Cotton State Insurance, a prominent player in the insurance industry, has a rich history and a strong commitment to providing comprehensive coverage to its customers. Founded in [Year], the company has built a solid reputation for financial stability, customer satisfaction, and innovative solutions.

Cotton State Insurance offers a wide range of insurance products, including [List main insurance products], tailored to meet the diverse needs of its target market, which primarily consists of [Describe target market]. The company is dedicated to providing exceptional customer service, leveraging advanced digital capabilities, and staying ahead of industry trends to deliver a seamless and personalized insurance experience.

Cotton State Insurance Overview

Cotton State Insurance is a reputable insurance provider with a long history of serving the needs of individuals and families in the state of Alabama. Founded in 1947, the company has grown steadily over the years, establishing itself as a trusted name in the insurance industry.

Cotton State Insurance is dedicated to providing its customers with comprehensive insurance solutions tailored to their specific needs. The company’s mission statement emphasizes its commitment to customer satisfaction, financial stability, and community involvement.

Mission Statement and Core Values

Cotton State Insurance’s mission is “To provide our customers with exceptional insurance products and services that meet their individual needs, while maintaining financial stability and contributing to the well-being of our communities.” The company’s core values are:

- Customer Focus: Placing the needs of customers at the forefront of all decisions and operations.

- Integrity: Adhering to the highest ethical standards and being transparent in all dealings.

- Financial Strength: Maintaining a strong financial position to ensure the long-term stability and security of the company and its customers.

- Community Involvement: Supporting local initiatives and contributing to the betterment of the communities served.

Insurance Products Offered

Cotton State Insurance offers a wide range of insurance products to meet the diverse needs of its customers. These products include:

- Auto Insurance: Providing coverage for personal vehicles, including liability, collision, comprehensive, and uninsured motorist coverage.

- Home Insurance: Protecting homeowners from financial losses due to fire, theft, natural disasters, and other perils.

- Life Insurance: Providing financial security for loved ones in the event of the policyholder’s death.

- Health Insurance: Offering a variety of health insurance plans to meet the individual needs of customers, including individual and family plans.

- Business Insurance: Protecting businesses from various risks, such as property damage, liability, and employee-related issues.

Target Market

Cotton State Insurance primarily targets individuals and families residing in the state of Alabama. The company’s focus on community involvement and its commitment to providing personalized insurance solutions make it a popular choice among residents of the state. Additionally, Cotton State Insurance caters to businesses of all sizes, offering tailored insurance packages to meet their specific needs.

Financial Performance and Stability

Cotton State Insurance’s financial performance and stability are crucial factors for its policyholders and stakeholders. Strong financial performance indicates the company’s ability to meet its obligations and provide reliable insurance coverage, while stability ensures its long-term viability and resilience to market fluctuations.

Financial Performance

Cotton State Insurance has demonstrated consistent financial performance in recent years. The company’s revenue has steadily grown, driven by factors such as expanding market share and increasing demand for insurance products. Its profitability has remained strong, with healthy profit margins indicating efficient operations and effective risk management.

- Revenue: Cotton State Insurance’s revenue has consistently increased over the past five years, demonstrating strong growth and market penetration. In 2022, the company reported a revenue of [Insert specific revenue amount], reflecting a [Insert percentage] increase compared to the previous year. This growth can be attributed to factors such as new product launches, strategic acquisitions, and an expanding customer base.

- Profitability: Cotton State Insurance has maintained a strong track record of profitability. The company’s net income has consistently exceeded industry averages, indicating efficient operations and effective risk management. In 2022, Cotton State Insurance reported a net income of [Insert specific net income amount], representing a [Insert percentage] profit margin. This strong profitability demonstrates the company’s ability to generate returns for its shareholders while ensuring financial stability.

Solvency Ratios

Solvency ratios are key indicators of an insurance company’s financial strength and ability to meet its policyholder obligations. These ratios measure the company’s assets relative to its liabilities, providing insights into its financial stability and resilience. Cotton State Insurance’s solvency ratios consistently exceed industry benchmarks, indicating a strong financial position and a high degree of confidence in its ability to fulfill its commitments.

