Cheapest state to insure a car? It’s a question on the minds of many drivers, especially those seeking to save money on their auto insurance premiums. The cost of car insurance can vary drastically from state to state, influenced by factors like traffic density, accident rates, and the prevalence of theft. Understanding these factors can help you make informed decisions about where to live or where to register your car to potentially secure the most affordable rates.

This guide will delve into the intricacies of car insurance pricing across different states, highlighting key factors that impact premiums and providing valuable insights for drivers seeking to minimize their insurance costs. We’ll explore how state regulations, driving history, vehicle type, and other variables contribute to the final price tag, offering tips and strategies to help you find the most affordable car insurance options available.

Factors Influencing Car Insurance Costs

Car insurance premiums are influenced by various factors, including your demographics, the type of vehicle you drive, your driving history, and your location. Insurance companies use these factors to assess your risk and determine how much you should pay for coverage.

Demographics

Demographics play a significant role in determining your car insurance premiums. Insurance companies consider factors like age, gender, and marital status to assess your risk.

- Age: Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. Therefore, they often pay higher premiums. As drivers gain experience and age, their premiums tend to decrease.

- Gender: Traditionally, men have been statistically more likely to be involved in accidents than women. As a result, men often pay higher premiums than women. However, this trend is gradually changing, and some insurers are now offering gender-neutral rates.

- Marital Status: Married individuals are often considered less risky than single individuals. This is because married drivers may have more responsibilities and are more likely to drive safely. As a result, married individuals may qualify for lower premiums.

Vehicle Type

The type of vehicle you drive significantly impacts your car insurance premiums. Insurance companies consider factors like the vehicle’s make, model, year, safety features, and value.

- Make and Model: Certain car models are known to be more expensive to repair or replace. This can influence your insurance premiums. For example, luxury vehicles or sports cars are often more expensive to insure than standard sedans.

- Year: Newer vehicles typically have better safety features and are more expensive to repair. This can lead to higher insurance premiums for newer cars.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, are generally considered safer and may qualify for lower premiums.

- Value: The value of your vehicle is also a factor. More expensive vehicles are generally more expensive to insure.

Driving History

Your driving history is a significant factor in determining your car insurance premiums. Insurance companies review your driving record to assess your risk.

- Accidents: Drivers with a history of accidents, especially at-fault accidents, are considered higher risk and may face higher premiums.

- Traffic Violations: Traffic violations, such as speeding tickets, reckless driving, and DUI convictions, can significantly increase your insurance premiums.

- Driving Record: A clean driving record with no accidents or violations can qualify you for lower premiums.

Location

Your location can also impact your car insurance premiums. Insurance companies consider factors like the population density, crime rate, and weather conditions in your area.

- Population Density: Areas with high population density tend to have more traffic and a higher risk of accidents. This can lead to higher insurance premiums.

- Crime Rate: Areas with high crime rates are more likely to experience car thefts or vandalism. This can also result in higher insurance premiums.

- Weather Conditions: Areas prone to severe weather events, such as hurricanes, tornadoes, or floods, can have higher insurance premiums.

State-Specific Insurance Regulations

Each state in the US has its own set of car insurance regulations, which can significantly influence the cost of insurance. These regulations dictate the minimum coverage requirements, liability limits, and other factors that affect how much drivers pay for insurance.

Coverage Requirements

State insurance regulations determine the minimum coverage drivers must carry. These requirements vary from state to state, impacting the cost of car insurance. Some states require only the most basic coverage, while others mandate more comprehensive coverage, which can increase the cost.

- Liability Coverage: This covers damages to other people’s property or injuries caused by the insured driver. Most states have mandatory liability coverage, with varying minimum limits. States with higher liability limits generally have higher insurance premiums.

- Uninsured/Underinsured Motorist Coverage: This protects drivers in case of an accident with a driver who is uninsured or underinsured. Some states require this coverage, while others do not. The presence of this requirement can influence the cost of insurance.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses, lost wages, and other related costs for the insured driver and passengers in case of an accident. Some states mandate PIP, while others offer it as an optional coverage. PIP requirements can influence insurance costs.

