Cheapest insurance in Washington State sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the insurance landscape in Washington can feel like a maze, especially when you’re seeking the most affordable options. From understanding the unique factors that influence costs to exploring various strategies for finding the best deals, this guide will equip you with the knowledge to make informed decisions about your insurance needs.

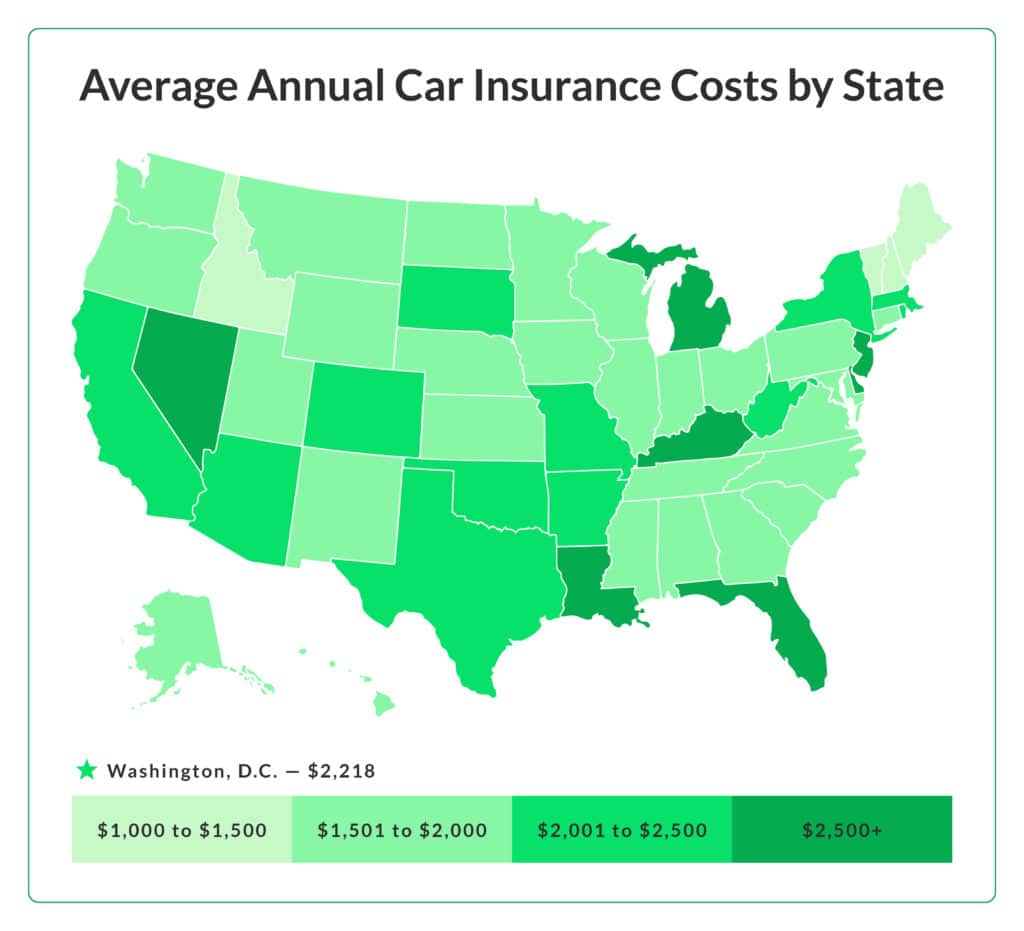

Washington State boasts a diverse population with varying insurance requirements. Factors like age, driving history, location, and the type of coverage you need all play a significant role in determining your premiums. Understanding how these factors influence costs is crucial for finding the best value for your money.

Understanding Washington State Insurance Landscape

Washington State presents a unique insurance landscape influenced by factors such as its diverse geography, economic activity, and regulatory environment. Understanding these factors is crucial for navigating the insurance market and finding the best coverage at the most affordable price.

