Cheapest car insurance Washington state is a topic that concerns many drivers. Navigating the world of car insurance can feel overwhelming, especially when you’re looking for the best possible rates. In Washington State, drivers face specific requirements and a range of coverage options, making it crucial to understand how factors like your driving history, vehicle type, and location can influence your premiums. This guide provides valuable insights into finding the cheapest car insurance options in Washington State, helping you make informed decisions and save money.

This comprehensive guide will explore the intricacies of car insurance in Washington State, shedding light on mandatory requirements, available coverage options, and key factors influencing premiums. We’ll delve into practical strategies for comparing quotes, negotiating rates, and maximizing discounts, empowering you to secure the most affordable car insurance coverage. By understanding the factors that affect your premiums, you can take control of your insurance costs and find the best deal for your individual needs.

Understanding Car Insurance in Washington State: Cheapest Car Insurance Washington State

Car insurance is essential in Washington State, not only for protecting yourself financially but also for complying with the law. The state has specific requirements that all drivers must meet, and understanding these requirements is crucial for ensuring you have the right coverage. This guide will provide you with a comprehensive overview of car insurance in Washington State, including mandatory requirements, different types of coverage, and factors influencing premiums.

Mandatory Car Insurance Requirements in Washington State

Washington State law mandates that all drivers carry a minimum level of car insurance to cover potential damages and liabilities arising from accidents. These minimum requirements are known as the “Financial Responsibility Law” and include:

- Liability Coverage: This coverage protects you from financial responsibility if you cause an accident resulting in injuries or property damage to others. The minimum liability coverage required in Washington State is:

- $25,000 for bodily injury per person

- $50,000 for bodily injury per accident

- $10,000 for property damage per accident

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. The minimum UM/UIM coverage required in Washington State is:

- $25,000 for bodily injury per person

- $50,000 for bodily injury per accident

- $10,000 for property damage per accident

It is crucial to understand that these minimum coverage limits might not be sufficient to cover all potential losses in case of a serious accident. You may consider increasing your coverage limits to provide greater financial protection.

Types of Car Insurance Coverage

While the state mandates specific minimum coverage, you can choose to purchase additional types of car insurance coverage based on your individual needs and risk tolerance. These optional coverage options include:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. Collision coverage is typically optional, but it is essential if you have a car loan or lease, as lenders usually require it.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, hail, or natural disasters. Like collision coverage, comprehensive coverage is usually optional, but it can be beneficial if you have a newer or more expensive vehicle.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers if you are injured in an accident, regardless of fault. PIP coverage is optional in Washington State, but it can be helpful in covering medical bills and other expenses that may not be fully covered by health insurance.

- Medical Payments Coverage (Med Pay): This coverage provides medical payments for you and your passengers, regardless of fault, even if you are not at fault in an accident. Med Pay coverage is optional and typically covers a limited amount of medical expenses, but it can be helpful in supplementing your health insurance.

- Rental Reimbursement Coverage: This coverage provides reimbursement for rental car expenses if your vehicle is damaged in an accident and is being repaired. Rental reimbursement coverage is optional and can be helpful in maintaining your mobility while your vehicle is being repaired.

- Roadside Assistance Coverage: This coverage provides assistance with services such as towing, flat tire changes, and jump starts. Roadside assistance coverage is optional and can be a valuable addition to your car insurance policy, especially if you frequently drive long distances or in remote areas.

Factors Influencing Car Insurance Premiums in Washington State

Several factors can influence the cost of your car insurance premiums in Washington State. These factors include:

- Driving Record: Your driving history, including accidents, traffic violations, and DUI convictions, significantly impacts your premiums. Drivers with a clean driving record typically pay lower premiums than those with a history of violations or accidents.

- Age and Gender: Insurance companies often consider age and gender when setting premiums, as younger and inexperienced drivers are statistically more likely to be involved in accidents.

- Vehicle Type and Value: The type, make, model, and value of your vehicle influence premiums. More expensive or high-performance vehicles are generally associated with higher insurance costs.

- Location: Your location, including the city and zip code, affects your premiums. Areas with higher crime rates or a higher frequency of accidents tend to have higher insurance costs.

- Credit Score: In some states, insurance companies may use your credit score as a factor in determining your premiums. While this practice is not always transparent, it is generally accepted that individuals with good credit scores tend to pay lower premiums.