Minimum Liability Limits

State regulations set minimum liability limits that drivers must carry. These limits determine the maximum amount the insurance company will pay for damages caused by the insured driver. Higher liability limits typically translate to higher insurance premiums.

- Bodily Injury Liability: This coverage covers injuries to other people in an accident caused by the insured driver. States have varying minimum limits for bodily injury liability, which can impact the cost of insurance.

- Property Damage Liability: This coverage pays for damages to other people’s property in an accident caused by the insured driver. States have varying minimum limits for property damage liability, which can influence insurance costs.

Other Regulations

States have other regulations that can influence car insurance costs. These regulations include:

- No-Fault Laws: These laws determine how accident claims are handled. Some states have no-fault laws, where drivers are responsible for their own injuries, regardless of fault. Other states have fault-based systems, where the at-fault driver is responsible for damages. No-fault laws can impact the cost of insurance.

- Financial Responsibility Laws: These laws require drivers to prove they have financial means to cover damages caused by an accident. States have varying requirements for financial responsibility, which can influence insurance costs.

- Insurance Rate Regulation: Some states regulate insurance rates, setting limits on how much insurers can charge for premiums. States with stricter rate regulations generally have lower insurance costs.

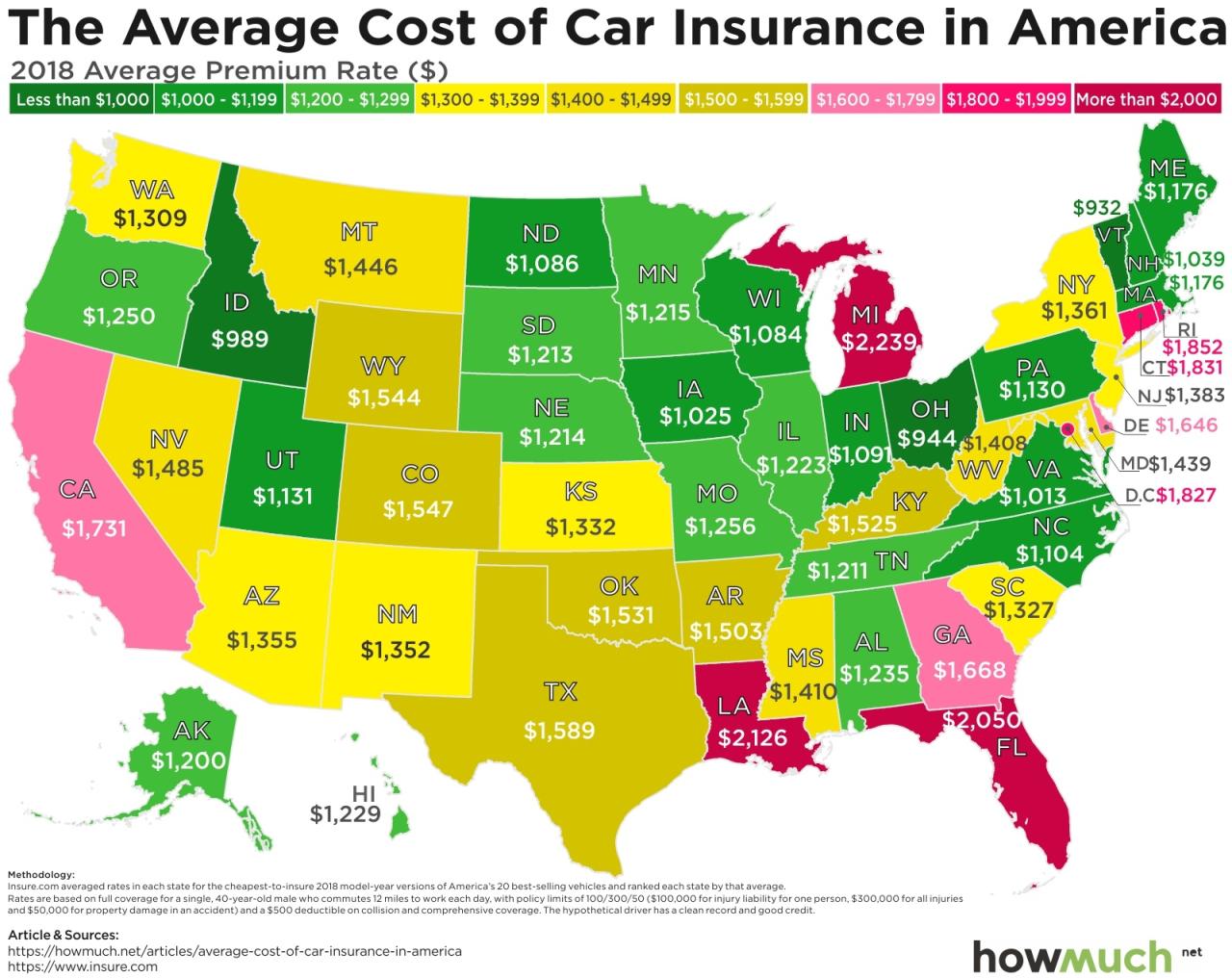

Average Car Insurance Premiums by State

Car insurance premiums vary significantly across the United States, influenced by factors like state regulations, driving conditions, and the prevalence of vehicle theft. To gain a comprehensive understanding of these differences, we will delve into the average annual car insurance premiums for various vehicle types in each state.

Average Car Insurance Premiums by State and Vehicle Type, Cheapest state to insure a car

The table below presents the average annual car insurance premiums for sedans, SUVs, and pickup trucks in each state. These figures are based on data collected from reputable insurance companies and research institutions, providing insights into the cost of car insurance across the nation.

