Cheapest states for auto insurance can be a game-changer for drivers looking to save money on their premiums. Understanding the factors that influence auto insurance costs, such as driving history, vehicle type, and location, is crucial for finding the most affordable options. By comparing rates across different states, you can potentially unlock significant savings on your car insurance.

This guide delves into the reasons behind varying insurance costs across the United States, highlighting the states with the lowest average premiums. We’ll explore how state regulations and insurance market competition impact pricing, and provide practical tips for finding affordable coverage.

Factors Influencing Auto Insurance Costs

Auto insurance premiums are determined by a complex interplay of factors, each contributing to the overall cost of coverage. Understanding these factors is crucial for consumers to make informed decisions about their insurance needs and potentially save money.

Driving History

Your driving history is a significant factor in determining your auto insurance premiums. Insurance companies assess your risk based on past driving behavior, such as accidents, traffic violations, and claims history.

- A clean driving record with no accidents or violations generally results in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your insurance costs.

- Insurance companies often use a points system to track driving violations. Each violation accumulates points, leading to higher premiums.

- The severity of the accident or violation also influences the impact on your premium. A minor fender bender might have a lesser impact than a serious accident involving injuries or property damage.

Vehicle Type

The type of vehicle you drive plays a significant role in your auto insurance premiums. Insurance companies consider factors such as:

- Vehicle Value: More expensive vehicles generally have higher insurance premiums due to the higher cost of repairs or replacement in case of an accident.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, often receive lower premiums. These features reduce the risk of accidents and injuries, making the vehicle less expensive to insure.

- Vehicle Performance: High-performance vehicles with powerful engines and sporty handling are often associated with higher risks and, consequently, higher insurance premiums.

- Vehicle Age: Older vehicles tend to have lower insurance premiums due to their depreciated value and potential for mechanical issues. However, classic or antique cars might be subject to specialized insurance policies with higher premiums.

Age

Age is a factor that influences auto insurance premiums. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This higher risk translates into higher premiums.

- As drivers gain experience and age, their risk profile typically decreases, leading to lower premiums.

- However, senior drivers, particularly those over 70, may also face higher premiums due to potential age-related health concerns that could affect their driving abilities.