- Coverage Levels: The level of coverage you choose, such as the limits of liability and comprehensive coverage, directly impacts your premiums. Higher coverage limits generally lead to higher premiums.

- Deductible: Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums, while a lower deductible leads to higher premiums.

- Discounts: Insurance companies offer various discounts to their policyholders, such as discounts for good driving records, safety features in your vehicle, multi-car policies, and bundling insurance policies with the same insurer.

Finding the Cheapest Car Insurance Options

Finding the cheapest car insurance in Washington State involves comparing quotes from various providers and understanding the factors that influence your premium. This process requires careful consideration of your individual needs and a proactive approach to securing the best deal.

Key Factors to Consider When Comparing Car Insurance Quotes, Cheapest car insurance washington state

When comparing car insurance quotes, several key factors influence the price you’ll pay. These factors include:

- Your driving history: Your driving record, including accidents, tickets, and violations, significantly impacts your premium. A clean record generally leads to lower rates.

- Your age and gender: Younger drivers, particularly males, often face higher premiums due to increased risk.

- Your vehicle: The make, model, year, and safety features of your car influence the cost of insuring it.

- Your location: Where you live affects your premium, as rates vary based on factors like crime rates and traffic congestion.

- Your coverage options: The level of coverage you choose, such as liability, collision, and comprehensive, directly impacts your premium.

- Your credit score: Some insurance companies use your credit score as a factor in determining your premium. A higher credit score can lead to lower rates.

Tips for Negotiating Car Insurance Premiums

Negotiating car insurance premiums can help you secure a more affordable rate. Here are some effective strategies:

- Shop around: Obtain quotes from multiple insurance companies to compare prices and coverage options.

- Bundle your policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often lead to discounts.

- Ask about discounts: Many insurance companies offer discounts for safe driving, good grades, loyalty, and other factors.

- Increase your deductible: Choosing a higher deductible can reduce your monthly premium, but it also means you’ll pay more out of pocket if you have an accident.

- Consider a usage-based insurance program: These programs use telematics devices or smartphone apps to track your driving habits, potentially offering discounts for safe driving.

