Compare car insurance by state to find the best rates and coverage for your needs. Car insurance rates vary significantly across the country due to factors like state regulations, traffic density, and local crime rates. Understanding these differences can help you save money on your premiums.

This guide explores the key considerations for comparing car insurance rates, including coverage options, deductibles, and discounts. We’ll also provide insights on how to find the best insurance for your specific situation and navigate the claims process.

Understanding Car Insurance Variations by State: Compare Car Insurance By State

Car insurance premiums vary significantly from state to state, and understanding these differences is crucial for drivers seeking the best coverage at the most affordable price. Several factors contribute to this disparity, making it essential to compare quotes across multiple insurers and states to find the most suitable option.

State Regulations and Laws

State regulations and laws play a significant role in shaping car insurance rates. These regulations govern various aspects of insurance, including:

- Minimum Coverage Requirements: Each state mandates specific minimum coverage levels, including liability, personal injury protection (PIP), and uninsured/underinsured motorist (UM/UIM) coverage. States with higher minimum coverage requirements typically have higher average premiums.

- No-Fault Laws: Some states operate under no-fault insurance systems, where drivers are primarily responsible for their own injuries and damages, regardless of fault. These systems can impact premiums, as they limit liability claims and reduce overall costs.

- Tort Laws: States with “tort” laws allow drivers to sue for damages, potentially leading to higher insurance premiums due to increased risk of liability claims.

- Insurance Rate Regulation: States have varying levels of regulation on insurance rates. Some states allow insurers more flexibility in setting rates, while others impose stricter regulations, potentially impacting the overall cost of insurance.

For example, in states with higher minimum coverage requirements, such as New Jersey, drivers are required to carry more comprehensive coverage, resulting in higher premiums. Conversely, states like Florida, with lower minimum coverage requirements, may have lower average premiums.

Demographics and Driving Conditions

Demographic factors and driving conditions significantly impact car insurance rates.

- Population Density: States with high population densities often have higher car insurance premiums due to increased traffic congestion, higher risk of accidents, and greater potential for claims.

- Driving Habits: States with higher rates of traffic violations, accidents, and drunk driving may have higher insurance premiums as insurers perceive them as riskier.

- Weather Conditions: States with extreme weather conditions, such as hurricanes, tornadoes, or heavy snowfall, may have higher insurance premiums due to the increased risk of damage to vehicles.

- Cost of Repairs: States with higher costs of living and labor may have higher car insurance premiums due to the increased cost of vehicle repairs.

For instance, California, with its high population density and diverse driving conditions, has higher average premiums compared to states like Wyoming, which has a lower population density and less congested roads.

Key Considerations for Comparing Car Insurance

Comparing car insurance policies across different companies can be a daunting task, especially when considering the wide range of coverage options and pricing structures. To make informed decisions, it’s crucial to understand the key factors that influence insurance costs and policy features. This section will guide you through the essential considerations for comparing car insurance quotes effectively.

Coverage Options

- Liability Coverage: This coverage protects you financially if you cause an accident that injures another person or damages their property. It typically includes bodily injury liability and property damage liability. The limits for these coverages, such as $100,000/$300,000 or $250,000/$500,000, represent the maximum amount your insurer will pay for each incident. It’s crucial to choose limits that adequately protect your assets.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. It’s typically optional but may be required if you have a car loan or lease.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, natural disasters, and animal collisions. It’s also usually optional, but it can be essential if you have a newer or high-value vehicle.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. It’s essential for protecting yourself financially in such situations.

- Personal Injury Protection (PIP): This coverage, often required in certain states, pays for your medical expenses, lost wages, and other related costs if you’re injured in an accident, regardless of fault. It’s a valuable addition to your policy for ensuring financial protection in case of an accident.

- Medical Payments Coverage (Med Pay): This coverage pays for your medical expenses, regardless of fault, up to a certain limit. It’s a supplementary coverage that can provide additional protection beyond PIP.

Essential Factors for Comparing Quotes

- Deductibles: This is the amount you pay out of pocket for repairs or replacement of your vehicle before your insurance coverage kicks in. A higher deductible typically results in a lower premium, while a lower deductible means a higher premium.

- Coverage Limits: The maximum amount your insurer will pay for specific types of claims, such as liability, collision, or comprehensive coverage, are crucial to consider. Higher limits generally provide greater financial protection but come with higher premiums.

