Condo insurance washington state – Condo insurance in Washington State is crucial for protecting your investment and ensuring peace of mind. Unlike homeowners insurance, condo insurance specifically covers your individual unit within a multi-unit complex. This guide delves into the nuances of condo insurance in Washington, covering essential coverage options, key considerations, and factors influencing premiums.

Understanding the distinctions between condo insurance and homeowners insurance is paramount. Condo insurance primarily protects your personal belongings and your unit’s interior, while the condo association’s master policy covers common areas and the building’s exterior. It’s essential to review both policies to determine your individual responsibilities and coverage limits.

Key Considerations for Condo Insurance in Washington

Understanding the specific details of your condo insurance policy is crucial in Washington state. This is especially true considering the unique aspects of condo ownership, where shared responsibilities with the condo association play a significant role.

Shared vs. Individual Responsibilities in Condo Insurance

It is vital to clearly understand the distinction between the coverage provided by the condo association’s master policy and your individual condo insurance policy. The master policy typically covers the building’s structure, common areas, and shared amenities, while your individual policy covers your personal belongings and any improvements you make to your unit.

For instance, the master policy might cover damage to the building’s roof, while your individual policy would cover damage to your personal belongings in your unit during a fire. It’s essential to review both the master policy and your individual policy to identify any gaps in coverage and ensure you have adequate protection.

The Role of the Declaration Page, Condo insurance washington state

The Declaration Page is a crucial document within your condo insurance policy. It summarizes the key features of your policy, including:

* Coverage Limits: This indicates the maximum amount your insurance company will pay for specific types of losses, such as damage to your personal belongings or liability claims.

* Deductibles: This is the amount you are responsible for paying out-of-pocket before your insurance coverage kicks in.

* Covered Perils: This lists the specific events or risks covered by your policy, such as fire, theft, or vandalism.

By carefully reviewing the Declaration Page, you can ensure that your policy aligns with your individual needs and financial circumstances. For example, if you have valuable personal belongings, you might need to increase your coverage limits accordingly.

Impact of Building Codes and Regulations

Local building codes and regulations can significantly impact your condo insurance requirements in Washington. These codes establish standards for construction, safety, and maintenance, which can influence the types of coverage you need.

For instance, if your condo association fails to comply with building code requirements, your insurance company might deny coverage for damages resulting from code violations. It is crucial to stay informed about local building codes and regulations and ensure your condo association is compliant. This proactive approach can help minimize potential insurance disputes and ensure your coverage remains valid.

Factors Influencing Condo Insurance Premiums

Condo insurance premiums in Washington are influenced by a variety of factors, some of which are unique to the state’s specific geography and housing market. These factors are crucial to understand, as they can significantly impact the cost of your insurance.

Location

The location of your condo is a primary factor influencing insurance premiums. Cities with a higher risk of natural disasters, such as earthquakes, floods, and wildfires, tend to have higher insurance premiums. For example, Seattle, located on the Puget Sound, is at risk of earthquakes and tsunamis, while areas near the Cascade Mountains are susceptible to wildfires. Additionally, areas with higher crime rates may also have higher premiums due to an increased risk of theft and vandalism.

Building Age

Older buildings often have higher insurance premiums due to their increased risk of needing repairs or replacement. Older buildings may have outdated plumbing, electrical wiring, and building materials, which can increase the likelihood of damage or failure. Newer buildings generally have more modern safety features and construction standards, making them less prone to damage and resulting in lower insurance premiums.

Personal Belongings Value

The value of your personal belongings is also a significant factor in determining your insurance premiums. If you have valuable items, such as jewelry, artwork, or electronics, your premiums will be higher. This is because you will need more coverage to protect your belongings in the event of a loss.

Average Condo Insurance Premiums Across Cities in Washington State

| City | Average Annual Premium |

|---|---|

| Seattle | $1,200 |

| Bellevue | $1,000 |

| Tacoma | $900 |

| Spokane | $800 |

Note: These are just estimates, and actual premiums may vary depending on the specific factors discussed above.

Tips for Reducing Condo Insurance Premiums

Here are some tips for condo owners to potentially reduce their insurance premiums:

- Increase your deductible: A higher deductible means you will pay more out of pocket if you need to file a claim, but it can lower your premium.

- Install safety features: Installing smoke detectors, fire alarms, and security systems can demonstrate to insurers that you are taking steps to mitigate risks, potentially leading to lower premiums.

- Shop around for quotes: Compare quotes from different insurance companies to find the best rates.

- Bundle your policies: Combining your condo insurance with other policies, such as auto insurance, can often result in discounts.

- Maintain a good credit score: Insurers often use credit scores to assess risk. Maintaining a good credit score can help you qualify for lower premiums.

Filing a Condo Insurance Claim in Washington

In the unfortunate event of damage or loss to your condo, understanding the claim process is crucial. This section Artikels the steps involved in filing a condo insurance claim in Washington, providing insights into claim processing timelines and the necessary documentation.

Claim Filing Process

Filing a condo insurance claim in Washington generally involves the following steps:

- Contact your insurance company immediately. Notify your insurance company as soon as possible after the incident. This allows them to start the claim process promptly and initiate investigations.

- Provide initial details of the incident. Your insurance company will ask for basic information about the incident, including the date, time, and location of the damage or loss. They may also request a brief description of what happened.

