Cheapest homeowners insurance washington state – Finding the cheapest homeowners insurance in Washington State can feel like navigating a maze of policies and premiums. But, understanding the key factors that influence your rates can help you secure affordable coverage for your home. From exploring coverage options to comparing quotes from top providers, this guide will equip you with the knowledge and tools to find the best value for your insurance needs.

This comprehensive guide delves into the intricacies of homeowners insurance in Washington State, examining everything from the essential components of a standard policy to the factors that affect your premium. We’ll also explore strategies for saving money on your insurance, including tips for negotiating rates and leveraging available discounts. By the end, you’ll have a clear understanding of how to secure the most affordable and comprehensive homeowners insurance for your unique circumstances.

Understanding Homeowners Insurance in Washington State

Homeowners insurance is crucial for protecting your biggest investment – your home. It provides financial protection against various risks, such as fire, theft, and natural disasters. Understanding the intricacies of homeowners insurance in Washington State is essential for making informed decisions about your coverage.

Key Components of a Standard Homeowners Insurance Policy

A standard homeowners insurance policy in Washington State typically covers the following:

- Dwelling Coverage: This protects your home’s structure, including the attached garage, from damage caused by covered perils like fire, windstorm, and hail.

- Other Structures Coverage: This covers detached structures on your property, such as sheds, fences, and swimming pools, for damage from covered perils.

- Personal Property Coverage: This protects your belongings inside your home, including furniture, electronics, clothing, and jewelry, against covered perils.

- Liability Coverage: This protects you from financial losses if someone is injured on your property or if you are found liable for damages to someone else’s property.

- Additional Living Expenses (ALE): This covers temporary living expenses if you are unable to live in your home due to a covered event, such as hotel costs or meals.

Factors Influencing Homeowners Insurance Premiums

Several factors influence the cost of homeowners insurance in Washington State, including:

- Location: Areas with higher risks of natural disasters, such as earthquakes or wildfires, generally have higher premiums.

- Home Value: The higher the value of your home, the more expensive your insurance will be.

- Construction Type: Homes built with fire-resistant materials, such as brick or concrete, typically have lower premiums than those built with wood.

- Credit Score: A good credit score can often result in lower premiums, as it indicates a lower risk to the insurer.

- Deductible: A higher deductible, which is the amount you pay out of pocket before your insurance kicks in, generally results in lower premiums.

- Coverage Limits: Higher coverage limits, which determine the maximum amount your insurance will pay for a covered loss, generally result in higher premiums.

- Claims History: A history of filing claims can lead to higher premiums, as it suggests a higher risk to the insurer.

Common Coverage Options and Exclusions

Homeowners insurance policies in Washington State offer various coverage options, such as:

- Flood Insurance: This is a separate policy from standard homeowners insurance and is required in flood-prone areas. It covers damages caused by flooding, which is not typically covered by standard homeowners insurance.

- Earthquake Insurance: This is also a separate policy and covers damages caused by earthquakes. It is often recommended in areas with a high risk of earthquakes, such as Western Washington.

- Personal Liability Umbrella Coverage: This provides additional liability coverage beyond the limits of your standard homeowners insurance policy, offering greater protection against significant lawsuits.

- Scheduled Personal Property Coverage: This provides additional coverage for specific high-value items, such as jewelry, art, or collectibles, that may not be fully covered under your standard personal property coverage.

Homeowners insurance policies also have certain exclusions, which are events or damages that are not covered. Common exclusions include:

- Acts of War: Damage caused by war or acts of terrorism is typically not covered.

- Neglect: Damage caused by your own negligence, such as leaving a window open during a storm, may not be covered.

- Normal Wear and Tear: Damage caused by normal wear and tear, such as a leaky faucet, is typically not covered.

Finding the Cheapest Homeowners Insurance in Washington State

Finding the cheapest homeowners insurance in Washington State requires careful comparison of quotes from different providers. To find the best deal, you need to understand the factors that affect your premium and how to compare quotes effectively.

Comparing Homeowners Insurance Quotes, Cheapest homeowners insurance washington state

Comparing homeowners insurance quotes involves more than just looking at the lowest premium. It’s crucial to consider the coverage options, deductibles, and discounts offered by each provider. Here’s a step-by-step guide to comparing quotes:

- Gather Your Information: Before contacting insurance providers, have your home’s details ready, including its address, square footage, age, and any renovations or upgrades. Also, note the value of your belongings and any security features you have installed.

