Cost of State Farm car insurance is a key consideration for many drivers, as it can significantly impact your monthly budget. State Farm, one of the largest insurance providers in the United States, offers a wide range of coverage options and discounts that can influence your premiums. This article explores the key factors that determine State Farm car insurance costs, providing insights into how you can potentially save money on your premiums.

Understanding the factors that influence your State Farm car insurance rates is essential for making informed decisions about your coverage. From your driving history and vehicle type to your location and credit score, numerous elements contribute to the final cost. By gaining a comprehensive understanding of these factors, you can better navigate the insurance landscape and secure the most competitive rates.

Factors Influencing State Farm Car Insurance Costs

State Farm, like other insurance companies, determines car insurance premiums based on a variety of factors. These factors are designed to assess the risk of you being involved in an accident and the potential cost of claims. Understanding these factors can help you make informed decisions about your insurance coverage and potentially lower your premiums.

Driving History

Your driving history plays a significant role in determining your State Farm car insurance premium. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, having accidents or traffic violations can significantly increase your premiums. For instance, a driver with a DUI conviction will likely face much higher premiums compared to a driver with no traffic violations.

Vehicle Information

The type of vehicle you drive is another important factor. State Farm considers factors such as the vehicle’s make, model, year, and safety features. Vehicles with advanced safety features, like anti-lock brakes and airbags, are generally considered safer and may result in lower premiums. Higher-performance vehicles, on the other hand, are often associated with higher risk and may lead to higher premiums. For example, a driver with a new, high-performance sports car may face higher premiums than a driver with a mid-size sedan with advanced safety features.

Location

Where you live can significantly impact your State Farm car insurance rates. Areas with higher crime rates, denser populations, and more traffic congestion often have higher accident rates. This increased risk is reflected in higher premiums for drivers in these areas. For example, a driver living in a bustling city with a high accident rate might pay higher premiums than a driver living in a rural area with lower traffic volume.

Age and Gender

Age and gender are also considered factors in determining your State Farm car insurance premium. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Therefore, they often face higher premiums. Similarly, gender can also play a role, as statistics show that young male drivers tend to have higher accident rates than young female drivers. However, it’s important to note that State Farm, like many other insurance companies, has moved away from using gender as a primary factor in pricing.

Credit Score

Surprisingly, your credit score can also influence your State Farm car insurance premium. Insurance companies believe that people with good credit scores are more likely to be responsible and financially stable, which can translate to lower risk. Drivers with lower credit scores may face higher premiums. However, this practice is controversial and varies by state.

Coverage and Deductibles

The type of coverage you choose and the amount of your deductible will also impact your premium. Higher coverage levels, such as comprehensive and collision coverage, provide more protection but will generally result in higher premiums. Choosing a higher deductible, which is the amount you pay out of pocket before insurance kicks in, can help lower your premium. For example, a driver with a $1,000 deductible will generally pay a lower premium than a driver with a $500 deductible.

Discounts

State Farm offers a variety of discounts that can help lower your premium. These discounts can be based on factors such as safe driving history, good student status, multiple car insurance, homeownership, and more. Taking advantage of available discounts can significantly reduce your insurance costs.

State Farm Car Insurance Coverage Options

State Farm offers a wide range of car insurance coverage options to cater to diverse needs and preferences. These options provide financial protection against various risks associated with car ownership, ensuring peace of mind in the event of an accident or other unforeseen circumstances. Understanding these coverage options and their benefits is crucial for making informed decisions about your insurance needs.

Liability Coverage, Cost of state farm car insurance

Liability coverage is a crucial component of car insurance, providing financial protection if you are at fault in an accident that causes damage to another person’s property or injuries to another person. This coverage helps pay for:

- Medical expenses: Covers the medical bills of the injured party, including hospital stays, surgeries, and rehabilitation.

- Property damage: Covers the cost of repairing or replacing the damaged property of the other party, including their vehicle, other property, and any personal belongings.

- Legal fees: Covers legal expenses incurred in defending yourself against a lawsuit filed by the other party.

Liability coverage is typically expressed as a per-person limit and a per-accident limit. For example, a policy with a 25/50/10 limit would cover up to $25,000 per person for injuries, up to $50,000 per accident for injuries, and up to $10,000 per accident for property damage.