- File a formal claim. Your insurance company will provide you with a claim form, which you will need to complete and submit. This form will require detailed information about the incident, including the nature of the damage or loss, the value of the affected property, and any witnesses or other relevant details.

- Cooperate with the insurance company’s investigation. Your insurance company will investigate the claim to verify the incident and assess the extent of the damage or loss. This may involve inspections, interviews, and review of supporting documentation.

- Receive a claim decision. Once the investigation is complete, your insurance company will make a decision on your claim. They will notify you in writing about the outcome, including the amount of coverage, any applicable deductibles, and the payment process.

Claim Processing Timeline

The claim processing timeline can vary depending on the complexity of the claim and the cooperation of all parties involved. However, in general, the process can take several weeks or even months to complete. Here are some typical timelines:

- Initial claim notification: Within 24-48 hours

- Claim investigation: 1-2 weeks

- Claim decision: 2-4 weeks

- Payment processing: 1-2 weeks

Documentation Required for a Condo Insurance Claim

To support your claim, you will need to provide your insurance company with certain documentation. This may include:

- Police report: If the damage or loss resulted from a crime, such as theft or vandalism.

- Photos and videos: Documenting the damage or loss.

- Receipts and invoices: For the damaged or lost property, to demonstrate its value.

- Estimates: From qualified professionals, such as contractors or repair services, for the cost of repairs or replacement.

- Proof of ownership: For the damaged or lost property, such as a deed or purchase agreement.

Common Types of Condo Insurance Claims

Condo owners in Washington frequently file claims for various reasons. Here’s a table summarizing common types of claims and examples of covered and excluded events:

| Claim Type | Covered Events | Excluded Events |

|---|---|---|

| Fire and Smoke Damage | Fire damage caused by a faulty appliance, lightning strike, or other covered perils. | Fire damage caused by intentional acts of the insured, such as arson. |

| Water Damage | Water damage from a burst pipe, leaking roof, or overflowing bathtub. | Water damage from flooding due to heavy rainfall or a natural disaster. |

| Theft and Vandalism | Theft of personal property from the condo unit, vandalism to the unit or its contents. | Theft of personal property from a common area of the condo building. |

| Wind and Hail Damage | Damage to the condo unit caused by strong winds or hail. | Damage to the condo unit caused by a hurricane or tornado. |

Resources and Additional Information

Navigating the world of condo insurance in Washington State can be complex. To help you make informed decisions, we’ve compiled a list of resources and additional information that may prove valuable.

Reputable Insurance Providers in Washington

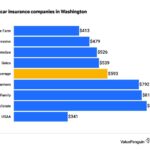

To find the right insurance provider, consider comparing quotes from various companies. Here’s a list of reputable insurance providers offering condo insurance in Washington State:

- State Farm: Known for its comprehensive coverage options and customer service.

- Allstate: Offers a range of condo insurance policies with customizable features.

- Farmers Insurance: Provides personalized insurance solutions tailored to individual needs.

- Liberty Mutual: Offers competitive rates and a variety of coverage options.

- USAA: A leading provider of insurance for military members and their families.

Official Resources

The Washington State Department of Insurance and the Washington Association of Realtors offer valuable resources for condo owners.

- Washington State Department of Insurance: This website provides comprehensive information on insurance regulations, consumer protection, and resources for filing complaints.

https://www.insurance.wa.gov/ - Washington Association of Realtors: This organization provides valuable resources for real estate professionals and consumers, including information on condo insurance.

https://www.warealtor.com/

Common Questions Regarding Condo Insurance

Condo owners often have questions about their insurance coverage.

- What does condo insurance cover? Condo insurance typically covers your personal belongings, liability, and any damage to your unit that is not covered by the master policy.

- How much condo insurance do I need? The amount of coverage you need depends on the value of your belongings and the potential liability risks. It’s essential to consult with an insurance agent to determine the right coverage amount.

- What is the difference between a master policy and a unit policy? The master policy covers the common areas of the condo complex, while the unit policy covers your individual unit.

- What are some common exclusions in condo insurance? Common exclusions may include damage caused by floods, earthquakes, or acts of war. It’s important to review your policy carefully to understand what is and isn’t covered.

- How do I file a condo insurance claim? If you need to file a claim, contact your insurance company immediately. They will provide you with instructions on how to proceed.

Conclusive Thoughts: Condo Insurance Washington State

Navigating the world of condo insurance in Washington State can seem complex, but armed with the right knowledge, you can secure the coverage you need to safeguard your investment. By carefully considering your individual needs, understanding the nuances of condo insurance policies, and actively engaging with your insurance provider, you can make informed decisions that ensure peace of mind and financial security.

Question Bank

What are the typical coverage options included in a condo insurance policy in Washington?

Common coverage options include liability coverage, personal property coverage, loss of use coverage, and additional living expenses coverage. Specific coverage options and limits may vary depending on the insurer and your policy.

How can I reduce my condo insurance premiums?

You can potentially lower your premiums by increasing your deductible, installing security systems, maintaining good credit, and bundling your condo insurance with other policies.

What are some common exclusions in condo insurance policies?

Common exclusions include earthquake coverage, flood coverage, and damage caused by acts of war or terrorism. It’s essential to review your policy carefully to understand any limitations or exclusions.

What are the steps involved in filing a condo insurance claim?

Contact your insurance provider immediately after an incident. Provide them with detailed information about the event and any relevant documentation. They will guide you through the claim process and provide instructions for filing the claim.