Compare car insurance rates by state and discover how your location impacts your premiums. Understanding the factors that influence car insurance costs in different states can help you find the best coverage at the most affordable price.

From state-specific regulations to driving conditions and risk factors, a variety of elements contribute to the wide range of car insurance rates across the country. This comprehensive guide explores these factors, providing valuable insights to help you navigate the complex world of car insurance.

Factors Influencing Car Insurance Rates

Car insurance rates are not uniform across the United States. They vary significantly from state to state, driven by a complex interplay of factors. These factors influence the likelihood of accidents and the costs associated with them, ultimately impacting the premiums car insurance companies charge.

State Laws and Regulations

State governments play a crucial role in shaping car insurance rates by setting minimum coverage requirements, regulating insurance companies, and establishing consumer protection laws. These regulations directly impact the cost of insurance by influencing the types of coverage required, the limits on coverage amounts, and the procedures for handling claims.

- For example, states with higher minimum liability coverage requirements generally have higher insurance rates. This is because drivers in these states are required to carry more insurance, which increases the potential payout for insurance companies in the event of an accident.

- Similarly, states with strict regulations on insurance company practices, such as those limiting rate increases, can also influence lower insurance rates.

Demographics

Demographics, including population density, age, and income levels, can also influence car insurance rates.

- States with higher population densities tend to have more traffic congestion and a greater likelihood of accidents, leading to higher insurance rates.

- Younger drivers, especially those under 25, often have higher insurance rates due to their inexperience and higher risk of accidents.

- Similarly, drivers in higher-income areas may face higher insurance rates due to the value of their vehicles and the potential for higher claims.

Driving History

An individual’s driving history is a significant factor influencing their car insurance rates.

- Drivers with a history of accidents, traffic violations, or DUI convictions are considered higher risk and will typically pay higher premiums.

- On the other hand, drivers with a clean driving record, no accidents, and no violations, are considered lower risk and often enjoy lower insurance rates.

Vehicle Type

The type of vehicle you drive also plays a significant role in determining your car insurance rates.

- Luxury cars, sports cars, and high-performance vehicles are often more expensive to repair or replace, leading to higher insurance premiums.

- Conversely, older, less expensive vehicles generally have lower insurance rates due to their lower value and repair costs.

- The safety features of your vehicle, such as anti-lock brakes, airbags, and stability control, can also influence your insurance rates. Vehicles with more safety features are often considered safer and may result in lower premiums.

Other Factors

Besides the factors mentioned above, several other factors can influence car insurance rates.

- Your credit score can impact your insurance rates, as insurance companies may view a lower credit score as an indicator of higher risk.

- Your occupation can also play a role, as some professions may involve more driving or expose you to higher risk of accidents.

- The location where you park your vehicle can also affect your rates, with higher rates for vehicles parked in high-crime areas.

State-Specific Regulations and Laws

Car insurance regulations and laws vary significantly from state to state, influencing the types of coverage required, the minimum limits, and ultimately, the cost of car insurance. Understanding these state-specific requirements is crucial for drivers to ensure they are adequately protected and comply with the law.

Mandatory Coverage Requirements

Each state mandates certain types of car insurance coverage to protect drivers and others involved in accidents. These requirements are designed to ensure financial responsibility and compensate victims for damages or injuries.

- Liability Coverage: This is the most common requirement in all states and covers bodily injury and property damage caused to others in an accident. It is typically expressed as a per-person and per-accident limit, for example, 25/50/25, meaning $25,000 per person, $50,000 per accident for bodily injury, and $25,000 for property damage.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who is uninsured or has insufficient insurance. It covers your medical expenses and property damage.

- Personal Injury Protection (PIP): Some states require PIP coverage, which pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. It is optional in some states.

- Comprehensive Coverage: This coverage protects your vehicle against damages from non-accident events, such as theft, vandalism, fire, or natural disasters. It is optional in some states.

State-Specific Regulations Affecting Car Insurance Costs

Beyond mandatory coverage requirements, several state-specific regulations directly impact car insurance costs.

- No-Fault Laws: Some states have no-fault insurance laws, where drivers are primarily responsible for their own injuries, regardless of fault. This can reduce litigation costs but may also lead to higher premiums.