| State | Sedan | SUV | Pickup Truck |

|---|---|---|---|

| Alabama | $1,478 | $1,625 | $1,782 |

| Alaska | $1,985 | $2,132 | $2,279 |

| Arizona | $1,564 | $1,711 | $1,858 |

| Arkansas | $1,392 | $1,539 | $1,686 |

| California | $2,158 | $2,305 | $2,452 |

| Colorado | $1,675 | $1,822 | $1,969 |

| Connecticut | $1,842 | $1,989 | $2,136 |

| Delaware | $1,521 | $1,668 | $1,815 |

| Florida | $2,084 | $2,231 | $2,378 |

| Georgia | $1,455 | $1,602 | $1,749 |

| Hawaii | $2,348 | $2,495 | $2,642 |

| Idaho | $1,419 | $1,566 | $1,713 |

| Illinois | $1,736 | $1,883 | $2,030 |

| Indiana | $1,387 | $1,534 | $1,681 |

| Iowa | $1,325 | $1,472 | $1,619 |

| Kansas | $1,408 | $1,555 | $1,702 |

| Kentucky | $1,354 | $1,501 | $1,648 |

| Louisiana | $1,795 | $1,942 | $2,089 |

| Maine | $1,582 | $1,729 | $1,876 |

| Maryland | $1,694 | $1,841 | $1,988 |

| Massachusetts | $1,927 | $2,074 | $2,221 |

| Michigan | $1,653 | $1,800 | $1,947 |

| Minnesota | $1,489 | $1,636 | $1,783 |

| Mississippi | $1,432 | $1,579 | $1,726 |

| Missouri | $1,461 | $1,608 | $1,755 |

| Montana | $1,547 | $1,694 | $1,841 |

| Nebraska | $1,376 | $1,523 | $1,670 |

| Nevada | $1,749 | $1,896 | $2,043 |

| New Hampshire | $1,615 | $1,762 | $1,909 |

| New Jersey | $1,974 | $2,121 | $2,268 |

| New Mexico | $1,628 | $1,775 | $1,922 |

| New York | $2,056 | $2,203 | $2,350 |

| North Carolina | $1,427 | $1,574 | $1,721 |

| North Dakota | $1,284 | $1,431 | $1,578 |

| Ohio | $1,592 | $1,739 | $1,886 |

| Oklahoma | $1,495 | $1,642 | $1,789 |

| Oregon | $1,723 | $1,870 | $2,017 |

| Pennsylvania | $1,641 | $1,788 | $1,935 |

| Rhode Island | $1,885 | $2,032 | $2,179 |

| South Carolina | $1,506 | $1,653 | $1,800 |

| South Dakota | $1,318 | $1,465 | $1,612 |

| Tennessee | $1,448 | $1,595 | $1,742 |

| Texas | $1,682 | $1,829 | $1,976 |

| Utah | $1,471 | $1,618 | $1,765 |

| Vermont | $1,758 | $1,905 | $2,052 |

| Virginia | $1,559 | $1,706 | $1,853 |

| Washington | $1,814 | $1,961 | $2,108 |

| West Virginia | $1,421 | $1,568 | $1,715 |

| Wisconsin | $1,535 | $1,682 | $1,829 |

| Wyoming | $1,452 | $1,599 | $1,746 |

Factors Contributing to Lower Car Insurance Rates: Cheapest State To Insure A Car

While various factors influence car insurance premiums, certain states consistently offer lower rates. These lower rates often stem from a combination of factors that contribute to a more favorable insurance environment.

Lower Accident Rates

States with lower accident rates generally experience lower car insurance premiums. This is because insurance companies pay out fewer claims in these areas, leading to lower overall costs. A lower accident rate can be attributed to factors like:

- Improved Road Infrastructure: Well-maintained roads and highways with proper signage, lighting, and safety features contribute to fewer accidents.

