Cheapest states for car insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the world of car insurance can be a daunting task, especially when trying to find the most affordable rates. With premiums varying significantly across the country, understanding what factors influence costs and identifying states with the lowest average premiums can save drivers substantial amounts of money. This guide explores the key elements that contribute to car insurance pricing, highlighting states where drivers can benefit from lower rates.

From driving history and vehicle type to age, location, and coverage levels, a multitude of factors come into play when calculating car insurance premiums. By understanding these factors, drivers can make informed decisions to minimize their insurance costs. This exploration delves into the complexities of car insurance pricing, providing practical tips and strategies to help drivers find the most affordable rates.

Factors Influencing Car Insurance Costs: Cheapest States For Car Insurance

Car insurance premiums are determined by a complex interplay of various factors. Understanding these factors can help you make informed decisions to potentially reduce your insurance costs.

Driving History

Your driving history plays a significant role in determining your car insurance premiums. A clean driving record with no accidents, violations, or claims can result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely lead to higher premiums. Insurance companies use this data to assess your risk of future accidents and adjust your premiums accordingly.

For instance, a driver with a history of two accidents within the past three years might face a premium increase of 20-30% compared to a driver with a clean record.

Vehicle Type

The type of vehicle you drive is another major factor affecting your insurance costs. Certain car models are considered more expensive to repair or replace, making them riskier for insurance companies. Additionally, high-performance vehicles with powerful engines or sporty features are often associated with a higher risk of accidents, resulting in higher premiums.

For example, a luxury SUV with a powerful engine and advanced safety features might have a higher insurance premium compared to a compact sedan with a standard engine.

Age

Age is a significant factor in car insurance pricing. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents due to factors such as inexperience, risk-taking behavior, and lack of driving history. Older drivers, however, might face higher premiums due to potential health issues or declining driving abilities.

For instance, a 20-year-old driver might pay significantly higher premiums than a 40-year-old driver with a similar driving record and vehicle.