Types of Insurance in Washington State

Washington residents, like individuals across the nation, seek various types of insurance to protect themselves and their assets. The most common types of insurance in Washington State include:

- Auto Insurance: Mandatory in Washington State, auto insurance protects drivers against financial losses arising from accidents. The state’s diverse geography, including mountainous regions and urban areas, influences the risk factors and, consequently, insurance premiums.

- Homeowners Insurance: Homeowners insurance provides coverage for damage or loss to a home and its contents. Washington’s susceptibility to natural disasters like earthquakes and wildfires significantly impacts the cost of homeowners insurance.

- Health Insurance: Access to affordable health insurance is a major concern for Washington residents. The state has implemented various programs and regulations to expand coverage and control costs. The Affordable Care Act (ACA) plays a crucial role in providing health insurance options to individuals and families.

- Business Insurance: Businesses in Washington State need various types of insurance to protect against financial risks. This includes general liability insurance, property insurance, and workers’ compensation insurance, among others. The specific insurance needs of a business depend on its industry, size, and operations.

The Washington State Insurance Commissioner

The Washington State Insurance Commissioner is a crucial regulatory body responsible for overseeing the state’s insurance market. The Commissioner’s role includes:

- Protecting Consumers: The Commissioner works to ensure that insurance companies operate fairly and transparently, protecting consumers from unfair practices and misleading information.

- Regulating the Market: The Commissioner establishes and enforces regulations for insurance companies operating in Washington State, ensuring financial stability and consumer protection.

- Resolving Disputes: The Commissioner provides a mechanism for resolving disputes between consumers and insurance companies, ensuring a fair and impartial process.

- Educating Consumers: The Commissioner promotes consumer education and awareness about insurance products and services, empowering consumers to make informed decisions.

Factors Determining Insurance Costs

In Washington State, several factors influence your insurance premiums. These factors are used to assess your risk and determine how much you’ll pay for your coverage. Understanding these factors can help you make informed decisions about your insurance choices and potentially save money.

Age

Age is a significant factor in determining insurance costs. Younger drivers are statistically more likely to be involved in accidents, which translates to higher premiums. As drivers age and gain experience, their risk profile decreases, leading to lower premiums.

Driving History

Your driving history is a critical factor in determining your insurance premiums. A clean driving record with no accidents, violations, or DUI convictions will result in lower premiums. Conversely, a history of accidents, traffic violations, or DUI convictions will significantly increase your insurance costs.

Location

Your location in Washington State can influence your insurance premiums. Areas with higher crime rates, traffic congestion, or a greater number of accidents tend to have higher insurance rates.

Coverage Levels

The level of coverage you choose directly impacts your insurance premiums. Higher coverage levels, such as comprehensive and collision coverage, provide greater financial protection but come at a higher cost.

Vehicle Type

The type of vehicle you drive plays a role in your insurance premiums. Sports cars, luxury vehicles, and high-performance cars are generally more expensive to insure due to their higher repair costs and increased risk of theft.

Credit Score

In Washington State, insurance companies can use your credit score to determine your insurance premiums. This practice is controversial, but it’s based on the idea that individuals with good credit are more financially responsible and less likely to file claims.

Other Factors

Other factors can influence your insurance premiums, including:

- Marital Status: Married individuals generally have lower premiums than single individuals.

- Gender: Historically, men have paid higher premiums than women, but this practice is being phased out in many states.

- Occupation: Some occupations, such as those involving long commutes or driving for work, may lead to higher premiums.

- Driving Habits: Your driving habits, such as the number of miles you drive annually, can impact your premiums.

- Safety Features: Vehicles with safety features, such as anti-theft systems, airbags, and anti-lock brakes, may qualify for discounts.

Finding Affordable Insurance Options

Finding the cheapest insurance in Washington State requires a strategic approach. You need to compare quotes, negotiate rates, and explore discounts to get the best deal. This section Artikels strategies for finding affordable insurance options in Washington.

Comparing Quotes

Comparing quotes from multiple insurance providers is essential to find the cheapest option. Several online tools and websites allow you to enter your information and receive quotes from various companies. This allows you to compare prices, coverage options, and discounts side-by-side.