Location

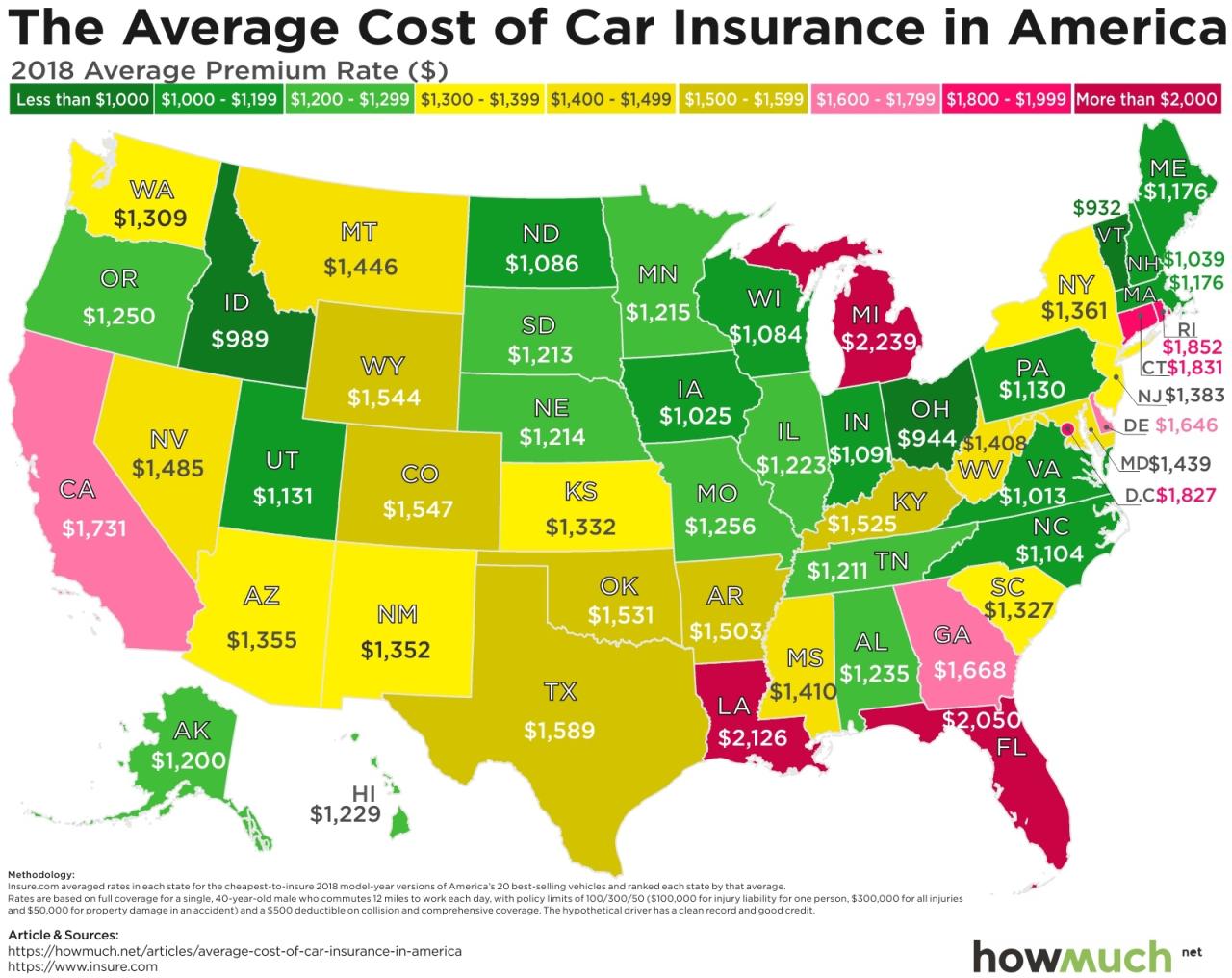

The location where you live significantly influences your auto insurance premiums. Factors such as:

- Population Density: Areas with high population density, such as major cities, tend to have higher traffic congestion and a greater risk of accidents, leading to higher insurance premiums.

- Crime Rates: Areas with high crime rates may have higher auto theft rates, resulting in higher insurance premiums.

- Weather Conditions: Regions prone to extreme weather events, such as hurricanes, tornadoes, or heavy snowfall, can have higher premiums due to the increased risk of damage to vehicles.

- State Laws and Regulations: Different states have varying laws and regulations regarding auto insurance, which can impact premiums. For example, states with mandatory coverage requirements or higher minimum liability limits might have higher premiums.

Coverage Levels

The amount of coverage you choose for your auto insurance policy also significantly impacts your premiums.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property. Higher liability limits provide greater financial protection but come with higher premiums.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault. Choosing a higher deductible, which is the amount you pay out of pocket before insurance kicks in, can lower your premium.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, or natural disasters. Similar to collision coverage, a higher deductible can lower your premium.