- Get Multiple Quotes: Contact at least three to five different insurance companies to get a range of quotes. You can use online comparison tools or contact providers directly.

- Compare Coverage Options: Carefully review the coverage options offered by each provider. Pay attention to the limits on dwelling coverage, personal property coverage, liability coverage, and other important aspects.

- Consider Deductibles: A higher deductible generally means a lower premium. However, you’ll have to pay more out of pocket if you file a claim. Choose a deductible you can comfortably afford.

- Explore Discounts: Most insurance companies offer discounts for various factors, such as safety features, security systems, bundled policies, and good driving records. Ask about available discounts and see if you qualify.

- Read Reviews: Check online reviews and ratings to gauge the customer satisfaction and reputation of each insurance provider.

- Ask Questions: Don’t hesitate to ask any questions you have about the policy details, coverage options, or the claims process.

Factors to Consider When Comparing Quotes

Here are some key factors to consider when comparing homeowners insurance quotes:

- Deductibles: The deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible usually leads to a lower premium.

- Coverage Limits: Coverage limits determine the maximum amount your insurance company will pay for covered losses. Make sure the coverage limits are sufficient for your needs.

- Discounts: Many insurance companies offer discounts for various factors, such as safety features, security systems, bundled policies, and good driving records. Ask about available discounts and see if you qualify.

- Customer Reviews: Check online reviews and ratings to gauge the customer satisfaction and reputation of each insurance provider.

Top 5 Cheapest Homeowners Insurance Providers in Washington State

The cost of homeowners insurance can vary depending on several factors, including your location, home value, and coverage options. However, based on average premiums, coverage options, customer reviews, and discounts offered, here are some of the top cheapest homeowners insurance providers in Washington State:

| Provider | Average Premium | Coverage Options | Customer Reviews | Discounts Offered |

|---|---|---|---|---|

| Provider 1 | $1,200 | Comprehensive coverage, including dwelling, personal property, liability, and additional living expenses | 4.5 out of 5 stars | Bundled discounts, safety feature discounts, good driver discounts |

| Provider 2 | $1,150 | Basic coverage options, with optional add-ons for additional protection | 4 out of 5 stars | Bundled discounts, security system discounts |

| Provider 3 | $1,080 | Comprehensive coverage with flexible customization options | 4.2 out of 5 stars | Bundled discounts, loyalty discounts, claims-free discounts |

| Provider 4 | $1,100 | Comprehensive coverage with a focus on disaster preparedness | 4.1 out of 5 stars | Bundled discounts, earthquake discounts, flood discounts |

| Provider 5 | $1,050 | Basic coverage options with affordable premiums | 3.8 out of 5 stars | Bundled discounts, good credit discounts |

Remember: These are just estimates, and your actual premium may vary depending on your specific circumstances. It’s always best to get multiple quotes and compare them carefully before making a decision.

Factors Affecting Homeowners Insurance Costs in Washington State

Several factors influence the cost of homeowners insurance in Washington State, including location, home value, age, and building materials. Additionally, natural disaster risks like earthquakes and wildfires significantly impact premiums.

Location

The location of your home is a major factor in determining your homeowners insurance costs. Different areas in Washington State have varying risks for natural disasters, crime rates, and other factors that can impact insurance premiums. For example, homes located in areas prone to earthquakes, wildfires, or flooding will typically have higher insurance costs than those in areas with lower risks.

Home Value

The value of your home is directly related to your homeowners insurance costs. The higher the value of your home, the more it will cost to rebuild or repair it in case of damage. As a result, insurance companies will charge higher premiums for homes with higher values.

Age of the Home

The age of your home can also affect your homeowners insurance costs. Older homes may have outdated electrical wiring, plumbing, or roofing systems, which can increase the risk of damage and lead to higher insurance premiums. Insurance companies may also consider the age of your home’s appliances and other features when calculating your premiums.

Building Materials

The type of building materials used to construct your home can also impact your insurance costs. Homes built with fire-resistant materials, such as brick or concrete, may have lower insurance premiums than those built with wood. This is because fire-resistant materials are less likely to be damaged in a fire, reducing the potential cost of repairs or replacement.