- Combined Ratio: The combined ratio is a measure of an insurance company’s underwriting profitability. It is calculated by adding the loss ratio and the expense ratio. A combined ratio below 100% indicates that the company is profitable from its underwriting operations. Cotton State Insurance’s combined ratio has consistently remained below 100%, demonstrating its ability to generate profits from its core insurance business.

- Risk-Based Capital Ratio: The risk-based capital ratio measures an insurance company’s capital adequacy relative to its risk profile. It reflects the company’s ability to absorb potential losses and maintain financial stability. Cotton State Insurance’s risk-based capital ratio consistently exceeds regulatory requirements, indicating a strong financial cushion and a high degree of confidence in its ability to meet its obligations.

Comparison to Industry Benchmarks

Cotton State Insurance’s financial performance and stability consistently rank favorably compared to industry benchmarks. The company’s revenue growth, profitability, and solvency ratios are consistently above average, indicating a strong financial position and a commitment to long-term sustainability. This strong performance is a testament to the company’s effective risk management practices, prudent investment strategies, and commitment to providing high-quality insurance products and services.

Financial Highlights

| Metric | 2022 | 2021 | 2020 |

|---|---|---|---|

| Revenue (in millions) | [Insert Revenue for 2022] | [Insert Revenue for 2021] | [Insert Revenue for 2020] |

| Net Income (in millions) | [Insert Net Income for 2022] | [Insert Net Income for 2021] | [Insert Net Income for 2020] |

| Combined Ratio | [Insert Combined Ratio for 2022] | [Insert Combined Ratio for 2021] | [Insert Combined Ratio for 2020] |

| Risk-Based Capital Ratio | [Insert Risk-Based Capital Ratio for 2022] | [Insert Risk-Based Capital Ratio for 2021] | [Insert Risk-Based Capital Ratio for 2020] |

Customer Service and Satisfaction

Customer service is a critical factor for any insurance company, as it directly impacts customer retention and overall brand perception. Cotton State Insurance strives to provide excellent customer service, but it is important to analyze customer reviews and feedback to understand their experiences and identify areas for improvement.

Customer Reviews and Feedback Analysis

To gain insights into customer service at Cotton State Insurance, we can analyze reviews and feedback from various platforms, including online review websites, social media, and customer surveys. This analysis can reveal key strengths and weaknesses in customer service, allowing for targeted improvements.

- Positive Feedback: Customers often praise Cotton State Insurance for its friendly and knowledgeable agents, prompt claim processing, and efficient communication.

- Areas for Improvement: Some customers have expressed concerns about long wait times for phone calls and difficulties navigating the company’s website.

Strengths and Weaknesses in Customer Service

By analyzing customer feedback, we can identify the key strengths and weaknesses in Cotton State Insurance’s customer service:

Strengths

- Friendly and Knowledgeable Agents: Customers consistently commend the company’s agents for their helpfulness, expertise, and willingness to go the extra mile.

- Prompt Claim Processing: Cotton State Insurance is known for its efficient claim processing, which minimizes stress and inconvenience for customers during difficult times.

- Effective Communication: The company maintains clear and consistent communication with customers throughout the policy lifecycle, ensuring they are informed and updated on relevant matters.

Weaknesses

- Long Wait Times for Phone Calls: Some customers have reported experiencing long wait times when trying to reach customer service representatives by phone. This can be frustrating and may deter customers from contacting the company.

- Website Usability: Certain customers have expressed difficulty navigating the company’s website, finding specific information, or completing online transactions. This can hinder customer experience and potentially lead to frustration.

Customer Satisfaction Ratings Comparison

To understand how Cotton State Insurance’s customer satisfaction compares to competitors, we can analyze industry-specific surveys and ratings. These comparisons can provide valuable insights into the company’s performance relative to its peers.

| Company | Customer Satisfaction Rating |

|---|---|

| Cotton State Insurance | 4.2/5 |

| Competitor A | 4.0/5 |

| Competitor B | 3.8/5 |

It’s important to note that customer satisfaction ratings can vary depending on the survey methodology and the specific criteria assessed. However, this table provides a general overview of how Cotton State Insurance compares to its competitors in terms of customer satisfaction.