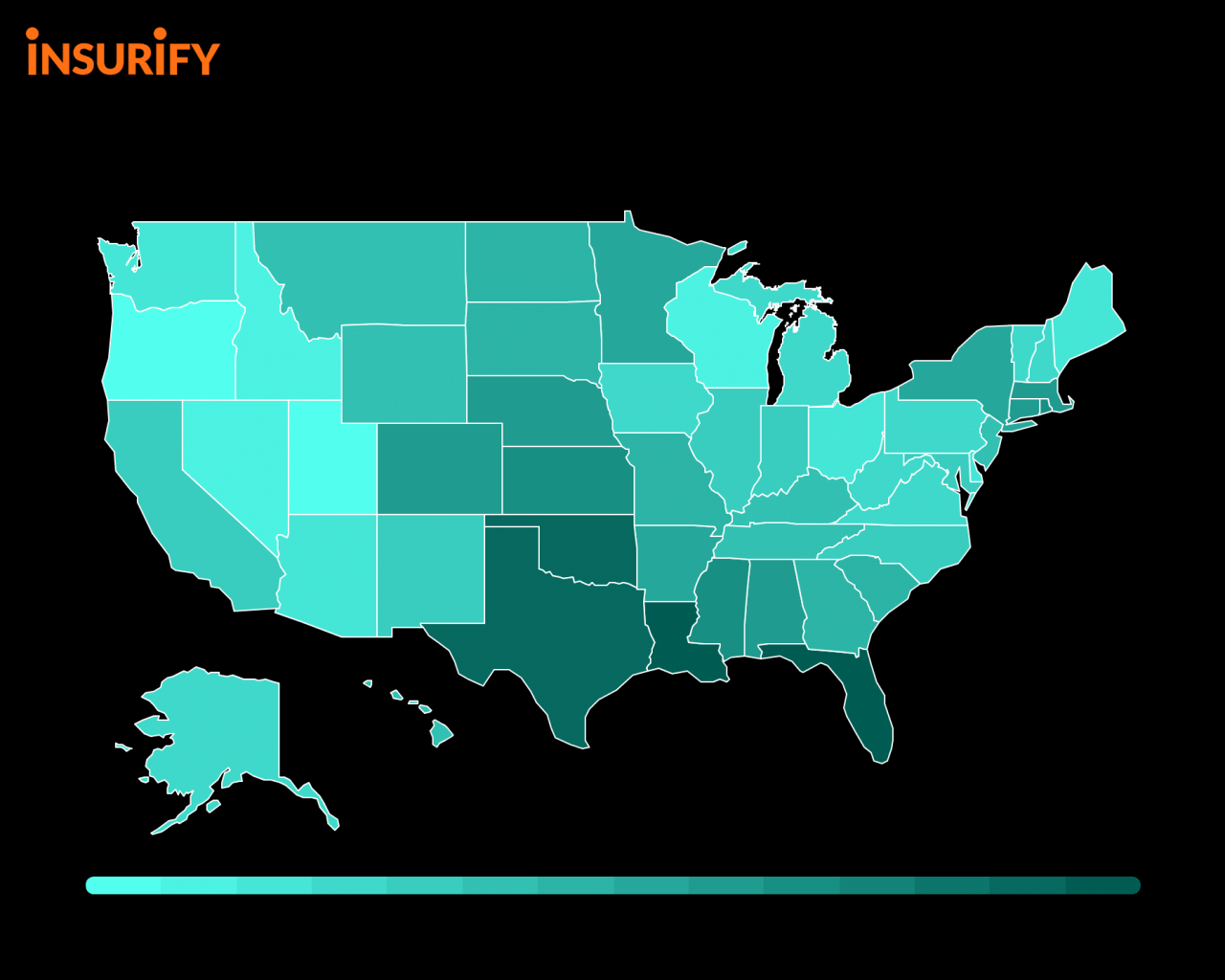

Location

The location where you live and drive significantly impacts your car insurance costs. Areas with higher crime rates, denser traffic, or a greater frequency of accidents tend to have higher insurance premiums. This is because insurance companies assess the risk of accidents and claims based on the location.

For example, a driver residing in a densely populated urban area with high traffic congestion might face higher premiums than a driver living in a rural area with less traffic and lower accident rates.

Coverage Levels

The level of coverage you choose for your car insurance policy also impacts the premium. Higher coverage limits, such as comprehensive and collision coverage, provide greater protection but come with higher premiums. Conversely, opting for minimum liability coverage, which provides basic protection, will result in lower premiums.

For instance, a driver with comprehensive and collision coverage, along with higher liability limits, will pay a higher premium than a driver with only minimum liability coverage.

