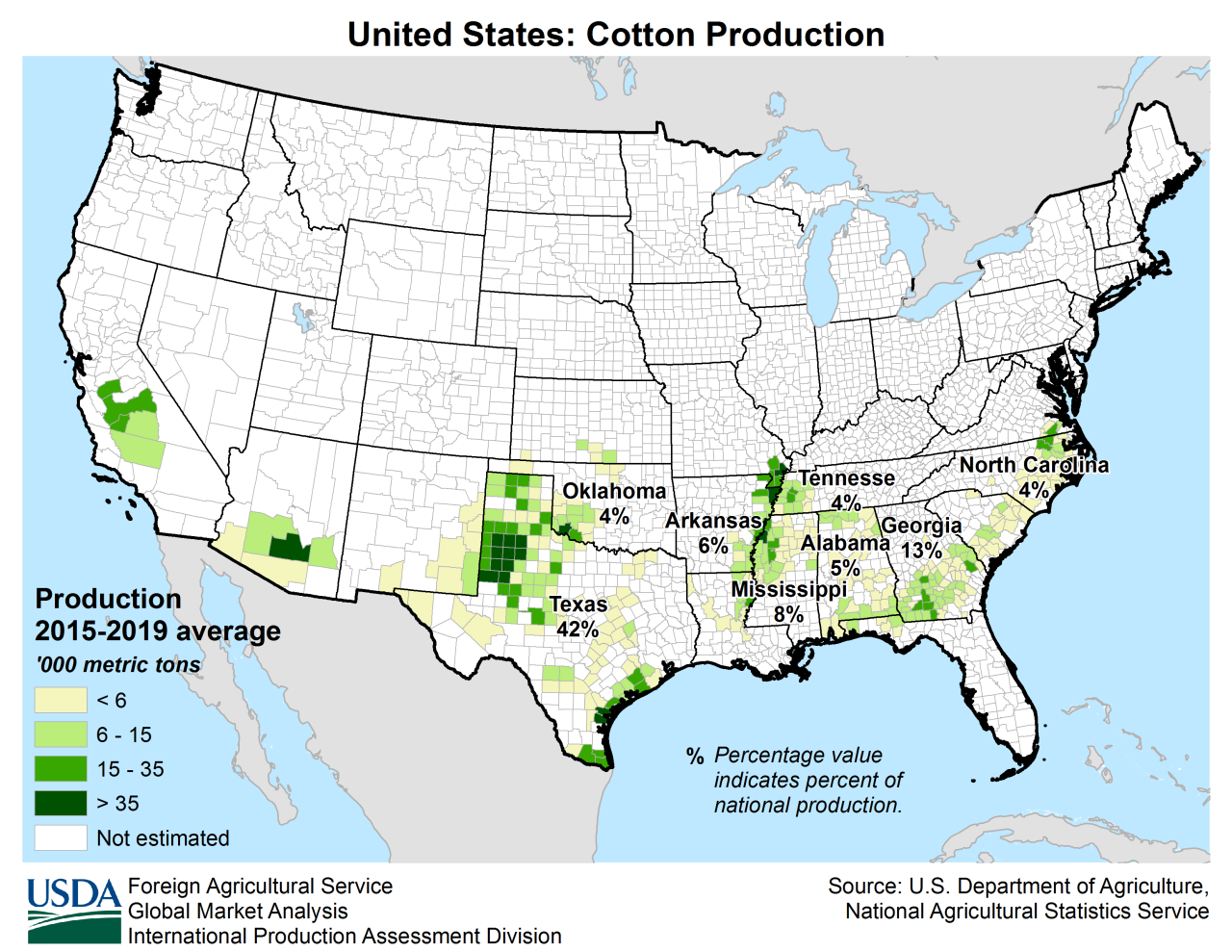

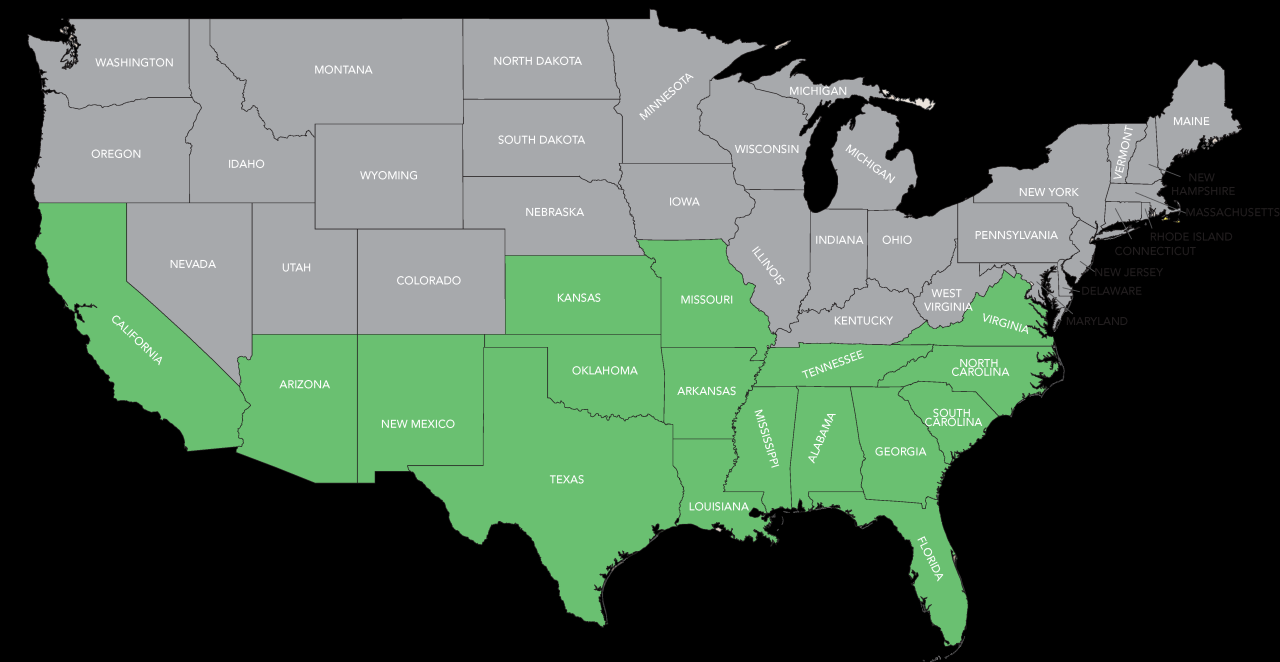

The Cotton States, also known as the Deep South, is a region in the southeastern United States historically associated with cotton production. This region encompasses a significant portion of the South, with its unique agricultural and economic characteristics shaping its history and present-day identity.

Geographic Scope

The Cotton States traditionally include the following states:

- Alabama

- Arkansas

- Florida

- Georgia

- Kentucky (parts of the state)

- Louisiana

- Mississippi

- Missouri (parts of the state)

- North Carolina

- South Carolina

- Tennessee

- Texas (parts of the state)

- Virginia (parts of the state)

This region is characterized by a warm, humid climate, fertile soil, and a long growing season, making it ideal for cotton cultivation.

Agricultural and Economic Characteristics

The Cotton States have historically been heavily reliant on agriculture, particularly cotton production. Cotton was the primary cash crop, driving the region’s economy and shaping its social structure.

- Cotton production has declined significantly in recent decades due to factors such as mechanization, competition from other agricultural sectors, and changes in global demand.

- Other agricultural products, such as soybeans, peanuts, and poultry, have become increasingly important in the region’s economy.

- The Cotton States have also witnessed economic diversification, with industries such as manufacturing, tourism, and healthcare playing a growing role.

Historical Significance of Cotton Production

Cotton production has been deeply intertwined with the history of the Cotton States.