- Discounts: Many insurers offer discounts for various factors, including safe driving records, good credit scores, multiple vehicle insurance, and safety features in your car. Taking advantage of these discounts can significantly reduce your premium.

Evaluating Value and Affordability

- Compare Quotes from Multiple Insurers: Don’t settle for the first quote you receive. Obtain quotes from several insurers to compare coverage options, premiums, and discounts. Online comparison tools can be helpful for this process.

- Consider Your Individual Needs: The right insurance policy depends on your individual circumstances, such as your driving history, the type of vehicle you drive, and your financial situation.

- Read Policy Documents Carefully: Before making a decision, carefully review the policy documents to understand the specific coverage details, exclusions, and limitations.

State-Specific Car Insurance Requirements

Every state in the US has its own set of minimum car insurance requirements, which dictate the types and amounts of coverage drivers must carry to legally operate a vehicle. These requirements are designed to ensure that drivers have financial protection in case of an accident and to help compensate victims for their losses. Understanding these requirements is crucial for drivers, as failing to comply can result in serious consequences.

Minimum Liability Coverage Requirements

This table summarizes the minimum liability coverage requirements for each state:

| State | Bodily Injury Liability per Person | Bodily Injury Liability per Accident | Property Damage Liability |

|---|---|---|---|

| Alabama | $25,000 | $50,000 | $25,000 |

| Alaska | $50,000 | $100,000 | $25,000 |

| Arizona | $25,000 | $50,000 | $15,000 |

| Arkansas | $25,000 | $50,000 | $25,000 |

| California | $15,000 | $30,000 | $5,000 |

| Colorado | $25,000 | $50,000 | $15,000 |

| Connecticut | $20,000 | $40,000 | $10,000 |

| Delaware | $30,000 | $60,000 | $10,000 |

| Florida | $10,000 | $20,000 | $10,000 |

| Georgia | $25,000 | $50,000 | $25,000 |

| Hawaii | $20,000 | $40,000 | $10,000 |

| Idaho | $25,000 | $50,000 | $25,000 |

| Illinois | $20,000 | $40,000 | $15,000 |

| Indiana | $25,000 | $50,000 | $10,000 |

| Iowa | $20,000 | $40,000 | $15,000 |

| Kansas | $25,000 | $50,000 | $25,000 |

| Kentucky | $25,000 | $50,000 | $25,000 |

| Louisiana | $15,000 | $30,000 | $10,000 |

| Maine | $50,000 | $100,000 | $25,000 |

| Maryland | $30,000 | $60,000 | $15,000 |

| Massachusetts | $20,000 | $40,000 | $5,000 |

| Michigan | $25,000 | $50,000 | $25,000 |

| Minnesota | $30,000 | $60,000 | $10,000 |

| Mississippi | $25,000 | $50,000 | $25,000 |

| Missouri | $25,000 | $50,000 | $25,000 |

| Montana | $25,000 | $50,000 | $25,000 |

| Nebraska | $25,000 | $50,000 | $25,000 |

| Nevada | $15,000 | $30,000 | $10,000 |

| New Hampshire | $25,000 | $50,000 | $25,000 |

| New Jersey | $15,000 | $30,000 | $5,000 |

| New Mexico | $25,000 | $50,000 | $10,000 |

| New York | $25,000 | $50,000 | $10,000 |

| North Carolina | $30,000 | $60,000 | $25,000 |

| North Dakota | $25,000 | $50,000 | $25,000 |

| Ohio | $25,000 | $50,000 | $25,000 |

| Oklahoma | $25,000 | $50,000 | $25,000 |

| Oregon | $25,000 | $50,000 | $20,000 |

| Pennsylvania | $15,000 | $30,000 | |

| Rhode Island | $25,000 | $50,000 | $25,000 |

| South Carolina | $25,000 | $50,000 | $25,000 |

| South Dakota | $25,000 | $50,000 | $25,000 |

| Tennessee | $25,000 | $50,000 | $25,000 |

| Texas | $30,000 | $60,000 | $25,000 |

| Utah | $25,000 | $65,000 | $15,000 |

| Vermont | $25,000 | $50,000 | $25,000 |

| Virginia | $25,000 | $50,000 | $20,000 |

| Washington | $25,000 | $50,000 | $10,000 |

| West Virginia | $25,000 | $50,000 | $25,000 |

| Wisconsin | $25,000 | $50,000 | $10,000 |

| Wyoming | $25,000 | $50,000 | $25,000 |

Uninsured/Underinsured Motorist Coverage Requirements, Compare car insurance by state