- Tort Laws: Other states have tort laws, where drivers can sue for damages caused by another driver’s negligence. This can lead to higher premiums as insurers must account for potential lawsuits.

- Minimum Coverage Limits: The minimum coverage limits required by each state can vary significantly, influencing the cost of insurance. Higher minimum limits typically result in higher premiums.

- Insurance Rate Regulation: States have different regulations regarding how insurers set rates. Some states allow insurers more freedom to set rates based on factors like driving history and credit score, while others impose stricter regulations.

- Insurance Fraud Laws: States have varying laws and penalties for insurance fraud, which can impact the cost of insurance. Stricter enforcement of fraud laws can help reduce fraudulent claims and lower premiums.

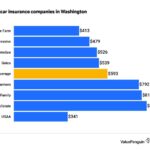

Average Car Insurance Rates by State

Understanding the average car insurance rates in different states is crucial for making informed decisions about your coverage. Rates can vary significantly based on a multitude of factors, including state-specific regulations, demographics, and driving conditions. This section delves into the average car insurance rates across the United States, providing insights into the trends and patterns observed.

Average Car Insurance Rates by State

The table below presents the average annual car insurance premiums for different coverage types in various states. The data is based on national averages and may vary depending on individual factors like driving history, vehicle type, and coverage levels.

| State | Liability | Collision | Comprehensive |

|---|---|---|---|

| Alabama | $600 | $400 | $250 |

| Alaska | $800 | $500 | $300 |

| Arizona | $700 | $450 | $275 |

| Arkansas | $550 | $350 | $225 |

| California | $900 | $600 | $350 |

| Colorado | $750 | $500 | $300 |

| Connecticut | $850 | $550 | $325 |

| Delaware | $650 | $400 | $250 |

| Florida | $1,000 | $650 | $375 |

| Georgia | $700 | $450 | $275 |

The table illustrates that car insurance rates can vary significantly across states. For example, the average annual premium for liability coverage in Florida is around $1,000, while in Arkansas it’s only $550. These differences can be attributed to factors such as state-specific regulations, the frequency of accidents, and the cost of living.

Impact of Driving Conditions and Risk Factors

The cost of car insurance is influenced by a variety of factors, including driving conditions and risk factors. These factors are often used by insurance companies to assess the likelihood of accidents and, consequently, the potential cost of claims. States with higher risk factors, such as high traffic density, severe weather conditions, or high crime rates, often have higher average car insurance rates.

Traffic Density

Traffic density plays a significant role in car insurance rates. States with congested roads and heavy traffic experience a higher frequency of accidents, which translates to higher insurance premiums. This is because more cars on the road increase the likelihood of collisions, and the potential for severe accidents is also greater in dense traffic.

For example, states like California and New York, known for their dense urban areas and heavy traffic, tend to have higher average car insurance rates compared to states with less congested roads.

Weather Conditions

Extreme weather conditions, such as heavy snowfall, hurricanes, and tornadoes, can significantly impact car insurance rates. These conditions increase the risk of accidents, damage to vehicles, and even fatalities. States that are prone to such weather events often have higher insurance premiums to account for the increased risk.

For instance, states along the Gulf Coast, frequently exposed to hurricanes, often have higher car insurance rates compared to states with milder climates. Similarly, states in the Northeast, susceptible to heavy snowfall and icy conditions, also experience higher insurance costs due to the increased risk of accidents during winter months.

Crime Rates

High crime rates can also influence car insurance premiums. States with higher rates of theft and vandalism tend to have higher insurance rates. This is because insurance companies have to factor in the increased risk of claims due to these crimes.

For instance, states with high urban crime rates often have higher car insurance premiums compared to states with lower crime rates. This is because the likelihood of car theft, vandalism, and other crimes is higher in areas with higher crime rates.

Cost Comparison Tools and Resources

Finding the best car insurance rates can be a daunting task, but luckily, several online tools and resources can help you compare rates from different insurance companies in your state. These tools are designed to simplify the process and make it easier to find the most affordable and comprehensive coverage for your needs.

Online Comparison Websites

These websites act as a central hub where you can input your information, and they will automatically generate quotes from multiple insurance providers. This allows you to compare prices, coverage options, and discounts side-by-side, making it easier to identify the best deal for you.

