Cheapest insurance rates by state are a hot topic for anyone looking to save money on their premiums. Understanding the factors that influence these rates, from state regulations to individual driving habits, can make a big difference in your wallet. While some states consistently boast lower average rates, others see significantly higher premiums due to factors like population density, accident rates, and the cost of living.

This guide will explore the intricacies of insurance pricing across the United States, delving into state-specific trends and providing practical tips to help you find the most affordable coverage for your needs. Whether you’re a seasoned driver or a new car owner, understanding the nuances of insurance rates is crucial for making informed decisions and securing the best possible value.

Factors Influencing Insurance Rates

Insurance rates vary significantly across states, and understanding the factors driving these differences is crucial for consumers seeking the best deals. These factors are complex and often interact with each other, making it difficult to pinpoint a single reason for higher or lower premiums in a given state.

State Regulations, Cheapest insurance rates by state

State regulations play a significant role in shaping insurance costs. Each state has its own set of laws governing the insurance industry, including how insurers can calculate premiums, what types of coverage are required, and how claims are handled. These regulations can have a direct impact on the price of insurance.

- Minimum Coverage Requirements: States with higher minimum coverage requirements, such as requiring more comprehensive or collision coverage, tend to have higher insurance rates. This is because insurers are obligated to cover more potential risks, leading to higher premiums. For example, states with mandatory uninsured motorist coverage often have higher rates compared to states without such requirements.

- Rate Regulation: Some states have stricter rate regulation laws, which limit how much insurers can charge for premiums. These regulations can help to keep premiums lower, but they can also make it more challenging for insurers to operate profitably. In states with less strict rate regulation, insurers have more flexibility in setting premiums, which can lead to higher rates.

- Tort Laws: Tort laws govern how individuals can sue for damages in the event of an accident. States with “tort reform” laws, which limit the amount of damages that can be awarded in lawsuits, tend to have lower insurance rates. This is because insurers face lower potential payouts for claims. On the other hand, states with more lenient tort laws can have higher insurance rates due to the potential for larger payouts.

Demographics and Socioeconomic Factors

Demographics and socioeconomic factors also influence insurance rates. These factors can impact the frequency and severity of accidents, which ultimately affects the cost of insurance.

- Population Density: States with higher population densities tend to have higher insurance rates. This is because increased traffic congestion and higher concentrations of people can lead to more accidents. Urban areas, with their higher population densities and more congested roads, typically experience higher accident rates, resulting in higher premiums.

- Driving Habits: Driving habits, such as speeding, distracted driving, and driving under the influence, can contribute to higher accident rates and, consequently, higher insurance premiums. States with a higher prevalence of these risky driving behaviors tend to have higher insurance rates. For instance, states with a higher number of DUI-related accidents often have higher premiums due to the increased risk of accidents.

- Income Levels: States with higher average income levels tend to have higher insurance rates. This is because higher-income individuals often drive more expensive vehicles, which can lead to higher repair costs in the event of an accident. Moreover, higher-income individuals may be more likely to drive luxury cars, which are often more expensive to insure due to their higher repair costs and replacement value.

Cost of Living and Healthcare

The cost of living and healthcare expenses in a state can also influence insurance rates. Higher costs of living and healthcare can translate into higher repair costs for vehicles and higher medical expenses for injuries.

- Vehicle Repair Costs: States with higher costs of living, particularly those with higher costs of labor and materials, tend to have higher vehicle repair costs. These higher costs can lead to higher insurance premiums, as insurers need to account for the increased expense of repairing damaged vehicles.