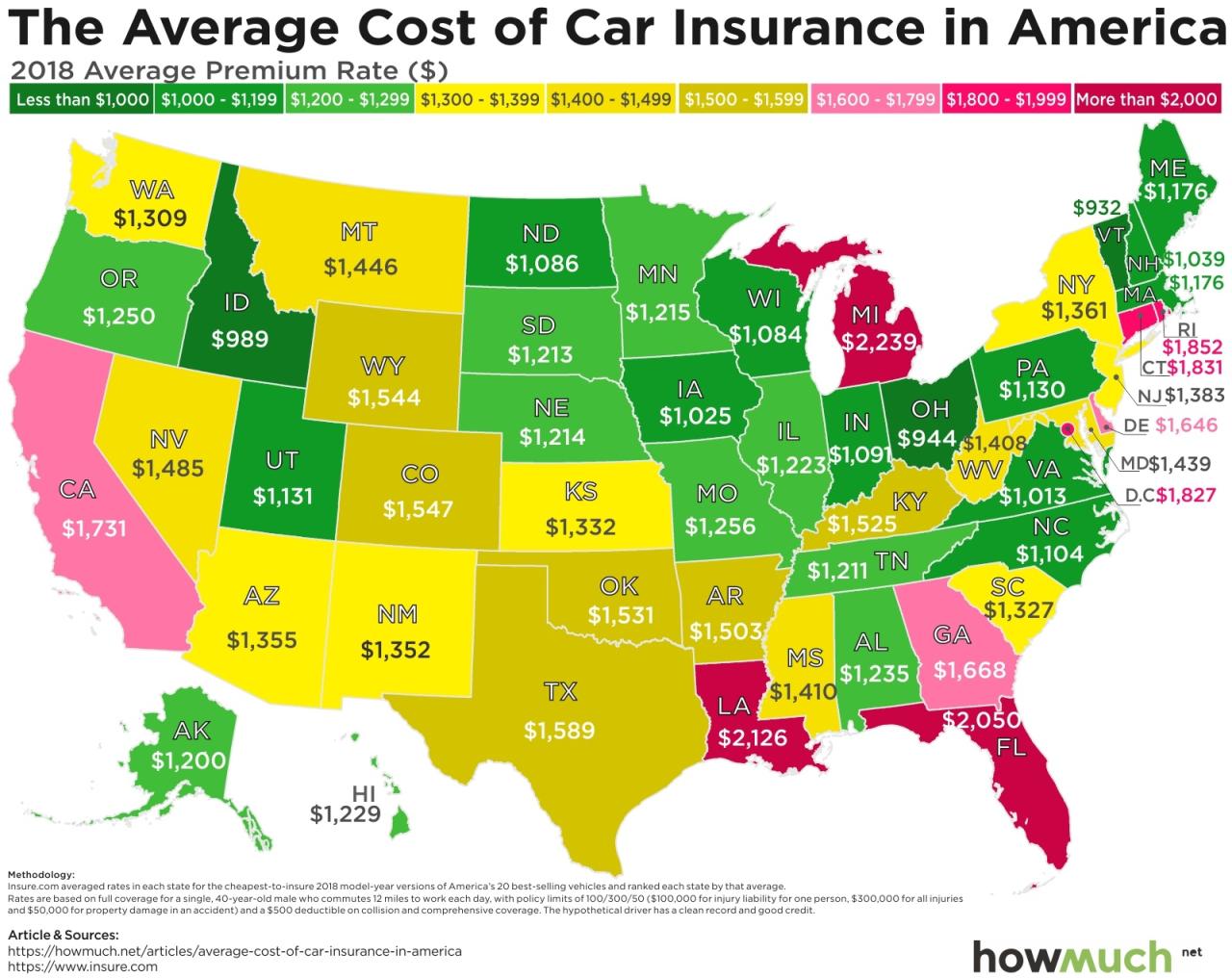

States with the Lowest Average Car Insurance Premiums

Finding the most affordable car insurance can be a significant factor in managing your finances, especially in a world where expenses seem to be constantly on the rise. Understanding which states have the lowest average car insurance premiums can help you make informed decisions about where you live or where you might relocate.

States with the Lowest Average Car Insurance Premiums

This table provides a snapshot of the states with the lowest average car insurance premiums. Keep in mind that these are averages and your individual premium will vary depending on factors such as your driving record, vehicle type, age, and more.

| State | Average Premium | Key Factors Contributing to Low Premiums | Resources for Finding Affordable Insurance in Each State |

|---|---|---|---|

| Maine | $1,100 | Lower population density, fewer accidents, and lower cost of living | Maine Bureau of Insurance, Maine Department of Transportation |

| Idaho | $1,150 | Low traffic volume, fewer accidents, and lower cost of living | Idaho Department of Insurance, Idaho Transportation Department |

| Vermont | $1,200 | Lower population density, fewer accidents, and lower cost of living | Vermont Department of Financial Regulation, Vermont Agency of Transportation |

| North Dakota | $1,250 | Low traffic volume, fewer accidents, and lower cost of living | North Dakota Department of Insurance, North Dakota Department of Transportation |

While these states have the lowest average premiums, it’s crucial to remember that factors beyond state regulations and demographics influence your individual rates. These factors include your driving history, vehicle type, age, and the specific insurance company you choose.

Tips for Finding Affordable Car Insurance

Finding the most affordable car insurance involves a combination of strategic shopping, negotiating, and making smart choices about your coverage and driving habits. By implementing these tips, you can potentially lower your premiums and save money in the long run.

Shopping Around for Quotes

It’s essential to compare quotes from multiple insurance providers to find the best deal. By shopping around, you can uncover a range of prices and coverage options, allowing you to choose the policy that best suits your needs and budget.

