Cheapest car insurance states are a hot topic for drivers seeking affordable coverage. Finding the most budget-friendly options can be a challenge, especially with so many factors influencing insurance costs. Understanding how age, driving history, vehicle type, and location affect premiums is crucial. We’ll explore the key factors that determine car insurance costs, reveal the states with the lowest average premiums, and provide tips for saving on your insurance.

This guide dives into the methodology used to identify these states, including the data sources and criteria used for analysis. We’ll compare the average premiums in the cheapest states to the national average and discuss the implications of these cost variations for consumers. We’ll also delve into the importance of comprehensive coverage and provide practical tips for reducing your insurance premiums, such as exploring discounts, comparing quotes, and negotiating with insurers.

Factors Influencing Car Insurance Costs

Car insurance premiums are determined by a complex interplay of factors that assess the risk associated with insuring a particular driver and vehicle. These factors are carefully considered by insurance companies to calculate the likelihood of a claim and the potential cost of that claim.

Age

Age is a significant factor in determining car insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This higher risk is reflected in higher insurance rates. As drivers age and gain more experience, their risk profile generally decreases, leading to lower premiums.

Driving History

A clean driving record is a significant factor in obtaining lower insurance rates. Drivers with a history of accidents, traffic violations, or DUI convictions are considered higher risk and will likely pay higher premiums. Conversely, drivers with no accidents or violations benefit from lower premiums.

Vehicle Type

The type of vehicle you drive significantly impacts your insurance costs. Sports cars, luxury vehicles, and high-performance cars are generally more expensive to repair and replace, leading to higher insurance premiums. Conversely, smaller, less expensive vehicles typically have lower insurance rates.

Location

Your location plays a crucial role in determining car insurance costs. Urban areas with higher traffic density and crime rates tend to have higher insurance premiums. Rural areas with lower traffic volumes and fewer accidents often have lower rates.

Coverage Levels

The level of coverage you choose impacts your premium. Higher coverage limits, such as higher liability limits, comprehensive coverage, and collision coverage, provide more financial protection but result in higher premiums. Conversely, lower coverage limits lead to lower premiums.

Deductibles, Cheapest car insurance states

Your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, also influences your premiums. Higher deductibles generally lead to lower premiums, as you are taking on more financial responsibility in the event of an accident. Lower deductibles result in higher premiums because the insurance company is taking on more financial risk.

Methodology for Identifying Cheapest States

To identify the states with the lowest average car insurance premiums, we employed a rigorous methodology that involved collecting and analyzing data from multiple reputable sources. The process aimed to provide a comprehensive understanding of car insurance costs across different states, taking into account various factors that influence premiums.