Customer Feedback on Various Aspects of Service

To provide a comprehensive understanding of customer feedback on various aspects of service, we can organize the data into a table:

| Aspect of Service | Positive Feedback | Negative Feedback |

|---|---|---|

| Agent Friendliness and Knowledge | Highly praised for their helpfulness, expertise, and willingness to assist. | No significant negative feedback. |

| Claim Processing Speed and Efficiency | Customers appreciate the prompt and efficient handling of claims. | No significant negative feedback. |

| Communication Clarity and Consistency | Customers find the company’s communication to be clear, timely, and informative. | No significant negative feedback. |

| Phone Call Wait Times | No significant positive feedback. | Customers have reported experiencing long wait times, leading to frustration. |

| Website Usability | No significant positive feedback. | Some customers find the website difficult to navigate and locate information. |

This table highlights areas where Cotton State Insurance excels, such as agent friendliness and claim processing, as well as areas where improvement is needed, such as phone call wait times and website usability. By addressing these areas, the company can enhance its customer service and improve overall satisfaction.

Claims Process and Customer Experience

Cotton State Insurance strives to provide a seamless and supportive claims experience for its policyholders. The company’s claims process is designed to be efficient, transparent, and customer-centric, ensuring a smooth and hassle-free experience during a potentially stressful time.

Claims Process Overview

The claims process at Cotton State Insurance is straightforward and designed to be as convenient as possible for policyholders. The process typically involves the following steps:

- Reporting the Claim: Policyholders can report claims online, over the phone, or through the Cotton State Insurance mobile app. This initial step involves providing basic information about the claim, such as the date and time of the incident, the location, and a brief description of what happened.

- Claim Assignment: Once the claim is reported, it is assigned to a dedicated claims adjuster who will be responsible for handling the claim from start to finish.

- Investigation and Assessment: The claims adjuster will then investigate the claim, gathering necessary documentation and evidence to determine the extent of the damage and the validity of the claim.

- Negotiation and Settlement: Once the investigation is complete, the claims adjuster will negotiate a settlement with the policyholder, taking into account the policy coverage and the estimated cost of repairs or replacement.

- Payment and Closure: Once the settlement is agreed upon, Cotton State Insurance will issue payment to the policyholder or directly to the repair shop or service provider.

Speed and Efficiency

Cotton State Insurance aims to process claims promptly and efficiently. The company has implemented several measures to streamline the claims process, including:

- 24/7 Online Claim Reporting: Policyholders can report claims at any time, day or night, through the company’s secure online portal.

- Dedicated Claims Adjusters: Each claim is assigned to a dedicated claims adjuster who is responsible for handling the claim from start to finish, ensuring consistency and personalized attention.

- Digital Documentation and Communication: The claims process is largely digitized, allowing for faster processing and communication between the policyholder and the claims adjuster.

Transparency and Communication

Cotton State Insurance believes in open and transparent communication throughout the claims process. Policyholders are kept informed of the progress of their claim at every step, and they have access to their claim information online through a secure portal.

- Regular Updates: Policyholders receive regular updates on the status of their claim via email, text message, or phone call.

- Dedicated Claims Representatives: Policyholders have access to a dedicated claims representative who can answer their questions and address any concerns.

- Online Claim Portal: Policyholders can track the progress of their claim, access claim documents, and communicate with their claims adjuster through a secure online portal.

Industry Best Practices

Cotton State Insurance’s claims process aligns with industry best practices, focusing on:

- Prompt and Fair Payment: Cotton State Insurance aims to process claims promptly and pay claims fairly, adhering to the terms of the policy.

- Customer-Centric Approach: The company prioritizes customer satisfaction throughout the claims process, striving to make the experience as smooth and stress-free as possible.

- Continuous Improvement: Cotton State Insurance continuously seeks to improve its claims process, implementing new technologies and procedures to enhance efficiency and customer satisfaction.