- Use online comparison tools: Many websites allow you to compare quotes from multiple insurance providers simultaneously. These tools save time and effort, enabling you to quickly compare prices and coverage options. Popular websites include Insurance.com, The Zebra, and Policygenius.

- Contact insurance providers directly: While online tools are convenient, contacting insurance providers directly allows you to discuss specific needs and ask questions about their policies. This personalized approach can help you find a policy that best suits your circumstances.

- Consider using a broker: Insurance brokers work with multiple insurance companies and can help you find the best policy for your needs. They can provide personalized advice and negotiate rates on your behalf. While they may charge a fee, their expertise can be valuable in finding affordable insurance.

Negotiating Rates

Once you’ve received quotes, don’t be afraid to negotiate with insurance providers to lower your premiums. Insurance companies are often willing to work with you to find a rate that fits your budget.

- Highlight your good driving record: A clean driving history demonstrates your responsible driving habits, which can influence lower premiums. Emphasize your lack of accidents or traffic violations to secure a better rate.

- Bundle your policies: Combining your auto and home insurance with the same provider can often result in significant discounts. This strategy shows loyalty and provides an incentive for the insurer to offer a lower rate.

- Ask about payment options: Paying your premiums annually or semi-annually instead of monthly can sometimes lead to a lower rate. This shows commitment and can be beneficial in negotiating a better price.

- Shop around regularly: Don’t assume your current insurer is offering the best rate. Shop around periodically to compare prices and ensure you’re getting the most competitive rate.

Exploring Discounts

Insurance providers offer various discounts to lower premiums. Researching and understanding these discounts can significantly reduce your insurance costs.

- Good student discount: This discount is available to students with good grades, demonstrating responsible behavior and a lower risk profile.

- Safe driver discount: This discount is often offered to drivers with a clean driving record, reflecting their responsible driving habits and lower risk of accidents.

- Multi-car discount: This discount is available when you insure multiple vehicles with the same insurer, showing loyalty and a larger portfolio of business.

- Anti-theft device discount: Installing anti-theft devices on your vehicle can reduce your insurance costs by mitigating the risk of theft and damage.

- Loyalty discount: Insurance providers often offer discounts to long-term customers who have maintained their policies for a significant period.

- Homeowner discount: If you own your home, you may qualify for a discount on your auto insurance. This reflects a greater sense of responsibility and stability.