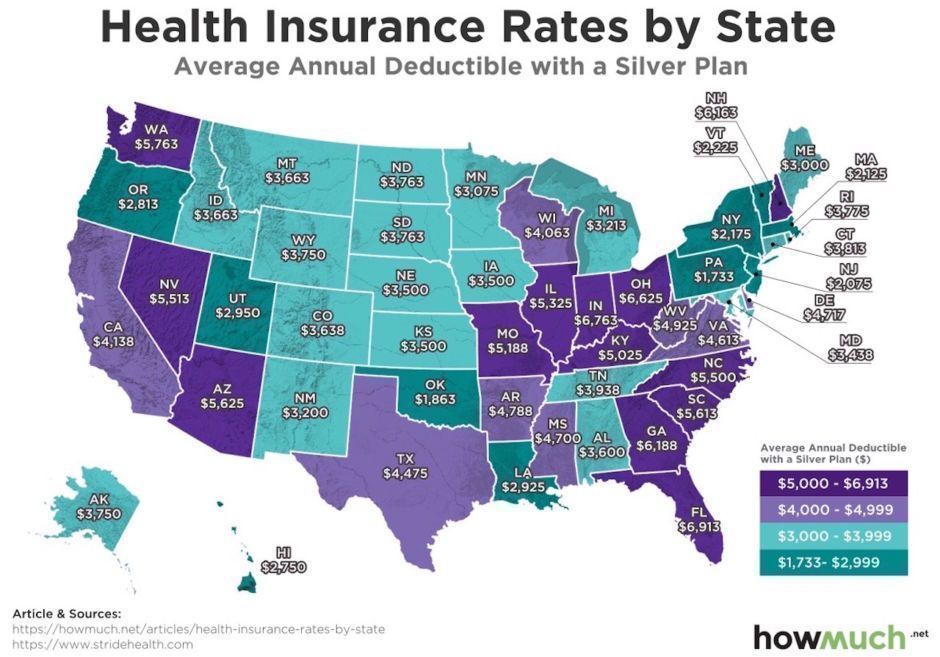

- Medical Expenses: States with higher healthcare costs, including higher doctor’s fees, hospital bills, and prescription drug costs, tend to have higher insurance rates. This is because insurers need to cover the higher medical expenses associated with accidents. For instance, states with a high concentration of specialized medical facilities, such as trauma centers, may have higher insurance rates due to the higher cost of treating severe injuries.

Weather and Natural Disasters

Weather patterns and the frequency of natural disasters can significantly impact insurance rates. States prone to severe weather events, such as hurricanes, earthquakes, or tornadoes, tend to have higher insurance rates due to the increased risk of damage to vehicles and property.

- Hurricane-Prone States: States along the Atlantic and Gulf coasts, which are frequently impacted by hurricanes, often have higher insurance rates due to the potential for significant property damage. Insurers factor in the likelihood of hurricanes and their potential impact on vehicles and homes when calculating premiums.

- Earthquake-Prone States: States located in earthquake-prone regions, such as California, often have higher insurance rates to cover the risk of earthquake damage. Insurers assess the seismic activity in these areas and adjust premiums accordingly.

- Flood Zones: States with extensive flood zones, particularly those near rivers or coastlines, often have higher insurance rates. Insurers consider the risk of flooding when setting premiums, as flooding can cause significant damage to vehicles and property.

State-Specific Insurance Rate Trends

Insurance rates vary significantly from state to state due to a complex interplay of factors. Understanding these trends can help individuals make informed decisions about their insurance needs and potentially find more affordable options.