- Utilize online comparison websites: These platforms allow you to enter your information once and receive quotes from multiple insurers simultaneously. This saves you time and effort compared to contacting each company individually.

- Contact insurance agents directly: Reaching out to agents can be beneficial, especially if you have specific questions or require personalized advice. Agents can help you navigate the process and find suitable options.

- Consider contacting insurers in your state: Explore insurance companies that are based in your state, as they might offer more competitive rates due to a better understanding of local driving conditions and risks.

Negotiating Premiums

Once you have received quotes from various insurers, you can leverage your knowledge to negotiate lower premiums. Be prepared to discuss your driving history, credit score, and other factors that might influence your rates.

- Bundle your policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can lead to significant discounts. Insurers often offer incentives for bundling multiple policies with them.

- Ask about discounts: Many insurers offer discounts for various factors, including good driving records, safety features in your vehicle, and even being a member of certain organizations or professional groups. Inquire about these discounts and see if you qualify.

- Consider paying your premium upfront: Some insurers offer discounts for paying your premium in full rather than monthly installments. This can be a cost-effective option if you have the financial flexibility.

Improving Driving Habits

Your driving record plays a significant role in determining your insurance rates. By adopting safe driving practices, you can reduce your risk of accidents and potentially lower your premiums.

- Maintain a clean driving record: Avoiding traffic violations, such as speeding tickets and reckless driving, is crucial. A clean driving record demonstrates responsible driving habits and can lead to lower insurance rates.

- Take defensive driving courses: Enrolling in a defensive driving course can improve your driving skills and potentially earn you a discount on your insurance. These courses often teach strategies for avoiding accidents and navigating challenging driving situations.

- Avoid distractions while driving: Distracted driving, such as texting or using your phone, increases the risk of accidents. Focusing solely on the road is essential for safe driving and can help you maintain a clean driving record.

Choosing the Right Coverage

Selecting the appropriate coverage is crucial to ensure you are adequately protected while avoiding unnecessary expenses. Carefully assess your needs and choose the coverage levels that best fit your situation.

- Consider your vehicle’s value: If your vehicle is older or has lower market value, you might be able to opt for lower liability limits, which can save you money on premiums. However, it’s important to ensure you have sufficient coverage to protect yourself in case of an accident.

- Evaluate your risk tolerance: Consider your driving habits, the area you live in, and your financial situation to determine the level of coverage you need. If you are a safe driver in a low-risk area, you might be able to opt for lower coverage levels.

- Explore optional coverages: Additional coverages, such as collision and comprehensive coverage, can provide extra protection but come at a higher cost. Assess your needs and determine if these additional coverages are necessary for your situation.

Considerations for Choosing Car Insurance

Choosing the right car insurance is crucial for financial protection in case of an accident or other unforeseen events. Understanding the different coverage options and their implications is essential for making an informed decision that meets your specific needs and budget.

Types of Car Insurance Coverage

Car insurance policies typically include various coverage options, each designed to protect you against specific risks. Understanding the benefits and drawbacks of each coverage type is essential for making informed decisions.

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or damage to another person’s property. It covers the other driver’s medical expenses, lost wages, and property damage.

- Bodily Injury Liability: This coverage pays for the medical expenses, lost wages, and other damages resulting from injuries caused by you to others in an accident.

- Property Damage Liability: This coverage pays for damages to another person’s vehicle or property that you are responsible for in an accident.

Liability coverage is typically required by law in most states, and it’s crucial to have sufficient coverage to protect yourself from significant financial losses.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. It helps cover the cost of repairs or replacement, less your deductible.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than accidents, such as theft, vandalism, natural disasters, or collisions with animals. It helps cover repairs or replacement, less your deductible.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who is uninsured or has insufficient insurance. It covers your medical expenses, lost wages, and property damage, up to the policy limits.

Understanding Insurance Discounts

Car insurance discounts can significantly reduce your premiums. By understanding the various discounts available and taking advantage of them, you can save a substantial amount of money on your car insurance.

Discounts Based on Safe Driving Records

Safe drivers are rewarded with discounts. Insurance companies recognize that drivers with clean records are less likely to file claims.