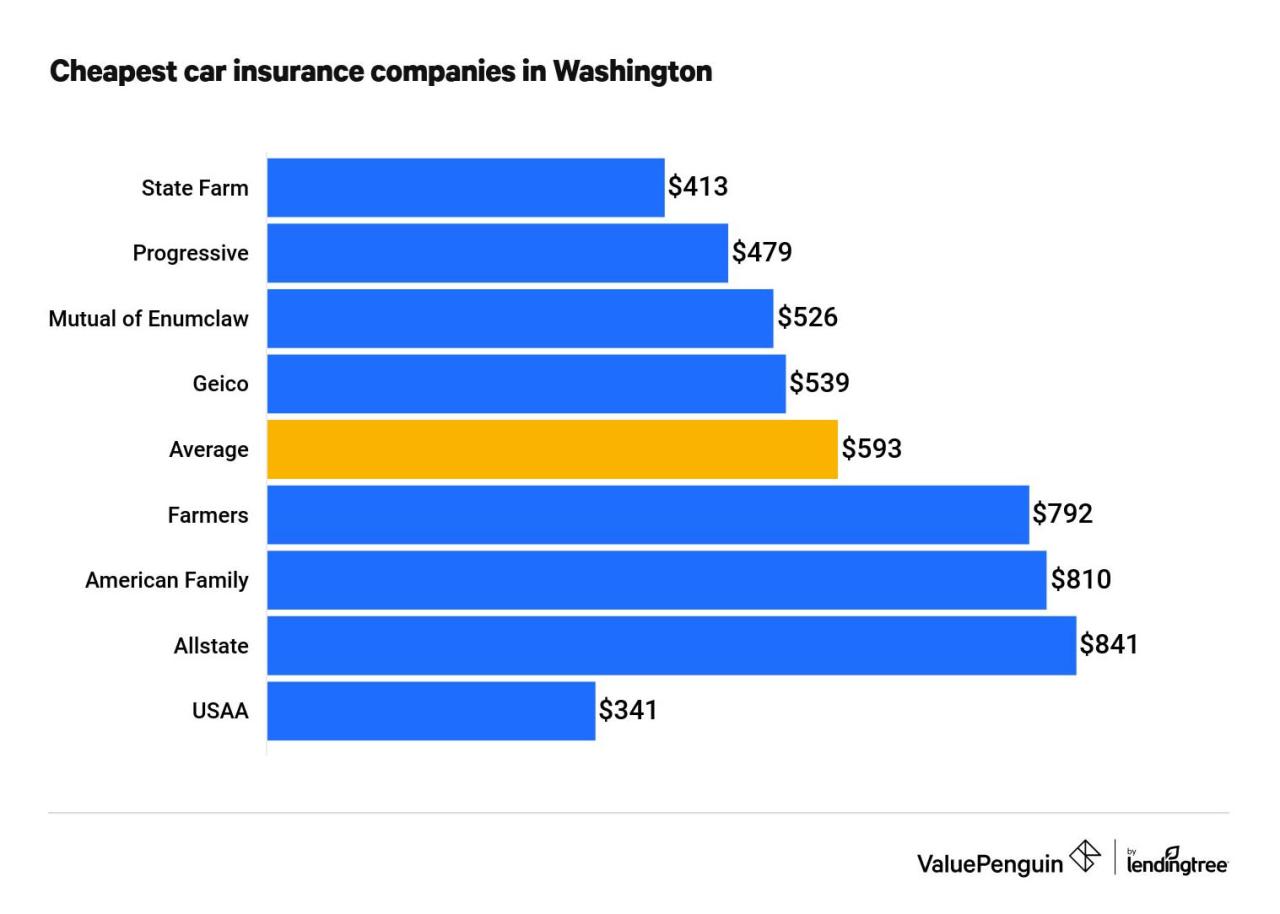

Top Car Insurance Providers in Washington State

| Provider | Average Premium | Customer Satisfaction | Coverage Options |

|---|---|---|---|

| State Farm | $1,200 | Excellent | Comprehensive |

| Geico | $1,100 | Good | Comprehensive |

| Progressive | $1,000 | Good | Comprehensive |

| USAA | $900 | Excellent | Comprehensive |

| Farmers | $1,300 | Good | Comprehensive |

Discounts and Savings

Car insurance in Washington State can be expensive, but there are many discounts available to help you save money. By taking advantage of these discounts, you can significantly reduce your premium.

Common Car Insurance Discounts

Discounts are offered by insurance companies to encourage safe driving practices, vehicle safety features, and customer loyalty. Understanding these discounts and how to qualify for them can help you find the cheapest car insurance in Washington State.

- Good Driver Discount: This is one of the most common discounts, and it is awarded to drivers with a clean driving record. You may qualify for this discount if you haven’t had any accidents or traffic violations in a certain period of time.

- Safe Driver Discount: Similar to the good driver discount, this is awarded to drivers who have completed a defensive driving course or have a good driving history.

- Multi-Car Discount: If you insure multiple vehicles with the same company, you may qualify for a multi-car discount. This discount can be significant, as it rewards you for bundling your insurance policies.

- Multi-Policy Discount: Similar to the multi-car discount, you can save money by bundling your car insurance with other types of insurance, such as homeowners or renters insurance.

- Good Student Discount: This discount is available to students who maintain a certain GPA or are enrolled in a college or university.

- Anti-theft Device Discount: If your vehicle has anti-theft devices installed, you may qualify for a discount. This discount recognizes that vehicles with anti-theft devices are less likely to be stolen.

- Low Mileage Discount: If you drive less than a certain number of miles per year, you may qualify for a low mileage discount. This discount is available to drivers who use their cars less frequently.

- Pay-in-Full Discount: You may be eligible for a discount if you pay your car insurance premium in full rather than in monthly installments.

- Loyalty Discount: Insurance companies often offer discounts to long-term customers who have been with them for a certain period of time.

Maximizing Discounts

To maximize your car insurance discounts, it’s important to be proactive and take advantage of all available opportunities. Here are some tips:

- Maintain a clean driving record: Avoid traffic violations and accidents.

- Take a defensive driving course: This course can help you improve your driving skills and potentially qualify for a safe driver discount.

- Bundle your insurance policies: Combine your car insurance with other types of insurance, such as homeowners or renters insurance, to receive a multi-policy discount.

- Install anti-theft devices: Consider installing anti-theft devices, such as alarms or tracking systems, to qualify for a discount.

- Pay your premium in full: If possible, pay your premium in full to take advantage of a pay-in-full discount.

