Cheapest car insurance united states – Cheapest car insurance in the United States: Navigating the world of car insurance can feel like a maze, especially when you’re trying to find the most affordable option. With so many factors influencing your premium, it can be challenging to know where to start. But fear not, because understanding the key elements that impact your car insurance costs can empower you to make informed decisions and find the best deals.

From your driving history and location to the type of coverage you choose, a multitude of factors come into play. By understanding these factors and exploring the various strategies available, you can significantly reduce your insurance premiums and drive with peace of mind. This guide will equip you with the knowledge and tools to navigate the insurance landscape and secure the most affordable coverage for your needs.

Factors Influencing Car Insurance Costs

Car insurance premiums are influenced by various factors, including your driving history, vehicle type, location, and demographics. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Factors Affecting Car Insurance Premiums, Cheapest car insurance united states

The cost of your car insurance is determined by several factors, each playing a role in assessing your risk as a driver.

| Factor | Description | Impact on Premium | Example |

|---|---|---|---|

| Driving History | Your past driving record, including accidents, violations, and claims. | Higher premiums for drivers with poor driving history, lower premiums for those with clean records. | A driver with multiple speeding tickets and an at-fault accident will likely pay higher premiums than a driver with a clean record. |

| Age and Gender | Younger and inexperienced drivers are statistically more likely to be involved in accidents, while older drivers may have health concerns that affect their driving abilities. | Higher premiums for young drivers, lower premiums for older drivers. Gender can also influence premiums in some states. | A 18-year-old driver will generally pay higher premiums than a 50-year-old driver. |

| Vehicle Type | The make, model, and year of your vehicle, as well as its safety features and theft risk. | Higher premiums for expensive, high-performance vehicles, lower premiums for older, less expensive vehicles. | A brand-new luxury sports car will generally cost more to insure than a 10-year-old sedan. |