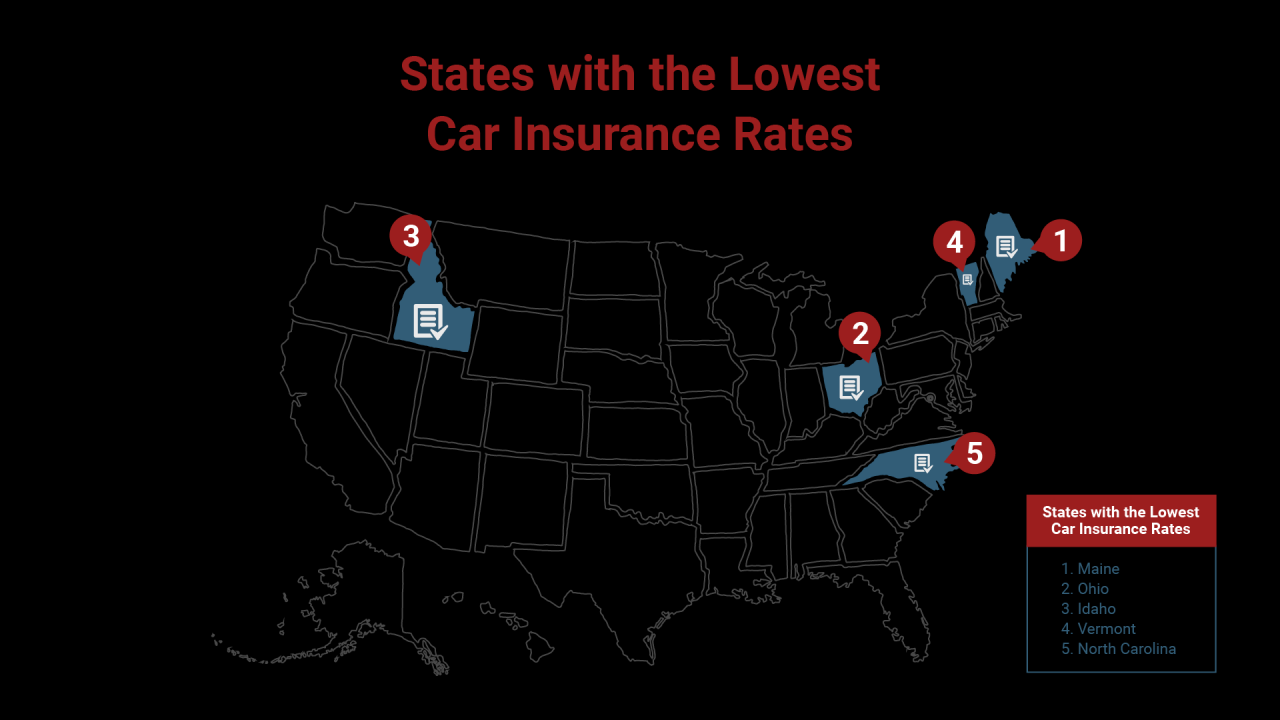

Cheapest States for Auto Insurance

Finding the most affordable auto insurance can be a significant factor in your overall budget. States have varying insurance regulations, driving conditions, and risk profiles, which directly impact the cost of premiums. This can lead to significant differences in average insurance costs across the country. Let’s delve into the states with the most affordable auto insurance rates.

Cheapest States for Auto Insurance

The following table presents the top 5 cheapest states for auto insurance based on average annual premiums, as reported by the Insurance Information Institute (III) in 2023.

| Rank | State | Average Annual Premium |

|---|---|---|

| 1 | Maine | $860 |

| 2 | Idaho | $923 |

| 3 | Vermont | $944 |

| 4 | North Dakota | $948 |

| 5 | Utah | $974 |

Understanding State Regulations and Insurance Markets

State regulations and the competitive landscape of the insurance market significantly influence auto insurance costs. Understanding these factors helps consumers navigate the complex world of auto insurance and make informed decisions.

Impact of State Regulations on Auto Insurance Costs

State regulations play a crucial role in shaping auto insurance costs. These regulations can impact the types of coverage required, the pricing of insurance, and the overall availability of insurance options.

- Mandatory Coverage Requirements: States have different mandatory coverage requirements, which influence the minimum amount of insurance consumers must carry. States with more comprehensive mandatory coverage requirements generally have higher insurance premiums. For example, states requiring personal injury protection (PIP) coverage, which covers medical expenses and lost wages, tend to have higher premiums than states without this requirement.

- Rate Regulation: Some states regulate insurance rates, while others allow insurers more freedom in setting premiums. States with stricter rate regulation may have lower premiums, as insurers are limited in how much they can charge. However, this can also lead to less innovation and competition in the insurance market.

- Insurance Market Competition: The level of competition in the insurance market can impact premiums. States with a large number of insurance companies competing for customers often have lower premiums, as insurers are more likely to offer competitive rates to attract business. Conversely, states with limited competition may have higher premiums, as insurers have less incentive to lower their prices.

Regulatory Environments of Cheapest and Most Expensive States

Comparing the regulatory environments of states with the lowest and highest auto insurance premiums provides insights into how regulations affect costs.

- Cheapest States: States like Idaho, Maine, and North Dakota tend to have lower auto insurance premiums. These states often have fewer mandatory coverage requirements, less stringent rate regulation, and a more competitive insurance market.

