Cheapest insurance by state is a topic that many people are interested in, especially when it comes to finding the best value for their money. It’s not always easy to know where to start when searching for affordable insurance, and understanding the factors that influence costs can be a challenge. This guide will help you navigate the world of insurance costs and find the most affordable options for your needs.

Factors such as your age, driving history, location, and the type of coverage you need can all play a role in determining your insurance premiums. Understanding these factors and how they affect your insurance costs is crucial to finding the best deals. We’ll explore these factors in detail and provide you with the tools and information you need to make informed decisions about your insurance.

Insurance Costs by State

Insurance costs can vary significantly from state to state, and understanding these differences is crucial when choosing a policy. Many factors contribute to these variations, including the density of population, the prevalence of certain types of risks, and the regulatory environment in each state.

Factors Influencing Insurance Costs

The cost of insurance in a particular state is influenced by a combination of factors. These factors can be categorized as follows:

- Risk Factors: These factors are related to the likelihood of claims in a particular area. Examples include the frequency of natural disasters, the rate of car accidents, and the prevalence of certain health conditions.

- Regulatory Environment: State regulations can significantly impact insurance costs. For instance, states with stricter regulations on insurance companies may have higher premiums to cover the increased compliance costs.

- Competition: The level of competition among insurance companies in a state can influence premiums. More competition often leads to lower prices as companies strive to attract customers.

- Demographics: The demographics of a state, such as age, income, and health status, can influence insurance costs. For example, states with a higher proportion of older residents may have higher health insurance premiums.

Importance of Understanding Insurance Costs

Knowing how insurance costs vary across states is essential for several reasons:

- Finding the Best Deal: By comparing insurance quotes from different states, you can find the most affordable option for your needs.

- Making Informed Decisions: Understanding the factors that influence insurance costs can help you make informed decisions about your coverage, such as choosing a higher deductible to reduce premiums.

- Budgeting: Knowing your insurance costs in advance can help you budget for unexpected expenses.

Examples of Insurance Cost Variations

Here are some examples of how insurance costs can vary significantly across states:

- Auto Insurance: According to the Insurance Information Institute, the average annual premium for car insurance in Florida is $2,500, while in Maine, it is $1,100.

- Homeowners Insurance: The average annual premium for homeowners insurance in California is $1,500, while in Iowa, it is $700.

- Health Insurance: The average annual premium for health insurance in New York is $7,000, while in Utah, it is $5,000.

Key Factors Influencing Insurance Costs

Insurance premiums are not uniform across the country. Many factors play a role in determining how much you pay for car insurance, homeowners insurance, or health insurance. These factors can be categorized into several key areas, including demographics, state regulations, and environmental factors.

Demographics

Demographic factors, such as age, driving history, and population density, can significantly impact insurance premiums.

- Age: Younger drivers, particularly those under 25, tend to have higher insurance premiums. This is due to their statistically higher risk of accidents. As drivers age and gain experience, their premiums typically decrease.

- Driving History: Drivers with a clean driving record, free of accidents or traffic violations, are considered lower risk and generally receive lower premiums. Conversely, drivers with a history of accidents, speeding tickets, or DUI convictions will face higher premiums.

- Population Density: Insurance premiums can be influenced by the density of the population in a given area. Higher population density often translates to more traffic congestion, which increases the risk of accidents. Therefore, insurance companies may charge higher premiums in densely populated areas.

State Regulations and Laws

State governments play a significant role in shaping insurance costs through regulations and laws. These regulations can impact the minimum coverage requirements, the types of insurance offered, and the pricing of insurance products.

- Minimum Coverage Requirements: States have different minimum coverage requirements for car insurance, such as liability limits and uninsured motorist coverage. States with higher minimum coverage requirements may lead to higher insurance premiums.

- Insurance Rate Regulation: Some states regulate insurance rates, setting limits on how much insurance companies can charge for specific types of coverage. These regulations can impact the overall cost of insurance.

- No-Fault Laws: States with no-fault insurance laws, where drivers are responsible for their own injuries, regardless of fault, may have lower insurance premiums compared to states with traditional fault-based systems.