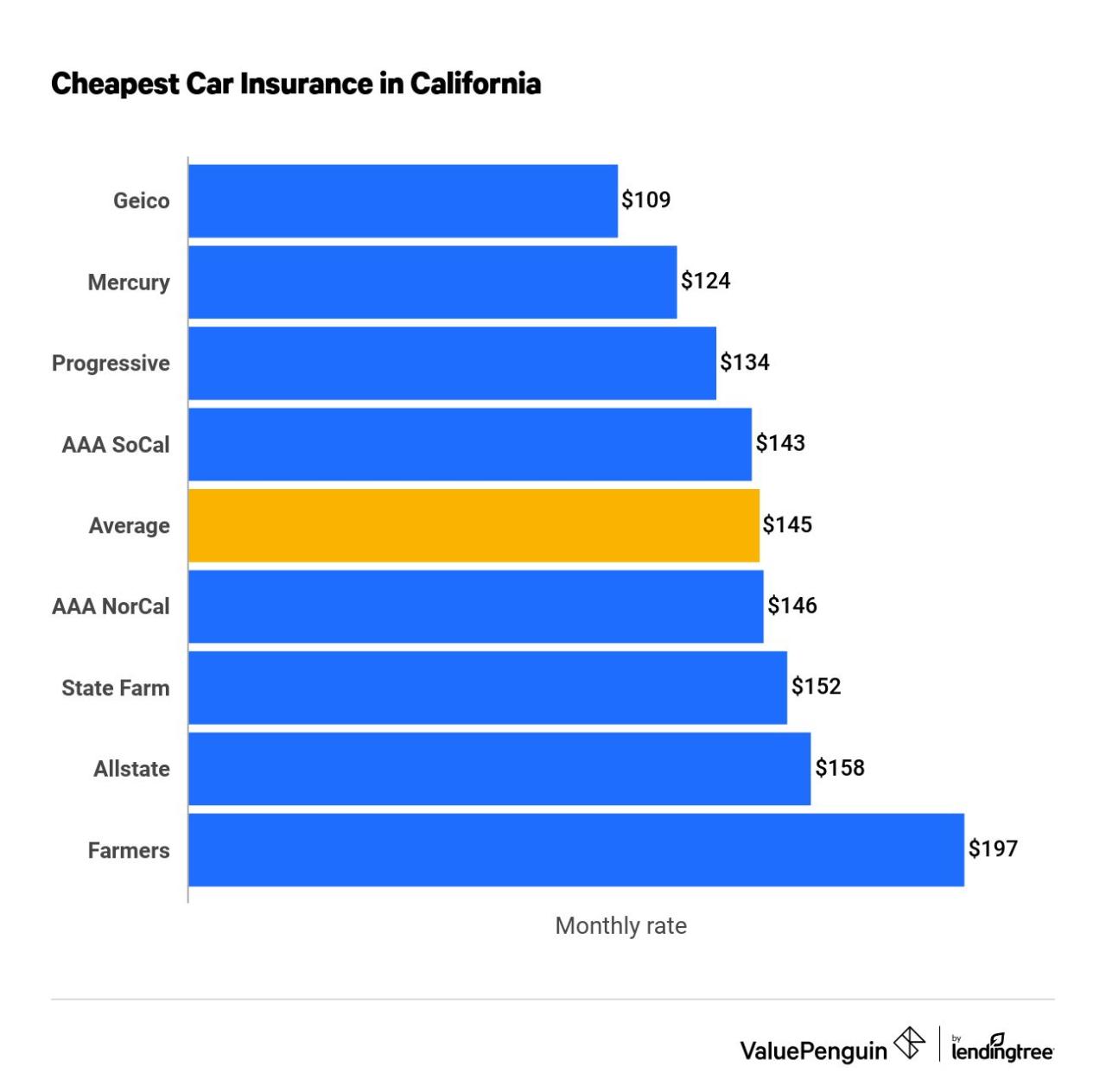

| Location | The state, city, and even neighborhood you live in can impact your insurance premiums. | Higher premiums in areas with high traffic density, higher crime rates, and more frequent accidents. | A driver living in a major metropolitan area with high traffic congestion may pay higher premiums than a driver in a rural area with lower traffic volume. |

| Credit Score | In many states, your credit score is used to assess your financial responsibility and risk. | Higher premiums for individuals with lower credit scores, lower premiums for those with good credit. | A driver with a credit score of 600 may pay higher premiums than a driver with a credit score of 750. |

| Coverage and Deductible | The type and amount of coverage you choose, as well as your deductible, will affect your premium. | Higher premiums for more comprehensive coverage and lower deductibles, lower premiums for less comprehensive coverage and higher deductibles. | A driver who chooses comprehensive and collision coverage with a $500 deductible will pay higher premiums than a driver who chooses liability coverage only with a $1000 deductible. |

Understanding Car Insurance Quotes

Car insurance quotes are the starting point for finding the best coverage at a price that suits your budget. They’re essentially estimates of how much your insurance will cost based on your individual circumstances.

Components of a Car Insurance Quote

The quote process involves providing the insurer with information about you, your vehicle, and your driving history. Based on this information, the insurer calculates the cost of your insurance using a variety of factors. Here are some of the key components that are included in a typical car insurance quote:

- Your Personal Information: This includes your name, address, date of birth, and driving history. This information helps the insurer assess your risk profile as a driver.

- Your Vehicle Information: The make, model, year, and value of your vehicle are essential. These details help the insurer determine the cost of repairs or replacement in case of an accident.

- Your Driving History: Your driving record, including any accidents, violations, or points on your license, plays a significant role in determining your insurance premium.

- Your Coverage Options: The type and amount of coverage you choose directly impacts the cost of your insurance.

- Your Location: Your zip code and the area where you live can influence the cost of your insurance due to factors such as traffic density, crime rates, and weather conditions.

- Your Credit Score: In some states, insurers can use your credit score to assess your risk profile. This is because studies have shown a correlation between credit score and insurance claims.