Collision Coverage

Collision coverage protects you against damage to your own vehicle caused by a collision with another vehicle or an object. This coverage pays for repairs or replacement of your vehicle, minus your deductible.

- Example: If you collide with another car and damage your vehicle, collision coverage will help pay for repairs or replacement, after you pay your deductible.

Collision coverage is optional, but it is generally recommended for newer vehicles or vehicles with a high market value.

Comprehensive Coverage

Comprehensive coverage protects you against damage to your own vehicle caused by events other than collisions, such as:

- Theft: Covers the loss of your vehicle due to theft.

- Vandalism: Covers damage to your vehicle caused by vandalism or malicious acts.

- Natural disasters: Covers damage to your vehicle caused by natural disasters such as floods, earthquakes, and hail storms.

- Fire: Covers damage to your vehicle caused by fire.

Comprehensive coverage is also optional, but it is generally recommended for newer vehicles or vehicles with a high market value.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you against financial losses if you are injured in an accident caused by an uninsured or underinsured driver. This coverage pays for:

- Medical expenses: Covers your medical bills if you are injured in an accident caused by an uninsured or underinsured driver.

- Lost wages: Covers your lost wages if you are unable to work due to injuries sustained in an accident caused by an uninsured or underinsured driver.

- Pain and suffering: May cover pain and suffering if you are injured in an accident caused by an uninsured or underinsured driver.

UM/UIM coverage is optional, but it is highly recommended, as it provides essential protection in situations where the other driver does not have adequate insurance or no insurance at all.

Coverage Levels and Costs

| Coverage Level | Liability | Collision | Comprehensive | Uninsured/Underinsured Motorist | Estimated Monthly Premium |

|---|---|---|---|---|---|

| Basic | 25/50/10 | No | No | No | $50-$100 |

| Standard | 50/100/25 | Yes | Yes | Yes | $100-$200 |

| Premium | 100/300/50 | Yes | Yes | Yes | $200-$300 |

*Estimated monthly premiums are for illustrative purposes only and may vary based on factors such as driving history, vehicle type, age, and location.

Discounts and Savings Opportunities

State Farm offers a variety of discounts that can significantly reduce your car insurance premiums. These discounts are designed to reward safe driving habits, responsible behavior, and loyalty to the company.

Discounts Available

State Farm offers a range of discounts to help you save on your car insurance premiums. Here are some of the most common discounts:

- Safe Driving Discount: This discount is available to drivers with a clean driving record, typically for a certain period of time. The discount amount can vary based on your driving history and the specific discount program offered by State Farm.

- Good Student Discount: Students who maintain a certain grade point average (GPA) may be eligible for this discount. The required GPA and the discount amount can vary depending on your age and the specific State Farm policy.

- Multi-Policy Discount: Bundling your car insurance with other insurance policies from State Farm, such as homeowners or renters insurance, can lead to significant savings. The discount amount may vary based on the specific policies you bundle.

- Defensive Driving Course Discount: Completing a certified defensive driving course can demonstrate your commitment to safe driving and may qualify you for a discount. The discount amount may vary depending on the course provider and State Farm’s policy.

- Anti-theft Device Discount: Installing anti-theft devices in your car, such as an alarm system or GPS tracking, can help deter theft and may earn you a discount. The discount amount may vary depending on the type of device and State Farm’s policy.

- Loyalty Discount: State Farm often rewards long-term customers with loyalty discounts. The discount amount may vary based on your policy history and State Farm’s specific program.

- Paperless Billing Discount: Choosing paperless billing can save you money and reduce your environmental impact. State Farm may offer a discount for opting out of paper statements.

- Automatic Payment Discount: Setting up automatic payments for your insurance premiums can make it easier to stay on top of your bills and may earn you a discount. The discount amount may vary depending on State Farm’s policy.

Discount Eligibility and Potential Savings

The eligibility criteria and potential savings for each discount can vary depending on your individual circumstances and the specific State Farm policy you have. However, here’s a general overview:

| Discount | Eligibility Criteria | Potential Savings |

|---|---|---|

| Safe Driving Discount | Clean driving record for a specified period | 5-20% |

| Good Student Discount | Maintain a certain GPA | 5-15% |

| Multi-Policy Discount | Bundling multiple insurance policies | 10-25% |

| Defensive Driving Course Discount | Completion of a certified course | 5-10% |

| Anti-theft Device Discount | Installation of approved devices | 5-15% |

| Loyalty Discount | Long-term customer with a good history | 5-10% |

| Paperless Billing Discount | Opting for electronic statements | 2-5% |

| Automatic Payment Discount | Setting up automatic payments | 2-5% |

It’s important to note that these are just estimates, and your actual savings may vary. Contact your State Farm agent for specific details about the discounts available to you and their potential impact on your premiums.