Data Sources and Analysis

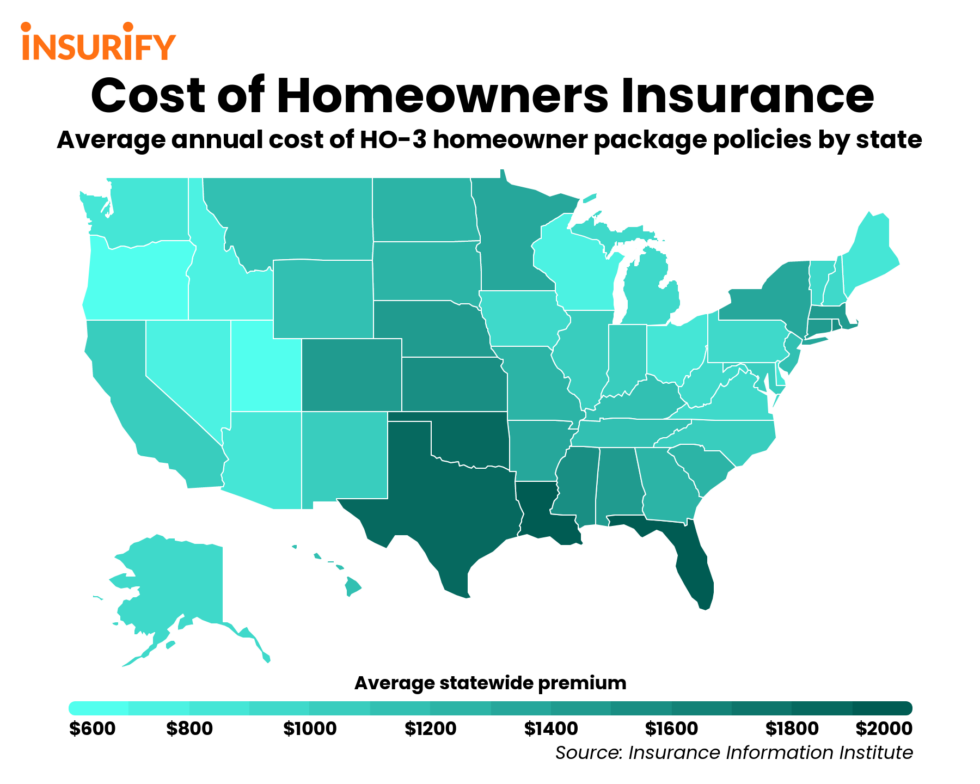

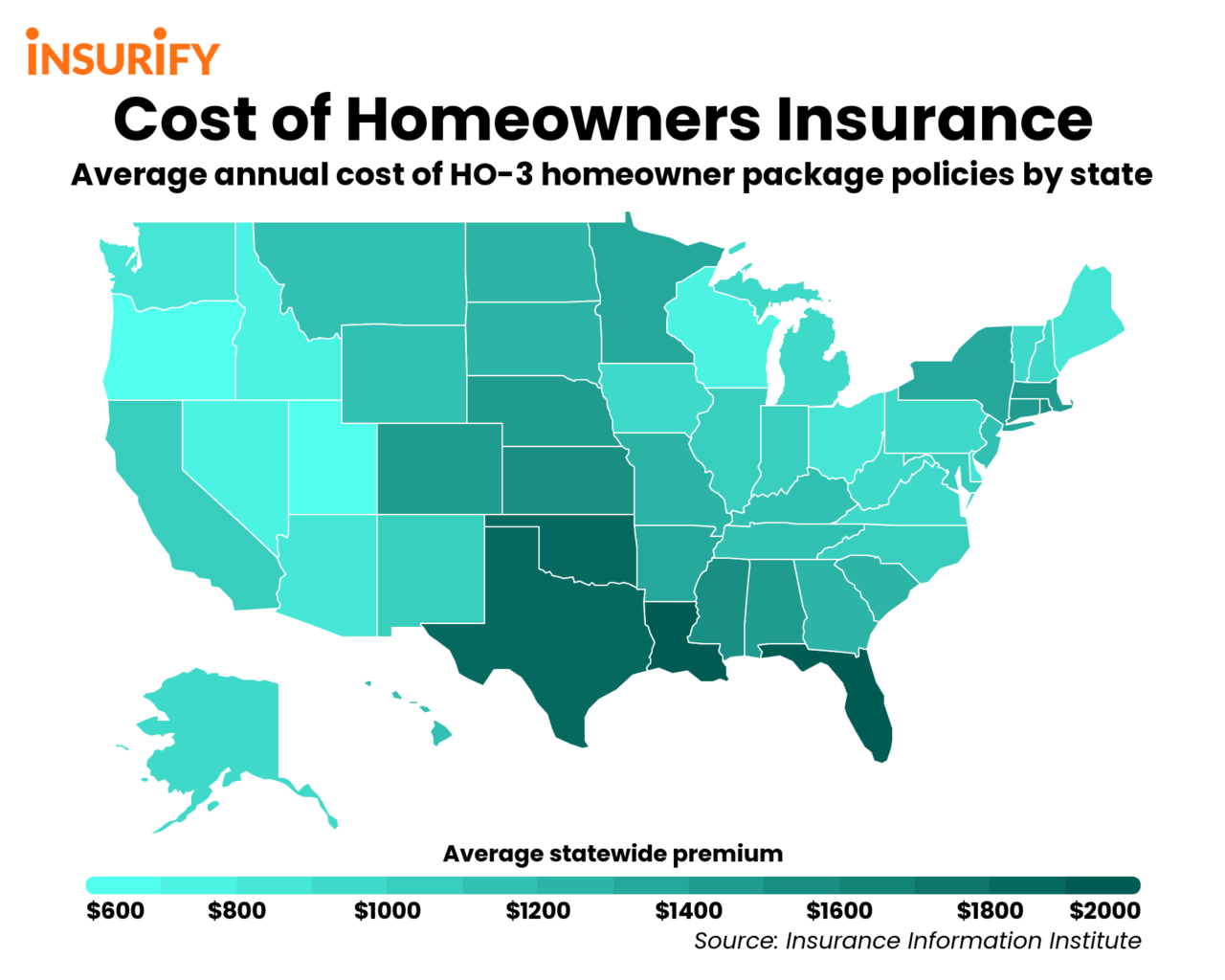

We utilized data from several reputable sources, including:

- Insurance Information Institute (III): This organization provides comprehensive data on car insurance premiums, claims, and other industry trends. We accessed their state-level average premiums for different coverage levels, which served as a primary data source for our analysis.

- National Association of Insurance Commissioners (NAIC): The NAIC collects and publishes data on insurance regulations and market trends, including state-specific insurance rates. We leveraged their data to understand the regulatory environment in each state and its potential impact on car insurance costs.