Coverage Options and Their Impact on Premium Costs

Car insurance quotes offer different coverage options, each with varying levels of protection and corresponding costs. Understanding the different types of coverage and their impact on your premium is crucial to finding the right balance between affordability and protection.

| Coverage Option | Description | Cost Impact | Example |

|---|---|---|---|

| Liability Coverage | Covers damage or injuries you cause to others in an accident. | Higher liability limits generally result in higher premiums. | A higher liability limit of $100,000 per person and $300,000 per accident will likely cost more than a lower limit of $25,000 per person and $50,000 per accident. |

| Collision Coverage | Covers damage to your vehicle in an accident, regardless of fault. | Optional coverage, but often required if you have a loan on your vehicle. | If you choose collision coverage, your insurance will pay for repairs or replacement of your vehicle if you’re involved in an accident, even if you’re at fault. |

| Comprehensive Coverage | Covers damage to your vehicle from events other than accidents, such as theft, vandalism, or natural disasters. | Optional coverage, but often required if you have a loan on your vehicle. | If your vehicle is stolen or damaged by a hailstorm, comprehensive coverage will pay for repairs or replacement. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. | Provides additional protection but can increase your premium. | If you’re hit by an uninsured driver and sustain injuries, this coverage can help pay for your medical expenses and other related costs. |

Strategies for Finding Affordable Car Insurance

Finding the cheapest car insurance in the United States can be a daunting task, but it’s essential to secure the right coverage at a price that fits your budget. By implementing smart strategies and understanding the factors that influence premiums, you can significantly reduce your car insurance costs.

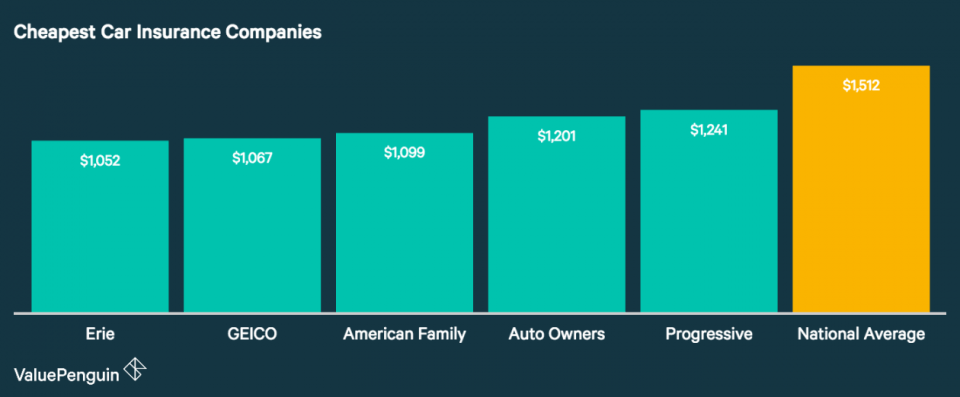

Comparing Quotes from Multiple Providers

It’s crucial to compare quotes from various insurance providers to find the most competitive rates. Each insurer uses its own proprietary algorithms and rating factors to determine premiums, resulting in diverse pricing structures. By obtaining quotes from multiple companies, you can identify the best deals available and ensure you’re not overpaying for your coverage.

Considerations for Different Car Insurance Needs

Car insurance needs vary depending on individual circumstances, such as age, driving history, and the type of vehicle. Understanding these needs and choosing the right coverage can help you save money and ensure you’re adequately protected.

Coverage Options for Young Drivers

Young drivers are statistically more likely to be involved in accidents, making them a higher risk for insurance companies. As a result, they often face higher premiums.

- Minimum Liability Coverage: This is the most basic coverage required by law, providing financial protection to others in case of an accident caused by the insured driver. Young drivers with limited driving experience should prioritize this coverage to avoid financial ruin.

- Collision and Comprehensive Coverage: These coverages protect your vehicle against damage from accidents and non-accident events, respectively. While optional, they can be beneficial for young drivers who may be more prone to accidents or have limited financial resources to repair their car.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage to cover your damages. It’s crucial for young drivers, as they may be more likely to encounter drivers without adequate insurance.