Customer Reviews and Experiences

Customer reviews and testimonials provide valuable insights into the overall experience of State Farm car insurance policyholders. These reviews offer a glimpse into the strengths and weaknesses of the company, particularly regarding customer service, claims handling, and pricing.

Customer Sentiment Analysis

Analyzing customer reviews reveals common themes and sentiments expressed by State Farm policyholders. Positive reviews often highlight the company’s reputation for reliability, prompt claims processing, and excellent customer service. Policyholders appreciate the availability of agents and the ease of communication. On the other hand, negative reviews often focus on issues related to pricing, claims denials, and lengthy claim processing times.

- Many customers praise State Farm for its strong reputation and financial stability, providing peace of mind in case of accidents.

- Customers appreciate the availability and responsiveness of State Farm agents, who are often seen as knowledgeable and helpful.

- Positive reviews also mention the company’s user-friendly online platform and mobile app, simplifying policy management and communication.

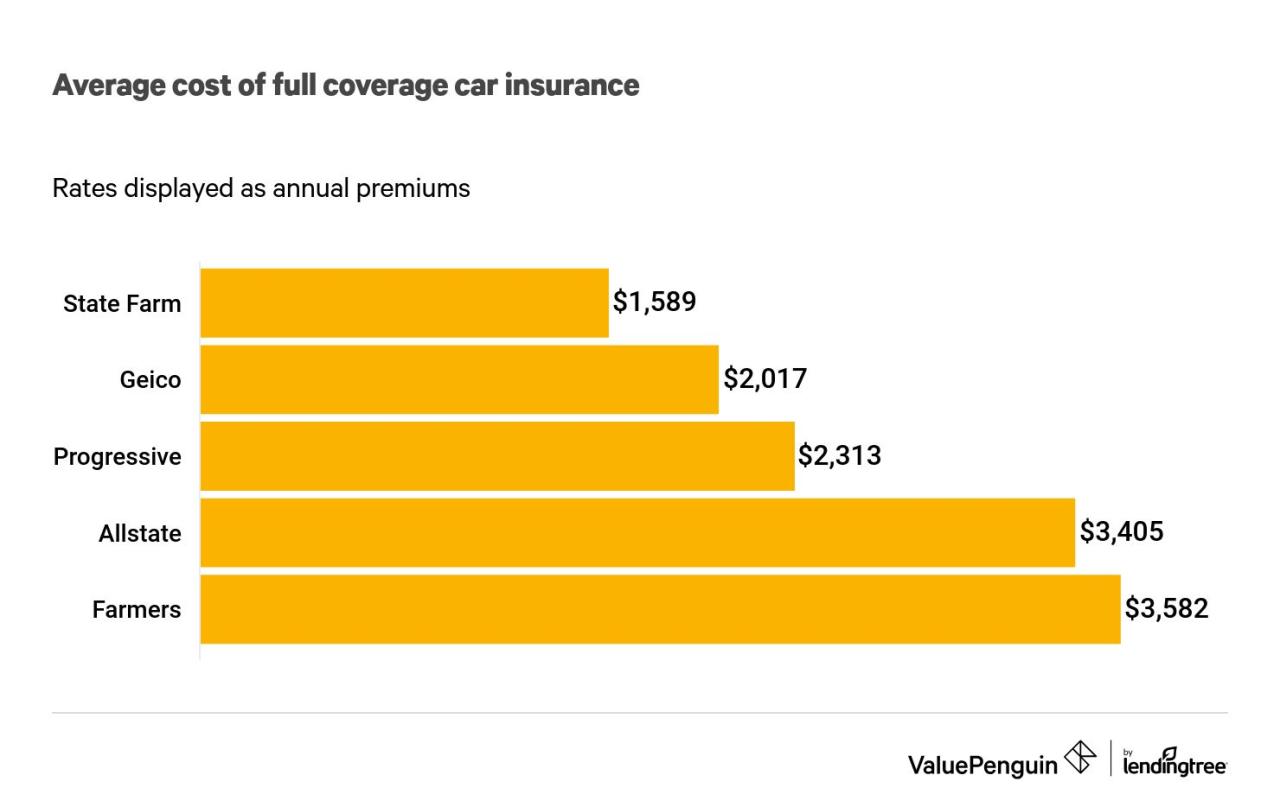

- Negative reviews often express concerns about pricing, citing instances where premiums seemed higher compared to competitors.