- Effective Traffic Enforcement: Stringent traffic laws and effective enforcement deter reckless driving, reducing the number of accidents.

- Driver Education Programs: States with robust driver education programs often have better-trained drivers, leading to fewer accidents.

- Lower Population Density: States with lower population density generally have less traffic congestion, reducing the risk of accidents.

Lower Vehicle Theft Rates

States with lower vehicle theft rates often have lower car insurance premiums. This is because insurance companies pay out fewer claims for stolen vehicles, leading to lower overall costs. A lower theft rate can be attributed to:

- Stronger Law Enforcement: Effective law enforcement and robust crime prevention measures can deter vehicle theft.

- Community Policing Initiatives: Programs that foster community engagement and cooperation with law enforcement can help reduce crime rates, including vehicle theft.

- Vehicle Security Features: States with higher adoption rates of advanced vehicle security systems, such as immobilizers and GPS tracking devices, often have lower theft rates.

More Competitive Insurance Markets

States with a more competitive insurance market often have lower car insurance premiums. Competition among insurance companies forces them to offer more affordable rates to attract customers. Factors that contribute to a more competitive market include:

- A Large Number of Insurance Companies: A diverse range of insurance companies operating in a state increases competition, driving down prices.

- Ease of Entry for New Companies: States with less stringent regulations for new insurance companies entering the market encourage competition and lower premiums.

- Consumer Awareness: States with well-informed consumers who actively compare rates and shop around for the best deals promote competition among insurance companies.

Finding Affordable Car Insurance

Finding affordable car insurance is essential, especially in a state with high average premiums. By implementing smart strategies, you can significantly reduce your insurance costs.

Comparing Quotes from Multiple Insurers

It’s crucial to compare quotes from multiple insurance companies to find the best deal. Each insurer uses different factors to calculate premiums, resulting in varying rates. Online comparison websites and insurance brokers can help streamline the process.

Negotiating Rates

Once you’ve received quotes, don’t hesitate to negotiate. Many insurers are willing to adjust their rates, especially if you’re a loyal customer or have a good driving record. Be prepared to explain your situation and highlight any factors that make you a low-risk driver.

Considering Discounts

Insurers offer various discounts to reduce premiums. These can include:

- Good driver discounts: For drivers with clean driving records.