- The development of the cotton gin in the late 18th century revolutionized cotton production, making it more efficient and profitable. This led to a surge in cotton cultivation and the expansion of plantation agriculture in the region.

- The reliance on slave labor to cultivate cotton played a significant role in the history of slavery in the United States. The economic importance of cotton fueled the expansion of slavery and shaped the social and political landscape of the region.

- The Civil War, in part, was fought over the issue of slavery and the economic dominance of cotton in the South. The defeat of the Confederacy and the abolition of slavery marked a turning point in the history of the Cotton States.

Home Insurance Needs in the Cotton States: Cotton States Home Insurance

Homeowners in the Cotton States face unique challenges due to their location and the specific weather patterns they experience. The region is known for its warm climate, but also for its susceptibility to severe weather events, which can cause significant damage to homes and property.

Weather Events and Their Impact

The Cotton States are particularly vulnerable to hurricanes, tornadoes, and hailstorms. These weather events can cause extensive damage to homes, including roof damage, broken windows, and flooding.

- Hurricanes: These powerful storms can bring high winds, heavy rain, and storm surges, leading to widespread property damage and even loss of life. Coastal areas are particularly vulnerable to hurricane damage.

- Tornadoes: These violent rotating columns of air can cause significant damage to homes, including roof damage, wall damage, and foundation damage.