Average Insurance Rates by State

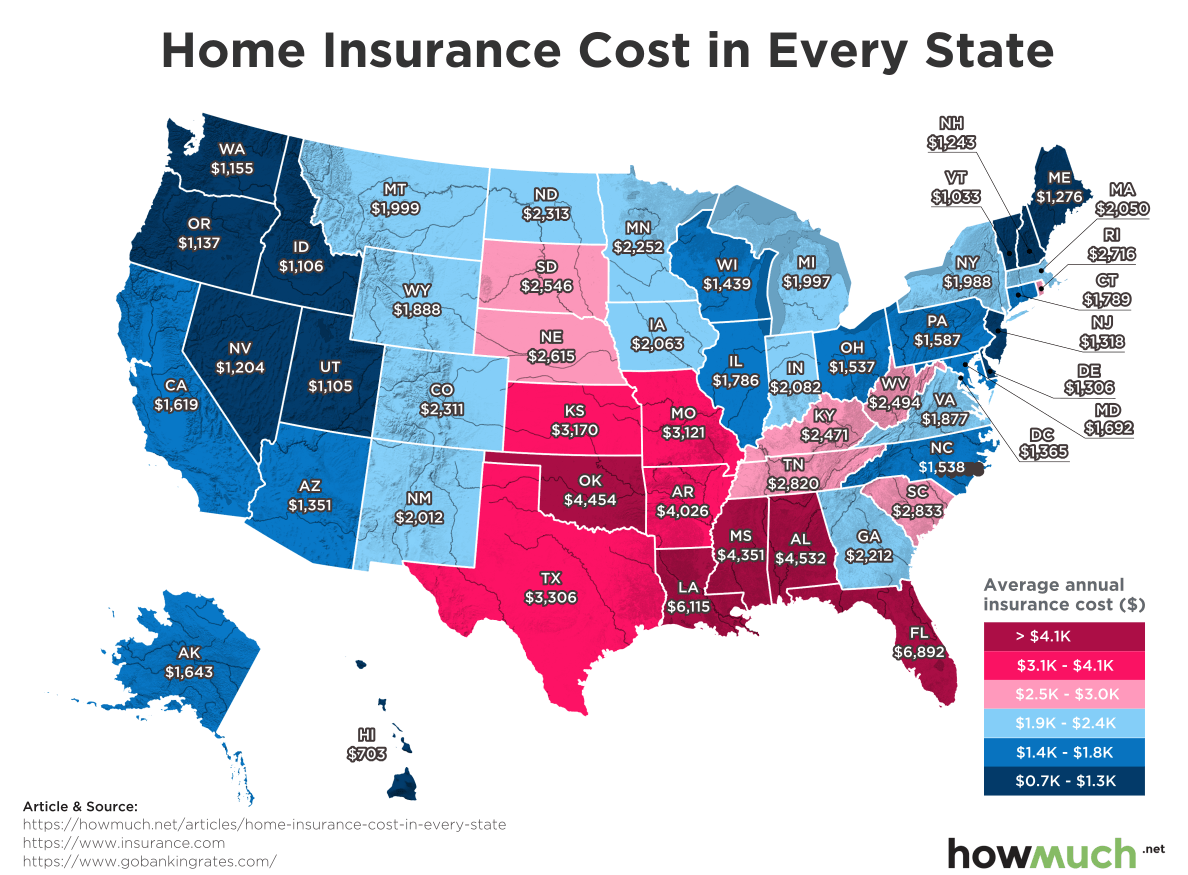

The following table displays average insurance rates for auto and home insurance across all states. It is important to note that these are just averages, and actual rates can vary widely based on individual factors.