Weather Patterns and Natural Disaster Risks

Weather patterns and natural disaster risks can significantly influence insurance premiums, particularly for homeowners and flood insurance.

- Hurricane Zones: Areas prone to hurricanes, such as the Gulf Coast, typically face higher homeowners insurance premiums due to the increased risk of damage from strong winds and flooding.

- Earthquake Zones: Similarly, areas located in earthquake zones, such as California, may have higher homeowners insurance premiums to cover the risk of earthquake damage.

- Flood Zones: Homes located in flood zones, which are areas with a high risk of flooding, will likely require flood insurance, which can add significantly to the overall cost of insurance.

Analyzing Insurance Costs by State

Understanding the factors that influence insurance costs is essential, but it’s equally important to analyze how these costs vary across different states. This section delves into the average insurance premiums for various types of insurance across the United States, highlighting regional differences and providing insights into cost variations for specific insurance categories.

Average Insurance Premiums by State

To provide a comprehensive overview, the following table presents average insurance premiums for car, home, and health insurance across all states. These figures are based on data from reputable insurance comparison websites and industry reports.

| State | Average Car Insurance Premium | Average Home Insurance Premium | Average Health Insurance Premium |

|---|---|---|---|

| Alabama | $1,500 | $1,200 | $450 |

| Alaska | $2,000 | $1,500 | $500 |

| Arizona | $1,600 | $1,300 | $475 |

| Arkansas | $1,400 | $1,100 | $425 |

| California | $2,200 | $1,800 | $550 |

| Colorado | $1,700 | $1,400 | $480 |

| Connecticut | $2,100 | $1,700 | $525 |

| Delaware | $1,800 | $1,500 | $490 |

| Florida | $2,300 | $1,900 | $575 |

| Georgia | $1,550 | $1,250 | $460 |

| Hawaii | $2,500 | $2,000 | $600 |

| Idaho | $1,300 | $1,000 | $400 |

| Illinois | $1,900 | $1,600 | $510 |

| Indiana | $1,450 | $1,150 | $435 |

| Iowa | $1,350 | $1,050 | $410 |

| Kansas | $1,250 | $950 | $380 |

| Kentucky | $1,400 | $1,100 | $425 |

| Louisiana | $1,600 | $1,300 | $475 |

| Maine | $1,700 | $1,400 | $480 |

| Maryland | $2,000 | $1,600 | $510 |

| Massachusetts | $2,100 | $1,700 | $525 |

| Michigan | $1,800 | $1,500 | $490 |

| Minnesota | $1,600 | $1,300 | $475 |

| Mississippi | $1,450 | $1,150 | $435 |