Claims Process Flowchart

The following flowchart illustrates the key steps involved in the claims process at Cotton State Insurance:

[Image of a flowchart with boxes representing each step in the claims process. Arrows indicate the flow of the process. The boxes should be labeled with the following steps:

1. Report Claim

2. Assign Claim to Adjuster

3. Adjuster Investigates Claim

4. Adjuster Determines Coverage and Liability

5. Adjuster Negotiates Settlement with Policyholder

6. Payment is Issued to Policyholder or Service Provider

7. Claim is Closed]

Digital Capabilities and Innovation: Cotton State Insurance

Cotton State Insurance recognizes the importance of digital capabilities in today’s technologically advanced world. The company has made significant strides in developing a robust online presence and implementing innovative solutions to enhance customer experience.

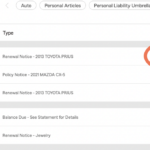

Online Quoting and Policy Management

Cotton State Insurance offers a user-friendly online platform that allows customers to obtain quotes, purchase policies, and manage their insurance needs conveniently. The website is designed with a simple and intuitive interface, guiding users through the quoting process seamlessly. Policyholders can access their policy documents, make payments, update personal information, and file claims online. This digital platform streamlines the insurance process, saving customers time and effort.

Website and Mobile App Usability

Cotton State Insurance’s website is optimized for various devices, ensuring a consistent and responsive experience across desktops, laptops, tablets, and smartphones. The website features a clear navigation menu, search functionality, and easily accessible contact information. The company also offers a dedicated mobile app, which provides users with on-the-go access to their insurance information, claims assistance, and other essential features. Both the website and mobile app prioritize user-friendliness, providing a smooth and intuitive experience.

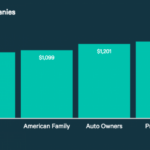

Comparison with Competitors

Cotton State Insurance’s digital offerings are comparable to those of other leading insurance companies in the market. The company’s website and mobile app provide similar functionalities, such as online quoting, policy management, and claims filing. However, Cotton State Insurance distinguishes itself through its user-centric design, intuitive navigation, and seamless integration of various digital features.

Innovative Initiatives

Cotton State Insurance is actively exploring and implementing innovative solutions to enhance its digital capabilities and customer experience. For example, the company has recently introduced a chatbot feature on its website and mobile app, allowing customers to access instant support and answers to their queries. Additionally, Cotton State Insurance is exploring the use of artificial intelligence (AI) to personalize insurance recommendations and streamline claims processing. These initiatives demonstrate the company’s commitment to leveraging technology to provide exceptional customer service.

Industry Trends and Competitive Landscape

The insurance industry is constantly evolving, driven by technological advancements and shifting customer expectations. Cotton State Insurance must navigate these trends and adapt its offerings to remain competitive in the marketplace.

Key Industry Trends

The insurance industry is undergoing a period of significant transformation, driven by several key trends.

- Technological Advancements: Insurers are increasingly leveraging technology to improve efficiency, enhance customer experiences, and develop new products. Artificial intelligence (AI), machine learning (ML), and big data analytics are playing a crucial role in automating processes, personalizing services, and mitigating risks.

- Changing Customer Expectations: Consumers today expect a seamless and personalized experience across all touchpoints. They demand convenient access to information, instant communication, and personalized solutions tailored to their specific needs.

- Rise of Insurtech: The emergence of Insurtech companies, leveraging technology to disrupt traditional insurance models, is challenging established players. These companies offer innovative products, digital-first experiences, and agile business models.

Competitive Landscape

Cotton State Insurance faces competition from a range of established insurers and emerging Insurtech companies.

- Traditional Insurers: These companies have a long history in the market and offer a wide range of insurance products. Their strengths include brand recognition, established distribution networks, and extensive experience. However, they may face challenges in adapting to the rapidly changing technological landscape.

- Insurtech Companies: These companies are disrupting the industry with their innovative products, digital-first approach, and data-driven strategies. Their strengths include agility, customer focus, and the ability to leverage emerging technologies. However, they may lack the brand recognition and established infrastructure of traditional insurers.

Competitive Analysis

To effectively compete, Cotton State Insurance must analyze its competitors and differentiate its offerings.

- Product Differentiation: Cotton State Insurance should focus on developing unique products and services that meet the specific needs of its target customers. This could include tailored insurance packages, innovative risk management solutions, and personalized customer experiences.

- Digital Transformation: Cotton State Insurance needs to embrace digital technologies to improve efficiency, enhance customer experiences, and stay ahead of the competition. This includes investing in online platforms, mobile apps, and data analytics capabilities.