- Hailstorms: Hailstones can cause significant damage to roofs, windows, and siding, leading to costly repairs.

Flooding and Agricultural Pests

Flooding is another major risk in the Cotton States. Heavy rainfall, overflowing rivers, and storm surges can cause flooding, damaging homes and property.

- Flooding: This can lead to damage to the foundation, walls, and electrical systems of homes, as well as contamination of belongings.

- Agricultural Pests: The Cotton States are home to a variety of agricultural pests, including termites, ants, and rodents. These pests can cause damage to homes, especially wooden structures.

Key Considerations for Home Insurance

Choosing the right home insurance policy is crucial to protect your most valuable asset. Understanding the different types of coverage available and the factors that influence premiums can help you make informed decisions.

Types of Home Insurance Policies

Home insurance policies can be broadly categorized into two main types:

- Actual Cash Value (ACV): This policy pays the replacement cost of your damaged property minus depreciation. For example, if your 10-year-old roof is damaged, the insurance company will pay the cost of a new roof minus the depreciation value of your old roof.

- Replacement Cost Value (RCV): This policy pays the full cost of replacing your damaged property, regardless of depreciation. This means you will receive enough money to replace your damaged items with new ones, providing you with greater financial protection.

Here’s a table outlining the coverage features of common policies:

| Policy Type | Coverage Features | Advantages | Disadvantages |

|---|---|---|---|

| Basic (HO-1) | Covers damage from fire, lightning, windstorm, hail, explosion, vandalism, and theft. | Lower premiums | Limited coverage |

| Broad (HO-2) | Covers damage from the same perils as HO-1, plus additional perils like falling objects, weight of snow or ice, and damage from freezing pipes. | More comprehensive coverage than HO-1 | Higher premiums than HO-1 |

| Special (HO-3) | Covers all risks except those specifically excluded in the policy. | Most comprehensive coverage | Highest premiums |

| Renters (HO-4) | Covers personal property within a rental unit. | Provides protection for your belongings | Does not cover the structure itself |

| Condominium (HO-6) | Covers personal property and improvements made to the unit, but not the building structure. | Protects your personal belongings and unit improvements | Does not cover the building structure itself |

Factors Influencing Home Insurance Premiums in the Cotton States

Several factors can affect your home insurance premiums in the Cotton States. Understanding these factors can help you manage your costs:

- Location: Homes in areas prone to natural disasters, such as hurricanes, tornadoes, or earthquakes, generally have higher premiums.

- Home Value: The higher the value of your home, the more it will cost to insure.

- Construction Materials: Homes built with fire-resistant materials, such as brick or stone, may qualify for lower premiums.

- Safety Features: Installing safety features like smoke detectors, burglar alarms, and fire sprinklers can reduce your premiums.

- Claim History: A history of filing claims can lead to higher premiums.

- Credit Score: Your credit score can influence your insurance premiums in some states.

Finding the Right Home Insurance Provider

Choosing the right home insurance provider is crucial for protecting your biggest investment. It’s not just about finding the cheapest policy; it’s about finding a company that provides reliable coverage, excellent customer service, and financial stability.

Evaluating Insurance Providers

When selecting a home insurance provider, it’s essential to consider various factors to ensure you’re getting the best possible coverage at a reasonable price. Here are some key areas to focus on:

- Financial Stability: Look for companies with strong financial ratings, such as those from A.M. Best, Standard & Poor’s, or Moody’s. A company’s financial strength indicates its ability to pay claims when you need them.

- Customer Service: Check online reviews and ratings to gauge a company’s customer service reputation. Look for providers known for prompt responses, clear communication, and helpful claim handling processes.

- Coverage Options: Compare the coverage options offered by different providers to ensure they meet your specific needs. Consider factors like dwelling coverage, personal property coverage, liability coverage, and additional living expenses.

- Pricing and Discounts: Get quotes from multiple providers to compare premiums and look for potential discounts, such as those for security systems, fire alarms, or bundling insurance policies.

- Claims Process: Inquire about a company’s claims process, including how they handle claims, the speed of processing, and their procedures for paying out claims.

Comparing Insurance Companies

Here’s a table comparing the services and pricing of major insurance companies in the Cotton States, based on average premiums for a standard home insurance policy:

| Insurance Company | Average Premium | Financial Rating | Customer Service Rating | Coverage Options | Discounts |

|---|---|---|---|---|---|

| State Farm | $1,200 | A+ | 4.5/5 | Comprehensive | Multiple discounts |

| Allstate | $1,350 | A+ | 4/5 | Comprehensive | Multiple discounts |

| Farmers Insurance | $1,400 | A+ | 4/5 | Comprehensive | Multiple discounts |

| Liberty Mutual | $1,300 | A+ | 4/5 | Comprehensive | Multiple discounts |

| USAA | $1,150 | A+ | 4.5/5 | Comprehensive | Multiple discounts |

Negotiating Premiums and Coverage

You can often negotiate lower premiums and secure better coverage by:

- Shopping Around: Get quotes from multiple insurance providers to compare premiums and coverage options.