- Accident-free discount: This discount is awarded to drivers who have not been involved in any accidents for a specified period, typically three to five years.

- Defensive driving course discount: Completing a defensive driving course demonstrates your commitment to safe driving practices, leading to a discount.

- Good driver discount: This general discount is awarded to drivers with a clean driving record and no violations, such as speeding tickets or traffic violations.

Discounts Based on Good Student Status

Good students are often considered responsible and cautious, making them attractive to insurance companies.

- Good student discount: This discount is available to students who maintain a certain GPA, typically a 3.0 or higher.

Discounts Based on Multiple Car Insurance Policies, Cheapest states for car insurance

Insuring multiple vehicles with the same company can result in significant savings.

- Multi-car discount: Bundling your car insurance with other policies, such as homeowners or renters insurance, often leads to a discount.

Discounts Based on Anti-theft Devices

Installing anti-theft devices in your car reduces the risk of theft, leading to lower premiums.

- Anti-theft device discount: This discount is offered for installing devices such as alarms, immobilizers, or tracking systems that deter theft.

Discounts Based on Loyalty Programs

Loyalty programs reward customers for staying with the same insurance company for an extended period.

- Loyalty discount: This discount is given to policyholders who have been with the same insurance company for a specific duration, often five years or more.

Tips for Maximizing Discounts and Reducing Insurance Costs

- Review your driving record: Ensure your driving record is accurate and free of any errors or outdated information.

- Shop around: Compare quotes from multiple insurance companies to find the best rates and discounts.

- Ask about available discounts: Inquire about all available discounts, even if you think you may not qualify.

- Bundle your policies: Combine your car insurance with other policies to potentially receive a multi-policy discount.

- Consider installing anti-theft devices: Investing in anti-theft devices can reduce your premiums and protect your car.

- Maintain a good driving record: Avoid speeding tickets, traffic violations, and accidents to qualify for safe driving discounts.

Impact of Demographics on Car Insurance Rates

Car insurance companies utilize various factors to determine your premium, and demographics play a significant role in this calculation. These factors, which include age, gender, marital status, and occupation, are used to assess your risk of being involved in an accident.

Age

Age is a crucial factor in determining car insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents due to their lack of experience and higher risk-taking behavior. As drivers age, their risk of accidents generally decreases.

Insurance companies typically charge higher premiums for younger drivers, reflecting the higher risk they pose.

Gender

Historically, insurance companies have used gender as a factor in determining premiums, with men generally paying higher rates than women. This is based on statistical data that shows men tend to have higher accident rates than women.

However, in many jurisdictions, it is now illegal to use gender as a factor in calculating car insurance premiums due to gender discrimination concerns.

Marital Status

Marital status can also influence car insurance rates. Statistically, married individuals tend to have lower accident rates than single individuals. This is attributed to factors such as increased responsibility, greater stability, and potentially a more cautious driving approach.

Insurance companies often offer lower premiums to married individuals, reflecting their lower risk profile.

Occupation

Certain occupations may increase the likelihood of being involved in an accident. For example, individuals with jobs that require them to drive long distances or work irregular hours might be considered higher risk.

Insurance companies may adjust premiums based on occupation, reflecting the potential impact on driving habits and risk.

Closing Notes

Finding the cheapest car insurance doesn’t have to be a stressful endeavor. By understanding the factors that influence premiums, comparing quotes from multiple insurers, and taking advantage of available discounts, drivers can secure affordable coverage that meets their needs. Remember, a little research and planning can go a long way in saving money on your car insurance. With the right approach, you can find the best rates and drive with confidence, knowing you’re protected and financially secure.

Expert Answers

What is the average cost of car insurance in the US?

The average cost of car insurance in the US varies depending on factors like location, age, driving history, and coverage levels. However, a national average can be around $1,700 per year.

How often should I review my car insurance rates?

It’s recommended to review your car insurance rates at least annually, or even more frequently if you experience significant life changes, such as a new job, marriage, or moving to a different state.

Can I bundle my car and home insurance for a discount?

Yes, many insurance companies offer discounts for bundling multiple policies, such as car and home insurance. This can often lead to significant savings.