- Some customers have reported difficulties in obtaining fair settlements for their claims, leading to frustration and dissatisfaction.

- Other negative reviews highlight instances of lengthy claim processing times, which can be particularly stressful for policyholders in need of quick assistance.

Real-World Examples of Claims Handling

To gain a better understanding of how State Farm handles claims, it’s helpful to explore real-world examples shared by customers.

- One customer recounted a positive experience with a car accident claim, praising the prompt and efficient handling by the State Farm agent. The agent provided clear guidance throughout the process, ensuring a smooth settlement.

- Another customer shared a negative experience with a claim denial, expressing frustration with the lack of transparency and communication from the company. The customer felt that the denial was unjustified and ultimately had to seek legal counsel to resolve the issue.

- A third customer described a lengthy and frustrating experience with a claim for vehicle repairs. The customer faced delays in obtaining approval for repairs and encountered difficulties in coordinating with the chosen repair shop.

Comparison with Other Car Insurance Providers

Choosing the right car insurance provider can be a complex decision, as numerous companies offer varying rates, coverage options, and customer service experiences. Comparing State Farm to its competitors is crucial to determine if it aligns with your specific needs and preferences.

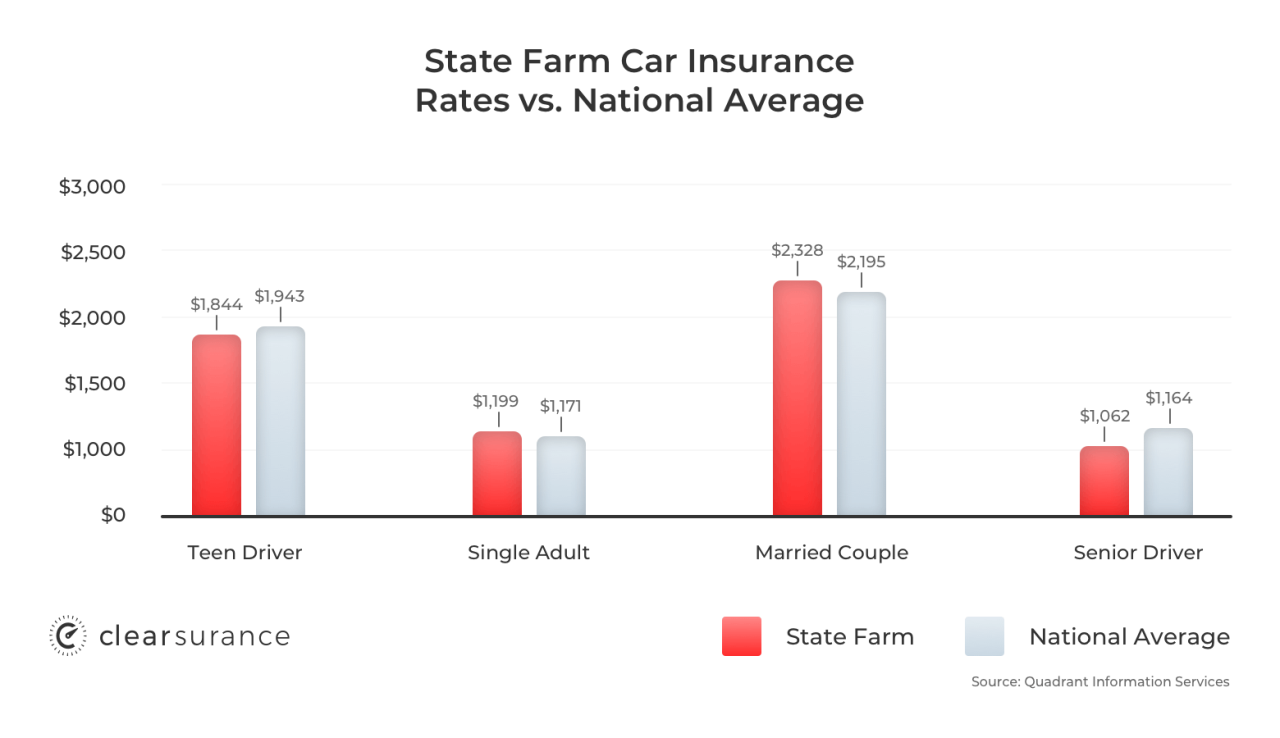

State Farm vs. Other Major Providers

To make an informed decision, comparing State Farm’s rates and coverage options with other major providers is essential. This comparison allows you to assess the value proposition of each insurer and identify which best suits your individual circumstances.