- Shop around for quotes: Get quotes from multiple insurance companies to compare prices and discounts.

Finding and Utilizing Discounts Specific to Washington State

Washington State has a number of unique discounts that are not available in other states. Here are some of the most common discounts:

- Washington State Department of Licensing (DOL) Discount: If you have a valid Washington State driver’s license and are enrolled in the DOL’s Driver Improvement Program, you may qualify for a discount.

- Washington State Insurance Commissioner Discount: The Washington State Insurance Commissioner offers a discount to drivers who have completed a driver safety course approved by the commissioner.

- Washington State Farm Bureau Discount: The Washington State Farm Bureau offers a discount to its members who insure their vehicles with participating insurance companies.

- Washington State Good Driver Discount: This discount is available to drivers who have a clean driving record for a certain period of time.

Factors Affecting Insurance Costs

Many factors influence the cost of car insurance in Washington State. Understanding these factors can help you make informed decisions to potentially reduce your premiums.

Driving History

Your driving history is a significant factor in determining your car insurance rates. Insurance companies consider your driving record, including:

- Accidents: Accidents, especially those involving injuries or property damage, can significantly increase your premiums. The more accidents you have, the higher your risk is considered, and the more you’ll likely pay for insurance.

- Traffic Violations: Traffic violations like speeding tickets, reckless driving, or DUI convictions also impact your premiums. These violations indicate a higher risk of future accidents, leading to higher insurance costs.

- Driving Experience: Drivers with less experience are generally considered higher risk. New drivers often have less experience and may be more likely to be involved in accidents. As you gain more experience and a clean driving record, your rates may decrease.

Credit Score

While it may seem surprising, your credit score can also influence your car insurance premiums in Washington State. Insurance companies believe that individuals with good credit scores are more financially responsible and less likely to file claims.

Note: Washington State has a law that prohibits insurance companies from using credit scores to set rates for car insurance. However, credit scores can still be used for other purposes, such as underwriting and risk assessment.

Car Type

The type of car you drive significantly impacts your insurance premiums. Here’s why:

- Vehicle Value: More expensive cars are generally more costly to repair or replace in the event of an accident. Insurance companies factor in the vehicle’s value when calculating premiums.

- Safety Features: Cars with advanced safety features, such as anti-lock brakes, airbags, and stability control, are often considered safer. These features can reduce your insurance premiums as they minimize the risk of accidents and injuries.

- Repair Costs: Some car models are known to have higher repair costs, which can impact your insurance premiums. Cars with complex parts or a history of frequent repairs may result in higher insurance rates.

Age

Your age can influence your car insurance rates. Here’s how:

- Young Drivers: Younger drivers, especially those under 25, are often considered higher risk due to their lack of experience. They are more likely to be involved in accidents, leading to higher premiums.

- Older Drivers: Older drivers may also face higher premiums due to potential health concerns or reduced reaction times. However, some insurance companies offer discounts for senior drivers who complete defensive driving courses.

- Mid-Age Drivers: Drivers in their mid-age range, typically between 30 and 50, often have lower insurance rates as they have established driving experience and are statistically less likely to be involved in accidents.

Location

The location where you live and drive can significantly impact your insurance premiums.

- Population Density: Areas with high population density, such as cities, often have more traffic congestion and a higher risk of accidents. This can lead to higher insurance rates.

- Crime Rates: Areas with higher crime rates may also have higher insurance premiums due to the increased risk of car theft or vandalism.

- Weather Conditions: Regions with harsh weather conditions, such as frequent snow or ice, can increase the risk of accidents. This can result in higher insurance premiums.

Claims History

Your claims history is a crucial factor in determining your insurance rates.

- Number of Claims: The more claims you file, the higher your risk is considered, and the more you’ll likely pay for insurance.

- Types of Claims: The type of claims you file can also influence your premiums. For example, a claim for a minor fender bender may have a less significant impact than a claim for a serious accident involving injuries.

- Claim Frequency: If you frequently file claims, insurance companies may view you as a higher risk and increase your premiums.

Driving Habits

Your driving habits also play a role in determining your insurance rates.

- Mileage: The more you drive, the higher your risk of being involved in an accident. Insurance companies often consider your annual mileage when calculating premiums.