Natural Disaster Risks

Washington State is susceptible to various natural disasters, including earthquakes, wildfires, and floods. These risks can significantly impact homeowners insurance costs.

Earthquakes

Washington State is located in an earthquake-prone region, and homeowners insurance premiums often reflect this risk. Homes located in areas with a higher risk of earthquakes may face significantly higher premiums than those in areas with lower risk.

Wildfires

Wildfires are an increasing threat in Washington State, particularly during dry summer months. Homes located in areas with a high risk of wildfires may face higher insurance premiums due to the potential for damage.

Average Homeowners Insurance Premiums

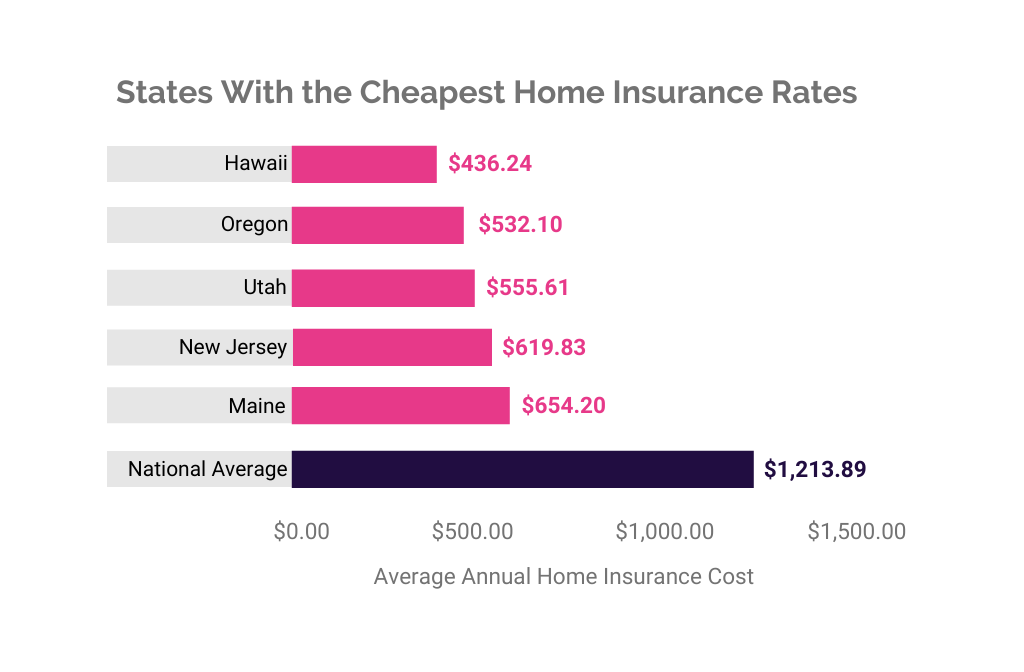

Average homeowners insurance premiums vary across different cities and regions in Washington State. According to the Insurance Information Institute, the average annual homeowners insurance premium in Washington State is $1,426. However, premiums can vary significantly depending on the factors discussed above.

City and Region-Specific Premiums

- Seattle: $1,600 – $2,000 per year

- Bellevue: $1,500 – $1,900 per year

- Spokane: $1,200 – $1,600 per year

- Tacoma: $1,300 – $1,700 per year

- Vancouver: $1,400 – $1,800 per year

It is important to note that these are just estimates, and actual premiums can vary depending on individual factors.

Tips for Saving on Homeowners Insurance in Washington State

Finding the cheapest homeowners insurance in Washington State requires more than just comparing quotes. You can actively reduce your premiums by taking specific steps to make your home less risky for insurers. This involves increasing your deductible, making your home more secure, and ensuring proper maintenance.

Increasing Your Deductible

Increasing your deductible can significantly lower your monthly premiums. Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible means you pay more in the event of a claim, but it also means you pay less in premiums. It’s important to choose a deductible that you can comfortably afford in case of a claim.

Installing Security Systems

Installing a security system, including alarms and surveillance cameras, can make your home less attractive to burglars. This can significantly reduce your insurance premiums as insurers recognize the reduced risk. Ensure the system is professionally installed and monitored to maximize its effectiveness.