Uninsured/underinsured motorist (UM/UIM) coverage protects drivers and passengers in the event of an accident caused by a driver who is uninsured or has insufficient insurance. While some states mandate UM/UIM coverage, others allow drivers to opt out. Here’s a breakdown of the requirements in different states:

* Mandatory UM/UIM Coverage: Many states require drivers to carry a minimum amount of UM/UIM coverage, which may be equal to or higher than the minimum liability coverage. This ensures that drivers have financial protection even when the other driver is at fault and lacks adequate insurance.

* Optional UM/UIM Coverage: Some states allow drivers to decline UM/UIM coverage, but this can leave them financially vulnerable in an accident with an uninsured or underinsured driver.

* UM/UIM Coverage Limits: States may set specific limits on UM/UIM coverage, which determine the maximum amount that can be paid out in the event of a claim.

* Stacking: Some states allow drivers to “stack” their UM/UIM coverage, meaning that the coverage limits are added together for each covered vehicle under their policy. This can provide significantly higher coverage in case of an accident.

Implications of Failing to Meet State-Mandated Insurance Requirements

Failing to meet state-mandated insurance requirements can have serious consequences, including:

* Fines and Penalties: Drivers who are caught driving without the required insurance can face hefty fines and penalties, which can vary from state to state.

* License Suspension: In some states, driving without insurance can lead to license suspension, making it impossible to legally operate a vehicle.

* Vehicle Impoundment: Your vehicle may be impounded until proof of insurance is provided.

* Financial Responsibility: Even if you are not at fault in an accident, you may be held financially responsible for damages if you lack adequate insurance.

* Increased Insurance Premiums: If you are caught driving without insurance, your insurance premiums may increase significantly when you finally get insured.

* Criminal Charges: In some cases, driving without insurance can even result in criminal charges.

Finding the Best Car Insurance for Your Needs

Finding the most suitable car insurance policy involves more than just comparing prices. It’s about finding the right coverage that meets your specific needs and financial situation. This means considering factors like your driving history, the value of your car, and your personal risk tolerance.

Comparing Car Insurance Quotes

To find the best car insurance deal, it’s crucial to compare quotes from multiple insurance companies. This process involves gathering information about your car, driving history, and desired coverage, and then submitting it to different insurers. Here’s a step-by-step guide to make this process efficient:

- Gather Your Information: Before starting, have your driver’s license, vehicle information (make, model, year), and details about your driving history readily available. This includes your driving record, any accidents or violations, and your previous insurance policies.

- Utilize Online Comparison Tools: Several websites allow you to compare car insurance quotes from various companies simultaneously. These platforms streamline the process by collecting your information once and sending it to multiple insurers. Examples of reputable online comparison tools include:

- NerdWallet: Provides comprehensive car insurance comparisons, allowing you to filter by state, coverage, and other factors.

- Insurance.com: Offers a wide range of insurance providers and customizable quote requests, making it easy to find the best deals.

- Bankrate: A well-known financial resource, Bankrate also provides car insurance comparison tools, offering insights into different coverage options.

- Contact Insurance Companies Directly: While online comparison tools are convenient, contacting insurance companies directly can provide more personalized service. You can discuss specific coverage needs and negotiate rates.

- Review and Compare Quotes: Once you have gathered quotes from multiple sources, carefully compare the coverage offered, premiums, and deductibles. Ensure that the policies meet your specific requirements and budget.

Considering Personal Circumstances and Driving History

When comparing car insurance quotes, it’s crucial to consider your personal circumstances and driving history. These factors significantly influence your insurance premiums.

- Driving History: A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents or traffic tickets can significantly increase your rates.

- Vehicle Value: The value of your car directly impacts your insurance premiums. Higher-value vehicles generally require more comprehensive coverage, leading to higher costs.

- Location: The state and city where you live influence your insurance rates. Areas with higher crime rates or more frequent accidents tend to have higher premiums.