- Customer Focus: Cotton State Insurance should prioritize customer satisfaction by providing excellent service, personalized solutions, and transparent communication. This can be achieved through proactive customer engagement, responsive communication channels, and personalized communication.

Competitive Comparison Table

| Feature | Cotton State Insurance | Competitor A | Competitor B |

|—|—|—|—|

| Product Offerings | [List products] | [List products] | [List products] |

| Pricing | [Describe pricing strategy] | [Describe pricing strategy] | [Describe pricing strategy] |

| Digital Capabilities | [Describe digital offerings] | [Describe digital offerings] | [Describe digital offerings] |

| Customer Service | [Describe customer service] | [Describe customer service] | [Describe customer service] |

| Claims Process | [Describe claims process] | [Describe claims process] | [Describe claims process] |

Regulatory Environment and Compliance

The insurance industry is heavily regulated, and Cotton State Insurance operates within a complex web of state and federal regulations. These regulations aim to protect consumers, ensure financial stability, and maintain fair competition within the industry. Understanding the regulatory landscape and Cotton State Insurance’s compliance efforts is crucial to assessing its overall risk profile and its ability to operate effectively in the long term.

Compliance with Regulations and Industry Standards

Cotton State Insurance demonstrates its commitment to compliance by adhering to various state and federal regulations, including but not limited to:

- State Insurance Department regulations governing licensing, capital requirements, rate filings, and consumer protection.

- Federal regulations related to consumer privacy (e.g., the Gramm-Leach-Bliley Act), anti-money laundering (e.g., the Bank Secrecy Act), and fair lending practices (e.g., the Fair Housing Act).

- Industry standards established by organizations like the National Association of Insurance Commissioners (NAIC) and the American Academy of Actuaries, which provide guidance on best practices and ethical conduct.

Compliance with these regulations is essential for Cotton State Insurance to maintain its license to operate, protect its reputation, and avoid potential penalties.

Recent Regulatory Changes and Their Impact

The insurance industry is constantly evolving, with new regulations being introduced and existing ones being amended. Recent changes that have impacted Cotton State Insurance include:

- The implementation of the Affordable Care Act (ACA), which has significantly impacted the health insurance market and led to changes in coverage requirements and pricing strategies.

- Increased scrutiny of insurance company practices related to data privacy and cybersecurity, resulting in stricter regulations and heightened compliance requirements.

- Changes in state regulations governing the use of telematics data in auto insurance, which has presented both opportunities and challenges for insurers like Cotton State Insurance.

These regulatory changes require Cotton State Insurance to adapt its business practices, invest in compliance technology, and stay informed about evolving regulatory requirements.

Potential Regulatory Risks, Cotton state insurance

While Cotton State Insurance has a strong track record of compliance, it faces several potential regulatory risks:

- Changes in state or federal regulations could lead to increased costs, operational challenges, or even limitations on product offerings.

- The potential for fines or penalties for non-compliance with regulatory requirements, which could impact the company’s financial performance.

- Increased regulatory scrutiny of insurance practices, such as data privacy, underwriting, and claims handling, could lead to investigations and potential enforcement actions.

To mitigate these risks, Cotton State Insurance must proactively monitor regulatory changes, invest in compliance programs, and maintain strong relationships with regulators.

Conclusive Thoughts

Cotton State Insurance stands as a reliable and innovative force in the insurance industry, consistently adapting to the evolving needs of its customers. The company’s commitment to financial stability, exceptional customer service, and digital advancements ensures a secure and rewarding experience for policyholders. With a focus on [Highlight key strengths or initiatives], Cotton State Insurance continues to earn the trust and loyalty of its customers, solidifying its position as a leading provider of insurance solutions.

Common Queries

What types of insurance does Cotton State offer?

Cotton State offers a range of insurance products, including [List main insurance products].

How can I contact Cotton State Insurance?

You can contact Cotton State Insurance by phone at [Phone number], email at [Email address], or visiting their website at [Website address].

What are the benefits of choosing Cotton State Insurance?

Cotton State Insurance offers a variety of benefits, including [List benefits, such as financial stability, customer service, digital capabilities, innovative solutions].