| State | Average Auto Insurance Rate | Average Home Insurance Rate |

|---|---|---|

| Alabama | $1,568 | $1,350 |

| Alaska | $2,180 | $1,600 |

| Arizona | $1,470 | $1,200 |

| Arkansas | $1,420 | $1,150 |

| California | $2,000 | $1,500 |

| Colorado | $1,650 | $1,300 |

| Connecticut | $1,900 | $1,600 |

| Delaware | $1,750 | $1,450 |

| Florida | $2,300 | $1,800 |

| Georgia | $1,600 | $1,350 |

| Hawaii | $2,400 | $1,900 |

| Idaho | $1,450 | $1,200 |

| Illinois | $1,800 | $1,450 |

| Indiana | $1,550 | $1,250 |

| Iowa | $1,400 | $1,150 |

| Kansas | $1,350 | $1,100 |

| Kentucky | $1,500 | $1,250 |

| Louisiana | $2,000 | $1,650 |

| Maine | $1,650 | $1,350 |

| Maryland | $1,850 | $1,550 |

| Massachusetts | $1,950 | $1,650 |

| Michigan | $1,700 | $1,400 |

| Minnesota | $1,500 | $1,250 |

| Mississippi | $1,600 | $1,300 |

| Missouri | $1,450 | $1,200 |

| Montana | $1,550 | $1,250 |

| Nebraska | $1,300 | $1,100 |

| Nevada | $1,700 | $1,400 |

| New Hampshire | $1,600 | $1,300 |

| New Jersey | $1,900 | $1,600 |

| New Mexico | $1,650 | $1,350 |

| New York | $2,000 | $1,700 |

| North Carolina | $1,550 | $1,250 |

| North Dakota | $1,350 | $1,100 |

| Ohio | $1,600 | $1,300 |

| Oklahoma | $1,400 | $1,150 |

| Oregon | $1,650 | $1,350 |

| Pennsylvania | $1,750 | $1,450 |

| Rhode Island | $1,800 | $1,500 |

| South Carolina | $1,650 | $1,350 |

| South Dakota | $1,300 | $1,100 |

| Tennessee | $1,500 | $1,250 |

| Texas | $1,700 | $1,400 |

| Utah | $1,450 | $1,200 |

| Vermont | $1,700 | $1,400 |

| Virginia | $1,650 | $1,350 |

| Washington | $1,700 | $1,400 |

| West Virginia | $1,500 | $1,250 |

| Wisconsin | $1,550 | $1,250 |

| Wyoming | $1,400 | $1,150 |

Reasons for State-Specific Rate Variations

Insurance rates are influenced by a variety of factors that differ from state to state. Some of the most significant contributors to rate variations include:

- Cost of Living: States with higher costs of living, such as California and New York, tend to have higher insurance rates. This is because the cost of repairing or replacing damaged property is more expensive in these areas.

- Traffic Density and Accident Rates: States with heavy traffic and high accident rates, such as Florida and Texas, often have higher auto insurance rates. Insurance companies factor in the likelihood of claims when setting rates.

- Natural Disaster Risk: States prone to natural disasters, such as California (earthquakes) and Florida (hurricanes), typically have higher home insurance rates. Insurers assess the risk of potential claims from these events.

- State Regulations: Each state has its own set of insurance regulations, which can impact rates. Some states have stricter regulations regarding coverage requirements or claim handling, which can lead to higher costs for insurance companies.

- Competition in the Insurance Market: States with a higher number of insurance companies competing for customers may have lower rates. Increased competition can drive down prices as companies strive to attract customers.

Impact of Insurance Regulations

State-specific insurance regulations significantly influence the cost of insurance premiums. These regulations are designed to protect consumers, ensure market stability, and promote fair competition. However, the impact of these regulations on insurance pricing can vary greatly depending on the specific rules and their implementation.

Impact of Regulations on Insurance Pricing

Regulations can influence insurance pricing in various ways. For example, mandatory coverage requirements can increase premiums by forcing insurers to cover certain risks, even if they are not profitable. Minimum limits for liability coverage can also impact pricing, as they require insurers to offer higher coverage levels, which may increase costs. Additionally, regulations related to rate setting, such as approval requirements for rate increases, can influence the speed and magnitude of premium changes.

Examples of Regulations Impacting Rates

Here are some specific examples of regulations that can impact insurance rates:

- Mandatory Coverage: Many states require drivers to carry certain types of insurance, such as liability coverage, personal injury protection (PIP), and uninsured motorist coverage. These mandatory coverages increase the overall cost of insurance for all policyholders, as insurers must factor in the cost of covering these mandated risks.

- Minimum Limits: State regulations set minimum liability coverage limits that drivers must carry. These limits can influence premiums, as higher limits generally lead to higher premiums. For example, states with higher minimum liability limits may have higher average insurance premiums than states with lower limits.

- Rate Filing Requirements: Some states require insurers to file their rates with the state insurance department for approval before they can be implemented. This process can delay rate changes and may limit the ability of insurers to adjust premiums quickly to reflect changing market conditions.

Comparison of State Regulation Approaches

States vary significantly in their approaches to regulating insurance markets. Some states have more stringent regulations, while others have a more laissez-faire approach. This variation can impact insurance costs in several ways:

- Rate Regulation: Some states have strict rate regulation, requiring insurers to justify rate increases and limiting the amount of profit they can make. This can lead to lower premiums in the short term but may discourage insurers from entering the market or offering competitive rates in the long run.

- Consumer Protection: States with strong consumer protection laws often have higher insurance costs, as insurers must comply with more stringent regulations. However, these regulations can also benefit consumers by ensuring they receive fair treatment and adequate coverage.

- Competition: States with more competitive insurance markets often have lower premiums, as insurers are forced to offer competitive rates to attract customers. However, increased competition can also lead to less financial stability for insurers, potentially increasing the risk of insolvencies.