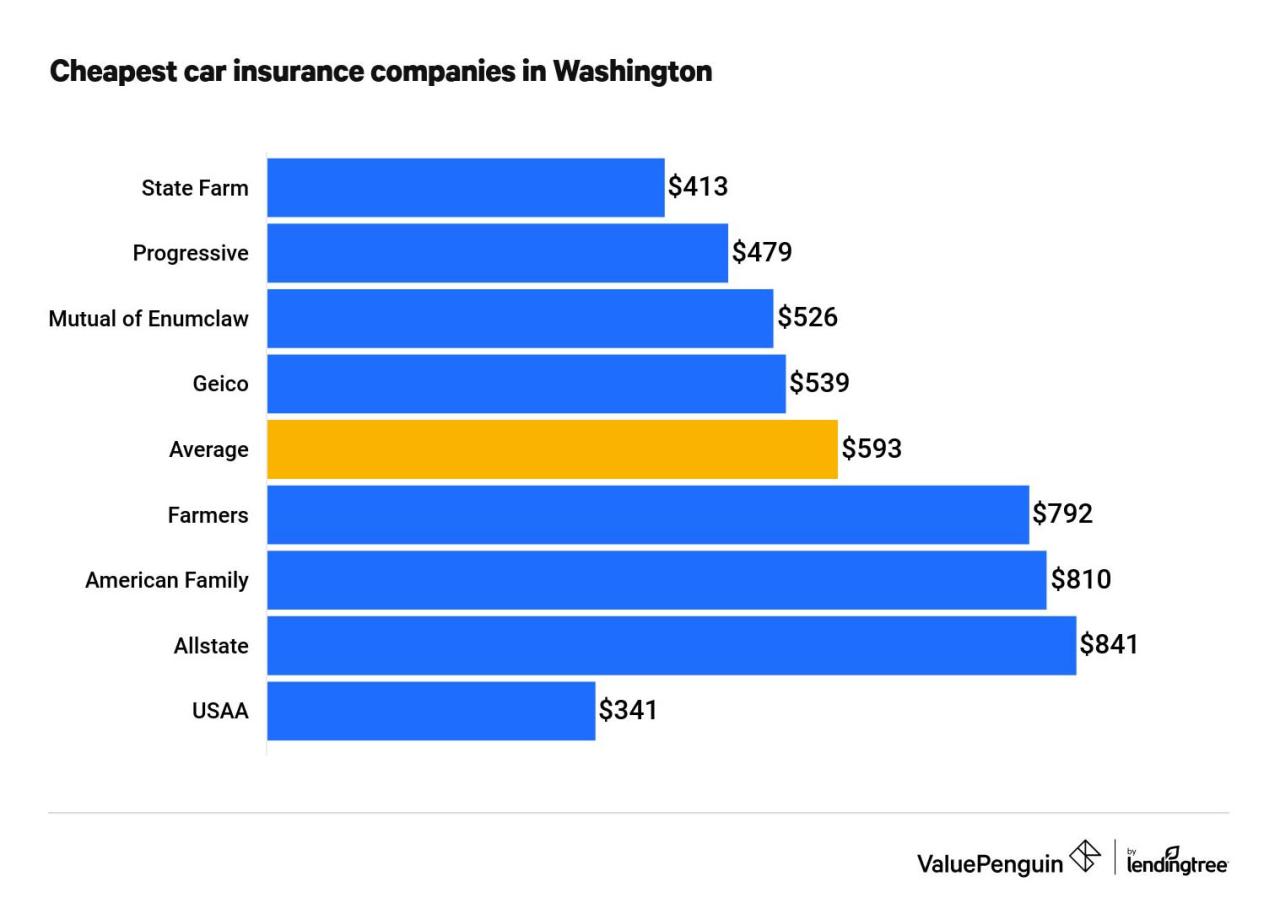

Comparing Insurance Providers

The following table compares different insurance providers in Washington State based on key metrics:

| Insurance Provider | Average Premiums | Customer Satisfaction | Available Discounts |

|---|---|---|---|

| State Farm | $1,200-$1,500 | 4.5/5 | Good student, safe driver, multi-car, anti-theft, loyalty, homeowner |

| Geico | $1,100-$1,400 | 4.2/5 | Good student, safe driver, multi-car, anti-theft, loyalty |

| Progressive | $1,000-$1,300 | 4.0/5 | Good student, safe driver, multi-car, anti-theft, loyalty, homeowner |

| Allstate | $1,300-$1,600 | 4.3/5 | Good student, safe driver, multi-car, anti-theft, loyalty, homeowner |

| USAA | $1,000-$1,200 | 4.8/5 | Good student, safe driver, multi-car, anti-theft, loyalty, homeowner |

Asking Questions

When seeking quotes, it’s essential to ask insurance companies specific questions to ensure you understand the coverage and costs involved.

- What is the coverage limit for liability?

- What is the deductible for collision and comprehensive coverage?

- What discounts are available?

- What are the payment options?

- What is the claims process?

- What is the customer service availability?

- What is the financial stability of the insurance company?

Essential Insurance Coverage in Washington State: Cheapest Insurance In Washington State

In Washington State, securing the right insurance coverage is crucial for protecting your assets and well-being. Understanding the essential insurance requirements and available options can help you make informed decisions that safeguard your financial future.

Minimum Insurance Requirements for Driving

Washington State mandates specific insurance coverage for all drivers to ensure financial protection in case of accidents. These minimum requirements include:

- Liability Coverage: This covers damages to other vehicles and injuries to other people in an accident caused by you. Washington State requires a minimum of $25,000 per person, $50,000 per accident, and $10,000 for property damage.

- Uninsured/Underinsured Motorist Coverage: This protects you in case you are involved in an accident with an uninsured or underinsured driver. Washington State requires a minimum of $25,000 per person, $50,000 per accident, and $10,000 for property damage.