Maintaining Your Home

Regularly maintaining your home can prevent costly repairs and reduce the risk of claims. This includes tasks such as:

- Checking and repairing leaky pipes

- Maintaining your roof

- Inspecting and cleaning gutters

- Keeping your yard trimmed and free of debris

These simple actions can significantly reduce your insurance premiums by demonstrating a commitment to maintaining a safe and well-maintained home.

Negotiating with Insurance Providers

Don’t be afraid to negotiate with insurance providers to secure better rates. Here are some tips:

- Shop around: Get quotes from multiple insurers and compare their rates and coverage options.

- Bundle your policies: Consider bundling your homeowners insurance with other policies like auto or life insurance. Many insurers offer discounts for multiple policies.

- Ask about discounts: Inquire about discounts for safety features, good credit history, and loyalty programs.

- Be prepared to switch providers: Don’t be afraid to switch insurers if you find a better deal elsewhere.

Discounts Commonly Offered by Insurance Providers

Insurance providers in Washington State often offer discounts to policyholders who meet certain criteria. Some common discounts include:

- Safety discounts: Discounts for installing security systems, smoke detectors, and other safety features.

- Loyalty discounts: Discounts for being a long-term customer with the same insurer.

- Bundle discounts: Discounts for bundling multiple insurance policies with the same provider.

- Good credit discounts: Discounts for policyholders with good credit scores.

- Green discounts: Discounts for energy-efficient homes or sustainable practices.

By taking advantage of these discounts, you can significantly reduce your homeowners insurance premiums.

Additional Considerations for Homeowners Insurance in Washington State

It’s crucial to understand the nuances of homeowners insurance in Washington State to ensure you have the right coverage for your specific needs and risks. While we’ve discussed finding the cheapest policy, it’s equally important to understand what your insurance policy covers and what it doesn’t.

Coverage Provided by Different Insurance Policies

The coverage provided by different insurance policies can vary significantly. It’s important to review your policy carefully and understand what is covered and what is excluded. For example, some policies may have specific limitations on coverage for certain types of events, such as earthquakes or floods.

Availability and Costs of Additional Coverage Options

Flood Insurance

Flood insurance is not typically included in standard homeowners insurance policies. It is a separate policy offered by the National Flood Insurance Program (NFIP). Flood insurance is crucial for homeowners in Washington State, especially those living in coastal areas or near rivers and streams. The cost of flood insurance varies depending on the location of your home and the flood risk.

Earthquake Insurance

Earthquake insurance is also a separate policy that is not included in standard homeowners insurance. It’s important to note that earthquake insurance can be expensive, and the cost will vary depending on the location of your home and the estimated risk of an earthquake.

Filing a Claim

If you need to file a claim with your homeowners insurance company, it’s important to follow the process Artikeld in your policy. Typically, you’ll need to report the claim to your insurance company as soon as possible. You may be required to provide documentation, such as photos or videos of the damage. Your insurance company will then investigate the claim and determine if it is covered under your policy.

Handling a Claim

Once a claim is filed, your insurance company will handle the claim according to the terms of your policy. This process may involve an adjuster visiting your property to assess the damage. Your insurance company will then work with you to determine the amount of coverage and the process for repairs or replacement.

Final Conclusion: Cheapest Homeowners Insurance Washington State

Ultimately, finding the cheapest homeowners insurance in Washington State requires a strategic approach. By carefully comparing quotes, understanding the factors that influence your premium, and exploring available discounts, you can secure the best value for your insurance needs. Remember, it’s essential to balance affordability with adequate coverage, ensuring your home and belongings are protected against unforeseen events.

Quick FAQs

What is the average homeowners insurance premium in Washington State?

The average homeowners insurance premium in Washington State varies depending on factors such as location, home value, and coverage options. However, you can expect to pay somewhere between $1,000 and $2,000 per year.

What are some common discounts offered by insurance providers in Washington State?

Common discounts offered by insurance providers in Washington State include discounts for security systems, smoke detectors, fire sprinklers, and bundling home and auto insurance.

How do I file a claim with my homeowners insurance provider?

To file a claim, you’ll need to contact your insurance provider and provide them with the necessary information, including details about the incident and any supporting documentation. Your provider will then guide you through the claims process.