- Safe driver discounts: For drivers who have completed defensive driving courses.

- Multi-car discounts: For insuring multiple vehicles with the same insurer.

- Bundling discounts: For combining your car insurance with other policies, such as homeowners or renters insurance.

- Payment discounts: For paying your premium in full or opting for automatic payments.

Understanding Different Types of Car Insurance Policies

Car insurance policies offer different levels of coverage, impacting your premiums.

- Liability coverage: This is the most basic type of insurance, covering damages to other vehicles and property in an accident you cause.

- Collision coverage: Covers damage to your vehicle in an accident, regardless of fault.

- Comprehensive coverage: Protects your vehicle against damage from non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: Provides financial protection if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

Choosing the Right Coverage

Consider your driving habits, the value of your vehicle, and your financial situation when deciding on the appropriate coverage. A higher level of coverage may provide greater peace of mind but will also increase your premiums.

Illustrative Examples

The differences in car insurance premiums between states can be substantial, even for the same vehicle and driver profile. This variation is due to factors like state-specific regulations, the frequency and severity of accidents, and the cost of healthcare. Let’s examine a few real-world scenarios to understand how these factors influence insurance costs.

Impact of State-Specific Regulations on Premiums

State-specific regulations can significantly impact car insurance costs. For example, some states require drivers to carry higher minimum liability coverage limits, while others have more stringent requirements for safety features. Let’s look at two scenarios:

- Scenario 1: Minimum Liability Coverage: Consider two drivers, both 30 years old with clean driving records, driving the same 2023 Honda Civic in Texas and Pennsylvania. Texas has a minimum liability coverage requirement of 30/60/25, while Pennsylvania requires 15/30/5. This means the driver in Texas needs to carry more coverage, which can result in a higher premium compared to the driver in Pennsylvania.

- Scenario 2: Safety Features: Imagine two identical 2023 Toyota Camrys, one driven in Michigan and the other in New Hampshire. Michigan requires all new vehicles to have electronic stability control, while New Hampshire does not. Since electronic stability control is a safety feature that can reduce accidents, insurance companies may offer lower premiums in Michigan for the Camry equipped with this feature.

Impact of Accident Frequency and Severity on Premiums

The frequency and severity of accidents in a particular state can influence insurance premiums. States with higher accident rates tend to have higher insurance costs. Let’s consider two scenarios:

- Scenario 1: High Accident Rates: Suppose two 25-year-old drivers, both with clean driving records, own the same 2023 Ford Mustang in Florida and Maine. Florida has a significantly higher accident rate than Maine. As a result, insurance companies in Florida may charge higher premiums to account for the increased risk of accidents.

- Scenario 2: Cost of Healthcare: Consider two 40-year-old drivers, both with clean driving records, driving the same 2023 Chevrolet Silverado in California and Mississippi. California has a significantly higher cost of healthcare than Mississippi. In case of an accident, insurance companies in California may need to pay higher medical bills, leading to higher premiums for drivers in California.

Outcome Summary

By understanding the factors that influence car insurance costs and utilizing the strategies Artikeld in this guide, you can navigate the complexities of the insurance market and secure the most favorable rates for your specific needs. Whether you’re considering a move to a new state or simply looking for ways to lower your existing premiums, this information empowers you to make informed decisions and save money on your car insurance.

Key Questions Answered

How can I find the cheapest car insurance in my state?

The best way to find the cheapest car insurance in your state is to compare quotes from multiple insurers. Use online comparison tools or contact insurance agents directly to get quotes from several companies. Don’t forget to factor in discounts and coverage options when comparing prices.

What are some common car insurance discounts?

Common car insurance discounts include good driver discounts, safe driver discounts, multi-car discounts, and discounts for bundling home and auto insurance. Some insurers also offer discounts for safety features in your vehicle, like anti-theft devices or airbags.

What is the average car insurance premium in the United States?

The average annual car insurance premium in the United States varies depending on factors such as location, vehicle type, and driver profile. However, according to recent data, the average premium is around $1,500 per year.