Finding the Best Rates

Finding the cheapest insurance rates requires a proactive approach. By understanding the factors influencing insurance costs and employing effective strategies, you can significantly reduce your premiums. Here’s a comprehensive guide to help you find the best rates in your state.

Comparing Quotes from Multiple Insurers

It’s crucial to compare quotes from multiple insurers to find the most competitive rates. This ensures you’re not settling for a higher premium than necessary.

- Contact multiple insurers: Reach out to at least three to five insurers to obtain quotes. You can do this online, over the phone, or by visiting an insurance agent in person. Don’t hesitate to ask for quotes from both well-known national companies and regional or local insurers, as they may offer more competitive rates in certain areas.

- Provide accurate information: When requesting quotes, ensure you provide accurate information about your vehicle, driving history, and other relevant details. Inaccurate information can lead to higher premiums, so it’s essential to be truthful and thorough.

- Review quote details: Carefully review the quotes you receive, paying attention to the coverage options, deductibles, and any additional fees. Compare the rates and coverage to determine the best value for your needs.

Utilizing Online Comparison Tools

Online comparison tools simplify the process of comparing insurance quotes from multiple insurers. These platforms allow you to enter your information once and receive quotes from several insurers within minutes.

- Use reputable comparison websites: Many websites specialize in insurance comparisons. Look for platforms that have a good reputation and are known for their accuracy and transparency. Consider using sites like Policygenius, NerdWallet, or Insurance.com.

- Compare coverage options: When using online comparison tools, ensure you compare quotes for the same coverage options. This will allow for a fair comparison of prices and avoid any surprises later on.

- Read reviews: Before choosing an insurer based on a comparison tool, it’s wise to read reviews from other customers. This can provide insights into the insurer’s reputation for customer service, claims handling, and overall satisfaction.

Negotiating with Insurers

While insurance rates are generally set by insurers, you can still negotiate for a lower premium. This can be especially helpful if you have a good driving record, multiple policies, or have been a loyal customer for a long time.

- Be prepared to switch insurers: Threatening to switch insurers can be a powerful tool for negotiation. Let the insurer know you’re considering other options and are open to switching if they don’t offer a competitive rate.

- Highlight your positive factors: Emphasize your good driving record, any safety features in your vehicle, and your loyalty to the insurer. This can help you make a compelling case for a lower premium.

- Ask for a discount: Inquire about any available discounts, such as those for good students, safe drivers, or bundling multiple policies. Don’t hesitate to ask for a lower premium if you meet the criteria for a discount.

Considering Discounts and Bundles

Insurers offer various discounts to incentivize customers and reduce premiums. By taking advantage of these discounts, you can save significantly on your insurance costs.

| Discount Type | Description | Example |

|---|---|---|

| Good Student Discount | Available to students with good grades. | A student with a 3.5 GPA or higher may qualify for a 10% discount. |

| Safe Driver Discount | Offered to drivers with a clean driving record. | A driver with no accidents or violations in the past three years may receive a 15% discount. |

| Multi-Car Discount | Applied when insuring multiple vehicles with the same insurer. | Insuring two cars with the same insurer could result in a 10% discount on each policy. |

| Bundled Discount | Offered when combining multiple insurance policies, such as auto and home insurance. | Bundling auto and home insurance could lead to a 15% discount on both policies. |

Practical Tips for Saving on Insurance Premiums

In addition to comparing quotes and negotiating with insurers, there are several practical tips you can implement to save on your insurance premiums:

- Maintain a good driving record: Avoid traffic violations, accidents, and other driving infractions. A clean driving record is a significant factor in determining insurance rates.

- Consider a higher deductible: A higher deductible means you pay more out of pocket in case of an accident but could result in lower premiums. Choose a deductible that you can comfortably afford.

- Install safety features: Adding safety features to your vehicle, such as anti-theft devices or advanced braking systems, can qualify you for discounts. This can demonstrate your commitment to safety and potentially reduce your premiums.

- Shop around regularly: Insurance rates can change over time, so it’s a good idea to shop around for quotes every year or two. This ensures you’re getting the best rate possible and haven’t become complacent with your current insurer.