- Driving Style: Aggressive driving habits, such as speeding or tailgating, can increase your risk of accidents and lead to higher premiums. Insurance companies may use telematics devices to monitor your driving habits and adjust your rates accordingly.

- Parking Location: Parking your car in a garage or a secure location can reduce your risk of theft or vandalism, potentially leading to lower premiums.

Navigating the Insurance Process

Obtaining car insurance in Washington State can seem daunting, but it doesn’t have to be. With a clear understanding of the process and some helpful tips, you can easily navigate the process and find the best coverage for your needs.

Obtaining Car Insurance Quotes

Getting quotes is the first step in finding the right car insurance. This process involves providing information about yourself and your vehicle to different insurance companies. Here’s a step-by-step guide:

- Gather Your Information: Before you start, gather the necessary information. This includes your driver’s license number, vehicle identification number (VIN), and details about your driving history, including any accidents or violations. Also, have information about your vehicle, such as the year, make, model, and any modifications.

- Contact Insurance Companies: You can obtain quotes through various methods. You can visit insurance company websites, call them directly, or use online comparison websites. These websites allow you to compare quotes from multiple insurers simultaneously.

- Provide Accurate Information: Be truthful and accurate when providing information about yourself and your vehicle. This helps ensure you get the correct quote and avoid potential issues later on.

- Compare Quotes: Once you have a few quotes, compare them carefully. Look at the coverage offered, the premium, and any additional fees or discounts. Consider your individual needs and budget when making your decision.

- Choose a Policy: After comparing quotes, select the policy that best meets your needs and budget. Ensure you understand the coverage you are getting and any exclusions or limitations.

Understanding and Comparing Insurance Policies

After obtaining quotes, carefully review each policy to ensure you understand the coverage and its limitations.

- Coverage Types: Familiarize yourself with the different types of coverage available, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Consider the level of protection you need based on your financial situation and driving habits.

- Deductibles: Understand the deductible for each type of coverage. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles usually result in lower premiums, but you will have to pay more in case of an accident.

- Limits: Pay attention to the coverage limits, which specify the maximum amount your insurance company will pay for each type of coverage. Higher limits generally mean higher premiums, but you will have more financial protection in case of a significant claim.

- Exclusions and Limitations: Review the policy for any exclusions or limitations. These are specific situations where coverage might not apply. For example, coverage might be limited for certain types of accidents or driving situations.

- Compare Policy Details: Once you have a good understanding of each policy, compare them side-by-side. Focus on the key features, coverage amounts, and pricing. This will help you make an informed decision based on your individual needs and budget.

Filing a Claim

In case of an accident, understanding the claim process is crucial. Here’s a breakdown of the steps involved:

- Report the Accident: Immediately report the accident to your insurance company. Provide them with details about the accident, including the date, time, location, and any injuries involved.

- Gather Information: Collect as much information as possible about the accident. This includes the names and contact information of all parties involved, witness information, police reports, and photos or videos of the accident scene.

- File a Claim: Follow your insurance company’s instructions for filing a claim. This may involve completing a claim form or providing specific documentation.

- Cooperate with Your Insurer: Be prepared to cooperate with your insurance company during the claim process. This might involve providing additional information, attending inspections, or meeting with an adjuster.

- Negotiate a Settlement: If your insurance company offers a settlement, review it carefully and understand its terms. You have the right to negotiate with your insurer to ensure you receive a fair settlement.

Final Wrap-Up

Finding the cheapest car insurance in Washington State doesn’t have to be a daunting task. By understanding the factors that influence your premiums, comparing quotes, and leveraging available discounts, you can significantly reduce your insurance costs. Remember, staying informed and taking proactive steps can make a big difference in your overall insurance expenses. With this guide, you are equipped to navigate the world of car insurance in Washington State and secure the best possible coverage at an affordable price.

FAQ Guide

How often should I review my car insurance rates?

It’s a good idea to review your car insurance rates at least once a year, or even more frequently if you experience significant life changes like a new job, a change in your driving record, or a move to a new location.

What are the consequences of driving without car insurance in Washington State?

Driving without car insurance in Washington State is illegal and can result in serious consequences, including fines, license suspension, and even vehicle impoundment.

Can I get car insurance if I have a poor driving record?

Yes, you can still get car insurance even if you have a poor driving record. However, your premiums will likely be higher. Consider contacting multiple insurance companies for quotes to find the best options.