- Improving Home Security: Install security systems, fire alarms, and smoke detectors to qualify for discounts.

- Raising Your Deductible: A higher deductible usually means lower premiums. Consider raising your deductible if you’re comfortable with a higher out-of-pocket expense in the event of a claim.

- Bundling Policies: Combining your home insurance with other policies, such as auto or renters insurance, can often result in significant savings.

- Negotiating Directly: Once you’ve chosen a provider, don’t be afraid to negotiate for a lower premium or better coverage. Be prepared to explain your needs and compare their offers to those of other providers.

Understanding Policy Exclusions and Limitations

While your home insurance policy offers protection against various perils, it’s essential to understand that it doesn’t cover everything. There are specific situations and events that are excluded from coverage, and some coverage may be limited. Understanding these exclusions and limitations is crucial to avoid unexpected financial burdens in case of a claim.

Common Exclusions and Limitations

Exclusions and limitations are specific conditions or events that are not covered by your insurance policy. These are typically Artikeld in the policy’s “exclusions” and “limitations” sections.

- Natural Disasters: Some policies may have specific exclusions or limitations for certain natural disasters, such as earthquakes, floods, or landslides. These events are often covered by separate policies, such as flood insurance.

- Acts of War: Home insurance policies typically exclude coverage for damage caused by acts of war or terrorism.

- Neglect or Intentional Acts: Coverage is generally denied for damage caused by intentional acts or negligence, such as failing to maintain your property.

- Certain Types of Property: Some items, such as valuable jewelry, artwork, or collections, may require additional coverage through a separate policy or endorsement.

- Pre-existing Conditions: Damage that existed before the policy’s effective date may not be covered. For example, if your roof had a leak before you purchased the policy, the damage may not be covered.

Importance of Understanding Policy Language and Terms

The language used in insurance policies can be complex and technical. It’s important to understand the terms and conditions of your policy, including the exclusions and limitations, to avoid surprises during a claim.

“Read your policy carefully and ask questions if you don’t understand anything.”

Consult with your insurance agent or broker if you have any questions or concerns about the policy’s coverage.

Examples of Situations Where Coverage May Be Limited or Denied, Cotton states home insurance

Here are some examples of situations where coverage may be limited or denied:

- Damage Caused by a Flood: If your home is damaged by a flood, your policy may not cover the damage if you don’t have flood insurance.

- Damage Caused by a Landslide: Some policies may have specific exclusions or limitations for landslides, depending on the location and the policy’s terms.

- Damage Caused by a Burglary: While your policy may cover theft, it may not cover certain items, such as cash, jewelry, or artwork, unless you have additional coverage.

- Damage Caused by a Tree Falling on Your Home: If a tree falls on your home during a hurricane, your policy may cover the damage, but it may not cover the cost of removing the tree.

Filing a Home Insurance Claim

Navigating the process of filing a home insurance claim can be overwhelming, especially during a stressful time. Understanding the steps involved and knowing how to communicate effectively with your insurance company can make the process smoother. This section Artikels the key steps and provides valuable tips to help you file a claim efficiently and successfully.

Steps Involved in Filing a Home Insurance Claim

- Contact your insurance company immediately. This is the first and most crucial step. Your insurance company will provide you with the necessary claim forms and instructions.

- Document the damage. Take detailed photographs and videos of the damaged property. This will be crucial for supporting your claim. Include pictures of the damaged area, as well as the overall context of the damage.

- Keep a record of all expenses. Save all receipts and invoices related to the damage, such as repairs, temporary housing, and other related expenses. This documentation will help you get reimbursed for your losses.

- Be prepared for an inspection. An insurance adjuster will likely come to your property to assess the damage. Be prepared to answer their questions and provide any necessary documentation.

- Negotiate your claim. The insurance company will provide you with an initial settlement offer. You have the right to negotiate this offer, so be prepared to discuss the damage and your expenses. If you disagree with the offer, you can appeal it.

Documenting Damages and Providing Supporting Evidence

Documenting the damage is crucial for supporting your claim. Detailed documentation helps the insurance adjuster understand the extent of the damage and allows them to assess your claim accurately.