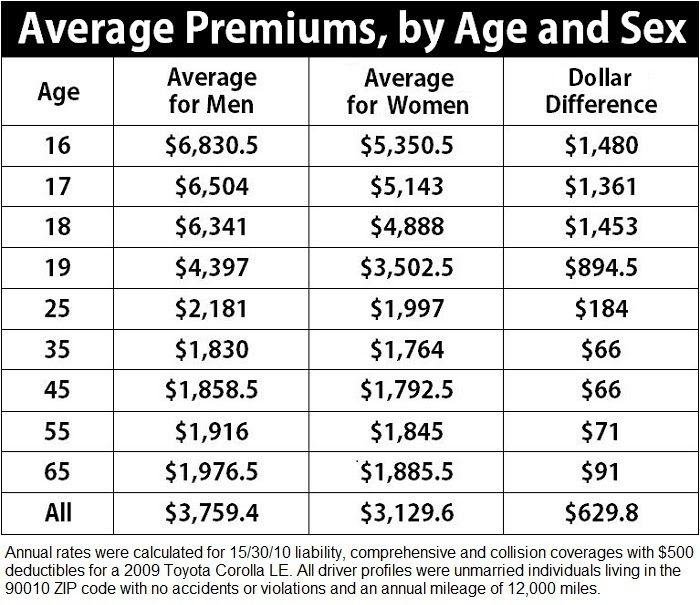

- Age and Gender: Younger drivers and males generally pay higher premiums due to their statistically higher risk of accidents. However, this can vary depending on the insurance company and state.

- Credit Score: Some insurance companies use your credit score as a factor in determining your premiums. A higher credit score generally indicates a lower risk, resulting in lower rates.

“It’s important to remember that insurance premiums are not one-size-fits-all. Your personal circumstances and driving history play a significant role in determining the cost of your car insurance.”

Understanding Common Car Insurance Discounts

Car insurance discounts are a great way to save money on your premiums. Most insurance companies offer a variety of discounts, and you can often qualify for several. Understanding the different types of discounts available can help you find the best deal on your car insurance.

Types of Car Insurance Discounts

Many factors can influence your car insurance premium, and discounts are a common way to lower your costs. Here are some of the most common car insurance discounts:

- Safe Driving Discounts: These discounts are offered to drivers with a clean driving record. You may qualify for a discount if you have not had any accidents or traffic violations in a certain period. Some companies also offer discounts for completing a defensive driving course.

- Good Student Discount: This discount is available to students who maintain a certain GPA. It’s often offered to high school and college students.

- Multi-Car Discount: You can save money on your insurance premiums if you insure multiple cars with the same company. This discount typically applies to each car you insure.

- Multi-Policy Discount: This discount is available to policyholders who bundle their car insurance with other types of insurance, such as homeowners or renters insurance.

- Vehicle Safety Features Discount: Some cars come equipped with safety features that can help reduce the risk of accidents. These features may include anti-lock brakes, airbags, and electronic stability control. Insurance companies often offer discounts for vehicles with these safety features.

- Loyalty Discount: This discount is offered to customers who have been with the same insurance company for a certain period. The longer you stay with the same company, the bigger your discount may be.

- Group Affiliation Discount: Some insurance companies offer discounts to members of certain groups, such as professional organizations, alumni associations, or employee groups. This is often based on a partnership between the insurance company and the group.

- Pay-in-Full Discount: You can often save money on your car insurance premiums if you pay your entire premium upfront. This is because insurance companies have to pay interest on premiums that are paid in installments.

- Telematics Discount: Some insurance companies offer discounts to drivers who use telematics devices, such as a black box or smartphone app. These devices track your driving habits and can help insurance companies assess your risk.

- Low Mileage Discount: If you drive less than a certain number of miles per year, you may qualify for a low mileage discount. This discount is typically offered to drivers who work from home, use public transportation, or drive a second car for long distances.

Maximizing Car Insurance Discounts

It’s important to ask your insurance company about all the discounts you may qualify for. Not all companies offer the same discounts, and some may have different eligibility criteria. Here are some tips for maximizing your car insurance discounts:

- Maintain a Clean Driving Record: One of the best ways to save money on car insurance is to avoid accidents and traffic violations. These incidents can increase your premiums significantly.

- Consider Safety Features: When buying a new car, consider the safety features that come standard or as optional extras. These features can not only help keep you safe but also lead to lower insurance premiums.