- Progressive: Known for its customizable coverage options and its popular “Name Your Price” tool that allows customers to set their desired premium and see available coverage options. Progressive also offers a wide range of discounts, including safe driving, good student, and multi-policy discounts.

- Geico: Renowned for its competitive rates and straightforward online quoting process. Geico’s commercials are often humorous and memorable, contributing to its brand recognition. The company also offers a variety of discounts, including multi-car, multi-policy, and good driver discounts.

- Allstate: Emphasizes its commitment to customer service and its “Mayhem” advertising campaign that highlights common insurance claims. Allstate provides a range of coverage options and discounts, including accident forgiveness, good student, and safe driver discounts.

- USAA: Exclusively for military members and their families, USAA is known for its exceptional customer service and competitive rates. The company offers a wide range of coverage options and discounts, including military discounts, good student discounts, and safe driver discounts.

Tips for Obtaining the Best Rates: Cost Of State Farm Car Insurance

Securing the most competitive State Farm car insurance rates involves a combination of proactive steps and strategic choices. By understanding the factors that influence your premiums and taking advantage of available discounts, you can significantly reduce your insurance costs.

Improving Your Driving Record

A clean driving record is a cornerstone of affordable car insurance. By practicing safe driving habits and avoiding violations, you can significantly reduce your premiums. Here are some key strategies to maintain a good driving record:

- Defensive Driving Courses: Enrolling in a defensive driving course can help you develop safer driving techniques and potentially earn discounts on your insurance.

- Avoid Traffic Violations: Speeding tickets, reckless driving citations, and DUI convictions can dramatically increase your insurance rates.

- Maintain a Safe Driving History: Consistent safe driving over time demonstrates responsible behavior, which can positively impact your insurance premiums.

Maintaining a Good Credit Score

While it may seem surprising, your credit score can influence your car insurance rates. Insurers often use credit scores as a proxy for risk assessment, believing that individuals with good credit are more likely to be responsible drivers.

- Monitor Your Credit Regularly: Regularly check your credit report for errors and take steps to improve your score if needed.

- Pay Bills on Time: Timely payments demonstrate financial responsibility, which can positively impact your credit score.

- Manage Debt Wisely: High credit utilization ratios can negatively impact your credit score.

Bundling Insurance Policies

Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant discounts.

- Explore Bundling Options: Contact State Farm to inquire about bundling your car insurance with other policies.

- Compare Bundled Rates: Get quotes from other insurers to compare bundled rates and see if you can find a better deal.

Shopping Around and Comparing Quotes

One of the most effective ways to find the best car insurance rates is to shop around and compare quotes from multiple insurers.

- Use Online Comparison Tools: Utilize online comparison tools that allow you to enter your information and receive quotes from various insurers simultaneously.

- Contact Insurers Directly: Reach out to insurers directly to obtain personalized quotes and discuss your specific needs.

- Negotiate Rates: Once you have gathered quotes from multiple insurers, you can use them as leverage to negotiate better rates with State Farm.

Final Wrap-Up

Ultimately, the cost of State Farm car insurance is influenced by a complex interplay of factors. By understanding these factors and taking proactive steps to manage them, you can potentially secure lower premiums and ensure that you have the right coverage for your needs. Remember to shop around, compare quotes, and leverage available discounts to find the best value for your money.

FAQ Summary

What are the main factors that affect State Farm car insurance rates?

Factors such as your driving history, vehicle type, location, age, and credit score can all influence your premiums.

Does State Farm offer discounts for good drivers?

Yes, State Farm offers discounts for safe drivers, including those with a clean driving record and those who complete defensive driving courses.

How can I compare State Farm car insurance quotes with other providers?

You can use online comparison tools or contact multiple insurance companies directly to get quotes and compare coverage options and prices.