Coverage Options for Families

Families have unique car insurance needs, as they often have multiple drivers and vehicles, and may need additional coverage for passengers.

- Higher Liability Limits: Families should consider higher liability limits than the minimum required by law to ensure adequate protection for their assets and loved ones in case of a serious accident.

- Medical Payments Coverage: This coverage pays for medical expenses for you and your passengers, regardless of who is at fault. It’s particularly important for families with young children who may be more vulnerable in accidents.

- Uninsured/Underinsured Motorist Coverage: This coverage is essential for families, as they are more likely to have multiple vehicles and drivers on the road, increasing the risk of encountering uninsured or underinsured drivers.

Coverage Options for High-Risk Individuals

High-risk individuals, such as those with poor driving records or who drive high-performance vehicles, may face higher premiums and limited coverage options.

- SR-22 Insurance: This type of insurance is required by some states for drivers with a suspended license or serious driving violations. It provides proof of financial responsibility and can be obtained through a specialized insurance company.

- High-Risk Insurance Pools: These pools are designed for drivers who cannot obtain insurance through traditional channels due to their risk profile. They offer limited coverage options at higher premiums.

- Specialized Coverage: Some insurance companies offer specialized coverage options for high-risk individuals, such as coverage for modified vehicles or for drivers with a history of DUIs.

Coverage Options for Different Car Insurance Needs

| Car Owner Profile | Specific Needs | Relevant Coverage | Example |

|---|---|---|---|

| Young Driver | Minimum coverage required by law, protection against financial ruin | Minimum Liability Coverage, Collision and Comprehensive Coverage (optional) | A 19-year-old driver with a clean driving record may need minimum liability coverage to meet state requirements, and optional collision and comprehensive coverage to protect their vehicle in case of an accident. |

| Family | Protection for multiple drivers and vehicles, coverage for passengers | Higher Liability Limits, Medical Payments Coverage, Uninsured/Underinsured Motorist Coverage | A family with two drivers and a minivan may need higher liability limits to protect their assets, medical payments coverage for their children, and uninsured/underinsured motorist coverage for protection against drivers without adequate insurance. |

| High-Risk Individual | Proof of financial responsibility, limited coverage options | SR-22 Insurance, High-Risk Insurance Pools, Specialized Coverage | A driver with a DUI conviction may need SR-22 insurance to reinstate their license and may have to obtain coverage through a high-risk insurance pool at a higher premium. |

Impact of Technology on Car Insurance Costs: Cheapest Car Insurance United States

Technology is rapidly transforming the car insurance industry, impacting how premiums are calculated and ultimately affecting the cost of coverage. These advancements are not only changing the way insurance companies assess risk but also how drivers interact with their policies.

Telematics and Usage-Based Insurance

Telematics refers to the use of technology to collect and analyze data about driving behavior. Usage-based insurance (UBI) leverages this data to personalize premiums based on actual driving habits.

- Data Collection: Telematics devices, often in the form of smartphone apps or plug-in dongles, track driving metrics such as speed, acceleration, braking, and mileage.

- Risk Assessment: Insurance companies use this data to identify safer drivers, rewarding them with lower premiums. For example, drivers who maintain consistent speeds, avoid hard braking, and drive during off-peak hours may receive discounts.

- Personalized Pricing: UBI allows for more accurate risk assessment, leading to more personalized pricing. Drivers who exhibit safer driving habits benefit from lower premiums, while those with riskier driving behaviors may face higher costs.

Driver Assistance Systems and Autonomous Vehicles

The increasing adoption of advanced driver assistance systems (ADAS) and autonomous vehicles (AVs) is poised to significantly impact car insurance premiums.

- Reduced Accidents: ADAS features like lane departure warning, automatic emergency braking, and adaptive cruise control are designed to prevent accidents. As these technologies become more prevalent, the number of accidents could decrease, leading to lower insurance costs.

- Shifting Liability: The emergence of AVs raises complex questions about liability in the event of an accident. If an AV is responsible for an accident, determining fault and assigning liability could become more complicated, potentially impacting insurance coverage.