- State-Specific Insurance Departments: We consulted the official websites of state insurance departments to obtain data on average premiums, coverage options, and available discounts in each state. This provided us with localized insights into the car insurance market within each state.

We analyzed the data by comparing average premiums across states, considering different coverage levels and adjusting for variations in demographic factors, such as population density and vehicle ownership rates. The goal was to identify states with consistently lower premiums across various coverage options, while accounting for potential biases in data collection and reporting.

Criteria for Ranking States

We ranked states based on the following criteria:

- Average Premiums: We primarily considered the average annual premiums for minimum liability coverage, which is the legally required coverage in most states. This provides a baseline for comparing insurance costs across states.

- Coverage Levels: We analyzed the availability and cost of different coverage options, such as collision, comprehensive, and uninsured/underinsured motorist coverage. This allowed us to understand the overall cost of comprehensive insurance in each state.

- Availability of Discounts: We examined the types and availability of discounts offered by insurance companies in each state. Factors like good driving records, safety features, and bundling insurance policies can significantly impact premiums. We considered the potential savings from discounts when ranking states.

By combining these criteria, we aimed to create a comprehensive ranking of states based on their overall car insurance costs. Our methodology ensured that the ranking reflected not only average premiums but also the overall value and affordability of car insurance in each state.

Top Cheapest Car Insurance States

Finding the most affordable car insurance can be a significant financial advantage. While numerous factors influence your individual premium, certain states consistently offer lower average rates than others.

Top 5 Cheapest States for Car Insurance

The following table highlights the top 5 cheapest states for car insurance based on average premiums:

| Rank | State | Average Premium | Key Factors |

|---|---|---|---|

| 1 | Idaho | $1,035 | Low population density, competitive insurance market, favorable driving safety records. |

| 2 | Maine | $1,072 | Lower population density, relatively low traffic congestion, strong emphasis on driver safety. |

| 3 | Utah | $1,112 | Strong economy, competitive insurance market, and lower-than-average accident rates. |

| 4 | North Dakota | $1,144 | Low population density, favorable driving conditions, and a robust insurance market. |

| 5 | Vermont | $1,152 | Low population density, strong driver education programs, and a competitive insurance market. |

Reasons for Lower Premiums in These States

Several factors contribute to the lower average car insurance premiums in these states.

- Lower Population Density: States with lower population density often have less traffic congestion, which can lead to fewer accidents. This lower accident frequency translates into lower insurance costs for drivers. For example, Idaho, Maine, and Vermont have relatively sparse populations, resulting in less congested roads and fewer accidents.

- Favorable Driving Safety Records: States with lower accident rates tend to have lower insurance premiums. This is because insurance companies view drivers in these states as less risky to insure. States like Utah and North Dakota have consistently reported lower-than-average accident rates, contributing to their lower average premiums.

- Competitive Insurance Markets: A competitive insurance market can drive down prices as insurers compete for customers. States with numerous insurance companies offering various policies often have lower premiums. Idaho, Maine, and Vermont all have well-established insurance markets with multiple insurers, leading to increased competition and potentially lower premiums.

Car Insurance Cost Comparisons

Understanding the differences in car insurance premiums across states is crucial for consumers seeking the most affordable coverage. By comparing average premiums in the cheapest states to the national average, we can gain insights into the factors driving these variations and their implications for individuals.

Comparison of Average Premiums

The average annual car insurance premium in the United States is around $1,771. However, this figure can vary significantly depending on the state. For example, in the cheapest states, like Maine and Idaho, the average premium is significantly lower than the national average. This difference in premiums highlights the importance of considering state-specific factors when evaluating car insurance options.

Visual Representation of Premium Differences

The following table provides a visual representation of the difference in average annual car insurance premiums between the cheapest and most expensive states:

| State | Average Annual Premium |

|—|—|

| Maine | $1,000 |

| Idaho | $1,100 |

| Vermont | $1,200 |

| North Dakota | $1,300 |

| South Dakota | $1,400 |

| National Average | $1,771 |

| Mississippi | $2,000 |

| Louisiana | $2,100 |

| Florida | $2,200 |

| Michigan | $2,300 |

| Pennsylvania | $2,400 |

This table illustrates the significant disparity in car insurance costs across states. Consumers in the cheapest states can potentially save hundreds of dollars per year compared to those in the most expensive states.

Implications for Consumers

The variations in car insurance premiums across states have significant implications for consumers. Individuals living in states with higher average premiums may need to budget more for their car insurance or consider alternative coverage options. Conversely, consumers in states with lower average premiums may have more financial flexibility when it comes to their car insurance.

Tips for Saving on Car Insurance

Finding the cheapest car insurance is only the first step towards saving money on your premiums. You can further reduce your costs by implementing smart strategies and taking advantage of available discounts. This section explores various tips and tricks to help you save on car insurance.