- Compare.com: This website allows you to compare car insurance quotes from various insurers, including well-known brands like Geico, Progressive, and State Farm. It also provides information on different coverage options and discounts available.

- Policygenius: Policygenius is another popular platform that offers free car insurance quotes from multiple providers. It also provides personalized recommendations based on your specific needs and driving history.

- The Zebra: The Zebra is known for its user-friendly interface and comprehensive comparison features. It allows you to compare quotes from over 100 insurers, including regional and national providers.

- Insurify: Insurify is a website that focuses on providing personalized car insurance quotes based on your driving history, location, and other factors. It also offers a wide range of coverage options and discounts to choose from.

Insurance Company Websites

Many insurance companies have their own websites where you can get a free quote. This allows you to directly compare rates from a specific insurer without using a third-party comparison site.

- Geico: Geico is a well-known insurer that offers a variety of coverage options and discounts. You can get a quote online or through their mobile app.

- Progressive: Progressive is another popular insurer that offers customizable coverage and discounts. They also have a user-friendly website and mobile app for getting quotes.

- State Farm: State Farm is a large insurance company with a strong reputation for customer service. You can get a quote online or by contacting their agents directly.

Tips for Effective Use, Compare car insurance rates by state

Using these tools effectively can ensure you get the most accurate and reliable comparisons. Here are some tips to keep in mind:

- Provide accurate information: Be honest and thorough when entering your information, as inaccuracies can lead to inaccurate quotes.

- Compare apples to apples: Make sure you are comparing the same coverage options across different insurers. This will ensure a fair comparison of prices.

- Check for discounts: Many insurers offer discounts for various factors, such as good driving records, safety features, and bundling insurance policies. Ask about these discounts to see if you qualify.

- Read the fine print: Before committing to a policy, carefully review the terms and conditions to understand the coverage details and any limitations.

Tips for Saving on Car Insurance: Compare Car Insurance Rates By State

Car insurance is a necessary expense, but it doesn’t have to break the bank. With a little research and effort, you can find ways to reduce your premiums and save money. Here are some practical tips and strategies for consumers to reduce their car insurance costs.

Bundling Insurance Policies

Bundling your insurance policies can save you money on both your car and home insurance premiums. When you bundle your policies with the same insurer, you can often qualify for a significant discount. Bundling is a common strategy offered by insurance companies, as it encourages customer loyalty and reduces administrative costs.

Maintaining a Good Driving Record

One of the most important factors influencing your car insurance rates is your driving record. Maintaining a clean driving record is essential for keeping your premiums low. Insurance companies view drivers with a history of accidents, traffic violations, or DUIs as higher risk and charge them higher premiums. If you have a good driving record, you can often qualify for a safe driver discount.

Choosing a Higher Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can help you lower your premiums. The trade-off is that you’ll have to pay more out of pocket if you have an accident. However, if you’re comfortable with a higher deductible, it can be a great way to save money on your insurance.

Negotiating with Insurance Companies

Don’t be afraid to negotiate with your insurance company. Many insurance companies are willing to work with you to find a rate that works for both of you. You can try negotiating a lower premium by:

- Comparing quotes from different insurers.

- Mentioning that you’re considering switching to another insurer.

- Asking about discounts you may be eligible for.

Exploring Discounts

Many insurance companies offer discounts for various factors, such as:

- Good student discounts

- Safe driver discounts

- Multi-car discounts

- Discounts for anti-theft devices

- Discounts for paying your premium in full

- Discounts for having a good credit score

End of Discussion

By understanding the factors that influence car insurance rates in your state, you can make informed decisions about your coverage and potentially save money. Remember to compare quotes from multiple insurers, consider discounts, and take advantage of online tools to find the best deals.

Answers to Common Questions

What factors affect car insurance rates the most?

Several factors influence car insurance rates, including your driving history, age, vehicle type, location, and credit score.

How can I compare car insurance rates online?

Many reputable online comparison tools allow you to enter your information and receive quotes from multiple insurance companies.

Is it worth bundling my car and home insurance?

Bundling your insurance policies can often lead to significant discounts, making it a worthwhile option for many consumers.