- Most Expensive States: States like Michigan, New Jersey, and Pennsylvania typically have higher auto insurance premiums. These states often have more comprehensive mandatory coverage requirements, stricter rate regulation, and a less competitive insurance market.

Tips for Finding Affordable Auto Insurance: Cheapest States For Auto Insurance

Finding the cheapest auto insurance involves more than just comparing prices. You need to be strategic in your approach, understanding your options and taking steps to lower your premiums. By following these tips, you can significantly reduce your auto insurance costs and find a policy that fits your needs and budget.

Comparing Quotes

Obtaining multiple quotes from different insurance providers is the first step to finding the best price for your auto insurance. This allows you to compare coverage options, deductibles, and premiums to identify the most cost-effective policy.

- Use online comparison websites. Websites like Insurance.com, NerdWallet, and The Zebra allow you to enter your information once and receive quotes from multiple insurers. This saves you time and effort, enabling you to compare different options side-by-side.

- Contact insurance companies directly. Reach out to insurers directly, especially if you have specific needs or a complex insurance situation. They may offer discounts or promotions not available through comparison websites.

- Review quotes carefully. Don’t just focus on the lowest price. Ensure the coverage offered matches your needs and that the policy includes essential features like liability, collision, and comprehensive coverage.

Negotiating Rates

Once you’ve received quotes, don’t hesitate to negotiate with insurance providers to potentially lower your premium.

- Shop around and use quotes as leverage. If you’ve received lower quotes from other insurers, use them as leverage to negotiate a better rate with your current provider.

- Ask about discounts. Most insurers offer discounts for various factors, such as good driving records, safety features in your car, and bundling multiple insurance policies. Make sure you inquire about and qualify for any available discounts.

- Consider increasing your deductible. A higher deductible generally leads to lower premiums. Evaluate your risk tolerance and financial situation to determine if increasing your deductible is a viable option.

Exploring Discounts

Insurers offer various discounts to lower premiums. Understanding these discounts and qualifying for them can significantly reduce your insurance costs.

- Good driver discounts. Maintain a clean driving record, avoiding accidents, traffic violations, and speeding tickets, to qualify for good driver discounts.

- Safe vehicle discounts. Cars equipped with anti-theft devices, airbags, and other safety features often qualify for discounts. Research your car’s safety features to see if they qualify you for a discount.

- Bundling discounts. Combining multiple insurance policies, such as auto, home, or renters insurance, with the same insurer often leads to significant discounts.

- Student discounts. Good student discounts are available for students with high GPAs or who attend college. Ensure you provide the necessary documentation to qualify for this discount.

- Loyalty discounts. Long-term customers often receive loyalty discounts. Staying with the same insurer for an extended period can lead to lower premiums.

Step-by-Step Guide for Obtaining Multiple Quotes

Following a structured approach can simplify the process of obtaining quotes from different insurance providers.

- Gather your information. Collect essential information, such as your driver’s license, vehicle registration, and current insurance policy details. Having this information readily available speeds up the quoting process.

- Choose comparison websites or insurers. Select reputable comparison websites or insurance providers you want to get quotes from. Consider factors like their reputation, coverage options, and customer service.

- Fill out the online forms. Complete the online forms accurately and thoroughly, providing all necessary information. This ensures you receive accurate and relevant quotes.

- Compare quotes carefully. Review each quote carefully, comparing coverage, deductibles, and premiums. Don’t just focus on the lowest price, ensure the coverage matches your needs.

- Contact insurers directly. If you have specific questions or require more information, contact insurers directly. This allows you to discuss your individual needs and explore potential discounts.

Impact of Driving Habits on Premiums

Your driving habits significantly impact your auto insurance premiums. Insurance companies carefully assess your driving history, mileage, and vehicle safety features to determine your risk profile. The more risky you are perceived to be, the higher your premium will be.

Miles Driven

The number of miles you drive annually plays a crucial role in your premium. Insurance companies recognize that the more miles you drive, the greater your exposure to accidents.