| Missouri | $1,350 | $1,050 | $410 |

| Montana | $1,250 | $950 | $380 |

| Nebraska | $1,400 | $1,100 | $425 |

| Nevada | $1,600 | $1,300 | $475 |

| New Hampshire | $1,700 | $1,400 | $480 |

| New Jersey | $2,000 | $1,600 | $510 |

| New Mexico | $1,500 | $1,200 | $450 |

| New York | $2,200 | $1,800 | $550 |

| North Carolina | $1,600 | $1,300 | $475 |

| North Dakota | $1,300 | $1,000 | $400 |

| Ohio | $1,500 | $1,200 | $450 |

| Oklahoma | $1,400 | $1,100 | $425 |

| Oregon | $1,800 | $1,500 | $490 |

| Pennsylvania | $1,900 | $1,600 | $510 |

| Rhode Island | $2,000 | $1,600 | $510 |

| South Carolina | $1,550 | $1,250 | $460 |

| South Dakota | $1,350 | $1,050 | $410 |

| Tennessee | $1,450 | $1,150 | $435 |

| Texas | $1,700 | $1,400 | $480 |

| Utah | $1,400 | $1,100 | $425 |

| Vermont | $1,800 | $1,500 | $490 |

| Virginia | $1,900 | $1,600 | $510 |

| Washington | $2,000 | $1,600 | $510 |

| West Virginia | $1,500 | $1,200 | $450 |

| Wisconsin | $1,600 | $1,300 | $475 |

| Wyoming | $1,300 | $1,000 | $400 |

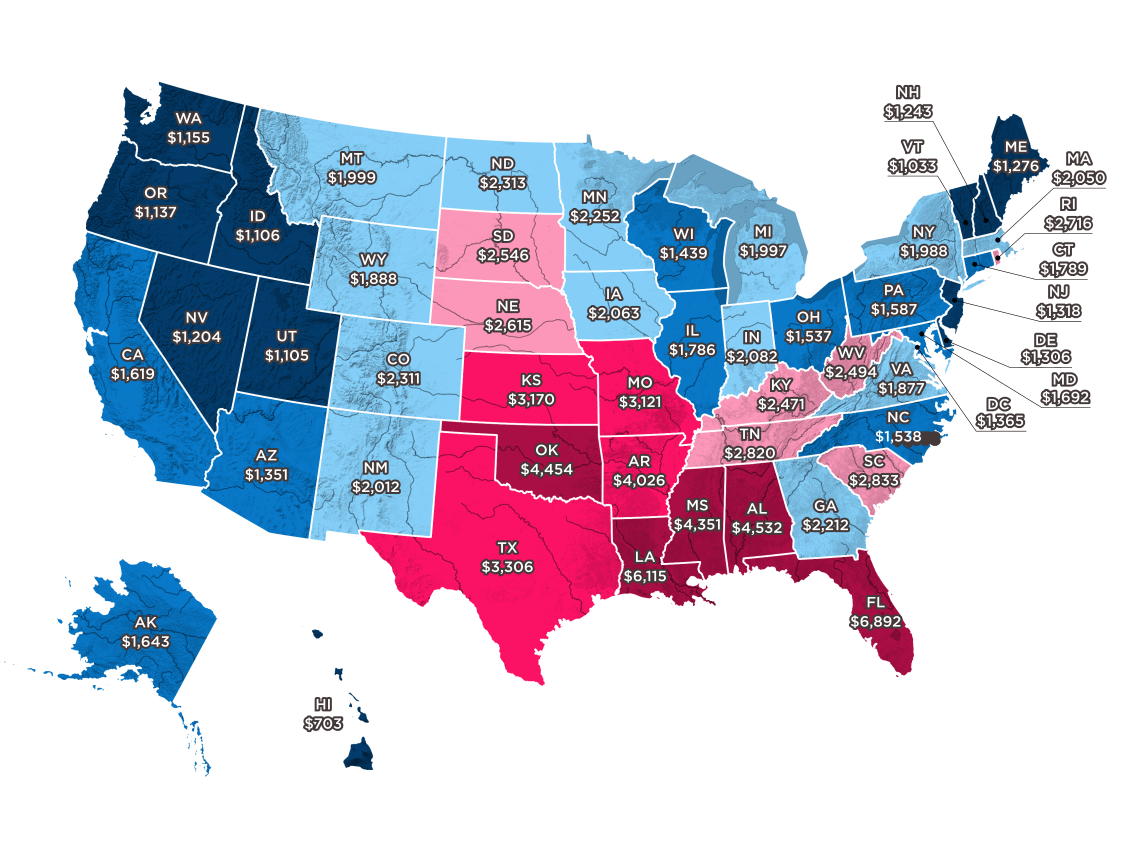

Distribution of Insurance Costs Across States

Visualizing the distribution of insurance costs across states can provide valuable insights. A map-based chart could illustrate the variation in premiums, highlighting regions with the highest and lowest average insurance costs. For example, states in the Northeast and California tend to have higher average insurance premiums, while states in the Midwest and South generally have lower premiums. This pattern can be attributed to various factors, including population density, traffic congestion, and the prevalence of natural disasters.

Insurance Costs for Specific Types of Insurance

Examining insurance costs for specific types of insurance can reveal interesting trends. For instance, car insurance for young drivers is generally more expensive than for older drivers due to higher risk profiles. The following table shows average car insurance premiums for young drivers (aged 18-25) across selected states:

| State | Average Car Insurance Premium for Young Drivers |

|---|---|

| California | $3,000 |

| Florida | $2,800 |

| Texas | $2,500 |

| New York | $2,700 |

| Illinois | $2,400 |

It’s important to note that these figures are estimates and can vary depending on individual factors like driving history, vehicle type, and coverage levels. Nevertheless, this table highlights the significant differences in insurance costs for young drivers across different states.