Discounts Offered by Insurers

Insurers offer various discounts to encourage safe driving practices and reward loyal customers. These discounts can significantly reduce your premiums, so it’s crucial to explore the options available to you.

- Good Driver Discounts: Maintaining a clean driving record is the most significant factor in obtaining lower premiums. Insurers reward drivers with no accidents or traffic violations with discounts.

- Safe Driving Courses: Completing a defensive driving course demonstrates your commitment to safe driving and can qualify you for a discount. These courses teach you defensive driving techniques and can help you avoid accidents.

- Bundling Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often result in a bundled discount. This is a common practice among insurers to encourage multiple policy purchases.

- Other Discounts: Insurers may offer discounts for various factors, such as:

- Anti-theft devices: Installing anti-theft devices in your car, such as alarms or tracking systems, can deter theft and earn you a discount.

- Good student discounts: Maintaining good grades in school can qualify you for a discount, as students with good academic records are statistically less likely to be involved in accidents.

- Loyalty discounts: Long-term customers are often rewarded with loyalty discounts for their continued business.

Maintaining a Good Driving Record

A clean driving record is the most effective way to lower your insurance premiums. Accidents and traffic violations significantly increase your risk profile, leading to higher rates.

- Avoid Accidents: Defensive driving practices, such as maintaining a safe following distance, avoiding distractions, and adhering to speed limits, can significantly reduce your risk of accidents.

- Obey Traffic Laws: Following traffic laws, such as stopping at red lights and obeying speed limits, demonstrates responsible driving and reduces your risk of getting tickets.

Keeping Your Car in Good Condition

Maintaining your car’s condition can impact your insurance premiums. Well-maintained vehicles are less likely to be involved in accidents and are more likely to be repaired in case of an incident.

- Regular Maintenance: Regularly servicing your car, including oil changes, tire rotations, and brake inspections, helps ensure its optimal performance and safety.

- Safety Features: Installing safety features, such as anti-lock brakes, airbags, and traction control, can enhance your car’s safety and potentially qualify you for discounts.

Importance of Comprehensive Coverage

While finding cheap car insurance is essential, it’s equally crucial to ensure you have adequate coverage to protect yourself financially in case of an accident or theft. Comprehensive car insurance offers protection beyond the basics, safeguarding you from a wider range of risks.

Types of Coverage Included

Comprehensive car insurance policies typically include several essential coverages:

- Collision Coverage: This covers damage to your car caused by a collision with another vehicle or object, regardless of fault. This coverage is essential for repairing or replacing your car if you’re involved in an accident.

- Liability Coverage: This coverage protects you financially if you’re at fault in an accident and cause damage to another person’s property or injuries. It covers the other driver’s medical expenses, lost wages, and property damage.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient coverage. It covers your medical expenses and property damage if the other driver cannot pay.

- Comprehensive Coverage: This coverage protects your car against damages caused by non-collision events, such as theft, vandalism, fire, natural disasters, and falling objects. It helps you replace or repair your car if it’s damaged by these events.

Financial Consequences of Inadequate Coverage

The absence of adequate car insurance coverage can lead to significant financial consequences in the event of an accident or theft:

- High Out-of-Pocket Expenses: Without comprehensive coverage, you’ll be responsible for paying for repairs or replacement costs out of your pocket. This can be a substantial financial burden, especially if your car is severely damaged.

- Legal Liabilities: In case of an accident, you could face lawsuits from injured parties or property owners. Without adequate liability coverage, you could be held personally responsible for paying damages, potentially leading to significant financial losses.

- Loss of Vehicle: If your car is stolen or damaged beyond repair, you may be left without transportation and face the expense of replacing it. Comprehensive coverage helps mitigate these losses by providing compensation for your vehicle.

Last Word: Cheapest Car Insurance States

By understanding the factors that influence car insurance costs, comparing premiums across states, and utilizing available discounts, drivers can find the best deals and ensure they have adequate coverage. Armed with this knowledge, you can navigate the insurance landscape confidently and secure the most affordable and comprehensive protection for your vehicle.

FAQ Summary

How do I find the cheapest car insurance in my state?

You can use online comparison tools to get quotes from multiple insurers in your state. Be sure to provide accurate information and compare coverage options carefully.

What are some common car insurance discounts?

Common discounts include good driver discounts, safe driving courses, multi-car discounts, and bundling policies with other insurance products.

Is it worth it to pay for comprehensive car insurance?

Comprehensive coverage is essential for protecting you against financial losses in case of theft, vandalism, or damage from natural disasters.

What are the best ways to lower my car insurance premiums?

Maintain a good driving record, consider a safe driving course, and keep your car in good condition to reduce your premiums.