- High Mileage: If you drive a significant number of miles daily for work or commuting, you are more likely to be involved in an accident. Insurance companies often charge higher premiums for drivers with high mileage.

- Low Mileage: Conversely, drivers who drive less frequently, such as those who work from home or rely on public transportation, generally pay lower premiums. This is because they have a lower risk of accidents.

Driving History

Your driving history is a critical factor in determining your auto insurance premium. A clean driving record with no accidents or violations will earn you lower premiums. However, any negative entries on your driving record, such as speeding tickets, DUI convictions, or accidents, can significantly increase your premium.

- Accidents: Insurance companies consider the number and severity of accidents you have been involved in. A major accident, particularly one that resulted in injuries or property damage, can lead to a substantial increase in your premium.

- Traffic Violations: Traffic violations, such as speeding tickets, reckless driving, and running red lights, indicate a higher risk of future accidents. These violations can result in increased premiums, even if you have not been involved in an accident.

- DUI Convictions: Driving under the influence (DUI) convictions are considered very serious offenses. Insurance companies view DUI drivers as high-risk individuals and often impose significant premium increases or even refuse coverage.

Safety Features

The safety features of your vehicle can also impact your auto insurance premium. Insurance companies recognize that vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, are safer and less likely to be involved in accidents.

- Advanced Safety Features: Drivers with vehicles equipped with advanced safety features often qualify for discounts on their premiums. This is because these features reduce the likelihood of accidents and injuries, leading to lower insurance costs.

- Lack of Safety Features: Vehicles without safety features are considered higher risk and may lead to higher premiums. Insurance companies may offer incentives to encourage drivers to upgrade their vehicles with safety features.

Insurance Coverage Options and Their Costs

Understanding the different types of auto insurance coverage available is crucial for making informed decisions about your policy and its cost. These coverage options provide financial protection in case of accidents or other incidents involving your vehicle.

Liability Coverage, Cheapest states for auto insurance

Liability coverage is a crucial component of auto insurance. It protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries to another person. This coverage is typically divided into two parts:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages resulting from injuries to another person in an accident you caused.

- Property Damage Liability: This coverage pays for repairs or replacement costs of the other person’s vehicle or property damaged in an accident you caused.

The amount of liability coverage you need depends on your individual circumstances and state laws. Most states have minimum liability coverage requirements, but you may want to consider higher limits to protect yourself from significant financial losses in case of a serious accident.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional, but it is often recommended, especially if you have a newer vehicle or a loan on your car.

Collision coverage typically has a deductible, which is the amount you pay out-of-pocket before the insurance company covers the remaining costs.

The deductible amount can impact the cost of your premium. A higher deductible usually means a lower premium, while a lower deductible leads to a higher premium.

Comprehensive Coverage

Comprehensive coverage protects you from losses due to events other than accidents, such as theft, vandalism, fire, hail, or other natural disasters. Like collision coverage, comprehensive coverage is optional and typically has a deductible.

Comprehensive coverage usually does not cover damage caused by wear and tear or routine maintenance issues.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who is uninsured or has insufficient insurance. This coverage pays for your medical expenses, lost wages, and other damages, even if the other driver is at fault.

Uninsured/underinsured motorist coverage is often required by state law.

It is important to note that the amount of coverage you have may not be enough to cover all your losses in a serious accident. It is essential to consider your individual needs and consult with an insurance agent to determine the appropriate coverage limits.

Conclusion

Ultimately, finding the cheapest auto insurance involves a combination of understanding your individual risk factors, researching different providers, and utilizing available discounts. By taking an active approach to your insurance needs, you can secure affordable coverage that protects you on the road while minimizing your financial burden.

FAQ Insights

How often should I compare auto insurance quotes?

It’s recommended to compare quotes at least annually, or even more frequently if you experience significant life changes, such as moving, getting married, or adding a new driver to your policy.

What are some common discounts available for auto insurance?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, bundling discounts (home and auto), and discounts for safety features like anti-theft devices or airbags.

What are the consequences of driving without car insurance?

Driving without car insurance is illegal in most states and can result in hefty fines, license suspension, and even jail time. In the event of an accident, you could be held personally liable for damages, potentially leading to significant financial hardship.