Homeowners Insurance

Homeowners insurance is essential for protecting your home and belongings against various risks. It provides financial coverage for:

- Dwelling Coverage: This covers the structure of your home against damage from events like fire, theft, or natural disasters.

- Liability Coverage: This protects you from financial liability if someone is injured on your property or you are found liable for damages to their property.

- Personal Property Coverage: This covers your belongings, such as furniture, electronics, and clothing, against damage or loss.

Health Insurance

Health insurance is vital for protecting your financial well-being in case of unexpected medical expenses. Washington State offers various health insurance plans, including:

- Washington Healthplan Finder: This state-run marketplace offers subsidized health insurance plans for individuals and families who meet certain income requirements.

- Employer-Sponsored Plans: Many employers in Washington State offer health insurance plans to their employees, which can provide comprehensive coverage at a lower cost.

- Individual Plans: You can also purchase health insurance plans directly from private insurance companies. These plans can vary in coverage and cost, so it’s important to compare options carefully.

Tips for Saving on Insurance

In Washington State, securing affordable insurance is a priority for many. By understanding how insurance premiums are calculated and implementing smart strategies, you can significantly reduce your costs. Here are some tips for saving on insurance:

Improving Driving Habits

Maintaining a clean driving record is crucial for lowering your insurance premiums. This involves:

- Avoiding traffic violations: Every ticket, even for minor offenses, can lead to higher insurance rates.

- Practicing safe driving: Following traffic rules, avoiding distractions, and maintaining a safe speed significantly reduce the risk of accidents, ultimately benefiting your insurance costs.

- Taking defensive driving courses: These courses teach you safe driving techniques and can earn you discounts from some insurance companies.

Bundling Policies

Many insurance companies offer discounts when you bundle multiple policies with them. This means combining your auto, home, renters, or life insurance into one package. By doing so, you can often secure significant savings.

Increasing Deductibles

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible generally means a lower premium. Carefully consider your risk tolerance and financial situation when deciding on your deductible.

Common Discounts Offered by Insurance Companies in Washington State

Insurance companies in Washington State offer a variety of discounts to help customers save money. Here are some common ones:

- Good student discount: This discount is often available to students with good grades.

- Safe driver discount: This discount is awarded to drivers with a clean driving record.

- Multi-car discount: If you insure multiple vehicles with the same company, you may qualify for a discount.

- Anti-theft device discount: Installing anti-theft devices in your car can earn you a discount.

- Loyalty discount: Some companies offer discounts to customers who have been with them for a certain period.

- Homeowner discount: If you own your home, you may qualify for a discount on your car insurance.

- Telematics discount: Using a device that tracks your driving habits can earn you a discount.

Resources for Finding Affordable Insurance Options, Cheapest insurance in washington state

Finding the best insurance rates can be challenging. Fortunately, several resources can assist you in your search:

- Washington State Office of the Insurance Commissioner (OIC): The OIC provides information on insurance rates, consumer rights, and how to file complaints.

- Independent insurance agents: These agents work with multiple insurance companies, allowing them to shop around for the best rates for you.

- Online insurance comparison websites: These websites allow you to compare quotes from multiple insurance companies in one place.

Conclusion

Finding the cheapest insurance in Washington State is a journey that requires research, comparison, and a bit of negotiation. By utilizing the strategies Artikeld in this guide, you can empower yourself to secure affordable coverage that meets your individual needs. Remember, a little effort upfront can lead to significant savings over time, allowing you to enjoy peace of mind knowing you’re protected without breaking the bank.

FAQ Explained

What are the minimum insurance requirements for driving in Washington State?

You must have liability insurance, which covers damage to other people’s property or injuries caused by an accident. This includes bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

What discounts are available for car insurance in Washington State?

Common discounts include good driver discounts, safe driver courses, multi-car discounts, bundling home and auto insurance, and anti-theft device discounts.

How do I find out if I qualify for financial assistance for health insurance?

You can visit the Washington Healthplanfinder website or contact the Washington State Health Care Authority for information about eligibility for subsidies and tax credits.