- Data-Driven Pricing: Insurance companies are already starting to factor in ADAS features when assessing risk. Vehicles equipped with advanced safety technologies may qualify for discounts, reflecting the potential for reduced accidents.

Understanding Insurance Discounts and Benefits

Car insurance discounts are a great way to save money on your premiums. Many insurers offer a variety of discounts, and some are more common than others. These discounts can be applied to your policy based on your driving history, the car you drive, and other factors. Understanding the various discounts available can help you save money on your car insurance.

Types of Car Insurance Discounts

Discounts can significantly impact your premium, so it’s essential to understand the different types of discounts and how to qualify for them. Here are some common car insurance discounts:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record. Typically, it’s given to drivers who haven’t had any accidents or traffic violations in a specific period.

- Safe Driver Discount: This discount is awarded to drivers who have completed a defensive driving course. These courses teach drivers safe driving practices and can help reduce the risk of accidents.

- Multi-Car Discount: This discount is offered to policyholders who insure multiple vehicles with the same insurer. The more cars you insure, the greater the discount.

- Multi-Policy Discount: This discount is offered to policyholders who bundle their car insurance with other types of insurance, such as home or renters insurance. The more policies you bundle, the greater the discount.

- Good Student Discount: This discount is offered to students who maintain a certain grade point average. The discount can vary depending on the insurer and the student’s grade point average.

- Anti-theft Device Discount: This discount is offered to drivers who have anti-theft devices installed in their cars. These devices can help deter theft and reduce the risk of an insurance claim.

- Loyalty Discount: This discount is offered to policyholders who have been with the same insurer for a specific period. The longer you’ve been with the insurer, the greater the discount.

- Low Mileage Discount: This discount is offered to drivers who drive fewer miles than average. This discount can be significant for drivers who commute short distances or work from home.

- Vehicle Safety Feature Discount: This discount is offered to drivers who have vehicles equipped with safety features, such as airbags, anti-lock brakes, and electronic stability control. These features can help reduce the risk of accidents and injuries.

Eligibility Criteria for Car Insurance Discounts

The eligibility criteria for car insurance discounts can vary depending on the insurer. Here’s a table that Artikels the eligibility criteria for some common car insurance discounts:

| Discount/Benefit | Eligibility Criteria | Impact on Premium | Example |

|---|---|---|---|

| Good Driver Discount | Clean driving record for a specified period (typically 3-5 years) with no accidents or traffic violations. | Significant reduction in premium. | A driver with a clean driving record for 5 years could receive a 10-20% discount on their premium. |

| Safe Driver Discount | Completion of a defensive driving course approved by the insurer. | Moderate reduction in premium. | A driver who completes a defensive driving course could receive a 5-10% discount on their premium. |

| Multi-Car Discount | Insuring multiple vehicles with the same insurer. | Significant reduction in premium. | A driver who insures two cars with the same insurer could receive a 10-20% discount on their premium. |

| Multi-Policy Discount | Bundling car insurance with other types of insurance (e.g., home, renters, or life insurance) with the same insurer. | Significant reduction in premium. | A driver who bundles their car insurance with their homeowners insurance could receive a 10-20% discount on their premium. |

| Good Student Discount | Maintaining a specific grade point average (GPA) as defined by the insurer. | Moderate reduction in premium. | A student with a GPA of 3.0 or higher could receive a 5-10% discount on their premium. |

| Anti-theft Device Discount | Having an anti-theft device installed in the vehicle, such as an alarm system or GPS tracking device. | Moderate reduction in premium. | A driver with a car alarm system could receive a 5-10% discount on their premium. |

| Loyalty Discount | Maintaining a continuous policy with the same insurer for a specified period (typically 1-3 years). | Moderate reduction in premium. | A driver who has been with the same insurer for 3 years could receive a 5-10% discount on their premium. |

| Low Mileage Discount | Driving fewer miles than average, as defined by the insurer. | Moderate reduction in premium. | A driver who drives less than 5,000 miles per year could receive a 5-10% discount on their premium. |

| Vehicle Safety Feature Discount | Having a vehicle equipped with safety features, such as airbags, anti-lock brakes, and electronic stability control. | Moderate reduction in premium. | A driver with a car equipped with advanced safety features could receive a 5-10% discount on their premium. |

Navigating the Insurance Claims Process

Filing a car insurance claim can be a stressful experience, but understanding the process can make it smoother. This section will guide you through the steps involved, emphasizing the importance of policy comprehension and communication with your insurance provider.