Importance of Coverage and Deductibles

Choosing the right coverage levels and deductibles is crucial when buying insurance. These choices significantly impact your premiums and the overall cost of insurance, so understanding the implications is essential. This section will explain how to balance your coverage needs with your budget constraints.

Coverage Levels

Coverage levels determine the amount of financial protection you receive in case of an accident or other covered event. Higher coverage levels provide more protection but also result in higher premiums. Conversely, lower coverage levels offer less protection but come with lower premiums.

- Liability Coverage: This coverage protects you financially if you are found liable for an accident that causes damage to another person’s property or injuries. It covers legal fees and medical expenses for the other party.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, or natural disasters.

Deductibles

A deductible is the amount you pay out-of-pocket before your insurance policy kicks in. Higher deductibles usually mean lower premiums, while lower deductibles mean higher premiums.

- Choosing a Deductible: Consider your financial situation and risk tolerance when deciding on a deductible. A higher deductible might be a good option if you are comfortable paying more out-of-pocket in case of an accident, as it will lower your premiums. However, if you have a limited budget and cannot afford to pay a high deductible, a lower deductible might be a better choice.

- Balancing Coverage and Deductibles: It’s essential to find a balance between coverage levels and deductibles that meets your individual needs and budget. You can use online tools or consult with an insurance agent to compare different coverage options and deductibles and find the most cost-effective solution for you.

Impact on Premiums and Overall Cost

The choices you make regarding coverage levels and deductibles directly influence your insurance premiums.

- Higher Coverage Levels: Higher coverage levels generally lead to higher premiums. This is because you are paying for more financial protection in case of an accident or other covered event.

- Lower Deductibles: Lower deductibles also result in higher premiums. This is because your insurance company is taking on more financial responsibility in case of a claim.

- Overall Cost: The overall cost of insurance is a combination of your premiums and any out-of-pocket expenses you incur, such as deductibles.

Consumer Resources and Information

Navigating the world of insurance rates can be overwhelming, but there are valuable resources available to help consumers make informed decisions. Several organizations and websites provide valuable information and guidance on insurance rates, helping consumers find the best coverage at the most affordable prices.

Reputable Organizations and Websites

Several organizations and websites provide valuable information and guidance on insurance rates, helping consumers find the best coverage at the most affordable prices. Here is a table that Artikels some of the most reputable resources:

| Organization Name | Website Address | Key Services Offered |

|---|---|---|

| National Association of Insurance Commissioners (NAIC) | https://www.naic.org/ | Provides information on insurance regulations, consumer protection, and industry trends. |

| Insurance Information Institute (III) | https://www.iii.org/ | Offers educational materials on various insurance topics, including rate comparisons and consumer tips. |

| Consumer Reports | https://www.consumerreports.org/ | Provides independent reviews and ratings of insurance companies, helping consumers make informed choices. |

| The Zebra | https://www.thezebra.com/ | An online insurance comparison platform that allows consumers to compare rates from multiple insurers. |

| NerdWallet | https://www.nerdwallet.com/ | Offers comprehensive financial advice, including guidance on insurance rates and comparison tools. |

End of Discussion: Cheapest Insurance Rates By State

By understanding the factors that influence insurance rates, taking advantage of available discounts, and carefully comparing quotes, you can significantly reduce your premiums and ensure you have the right coverage at a price that fits your budget. Don’t settle for the first quote you find – explore your options, ask questions, and take control of your insurance costs. Remember, finding the cheapest insurance rates by state is a journey, not a destination, and the more informed you are, the better equipped you’ll be to make smart choices that protect your finances and provide peace of mind.

FAQ Overview

How often should I compare insurance quotes?

It’s recommended to compare quotes at least annually, or even more frequently if you experience major life changes, such as a new car, a move to a different state, or a change in your driving record.

What are some common insurance discounts?

Many insurers offer discounts for good driving records, safety features in your car, bundling multiple insurance policies, and being a member of certain organizations or groups.

Can I negotiate my insurance premium?

Yes, you can often negotiate your premium by comparing quotes from multiple insurers and highlighting your good driving record and any discounts you qualify for.

How do I choose the right deductible?

A higher deductible typically means lower premiums, but it also means you’ll have to pay more out of pocket if you have a claim. Choose a deductible that balances your risk tolerance and budget.