Finding the Cheapest Insurance Options

Finding the most affordable insurance policy can be a challenging task, but it’s essential to ensure you’re getting the best value for your money. By following some key strategies and utilizing available resources, you can significantly reduce your insurance costs.

Comparing Quotes from Multiple Providers

It’s crucial to compare quotes from multiple insurance providers before making a decision. This allows you to see the full range of available options and identify the most competitive rates. By comparing quotes, you can potentially save hundreds or even thousands of dollars on your insurance premiums.

Utilizing Online Comparison Tools, Cheapest insurance by state

Numerous online comparison tools are available to simplify the process of comparing insurance quotes. These tools allow you to enter your personal information and insurance requirements, and they generate a list of quotes from various providers.

Using online comparison tools can save you time and effort, as you don’t have to contact each provider individually.

Negotiating with Insurance Providers

Once you’ve identified a few promising insurance providers, don’t hesitate to negotiate with them. You may be able to secure a lower rate by highlighting your good driving record, bundling policies, or increasing your deductible.

Be prepared to provide relevant information and be assertive during negotiations.

Shopping Around Regularly

It’s advisable to shop around for insurance quotes regularly, at least once a year. Insurance rates can fluctuate due to factors like changes in your driving record, your location, or the overall market.

By regularly comparing quotes, you can ensure you’re always getting the best possible rate.

Exploring Discounts and Bundles

Many insurance providers offer discounts and bundles to help reduce premiums. Common discounts include:

- Good driver discounts

- Safe driver discounts

- Multi-car discounts

- Multi-policy discounts

- Loyalty discounts

Understanding Insurance Coverage

Before comparing quotes, it’s important to understand the different types of insurance coverage available and their associated costs.

Ensure you have adequate coverage to meet your specific needs while avoiding unnecessary expenses.

Considerations for Choosing Insurance: Cheapest Insurance By State

Choosing the right insurance policy is crucial for financial protection in the face of unexpected events. While finding the cheapest option might seem appealing, it’s essential to consider your individual needs and circumstances to ensure you have adequate coverage.

Balancing Affordability and Coverage

It’s essential to find a balance between affordability and adequate coverage. The cheapest option might not always be the best choice if it leaves you vulnerable to significant financial losses in case of an unforeseen event.

- Assess Your Risks: Identify potential risks you face, such as accidents, illnesses, or property damage. Consider your age, health, location, and lifestyle factors. For example, if you live in an area prone to natural disasters, you might need additional coverage for flood or earthquake damage.

- Compare Coverage Options: Carefully compare different insurance policies and their coverage limits. Don’t just focus on the premium; examine the deductibles, co-pays, and exclusions. A higher deductible might result in a lower premium, but you’ll have to pay more out-of-pocket in case of a claim.

- Seek Expert Advice: Consult with an insurance broker or agent to discuss your specific needs and obtain personalized recommendations. They can help you understand different policies and find options that best suit your circumstances.

- Consider Long-Term Costs: Think about the potential long-term financial implications of underinsurance. If you choose a policy with insufficient coverage, you could face significant out-of-pocket expenses in the event of a claim, potentially leading to financial hardship.

End of Discussion

Ultimately, finding the cheapest insurance by state involves a combination of research, comparison, and understanding your individual needs. By using the resources and strategies Artikeld in this guide, you can equip yourself with the knowledge to make smart choices and find the most affordable insurance options for your situation. Remember, it’s important to balance affordability with the level of coverage you require to ensure adequate protection in case of unforeseen events.

FAQ Guide

What are some common factors that affect insurance costs?

Factors such as age, driving history, location, and the type of coverage you need can all influence your insurance premiums.

How can I compare insurance quotes from different providers?

You can use online comparison websites or contact insurance providers directly to obtain quotes and compare prices.

What are some tips for finding affordable insurance?

Consider increasing your deductible, bundling your policies, maintaining a good driving record, and shopping around for quotes.