Steps Involved in Filing a Car Insurance Claim

Understanding the steps involved in filing a car insurance claim is crucial for a smooth and successful process. Here’s a breakdown of the typical steps:

- Report the Accident: The first step is to report the accident to your insurance company as soon as possible. This can be done by phone, online, or through their mobile app. Provide all the necessary details, including the date, time, location, and parties involved.

- File a Claim: Once you’ve reported the accident, you’ll need to file a formal claim. This usually involves completing a claim form, which may require information about the accident, the damages, and your policy details.

- Provide Supporting Documentation: To support your claim, you’ll need to provide relevant documentation, such as a police report, photos of the damage, and medical records if applicable. Ensure all documents are accurate and complete.

- Claim Investigation: Your insurance company will investigate the claim to determine the extent of the damage and the liability involved. This may involve an adjuster inspecting the vehicle or reviewing medical records.

- Claim Settlement: Once the investigation is complete, your insurance company will determine the amount of coverage available under your policy. This may involve negotiating a settlement with you or paying for repairs directly to a repair shop.

Understanding Policy Coverage and Reporting Requirements

Knowing the details of your car insurance policy is essential for navigating the claims process effectively. Here are some key aspects to understand:

- Coverage Limits: Your policy will specify the maximum amount your insurance company will pay for covered losses. This information is crucial for understanding what expenses will be covered and how much you might be responsible for.

- Deductibles: Your deductible is the amount you’re responsible for paying out of pocket before your insurance coverage kicks in. Understanding your deductible will help you anticipate your financial responsibility in the event of a claim.

- Reporting Deadlines: Your policy will also Artikel specific timeframes for reporting accidents. Failure to meet these deadlines could result in your claim being denied.

Handling Communication with Insurance Providers

Effective communication with your insurance provider is essential for a successful claims process. Here are some tips:

- Be Prompt: Respond to all communication from your insurance provider promptly. This includes phone calls, emails, and letters. Delays can hinder the claims process.

- Be Clear and Concise: When communicating with your insurance company, be clear and concise in your explanations. Provide all the relevant information and avoid jargon or technical terms that may be confusing.

- Document Everything: Keep a detailed record of all communication with your insurance company, including dates, times, and the content of conversations. This documentation can be helpful if any disputes arise.

- Be Patient: The claims process can take time, so be patient and understanding. If you have any questions or concerns, don’t hesitate to reach out to your insurance provider for clarification.

Ultimate Conclusion

Finding the cheapest car insurance in the United States is a journey that involves understanding your needs, exploring various options, and utilizing available resources. By taking the time to compare quotes, leverage discounts, and make informed decisions, you can secure affordable coverage that fits your budget and provides the protection you need on the road. Remember, it’s not just about finding the lowest price, but about finding the best value for your money, ensuring that you’re adequately covered for any unexpected events.

Frequently Asked Questions

How often should I review my car insurance rates?

It’s recommended to review your car insurance rates at least annually, or even more frequently if you experience any major life changes, such as a change in your driving record, vehicle, or address.

Can I get car insurance without a driving license?

In most cases, you will need a valid driver’s license to obtain car insurance. However, there may be exceptions, such as if you are a learner driver or if you are insuring a car that you don’t drive yourself.

What are the consequences of driving without car insurance?

Driving without car insurance is illegal and can result in hefty fines, license suspension, and even jail time. It can also leave you financially responsible for any accidents you cause.