- Take clear and comprehensive photos and videos. Capture the damage from multiple angles, including close-ups and wide shots. Document the overall context of the damage, such as the location of the damaged area within your home.

- Create a detailed inventory of damaged items. List all the items that were damaged, including their description, purchase date, and estimated value. Include any receipts or invoices for these items as proof of purchase.

- Save all related documentation. This includes receipts for repairs, temporary housing expenses, and other related costs. Keeping all documentation organized and readily accessible will streamline the claim process.

Communicating with Insurance Adjusters

Effective communication with the insurance adjuster is key to a smooth claim process. Being prepared, clear, and concise in your communication can help you avoid delays and ensure a fair settlement.

- Be patient and understanding. Insurance adjusters are often dealing with multiple claims, so delays are inevitable. However, you should still be proactive in following up on your claim and communicating any concerns.

- Be honest and transparent. Provide accurate information about the damage and your expenses. Any discrepancies or inaccuracies can delay the claim process or even lead to its denial.

- Keep a record of all communication. This includes emails, phone calls, and any in-person interactions with the insurance adjuster. This record will help you keep track of the progress of your claim and ensure you are not overlooked.

Protecting Your Home and Property

Taking preventative measures to protect your home is crucial for minimizing risks and ensuring peace of mind. By proactively addressing potential threats, you can safeguard your investment and potentially reduce insurance premiums.

Preventing Home Damage

Taking preventative measures can significantly reduce the risk of damage to your home and belongings.

- Regular Maintenance: Regularly inspect and maintain your home’s systems, including plumbing, electrical, heating, and cooling. Addressing minor issues early can prevent costly repairs later.

- Roof Inspections: Schedule annual roof inspections to identify any damage or wear and tear. A well-maintained roof is essential for protecting your home from water damage.

- Gutter Cleaning: Clean your gutters regularly to prevent clogs and water damage. Blocked gutters can lead to water pooling around your foundation, causing leaks and structural issues.

- Landscaping: Maintain proper landscaping around your home, trimming trees and bushes to prevent them from coming into contact with your roof or siding. This can help prevent damage from falling branches or debris.

- Fire Safety: Install smoke detectors and carbon monoxide detectors throughout your home, and test them regularly. Have a fire escape plan and practice it with your family.

Preparing for Weather Events

Preparing for potential weather events is essential for protecting your home and family.

- Emergency Kit: Prepare an emergency kit that includes essential supplies such as food, water, first aid supplies, flashlights, batteries, and a weather radio.

- Storm Shutters: Consider installing storm shutters to protect your windows from high winds and flying debris.

- Flood Mitigation: If you live in a flood-prone area, take steps to mitigate flood risk, such as installing flood barriers or elevating your electrical outlets.

- Insurance Review: Review your home insurance policy to ensure it adequately covers potential weather-related damages.

- Stay Informed: Stay informed about weather forecasts and warnings. If a severe weather event is predicted, take necessary precautions.

Investing in Home Security

Investing in home security systems and other protective measures can deter crime and provide peace of mind.

- Security Systems: Install a home security system with alarms, motion sensors, and cameras. These systems can deter burglars and alert you to potential threats.

- Lighting: Install motion-activated lights around your property to deter crime and improve visibility at night.

- Locks: Use high-quality locks on all doors and windows. Consider upgrading to deadbolt locks for added security.

- Landscaping: Maintain your landscaping to improve visibility and make it more difficult for criminals to hide. Trim bushes and trees to create a clear line of sight.

- Neighborhood Watch: Participate in your neighborhood watch program and communicate with your neighbors about any suspicious activity.

Final Summary

Navigating the complexities of home insurance in the Cotton States requires careful consideration of your specific needs and risks. By understanding the different types of policies, comparing providers, and taking preventative measures, you can ensure that your home and property are protected from unforeseen events. Remember, investing in the right insurance is an essential step in safeguarding your financial security and peace of mind.

Question Bank

What is the average cost of home insurance in the Cotton States?

The average cost of home insurance in the Cotton States varies depending on factors such as location, property value, coverage level, and the insurer. It’s best to get quotes from multiple providers to compare prices and coverage options.

What are some common exclusions in home insurance policies?

Common exclusions in home insurance policies may include coverage for damage caused by earthquakes, floods (unless you have specific flood insurance), or acts of war. It’s essential to carefully review your policy documents to understand the limitations.

How can I increase my chances of getting a claim approved?

To increase your chances of getting a claim approved, ensure you have a detailed inventory of your belongings, maintain proper documentation, and communicate clearly with your insurance adjuster. Be prepared to provide evidence of damage and follow the claim process diligently.