- Bundle Your Insurance: Combining your car insurance with other types of insurance, such as homeowners or renters insurance, can lead to significant savings.

- Shop Around: Don’t be afraid to compare quotes from different insurance companies. This can help you find the best deal on your car insurance.

- Ask About Discounts: Make sure you ask your insurance company about all the discounts you may qualify for. They may not always bring it up themselves, so it’s important to be proactive.

Navigating the Car Insurance Claims Process

A car accident can be a stressful and confusing experience. Navigating the insurance claims process can add to the pressure. Understanding the process and your policy terms is crucial for a smooth and fair resolution.

Understanding the Claims Process

The claims process typically involves these steps:

- Report the accident: Contact your insurance company immediately after the accident. Provide details about the incident, including the date, time, location, and any injuries.

- File a claim: Your insurance company will guide you through the claim filing process. You may need to provide documentation, such as a police report, photos of the damage, and medical records.

- Assessment and investigation: Your insurance company will assess the damage to your vehicle and investigate the accident. They may request additional information or schedule an inspection.

- Negotiation and settlement: Once the investigation is complete, your insurance company will negotiate a settlement amount. You may have the option to accept the offer or negotiate a higher amount.

- Payment: If you accept the settlement offer, your insurance company will issue payment for the repairs or other covered expenses.

Understanding Policy Terms

Your car insurance policy Artikels the terms and conditions of your coverage. It’s essential to understand your policy terms before an accident occurs. Key aspects to understand include:

- Coverage limits: Your policy specifies the maximum amount your insurance company will pay for covered losses. For example, your liability coverage limits determine the maximum amount your insurer will pay for damages to another person’s property or injuries caused by an accident.

- Deductibles: Your deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. A higher deductible generally results in lower premiums.

- Exclusions: Your policy may exclude certain types of claims. For example, your insurance may not cover damage caused by driving under the influence of alcohol or drugs.

Comparing Claims Filing Procedures and Customer Service

Insurance companies vary in their claims filing procedures and customer service experiences. Researching and comparing different companies can help you find one that best suits your needs.

- Online claims filing: Some insurance companies offer online claims filing, which can be a convenient option. However, it’s important to ensure that the online system is user-friendly and secure.

- Customer service availability: Look for insurance companies that offer 24/7 customer service and have responsive representatives.

- Claims processing time: Compare the average claims processing time of different insurance companies. A faster processing time can help you get back on the road quicker.

- Customer satisfaction ratings: Check customer satisfaction ratings from independent organizations like J.D. Power. These ratings can provide insights into the overall customer experience with different insurance companies.

Resolving Disputes or Challenging Insurance Decisions

In some cases, you may need to resolve a dispute or challenge an insurance company decision. Here are some tips:

- Review your policy: Start by carefully reviewing your policy terms to understand your coverage and rights.

- Document everything: Keep detailed records of all communications with your insurance company, including dates, times, and summaries of conversations.

- Contact your insurance company: Try to resolve the dispute through direct communication with your insurance company. Be polite and professional, but firm in your position.

- Seek mediation: If you cannot reach a resolution through direct communication, consider seeking mediation. A mediator can help facilitate a fair and impartial agreement between you and your insurance company.

- File a complaint: If mediation is unsuccessful, you can file a complaint with your state’s insurance department. The department can investigate your complaint and help you resolve the issue.

- Consult an attorney: If you are facing a significant dispute with your insurance company, consider consulting an attorney specializing in insurance law.

Summary

By understanding the factors that influence car insurance rates and taking advantage of available discounts, you can find the most affordable and comprehensive coverage for your needs. Remember to compare quotes from multiple insurers and carefully review the policy terms before making a decision. With the right information and a little effort, you can save money and ensure you have the protection you need on the road.

Query Resolution

How often should I compare car insurance quotes?

It’s a good idea to compare quotes at least once a year, or even more frequently if you experience significant life changes, such as a new job, a move, or a change in your driving record.

What factors affect car insurance rates?

Factors that can influence your car insurance rates include your age, driving history, vehicle type, location, and credit score.

How can I lower my car insurance premiums?

You can lower your premiums by taking advantage of discounts for safe driving, good student status, bundling insurance policies, and installing safety features in your vehicle.